Professional Documents

Culture Documents

Assurance Engagement

Assurance Engagement

Uploaded by

M MybarakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assurance Engagement

Assurance Engagement

Uploaded by

M MybarakCopyright:

Available Formats

Conclusion

Appropriate subject matter Financial statements

Users - shareholders

Three party relationship Practitioner - auditor

Elements

Responsible party - management

Suitable criteria Accounting standards

Sufficient, appropriate evidence

Audit Stages

Obtain understanding of entity and environment

Set materiality limits

Risk of material misstatement

Inherent Risk

Control environment

Entity's risk assessment process

Information processing

Performance reviews

Categories Authorization

Physical controls

Segregation of duties

Completeness

Control activities

Occurrence

Planning

Audit Risk Control Risk

Transaction-level Cut-off

Accuracy

Data Audit

Classification

Taxation Audit Objectives

Effectiveness and efficiency of operations

Environmental Audit

Non-Financial Reliability of management reporting, analysis and

Audit of Internal Controls decision-making

Entity-level

Fraud Investigation/Forensic Audit Reliability of financial reporting

Assurance Engagement Compliance with applicable laws and regulations

Negative Information system

Limited Monitoring of controls

Levels

Reasonable

Detection Risk

Risk assessment techniques

Develop response to assessed risks

Controls testing

Audit evidence

Substantive testing

Sufficiency

Execution

Reliability - Source

Audit Process

Appropriateness Reliability - Nature

Relevance

Documentation

Completion procedures

Evaluation of audit evidence

Management representations

Completion

Communicating with management and those

charged with governance

Internal completion documents

Quality control over the audit engagement

Audit report

Ongoing elements

Risk assessment

Engagement and client management

Financial Statement Audit Pre-engagement

Acceptance and continuance

Engagement letter

Self-interest

Self-review

Threats to independence Advocacy

Familiarity

Intimidation

Eliminate the threat

Integrity, objectivity and independence Reduce the threat to an acceptable level

Safeguards

Continued awareness

Communication with those charged with governance

Remove the individual(s) from the audit team

Alternative scenarios Refuse to accept the audit engagement

Ethical standards Resign from the audit engagement

Financial, business, employment and personal

relationships

Long association with audit engagement

Fees, remuneration and evaluation policies,

litigation, gifts and hospitality

Non-audit services provided to audit clients

You might also like

- Payroll (HR) RCM 2022-2023Document1 pagePayroll (HR) RCM 2022-2023Aman ParchaniNo ratings yet

- Cybersecurity Mind Map V01R04 DOC ID 2017095Document1 pageCybersecurity Mind Map V01R04 DOC ID 2017095James HowlettNo ratings yet

- 04 HIRA For Reinforcement WorkDocument7 pages04 HIRA For Reinforcement WorkMithlesh Singh50% (2)

- ECM3701 Electronic Communcation Technology: Minor Test No: 01 Year ModuleDocument4 pagesECM3701 Electronic Communcation Technology: Minor Test No: 01 Year ModuleTale Banks0% (1)

- Designer MilkDocument30 pagesDesigner MilkParashuram Shanigaram67% (6)

- We Googled You AnalysisDocument8 pagesWe Googled You AnalysisSoumya Bhattacharya100% (1)

- Polyphonic HMI Case PresentationDocument48 pagesPolyphonic HMI Case PresentationUtpal Biyani100% (4)

- Risk Treatment ProcessDocument1 pageRisk Treatment Processcybertank378No ratings yet

- Performance Evaluation ProcessDocument1 pagePerformance Evaluation Processcybertank378No ratings yet

- Process Clause MatrixDocument6 pagesProcess Clause Matrixmuhammad kamranNo ratings yet

- Iso 31000 Revisions Summary SlidesDocument5 pagesIso 31000 Revisions Summary SlidesEyob SNo ratings yet

