Professional Documents

Culture Documents

100%(2)100% found this document useful (2 votes)

515 viewsApex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Uploaded by

clvnngcThe Supreme Court upheld the decision of the Court of Appeals dismissing a petition filed by stockholders of Export and Industry Bank (EIB) challenging the Bangko Sentral ng Pilipinas' (BSP) resolution directing the Philippine Deposit Insurance Corporation (PDIC) to liquidate EIB. The Court found that the BSP, through the Monetary Board, is not required by law to make an independent determination of whether rehabilitation is possible once the PDIC has already made that determination. The PDIC determined that rehabilitation of EIB was no longer feasible after two failed bidding processes to rehabilitate the bank. Thus, the BSP did not gravely abuse its discretion in ordering the liquidation of EIB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- ACCA PerDocument11 pagesACCA Perdanjah12375% (8)

- Spouses Umaguing Vs Atty de VeraDocument2 pagesSpouses Umaguing Vs Atty de Veraclvnngc0% (1)

- Quasi Rational Economics - Thaler RichardDocument381 pagesQuasi Rational Economics - Thaler RichardKetlyn Accorsi100% (3)

- International Academy of Management and ECONOMICS (I/AME), Petitioner. LITTON AND COMPANY, INC, RespondentDocument3 pagesInternational Academy of Management and ECONOMICS (I/AME), Petitioner. LITTON AND COMPANY, INC, Respondenthoney samaniego100% (5)

- G.R. No. 196329 Roman v. Sec Case DigestDocument4 pagesG.R. No. 196329 Roman v. Sec Case DigestPlandito ElizabethNo ratings yet

- Knecht Vs UCCDocument2 pagesKnecht Vs UCCXing Keet LuNo ratings yet

- Stock VS Non Stock VS OpcDocument6 pagesStock VS Non Stock VS OpcRAY RAMIREZNo ratings yet

- Legal Ethics SyllabusDocument3 pagesLegal Ethics Syllabusclvnngc100% (1)

- 11e Ch3 Mini Case Client ContDocument10 pages11e Ch3 Mini Case Client ContHao Cui100% (1)

- Corporate LiquidationDocument6 pagesCorporate LiquidationWendelyn Tutor100% (1)

- Bankers AcceptancesDocument36 pagesBankers AcceptancesAlexhCreditor100% (1)

- G.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasDocument2 pagesG.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasFrancis Coronel Jr.No ratings yet

- Bangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestDocument3 pagesBangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestEmir Mendoza100% (4)

- G.R. No. 211222, August 07, 2017 - Allan S. Cu, vs. Small Business Guarantee and Finance CorporationDocument3 pagesG.R. No. 211222, August 07, 2017 - Allan S. Cu, vs. Small Business Guarantee and Finance CorporationFrancis Coronel Jr.100% (1)

- Ejercito v. Sandiganbayan DigestDocument1 pageEjercito v. Sandiganbayan DigestDianna Louise Dela GuerraNo ratings yet

- PNB v. Vila, G.R. No. 213241. August 1, 2016Document2 pagesPNB v. Vila, G.R. No. 213241. August 1, 2016Pamela Camille BarredoNo ratings yet

- PDIC, TIL, WarehouseDocument11 pagesPDIC, TIL, WarehouseA.T.Comia100% (1)

- Intengan vs. CADocument1 pageIntengan vs. CAMichelle Vale CruzNo ratings yet

- Park Hotel v. Soriano Case PresentationDocument16 pagesPark Hotel v. Soriano Case PresentationApril Rose VillamorNo ratings yet

- Spouses Cesar and Virginia Larrobis Vs Philippine Veterans BankDocument1 pageSpouses Cesar and Virginia Larrobis Vs Philippine Veterans BankAliceNo ratings yet

- Torres vs. Rural BankDocument2 pagesTorres vs. Rural BankkennerNo ratings yet

- CIVIL Spouses Jalbay Vs PNBDocument1 pageCIVIL Spouses Jalbay Vs PNBTrem GallenteNo ratings yet

- OTHERS - Verification and Certificate of Non-Forum Shopping and JuratDocument2 pagesOTHERS - Verification and Certificate of Non-Forum Shopping and JuratJeff SarabusingNo ratings yet

- Salud Vs Central BankDocument2 pagesSalud Vs Central BankCaroline A. LegaspinoNo ratings yet

- Commercial Law Case Digests - HernandoBar2023Document41 pagesCommercial Law Case Digests - HernandoBar2023FoliticNo ratings yet

- Ejercito V SandiganbayanDocument2 pagesEjercito V SandiganbayanAnonymous 5MiN6I78I0No ratings yet

- 30 Larrobis v. Philippine Veterans BankDocument2 pages30 Larrobis v. Philippine Veterans BankAgus DiazNo ratings yet

- Case Digest Berris Agricultural v. Abyadang (G.R. 183404Document3 pagesCase Digest Berris Agricultural v. Abyadang (G.R. 183404Charity RomagaNo ratings yet

