Professional Documents

Culture Documents

Project Report of KMF

Project Report of KMF

Uploaded by

Arun NagaCopyright:

Available Formats

You might also like

- Project Mba - Mbf22024Document109 pagesProject Mba - Mbf22024nkmj29raunathanNo ratings yet

- NVRDocument125 pagesNVRJohn Aldridge Chew100% (1)

- Business Management Paper 2 SLDocument7 pagesBusiness Management Paper 2 SLSaket Gudimella0% (1)

- Project Report of KMFDocument107 pagesProject Report of KMFTousif Ahmed67% (18)

- Finance Projectof KSDLDocument78 pagesFinance Projectof KSDLKiran Vijendra0% (1)

- Solutions Chapter 11Document31 pagesSolutions Chapter 11Brenda Wijaya100% (1)

- KMF Project Viva PresentationDocument12 pagesKMF Project Viva PresentationUmesh Allannavar100% (1)

- A Report On AStudy of WorkingCapital Management Ofjaipur DairyDocument80 pagesA Report On AStudy of WorkingCapital Management Ofjaipur Dairyrajeshosb100% (8)

- Synopsis of Financial Analysis in Dakshina Kannada Milk ProductionDocument2 pagesSynopsis of Financial Analysis in Dakshina Kannada Milk ProductionManjunath Shetty100% (3)

- Full Proj GPDocument72 pagesFull Proj GPyogesh_958759168No ratings yet

- Mcom Project Work 3 ChaptersDocument54 pagesMcom Project Work 3 ChaptersgeethaNo ratings yet

- Bgs Institute of TechnologyDocument22 pagesBgs Institute of Technologybalakrishna krNo ratings yet

- Financial Performance of Kerala Gramin Bank Special Reference To Southern AreaDocument81 pagesFinancial Performance of Kerala Gramin Bank Special Reference To Southern AreaPriyanka Ramath100% (1)

- 1830CMD023 Manohara RDocument68 pages1830CMD023 Manohara RPradeep GNo ratings yet

- Executive Summary KMFDocument66 pagesExecutive Summary KMFNAGESH SNo ratings yet

- Report On Working Capital ManagementDocument53 pagesReport On Working Capital ManagementRaman Kumar0% (1)

- Karnataka Milk Federation Deepak MB 1 Report 1Document40 pagesKarnataka Milk Federation Deepak MB 1 Report 1udaya kumarNo ratings yet

- TOTAL Project DataDocument69 pagesTOTAL Project Datathella deva prasadNo ratings yet

- Intership Bhaskar N Final 897Document46 pagesIntership Bhaskar N Final 897Sudeep GowdaNo ratings yet

- Swot Analysis of MymulDocument8 pagesSwot Analysis of MymulJagadish MariyappaNo ratings yet

- Vino KMF ProjectDocument81 pagesVino KMF ProjectSandesh SandyNo ratings yet

- INTERNSHIP2 MergedDocument40 pagesINTERNSHIP2 MergedNAGESH SNo ratings yet

- A Project Report On Ratio Analysis at BemulDocument94 pagesA Project Report On Ratio Analysis at BemulBabasab Patil (Karrisatte)No ratings yet

- Anil Final ProjectDocument93 pagesAnil Final ProjectSHAILESH GOWDANo ratings yet

- 04 KXCM6082 VenkatareddyDocument107 pages04 KXCM6082 Venkatareddy211pavanNo ratings yet

- SH RadhaDocument43 pagesSH Radhaharshini hapzNo ratings yet

- Annual Sustainability Report 2704Document86 pagesAnnual Sustainability Report 2704Gaming with AyushNo ratings yet

- CHethan B V ProjectDocument27 pagesCHethan B V Projectningegowda100% (1)

- 104 Bamul EwcmDocument109 pages104 Bamul Ewcmgauravfast77No ratings yet

- Employee Job Satisfaction at RBKMUL Chapter 2Document76 pagesEmployee Job Satisfaction at RBKMUL Chapter 2Raksha RakshuNo ratings yet

- Organizational Study of BamulDocument29 pagesOrganizational Study of BamulDivyaa NagarajNo ratings yet

- Executive Summary: K M F DDocument47 pagesExecutive Summary: K M F DUmesh AllannavarNo ratings yet

- A Project Report On Working Capital Management of Hindalco For The Last Five YearsDocument83 pagesA Project Report On Working Capital Management of Hindalco For The Last Five YearsBabasab Patil (Karrisatte)0% (1)

- Industry Profile KMF HASSAN QuestionDocument36 pagesIndustry Profile KMF HASSAN QuestionSujay HvNo ratings yet

- ProjectDocument85 pagesProjectJoshua JoelNo ratings yet

- MainDocument72 pagesMainNikhil NikzNo ratings yet

- A Project Report On Organization Study of Dharwad Milk UnionDocument45 pagesA Project Report On Organization Study of Dharwad Milk UnionBabasab Patil (Karrisatte)No ratings yet

- A PROJECT REPORT On Impact of Promotional Activities On Creating Awareness at NANDINI MILK HUBALIDocument83 pagesA PROJECT REPORT On Impact of Promotional Activities On Creating Awareness at NANDINI MILK HUBALIBabasab Patil (Karrisatte)100% (1)

- A Study On BAMUL (Comsumer Perception)Document105 pagesA Study On BAMUL (Comsumer Perception)gauravfast77100% (1)

- External Guide Internal GuideDocument16 pagesExternal Guide Internal GuidePriya PriyaNo ratings yet

- List of Charts FOR TRAINING AND DEVELOPMENTDocument31 pagesList of Charts FOR TRAINING AND DEVELOPMENTVaishnavi VaishnaviNo ratings yet

- Organisational Study Amp Marketing Distribution Channels Towards Karnataka Milk Federation KMFDocument71 pagesOrganisational Study Amp Marketing Distribution Channels Towards Karnataka Milk Federation KMFAfra SayedNo ratings yet

- Project Report ON "Financial Analysis of Verka Milk Plant Through Ratio Analysis"Document39 pagesProject Report ON "Financial Analysis of Verka Milk Plant Through Ratio Analysis"rajveer kaurNo ratings yet

- Working Capital Dodly DairyDocument90 pagesWorking Capital Dodly DairyRAKESHNo ratings yet

- B1714012 Omprakash Bongale ProjectDocument35 pagesB1714012 Omprakash Bongale ProjectBongale OmprakashNo ratings yet

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- Finance ProjectDocument81 pagesFinance ProjectreamsNo ratings yet

- KMF Bellary Final14.8.2009Document73 pagesKMF Bellary Final14.8.2009Amrutha upparNo ratings yet

- Project KOMULDocument22 pagesProject KOMULPushpaNo ratings yet

- VIJAYA DAIRY - FUNDS FLOW-Hari PrasadDocument76 pagesVIJAYA DAIRY - FUNDS FLOW-Hari Prasadthella deva prasadNo ratings yet

- Belgaum Milk Union Ltd.Document104 pagesBelgaum Milk Union Ltd.Meenakshi Chandavarkar100% (1)

- Summer Project ReportDocument57 pagesSummer Project Reportshrirangkatti100% (3)

- Shree Full Project in PDFDocument79 pagesShree Full Project in PDFGiri Sachin0% (1)

- About Us: "Nandini"Document37 pagesAbout Us: "Nandini"Amruthalaxman50% (2)

- 01 Supply Chain ManagementDocument57 pages01 Supply Chain ManagementJeby Benzy100% (1)

- SAM - KMF Report For MKUDocument55 pagesSAM - KMF Report For MKUsamthedon100% (2)

- Komul Executive SummaryDocument15 pagesKomul Executive Summarypraveennayaknayak25No ratings yet

- Final Project On Parag Dairy IndustryDocument68 pagesFinal Project On Parag Dairy IndustrySNEHAM29100% (2)

- CampcoDocument20 pagesCampcoRamya Pucheri Karuvakode100% (1)

- Abhishek BAMULDocument56 pagesAbhishek BAMULRanjith PNo ratings yet

- Working Capital ManagementDocument92 pagesWorking Capital ManagementHarish ChintuNo ratings yet

- Sai Agro IndustriesDocument77 pagesSai Agro Industriesanon_562144670No ratings yet

- WORKING CAPITAL PRO SimlexDocument78 pagesWORKING CAPITAL PRO Simlexboidapu kanakarajuNo ratings yet

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- Unit 1: Understanding Equity: Public Equity Vs Private EquityDocument10 pagesUnit 1: Understanding Equity: Public Equity Vs Private EquityPulkit AggarwalNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- Rogers Barco RaijuDocument7 pagesRogers Barco RaijuMohit KatiyarNo ratings yet

