Professional Documents

Culture Documents

Accountingtools: Accounting For Gift Cards - Gift Certificates

Accountingtools: Accounting For Gift Cards - Gift Certificates

Uploaded by

Nicah AcojonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountingtools: Accounting For Gift Cards - Gift Certificates

Accountingtools: Accounting For Gift Cards - Gift Certificates

Uploaded by

Nicah AcojonCopyright:

Available Formats

A c c o u n t i n gTo o l s

ACCOUNTING CPE COURSES & BOOKS

CPE Courses Books Articles Podcast Dictionary FAQs About Home

Accounting for gift cards | Gift certificates Search

May 23, 2018

Value Packs

The essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the Controller Library Value Pack

card holders use the related funds. There are varying treatments for the residual balances in these cards, as noted CFO Library Value Pack

below. Bookkeeper Library Value Pack

Financial Analysis Value Pack

Background of Gift Cards

Accounting Bestsellers

Accountants' Guidebook

Gift cards are a concept that has been in use for many years, first appearing as employer-provided scrip that Accounting Controls Guidebook

Accounting for Casinos & Gaming

employees could use to acquire goods in the company store. The current interpretation of the gift card has since been

Accounting for Inventory

expanded to include all consumers, not just employees. Gift cards are a boon to the companies selling the cards, for Accounting for Managers

the following reasons: Accounting Information Systems

Accounting Procedures Guidebook

Agricultural Accounting

Source of cash. The recipients of gift cards do not necessarily use them. Depending on the study, it appears Bookkeeping Guidebook

that between 10% and 20% of all gift cards are not used. Budgeting

Upspending. Many card recipients spend not only the amount on the card, but a great deal more, which is CFO Guidebook

known as upspending. Closing the Books

Construction Accounting

Returned goods. The amount of goods returned to the company decline from what would be experienced

Cost Accounting Fundamentals

with a gift purchase, since the card recipient knows exactly what he or she wants to buy.

Cost Accounting Textbook

Credit & Collections

Fixed Asset Accounting

Accounting for Gift Cards and Gift Certificates

Fraud Examination

GAAP Guidebook

Governmental Accounting

There are a number of accounting issues related to gift cards, which are:

Health Care Accounting

Hospitality Accounting

IFRS Guidebook

Liability recognition. The initial sale of a gift card triggers the recordation of a liability, not a sale. This is a

Lean Accounting Guidebook

debit to cash and a credit to the gift cards outstanding account. New Controller Guidebook

Sale recognition. When a gift card is used, the initial liability is shifted into a sale transaction. Nonprofit Accounting

Breakage. If there is a reasonable expectation that a certain proportion of gift cards will not be used, this Oil & Gas Accounting

amount can be recognized as revenue. Payables Management

Escheatment. When a gift card is not used, the funds must be remitted to the applicable state government; the Payroll Management

Public Company Accounting

company cannot retain the cash. This requirement is stated under local escheatment laws that cover

Real Estate Accounting

unclaimed property. Consequently, there must be a system for tracking unused gift cards, which trigger a

remittance once the statutory dormancy period has been exceeded.

Fraud reimbursement. A thief could obtain access to the identification codes for individual gift cards that are Finance Bestsellers

on display in retail stores, wait for someone to buy the cards, and then use the codes to buy goods. When this Business Ratios Guidebook

Corporate Cash Management

happens, the issuing entity should reimburse the defrauded customers, which should be tracked by the

Corporate Finance

accounting staff.

Cost Management

Enterprise Risk Management

Financial Analysis

Though it is not an accounting transaction, you should also be aware of the delay in recognizing sales caused by gift

Interpretation of Financials

cards. Card recipients may not use them for months, so the initial "sale" of the card only results in the recordation of a Investor Relations Guidebook

liability, which is eventually transformed into a sale when the card is used by the recipient. MBA Guidebook

Mergers & Acquisitions

Treasurer's Guidebook

Related Courses

You might also like

- JHS-183 (E) 7ZPJD0559C (Ed1) SERVICE MANUALDocument120 pagesJHS-183 (E) 7ZPJD0559C (Ed1) SERVICE MANUALJose Vivar100% (3)

- NCWC Final ReportDocument26 pagesNCWC Final ReportAnitah MasoniNo ratings yet

- TM-FTKC-Manual User PDFDocument72 pagesTM-FTKC-Manual User PDFnvn87100% (1)