- GOLDENHORN ONEGRC Three Lines of Defence Mapping 1580023424Document1 pageGOLDENHORN ONEGRC Three Lines of Defence Mapping 1580023424Gurcan KarayelNo ratings yet

- Huye Branch - Risk Assessment - Fy 2022-2023 InspectionsDocument119 pagesHuye Branch - Risk Assessment - Fy 2022-2023 Inspectionsseth uwitonzeNo ratings yet

- Reading 22 - Financial Reporting StandardDocument1 pageReading 22 - Financial Reporting Standardmaimaitaan120201No ratings yet

- Attachment 10 Incident Invetigation and Reporting TechniquesDocument1 pageAttachment 10 Incident Invetigation and Reporting TechniqueslilizuryaniNo ratings yet

- Infografía-PMI Guide To BADocument1 pageInfografía-PMI Guide To BACarlos GNo ratings yet

- TCI EA Reference DiagramDocument1 pageTCI EA Reference DiagramhumbertoNo ratings yet

- CMDB by ServiceNowDocument49 pagesCMDB by ServiceNowRussel Javier67% (3)

- Aspect Impact AnalysisDocument5 pagesAspect Impact Analysisdinesh InduNo ratings yet

- HIRADC Asphalt RoadDocument1 pageHIRADC Asphalt RoadAshadi Amir100% (1)

- (Example) Risk & Opportunities Register - YDIDocument5 pages(Example) Risk & Opportunities Register - YDIRudy Halim100% (1)

- Dynatrace Associate Mindmap 021523Document1 pageDynatrace Associate Mindmap 021523karim bakloutiNo ratings yet

- Sample Risk-Opportunity Assessment ReportDocument3 pagesSample Risk-Opportunity Assessment ReportCatherine Ferreol100% (1)

- 15.annexue2 - Process Sequence & InteractionDocument4 pages15.annexue2 - Process Sequence & Interactioncer.qualityNo ratings yet

- ISO 10002 Project PlanDocument1 pageISO 10002 Project Planchaouch.najehNo ratings yet

- Introduction To AuditingDocument2 pagesIntroduction To Auditinglied27106No ratings yet

- Technical Descriptor (How) : Raw Score Relative WeightDocument1 pageTechnical Descriptor (How) : Raw Score Relative WeightAlodia FarichaiNo ratings yet

- Worksheet - Income Sheet and Form Series 18 AICPA, AICPA Risk of Material Misstatement WorksheetsDocument20 pagesWorksheet - Income Sheet and Form Series 18 AICPA, AICPA Risk of Material Misstatement WorksheetswellawalalasithNo ratings yet

- CIMA-PGPMA-2017 Broucher PDFDocument26 pagesCIMA-PGPMA-2017 Broucher PDFJasbir Singh KhalsaNo ratings yet

- RP2-ISO9001 2015 ADocument50 pagesRP2-ISO9001 2015 AMasrawana Mohd Masran100% (1)

- Khareef Risk Register DraftDocument3 pagesKhareef Risk Register DraftRizwan KaziNo ratings yet

- ICPprivilegesDocument5 pagesICPprivilegesBUREAU VERITASNo ratings yet

- F8 Summary TopicDocument1 pageF8 Summary TopicChoi HongNo ratings yet

- Audit of CFS Mind MapDocument1 pageAudit of CFS Mind Mapgovarthan1976No ratings yet

- 2) - Aspect Impact RegisterDocument3 pages2) - Aspect Impact Registerganesh.shekharNo ratings yet

- MEEE Incident AnalysisDocument2 pagesMEEE Incident AnalysisacauaNo ratings yet

- INTERNAL CONTROLS - Section 3 Example of Documentation: FlowchartDocument8 pagesINTERNAL CONTROLS - Section 3 Example of Documentation: Flowchartحسين عبدالرحمنNo ratings yet

- Themes To Risk Factor DiagnosticDocument2 pagesThemes To Risk Factor DiagnosticRafasaxNo ratings yet