- Sept. 25 Letter To Westfield State University President Evan Dobelle, From Mass. Department of Higher Education Commissioner Richard M. FreelandDocument4 pagesSept. 25 Letter To Westfield State University President Evan Dobelle, From Mass. Department of Higher Education Commissioner Richard M. FreelandGreg SaulmonNo ratings yet

- Rous's Notes Finance CanDocument116 pagesRous's Notes Finance CanMoatasemMadianNo ratings yet

- Acct102 Midterm NotesDocument15 pagesAcct102 Midterm NotesWymple Kate Alexis FaisanNo ratings yet

- 001EBM Goh PR EtallDocument4 pages001EBM Goh PR EtallMabethNo ratings yet

- Chapter 4Document52 pagesChapter 4Maharani KumalasariNo ratings yet

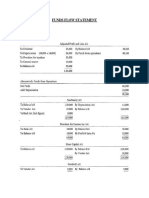

- Funds Flow Statement: Numerical 1Document4 pagesFunds Flow Statement: Numerical 1Neelu AhluwaliaNo ratings yet

- USAID SustainableFishingDocument41 pagesUSAID SustainableFishingfrancisdimeNo ratings yet

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDocument2 pagesRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir Mendoza100% (1)

- Economics IIDocument3 pagesEconomics IIWaqas AyubNo ratings yet

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- Bank Accounts and Credit SecuritiesDocument13 pagesBank Accounts and Credit SecuritiesJay Alcain OrpianoNo ratings yet

- Arch 159: The Architectural Firm: Architect Perry Jan N. Remolador, UapDocument15 pagesArch 159: The Architectural Firm: Architect Perry Jan N. Remolador, UapApril GabayanNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)BakhtawarNo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- MentormindDocument23 pagesMentormindSonia GraceNo ratings yet

- Assesment of Hindu Undivided FamiliesDocument17 pagesAssesment of Hindu Undivided FamiliesHarini Priyanka DravidaNo ratings yet

- Taxation LAW: I. General PrinciplesDocument5 pagesTaxation LAW: I. General PrinciplesclarizzzNo ratings yet

- Ap Drill 3 (She)Document5 pagesAp Drill 3 (She)ROMAR A. PIGANo ratings yet

- G Receipt VoucherDocument14 pagesG Receipt VoucherAqram Othman100% (1)

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocument2 pagesLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNo ratings yet

- Balance Sheet (LIST)Document6 pagesBalance Sheet (LIST)Apryl TaiNo ratings yet

- Gross Estate IntroductionDocument2 pagesGross Estate IntroductionJustz LimNo ratings yet

Project Report of KMF

Project Report of KMF

Uploaded by

Arun NagaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report of KMF

Project Report of KMF

Uploaded by

Arun NagaCopyright:

Available Formats

A Study on Working Capital Management at KMF

EXECUTIVE SUMMARY

Karnataka Milk Federation (KMF) is the apex body in Karnataka

representing Dairy Farmers Co-operatives. It is the third largest dairy co-

operative amongst the dairy co-operative operatives in the country. In South

India it stands first in terms of procurement as well as sales. One of the core

functions of the Federation is marketing of milk and milk products.

The Corporate Exposure and Learning (CEL) conducted at Karnataka

Milk Federation consist of two parts:-

Part A consists of a general study relating to the organization. It

consists of the kind of industry they belong to and the type of business

undertaken by them. It also consists of information about various divisions,

on how they function, the strategies and policies used by each division and

how they are able to achieve their goals. The study includes the functioning

of KMF with reference to Mc Kinsey’s 7S framework, which is an indicator

to KMF’s performance and for what it is till date.

Part B consists of a detailed study on the Working Capital

Management of the organization. The study states on how the liquidity

position is being maintained by KMF. This study is carried out to find the

financial health of KMF by using various ratios. The objective of this study

is to thoroughly analyze the organization’s solvency, profitability and

performance over the years.

Lal Bahadur Shastri Govt First Grade College, Bangalore 1

A Study on Working Capital Management at KMF

CHAPTER 1

INTRODUCTION

INTRODUCTION TO FINANCE:-

Lal Bahadur Shastri Govt First Grade College, Bangalore 2

A Study on Working Capital Management at KMF

Finance if the life blood of a business. The Financial Management

study about the process of procuring and judicious use of financial resources

with a view to maximizing the valued of the firm thereby the value of the

owners i.e., equity shareholders in a company is maximized.

The traditional view of Financial Management looks into the following

functions that a Finance Manager of a business firm will perform.

✔ Arrangement of short term and long term funds from financial

institutions.

✔ Mobilization of funds through financial instruments like Equity

shares, Preference shares, Debentures, Bonds etc.

✔ Orientation of Finance functions with the Accounting function and

compliance of legal provisions relating to funds procurement, use and

distribution.

With the increase in complexity of modern business situation, the role of a

Finance Manager is not just confined to procurement of funds, but his area

of functioning is extended to judicious and efficient use of funds available to

the firm, keeping in view the objectives of the firm and expectations of the

providers of funds.

INTRODUCTION TO WORKING CAPITAL

Lal Bahadur Shastri Govt First Grade College, Bangalore 3

A Study on Working Capital Management at KMF

Working capital management is a significant in financial management

due to the fact that it plays a pivotal role in keeping the wheels of a business

enterprise running. Working capital management is concerned with short-

term financial decisions. Shortage of funds for working capital has caused

many businesses to fail and in many cases, has retarded their growth. Lack

of efficient and effective utilization of working capital leads to earn low rate

of return on capital employed or even compels to sustain losses. The need

for skilled working capital management has thus become greater in recent

years.

A firm invests a part of its permanent capital in fixed assets and keeps

a part of it for working capital i.e. for meeting the day to day requirements.

We will hardly find affirm which does not require any amount of working

capital for its normal operations. The requirement of working capital varies

from firm to firm depending upon the nature of business, production policy,

market conditions, seasonality of operations, conditions of supply etc.

Working capital to a company is like the blood to the human body. Working

capital is the lifeblood of any business firm and shortage of funds for

working capital will lead to business failure. The management of short term

funds. Working capital management if carried out effectively, efficiently and

consistently, will assure the health of an organization.

MEANING OF WORKING CAPITAL:

Working capital is defined as “the excess of current liabilities”.

Current assets are those assets which will be converted into cash within the

Lal Bahadur Shastri Govt First Grade College, Bangalore 4

A Study on Working Capital Management at KMF

current accounting period or within the next year as a result of the ordinary

operations of the business. They are cash or near cash resources. These

include:

✔ Cash and Bank balances

✔ Receivables

✔ Inventory

○ Raw-materials, stores and spares

○ Work-in-progress

○ Finished goods

✔ Prepaid expenses

✔ Short-term advances

✔ Temporary investments

The value represented by these assets circulates among several items. Cash

is used to buy raw-materials, to pay wages and to meet other manufacturing

expenses. Finished goods are produced. These are held as inventories. When

these are sold, accounts receivables are created. The collection of accounts

receivable brings cash into the firm. The cycle starts again.

Current liabilities are the debts of the firms that have to be paid

during the current accounting period or within a year. These include:

✔ Creditors for goods purchased

✔ Outstanding expenses i.e., expenses due but not paid

✔ Short-term borrowings

✔ Advances received against sales

✔ Taxes and dividends payable

✔ Other liabilities maturing within a year.

Lal Bahadur Shastri Govt First Grade College, Bangalore 5

A Study on Working Capital Management at KMF

Working capital is also known as circulating capital, fluctuating capital and

revolving capital. The magnitude and composition keep on changing

continuously in the course of business.

OPERATIONAL DEFINITIONS OF THE CONCEPTS:-

Working capital

Working capital may be regarded as that portion of a firm’s total

capital, which is employed in financing its day-to-day operations such as

cash, debtors, inventories, marketable securities etc., it is the amount of

funds, which a firm holds, in the form of current assets to meet its current

obligations. It’s also known as Revolving and Circulating capital.

CLASSIFICATION OF WORKING CAPITAL:-

Gross Working Capital:

It is the capital invested in the total current assets of the enterprise.

E.g. Cash, Bills receivables, Sundry debtors, Short-term loans, Pre-paid

expenses etc.,

Net Working Capital:

It is the excess of current assets over current liabilities. Or it is the

difference between the current assets and current liabilities.

Negative Working Capital:-

Lal Bahadur Shastri Govt First Grade College, Bangalore 6

A Study on Working Capital Management at KMF

It refers to the excess of current liabilities over the current assets. Its

also known as Working Capital Deficit.