- BSB GROUP V GODocument4 pagesBSB GROUP V GOALEXA100% (2)

- Koruga v. Arcenas, Et. Al, G.R. No. 168332Document2 pagesKoruga v. Arcenas, Et. Al, G.R. No. 168332xxxaaxxxNo ratings yet

- Commercial Law Review Corporation Code PDFDocument47 pagesCommercial Law Review Corporation Code PDFSarah CruzNo ratings yet

- 5 Amacna Reyna TABANG VS. NLRCDocument8 pages5 Amacna Reyna TABANG VS. NLRCReinNo ratings yet

- Simex International Vs Court of AppealsDocument4 pagesSimex International Vs Court of AppealsLouisse Anne FloresNo ratings yet

- Topic: The Corporation and The State: Sbma V. UigDocument1 pageTopic: The Corporation and The State: Sbma V. UigRenzoSantosNo ratings yet

- Gabionza v. CADocument17 pagesGabionza v. CADelmar Jess TuquibNo ratings yet

- Van Zuiden Bros., Ltd. vs. GTVL Manufacturing Industries, Inc.Document3 pagesVan Zuiden Bros., Ltd. vs. GTVL Manufacturing Industries, Inc.hmn_scribd100% (1)

- Tuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287 (2012)Document5 pagesTuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287 (2012)DNAANo ratings yet

- G.R. No. 178467. April 26, 2017. - Carbonell vs. Metropolitan Bank and Trust CompanyDocument2 pagesG.R. No. 178467. April 26, 2017. - Carbonell vs. Metropolitan Bank and Trust CompanyFrancis Coronel Jr.100% (1)

- Busuego v. CADocument2 pagesBusuego v. CAKathryn Crisostomo Punongbayan100% (3)

- Metro Pacific Corporation Vs CIRDocument4 pagesMetro Pacific Corporation Vs CIRkoeyNo ratings yet

- RURAL BANK OF STA. CATALINA, INC. v. LAND BANK OF THE PHILIPPINESDocument2 pagesRURAL BANK OF STA. CATALINA, INC. v. LAND BANK OF THE PHILIPPINESJohn Ray PerezNo ratings yet

- Tan v. SEC (Jore)Document2 pagesTan v. SEC (Jore)mjpjoreNo ratings yet

- (G.R. No. 211837. March 16, 2022) The Real Bank Vs DalmacioDocument23 pages(G.R. No. 211837. March 16, 2022) The Real Bank Vs DalmacioChatNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosNo ratings yet

- Certification As To Conduct of InquestDocument1 pageCertification As To Conduct of InquestJan Carlou TiratiraNo ratings yet

- Conflict of Laws Syllabus Dean Ulpiano P. Sarmiento Iii: San Beda College-Alabang School of LawDocument11 pagesConflict of Laws Syllabus Dean Ulpiano P. Sarmiento Iii: San Beda College-Alabang School of LawJerric BellezaNo ratings yet

- LEG MED Course OutlineDocument2 pagesLEG MED Course OutlinecholoNo ratings yet

- New Central Bank ActDocument39 pagesNew Central Bank ActdollyccruzNo ratings yet

- Mirant Vs CaroDocument3 pagesMirant Vs CaroRowela Descallar100% (2)

- QTCI Vs GeorgeDocument2 pagesQTCI Vs Georgeariel_080503No ratings yet

- Associated Bank v. CADocument2 pagesAssociated Bank v. CASha SantosNo ratings yet

- 195 LANDL and Company Vs Metrobank, 435 SCRA 639 (2004)Document1 page195 LANDL and Company Vs Metrobank, 435 SCRA 639 (2004)Alan GultiaNo ratings yet

- Fidelity Case DigestDocument2 pagesFidelity Case DigestCandypopNo ratings yet

- 85 Apollo Salud v. Central BankDocument2 pages85 Apollo Salud v. Central BankAnonymous HWfwDFRMPsNo ratings yet

- Romeo P. Busuego, Catalino F. Banez and Renato F. Lim, Petitioners, vs. The Honorable Court of Appeals and The Monetary Board of The CentralDocument1 pageRomeo P. Busuego, Catalino F. Banez and Renato F. Lim, Petitioners, vs. The Honorable Court of Appeals and The Monetary Board of The CentralchaNo ratings yet

- Forest Hills V Fil-EstateDocument2 pagesForest Hills V Fil-EstateGlenn Mikko MendiolaNo ratings yet

- Agilent Technologies V. Integrated Silicon - G.R. No. 154618 (Case DIGEST)Document4 pagesAgilent Technologies V. Integrated Silicon - G.R. No. 154618 (Case DIGEST)Kenette Diane CantubaNo ratings yet

- Foreign Currency Deposit Case Digest 1Document2 pagesForeign Currency Deposit Case Digest 1Mervic Al Tuble-Niala100% (1)