- (Sir Chua's Accounting Lessons PH) L1 - Cash To Accrual Basis of AccountingDocument12 pages(Sir Chua's Accounting Lessons PH) L1 - Cash To Accrual Basis of AccountingNicah AcojonNo ratings yet

- Acco 30033 q3 - Ma'Am LizDocument7 pagesAcco 30033 q3 - Ma'Am LizNicah AcojonNo ratings yet

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- Food Assistance: SNAP, WIC, CSFPDocument2 pagesFood Assistance: SNAP, WIC, CSFPjgstorandt44No ratings yet

- Deposit SlipDocument1 pageDeposit SlipHabibie GunawanNo ratings yet

- CardConnect Final CC 5Document3 pagesCardConnect Final CC 5Juan Pablo MarinNo ratings yet

- Credit Account Application FormDocument6 pagesCredit Account Application Formapi-279331538No ratings yet

- Decoding Bank StatementsDocument1 pageDecoding Bank StatementsBalaji_SAPNo ratings yet

- Credit Card Fraud Prevention Strategies A Complete Guide - 2021 EditionFrom EverandCredit Card Fraud Prevention Strategies A Complete Guide - 2021 EditionNo ratings yet

- Ki Gerl 2017Document19 pagesKi Gerl 2017Bern Jonathan SembiringNo ratings yet

- Talent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027Document9 pagesTalent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027bambini84No ratings yet

- ILO7 Extent of Liability of Ict ProfessionalDocument7 pagesILO7 Extent of Liability of Ict ProfessionalCharlotte De Guzman DoloresNo ratings yet

- Unit 10 AB Financial AccountingDocument5 pagesUnit 10 AB Financial AccountingAlamzeb KhanNo ratings yet

- Florida Economic Development Grantees 2023Document5 pagesFlorida Economic Development Grantees 2023WTXL ABC27No ratings yet

- Lockbox Power PointDocument19 pagesLockbox Power Pointasrinu88881125100% (1)

- Deposit and Borrowing OperationsDocument5 pagesDeposit and Borrowing OperationsCinNo ratings yet

- Electronic Banking: Push and Pull MessagesDocument11 pagesElectronic Banking: Push and Pull MessagesKhawar Munir GorayaNo ratings yet

- Comercial BanksDocument21 pagesComercial BanksSanto AntonyNo ratings yet

- Sample BSNL Bill - Invoice - ChequeDocument7 pagesSample BSNL Bill - Invoice - ChequeQuick Solutions ConsultancyNo ratings yet

- Instalment Plan Credit Card Offer TNCDocument15 pagesInstalment Plan Credit Card Offer TNCivan alvarezNo ratings yet

- Self Service Loan Mod 1stDocument13 pagesSelf Service Loan Mod 1stGary SilvermanNo ratings yet

- Go4itCreditCardTermsConditions PDFDocument29 pagesGo4itCreditCardTermsConditions PDFJismin JosephNo ratings yet

- PNB Los Angeles Branch 316 W 2 St. Suite 700 Los Angeles, CA 90012 213-401-1800Document4 pagesPNB Los Angeles Branch 316 W 2 St. Suite 700 Los Angeles, CA 90012 213-401-1800theresapalileoNo ratings yet

- Notice of Proposed RulemakingDocument8 pagesNotice of Proposed RulemakingCircuit MediaNo ratings yet

- No Calls: Actual and Constructive NoticeDocument3 pagesNo Calls: Actual and Constructive NoticeKNOWLEDGE SOURCENo ratings yet

- Use Our Online Service To Obtain A Social Security Number CardDocument2 pagesUse Our Online Service To Obtain A Social Security Number CardSheng-Chun WuNo ratings yet

- Ecommerce PresentationDocument9 pagesEcommerce PresentationSurabhi AgrawalNo ratings yet

- Fraud Email RoutingDocument5 pagesFraud Email RoutingCursedDiamondsNo ratings yet

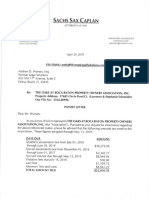

- Payoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners AssociationDocument4 pagesPayoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners Associationlarry-612445100% (1)