Permanent Working Capital:

It refers to the amount of investment made permanently in current

assets required throughout the year to carry out the business operations

successively. Permanent working capital is to be financed out of long-term

funds but no return can be expected from it. Permanent Working Capital is

also known as regular or fixed or had core Working Capital.

Temporary Working Capital:

It is the additional Working Capital, which is required for financing

the increase in the volume of business operations at different times during

the operating year. Thus it refers to the amount of Working Capital, which

goes on fluctuating or changing from time to time with the change in the

volume of business activities. Its also known as variable or fluctuating

Working Capital. It is to be financed out of short-term funds and some return

can be expected from it.

Current Assets:

Current assets are those assets which change their form and substance,

and which are converted into cash during the normal operating cycle of the

business or within an accounting year. In short, all those assets, which can

be converted into cash within an accounting year, are called Current Assets.

They include cash, short-term securities, debtors, bills receivables and stock

inventory.

Current Liabilities:

Lal Bahadur Shastri Govt First Grade College, Bangalore 7

A Study on Working Capital Management at KMF

Current Liabilities are those claims of outsiders, which are expected to

mature for payment within an accounting year. In other words, it refers to all

short term obligation or liabilities which are required to be repaid within a

period of one year out of short-term or current assets. They include creditors,

bills payables, outstanding expenses and provision for taxation etc.,

Cost of Goods Sold:

It refers to opening stock of finished goods plus purchases of finished

goods plus all direct expenses incurred on finished goods minus closing

stock of finished goods. Alternatively, the cost of goods sold can be taken as

sales of finished goods minus gross profit.

Cash:

Cash is the money, which the firm can disburse immediately without

any restrictions. It includes coins, currency and cheques held by the firm and

balances in bank accounts. Sometimes mere cash items such as marketable

securities or bank time cheques are included in cash.

OBJECTIVES OF WORKING CAPITAL:

The basic objectives of working capital management are as follows:

✔ By optimizing the investment in current assets and by reducing the

level of current liabilities, the company can reduce the locking up of

funds in working capital there by; it can improve the return on capital

employed in the business.

Lal Bahadur Shastri Govt First Grade College, Bangalore 8

A Study on Working Capital Management at KMF

✔ The second important objective of working capital management is that

the company should always be in a position to meet its current

obligations which should properly be supported by the current assets

available with the firm. But maintaining excess funds in working

capital means locking of funds without return.

TOOLS AND TECHNIQUES OF WORKING CAPIRAL ANALYSIS:-

✔ Gross current assets:- This tool tells us the amount invested in the

various components of current assets and its share in a total

investment of the company. By studying this, financial manager is

able to manage efficiently, the working capital, which ensures the

greatest return on its investment, planning and control of funds.

✔ Ratio Analysis: - A ratio is a quotient of two numbers i.e. the relation

of one item to another expressed in a simple mathematical form. Here

we are considering the ratios, which talks about the efficiency of

working capital management. They include:-

Working Capital management

Current Asset to Total Asset

Current Ratio

Net Working Capital Turnover Ratio

Gross Working Capital Ratio

Current Asset Turnover Ratio

Working Capital Turnover Ratio

Operating Cycle.

Cash Management

Lal Bahadur Shastri Govt First Grade College, Bangalore 9

A Study on Working Capital Management at KMF

Quick Ratio

Absolute Liquid Ratio

Liquid Asset to Working Capital Ratio

Cash/Bank to Current Asset

I

introduction to Nandini Milk Industry (KMF)

Karnataka Milk Federation – a harbinger of rural prosperity

Karnataka Milk Federation (KMF) is the largest cooperative dairy

Federation in South India, owned and managed by milk producers of

Karnataka State. KMF has over 2 million milk producers in over 10500

Dairy Cooperative Societies at village level, functioning under 13 District

Cooperative Milk Unions in Karnataka State. The mission of the federation

is to usher rural prosperity through dairy development. During the last four

decades of cooperative dairy development by KMF, the dairy industry in

Karnataka has progressed from a situation of milk-scarcity to that of milk-

surplus.

“Quality Excellence from Cow to Consumer” – is the motto of the

Federation to obtain better-quality Milk and milk products from our value

chain (Procurement to Processing to Marketing). Thus milk and milk

products, under “Nandini” brand name, are unmatched in quality made

available to consumers at most competitive prices. In a way Nandini Milk

and Milk Products are “Spreading wealth of health”.

Karnataka Cooperative Milk Producers' Federation Limited (KMF) is the

Apex Body in Karnataka representing Dairy Farmers' Co-operatives. It is the

second largest dairy co-operative amongst the dairy cooperatives in the

country. In South India it stands first in terms of procurement as well as

sales. One of the core functions of the Federation is marketing of Milk and

Milk Products. The Brand “Nandini" is the household name for Pure and

Fresh milk and milk products.

Lal Bahadur Shastri Govt First Grade College, Bangalore 10

A Study on Working Capital Management at KMF

KMF has 13 Milk Unions throughout the State which procure milk from

Primary Dairy Cooperative Societies (DCS) and distribute milk to the

consumers in various Towns/Cities/Rural markets in Karnataka.

The first ever World Bank funded Dairy Development Program in the

country started in Karnataka with the organization of Village Level Dairy

Co-operatives in 1974. The AMUL pattern of dairy co-operatives started

functioning in Karnataka from 1974-75 with the financial assistance from

World Bank, Operation Flood II & III. The dairy co-operatives were

established under the ANAND pattern in a three tier structure with the

Village Level Dairy Co-operatives forming the base level, the District Level

Milk Unions at the middle level to take care of the procurement, processing

and marketing of milk and the Karnataka Milk Federation as the Apex Body

to co-ordinate the growth of the sector at the State level.

Coordination of activities among the Unions and developing market for Milk

and Milk products is the responsibility of KMF. Marketing Milk in the

respective jurisdiction is organized by the respective Milk Unions.

Surplus/deficit of liquid milk among the member Milk Unions is monitored

by the Federation. While the marketing of all the Milk Products is organized

by KMF, both within and outside the State, all the Milk and Milk products

are sold under a common brand name NANDINI.

THE GROWTH PROCESS

The growth over the years and activities undertaken by KMF is summarized

briefly hereunder:

1976- 2010-2011(Up to

77 Jan'11)

12262 Regd./10766

Dairy Co-operatives Nos 416

Funct.

Membership Nos 37000 20.65 Lacs

38.34 / Peak Proc.41.83

Milk Procurement Kgs/day 50000

LKPD

26.26 / Curds: 2.38

Milk Sales Lts/day 95050

LKPD

Lal Bahadur Shastri Govt First Grade College, Bangalore 11

A Study on Working Capital Management at KMF

Cattle Feed

Kgs/DCS 220 2459

Consumed

Daily Payment to

Rs.Lakhs 0.90 584

Farmers

Turnover Rs.Crores 3802.00

World Bank Study - Observations

The World Bank, in its study on the effect of Co-operative dairying in

Karnataka, has pointed out that:

• The villages with Dairy Co-operative Societies are much better off than

those without.

• The families with dairy cattle are economically better than those without

dairy cattle.

• Women who had no control on the household income have better control in

terms of Milk Money.

• A single commodity �MILK� has acted as a catalyst in the change in the

Socio-Economic impact of the rural economy.

• There is a positive impact on those at the lower end of the economic ladder

both in terms of landholding and caste.

PERSPECTIVE PLAN 2010

Lal Bahadur Shastri Govt First Grade College, Bangalore 12

A Study on Working Capital Management at KMF

After the closure of OF-III project. Government of Karnataka and NDDB

signed an MOU during February 2000, for further strengthening the Dairy

Development Activities in Karnataka with an outlay of Rs.250 Cores.

Consequent to the announcement of new lending terms and conditions by

NDDB through an evolution of an action plan - Perspective 2010 to enable

the dairy cooperatives to face the challenges of the increased demand for

milk and milk products by focusing efforts in the four major thrust areas of

Strengthening the Cooperatives. Enhancing Productivity, Managing Quality

and building a National Information Network, plans are under

implementation.

FUTURE VISION

To consolidate the gains of Dairying achieved in the state of Karnataka and

with a view to efficiently chill, process and market ever developing and

increasing milk procurement with an utmost emphasis on the Quality and in

the process conserve the socio-economic interests of rural milk producers,

the Govt. of Karnataka through KMF has proposed to undertake several

projects with financial and technical support of NDDB for which an MOU

was signed between Govt. of Karnataka and NDDB on 10th Nov. 2004.

