Professional Documents

Culture Documents

MMi Daily Iron Ore Report For November 12th 2018

MMi Daily Iron Ore Report For November 12th 2018

Uploaded by

gpleirbagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MMi Daily Iron Ore Report For November 12th 2018

MMi Daily Iron Ore Report For November 12th 2018

Uploaded by

gpleirbagCopyright:

Available Formats

Daily Iron Ore Index Report November 12, 2018

IRON ORE PORT STOCK INDEX (IOPI)

November 12 2018 FOT Qingdao (inc. 16% VAT), RMB/wet tonne CFR Qingdao Equivalent (exc. 16% VAT), USD/dry tonne ¹

Index Fe Content Price Change Change % MTD YTD² Low ² High ² Price Change Change % MTD YTD² Low ² High ²

IOPI62 62% Fe Fines 591 0 0.0% 593 499 443 603 75.93 -0.16 -0.2% 76.47 66.71 75.83 77.89

IOPI58 58% Fe Fines 410 0 0.0% 413 354 304 419 51.52 -0.11 -0.2% 52.08 45.94 40.67 52.59

IOPI65 65% Fe Fines 736 0 0.0% 754 651 541 784 95.49 -0.20 -0.2% 98.20 87.95 96.35 101.71

IRON ORE SEABORNE INDEX (IOSI) MARKET COMMENTARY

November 12 2018 CFR Qingdao, USD/dry tonne Seventy-one vessels carrying 10.93 million mt of iron ore are likely to arrive at major Chinese ports during Novem-

ber 9-15, up 190,000 mt from that during November 2-8, SMM data showed. These marked the fourth consecutive

Index Fe Content Price Change Change % MTD YTD 3 Low 3 High 3 week of increase, but growth volumes were limited. For the same period, iron ore shipments departing Australian

ports will fall 820,000 mt to 15.34 million mt due to maintenance at ports; those leaving Brazilian ports are likely

IOSI62 62% Fe Fines 77.05 0.00 0.0% 75.68 68.51 63.25 86.20 to grow 460,000 mt to 7.84 million mt. These stay above the weekly average shipments of this year. Further

upward room is expected in the shipments in the short term.

IOSI65 65% Fe Fines 98.75 0.00 0.0% 97.93 94.39 86.20 101.50

IRON ORE PORT LUMP INDEX (IOPLI)

Week Ending 9 November FOT Qingdao (inc. 16% VAT), RMB/wet tonne CFR Qingdao Equivalent (exc. 16% VAT), USD/dry tonne ¹

3 3 3

Index Fe Content Price W-o-W Change % MTD YTD Low High Price W-oW Change % MTD YTD 3 Low 3 High 3

IOPLI62 62.5% Fe Lump 781 45 6.1% 759 633 565 781 97.53 5.88 6.4% 94.59 81.82 76.63 97.53

IRON ORE DOMESTIC CONCENTRATE SPOT PRICE ASSESSMENTS AND COMPOSITE INDEX

Week Ending November 9, 2018 RMB/tonne (excluding tax) 4 USD/tonne (excluding tax) 4

Province Region Product Basis This week Change % Low ² High ² This week Change % Low ² High ²

Hebei Hanxing 66% Fe Concentrate Dry 715 -0.4% 579 718 103.44 0.3% 83.76 103.87

Hebei Qian'an 65% Fe Concentrate Dry 805 0.6% 630 805 116.46 1.3% 91.14 116.46

Liaoning Anshan 65% Fe Concentrate Wet 555 0.0% 445 555 80.29 0.7% 64.38 80.29

Shandong Zibo 65% Fe Concentrate Dry 815 2.5% 620 815 117.91 3.2% 89.70 117.91

Week Ending November 9, 2018 This week Change % Low 5 High 5 ¹ Exchange rate applied: RMB/USD = 6.9476 ² Since March 1 ³ Since June 1

⁴ Weekly exchange rate applied: RMB/USD 6.9208 5 Last 12 months

China Mines Concentrate Composite Index RMB/WT 670.77 0.6% 534.50 670.77

IRON ORE PORT INDEX, FOT QINGDAO (RMB/WT) IRON ORE SEABORNE INDEX, CFR QINGDAO (USD/DMT)

850 105

750 95

650 85

550 75

450 65

350 55

250 45

IO PI62 IO PI58 IO PI65 IO SI62 IO SI65

IRON ORE PORT STOCK INDEX MONTHLY, QUARTERLY AND YEAR-TO-DATE AVERAGES

November 12 2018 FOT Qingdao (inc. 16% VAT), RMB/wet tonne CFR Qingdao Equivalent (exc. 16% VAT), USD/dry tonne ¹

Index Fe Content July August September October MTD QTD YTD² July August September October MTD QTD YTD²

IOPI62 62% Fe Fines 482 505 513 564 593 573 499 64.29 63.41 65.25 72.55 76.47 73.75 66.71

IOPI58 58% Fe Fines 349 363 385 401 413 405 354 44.14 44.86 45.84 50.47 52.08 50.97 45.94

IOPI65 65% Fe Fines 638 701 732 760 754 758 651 82.19 85.29 92.13 99.05 98.20 98.79 87.95

