Professional Documents

Culture Documents

Installment Sales

Installment Sales

Uploaded by

AliezaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Installment Sales

Installment Sales

Uploaded by

AliezaCopyright:

Available Formats

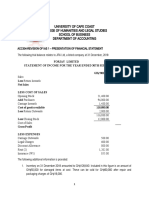

ILLUSTRATIVE PROBLEM:

Assume the following data summarize the transactions of Jury Sales Corporation for two consecutive years:

2018 2019

Installment Sales

Down Payment 60,000 72,000

Balance 240,000 288,000

Cost of installment sales 180,000 208,800

Collections on Installment Sales

2018 Sales:

Applying to interest 78,000 54,000

Applying to principal 57,000 78,000

2019 Sales:

Applying to interest - 93,000

Applying to principal - 66,000

Assuming the perpetual inventory system is used, the related entries relevant to installment sales for 2018 and 2019 are

as follows:

Journal Entries for the year 2018

1 Cash 60,000

Installment Contracts Receivable - 2018 240,000

Installment Sales 300,000

To record installment sales.

2 Cost of Installment Sales 180,000

Merchandise Inventory 180,000

To record cost of sales.

3 Cash 135,000

Installment Contracts Receivable - 2018 57,000

Interest Income 78,000

To record collection of installment sales.

Journal Entries for the year ended December 31, 2018

4 Installment Sales 300,000

Cost of Installment Sales 180,000

Deferred Gross Profit - 2018 120,000

To set-up deferred gross profit on 2018 installment sales.

[Gross profit rate = P120,000/300,000 = 40%]

5 Deferred Gross Profit - 2018 46,800

Realized Gross Profit 46,800

To record realized gross profit on installment sales.

Computation:

Collections applying to principal (60,000+57,000) 117,000

Multiply by: Gross Profit Rate 40%

Realized Gross Profit 46,800

6 Realized Gross Profit - 2018 46,800

Income Summary 46,800

To close realized gross profit account.

Journal Entries for the year 2019

1 Cash 72,000

Installment Contracts Receivable - 2019 288,000

Installment Sales 360,000

To record installment sales.

2 Cost of Installment Sales 208,800

Merchandise Inventory 208,800

To record cost of sales.

3 Cash 291,000

Installment Contacts Receivable - 2018 78,000

Installment Contacts Receivable - 2019 66,000

Interest Income 147,000

To record collection of installment sales.

Journal Entries for the year ended December 31, 2019

4 Installment Sales 360,000

Cost of Installment Sales 208,800

Deferred Gross Profit - 2019 151,200

To set-up deferred gross profit on 2018 installment sales.

[Gross profit rate = P151,200/P360,000 = 42%]

5 Deferred Gross Profit - 2018 31,200

Deferred Gross Profit - 2019 57,960

Realized Gross Profit 89,160

Computation:

Collections Gross Realized

Year (Principal) x Profit Rate = Gross Profit

2018 P78,000 40% P31,200

2019 138,000 42% 57,960

P89,160

6 Realized Gross Profit 89,160

Income Summary 89,160

To close realized gross profit account.

You might also like

- Cap Table TemplateDocument5 pagesCap Table TemplatetransitxyzNo ratings yet

- 8-Step AMA Case Analysis GuideDocument6 pages8-Step AMA Case Analysis GuidelpelessNo ratings yet

- Quiz Midterm - Answer KeyDocument11 pagesQuiz Midterm - Answer KeyGloria BeltranNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Residential Sales Contract (Virginia) (07/2016) - K1321Document16 pagesResidential Sales Contract (Virginia) (07/2016) - K1321Jacky BoungNo ratings yet

- Research Project 2 On Indigo AirlinesDocument13 pagesResearch Project 2 On Indigo AirlinesNaresh Reddy100% (3)

- Income Statement-Mcq ProblemsDocument3 pagesIncome Statement-Mcq Problemschey dabestNo ratings yet

- Module 5.3 Chapter 5 Answer Key 1Document8 pagesModule 5.3 Chapter 5 Answer Key 1BlueBladeNo ratings yet