PROJECTS:

• Channaraypatna Milk Powder Plant consisting of 30 MT Powder Plant, 4

LLPD Dairy and butter making facility - Established & UHT of 1LLPD is

being commissioned

• Proposed for establishment of Cattle Feed Plants

- Hassan 300 MTPD Capacity - project execution under progress

- Shimoga 300 MTPD Capacity

- Challagatta (Near B'lore) 500 MTPD Capacity

• Multi packaging unit and Ice Cream Plant at Bellary Milk shed area.

GOI PROJECT - RKVY (Rashtriya Krushi Vikas Yojane)

• Fodder densification unit at different place of capacity 10 Tones each.

• Bio Security measures at Nandini Sperm Station, unit of KMF

• Strengthening of Training Centers at Bangalore, Mysore, Dharwad.

• Strengthening Works at Bijapur, Gulbarga, Bidar & Bellary Daily.

Lal Bahadur Shastri Govt First Grade College, Bangalore 13

A Study on Working Capital Management at KMF

Other GOK Financial Support:

1. To support Milk Producers of DCS members GOK is providing an

amount of Rs.2.00 per liter as incentive to the milk producer from 2008-09

onwards.

2. GOK is providing financial assistance for strengthening Dairy

Development infrastructure facilities at Northern Karnataka milk unions

jurisdiction which will also redress regional imbalance as per Dr.

Nanjundappa's report.

UNITS OF KMF

KMF has the following Units functioning directly under its control:

• Mother Dairy, Yelahanka,Bangalore.

• Milk Product Plant, Channarayapatna.

• Nandini Milk Products, KMF Complex, Bangalore.

• Cattle Feed Plants at Rajanukunte/Gubbi/Dharwad/Hassan.

• Nandini Sperm Station (formerly known as Bull Breeding Farm & Frozen

Semen Bank) at Hessaraghatta.

• Pouch Film Plant at Munnekolalu, Marathhalli.

• Central Training Institute, Bangalore & Training Institutes at

Mysore/Dharwad.

• Sales Depots at B'lore, Mysore, M’lore, Hubli, Gulbarga, Tirupathi &

Kanpur.

Vision

• To march forward with a missionary zeal which will make KMF a

trailblazer of exemplary performance and achievements beckoning other

Milk Federations in the country in pursuit of total emulation of its good

deeds?

• To ensure prosperity of the rural Milk producers who are ultimate owners

of the Federation.

• To promote producer oriented viable cooperative society to impart an

impetus to the rural income, dairy productivity and rural employment.

• To a bridge the gap between price of milk procurement and sale price.

• To develop business acumen in marketing and trading disciplines so as to

serve consumers with quality milk, give a fillip to the income of milk

producers.

• To compete with MNCs and Private Dairies with better quality of milk and

milk products and in the process sustain invincibility of cooperatives.

Lal Bahadur Shastri Govt First Grade College, Bangalore 14

A Study on Working Capital Management at KMF

MISSION

• Heralding economic, social and cultural prosperity in the lives of our milk

producer members by promoting vibrant, self-sustaining and holistic

cooperative dairy development in Karnataka State

Objectives

KMF is a Cooperative Apex Body in the State of Karnataka representing

organizations of milk producers' and implementing alround dairy

development activities to achieve the following objectives:

• To ensure assured and remunerative market round the year for the milk

produced by the farmer members.

• To make available quality milk and other premier dairy products to urban

consumers.

• To build & develop village level institutions as cooperative model units to

manage the dairy activities.

• To ensure provision of inputs for milk production, processing facilities and

dissemination of know how.

• To facilitate rural development by providing opportunities for self

employment at village level, preventing migration to urban areas,

introducing cash economy and opportunity for a sustained income.

The philosophy of dairy development is to eliminate middlemen and

organize institutions to be owned and managed by the milk producers

themselves, employing professionals. To sum it up, every activity of KMF

revolves around meeting one basic objective: 'Achieve economies of scale to

ensure maximum returns to the milk producers, at the same time facilitate

wholesome milk at reasonable price to urban consumers'. Ultimately, the

complex network of cooperative organization should build a bridge between

masses of rural producers and millions of urban consumers and in the

process achieve a socio-economic revolution in every hinterland of the State.

Evolution

Karnataka Milk Federation which is most popular as KMF, evolved itself as

a premier and most profitable dairy farmers' organization in the State of

Karnataka.

As an agency in 1975 to implement the World Bank Aided Dairy

Development Projects, Karnataka Dairy Development Corporation (KDDC)

was formed, the company grew itself fast and as it spreads the wings of new

Lal Bahadur Shastri Govt First Grade College, Bangalore 15

A Study on Working Capital Management at KMF

found rural economic activity - Dairying all over the State, the genesis of

apex cooperative body took the shape of KMF in 1983 encompassing entire

State with 13 District Co-operative Milk Unions executing the various

parameters of Dairy activity - organization of Dairy Co-operatives, Milk

Routes, Veterinary Services, Procurement of milk in two shifts of the day,

Chilling, Processing of milk, distribution of milk and also establishment of

Cattle Feed Plants, Nandini Sperm Station, Liquid Nitrogen Supply,

Training Centers - as its main stay.

The entire system was reconstructed on the model of now well known

`ANAND' pattern dairy cooperative societies. Eight southern districts of

Karnataka was considered initially with a target of organizing 1800 Dairy

Co-operative Societies, four Milk Unions and processing facilities were set

up to the tune of 6.5 lakhs per day by 1984.

Under Operation Flood - II &III, project which started in 1984 & 1987

covered the remaining parts of Karnataka. Thirteen milk unions are

organized in 175 talukas of all 20 districts then and the field work was

extended by organizing more dairy cooperative societies. The processing

facilities i.e. chilling centers, milk dairies and powder plants were

transferred in phases to the administrative control of respective cooperative

milk unions and the activities continued to be implemented by these District

Organizations. Additional processing facilities were created & existing

facilities augmented every decade with the help of Govt. / Zilla Panchayat

and NDDB to handle ever increasing milk procurement without declaring

milk holidays. The processing facility as exists at 32.25 lakh liters/day is

further strengthened.

DAIRY SCENARIO:-

Indian Agriculture is an economic symbiosis of crop and cattle

production small and marginal farmers owing land holding engaged in

agriculture. Agriculture provides as employment for short duration in whole

year and part of workforce is virtually unemployed. In the situation dairying

sets right this imbalance in employment.

Dairying sector provides farm families the triple benefits of nutritive

food, supplementary income and productive employment for family labour.

Lal Bahadur Shastri Govt First Grade College, Bangalore 16

A Study on Working Capital Management at KMF

By looking into the progress in dairy sector, there are some

achievements & they are:-

✔ Number One Commodity:- Milk is India’s number one form

commodity in terms of its contribution to the National Economy.

✔ World’s Number One Producer: - In 1995, the United States was

the world’s number one milk producer with its annual milk production

of 72 million tons. In 1998, when India’s annual output is projected at

78 million tons.

✔ Values of Dairy Output:- The value of output from dairying based

on consumer process is high i.e. 1,05,000 crores (1997) and 1,50,00

crores (2000A

CHAPTER 2

RESEARCH

Lal Bahadur Shastri Govt First Grade College, Bangalore 17

A Study on Working Capital Management at KMF

DESIGN

RESEARCH DESIGN

According to Johade Cook “A research design is the arrangement of

conditions for collection and analysis of data in the manner that aim to

combine relevance to research process with economy in procedure”.

✔ “The research methodology or research design constitutes the blue

print for the collection, measurement and analysis of data”

✔ “Research Design is the plan and structure of investigation so

conceived as to obtain answers for the research questions. It includes

an outline of what the researcher will do from writing the hypothesis

and their operational implications to the final analysis of data”

The different types of research design are:

Lal Bahadur Shastri Govt First Grade College, Bangalore 18

A Study on Working Capital Management at KMF

✔ Exploratory Research.

✔ Conclusive Research.

✔ The research design adopted here is of Descriptive Research

Design.

This type of design is followed when

The objectives are clearly stated.

The sampling technique going to be adopted is known.

The sampling size is determined.

The type of data collection is determined.

DATA COLLECTION:-

The data collection is one of the important aspect in the research

design purely because, it is the way that how we can get answer to the

research question.

SOURCES OF DATA COLLECTION:-

All the details are collected from secondary sources only.

Secondary data includes, the annual reports, financial reports of the

company etc., discussion with the concerned officials has also helped to

verify and evaluate the variations and results either to confirm it..