- LIFE CYCLE INSTITUTE-Criticality AnalysisDocument1 pageLIFE CYCLE INSTITUTE-Criticality AnalysisJonathan Ferney CastroNo ratings yet

- Fifo Board - Rack "A" Example: Item Name: 0044 Needle Bearing SAP Code: B-NB-X050-0044-N0Document12 pagesFifo Board - Rack "A" Example: Item Name: 0044 Needle Bearing SAP Code: B-NB-X050-0044-N0Anonymous tv3qpx250% (2)

- Sample Risk RegisterDocument12 pagesSample Risk RegisteryevhenNo ratings yet

- 4-Final RA For Installation of Instalation Precast PDFDocument2 pages4-Final RA For Installation of Instalation Precast PDFeng mohamad husamNo ratings yet

- RA Sub Structrul WorkDocument6 pagesRA Sub Structrul Workshamshad ahamedNo ratings yet

- Risk / Opportunity Management Register For ProjectDocument1 pageRisk / Opportunity Management Register For Projectnikunj0% (1)

- HSE-Risk Assessment SheetDocument3 pagesHSE-Risk Assessment SheetRugadya PaulNo ratings yet

- Hirarc & Jha - Hits Rev. 00Document10 pagesHirarc & Jha - Hits Rev. 00Nelz PelaezNo ratings yet

- Ra For Concreate Floor BreakingDocument5 pagesRa For Concreate Floor Breakingshamshad ahamedNo ratings yet

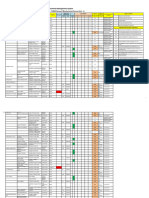

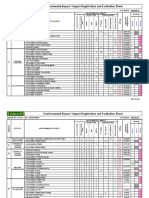

- Environmental Aspect / Impact Registration and Evaluation SheetDocument3 pagesEnvironmental Aspect / Impact Registration and Evaluation SheetrewrtegamingNo ratings yet

- HIRADC Scaffolding, Isolation Energy, Bekerja Di KetinggianDocument3 pagesHIRADC Scaffolding, Isolation Energy, Bekerja Di KetinggianLutfiNo ratings yet

- HIRADC - Pekerjaan 20 KV - PLTGU - Update 5 March 2018Document5 pagesHIRADC - Pekerjaan 20 KV - PLTGU - Update 5 March 2018ghieee100% (2)

- Process Effectiveness & Reliability (FMEA) EvaluationDocument1 pageProcess Effectiveness & Reliability (FMEA) EvaluationEdwin Otniel LumbantoruanNo ratings yet

- Career Framework Competencies - Effective January 1, 2015Document1 pageCareer Framework Competencies - Effective January 1, 2015odescribdNo ratings yet

- Risk Assessment Internal Quality AuditDocument2 pagesRisk Assessment Internal Quality AuditSheila Marie Gil-VersozaNo ratings yet

- RA Excavation & Backfilling WorkDocument6 pagesRA Excavation & Backfilling Workshamshad ahamedNo ratings yet

- Volume 8D Ishikawa-EnDocument2 pagesVolume 8D Ishikawa-EnNoonNo ratings yet

- Yale University Incident Management Process 1 of 17Document17 pagesYale University Incident Management Process 1 of 17Sam100% (1)

- Barricading Work Risk AssessmentsDocument1 pageBarricading Work Risk AssessmentsHSE1 SHAMNETNo ratings yet

- Notebook - Principle of AccountingDocument33 pagesNotebook - Principle of AccountingNguyễn Quỳnh AnhNo ratings yet

- Training Plan Training NeedDocument3 pagesTraining Plan Training NeedAum AumNo ratings yet

- Storage of Chemical - Risk AssessmentsDocument1 pageStorage of Chemical - Risk AssessmentsMohammed Amer PashaNo ratings yet

- Competency MatrixDocument1 pageCompetency MatrixMAHALAKSHMI SIVAKUMARNo ratings yet

- Problem-Solving ModelDocument1 pageProblem-Solving Modelsahand adib moradi langeroodiNo ratings yet