- Callanta Notes Crim 2 PDFDocument171 pagesCallanta Notes Crim 2 PDFEinstein NewtonNo ratings yet

- SMC Vs UnionDocument3 pagesSMC Vs UnionRyan ChristianNo ratings yet

- Intellectual Property Law ReviewerDocument2 pagesIntellectual Property Law ReviewerLadyfirst MANo ratings yet

- 1989 Bar Examination - MercantileDocument13 pages1989 Bar Examination - MercantilejerushabrainerdNo ratings yet

- 05 Robles Vs CADocument1 page05 Robles Vs CAJose Salve CabilingNo ratings yet

- 2 Provrem Central Sawmill Vs Alto SuretyDocument10 pages2 Provrem Central Sawmill Vs Alto SuretyNicholas FoxNo ratings yet

- Apex Bancrights Holdings Inc V Bangko Sentral NG PilipinasDocument3 pagesApex Bancrights Holdings Inc V Bangko Sentral NG Pilipinaszealous9carrotNo ratings yet

- Case Digest G.R. No. 214866Document2 pagesCase Digest G.R. No. 214866Trisha Laine PinpinNo ratings yet

- In Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRDocument3 pagesIn Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRnia coline mendozaNo ratings yet

- Filipinas Port Services v. GoDocument2 pagesFilipinas Port Services v. Goclvnngc100% (1)

- Burbe vs. MagultaDocument2 pagesBurbe vs. Magultaclvnngc100% (2)

- Pabalan vs. NLRCDocument2 pagesPabalan vs. NLRCclvnngcNo ratings yet

- Sales v. SECDocument3 pagesSales v. SECclvnngcNo ratings yet

- De Guzman vs. CADocument2 pagesDe Guzman vs. CAclvnngcNo ratings yet

- LRTA and MendozaDocument4 pagesLRTA and MendozaclvnngcNo ratings yet

- Air France vs. GillegoDocument2 pagesAir France vs. Gillegoclvnngc100% (1)

- INELCO vs. CADocument2 pagesINELCO vs. CAclvnngcNo ratings yet

- De Leon V de LeonDocument16 pagesDe Leon V de LeonclvnngcNo ratings yet

- San Miguel Corporation Supervisors and Exempt Union v. Honorable LaguesmaDocument1 pageSan Miguel Corporation Supervisors and Exempt Union v. Honorable LaguesmaclvnngcNo ratings yet

- YHT Realty vs. CADocument3 pagesYHT Realty vs. CAclvnngcNo ratings yet

- Miranda vs. Atty CarpioDocument2 pagesMiranda vs. Atty Carpioclvnngc100% (1)

- Royal Plant Workers Union vs. Coca Cola Bottlers Philippines, Inc.. - Cebu PlantDocument2 pagesRoyal Plant Workers Union vs. Coca Cola Bottlers Philippines, Inc.. - Cebu PlantclvnngcNo ratings yet

- Criminal Law 1 Course OutlineDocument6 pagesCriminal Law 1 Course OutlineclvnngcNo ratings yet

- Herrera Summarized Criminal Procedure RULE 110:: SectionDocument91 pagesHerrera Summarized Criminal Procedure RULE 110:: SectionclvnngcNo ratings yet

- Labor Republic Planters Bank V NLRCDocument4 pagesLabor Republic Planters Bank V NLRCclvnngcNo ratings yet

- Poe-Llamanzares v. COMELEC GR. No. 221697Document47 pagesPoe-Llamanzares v. COMELEC GR. No. 221697lenard5No ratings yet

- Ross Fundamentals of Corporate Finance 13e CH06 PPT AccessibleDocument61 pagesRoss Fundamentals of Corporate Finance 13e CH06 PPT AccessibleAdriana RisiNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- A Study On Brand Management of Miven Mayfran Conveyors LTDDocument63 pagesA Study On Brand Management of Miven Mayfran Conveyors LTDSuresh Babu Reddy100% (1)

- Cryptocurrencies - Advantages and Disadvantages: Flamur Bunjaku, Olivera Gjorgieva-Trajkovska, Emilija Miteva-KacarskiDocument9 pagesCryptocurrencies - Advantages and Disadvantages: Flamur Bunjaku, Olivera Gjorgieva-Trajkovska, Emilija Miteva-KacarskiTheGaming ZoneNo ratings yet

- Redemption of Preference SharesDocument9 pagesRedemption of Preference SharesRahul VermaNo ratings yet

- Capital Market in Indian Literature ReviewDocument6 pagesCapital Market in Indian Literature Reviewafmzfvlopbchbe100% (1)

- PEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryDocument2 pagesPEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryAlysia RabinaNo ratings yet

- Accounting Standards 5Document13 pagesAccounting Standards 5prash1820No ratings yet