The data is collected in two ways:

✔ Primary Data

✔ Secondary Data

Primary Data:-

Lal Bahadur Shastri Govt First Grade College, Bangalore 19

A Study on Working Capital Management at KMF

The primary data collection is one of the key tools used by the

researcher for data collection. It is the first hand information collected by the

researcher from the respondents directly. Primary data is collected through

observation and communication

Secondary Data:-

The secondary data is another form of data collection, where the data

is collected from the existing records, company manual and form previously

carried out research work and also through internet.

SCOPE OF THE STUDY:-

The study will help in analyzing the working capital for a period of

five years i.e. from 2005-06 to 2009-2010 of KMF. This is so because ratios

may not prescribe any practical standards, as they are several in numbers for

each element of study. The study helps us in finding out how well the

organization is managing the working capital.

IMPORTANCE OF THE STUDY:-

The study has got importance because working capital affects the day-

to-day operations of the business firm to larger extent. Thus, effective

management of the working capital is required for the smooth functioning of

the business firm.

There is always a need and much importance will be given for

working capital because there is always a time gap between the sales of

goods and receipt of sales proceeds. During this period, working capital is

Lal Bahadur Shastri Govt First Grade College, Bangalore 20

A Study on Working Capital Management at KMF

required for sustaining or maintaining the sales activities. If adequate

working capital is not maintained for this period , the firm will not be able ot

sustain or maintain the sales, since it may not be in a position to purchase

raw materials and pay wages and other expenses and produce the goods for

the sale.

Thus, every firm requires adequate Working Capital to run its

business smoothly and successfully. It is very important to have adequate

Working Capital for that there must be efficiency in managing the working

capital requirements of the firm. However, there is a danger from both

excessive and in-adequate working capital positions.

The following two reasons state its importance.

1. Investment in current assets represents a substantial portion of total

investment.

2. Investment in current assets and the level of current liabilities have to

be geared quickly to the changes in sales.

Thus importance of Working Capital Management is reflected in the fact

that Financial Managers spent a great deal of time managing current

assets and current liabilities.

OBJECTIVES OF THE STUDY:-

✔ To reflect the working efficiency of the concern.

✔ To compare the efficiency of the firm.

✔ To know the working capital of KMF as a whole.

✔ To study the pattern and procedure followed regarding working

capital management in KMF with special reference to:-

➢ Cash Management.

Lal Bahadur Shastri Govt First Grade College, Bangalore 21

A Study on Working Capital Management at KMF

✔ To study the liquidity of assets used. The ratio relating to the liquidity

speaks about how easy the assets can be converted into cash.

✔ To study in detail the reasons for ups and downs in working capital

position, by studying variations in individual assets.

STATEMENT OF THE PROBLEM:-

Working Capital management plays a vital role in an organization as

it represents a substantial portion of the total investment. The importance of

working capital management is reflected in the fact that financial managers

spend a great deal of time in managing current assets and liabilities. When

not managed in proper manner i.e., if the amount invested is more in

working capital it results in funds getting locked, which otherwise may be

invested elsewhere in a profitable manner and at the same time if there is

inadequate investment, it results in shortage of funds and day to day

activities may come to a standstill.

Working Capital analysis depends to a large extent on the study of

each asset independently by calculating ratios, preparing fund flow

statements etc. this techniques help in scientific decision-making process or

in deciding the efficiency in utilizing working capital. Thus the problem

taken for study is “Working Capital Analysis”

The study shows a comparative analysis of the relevant ratios

concerned with working capital of KMF.

.

REFERENCE PERIOD:-

The period covered under this is five financial years i.e. from

Lal Bahadur Shastri Govt First Grade College, Bangalore 22

A Study on Working Capital Management at KMF

2005-2006 to 2009-2010.

CONTEXT OF THE STUDY:-

The context of the study considers the following two important

facts which are very much essential for the study of Working Capital

Management in KMF.

✔ Whether the Working Capital of KMF is sufficient or adequate.

✔ Whether the Working Capital is properly framed and utilized.

REASON FOR THE STUDY:-

The reason or motive for the study on the “Working Capital

Management” indicates the never ending requirements of the working

capital and its importance in the day to day business operations of the

business organization; either it may be a small scale or medium scale or

large scale enterprise.

Therefore, the reason for the study on the “Working Capital

Management” mainly focuses on ‘the advance of working capital and its

proper management during all the times’.

LIMITATIONS OF THE STUDY:-

The study covers a period of 3 years with the available sources i.e.

from 2007-08 to 2009-10.

✔ 10 weeks being a very short time, I have done a study that I feel to be

comprehensive and possible in this time. However, some other details

of methods of analysis could definitely be found which I have missed

out there.

✔ The study has been restricted to the head office in Bangalore.

Lal Bahadur Shastri Govt First Grade College, Bangalore 23

A Study on Working Capital Management at KMF

✔ The study is general.

✔ Inter firm and intra firm comparison is not possible.

✔ Interactions with the company professionals were limited due to their

busy schedule.

✔ Limitations of historical accounts.

✔ Conclusions will be drawn based on theory and supplemented by

figure wherever feasible.

CHAPTER 3

COMPANY

PROFILE

Lal Bahadur Shastri Govt First Grade College, Bangalore 24

A Study on Working Capital Management at KMF

1. COMPANY PROFILE

INTRODUCTION

Mother Dairy a unit of Karnataka Milk Federation which is

located in Yelahanka in the Bangalore North Taluk, was established in a

total area of 28 acres during under of II with a processing capacity of two

lakh liters per day on 7.12.1984 later, the processing capacity of the diary

was expanded to handle 4 Lakh liters per day during 1993-94 with an

additional cost of Rs.3.64 Corers Total of investment for this project is

Rs.10.61 corers. The different facilities available at mother diary are mother

is procuring 2.4 lakh liters milk per day from kolar Milk sadali and

Gowribidnur are possessing bulk milk coolers, through road milk toners.

The Diary is processing and distributing on average 2.25 lakh liters of Milk

per day to the consumers in Bangalore city with the increase in demand for

liquid milk. It is planned to increase the processing capacity of the Diary.

Milk is highly nutritive and majority of Indian population rely on milk

for their protein supplement milk is obtained by milking well bread cows

Lal Bahadur Shastri Govt First Grade College, Bangalore 25

A Study on Working Capital Management at KMF

and buffaloes, either manually or through sterilized milking machine milk

cream, cheese ghee, condensed milk of milk-protein are the dairy products

which are separated from milk through various process. The essence of

organizational study relates to Co-ordination of one department with area

ores in this organization Industrialization is taking place in such a rapid

place that the entrepreneurs or industrialists often forget to know the overall

functioning of all the systems of an organization in the most of corporate

objectives. This may be viewed all one of the reason where most of our

industries one becoming with day to day. The magic behind the successful

entrepreneur in this competition age lines in one detailed knowledge of one

functionary of the organization system.

BACK GROUND

In June 1974, an integrated project was launched in Karnataka

restructure and reorganizes the Diary Industry on the co-operative principle

and to lay foundation for a new direction in diary development. Work on the

first are World Bank aided Diary development was initiated in 1975.

Initially the project covered its southern districts of Karnataka and

Karnataka diary Development Corporation was setup to implement the

project corporation was setup to implement the project. The multi level,

multiunit organization will total vertical integration of all Diary

Lal Bahadur Shastri Govt First Grade College, Bangalore 26

A Study on Working Capital Management at KMF

development activities was setup with cooperative societies at grass root

level, milk unions at the middle level and Diary development cooperation at

the state level as on apex body vested with responsibility of implementing

Rs.51 Corers project. At the end of September 1984 the World Bank aided

project ended and diary development activates continued under operation

flood- II.

The Activities were extended to cover the entire state except costal

taluks ultra Karnataka district and the process of diary development was

continued in the second phase form April -1984 as a successor to KDDC.

After the closure of operation flood. II, the diary Development activates,

which continued under operation flood-III ended on 31.03.1996. The spills

over works are financed by NDDB from 1.04.1996 under different terms and

conditions.

COMPANY OBJECTIVES

Karnataka milk federation (KMF) is a cooperative apex body in the state of

Karnataka representing dairy farmers’ organization and also implementing dairy

development activities to achieve the following objectives.

Providing assured and remunerative market for the milk produced by the

farmer members.

Lal Bahadur Shastri Govt First Grade College, Bangalore 27

A Study on Working Capital Management at KMF

Providing quality milk to urban consumers.To build village level institutions

in cooperative sector to manage the dairy activities.

To facilitate rural development by providing opportunities for self

employment at village level preventing immigration to urban areas,

introducing cash economy and opportunity for steady income.