IRON ORE SEABORNE INDEX MONTHLY, QUARTERLY AND YEAR-TO-DATE AVERAGES FREIGHT RATES

November 12 2018 CFR Qingdao, USD/dry tonne November 09, 2018 FREIGHT RATES - DRY BULK US$/wet tonne

5 5

Index Fe Content July August September October MTD QTD YTD 3 Route Designation Change Change % Low High

IOSI62 62% Fe Fines 65.09 67.89 68.79 72.31 75.68 73.09 68.51 W. Australia - Qingdao C5 6.79 -0.27 -3.87% 5.109 10.002

IOSI65 65% Fe Fines 91.90 94.04 96.48 98.97 97.93 98.73 94.39 Tubarao - Qingdao C3 15.91 -1.98 -11.08% 12.705 24.76

IRON ORE PORT LUMP INDEX MONTHLY, QUARTERLY AND YEAR-TO-DATE AVERAGES

Week Ending 9 November FOT Qingdao (inc. 16% VAT), RMB/wet tonne CFR Qingdao Equivalent (exc. 16% VAT), USD/dry tonne ¹

Index Fe Content July August September October MTD QTD YTD 3 July August September October MTD QTD YTD²

IOPLI62 62.5% Fe Lump 613 652 695 720 759 736 633 78.18 81.74 87.49 89.65 94.59 91.62 81.82

www.mmiprices.com Page 1/5 November 12, 2018

COPYRIGHT METALS MARKET INDEX, ALL RIGHTS RESERVED

Daily Iron Ore Index Report November 12, 2018

IRON ORE INDEX COMPARISONS CHINA DOMESTIC COMPOSITE MINES INDEX (RMB/Wet Tonne, including VAT)

105

680

100 660

95

640

90

620

T

M 85 T

/D 600

/W

D 80

S B

U M580

R

75

560

70

540

65

520

60

8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 500

1

- 1

- 1

- 1

- 1

- 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

n n n n n l-u l-

u

l-

u

l-

u

-

g -

g -

g -

g -

g -

p -

p

-

p

-

p t-c t-c t-c t-c -

v -

v

Ju

- Ju

- Ju Ju Ju J- -J3 -J0 -J7 u

A

u u u u e

S e

S

e

S

e

S O O O O

o o

1 8 -

5 -

2 -

9 6 1 2 2

-

3 -A

0 -A

7 -A

4 -A

1

-

7 -

4 -

1 -

8

-

5 -2 -9 -6 -N -N

1 2 2 1 1 2 3 1 2 2 1 1 2 2 9

IO SI62 IO PI62 (equival ent) IO SI65 IO PI65 (equival ent) China Dom estic Com posite Mines Index

IRON ORE BRAND SPOT PRICE ASSESMENTS

November 12 2018 PORT STOCK INDEX (RMB/WT) November 12 2018 SEABORNE INDEX (USD/DMT)

Price Change Diff to IOPI62 Price Change Diff to IOSI62

Roy Hill 565 0 -26 Roy Hill 70.85 0.00 -6.20

SIMEC Fines 502 0 -89 SIMEC Fines 64.55 0.00 -12.50

PB Fines 573 0 -18 PB Fines 75.90 0.00 -1.15

Newman Fines 589 -1 -2 Newman Fines 78.56 0.00 1.51

MAC Fines 556 0 -35 MAC Fines 71.05 0.00 -6.00

Jimblebar Blended Fines 521 -2 -70 Jimblebar Blended Fines 63.42 0.00 -13.63

Carajas Fines 727 0 136 Carajas Fines 97.29 0.00 20.24

Brazilian SSF 571 0 -20 Brazilian SSF 81.11 0.00 4.06

Brazilian Blend Fines 598 0 7 Brazilian Blend Fines 82.36 0.00 5.31

RTX Fines 502 2 -89 RTX Fines 67.75 0.00 -9.30

November 12 2018 PORT STOCK INDEX (RMB/WT)

Price Change Diff to IOPI58

SSF 344 -2 -66

FMG Blended Fines 406 -1 -4

Robe River 420 11 10

Western Fines 373 -4 -37

Atlas Fines 350 -5 -60

Yandi 450 -2 40

IRON ORE INDEX NORMALISATION DIFFERENTIALS

Port Stock Index Product Differentials (RMB/wet tonne) Seaborne Index Product Differentials (UDS/dry tonne)

Applicable range Value Change Applicable range Value Change

High Grade Fe 60 - 63% 12.00 0.00 High Grade Fe 60 - 63% 2.50 0.00

High Grade Fe 63 - 64% 48.00 0.00 High Grade Fe 63 - 64% 2.50 0.00

1% Fe High Grade Fe 64 - 65% 48.00 0.00 1% Fe High Grade Fe 64 - 65% 2.50 0.00

High Grade Fe 65 - 65.5% 48.00 0.00 High Grade Fe 65 - 65.5% 2.50 0.00

Low Grade Fe 21.00 0.00

High Fe Grade Al <2.25% 38.00 0.00 High Fe Grade Al <2.25% 9.75 0.00

High Fe Grade Al 2.25-4% 50.00 5.00 High Fe Grade Al 2.25-4% 0.50 0.00

1% Alumina 1% Alumina

Low Fe Grade Al <2.25% 82.00 0.00

Low Fe Grade Al 2.25-4% 25.00 0.00

High Fe Grade Si <4% 2.00 0.00 High Fe Grade Si <4% 2.25 0.00

1% Silica High Fe Grade Si 4-6.5% 32.00 0.00 1% Silica High Fe Grade Si 4 - 6.5% 3.25 0.00

