Professional Documents

Culture Documents

Income Taxation of Proprietary Educational Institutions

Income Taxation of Proprietary Educational Institutions

Uploaded by

Regina Grace GadoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Taxation of Proprietary Educational Institutions

Income Taxation of Proprietary Educational Institutions

Uploaded by

Regina Grace GadoCopyright:

Available Formats

Income Taxation of Proprietary Educational Institutions

For tax income tax purposes, educational institutions are classified as follows:

Proprietary educational institution;

Non-stock, non-profit educational institution; or,

Government educational institution.

In this Article, let us uncover how a proprietary educational institution is being subjected to income

tax.

Definition

Under the Tax Code, 'proprietary educational institution' is any private school maintained and

administered by private individuals or groups with an issued permit to operate from the

Department of Education, Culture and Sports (DECS), or the Commission on Higher Education

(CHED), or the Technical Education and Skills Development Authority (TESDA), as the case may

be, in accordance with existing laws and regulations.

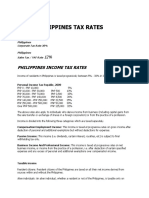

Income tax rates

As a rule, it is subject to a special income tax rate of ten percent (10%) on their taxable

income except on certain passive income. Notably, this is much lower than the regular corporate

income tax rate of 30% of taxable net income. However, they must dedicate their operations to

providing educational services because if they does not, then, they will cease to enjoy the benefit

of 10%. If the gross income from unrelated trade, business or other activity exceeds fifty percent

(50%) of the total gross income derived from all sources, they shall be taxed at 30% on the entire

taxable income. 'Unrelated trade, business or other activity' means any trade, business or other

activity, the conduct of which is not substantially related to the exercise or performance by such

educational institution of its primary purpose or function.

Allowable deductions

It is allowed to claim from its gross income, allowable deductions in like manner as an ordinary

taxpayer engaged in trade or business. In addition to the expenses allowable as deductions, it may

at its option elect either:

(a) to deduct expenditures otherwise considered as capital outlays of depreciable assets incurred

during the taxable year for the expansion of school facilities, or

(b) to deduct allowance for depreciation thereof.

In other words, capital outlays which would have been normally considered as an asset subject to

depreciation maybe claimed by proprietary educational institutions as an outright deduction from

its gross income.

Passive income

Finally, passive income of proprietary educational institutions is taxed in the same manner as

ordinary corporations. Examples of passive income are interest income from Philippine bank

deposits and royalties

You might also like

- Life Insurance Premium Certificate: (Financial Year 2018-2019)Document1 pageLife Insurance Premium Certificate: (Financial Year 2018-2019)Barnali ChakrabortyNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- Commissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Document3 pagesCommissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Violet Parker100% (1)

- Incomes From Unrelated Activities of Educational Institution AreDocument3 pagesIncomes From Unrelated Activities of Educational Institution AreAllan SantosNo ratings yet

- RMC 78-2022Document3 pagesRMC 78-2022Ian PalmaNo ratings yet

- Income Taxation Finals - CompressDocument9 pagesIncome Taxation Finals - CompressElaiza RegaladoNo ratings yet

- Income Tax BotswanaDocument15 pagesIncome Tax BotswanaFrancisNo ratings yet

- Corporation PT 2Document21 pagesCorporation PT 2Danica ConcepcionNo ratings yet

- Bir Ruling No 477-2013Document1 pageBir Ruling No 477-2013Jaz SumalinogNo ratings yet

- Tax On ServiceDocument21 pagesTax On ServiceHazel-mae LabradaNo ratings yet

- CIR V DLSU 2009 DigestDocument5 pagesCIR V DLSU 2009 DigestCelina Marie Panaligan100% (1)

- CIR v. DLSUDocument3 pagesCIR v. DLSUCarlyle Esquivias ChuaNo ratings yet

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeMark Lester Lee Aure100% (2)

- CIR V DLSU TaxDocument1 pageCIR V DLSU Taxrgomez_940509No ratings yet

- CIR V DLSUDocument1 pageCIR V DLSUrgomez_940509No ratings yet

- Philippines Income Tax RatesDocument6 pagesPhilippines Income Tax RatesKristina AngelieNo ratings yet