The Philosophy of dairy development is to eliminate middle men and organize

institutions to be owned and managed by the milk produces themselves,

employing professionals. Achieve economies of scale to ensure maximum

results to the milk producers at the same time providing whole some milk

producers at the same time providing wholesome milk at reasonable price to

urban consumers.

ORGANIZATION STATUS

At the End of March 2000, the network of Rs.8363 Diary co-operative

societies (DCS) have been organized and are spread over 166 taluks of the

total 175 taluks in all the 27 districts of Karnataka. These societies have

been organized into 13 milk unions. The unions are further federation there

are 38 chilling centers (Capacity 12.49 LLPD) 4 number of farm coolers

(Capacity 0.16) 17 number of liquid milk plants and two products diaries

for chilling and processing (21.20 LLPD) conservation (25TPD) and

marketing of Milk. To supply balanced cattle deed, three numbers of cattle

Lal Bahadur Shastri Govt First Grade College, Bangalore 28

A Study on Working Capital Management at KMF

feed plants of 100 TPD capacity with mineral mixture production facility in

one unit are functioning to ensure supply of quality germ plasma, bull

breeding farm and frozen semen bank has been established and is well

stocked with exotic quality high pedigree bill. To impart training one central

training Institute and 3 regional training centers are functioning. Three

diagnostic laboratories have been setup for disease monitoring. Three folder

demonstration farms at sahapur, kottanahalli, kudige and one seed

production farm at sahapur are also operating out of the above units, 16

numbers of dairies, 3 numbers of training centers and 3 numbers of

diagnostic labs are operating under respective unions.

OPERATION STATUS

The average procurement of milk touched a peak of 20.28 LKPD in

November 1999. In March 2000 liquid milk sales was at the level of 15.2

LLPD. The sale of cattle’s feed was 110605 tons during the year 1999-2000.

The turnover of the organization during 1999-2000 was Rs.998.39 Corers.

GENERAL Benefits of frontier technology are made available at framers

these hold sophisticated technology such as artificial insemination electronic

milk testing equipment, electronic mass media Technology, veterinary

biological etc. Are already being made available and further a pilot project

for embryo transfer at field level has been taken up in 1991 and about 237

Lal Bahadur Shastri Govt First Grade College, Bangalore 29

A Study on Working Capital Management at KMF

embryos have been implanted. The project now has been transferred to

Kolar Milk Unions, The activities cove prelusion of complete range of

inputs for basic milk production, processing facilities and marketing

facilities and marketing facilities. A special programmed for control of FMD

was implemented A progeny-testing scheme is also taken up to support

breeding activity. A herd book recording society known as Karnataka

Holstein Friesian Breeders Association (KAHFBA) has been established in

March 1991. With the active

KARNATAKA MILK FEDERATION (KMF)

The Role of Milk Federation

The Karnataka Co-operative milk producers federated Ltd.,

came into existence on 1/5/1984 by federating the milk unions in the state

and thus forming the state level apex organization. The federation is

implementing the project activities. The federation is implementing the

project activities when all the project activities are completed, the main role

of the federation will be to market surplus milk products and to produce and

supply centralized inputs.

FEDERATION FUNCTIONS

Lal Bahadur Shastri Govt First Grade College, Bangalore 30

A Study on Working Capital Management at KMF

Presently Mother Diary and Nandini Milk Products at Bangalore are

under the control of KMF fair cattle feed plants, a central training Institute

and centralized testing and quality control laboratory are functioning under

the direct control by KMF Co-operation of activities between the unions and

developing marketing in the area if union. The federation manager surpluses

and deficiencies of liquid milk amongst the member milk unions. However

the federation organizes marketing of products. The major quality of the

milk is sold as liquid milk. This apart other products like butter, Ghee, SMP,

Peda flavored milk, Burfi, Panner, Khava, Jamoons, Mysorepak, Badam

powder and Ice cream are also sold. Nandini Good Life pure Cow Milk with

an ambient shelf life of 45 days has been introduced by adopting ultra high

temperature treatment technology. The products are sold under the family

brand name of Nandini. The federation organizes marketing of liquid milk

and products outside the state. Excellence in quality is maintained to lay a

solid foundation for widespread acceptance of Nandini Products. This will

ensure an assured market for the ever increasing milk production Balanced

cattle feed, by pass cattle feed. Mineral mixture frozen semen straws and

liquid nitrogen are produced by the federation and supplied to the unions.

Training and development senior management personnel, acquiring and

applying all new relevant technologies prescribing quality guidelines and

norms are also the functions of the federation.

Lal Bahadur Shastri Govt First Grade College, Bangalore 31

A Study on Working Capital Management at KMF

MILE STONES

1955 - First Diary in Karnataka set up at Kudige, Kodagu

Dist.08.01.1955.

1965 - Biggest diary in Karnataka with 1.5 lakh liters per

Day liquid milk processing factory.

Set up in Bangalore on 23.02.1981

Expansion date 01.02.1981.

1974 - World Bank aided Karnataka Diary

Development project implemented 19.06.1974.

1974 - Karnataka Diary Development Corporation

(KDDC) is born .11.01.1974.

1975 - First spear head team is positioned 01.07.1975

1976 - First Registration of Union 23.11.1976

1980 - Karnataka Milk products Ltd. Established 01.3.1980

01.3.1980

1982 - First Milk product Diary started at Gejjalagere,

Monday 12.06.1982

1983 - Corporate brand name Nandini given 13.02.1983

a) First cattle feed plant commissioned at Rajanukunte

21.03.1983.

Lal Bahadur Shastri Govt First Grade College, Bangalore 32

A Study on Working Capital Management at KMF

b) Capacity Expanded form 100 Mtr to 200 Mtr

01.06.1997.

1984 - Bull Mother form and frozen semen Bank

Commissioned 01.01.1984. Operation Flood II

Implemented 01.04.1984 to 30.09.1987.

Operations flood II Implemented 01.04.1984 to

30.09.1987.

Karnataka milk federation is born 01.05.1984 KDDC

transformed into KMF into KMF 01.05.1984 KMPL

assets transferred to KMF 01.02.1984 product Diary

Dharwad Commissioned 12.09.1984 Mother Diary

Started functioning 01.12.1984

1985 - Remaining government dairies transferred to KMF

14.02.1985.

1987 - Operation Flood- III implemented 01.04.1987

Dairies at Hassan, Tumkur and Mysore transferred to

district milk unions 01.06.1987.

1988 - Dairies at Bangalore Gejjalagere, Dharwad

Belgaum and Mangalore transferred to district milk union

01.09.1988 training centers at Mysore Dharwad Gulbarga

transferred to Unions 01.12.1988.

Lal Bahadur Shastri Govt First Grade College, Bangalore 33

A Study on Working Capital Management at KMF

1989- Centralized marketing organized 01.05.1989 last milk

shed registered as a union (Raichur) 12.12.1989 milk

supplied to Kolkata Mother Dairy through railway

tankers from mother dairy, Bangalore 03.03.1989.

1991 - Karnataka Holstein Friesian Breeders Association

(KHAEBA) Registered 25.03.1991.

1992 - Commercial production and marketing of

NANDINI flavored milk launched September 1992.

1993 - Milk procurement on single day cross million Kg

Level in December 1986 and average milk procurement

per day for the year crosses million Kg level 1991-1992.

1994 - Liquid Milk sale crosses billion liters per day

February 1994.

1995 - Varieties of new Nandini Products Viz, Nandini

Panner, Burfi, Kava and sweet curds launched December

1995.

1996 - Foundation stone lay for cattle feed plant at

Hassan 09.02.1996 production stated 09.09.1998.

1996 - Foundation stone laid for mega Dairy and new

Powder plant at Bangalore, Mini Dairy schemes and

other development programmed 01.11.1996.

Lal Bahadur Shastri Govt First Grade College, Bangalore 34

A Study on Working Capital Management at KMF

1997 - Inauguration of Ice Cream manufacturing unit at

Mother Dairy premises Bangalore 12.06.1997

1998 - Launching new products Jamoon Mix –March 1998.

1999 - Tetra Fino Packaged Nandini “Good Life Milk March.

2000 - Badam Powder -17.01.2000

• Besan laddoo Sept 2004

• Good life High fat milk Dec 2000

• Nandini Goodlife Slim May 2002

• Good life 200ml Tetrabrick July 2002

• Good life 1 ltr Tetra Brik July 2002

2000 - MOU agreement signing by GOK & NDDB for

implementation of Perspective Plan.

2000 - Chilling Centre of 150 TLPD capacity at Hosakote

started

in Bangalore Union.

2000 - “Mega Dairy” started functioning in Bangalore Union.

