Professional Documents

Culture Documents

Post Office Saving Scheme

Post Office Saving Scheme

Uploaded by

kabitabalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Post Office Saving Scheme

Post Office Saving Scheme

Uploaded by

kabitabalaCopyright:

Available Formats

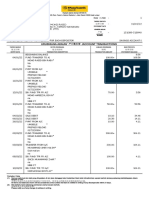

Comparison of the various Post office savings schemes

Scheme Interest Rate Minimum Maximum Eligibility Tax Implications

Investment Investment

Post Office 4% per annum – Rs 20 No limit Resident Indian, Minor Tax free Interest up to Rs

Savings Account (p.a.) and Majors 50,000 from financial year

– Non- 2018-19

Cheque

Facility Rs 50

Post Office Time First year – 6.9% Rs 200 No limit Individual Tax benefits up to 5 years

Deposit Account p.a. under section 80C

(TD) Second year - on deposits

6.9% p.a.

Third Year –

6.9% p.a.

Fourth Year –

7.7% p.a.

Post Office 7.6 % per annum Rs 1500 For one account Individual Interest earned is Taxable

Monthly Income payable monthly holder Rs 4.5 lacs & No deduction under Sec

Scheme Account and joint account 80C for Deposits made.

(MIS) holders Rs 9 lacs

Senior Citizen 8.6 % p.a. Rs 1000 Maximum deposit Individual of age> 60 – Tax benefit under section

Savings Scheme (Compounded over the lifetime years or age >55 years 80C for deposits

(SCSS) Annually) allowed at Rs 15 who have opted for VRS – TDS to be deducted on

lacs or Superannuation interest earned for more

than Rs 50,000 p.a.

15 year Public 7.9 % p.a. Rs 500 per Rs 1.5 lacs per Individual Tax rebate under section

Provident Fund (Compounded financial year financial year 80C for deposits

Account (PPF) Annually) (maximum Rs 1.5 lacs pa)

National Savings 7.9 % p.a. Rs 100 No Limit Individual Tax rebate under section

Certificates (Compounded 80C for deposits

(NSC) Annually) (maximum Rs 1.5 lacs pa)

Kisan Vikas 7.6 % p.a. Rs 1000 No limit Individual (Adult) Interest is taxable but no

Patra (KVP) (Compounded tax on the amount received

Annually) on maturity

Sukanya 8.4 % p.a. Rs 1000 per Rs 1.5 lacs per Girl Child – up to 10 Investment (up to Rs 1.5

Samriddhi (Compounded financial year financial year years from birth and 1 lacs exempt under Section

Accounts Annually) additional year of grace 80C), interest and amount

received on maturity is tax

free

You might also like

- The Automatic Millionaire by David BachDocument9 pagesThe Automatic Millionaire by David BachDennis Julius TettehNo ratings yet

- Sairam Pothuri Mar 20241713954431417Document1 pageSairam Pothuri Mar 20241713954431417Sai Ram PothuriNo ratings yet

- Post Office Surjit PDFDocument7 pagesPost Office Surjit PDFPawan SharmaNo ratings yet

- PO SavingsDocument8 pagesPO Savingsamrish_ydsNo ratings yet

- Po SchemesDocument3 pagesPo SchemesSitaraMadhavanNo ratings yet

- Post Office Savings SchemesDocument5 pagesPost Office Savings SchemeslucknowhubNo ratings yet

- Brief of Savings Schems @potoolsDocument4 pagesBrief of Savings Schems @potoolsNIKUNJA LENKANo ratings yet

- How Certificates of Deposit (CD) Work?: Treasury Bills and Dated SecuritiesDocument11 pagesHow Certificates of Deposit (CD) Work?: Treasury Bills and Dated SecuritiesyadavgunwalNo ratings yet

- Post Office AcountsDocument1 pagePost Office Acountsnusanjay8884No ratings yet

- SchemeDocument3 pagesSchemeavinash1109No ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- Post Office SchemeDocument10 pagesPost Office SchememehtadiveshNo ratings yet

- Scheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebateDocument4 pagesScheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebatesumitakumariNo ratings yet

- Conceptos Nrus RER RMT RG Persona Natural Persona JurídicaDocument1 pageConceptos Nrus RER RMT RG Persona Natural Persona JurídicaCesar ACNo ratings yet

- NPSDocument25 pagesNPSSatish BhadaniNo ratings yet

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCDocument10 pagesPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021No ratings yet