Low Fe Grade 15.00 3.00

High Fe Grade 0.09%<P<0.115% 3.00 0.00 High Fe Grade 0.09%<P<0.115% 0.50 0.00

0.01% 0.01%

High Fe Grade 0.115%<P<0.15% 7.00 -3.00 High Fe Grade 0.115%<P<0.15% 1.75 0.00

Phosphorus Phosphorus

Low Fe Grade 0.09<P<0.1% 5.00 0.00

Port Stock Differentials to Qingdao Port (RMB/wet tonne)

Port Value Change Port Value Change Port Value Change Port Value Change

Bayuquan -25.00 0.00 Fangcheng -5.00 0.00 Lanshan 0.00 0.00 Qingdao 0.00 0.00

Beilun 5.00 0.00 Jiangyin -10.00 0.00 Lianyungang 0.00 0.00 Rizhao 0.00 0.00

Caofeidian -5.00 5.00 Jingtang -5.00 5.00 Majishan 0.00 0.00 Shekou 0.00 0.00

Dalian -15.00 0.00 Lanqiao 0.00 0.00 Nantong -10.00 0.00 Tianjin -15.00 0.00

www.mmiprices.com Page 2/5 November 12, 2018

COPYRIGHT METALS MARKET INDEX, ALL RIGHTS RESERVED

Daily Iron Ore Index Report November 12, 2018

IRON ORE INDEX PREMIUMS/DISCOUNTS

November 12 2018 PORT STOCK INDEX (RMB/WT) November 12 2018 SEABORNE INDEX (USD/DMT)

Fe Content Spread to IOPI62 % Spread to IOPI62 Fe Content Spread to IOSI62 % Spread to IOSI62

58% Fe Fines -181 -30.63%

65% Fe Fines 145 24.53% 65% Fe Fines 21.70 28.16%

60% 60%

50% 50%

40% 40%

ksr ksr

a 30% a 30%

m m

h

c 20% h

c 20%

n

e n

e

B 10% B 10%

o

t o

t

ad

e

0% ad

e

0%

r r

p

S -10% p

S -10%

% %

-20% -20%

-30% -30%

-40% -40%

8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8

-1 -1 -1 -1 -1 1

l-u

1

l-

1

l-

1

l- -1

g -1

g -1

g -1

g -1

g -1

p -1 -1 -1 1

t-c

1

t-c

1

t-c

1

t-c -1

v -1

v

n

u n

u n n n J- u u u u u u u u e p

e p

e p

e o o

u u u J- J- J-

-J -J -J5 -J2 -J9 6 3 0 7 A

- A

-0 A

-7 A

-4 A

-1 -S S- S- S- -O -O -O -O N

- N

-

1 8 1 2 2 3 7 4 1 8 5 2 9 6 2 9

1 2 2 1 1 2 3 1 2 2 1 1 2

IO PI65 % Spread to IOPI62 IO PI58 % Spread to IOPI62 IO SI65 % Spread to IOSI62

WEEKLY IRON ORE PORT STOCK LUMP PREMIUM (62.5% FE LUMP—62% FE FINES) IRON ORE SEABORNE TO PORT STOCK SPREADS

14.00

3.00

12.00

2.50 10.00

8.00

2.00

U T 6.00

T M

M /D 4.00

D

/ 1.50 D

B S

U 2.00

M

R

1.00 0.00

-2.00

0.50

-4.00

-6.00

0.00 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8

-1 -1 -1 -1 1 1 1 1 1 -1 -1 -1 -1 -1 -1 -1 -1 1 1 1 1 1 1 -1

8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 l-u l-u l- l- l- g g g g p t-c t-c t-c t-c t-c v- v

-1 -1 -1 -1 -1 -1

lu -1

l -1

l -1

l -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 n

u n n n J- J- u u u u u u u eS p

e p

e p

e o o

n

u n

u n n n u u u g g g g g p p p p tc tc tc tc v v -J Ju

-1 Ju

-8 Ju

-5

J- J- J- A A A A - S- S- S- -O -O O

-5 O

-2 O

-9 N N

J- J- Ju

-5 Ju

-2 Ju

-9 -J -J3 -J0 -J7 u

A

u

A

u

A

u

A

u

A Se- e

S-

e

S-

e

S- O

- O

-2 O

-9 O

-6

o

N

o

N 4 2 9 6

1

3

2

0

3

-

6 -3 -0 -7 3 0 7 4 1 8 -

5 -2

1 8 6 - -0 -7 -4 -1 7 4 1 8 5 - - 1 1 2 1 2 2 1 1 2 1 2 2 1

1 2 2 1 2 2 3 1 2 2 1 1 2 2 9

1 1 2 3

Lump 62.5% Fe Premium R MB/dmtu IO SI65 Spread to IOPI65 Equiv alent IO SI62 Spread to IOPI62 Equiv alent