2001 - Starting of Sales Depot at M'lore in addition to Depos at

B'lore, Hubli & Thirupathi.

2002 - Adoption of “Mnemonic Symbol”

• In Bangalore, D.K. & Mysore

• in Shimoga & Dharwad

2002 - Release of 50gm. SMP in metalized Polypack.

2002 - Registration of KMF website as “www.kmfnandini.coop”.

2002 - ‘Nandini Shop on Wheels' started (Mobile display cum

sales vehicle).

2002 - Release of Urea Molasses Brick(3Kg Pack)

2002 - Powder plant of 30 MT capacity started at Mother Dairy.

2004 - MOU agreement signing by GOK & NDDB for

implementation of Perspective Plan 2010.

2005 - Laying of Foundation stone for 30 MTs Powder Plant at

Lal Bahadur Shastri Govt First Grade College, Bangalore 35

A Study on Working Capital Management at KMF

Channarayapatna.

2005 - Launching of ‘Nandini Set Curd'.

2006 - Packing Station commissioned at Kumbalgodu (Mandya

Union).

2006- Depos opened at Kerala (Kannur & Ernakulam).

2006 - Foundation stone laid for New 300 MTs capacity at

Hassan & Inauguration of Existing CFP expansion from

100 MTs to 200 MTs.

2006-

• Expansion of Gubbi CFP from 100MTs to 150 MTs.

• Expansion of Dharwad CFP from 100 MTS to 150

MTs.

2006 - Release of new generation Drinks Tetra Pack variants of

Flavored milk & Buttermilk.

2007 - Release of Nandini Homogenized cow milk(3.5%Fat /

8.5%SNF) in Bangalore.

2007 - Opening of“Nandini Dairy Farmers Welfare Trust” hostel.

2007 - Launching of ”Bounce” brand milk at GOA.

2007 - Inauguration of additional Infrastructure facilities for UHT

milk production at Kolar from existing 40,000 LPD to

1.5LLPD.

2008 - Commissioning of Channarayapatna Product Plant at a total

cost of Rs. 72 Crores.

• Launch of New products & new stunning packs

(Sundae, Crazy Cone ice cream/Lite Skimmed Milk/

Cool Milcafe/Choco Milk Shake/Dairy Whitener)

• Launch of Goodlife Slim in 1Ltr Brik.

2009 - Gulbarga Dairy & Milk Marketing taking over by KMF

QUALITY POLICY OF MOTHER DAIRY

Every employee of Mother Diary will strive to provide milk and milk

products of outstanding quality with competitive rates, prompt delivery and total

customers satisfaction.

Lal Bahadur Shastri Govt First Grade College, Bangalore 36

A Study on Working Capital Management at KMF

ISO 9002 AND HACCP IS 15000 (HACCP) CERTIFICATE

Mother Dairy has obtained ISO 9002 and HACCP Certificate from Bureau of

Indian Standard (BIS) of government of India form December 2000. Mother

Dairy is the first and only dairy to secure the comprehensive certificate in the

entire south India.

The importance of obtaining this certificate is to:

Procure Manufacture & distribute the products under controlled set of

procedures as per ISO 9003.

To identify a probable occurrence of Hazard as during the process of

procurement manufacturing and distribution.

To identify the severity of Hazards during critical control point.

To control the Identified Hazards and to produce the products of

International food produce the products of international food safety

standards.

PRODUCT LINE

The Principle aim of mother dairy is to satisfy people with different tastes

and preference and income as such it has a broad product line satisfy the people

of different taste.

Toned Milk

Full Cream Milk

Lal Bahadur Shastri Govt First Grade College, Bangalore 37

A Study on Working Capital Management at KMF

Curd

Butter

Ghee

Ice-Cream

Nandini Milk Products profile

This unit has specialized production of milk based ethnic sweets like

Nandini toned milk

Nandini homogenized milk

Nandini full cream milk

Nandini milk products

Nandini curd

Nandini ghee

Nandini butter

Nandini paneer

Nandini Burfi

Nandini cheese

Nandini Mysore park

Nandini Peda

Nandini Burfi

Nandini Khova

Nandini Jamoon mix

Nandini Badam powder

Nandini Sugar free Peda

Nandini Bite

Nandini chocolate

Nandini Bulk cheddar cheese

Nandini Skimmed milk powder

Lal Bahadur Shastri Govt First Grade College, Bangalore 38

A Study on Working Capital Management at KMF

1) Nandini Peda:-

Nandini Peda is a delicious treat for the family, made from pure

milk available in 250gms pack containing 10 pieces each.

Dharwad Peda Nandini Sugar Free Peda

2) Nandini Paneer:-

This is heated to a temperature of 65 degree centigrade for 30

minutes and maximum should be at 70%.

Diced Paneer

3) Nandini Burfi:-

The maximum moisture should be 13-14 % and acidity should be

0.35

Dry fruits burfi Coconut Burfi

Lal Bahadur Shastri Govt First Grade College, Bangalore 39

A Study on Working Capital Management at KMF

5) Nandini milk powder: -

Enjoy the taste of pure milk skimmed milk powder from pure mik,

processed and packed hygienically.

Skimmed Milk Powder

4) Nandini mysorepark:-

Fresh and tasty, Nandini Mysore Park is made from high quality

Bengal gram, Nandini ghee and sugar cane. It’s delicious way to relish a

sweet moment.

Mysore Pak

5) Nandini Gulab Jamoon mix:-

Gulab Jamoon mix is made from skimmed powder, Maida, soji, and

anadini special grade ghee.

•

Khova Jamoon

Lal Bahadur Shastri Govt First Grade College, Bangalore 40

A Study on Working Capital Management at KMF

COMPETITORS :

The success of each and every business unit is mainly depending on

how brilliantly it faces the competitions Mother dairy is not out of completion it

has 80% market share in Bangalore & Presently it is the brand leader for milk

products. The main competitors to Mother Dairy are:

Heritage

Arogya

Good Morning

Swastik

ORGANIZATIONAL OBJECTIVE AND STRATEGIES

The First step in an organization is the assessment of its objective and

strategies i.e., what business are we in? And at what level of quality do with wish

to provide or service? Where do we want to be in the future? It is only answering

there and other related questions that the organizational must assess the strengths

and weakness of its human resources.

NEEDS ASSESSMENT: Needs assessment diagnosis present problems and

future challenges to be meet through training and development organizations

spend vast sums of money (Usually as a percentage of turnover) on training and

development. Before committing such huge resource organization would do well

to assess the training needs of their employees organizational that implement

Lal Bahadur Shastri Govt First Grade College, Bangalore 41

A Study on Working Capital Management at KMF

training programmers without conducting needs assessment may be malign

errors.

TRAINING AND DEVELOPMENT OBJECTIVES

Once training needs are assessed, training and development goals

must be established. Without clearly set goal, it is not possible to design a

training and development program and after it has been implemented, there

will be no way of measuring its effectiveness. Goals must be tangible

verifiable, and measurable. This is easy where skills training are involved

KMF Officers

SRI.A.S.PREMANATH - MANAGING DIRECTOR , KMF

Place of

Name Designation

working

A.S.PREMANATH DIRECTOR (ADMN) KMF CO

RAVIKUMAR KAKADE DIRECTOR (MKT) KMF CO

MUNIRAJU DIRECTOR (AH) KMF CO

C.NARASIMHA REDDY DIRECTOR (R&D) KMF CO

DR:M.N.VENKATARAM DIRECTOR (C.T.I) KMF CO

Lal Bahadur Shastri Govt First Grade College, Bangalore 42

A Study on Working Capital Management at KMF

U

D.SRINATH ADNL DIR (MKT) KMF CO

SURESH G MUDDE

ADNL DIR (FIN) KMF CO

BIHAL

K.S.BHISE ADNL DIR KMF CO

Dr.BERNAD EARNEST (ADMIN/PUR) KMF CO

Dr.D.N.HEGDE ADNL DIR (FEEDS) KMF CO

ADNL DIR (AH)