- Jan-Mar 18 Int Rates Pamphlet FrontDocument1 pageJan-Mar 18 Int Rates Pamphlet Frontmanjunath s javalkarNo ratings yet

- GCAP - EnglishDocument2 pagesGCAP - EnglishJITENDRANo ratings yet

- Deductions 3Document35 pagesDeductions 3sanjeev kumar vsNo ratings yet

- CFP Theory MaterialDocument45 pagesCFP Theory MaterialShobhit KumarNo ratings yet

- Small Savings Scheme in IndiaDocument16 pagesSmall Savings Scheme in IndiasomashekhareddyNo ratings yet

- Tax Rebate Calculator of Salaried Class Indviduals 2013-14Document4 pagesTax Rebate Calculator of Salaried Class Indviduals 2013-14waheedNo ratings yet

- 4 O J2Mbwn 4-MY 6 01s: ConverslonDocument10 pages4 O J2Mbwn 4-MY 6 01s: ConverslonKoushikaNo ratings yet

- Key Features Existing of National Savings Schemes - Docx 2Document2 pagesKey Features Existing of National Savings Schemes - Docx 2Kaisar JamilNo ratings yet

- LT Infrastructure Final Product NoteDocument1 pageLT Infrastructure Final Product NoteChandra Mohan SNo ratings yet

- NBP Financial Sector Income Fund (Nfsif)Document1 pageNBP Financial Sector Income Fund (Nfsif)HIRA -No ratings yet

- Fixed Deposits Application Form Only For Resident IndividualDocument9 pagesFixed Deposits Application Form Only For Resident IndividualkaushikNo ratings yet

- Income Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDocument5 pagesIncome Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDDSingh SinghNo ratings yet

- Loan Elegibility SheetDocument17 pagesLoan Elegibility SheetAbhijeeth M NaikNo ratings yet

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDDwiref VoraNo ratings yet

- National Saving CenterDocument4 pagesNational Saving CenterMariyam TajamalNo ratings yet

- Handbook - Tax Planning Level 1Document22 pagesHandbook - Tax Planning Level 1Prem SagarNo ratings yet

- Tax Saving Declaration FormatDocument2 pagesTax Saving Declaration FormatPraveen Francis0% (1)

- What Is InfinitiDocument4 pagesWhat Is Infinitisu maiyahNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Small Savings: ObjectivesDocument5 pagesSmall Savings: ObjectivesGuruRajNo ratings yet

- PRODUCT NOTE - Mahindra Fixed DepositDocument5 pagesPRODUCT NOTE - Mahindra Fixed Depositmani8312No ratings yet

- Deductions From Total IncomeDocument38 pagesDeductions From Total IncomeVikas WadmareNo ratings yet

- Ovely Rofessional Niversity: Personal Financial PlanningDocument6 pagesOvely Rofessional Niversity: Personal Financial PlanningGagandeep SinghNo ratings yet

- Investment Environment & Securities MarketDocument28 pagesInvestment Environment & Securities MarketProf. Suyog ChachadNo ratings yet

- Declared Profit Rates General Pool (LCYFCY) For The Month of June 2023Document4 pagesDeclared Profit Rates General Pool (LCYFCY) For The Month of June 2023ammadbutt132No ratings yet

- Tax Saving InstrumentsDocument19 pagesTax Saving Instrumentsharry.anjh3613No ratings yet

- Interest Chart W.E.F. 01.10.2022-1Document4 pagesInterest Chart W.E.F. 01.10.2022-1sushant3333No ratings yet

- LT Tax Advantage FundDocument2 pagesLT Tax Advantage FundDhanashri WarekarNo ratings yet

- Untangling NPS Taxation: Your ContributionsDocument8 pagesUntangling NPS Taxation: Your ContributionsNItishNo ratings yet

- Indicative Profit Rates: Savings Accounts Term DepositsDocument1 pageIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebNo ratings yet

- Section 80 C and TaxationDocument3 pagesSection 80 C and TaxationdeepeshmahajanNo ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document3 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19Praveen kumarNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- NBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Document1 pageNBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Kiran SheikhNo ratings yet

- Key Features of The Existing National Savings SchemesDocument6 pagesKey Features of The Existing National Savings SchemesUrbana Raquib RodoseeNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- Axis Direct PDFDocument2 pagesAxis Direct PDFMahesh KorrapatiNo ratings yet