TOTAL IRON ORE INVENTORIES AT CHINA PORTS FUTURE TRADING—FRONT MONTH CLOSING PRICE

160

540 78

150 520

e 500 73

140 n e

t n n

n

m to

/

480

to

n B 68 /

o

il 130 D

li M460 S

U

R

m 440

120 63

420

110 400 58

100

Dalian 3pm Close SGX Front Month 6pm (RHS)

IRON ORE PORT INVENTORIES IRON ORE FUTURES CONTRACTS

Week Ending November 09, 2018 (million tonnes) DCE SGX

Province This week Change % Low⁴ High⁴ Closing Date 12 Nov 3pm close 12 Nov 6 pm

Jingtang 13.48 -9.53% 13.47 19.00 Contract I1901 Change Change % Dec'18 Change Change %

Qingdao 17.70 0.57% 15.60 19.97 Closing Price 520.0 -5.0 -0.95% 72.24 -1.06 -1.45%

Caofeidian 18.60 -1.06% 16.70 25.30 Vol traded ('000 lots) 125.16 -6.3 -4.81% 14.18 -0.58 -3.92%

Tianjin 9.80 4.26% 8.50 11.00 Open positions ('000 lots) 70.70 -4.0 -5.31% 131.36 7.72 6.25%

Rizhao 15.50 -3.13% 13.49 19.00 Day Low 517.0 -3.5 -0.67% 72.05 -0.70 -0.96%

Total (35 Ports) 131.62 -1.28% 128.70 150.04 Day High 521.5 -8.5 -1.60% 72.93 -0.70 -0.95%

www.mmiprices.com Page 3/5 November 12, 2018

COPYRIGHT METALS MARKET INDEX, ALL RIGHTS RESERVED

Daily Iron Ore Index Report November 12, 2018

DRY BULK FREIGHT RATES TOTAL CHINA IRON ORE IMPORT VOLUMES

30 120

25

100

20

t 80

/m15 t

SD m

n

U io 60

10 ll

i

m

5 40

0

20

C5 - W. Australia - Qingdao C3 - Tubarao - Qingdao

Steel Spot Market Prices - China

Steel Spot Market RMB/tonne

Product 9/11/2018 Change Change %

ReBar HRB400 ɸ18mm 4,602.0 -105 -2.23%

Wirerod Q300 ɸ6.5mm 4,772.0 -133 -2.71%

HRC Q235/SS400 5.5mm*1500*C 3,954.0 -119 -2.92%

CRC SPCC/ST12 1.0mm*1250*2500 4,633.0 -103 -2.17%

Medium & Heavy Plate Q235B 20mm 4,260.0 -66 -1.53%

GI ST02Z 1.0mm*1000*C 4,980.0 -90 -1.78%

Billet Q235 150*150mm 3,800.0 -100 -2.56%

CHINESE STEEL EXPORT PRICES CHINESE STEEL INVENTORIES

China Export Prices USD/tonne

Steel Inventories³ (unit: 1000 tonnes)

Product Specification Export tax (+)/Vate rebate (-) Change

Product 9/11/2018 2/11/2018 Change Change %

9/11/2018

Rebar 3,390 3,581 -191 -5.33%

Rebar BS4449 460B 12-25mm, + chrome -13% 550 -5

Wire Rod SAE1008 6.5-10mm +chrome -9% 575 -5 Wirerod 1,028 1,096 -68 -6.20%

Hot-rolled coil SS400/Q235 4.0-10.mm -9% 545 -5 Hot-rolled Coil 2,309 2,439 -130 -5.33%

Cold-rolled coil SPCC 1.0mm -13% 595 0 Medium & Thick Plate 1,124 1,130 -6 -0.53%

Medium & Heavy plate A-level Shipe plate 12-25mm 0% 580 0

Cold-rolled Coil 1,168 1,206 -38 -3.15%

Galvanised ST02Z/SGCC 1.0mm -13% 650 -5

Total 9,018 9,452 -434 -4.59%

Note: Calculation formula for converting export prices of rebar, cold-rolled steel and galvanizing into prices in China’s spot

market = FOB* exchange rate*1.16/(1.16-0.13); Calculation formula for converting export prices of wire rod and hot-rolled steel into ³ SM M statistics co ver invento ries o f majo r steel pro ducts in China’ s majo r markets: ho t-ro lled

prices in hina’s spot market = FOB* exchange rate *1.16/(1.16- 0.09); Calculation formula for converting export prices of medium- steel invento ries in 33 majo r cities; rebar and wire invento ries in 35 majo r cities; co ld-ro lled steel

thick plate into prices in China’s spot market = FOB* exchange rate and medium-thick plate invento ries in 31majo r cities.

CHINESE STEEL MILL PROFITABILITY

SMM Tracking of Steel Mill P&L - Rebar and Hot-rolled Coil (RMB/tonne)

Category Price Change (WoW) Note

MMi (Fe 62%), USD/mt exluding tax 76.19 -0.13 Mmi CFR Equivalent index for 12th October

Coke 2,610 100 2nd grade met coke, Tangshan, incl. tax

Steel Scrap 2,410 -70 steel scrap (6mm) in Zhangjiagang, exl. tax

Billet Cost 3,259 49 Q234, incl. tax

Rebar cost - Blast furnace 3,528 48 calculated based on theoretical w eight, incl. tax

Rebar profit - Blast furnace 972 -88 based on Shanghai prices, incl. tax

Hot-rolled coil cost - Blast furnace 3,584 49 based on actual w eight, incl. tax

Hot-rolled coil proft - Blast furnace 316 -189 based on Shanghai prices, incl. tax

No te: 1. Co sts in the table are caluclated based o n to days market prices and faco ut o ur management, sales, financial and depreciatio ns fees.