- Srs Template-IeeeDocument8 pagesSrs Template-IeeeIshwar RaiNo ratings yet

- Advacc Assign 3.docx 3Document7 pagesAdvacc Assign 3.docx 3Baobel PremiumsNo ratings yet

- Installment Sales - Exercises 1Document3 pagesInstallment Sales - Exercises 1Sova OmenPhoenixNo ratings yet

- Chapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsDocument4 pagesChapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsKeay ParadoNo ratings yet

- Installment ExercisesDocument2 pagesInstallment ExercisesalyssaNo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesRusselle Therese DaitolNo ratings yet

- AssignmentDocument3 pagesAssignmentalmira garciaNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- Latihan Soal Chapter 22Document9 pagesLatihan Soal Chapter 22JulyaniNo ratings yet

- Buscom Lecture-3Document4 pagesBuscom Lecture-3Dai SyNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- Ratios Questions A Level Topical Past PapersDocument21 pagesRatios Questions A Level Topical Past PapersJahanzaib ButtNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- PDF Cpar Afar Installment SalesDocument5 pagesPDF Cpar Afar Installment SalesChin FiguraNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Chapter 7 Inclass Problems Day 1 SOLUTIONSDocument3 pagesChapter 7 Inclass Problems Day 1 SOLUTIONSAbdullah alhamaadNo ratings yet

- AC316 Accounting For Special Transactions Pas 18 or Ias 18: RevenueDocument5 pagesAC316 Accounting For Special Transactions Pas 18 or Ias 18: RevenueKristan John ZernaNo ratings yet

- Financial Accounting Paper1.1Document20 pagesFinancial Accounting Paper1.1MahediNo ratings yet

- CMPC 131 AnswerDocument5 pagesCMPC 131 AnswerKharen ValdezNo ratings yet

- Installment Sales Reviewer Problems PDFDocument43 pagesInstallment Sales Reviewer Problems PDFUnnamed homosapien100% (1)

- Meycauayan College Advance Accounting and Reporting Part 1 Installment Sales Name: Date: I. Problem SolvingDocument2 pagesMeycauayan College Advance Accounting and Reporting Part 1 Installment Sales Name: Date: I. Problem SolvingMavie MalonzoNo ratings yet

- Quiz FMDocument3 pagesQuiz FMMarcos Jose AveNo ratings yet

- Chapter 2Document8 pagesChapter 2imel100% (3)

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Answers - Module 2Document4 pagesAnswers - Module 2bhettyna noayNo ratings yet

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopeNo ratings yet

- Lecture Notes - Financial Statement AnalysisDocument56 pagesLecture Notes - Financial Statement AnalysisRajnishKumarRohatgiNo ratings yet

- BBBBBDocument8 pagesBBBBBAlvira FajriNo ratings yet

- KMAMC Annual Report FY 18-19Document88 pagesKMAMC Annual Report FY 18-19World EntertainmentNo ratings yet

- Intercompany TransactionDocument3 pagesIntercompany TransactionHanna ValerosoNo ratings yet

- CPAR AP - Audit of ReceivablesDocument3 pagesCPAR AP - Audit of ReceivablesJohn Carlo CruzNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- Sample Problems - Estimated LiabilitiesDocument3 pagesSample Problems - Estimated LiabilitiesZaira PerezNo ratings yet

- ACC401-2023 Business Valuation TutorialsDocument3 pagesACC401-2023 Business Valuation TutorialsOhene Asare PogastyNo ratings yet

- Installment ProblemDocument1 pageInstallment ProblemAngela Conde100% (1)

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Installment Sales ReviewerDocument5 pagesInstallment Sales ReviewerJymldy EnclnNo ratings yet

- Novena Prayer For Our BelovedDocument9 pagesNovena Prayer For Our BelovedAliezaNo ratings yet

- (Citation Vat17 /L 13321) (CITATION Dieter /L 13321)Document2 pages(Citation Vat17 /L 13321) (CITATION Dieter /L 13321)AliezaNo ratings yet

- Activity Optimization TechniquesDocument2 pagesActivity Optimization TechniquesAliezaNo ratings yet

- Bepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitDocument21 pagesBepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitAliezaNo ratings yet