- CIR Vs DLSUDocument3 pagesCIR Vs DLSUHaniya Solaiman GuroNo ratings yet

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSDocument9 pagesMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47No ratings yet

- Module 5 Deductions From Gross IncomeDocument3 pagesModule 5 Deductions From Gross Incomekaswabelife16No ratings yet

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNo ratings yet

- PC 2Document3 pagesPC 2pepe.oblack13No ratings yet

- Cir Vs Dlsu FACTS: in 2004, The BIR Issued An LOA Covering The Tax Audit of DLSU's Fiscal Year 2003 andDocument1 pageCir Vs Dlsu FACTS: in 2004, The BIR Issued An LOA Covering The Tax Audit of DLSU's Fiscal Year 2003 andlawstud0322No ratings yet

- Commissioner of Internal Revenue vs. de La Salle University, Inc., 808 SCRA 156, November 09, 2016Document11 pagesCommissioner of Internal Revenue vs. de La Salle University, Inc., 808 SCRA 156, November 09, 2016Jane BandojaNo ratings yet

- Cir V. Dlsu: Tax RemediesDocument18 pagesCir V. Dlsu: Tax Remediesesmeralda de guzmanNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- CIR v. DLSUDocument74 pagesCIR v. DLSUmceline19No ratings yet

- Corporate Taxes in The PhilippinesDocument2 pagesCorporate Taxes in The PhilippinesAike SadjailNo ratings yet

- Tax CasesDocument11 pagesTax CasesJesse AlindoganNo ratings yet

- CIR V DLSU G.R. 196596 Nov. 9 2016Document4 pagesCIR V DLSU G.R. 196596 Nov. 9 2016Howard ClarkNo ratings yet

- RR No. 3-2022Document4 pagesRR No. 3-2022try saguilotNo ratings yet

- 20 CIR V Dlsu DigestDocument5 pages20 CIR V Dlsu DigestARCHIE AJIASNo ratings yet

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- CIR v. DLSU - CONSTI IIDocument4 pagesCIR v. DLSU - CONSTI IIJan Chrys MeerNo ratings yet

- Tax DiscussionDocument10 pagesTax DiscussionMaisie ZabalaNo ratings yet

- Tax - Wikipedia 111Document190 pagesTax - Wikipedia 111kidundarhNo ratings yet

- Study For Tax DeductionsDocument4 pagesStudy For Tax DeductionsHei Nah MontanaNo ratings yet

- 09 Ra 9337 PDFDocument41 pages09 Ra 9337 PDFHonorio John P. ZingapanNo ratings yet

- Ra 9337Document41 pagesRa 9337Arianne MarzanNo ratings yet

- Special Allowable Itemized Deductions NOLCO MCITDocument5 pagesSpecial Allowable Itemized Deductions NOLCO MCITjes mandanasNo ratings yet

- CIR-v.-St.-Lukes-Medical-Center-Inc.Document4 pagesCIR-v.-St.-Lukes-Medical-Center-Inc.Charmaine Ganancial SorianoNo ratings yet

- Corporate Income Taxes and Tax RatesDocument38 pagesCorporate Income Taxes and Tax RatesShaheen ShahNo ratings yet

- Title Ii Chapter IvDocument8 pagesTitle Ii Chapter IvMae CarpilaNo ratings yet

- Finals (Taxation)Document30 pagesFinals (Taxation)Ruffa Mae SanchezNo ratings yet

- Philippine Corporate TaxDocument3 pagesPhilippine Corporate TaxRaymond FaeldoñaNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 13-2022 Issued On January 24, 2022 CircularizesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 13-2022 Issued On January 24, 2022 CircularizesKatherine SyNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesJea XeleneNo ratings yet

- TAX ON OTHER EntityDocument5 pagesTAX ON OTHER EntitySaneej SamsudeenNo ratings yet

- Cap 1.2.5Document45 pagesCap 1.2.5DavidNo ratings yet

- Report Income Tax 1Document5 pagesReport Income Tax 1jossa pokkoNo ratings yet

- RMC 76 2003Document1 pageRMC 76 2003Dorothy PuguonNo ratings yet

- 02A Income Taxes: Clwtaxn de La Salle UniversityDocument46 pages02A Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- Presentation1 TaxDocument27 pagesPresentation1 Taxzerubabel abebeNo ratings yet