- Aswath CDocument2 pagesAswath CSonai DasNo ratings yet

- PDF&Rendition 1 1Document73 pagesPDF&Rendition 1 1Srividya SNo ratings yet

- Understanding The Padma Bridge ControversyDocument4 pagesUnderstanding The Padma Bridge Controversyromel1974No ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Your Personality and Successful TradingDocument17 pagesYour Personality and Successful TradingIan Moncrieffe100% (5)

- Limited Liability Partnership Act 2008 PDFDocument12 pagesLimited Liability Partnership Act 2008 PDFxvfidxwmgNo ratings yet

- C4 Partnership - Review - QuestionsDocument3 pagesC4 Partnership - Review - QuestionsJizelle BianaNo ratings yet

- Dividend TheoriesDocument35 pagesDividend TheoriesLalit ShahNo ratings yet

- PD1270Document2 pagesPD1270Ronadale Zapata-AcostaNo ratings yet

- Beaumont ISD Declaration of Financial ExigencyDocument3 pagesBeaumont ISD Declaration of Financial ExigencyBryan WeatherfordNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- Rental ContractDocument11 pagesRental ContractWinalene SescarNo ratings yet

- EWT Lecture Notes by Soros1Document131 pagesEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- Master Budget Short ProblemsDocument3 pagesMaster Budget Short ProblemsMary Berly MagueflorNo ratings yet

Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Uploaded by

clvnngc100%(2)100% found this document useful (2 votes)

515 views2 pagesThe Supreme Court upheld the decision of the Court of Appeals dismissing a petition filed by stockholders of Export and Industry Bank (EIB) challenging the Bangko Sentral ng Pilipinas' (BSP) resolution directing the Philippine Deposit Insurance Corporation (PDIC) to liquidate EIB. The Court found that the BSP, through the Monetary Board, is not required by law to make an independent determination of whether rehabilitation is possible once the PDIC has already made that determination. The PDIC determined that rehabilitation of EIB was no longer feasible after two failed bidding processes to rehabilitate the bank. Thus, the BSP did not gravely abuse its discretion in ordering the liquidation of EIB.

Original Description:

Case Digest

Original Title

Apex Bancrights Holdings, Inc. vs. Bangko Sentral Ng Pilipinas and PDIC

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Supreme Court upheld the decision of the Court of Appeals dismissing a petition filed by stockholders of Export and Industry Bank (EIB) challenging the Bangko Sentral ng Pilipinas' (BSP) resolution directing the Philippine Deposit Insurance Corporation (PDIC) to liquidate EIB. The Court found that the BSP, through the Monetary Board, is not required by law to make an independent determination of whether rehabilitation is possible once the PDIC has already made that determination. The PDIC determined that rehabilitation of EIB was no longer feasible after two failed bidding processes to rehabilitate the bank. Thus, the BSP did not gravely abuse its discretion in ordering the liquidation of EIB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(2)100% found this document useful (2 votes)

515 views2 pagesApex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG Pilipinas and PDIC

Uploaded by

clvnngcThe Supreme Court upheld the decision of the Court of Appeals dismissing a petition filed by stockholders of Export and Industry Bank (EIB) challenging the Bangko Sentral ng Pilipinas' (BSP) resolution directing the Philippine Deposit Insurance Corporation (PDIC) to liquidate EIB. The Court found that the BSP, through the Monetary Board, is not required by law to make an independent determination of whether rehabilitation is possible once the PDIC has already made that determination. The PDIC determined that rehabilitation of EIB was no longer feasible after two failed bidding processes to rehabilitate the bank. Thus, the BSP did not gravely abuse its discretion in ordering the liquidation of EIB.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

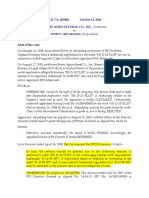

APEX

BANCRIGHTS HOLDINGS, INC. vs. BANGKO SENTRAL NG PILIPINAS and PDIC

G.R. No. 214866; October 2, 2017

J. Perlas-Bernabe

DOCTRINE:

Nothing in Section 30 of RA 7653 requires the BSP, through the Monetary Board, to make an

independent determination of whether a bank may still be rehabilitated or not. As expressly stated in the

afore-cited provision, once the receiver determines that rehabilitation is no longer feasible, the Monetary

Board is simply obligated to “(a) notify in writing the bank's board of directors of the same; and (b) direct

the PDIC to proceed with liquidation.” Suffice it to say that if the law had indeed intended that the

Monetary Board make a separate and distinct factual determination before it can order the liquidation of

a bank or quasi-bank, then there should have been a provision to that effect. There being none, it can

safely be concluded that the Monetary Board is not so required when the PDIC has already made such

determination.

FACTS:

Export and Industry Bank (EIB) entered into a three-way merger with Urban Bank, Inc. (UBI) and

Urbancorp Investments, Inc. (UII) in an attempt to rehabilitate UBI which was then under receivership.

Following the said merger, EIB itself encountered financial difficulties which prompted PDIC to extend

financial assistance to it. However, EIB still failed to overcome its financial problems, thereby causing PDIC

to release additional financial assistance to it. Despite this, EIB failed to comply with the BSP's capital

requirements, causing EIB's stockholders to commence the process of selling the bank.