- FCRA Release For Credit Report 16SEP2011Document1 pageFCRA Release For Credit Report 16SEP2011Marianne BokmaNo ratings yet

- Judicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowDocument9 pagesJudicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowElaine Diane EtingoffNo ratings yet

- Acting ChairpersonDocument33 pagesActing ChairpersonNovie AmorNo ratings yet

- A Look Inside UPS FedEx and USPS Declared Value Policies For The Parcel ShipperDocument18 pagesA Look Inside UPS FedEx and USPS Declared Value Policies For The Parcel Shipperattom8515100% (2)

- The Balance SheetDocument7 pagesThe Balance Sheetsevirous valeriaNo ratings yet

- Bounching Check LawDocument2 pagesBounching Check LawNeria SagunNo ratings yet

- Complaint To CFPB Re TransUnion LLC Refused To Provide My Annual Credit Report OnlineDocument4 pagesComplaint To CFPB Re TransUnion LLC Refused To Provide My Annual Credit Report OnlineNeil GillespieNo ratings yet

- DigitalCash RKDocument44 pagesDigitalCash RKsanjivkinkerNo ratings yet

- WP Fair Credit Reporting Act 8-1-14Document17 pagesWP Fair Credit Reporting Act 8-1-14EmpresarioNo ratings yet

- Credit Default SwapsDocument4 pagesCredit Default SwapsAbhijeit BhosaleNo ratings yet

- Credit Card Authorization Form RegularDocument2 pagesCredit Card Authorization Form RegularKeller MolinaNo ratings yet

- NIL Sec 1-12 Cases (1st)Document12 pagesNIL Sec 1-12 Cases (1st)Munchie MichieNo ratings yet

- AttachmentDocument31 pagesAttachmentHambaNo ratings yet

- REAL ID: State-by-State UpdateDocument36 pagesREAL ID: State-by-State UpdateCato InstituteNo ratings yet

- Audit of Westlake's Financial ReportDocument91 pagesAudit of Westlake's Financial ReportmcooperkplcNo ratings yet

- Credit Bureau Understanding Your Credit ReportDocument1 pageCredit Bureau Understanding Your Credit ReportsurfnewsNo ratings yet

- EziDebit - DDR Form - CompletePTDocument2 pagesEziDebit - DDR Form - CompletePTAndrewNeilYoungNo ratings yet

- Personal Banking: Consumer Pricing InformationDocument5 pagesPersonal Banking: Consumer Pricing InformationSteph BryattNo ratings yet

- Platinum Transaction Program GuideDocument47 pagesPlatinum Transaction Program GuideSSGFL10% (1)

- 0 Ebook 8 Templates 3Document12 pages0 Ebook 8 Templates 3Glenn MozleyNo ratings yet

- Distributed Data Mining in Credit Card Fraud DetectionDocument57 pagesDistributed Data Mining in Credit Card Fraud DetectionPankaj Gorasiya100% (1)

- Credit CardsDocument24 pagesCredit Cardsramking509No ratings yet

- 2P How Banks Create MoneyDocument28 pages2P How Banks Create MoneyNguyen Vu Thuc Uyen (K17 QN)No ratings yet

- Member HandbookDocument64 pagesMember HandbookJessicaNo ratings yet

- New American ExpressDocument27 pagesNew American Expressamitliarliar100% (2)

- Unclaimed DepositsDocument2 pagesUnclaimed DepositsRajesh RamachandranNo ratings yet

- Basics of Negotiation: 1. Basic Principle, Without Which Negotiation Is ImpossibleDocument19 pagesBasics of Negotiation: 1. Basic Principle, Without Which Negotiation Is ImpossibleΑλεξαντερ ΤερσενιδηςNo ratings yet

- Revised Client Package 11 04 20091Document17 pagesRevised Client Package 11 04 20091jbarreroNo ratings yet

- Collection State LawsDocument13 pagesCollection State LawsFreedomofMindNo ratings yet

- Angel Broking Demat Account OpeningDocument7 pagesAngel Broking Demat Account OpeningmNo ratings yet

- 9 The Bank AccountDocument11 pages9 The Bank AccountJc CoronacionNo ratings yet

- Fighting Predatory Lending in Tennessee - Metro Ideas ProjectDocument22 pagesFighting Predatory Lending in Tennessee - Metro Ideas ProjectAnonymous GF8PPILW50% (1)