2. The co st refers to average co st in the industry based o n SM M 's survey o f small, medium and large mills in China

www.mmiprices.com Page 4/5 November 12, 2018

COPYRIGHT METALS MARKET INDEX, ALL RIGHTS RESERVED

Daily Iron Ore Index Report November 12, 2018

IRON ORE INDEX SPECIFICATIONS, COMPILATION RATIONALE AND DATA EXCLUSIONS

Iron Ore Index Specifications (Port and Seaborne) Iron Ore Index Compilation Rational and Data Exclusions

65% Fe Fines 62% Fe Fines 58% Fe Fines 62.5% Fe Lump MMi iron ore indices are compiled from data provided by companies that are

part of the iron ore supply chain and involved in spot market transactions. The

Fe % 65.00 62.00 58.00 62.50 indices are calculated using detailed transaction-level data submitted to MMi by

Alumina % 1.40 2.25 2.25 1.50 these companies. This data is normalised to the appropriate specifications and

screened to remove outliers before volume-weighted average prices are

Silica% 1.50 4.00 5.50 3.50 calculated from the remaining core set of data.

Phosphorus % 0.06 0.09 0.05 0.08 For more details on MMi's iron ore methodology please download the guide

Sulphur % 0.01 0.02 0.02 0.02 published on our website at: www.mmiprices.com

Moisture % 8.00 8.00 9.00 4.00

Data Exclusions*

Granular size below 10mm for at least 90% of cargo; Size below 6.3mm max 15% 62% 58% 65%

Sizing

maximum of 40% below 150 micron Size above 31.15mm max 25% Port Index 0 0 0

Seaborne index 0 0

Pricing Point Qingdao Port (FOT and CFR respectively) FOT Qingdao Port Lump Index 62.5 0

Timing (Seaborne) Loading within 4 weeks, Delivery within 8 weeks Delivery within 2 weeks * Number of price submissions for iron ore indices that were excluded from

index calculations today as they were anomalous and could not be verified

Payment Terms L/C at sight L/C at sight or CAD

IRON ORE DOMESTIC CONCENTRATE INDEX CALCULATION METHODOLOGY

The compilation method for price index generally refers to the compilation method of CPI price index and other price indices, breakdown the price data and calculate the average value according

to a certain method, taking the vertical axis as the regional composite index (average of different grade index) and the horizontal axis as the grade composite index (average of different regional

index), a total composite index for domestic ore can be output ultimately. The process system is also adopted in the calculation i.e. each sub-index can be obtained as well.

AVERAGE IRON ORE SPECIFICATIONS APPLIED FOR BRAND PRICE ASSESSMENTS

PORT STOCK BRANDS SEABORNE BRANDS

November 12 2018 SPECIFICATIONS APPLIED FOR 62% BRAND ASSESSMENTS SPECIFICATIONS APPLIED FOR 62% BRAND ASSESSMENTS

Fe Alumina Silica Phos Moisture Fe Alumina Silica Phos Moisture

Roy Hill 61.00% 2.20% 4.50% 0.055% 8.00% Roy Hill 60.70% 2.30% 4.90% 0.055% 8.00%

SIMEC Fines 60.00% 2.30% 6.30% 0.060% 6.00% SIMEC Fines 60.00% 2.30% 6.30% 0.060% 6.00%

PB Fines 61.68% 2.32% 3.55% 0.100% 9.35% PB Fines 62% 62.00% 2.60% 4.30% 0.090% 10.00%

Newman Fines 62.47% 2.34% 4.15% 0.080% 7.72% Newman Fines 62.80% 2.20% 4.30% 0.080% 6.40%

MAC Fines 60.74% 2.24% 4.66% 0.090% 7.79% MAC Fines 61.00% 2.70% 4.70% 0.110% 9.30%

Jimblebar Blended Fines 61.36% 2.83% 4.34% 0.100% 6.76% Jimblebar Blended Fines 61.79% 2.67% 4.08% 0.115% 7.16%

Carajas Fines 64.79% 1.30% 2.00% 0.080% 8.29% Carajas Fines 65.10% 1.50% 1.70% 0.080% 8.50%

Brazilian SSF 62.00% 1.00% 6.50% 0.040% 6.00% Brazilian SSF 62.00% 1.00% 6.50% 0.040% 6.00%

Brazilian Blend Fines 62.68% 1.54% 4.81% 0.060% 8.42% Brazilian Blend Fines 62.50% 1.50% 5.00% 0.070% 7.00%

RTX Fines 61.00% 3.10% 4.50% 0.135% 7.50% RTX Fines 61.00% 3.10% 4.50% 0.135% 7.50%