- BSC Fuzzy-Delphi-Analysis - 26 Sep23Document19 pagesBSC Fuzzy-Delphi-Analysis - 26 Sep23Muhammad HurraraNo ratings yet

- Modelo Listening Exam c1 2014junio Task 1MODELODocument1 pageModelo Listening Exam c1 2014junio Task 1MODELOtereNo ratings yet

- For ConsultationDocument11 pagesFor ConsultationClarisse PoliciosNo ratings yet

- Fausto Romitelli Six Keywords PDFDocument4 pagesFausto Romitelli Six Keywords PDFNachinsky von FriedenNo ratings yet

- Testes Avaliação Inglês 6º AnoDocument43 pagesTestes Avaliação Inglês 6º AnoRui PauloNo ratings yet

- Jody Howard Director, Social Responsibility Caterpillar, IncDocument17 pagesJody Howard Director, Social Responsibility Caterpillar, IncJanak ValakiNo ratings yet

- Assignment 1Document2 pagesAssignment 1Mohammad Nasir AliNo ratings yet

- EXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and YetDocument3 pagesEXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and Yet愛HAKIMZVNo ratings yet

- Test Oil Compressor #4067 (06-12-22)Document1 pageTest Oil Compressor #4067 (06-12-22)albertoNo ratings yet

- Hair Stylist Cover LetterDocument7 pagesHair Stylist Cover Letterzys0vemap0m3100% (2)

- FIP Corrosion Protection of Prestressing SteelsDocument79 pagesFIP Corrosion Protection of Prestressing SteelsRizwanNo ratings yet

- Development All ChapterDocument76 pagesDevelopment All ChapterLeulNo ratings yet

- FMEADocument5 pagesFMEAmz007No ratings yet

- OLD 2900 Downflow Manual PDFDocument32 pagesOLD 2900 Downflow Manual PDFintermountainwaterNo ratings yet

- Answers QuestioDocument9 pagesAnswers QuestioWendelyn JimenezNo ratings yet

- Campbell Systematic Reviews - 2011 - Morton - Youth Empowerment Programs For Improving Self Efficacy and Self Esteem ofDocument81 pagesCampbell Systematic Reviews - 2011 - Morton - Youth Empowerment Programs For Improving Self Efficacy and Self Esteem ofAndra ComanNo ratings yet

- Argumentative Essay: The Willingness of The Community To Participate in Nationwide VaccinationDocument3 pagesArgumentative Essay: The Willingness of The Community To Participate in Nationwide VaccinationKathleen JimenezNo ratings yet

- NCM - 103Document5 pagesNCM - 103Delma SimbahanNo ratings yet

- Coin FlipDocument10 pagesCoin Flip林丽莹No ratings yet

- Math in Focus 3B WorksheetDocument6 pagesMath in Focus 3B WorksheetBobbili PooliNo ratings yet

- Manual enDocument216 pagesManual enmosquidoNo ratings yet

- ESS Questionnaire StaffDocument2 pagesESS Questionnaire StaffSarita LandaNo ratings yet

- A Study of The Aggressiveness Behavior of Senior High School Students of de La Salle Lipa As Predicted by The Perceived Parenting Styles of Their ParentsDocument32 pagesA Study of The Aggressiveness Behavior of Senior High School Students of de La Salle Lipa As Predicted by The Perceived Parenting Styles of Their ParentsVince Catapang100% (1)

- CAPtain Online ExplainedDocument13 pagesCAPtain Online ExplainedRebekaNo ratings yet

- TCVN 4513-1988 Internal Water Supply - Design Standard PDFDocument37 pagesTCVN 4513-1988 Internal Water Supply - Design Standard PDFDoThanhTungNo ratings yet

- Kindergarten Writing Lesson PlanDocument7 pagesKindergarten Writing Lesson Planapi-332051194No ratings yet

- Reading 23 NovDocument5 pagesReading 23 NovAdhwa QurrotuainiNo ratings yet