Professional Documents

Culture Documents

PF Form 15G PDF

PF Form 15G PDF

Uploaded by

Sorabh BhargavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PF Form 15G PDF

PF Form 15G PDF

Uploaded by

Sorabh BhargavCopyright:

Available Formats

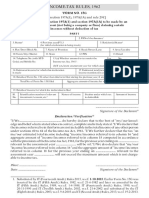

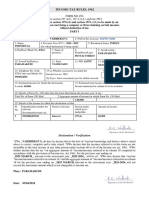

. FORM NO.

15G

[See section 197A(l),197A(1A) and rule 29C]

Declaration under section l97A(l> and section 197(1,{) to be made by an individual or person (not being

a comp.rny or firm ) claiming certain income without deductopn of tax.

PART I

1. Name of Assessee (Declarant) 2. PAN of the Assessee'

3. Status'2 4. Previous year(P.Y.)3 5. Residential Statuso

(for which declaration is beine made)

6. Flat/Door/Block No. I 7. Name of Premises 8. Road,/Street/Lane 9. Area/Locality

10. Town/City,/District | 11. State 12. PIN 13. Email

14. Telephone No. (with STD l.5. (a) Whether assessed to tax under the Yes No

Code) and Mobile No. Income-tax Act,7g6f : f----'l

(b) If yes, latest assessment year for which assessed

16. Estimated incomg for which this declaration is made 17. Estimated total income of the P.Y in which

income mentioned in column 16 to be includedo

18. Details of Form No. 15G other than this form filed during the previour year, if anyl

Total No. of Form No. 15G filed I Aggregate amount of income for which Form No. 15G filed

19. Details of income for which the declaration is filed

SI. Identification number of relevant Nature of income Section under which tax Amount of income

No. investment/account, etc.8 is deductible

Signature of tle Declarant'

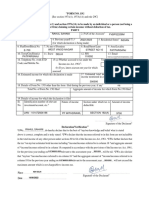

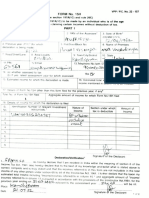

D eclarution/ Verifi cation

* I/We.......... do hereby that to the best of *my/our knowledge and belief what is

stated above is correct, complete and is ffuly stated.* L/We declare that the incomes referred to in this form are not

includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/We further

deciare that the tax *on my/our estimated total income induding *income/ineomes referred to in column 16 *and

aggtegate amount of *income/incomes referred to in column 18 computed in accordance with the provisions of the

Income-tax Ac-, 1967,'for the previous year ending on .................... relevant to the assessment year................. will

be nil. *L/We also declare that *my/our *income/incomes referred to in column 16 *and the aggregate amount of

*income/incomes referred to in column 18 for the previous year ending on ....................re1evant

to the assessment

year will not exceed the maximum amount which is not chargeable to income-tax.

Place:

Signature of the Dectarallt

Date:

PART II

[To be filled by the persoa responsible for paying the income referred to in column 16 of Part Il

1. Name of the person responsible for paying 2. Uniquc Identiflcation No.rr

3. PAN of the person 4. Complete Address 5. TAN of the person responsibe for paying

responsible for paying

6. Email 7. Telephone No. (with STD Code and Mobile No.) | 8. Amount of income paidi,

9. Date on which Declaration is received 10. Date on which the income has been paid/credited

(DDIMM/YYY9 (DDlMM/YyYY)

Place:

Signature of the person responsible for paying

Date: the income referred to in column 16 of part I

You might also like

- CIPS L4-Negotiating and Contracting in Procurement and SupplyDocument166 pagesCIPS L4-Negotiating and Contracting in Procurement and SupplyAsheque Iqbal100% (3)

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Form 15G PDFDocument2 pagesForm 15G PDFLegend RickNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Form 15HDocument2 pagesForm 15HNithya SathyaprasathNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form 15h Revised1Document2 pagesForm 15h Revised1rajprince26460No ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Form 15G 03 May 2024Document2 pagesForm 15G 03 May 2024ravaldigish62No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- Tata Consumer ANNEXURE - 2 FORM 15HDocument5 pagesTata Consumer ANNEXURE - 2 FORM 15HAnbarasu MookiahpandianNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- "FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)Document2 pages"FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)JAY SAINo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- Form 27CDocument2 pagesForm 27Ctulsi22187No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Shashank KSNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Megaprojects and Risk Management Emaar PropertiesDocument21 pagesMegaprojects and Risk Management Emaar PropertieschineduNo ratings yet