November 12 2018 SPECIFICATIONS APPLIED FOR 58% BRAND ASSESSMENTS

Fe Alumina Silica Phos Moisture

SSF 56.42% 3.00% 6.35% 0.050% 9.50%

FMG Blended Fines 58.36% 2.79% 5.90% 0.070% 7.13%

Robe River 56.63% 2.88% 1.85% 0.040% 9.09%

Western Fines 57.57% 2.86% 6.73% 0.060% 7.58%

Atlas Fines 56.59% 2.55% 7.14% 0.080% 8.46%

Yandi 57.13% 1.38% 6.34% 0.030% 9.21%

BLOOMBERG TICKERS

PORT STOCK INDICES

FOT Qingdao (RMB/wet tonne) CFR Qingdao Equivalent (USD/dry tonne)

IOPI62 IRCNQ001 IRCNQ004

IOPI58 IRCNQ002 IRCNQ005

IOPI65 IRCNQ003 IRCNQ006

CONTACT US

MMI Singapore Office Details: Level 28, Manulife Tower, 8 Cross Street Singapore. Tel: + 65 6850 7629 E: jarek@mmiprices.com Visit www.mmiprices.com for full index

SMM Singapore Office Details: Level 28, Manulife Tower, 8 Cross Street Singapore. Tel: + 65 6850 7630 E: service.en@smm.cn

SMM Shanghai Office Details: 9th FL, Building 9, Lujiazui Software Park, No.20, Lane 91, Pudong, Shanghai Tel: +86 021 5155 0306 E: service.en@smm.cn price histories and archive of daily reports

This information has been prepared by Metals Market Index ("MMi"). Use of the information presented here is at your sole risk, and any content, material and/or data presented or otherwise obtained through your use of the information in this document is at your own

discretion and risk and you will be solely responsible for any damage to you personally or your company or organisation or business associates whatsoever which in anyway results from the use, reliance or application of such content material and/or information. Certain

data has been obtained from various sources and any copyright existing in such data shall remain the property of the source. Except for the foregoing, MMi retains all copyright within this document. The copying or redistribution of any part of this document without the

express written authority of MMi is forbidden.

www.mmiprices.com Page 5/5 November 12, 2018

COPYRIGHT METALS MARKET INDEX, ALL RIGHTS RESERVED

You might also like

- Sasumua Dam Case StudyDocument24 pagesSasumua Dam Case StudyElijah Kamau100% (1)

- OneSteel Data Charts - FinalDocument20 pagesOneSteel Data Charts - FinalDaniel CheesmanNo ratings yet

- Cone Penetration Testing in Geotechnical PDFDocument56 pagesCone Penetration Testing in Geotechnical PDFWira Arga WaringgaNo ratings yet

- USDA Soil Report: Antelope County, NEDocument94 pagesUSDA Soil Report: Antelope County, NEhefflingerNo ratings yet

- EIL IOCL Baroda ScopeDocument6 pagesEIL IOCL Baroda ScopeSairaj KaleNo ratings yet

- Iron Resources and ProductionDocument60 pagesIron Resources and Productiontaokan81No ratings yet

- Plate Heat ExchangerDocument2 pagesPlate Heat Exchangerprashant_dc_inNo ratings yet

- Swagelok Fitting PDFDocument16 pagesSwagelok Fitting PDFmattuiffNo ratings yet

- Proceso de Engitec CX SystemDocument6 pagesProceso de Engitec CX SystemCinthia del RíoNo ratings yet

- Pipe ScheduleDocument2 pagesPipe Schedulepenny412100% (1)

- Piping Class Spec. - 3C24 (Lurgi) PDFDocument9 pagesPiping Class Spec. - 3C24 (Lurgi) PDFotezgidenNo ratings yet

- Processing of Columbite Tantalite Ores and Concentrates For Niobium and Niobium CompoundsDocument21 pagesProcessing of Columbite Tantalite Ores and Concentrates For Niobium and Niobium CompoundsOscar BenimanaNo ratings yet

- Technologies For The Production of Pharmaceutical Grade Sodium ChlorideDocument13 pagesTechnologies For The Production of Pharmaceutical Grade Sodium ChlorideAmyNo ratings yet

- Idaho Cobalt ProjectDocument218 pagesIdaho Cobalt ProjectCatalina LunaNo ratings yet

- Bayer Process Chemistry: Dr. M. ColeyDocument22 pagesBayer Process Chemistry: Dr. M. ColeyToanique HeadmanNo ratings yet

- Processing of Nickel Laterite Ores: A Review of Scientific LiteratureDocument5 pagesProcessing of Nickel Laterite Ores: A Review of Scientific LiteratureCofe Milk100% (1)

- Bong ADocument2 pagesBong AchinemeikeNo ratings yet

- FS - K.HILL BATTERY-GRADE MANGANESE PROJECT - K-Hill-FS-11142022Document482 pagesFS - K.HILL BATTERY-GRADE MANGANESE PROJECT - K-Hill-FS-11142022girl2wise100% (1)

- 2 Manfred WaidhasDocument18 pages2 Manfred WaidhasMuhammad Ali100% (1)

- AN Overview of The Petroleum Industry Reforms: Dr. Adeoye AdefuluDocument27 pagesAN Overview of The Petroleum Industry Reforms: Dr. Adeoye AdefuluAdeoye AdefuluNo ratings yet