BDO's expressed its interest in acquiring EIB. However, BDO’s acquisition of EIB did not proceed and the

latter's financial condition worsened. EIB 's president and chairman voluntarily turned-over the full

control of EIB to BSP, and informed the latter that the former will declare a bank holiday on April 27,

2012. On April 26, 2012, the BSP, through the Monetary Board, issued Resolution No. 6868 prohibiting EIB

from doing business in the Philippines and placing it under the receivership of PDIC, in accordance with

Section 30 of The New Central Bank Act. Accordingly, PDIC took over EIB.

PDIC submitted its initial receivership report to the Monetary Board which contained its finding that EIB

can be rehabilitated or permitted to resume business; provided, that a bidding for its rehabilitation would

be conducted, and that the following conditions would be met: (a) there are qualified interested banks

that will comply with the parameters for rehabilitation of a closed bank, capital strengthening, liquidity,

sustainability and viability of operations, and strengthening of bank governance; and (b) all parties

(including creditors and stockholders) agree to the rehabilitation and the revised payment terms and

conditions of outstanding liabilities. Accordingly, the Monetary Board issued Resolution No. 1317 noting

PDIC's initial report, and its request to extend the period within which to submit the final determination

of whether or not EIB can be rehabilitated. Two consequent public biddings were held and both did not

materialize as no bids were submitted.

PDIC informed BSP that EIB can hardly be rehabilitated. The Monetary Board passed Resolution 571

directing PDIC to proceed with the liquidation of EIB.

Petitioners, who are stockholders representing the majority stock of EIB, filed a petition for certiorari

before the CA challenging Resolution No. 571. In essence, petitioners blame PDIC for the failure to

rehabilitate EIB. In defense, PDIC countered that petitioners were already estopped from assailing the

placement of EIB under receivership and its eventual liquidation since they had already surrendered full

control of the bank to the BSP as early as April 26, 2012. For its part, BSP maintained that it had ample

factual and legal bases to order EIB's liquidation.

CA dismissed the petition for lack of merit.

ISSUE:

Whether or not the CA correctly ruled that the Monetary Board did not gravely abuse its

discretion in issuing Resolution No. 571 which directed the PDIC to proceed with the liquidation of EIB.

HELD:

No, the Monetary Board did not gravely abuse its discretion when it directed PDIC to proceed

with the liquidation of EIB.

Section 30 of RA 7653 provides for the grounds to place banks and quasi banks under receivership and

liquidation. It provides that “The actions of the Monetary Board taken under this section or under Section

29 of this Act shall be final and executory, and may not be restrained or set aside by the court except on

petition for certiorari on the ground that the action taken was in excess of jurisdiction or with such grave

abuse of discretion as to amount to lack or excess of jurisdiction.”

It is settled that the power and authority of the Monetary Board to close banks and liquidate them

thereafter when public interest so requires is an exercise of the police power of the State.

To recount, after the Monetary Board issued Resolution No. 686 which placed EIB under the receivership

of PDIC, the latter submitted its initial findings to the Monetary Board, stating that EIB can be

rehabilitated or permitted to resume business; provided, that a bidding for its rehabilitation would be

conducted, and that the above-cited conditions would be met.

Petitioners cannot insist that the Monetary Board must first make its own independent finding that the

bank could no longer be rehabilitated before ordering the liquidation of a bank.

As correctly held by the CA, nothing in Section 30 of RA 7653 requires the BSP, through the Monetary

Board, to make an independent determination of whether a bank may still be rehabilitated or not. As

expressly stated in the afore-cited provision, once the receiver determines that rehabilitation is no longer

feasible, the Monetary Board is simply obligated to “(a) notify in writing the bank's board of directors of

the same; and (b) direct the PDIC to proceed with liquidation.” Suffice it to say that if the law had indeed

intended that the Monetary Board make a separate and distinct factual determination before it can order

the liquidation of a bank or quasi-bank, then there should have been a provision to that effect. There

being none, it can safely be concluded that the Monetary Board is not so required when the PDIC has

already made such determination.

It must be stressed that the BSP, in its capacity as government regulator of banks, and the PDIC, as

statutory receiver of banks under RA 7653, are the principal agencies mandated by law to determine the

financial viability of banks and quasi-banks, and facilitate the receivership and liquidation of closed

financial institutions, upon a factual determination of the latter's insolvency.