B.NATRAJ ADNL DIR(Q.C) KMF CO

H.MUNAVAR JOINT DIR(RL 441),

KMF CO

AHMED,KCAS CO-OP AUDIT

UNION CHIEFS

DESIGNATIO PLACE OF

NAME

N WORKING

DR. V.LAXMAN BANGALORE MILK

.D

REDDY UNION

TUMKUR MILK

DR.K..SWAMY M.D

UNION

KOLAR-

K.L.GAJENDRAN M.D CHIKKABALLAPUR

A MILK UNION

BELGAUM MILK

P.D.HAMPALI M.D

UNION

HASSAN MILK

RANGANATH. B.P M.D

UNION

MANDYA MILK

DR.T.GURULINGAIAH M.D

UNION

Lal Bahadur Shastri Govt First Grade College, Bangalore 43

A Study on Working Capital Management at KMF

MYSORE-

T.KUMARA SWAMY M.D

CHAMARAJNAGAR

CHANDRASHEKARA DAKSHINA

M.D

NAYAK KANNADA

RAICHUR-

DR. T. PRASANNA M.D

BELLARY-KOPPAL

DR.K.RAMACHANDR DHARWAD MILK

M.D

A BHAT UNION

BIJAPUR-

DR. SURESH BABU M.D

BHAGALKOT

SHIMOGA MILK

DR. G T GOPAL M.D

UNION

GULBARGA MILK

DR. H.N.SUDHAKAR M.D

UNION

UNIT CHIEFS

NAME DESIGNATIO N PLACE OF WORKING

MILK PRODUCT

PLANT,CHANNARAY

H.N.SUBBUSWAMY DIR

APATNA

K.V JAGANNATHA RAO DIR

MOTHER DAIRY

DR. R.MAHESH A.D

NANDINI SPERM

STATION

CATTLE FEED

Y.GOPAL G.M

PLANT, GUBBI

CATTLE FEED

MOHAMOHD ISMAIL G.M PLANT,

RAJANUKUNTE

CATTLE FEED

P.V.MOHAN KRISHNA G.M

PLANT, DHARWAD

Lal Bahadur Shastri Govt First Grade College, Bangalore 44

A Study on Working Capital Management at KMF

CATTLE FEED

D.VIVEK G.M

PLANT, HASSAN

NANDINI MILK

SURESH KULKARNI G.M

PRODUCTS

V.RAJESHWAR GM POUCH FILM PLANT

TRAINING CENTRE,

K. MAHADEVAIAH J.D

MYSORE

TRAINING CENTRE,

P.S.BELLUNKI I/C J.D

DHARWAD

N.HANUMESH G.M GULBARGA DAIRY

Know Your Milk: -

Importance of milk

Lal Bahadur Shastri Govt First Grade College, Bangalore 45

A Study on Working Capital Management at KMF

Milk is nature's ideal food for infants and growing children.The

importance of milk in our diet has been recognized since Vedic

times, and all modern research has only supported and

reinforced this view. In fact, milk is now considered not only

desirable but essential from the time the child is born. The

baby is recommended to be breast-fed until it is weaned and

thereafter given cow/buffalo/goat milk till he or she reaches 12

years of age.

The National Institute of Nutrition has recommended a

minimum of 300 gms daily intake of milk for children between

1-3 years of age and 250 gms for those between 10-12 years.

MILK DEFINITION AND ITS COMPOSITION

Milk may be defined as the whole, fresh, clean, lacteal

secretion obtained by complete milking of one or more healthy

milk animals, excluding that obtained within 15 days before or

5 days after calving or such periods as may be necessary to

render the milk practically colostrum-free and containing the

minimum prescribed percentages of milk fat and milk-solids-

not-fat. In India, the term 'milk', when unqualified, refers to cow

or buffalo milk, or a combination thereof. Milk SNF means Milk

Solids-not-Fat, comprising protein, carbohydrates, vitamins,

minerals, etc in milk other than milk fat.

Lal Bahadur Shastri Govt First Grade College, Bangalore 46

A Study on Working Capital Management at KMF

ESSENTIAL NUTRIENTS IN MILK

Milk is almost an ideal food. It has high nutritive value. It

supplies body-building proteins, bone-forming minerals and

health-giving vitamins and furnishes energy-giving lactose and

milk fat. Besides supplying certain essential fatty acids, it

contains the above nutrients in an easily digestible and

assailable form. All these properties make milk an important

food for pregnant mothers, growing children, adolescents,

adults, invalids, convalescents and patients alike.

Milk is a powerful nutrition package containing nine essential

nutrients including calcium, protein and potassium. Milk is the

perfect beverage for today's kids and teens.

➢ Calcium:- Milk and dairy products are an important

source of calcium. Apart from bone health, Calcium also

plays vital role in blood clotting, nerve conduction, muscle

contraction, regulation of enzyme activity, cell membrane

function and blood pressure regulation.

➢ Protein:- Milk is a good source of low-cost high quality

protein, which is readily digested. This protein is important

for a number of bodily functions-vital to brain development

and the growth of body tissues.

➢ VitaminA:- Maintains normal vision and skin. Helps

regulate cell growth and integrity of the immune system.

➢ Vitamin B-12: -Essential for the growth and health of the

nervous system. Linked to normal activity of folic acid and

is involved in blood formation.

Lal Bahadur Shastri Govt First Grade College, Bangalore 47

A Study on Working Capital Management at KMF

➢ VitaminD: -Promotes the absorption of calcium and

phosphorus, and influences bone mineralization, the

strengthening of bones.

➢ Potassium:- Regulates the body's fluid balance and

blood pressure. It is also needed for muscle activity and

contractions.

➢ Phosphorus:- Helps generate energy in the body's cells

and influences bone mineralization, the strengthening of

bones.

➢ Niacin:- Keeps enzymes functioning normally and helps

the body process sugars and fatty acids. It is also

important for the development of the nervous system.

➢ Riboflavin:- Helps produce energy in the body's cells and

plays a vital role in the development of the nervous

system.

CLASS AND TYPE OF MILK

Dairies in India have to market milk by standardizing, as per

the various types of milk prescribed under Prevention of Food

Adulteration Act. These type of milk differ in their Milk fat and

Milk SNF contents.

Lal Bahadur Shastri Govt First Grade College, Bangalore 48

A Study on Working Capital Management at KMF

Raw milk procured from villages, contain numerous pathogenic

and spoilage bacteria. These microorganisms, if allowed to

grow, multiply at logarithmic rate and produce many toxins and

enzymes and spoil milk. Hence milk is processed by heat

treatment in dairies.

Various types of heat-treatment given to milk are as below –

1. Pasteurization –

The term Pasteurization has been coined

C or below. In this process, pathogenic and spoilage

organisms are destroyed. Normally pasteurized milk is packed

in sachets and shall be stored under refrigeration conditions,

so as to prevent the growth of remaining organisms in milk.

Pasteurized milk has a shelf life of 2 days when stored and

transported under refrigeration conditions. This milk is boiled

and consumed in Indian homes.°C for 15 seconds (or to any

temperature-time combination which is equally efficient), in

approved and properly operated equipment. After

pasteurization, the milk is immediately cooled to 6°after its

Lal Bahadur Shastri Govt First Grade College, Bangalore 49

A Study on Working Capital Management at KMF

inventor, Louis Pasteur of France. Pasteurization refers to the

process of heating every particle of milk to at least 72

2. Sterilization -

C for minimum period of 15 minutes. After heating, sterilized

milk bottles are gradually cooled to room temperature. Due to

economic disadvantages and browning of milk, this process is

used only for bottled flavored milk. This Sterilized milk has a

shelf-life of not less than 3 months, even at room temperature,

and can be consumed directly.°Sterilized milk is manufactured

by filling into bottles and heating bottled milk to not less

than120

3. Ultra High Treatment (UHT) –

Lal Bahadur Shastri Govt First Grade College, Bangalore 50

A Study on Working Capital Management at KMF

C for 4 seconds and cooled instantly which retains all the

vitamins and nutritional value of milk providing zero bacteria

product which needs no boiling. The milk is packed in 6 layer

tamper proofed Tetra-pack packaging which prevents the milk

from spoilage due to sunlight, bacteria, germs and oxygen,

thus ensuring freshness and purity of milk packed. The milk

can be stored without refrigeration for 60 days in fino-

packaging and 120 days in brik packaging.°During the process

of UHT, milk is heat-treated to temperature of 137

KMF has introduced four UHT milk variants in the market,

viz.,Nandini Good life

(3.5% Fat, 8.5%

SNF), Nandini Full Cream Milk (12% Fat, 9%

SNF),

Nandini Smart (1.5% Fat, 9% SNF) & Nandini slim (with less

than 0.5% fat and 9% SNF) catering to diverse groups of

consumers, including health conscious consumers.

Lal Bahadur Shastri Govt First Grade College, Bangalore 51

A Study on Working Capital Management at KMF

4.Homogenization –

Any of the above class and type of milk may be homogenized.

Homogenized milk is milk which has been treated in such a manner as to

ensure break-up of the fat globules in milk to such an extent that after

storage no visible cream separation occurs on the milk. Milk is