- CIR v. DLSUDocument2 pagesCIR v. DLSUJoseph DimalantaNo ratings yet

- Title: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncDocument3 pagesTitle: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncKim GuevarraNo ratings yet

- Tax DigestDocument7 pagesTax DigestPhilip UlepNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Taxation Law CabaneiroDocument420 pagesTaxation Law CabaneiroJared Libiran75% (4)

- Tax On CorporationsDocument6 pagesTax On CorporationsJumen Gamaru TamayoNo ratings yet

- 3 Tax Deductible Expenses With Limitations in PhilippinesDocument2 pages3 Tax Deductible Expenses With Limitations in PhilippinesChristine Bobis100% (1)

- Te Areohanui Robinson Payslip 01.04.24 To 14.04.24Document2 pagesTe Areohanui Robinson Payslip 01.04.24 To 14.04.24sayhimatesNo ratings yet

- Taxation HandoutsDocument5 pagesTaxation HandoutsTiyon TiyonNo ratings yet

- E-Payslip Admin. - 1561198Document2 pagesE-Payslip Admin. - 1561198xkr5f7wyt2No ratings yet

- Statement 16 02Document2 pagesStatement 16 02kerembonov761No ratings yet

- ReportDocument3 pagesReportabdukarimu abdallahNo ratings yet

- Common ECS MandateDocument1 pageCommon ECS Mandatehunterashu1deadlyNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnkit SambhareNo ratings yet

- CIR v. Wyeth Suaco Lab.Document3 pagesCIR v. Wyeth Suaco Lab.Angelique Padilla UgayNo ratings yet

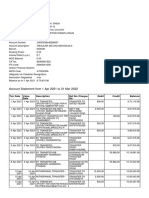

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNiwadi PremiNo ratings yet

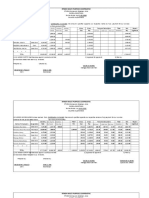

- RTMDH Multi Purpose Cooperative: Amt. Due For Overtime Holiday The Period Trans. Exp. 100% DeductionDocument10 pagesRTMDH Multi Purpose Cooperative: Amt. Due For Overtime Holiday The Period Trans. Exp. 100% DeductionREMA PALCORINNo ratings yet

- Nepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsDocument7 pagesNepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsSajjal GhimireNo ratings yet

- Government Suspense AccountsDocument63 pagesGovernment Suspense Accountsbharanivldv9No ratings yet

- 2nd QuarterDocument112 pages2nd QuarterRodnel MonceraNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- Introduction To Taxation: By: Michael Icaro, CpaDocument27 pagesIntroduction To Taxation: By: Michael Icaro, CpaAselleNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- Word Income From House PropertyDocument19 pagesWord Income From House PropertyRathin Banerjee100% (1)

- Council Tax Bill 2021/22Document2 pagesCouncil Tax Bill 2021/22Lucas Victor VargasNo ratings yet

- Tuitionfees 1 SttermDocument2 pagesTuitionfees 1 SttermBhaskhar AnnaswamyNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- ATX MYS - Examinable Documents Guidance Notes - 2020 0ct-2021sept - FINALDocument3 pagesATX MYS - Examinable Documents Guidance Notes - 2020 0ct-2021sept - FINALAmy LauNo ratings yet

- Tugas PA Bab 16Document7 pagesTugas PA Bab 16Adrian BatubaraNo ratings yet

- UBC Bank StatementDocument2 pagesUBC Bank Statementjeffersonmisnerdnn80No ratings yet

- Sample - Chapter 6 - Payroll SheetDocument10 pagesSample - Chapter 6 - Payroll SheetRishma Jane ValenciaNo ratings yet

- Quiz, TaxDocument2 pagesQuiz, TaxKathlene JaoNo ratings yet

- LN 6.1 IHC (Unlisted, Listed & Inv. Deal.)Document21 pagesLN 6.1 IHC (Unlisted, Listed & Inv. Deal.)muhammadsbs-wb20No ratings yet

- Time of Supply-20Document44 pagesTime of Supply-20Sidhant GoyalNo ratings yet

- Tata 1Mg Healthcare Solutions Private LimitedDocument3 pagesTata 1Mg Healthcare Solutions Private LimitedSandeep BhargavaNo ratings yet