You might also like

- ACCA PerDocument11 pagesACCA Perdanjah12375% (8)

- Spouses Umaguing Vs Atty de VeraDocument2 pagesSpouses Umaguing Vs Atty de Veraclvnngc0% (1)

- Quasi Rational Economics - Thaler RichardDocument381 pagesQuasi Rational Economics - Thaler RichardKetlyn Accorsi100% (3)

- International Academy of Management and ECONOMICS (I/AME), Petitioner. LITTON AND COMPANY, INC, RespondentDocument3 pagesInternational Academy of Management and ECONOMICS (I/AME), Petitioner. LITTON AND COMPANY, INC, Respondenthoney samaniego100% (5)

- G.R. No. 196329 Roman v. Sec Case DigestDocument4 pagesG.R. No. 196329 Roman v. Sec Case DigestPlandito ElizabethNo ratings yet

- Knecht Vs UCCDocument2 pagesKnecht Vs UCCXing Keet LuNo ratings yet

- Stock VS Non Stock VS OpcDocument6 pagesStock VS Non Stock VS OpcRAY RAMIREZNo ratings yet

- Legal Ethics SyllabusDocument3 pagesLegal Ethics Syllabusclvnngc100% (1)

- 11e Ch3 Mini Case Client ContDocument10 pages11e Ch3 Mini Case Client ContHao Cui100% (1)

- Corporate LiquidationDocument6 pagesCorporate LiquidationWendelyn Tutor100% (1)

- Bankers AcceptancesDocument36 pagesBankers AcceptancesAlexhCreditor100% (1)

- G.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasDocument2 pagesG.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasFrancis Coronel Jr.No ratings yet

- Bangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestDocument3 pagesBangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestEmir Mendoza100% (4)

- G.R. No. 211222, August 07, 2017 - Allan S. Cu, vs. Small Business Guarantee and Finance CorporationDocument3 pagesG.R. No. 211222, August 07, 2017 - Allan S. Cu, vs. Small Business Guarantee and Finance CorporationFrancis Coronel Jr.100% (1)

- Ejercito v. Sandiganbayan DigestDocument1 pageEjercito v. Sandiganbayan DigestDianna Louise Dela GuerraNo ratings yet

- PNB v. Vila, G.R. No. 213241. August 1, 2016Document2 pagesPNB v. Vila, G.R. No. 213241. August 1, 2016Pamela Camille BarredoNo ratings yet

- PDIC, TIL, WarehouseDocument11 pagesPDIC, TIL, WarehouseA.T.Comia100% (1)

- Intengan vs. CADocument1 pageIntengan vs. CAMichelle Vale CruzNo ratings yet

- Park Hotel v. Soriano Case PresentationDocument16 pagesPark Hotel v. Soriano Case PresentationApril Rose VillamorNo ratings yet

- Spouses Cesar and Virginia Larrobis Vs Philippine Veterans BankDocument1 pageSpouses Cesar and Virginia Larrobis Vs Philippine Veterans BankAliceNo ratings yet

- Torres vs. Rural BankDocument2 pagesTorres vs. Rural BankkennerNo ratings yet

- CIVIL Spouses Jalbay Vs PNBDocument1 pageCIVIL Spouses Jalbay Vs PNBTrem GallenteNo ratings yet

- OTHERS - Verification and Certificate of Non-Forum Shopping and JuratDocument2 pagesOTHERS - Verification and Certificate of Non-Forum Shopping and JuratJeff SarabusingNo ratings yet

- Salud Vs Central BankDocument2 pagesSalud Vs Central BankCaroline A. LegaspinoNo ratings yet

- Commercial Law Case Digests - HernandoBar2023Document41 pagesCommercial Law Case Digests - HernandoBar2023FoliticNo ratings yet

- Ejercito V SandiganbayanDocument2 pagesEjercito V SandiganbayanAnonymous 5MiN6I78I0No ratings yet

- 30 Larrobis v. Philippine Veterans BankDocument2 pages30 Larrobis v. Philippine Veterans BankAgus DiazNo ratings yet

- Case Digest Berris Agricultural v. Abyadang (G.R. 183404Document3 pagesCase Digest Berris Agricultural v. Abyadang (G.R. 183404Charity RomagaNo ratings yet

- BSB GROUP V GODocument4 pagesBSB GROUP V GOALEXA100% (2)

- Koruga v. Arcenas, Et. Al, G.R. No. 168332Document2 pagesKoruga v. Arcenas, Et. Al, G.R. No. 168332xxxaaxxxNo ratings yet

- Commercial Law Review Corporation Code PDFDocument47 pagesCommercial Law Review Corporation Code PDFSarah CruzNo ratings yet

- 5 Amacna Reyna TABANG VS. NLRCDocument8 pages5 Amacna Reyna TABANG VS. NLRCReinNo ratings yet

- Simex International Vs Court of AppealsDocument4 pagesSimex International Vs Court of AppealsLouisse Anne FloresNo ratings yet

- Topic: The Corporation and The State: Sbma V. UigDocument1 pageTopic: The Corporation and The State: Sbma V. UigRenzoSantosNo ratings yet

- Gabionza v. CADocument17 pagesGabionza v. CADelmar Jess TuquibNo ratings yet

- Van Zuiden Bros., Ltd. vs. GTVL Manufacturing Industries, Inc.Document3 pagesVan Zuiden Bros., Ltd. vs. GTVL Manufacturing Industries, Inc.hmn_scribd100% (1)

- Tuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287 (2012)Document5 pagesTuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287 (2012)DNAANo ratings yet

- G.R. No. 178467. April 26, 2017. - Carbonell vs. Metropolitan Bank and Trust CompanyDocument2 pagesG.R. No. 178467. April 26, 2017. - Carbonell vs. Metropolitan Bank and Trust CompanyFrancis Coronel Jr.100% (1)

- Busuego v. CADocument2 pagesBusuego v. CAKathryn Crisostomo Punongbayan100% (3)

- Metro Pacific Corporation Vs CIRDocument4 pagesMetro Pacific Corporation Vs CIRkoeyNo ratings yet

- RURAL BANK OF STA. CATALINA, INC. v. LAND BANK OF THE PHILIPPINESDocument2 pagesRURAL BANK OF STA. CATALINA, INC. v. LAND BANK OF THE PHILIPPINESJohn Ray PerezNo ratings yet

- Tan v. SEC (Jore)Document2 pagesTan v. SEC (Jore)mjpjoreNo ratings yet

- (G.R. No. 211837. March 16, 2022) The Real Bank Vs DalmacioDocument23 pages(G.R. No. 211837. March 16, 2022) The Real Bank Vs DalmacioChatNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosNo ratings yet

- Certification As To Conduct of InquestDocument1 pageCertification As To Conduct of InquestJan Carlou TiratiraNo ratings yet

- Conflict of Laws Syllabus Dean Ulpiano P. Sarmiento Iii: San Beda College-Alabang School of LawDocument11 pagesConflict of Laws Syllabus Dean Ulpiano P. Sarmiento Iii: San Beda College-Alabang School of LawJerric BellezaNo ratings yet

- LEG MED Course OutlineDocument2 pagesLEG MED Course OutlinecholoNo ratings yet

- New Central Bank ActDocument39 pagesNew Central Bank ActdollyccruzNo ratings yet

- Mirant Vs CaroDocument3 pagesMirant Vs CaroRowela Descallar100% (2)

- QTCI Vs GeorgeDocument2 pagesQTCI Vs Georgeariel_080503No ratings yet

- Associated Bank v. CADocument2 pagesAssociated Bank v. CASha SantosNo ratings yet

- 195 LANDL and Company Vs Metrobank, 435 SCRA 639 (2004)Document1 page195 LANDL and Company Vs Metrobank, 435 SCRA 639 (2004)Alan GultiaNo ratings yet

- Fidelity Case DigestDocument2 pagesFidelity Case DigestCandypopNo ratings yet

- 85 Apollo Salud v. Central BankDocument2 pages85 Apollo Salud v. Central BankAnonymous HWfwDFRMPsNo ratings yet

- Romeo P. Busuego, Catalino F. Banez and Renato F. Lim, Petitioners, vs. The Honorable Court of Appeals and The Monetary Board of The CentralDocument1 pageRomeo P. Busuego, Catalino F. Banez and Renato F. Lim, Petitioners, vs. The Honorable Court of Appeals and The Monetary Board of The CentralchaNo ratings yet

- Forest Hills V Fil-EstateDocument2 pagesForest Hills V Fil-EstateGlenn Mikko MendiolaNo ratings yet

- Agilent Technologies V. Integrated Silicon - G.R. No. 154618 (Case DIGEST)Document4 pagesAgilent Technologies V. Integrated Silicon - G.R. No. 154618 (Case DIGEST)Kenette Diane CantubaNo ratings yet

- Foreign Currency Deposit Case Digest 1Document2 pagesForeign Currency Deposit Case Digest 1Mervic Al Tuble-Niala100% (1)

- Callanta Notes Crim 2 PDFDocument171 pagesCallanta Notes Crim 2 PDFEinstein NewtonNo ratings yet

- SMC Vs UnionDocument3 pagesSMC Vs UnionRyan ChristianNo ratings yet

- Intellectual Property Law ReviewerDocument2 pagesIntellectual Property Law ReviewerLadyfirst MANo ratings yet

- 1989 Bar Examination - MercantileDocument13 pages1989 Bar Examination - MercantilejerushabrainerdNo ratings yet

- 05 Robles Vs CADocument1 page05 Robles Vs CAJose Salve CabilingNo ratings yet

- 2 Provrem Central Sawmill Vs Alto SuretyDocument10 pages2 Provrem Central Sawmill Vs Alto SuretyNicholas FoxNo ratings yet

- Apex Bancrights Holdings Inc V Bangko Sentral NG PilipinasDocument3 pagesApex Bancrights Holdings Inc V Bangko Sentral NG Pilipinaszealous9carrotNo ratings yet

- Case Digest G.R. No. 214866Document2 pagesCase Digest G.R. No. 214866Trisha Laine PinpinNo ratings yet

- In Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRDocument3 pagesIn Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRnia coline mendozaNo ratings yet