- Act 30-34Document5 pagesAct 30-34ジェフ ァーソンNo ratings yet

- Financial Institutions and InvestmentDocument3 pagesFinancial Institutions and Investmenttarekegn gezahegnNo ratings yet

- Final Report Asia Africa Trade and Investment Study - KamiyaDocument144 pagesFinal Report Asia Africa Trade and Investment Study - KamiyaMarco Kamiya100% (9)

- Cred Case StudyDocument18 pagesCred Case StudyMohamed Arif PullatNo ratings yet

- Prelims 1st Quiz Cost Accounting and Control 1 PDFDocument30 pagesPrelims 1st Quiz Cost Accounting and Control 1 PDFAia RohaNo ratings yet

- Conquistadors On The Beach SPANISH COMPANIESDocument6 pagesConquistadors On The Beach SPANISH COMPANIESMazana ÁngelNo ratings yet

- Flexible Budget Examples Chapter 18Document9 pagesFlexible Budget Examples Chapter 18Surbhi JainNo ratings yet

- I-Trade: IGI Securities LimitedDocument15 pagesI-Trade: IGI Securities LimitedVkNo ratings yet

- Intro - S4HANA - Using - Global - Bike - Case - Study - MM - Fiori - en - v3.3 Ccaso PDFDocument79 pagesIntro - S4HANA - Using - Global - Bike - Case - Study - MM - Fiori - en - v3.3 Ccaso PDFCamila HHNo ratings yet

- Pfin5 5th Edition Billingsley Solutions ManualDocument25 pagesPfin5 5th Edition Billingsley Solutions ManualSarahSweeneyjpox100% (54)

- Chapter 1 Information Systems in Global Business TodayDocument30 pagesChapter 1 Information Systems in Global Business TodayNguyễn Thị Hồng DiễmNo ratings yet

- Dokumen - Tips Mark Pitts Case Analysis Group 6pptxDocument7 pagesDokumen - Tips Mark Pitts Case Analysis Group 6pptxADITYAROOP PATHAKNo ratings yet

- Questions and AnswerDocument17 pagesQuestions and AnswerandreupnNo ratings yet

- 06 - ASM Shodh Chintan 2015Document234 pages06 - ASM Shodh Chintan 2015Dr. Rajeev Kr. SinghNo ratings yet

- BDO International Tax Webinar Slides BEPSDocument42 pagesBDO International Tax Webinar Slides BEPSSergio VinsennauNo ratings yet

- BUECO6923 Course Description CUCST Semester 1 2012Document11 pagesBUECO6923 Course Description CUCST Semester 1 2012Alex KouiderNo ratings yet

- Department of Labor: CnmiDocument1 pageDepartment of Labor: CnmiUSA_DepartmentOfLaborNo ratings yet

- Tax Code of BangladeshDocument5 pagesTax Code of Bangladeshsouravsam100% (2)

- KaveriSeeds StockNote04081720170804114204Document21 pagesKaveriSeeds StockNote04081720170804114204PIBM MBA-FINANCENo ratings yet

- INB 372: Introduction To International Business: Country Report On: South SudanDocument33 pagesINB 372: Introduction To International Business: Country Report On: South SudanFahim HossainNo ratings yet

- Employee Motivation and Performance Do The Work enDocument13 pagesEmployee Motivation and Performance Do The Work enMOUSSA KEITANo ratings yet

- ACCT551 Week 7 Quiz AnswersDocument3 pagesACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- Social Marketing TheoryDocument116 pagesSocial Marketing TheoryAmhara AmharaNo ratings yet

- Module 10 Inflation RevDocument12 pagesModule 10 Inflation RevGumiNo ratings yet

- Human Resource Management: Ms. Sumina Susan KochittyDocument40 pagesHuman Resource Management: Ms. Sumina Susan KochittyFebin.Simon1820 MBANo ratings yet

- Islam and Accounting Mervyn K. LewisDocument16 pagesIslam and Accounting Mervyn K. LewisWan KhaidirNo ratings yet

- Company ProfileDocument10 pagesCompany Profile1anupma0No ratings yet