- Feedback Demat Tariff For Retail Clients W e F 01-07-2016Document2 pagesFeedback Demat Tariff For Retail Clients W e F 01-07-2016vinay senNo ratings yet

- Edelweiss Tokio Life - GCAP - : OverviewDocument2 pagesEdelweiss Tokio Life - GCAP - : OverviewarunNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- ItfjfygjDocument3 pagesItfjfygjKrishna GNo ratings yet

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailNo ratings yet

- Compare The Tax Regime of Nepal and The United States of AmericaDocument6 pagesCompare The Tax Regime of Nepal and The United States of AmericaBikesh MaharjanNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- Ibs Tangkak 1 31/03/22Document2 pagesIbs Tangkak 1 31/03/22NABIL HAKIMNo ratings yet

- Acct Statement - XX3940 - 09082023Document21 pagesAcct Statement - XX3940 - 09082023THE CAMBRIDGENo ratings yet

- FAB SHARE Credit Cards TCs EnglishDocument9 pagesFAB SHARE Credit Cards TCs EnglishAnkur shahNo ratings yet

- 15038Document132 pages15038alicewilliams83nNo ratings yet

- LoanApplication 23660000180829Document12 pagesLoanApplication 23660000180829vijaybhaskar damireddyNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- Sanction Letter 2604Document3 pagesSanction Letter 2604sdfdsfNo ratings yet

- Amortization Pattern Check Reconciliation: Andreea Lungu-Tranole Alexandra-Elena DrugaDocument15 pagesAmortization Pattern Check Reconciliation: Andreea Lungu-Tranole Alexandra-Elena DrugaAdrian StefanescuNo ratings yet

- Rdo 105 - 2023Document1 pageRdo 105 - 2023May Ann Saranza - LustivaNo ratings yet

- Chapter 2 Topic 4 AnnuitiesDocument20 pagesChapter 2 Topic 4 Annuitiesincrediblesmile1234No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepriyanka singhNo ratings yet

- CPSPM 66257312 1702746681Document28 pagesCPSPM 66257312 1702746681BidhinNo ratings yet

- Tax Tables RTGS 2020Document1 pageTax Tables RTGS 2020Mai CarolNo ratings yet

- PROMISSORY NOTE (Sample)Document2 pagesPROMISSORY NOTE (Sample)adelainezernagmail.com100% (1)

- Question Rural Economy and Micro FinanceDocument11 pagesQuestion Rural Economy and Micro FinanceRitesh chaudharyNo ratings yet

- Payslip For Period 14, Gabriel Graur 725156 PDFDocument1 pagePayslip For Period 14, Gabriel Graur 725156 PDFGabriel DazetecNo ratings yet

- Mortgage Lab Reflection 1Document2 pagesMortgage Lab Reflection 1api-624628462No ratings yet

- Financial Institutions and Markets: 4th Ed. Chapter 22 PowerpointDocument17 pagesFinancial Institutions and Markets: 4th Ed. Chapter 22 PowerpointDaniel Williams100% (1)

- PDIC Illustrative ProblemsDocument5 pagesPDIC Illustrative ProblemsDiscord HowNo ratings yet

- Imaex 798Document2 pagesImaex 798Arman TamboliNo ratings yet

- Account - Statement - 080623 - 041223 (1) (1) (1) - 1Document11 pagesAccount - Statement - 080623 - 041223 (1) (1) (1) - 1krishnanaskar879No ratings yet

- Apr 30 23:59:59 IST 2023 Sunil Kumar Bhardwaj: 3rd Floor, No - 165 Megh Towers PH Road Maduravoyal Chennai - 600095Document1 pageApr 30 23:59:59 IST 2023 Sunil Kumar Bhardwaj: 3rd Floor, No - 165 Megh Towers PH Road Maduravoyal Chennai - 600095amanNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- MPGB RTGS Neft FormDocument1 pageMPGB RTGS Neft Formshubhambairagi32No ratings yet

- Advances Secured by Collateral SecuritiesDocument12 pagesAdvances Secured by Collateral SecuritiesShadow NarutoNo ratings yet

- Hire PurchaseDocument6 pagesHire PurchaseGanesh Bokkisam100% (1)

- ATM - GA - 4 - Basic Financial Functions 0211PGD072Document8 pagesATM - GA - 4 - Basic Financial Functions 0211PGD072Nimish kumarNo ratings yet

- Canara StatememtDocument31 pagesCanara StatememtUŕs RohithNo ratings yet