- Filipinas Port Services v. GoDocument2 pagesFilipinas Port Services v. Goclvnngc100% (1)

- Burbe vs. MagultaDocument2 pagesBurbe vs. Magultaclvnngc100% (2)

- Pabalan vs. NLRCDocument2 pagesPabalan vs. NLRCclvnngcNo ratings yet

- Sales v. SECDocument3 pagesSales v. SECclvnngcNo ratings yet

- De Guzman vs. CADocument2 pagesDe Guzman vs. CAclvnngcNo ratings yet

- LRTA and MendozaDocument4 pagesLRTA and MendozaclvnngcNo ratings yet

- Air France vs. GillegoDocument2 pagesAir France vs. Gillegoclvnngc100% (1)

- INELCO vs. CADocument2 pagesINELCO vs. CAclvnngcNo ratings yet

- De Leon V de LeonDocument16 pagesDe Leon V de LeonclvnngcNo ratings yet

- San Miguel Corporation Supervisors and Exempt Union v. Honorable LaguesmaDocument1 pageSan Miguel Corporation Supervisors and Exempt Union v. Honorable LaguesmaclvnngcNo ratings yet

- YHT Realty vs. CADocument3 pagesYHT Realty vs. CAclvnngcNo ratings yet

- Miranda vs. Atty CarpioDocument2 pagesMiranda vs. Atty Carpioclvnngc100% (1)

- Royal Plant Workers Union vs. Coca Cola Bottlers Philippines, Inc.. - Cebu PlantDocument2 pagesRoyal Plant Workers Union vs. Coca Cola Bottlers Philippines, Inc.. - Cebu PlantclvnngcNo ratings yet

- Criminal Law 1 Course OutlineDocument6 pagesCriminal Law 1 Course OutlineclvnngcNo ratings yet

- Herrera Summarized Criminal Procedure RULE 110:: SectionDocument91 pagesHerrera Summarized Criminal Procedure RULE 110:: SectionclvnngcNo ratings yet

- Labor Republic Planters Bank V NLRCDocument4 pagesLabor Republic Planters Bank V NLRCclvnngcNo ratings yet

- Poe-Llamanzares v. COMELEC GR. No. 221697Document47 pagesPoe-Llamanzares v. COMELEC GR. No. 221697lenard5No ratings yet

- Ross Fundamentals of Corporate Finance 13e CH06 PPT AccessibleDocument61 pagesRoss Fundamentals of Corporate Finance 13e CH06 PPT AccessibleAdriana RisiNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- A Study On Brand Management of Miven Mayfran Conveyors LTDDocument63 pagesA Study On Brand Management of Miven Mayfran Conveyors LTDSuresh Babu Reddy100% (1)

- Cryptocurrencies - Advantages and Disadvantages: Flamur Bunjaku, Olivera Gjorgieva-Trajkovska, Emilija Miteva-KacarskiDocument9 pagesCryptocurrencies - Advantages and Disadvantages: Flamur Bunjaku, Olivera Gjorgieva-Trajkovska, Emilija Miteva-KacarskiTheGaming ZoneNo ratings yet

- Redemption of Preference SharesDocument9 pagesRedemption of Preference SharesRahul VermaNo ratings yet

- Capital Market in Indian Literature ReviewDocument6 pagesCapital Market in Indian Literature Reviewafmzfvlopbchbe100% (1)

- PEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryDocument2 pagesPEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryAlysia RabinaNo ratings yet

- Accounting Standards 5Document13 pagesAccounting Standards 5prash1820No ratings yet

- Aswath CDocument2 pagesAswath CSonai DasNo ratings yet

- PDF&Rendition 1 1Document73 pagesPDF&Rendition 1 1Srividya SNo ratings yet

- Understanding The Padma Bridge ControversyDocument4 pagesUnderstanding The Padma Bridge Controversyromel1974No ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Your Personality and Successful TradingDocument17 pagesYour Personality and Successful TradingIan Moncrieffe100% (5)

- Limited Liability Partnership Act 2008 PDFDocument12 pagesLimited Liability Partnership Act 2008 PDFxvfidxwmgNo ratings yet

- C4 Partnership - Review - QuestionsDocument3 pagesC4 Partnership - Review - QuestionsJizelle BianaNo ratings yet

- Dividend TheoriesDocument35 pagesDividend TheoriesLalit ShahNo ratings yet

- PD1270Document2 pagesPD1270Ronadale Zapata-AcostaNo ratings yet

- Beaumont ISD Declaration of Financial ExigencyDocument3 pagesBeaumont ISD Declaration of Financial ExigencyBryan WeatherfordNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- Rental ContractDocument11 pagesRental ContractWinalene SescarNo ratings yet

- EWT Lecture Notes by Soros1Document131 pagesEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- Master Budget Short ProblemsDocument3 pagesMaster Budget Short ProblemsMary Berly MagueflorNo ratings yet