- Rules of Thumb For Materials of ConstructionDocument6 pagesRules of Thumb For Materials of ConstructionAMOL_AGASHENo ratings yet

- Frequent Sulfuric Acid LeakagesDocument7 pagesFrequent Sulfuric Acid LeakagesMuhammad BilalNo ratings yet

- Thermal Denitration of Ammonium Nitrate Solution in A Fluidized-Bed ReactorDocument10 pagesThermal Denitration of Ammonium Nitrate Solution in A Fluidized-Bed ReactorgauravNo ratings yet

- Unitoperations and ProcessesDocument19 pagesUnitoperations and ProcessesnirbhaykumarNo ratings yet

- All Pricelist March 2016Document8 pagesAll Pricelist March 2016Abhimanyu KumarNo ratings yet

- Microsoft SQL Server 2014 Business Intelligence Development Beginner's Guide Sample ChapterDocument35 pagesMicrosoft SQL Server 2014 Business Intelligence Development Beginner's Guide Sample ChapterPackt PublishingNo ratings yet

- Equipment Cost EstimationDocument2 pagesEquipment Cost EstimationmarcelkosasiNo ratings yet

- Preventing Corrosion in Sulfur Storage TanksDocument20 pagesPreventing Corrosion in Sulfur Storage TanksMatt Schlabach100% (1)

- European Nickel PLCDocument24 pagesEuropean Nickel PLCewin basokeNo ratings yet

- Fractionation SystemsDocument8 pagesFractionation SystemsKha Damayantirika Tsf 'reall'No ratings yet

- 34 Ozone BleachingDocument12 pages34 Ozone Bleachingsushil kumar100% (1)

- ARD Test HandbookDocument42 pagesARD Test HandbookEddie MendozaNo ratings yet

- Uhde Brochures PDF en 8Document24 pagesUhde Brochures PDF en 8Frank Pocomucha Gallardo100% (1)

- Cpi 2013Document1 pageCpi 2013Miguel Magat JovesNo ratings yet

- Pump TemplateDocument2 pagesPump TemplateamitkrayNo ratings yet

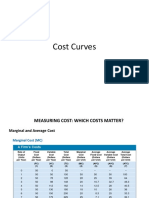

- Cost CurvesDocument40 pagesCost CurvesNRK Ravi Shankar CCBMDO - 16 BatchNo ratings yet

- Sablin Alpha Raab FDocument3 pagesSablin Alpha Raab Fsk281No ratings yet

- Nureg 0800Document18 pagesNureg 0800LoffeguttNo ratings yet

- Books FinalDocument128 pagesBooks FinalHardik Kumar MendparaNo ratings yet

- Data Sheet-Ball ValveDocument2 pagesData Sheet-Ball ValveJatin Vadhera VCSP100% (1)

- Wang Et Al 2022 Electrolyte Thermodynamic Models in Aspen Process Simulators and Their ApplicationsDocument12 pagesWang Et Al 2022 Electrolyte Thermodynamic Models in Aspen Process Simulators and Their Applicationsdavid rNo ratings yet

- Asme V Si UnitsDocument3 pagesAsme V Si UnitsvidhisukhadiyaNo ratings yet

- A.S.T.M. Tables: Cargo Name CategoryDocument2 pagesA.S.T.M. Tables: Cargo Name CategoryIordache DumitruNo ratings yet

- Optimization of Iron Ore and Concentrate Required by The Forecasted Factories According To The Per Capita Consumption of Steel in Afghanistan Based On The Linear Programming Model Until 2030Document8 pagesOptimization of Iron Ore and Concentrate Required by The Forecasted Factories According To The Per Capita Consumption of Steel in Afghanistan Based On The Linear Programming Model Until 2030International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Outlook For The PAL ProcessDocument14 pagesThe Outlook For The PAL ProcessGeorgi SavovNo ratings yet

- Iron Making in Mini Blast Furnace MBFDocument4 pagesIron Making in Mini Blast Furnace MBFMaheswar SethiNo ratings yet

- H2so4 SpillDocument4 pagesH2so4 SpilludayNo ratings yet

- Complex Refinery Flowchart - 2Document1 pageComplex Refinery Flowchart - 2Bilal AhmadNo ratings yet

- Ferrous Alloys Stainless SteelsDocument41 pagesFerrous Alloys Stainless SteelsSumedh SinghNo ratings yet

- Recent Developments in Magnetic Methods of Material SeparationDocument8 pagesRecent Developments in Magnetic Methods of Material SeparationevalenciaNo ratings yet

- TRANTER Plate and Frame PDFDocument28 pagesTRANTER Plate and Frame PDFnagtummalaNo ratings yet

- Aspen Shell & Tube Mechanical Product BrochureDocument2 pagesAspen Shell & Tube Mechanical Product BrochureThitikorn WassanarpheernphongNo ratings yet

- Solvent Extraction of Palladium From Chloride Media by TBPDocument6 pagesSolvent Extraction of Palladium From Chloride Media by TBPMoreno MarcatiNo ratings yet

- Bayer Process Chemistry: Dr. M. ColeyDocument28 pagesBayer Process Chemistry: Dr. M. ColeyToanique HeadmanNo ratings yet

- Ausmelt Matte Smelting PDFDocument12 pagesAusmelt Matte Smelting PDFgtdomboNo ratings yet