- Simple Company Statement of Financial Position As of December 31, 2018 Assets NoteDocument3 pagesSimple Company Statement of Financial Position As of December 31, 2018 Assets NoteAliezaNo ratings yet

- 01 22 2020 10.59.08Document1 page01 22 2020 10.59.08AliezaNo ratings yet

- BuscomDocument2 pagesBuscomAliezaNo ratings yet

- BuscomDocument1 pageBuscomAliezaNo ratings yet

- Characteristics of Contract of SaleDocument2 pagesCharacteristics of Contract of SaleAliezaNo ratings yet

- Sensitivity Analysis: Decision TheoryDocument18 pagesSensitivity Analysis: Decision TheoryAliezaNo ratings yet

- 67-4-3 AccountancyDocument23 pages67-4-3 AccountancyLokanathan KrishnamacharyNo ratings yet

- Insider MagazineDocument16 pagesInsider MagazineLoïc GuermeurNo ratings yet

- Piyush NTPC Training ReportDocument83 pagesPiyush NTPC Training ReportRavi GuptaNo ratings yet

- Unit 1 Class 7 Global DexterityDocument11 pagesUnit 1 Class 7 Global Dexteritygloria dungdungNo ratings yet

- Housing Loan ApplicationformDocument2 pagesHousing Loan Applicationformเอเรียล ชาเวซNo ratings yet

- Interim Order in The Matter of MBK Business Development (India) Limited.Document16 pagesInterim Order in The Matter of MBK Business Development (India) Limited.Shyam SunderNo ratings yet

- Point of Sale Display (POS)Document7 pagesPoint of Sale Display (POS)Ariana MagnusNo ratings yet

- Crafting The Brand PositioningDocument29 pagesCrafting The Brand PositioningAbhishek Raj PatelNo ratings yet

- Dissertation Topic Selection FormDocument2 pagesDissertation Topic Selection Formmohammedakbar88No ratings yet

- Tibia ImbuementsDocument3 pagesTibia ImbuementsBarry RazaNo ratings yet

- The Integrated Gaps Model of Service Quality: MKTG/HTM 386Document6 pagesThe Integrated Gaps Model of Service Quality: MKTG/HTM 386jaiswalpraveeNo ratings yet

- Abacus Power Suit Datasheet PDFDocument4 pagesAbacus Power Suit Datasheet PDFtomaNo ratings yet

- Case Study IllinoisDocument38 pagesCase Study IllinoisSyed Sherry Hassan0% (1)

- Briefing Guide July Week2&3 Metrobank EMVCardsDocument3 pagesBriefing Guide July Week2&3 Metrobank EMVCardsRafael-Cheryl Tupas-LimboNo ratings yet

- Group 1 Final TPDocument9 pagesGroup 1 Final TPRagib ShahriarNo ratings yet

- Report EMAS Circular EconomyDocument32 pagesReport EMAS Circular EconomyJuan Carlos CorazonesNo ratings yet

- Triumph Handbook July 2013Document43 pagesTriumph Handbook July 2013JovanNo ratings yet

- Problem (Orange Peel & Dented)Document2 pagesProblem (Orange Peel & Dented)Marketing TanajawaNo ratings yet

- IMT-05 Advertisement and Sales Promotion: NotesDocument2 pagesIMT-05 Advertisement and Sales Promotion: NotesPrasanta Kumar NandaNo ratings yet

- Basics of Market System and Market EquilibriumDocument15 pagesBasics of Market System and Market EquilibriumRajveer SinghNo ratings yet

- Inventory Management SystemDocument34 pagesInventory Management SystemAppex TechnologiesNo ratings yet

- 080 Divya LSCM AssignmentDocument8 pages080 Divya LSCM AssignmentpraveenaNo ratings yet

- MGMT PracticeDocument3 pagesMGMT Practicegmatej09No ratings yet

- The Circle of Life in Network Marketing RelationshipsDocument32 pagesThe Circle of Life in Network Marketing RelationshipsRanjan PalNo ratings yet

- Capital Allowances: Zulkhairi@um - Edu. MyDocument35 pagesCapital Allowances: Zulkhairi@um - Edu. MyNero ShaNo ratings yet