- Blasting RiskDocument7 pagesBlasting RiskSundaram KanagarajNo ratings yet

- Ammonia B PDFDocument9 pagesAmmonia B PDFmehrdad_k_rNo ratings yet

- Mining God's Way: Towards Mineral Resource Justice with Artisanal Gold Miners in East AfricaFrom EverandMining God's Way: Towards Mineral Resource Justice with Artisanal Gold Miners in East AfricaNo ratings yet

- November 20 2018 ReportDocument2 pagesNovember 20 2018 ReportSandesh Tukaram GhandatNo ratings yet

- Founder CIFCO Futures Iron Ore Weekly Report 20190610Document11 pagesFounder CIFCO Futures Iron Ore Weekly Report 20190610Gaurav GuptaNo ratings yet

- August 28 2018 ReportDocument2 pagesAugust 28 2018 ReportSandesh Tukaram GhandatNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- 3538-Article Text-11456-2-10-20230213Document7 pages3538-Article Text-11456-2-10-20230213dita febryantipNo ratings yet

- CHARACTERISTIC OF EXPANSIVE CLAY SOIL (Case Research at Bugel Village, Godong Subdistrict, Purwodadi Regency, Central Java Province)Document8 pagesCHARACTERISTIC OF EXPANSIVE CLAY SOIL (Case Research at Bugel Village, Godong Subdistrict, Purwodadi Regency, Central Java Province)Vera RohmadoniatiNo ratings yet

- Chapter 3Document23 pagesChapter 3arnie_suharnie100% (1)

- Economics Association 0 8461 1611-1-2010Document132 pagesEconomics Association 0 8461 1611-1-2010SenoritaNo ratings yet

- Ax Models Holland Etal For PerplexDocument19 pagesAx Models Holland Etal For PerplexTATIANA ANDREA SALAZAR ROMONo ratings yet

- Earth Science: Quarter 1 - Module 3Document42 pagesEarth Science: Quarter 1 - Module 3VillaErnestNo ratings yet

- Evs GR 5 - Worksheet Le Rocks and Minerals No 2Document4 pagesEvs GR 5 - Worksheet Le Rocks and Minerals No 2nitinNo ratings yet

- Set-Up Effect of Cohesive Soils in Pile Capacity - SvinkinDocument7 pagesSet-Up Effect of Cohesive Soils in Pile Capacity - SvinkinkyrheeNo ratings yet

- Ancient Method-Black GoldDocument2 pagesAncient Method-Black GoldJoelLadjoNo ratings yet

- Geo-E2010 Advanced Soil Mechanics L Wojciech Sołowski: 12 February 2017Document50 pagesGeo-E2010 Advanced Soil Mechanics L Wojciech Sołowski: 12 February 2017mananak123No ratings yet

- Chapter IDocument10 pagesChapter IKRISHNA RANJANNo ratings yet

- Bakers Price ListDocument2 pagesBakers Price ListRose DuffyNo ratings yet

- Soil Stress Total Stress, Pore Pressure, U Effective Stress, 'Document7 pagesSoil Stress Total Stress, Pore Pressure, U Effective Stress, 'Nala A.No ratings yet

- Rocks Sample Test: Multiple ChoiceDocument14 pagesRocks Sample Test: Multiple ChoiceMaricris G. Drio-RavanillaNo ratings yet

- BRICKS WordDocument10 pagesBRICKS WordAadityaNo ratings yet

- Aquifers and Their CharacteristicsDocument45 pagesAquifers and Their CharacteristicsravibiriNo ratings yet

- Assignment Igneous - JAMDocument12 pagesAssignment Igneous - JAMAnubhav SaikiaNo ratings yet

- Time Effects On Bearing Capacity of Driven PilesDocument4 pagesTime Effects On Bearing Capacity of Driven Pilessmw100% (1)

- Analytical Solution For Radial Consolidation Considering SoilDocument15 pagesAnalytical Solution For Radial Consolidation Considering SoilAnonymous VJHwe0XBNo ratings yet

- Professor David Norbury PDFDocument53 pagesProfessor David Norbury PDFArabel Vilas SerínNo ratings yet

- Study Material: Short Notes, Chapter1, Gwegraphy Class X: Compiled by Mrs Nigar Akhtar PGT AMU City School AligarhDocument14 pagesStudy Material: Short Notes, Chapter1, Gwegraphy Class X: Compiled by Mrs Nigar Akhtar PGT AMU City School Aligarhmonika khetanNo ratings yet

- Soil Classification Practice QuestionDocument4 pagesSoil Classification Practice QuestionVado PrinceNo ratings yet

- Bund DesignDocument10 pagesBund DesignNeil AgshikarNo ratings yet

- Foundation Construction - Strip FoundationsDocument3 pagesFoundation Construction - Strip Foundationsr_borgNo ratings yet

- Ground Improvement TechniqueDocument3 pagesGround Improvement TechniqueAlex Crispim Fortunato0% (1)

- CH - 3 Embankment Dam PDFDocument121 pagesCH - 3 Embankment Dam PDFHadush TadesseNo ratings yet

- Philippine Mineral DepositsDocument4 pagesPhilippine Mineral DepositsCris Reven GibagaNo ratings yet