- Guidelines in The Allocation and Distribution of Patronage RefundDocument33 pagesGuidelines in The Allocation and Distribution of Patronage RefundNicah AcojonNo ratings yet

- Consolidated FSDocument5 pagesConsolidated FSNicah AcojonNo ratings yet

- 01Document24 pages01Nicah AcojonNo ratings yet

- This Study Resource Was: Multiple ChoiceDocument6 pagesThis Study Resource Was: Multiple ChoiceNicah AcojonNo ratings yet

- Final Examination in Accounting Information SystemsDocument7 pagesFinal Examination in Accounting Information SystemsNicah Acojon100% (1)

- Bsa201 CH10 QuizDocument3 pagesBsa201 CH10 QuizNicah AcojonNo ratings yet

- ACCO 30033 Quiz 1 and 2: Government Accounting Concepts and ProblemsDocument8 pagesACCO 30033 Quiz 1 and 2: Government Accounting Concepts and ProblemsNicah AcojonNo ratings yet

- Bsa201 CH03Document133 pagesBsa201 CH03Nicah AcojonNo ratings yet

- College of Accountancy & Finance: Flexible LearningDocument3 pagesCollege of Accountancy & Finance: Flexible LearningNicah AcojonNo ratings yet

- Bsa201 CH12Document109 pagesBsa201 CH12Nicah AcojonNo ratings yet

- Automated Payroll Processing: Risk and Procedures For Control McqsDocument18 pagesAutomated Payroll Processing: Risk and Procedures For Control McqsNicah AcojonNo ratings yet

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProcedureDocument42 pagesThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProcedureNicah AcojonNo ratings yet

- Polytechnic University of The PhilippinesDocument40 pagesPolytechnic University of The PhilippinesNicah AcojonNo ratings yet

- Bsa201 CH02 WRDocument57 pagesBsa201 CH02 WRNicah AcojonNo ratings yet

- Bsa201 CH12 QuizDocument2 pagesBsa201 CH12 QuizNicah AcojonNo ratings yet

- James A. Hall, AIS 6 EditionDocument57 pagesJames A. Hall, AIS 6 EditionNicah AcojonNo ratings yet

- The Expenditure Cycle Part I: Purchases and Cash Disbursements ProceduresDocument28 pagesThe Expenditure Cycle Part I: Purchases and Cash Disbursements ProceduresNicah AcojonNo ratings yet

- Bsa201 - Acojon, Nicah P. - Problem 2-7 and 2-8Document2 pagesBsa201 - Acojon, Nicah P. - Problem 2-7 and 2-8Nicah AcojonNo ratings yet

- Bsa201 CH05 QuizDocument3 pagesBsa201 CH05 QuizNicah AcojonNo ratings yet

- Bsa201 CH01 WRDocument36 pagesBsa201 CH01 WRNicah AcojonNo ratings yet

- Exercise 5Document3 pagesExercise 5Nicah AcojonNo ratings yet

- Bsa201 CH01Document88 pagesBsa201 CH01Nicah AcojonNo ratings yet

- 1 Month ExpensesDocument4 pages1 Month ExpensesNicah AcojonNo ratings yet

- 3-Standard DevDocument1 page3-Standard DevNicah AcojonNo ratings yet

- CBSE 9, Math, CBSE - Lines and Angles, HOTS QuestionsDocument2 pagesCBSE 9, Math, CBSE - Lines and Angles, HOTS QuestionsADITI RANJANNo ratings yet

- The Plane Truth: Debi Goenka, Gautam S PatelDocument7 pagesThe Plane Truth: Debi Goenka, Gautam S PatelSagar MalageNo ratings yet

- Mechanical Workshop PracticesDocument5 pagesMechanical Workshop PracticesPradeep GsNo ratings yet

- MCi Guardrail E-Catalog (Upp)Document6 pagesMCi Guardrail E-Catalog (Upp)Nusaibah YusofNo ratings yet

- TSWDocument23 pagesTSWKiran Kagitapu100% (1)

- Major Works CT Scan For Release - FINALDocument90 pagesMajor Works CT Scan For Release - FINALAndrew ArahaNo ratings yet

- 4925B Dual MosfetDocument8 pages4925B Dual MosfetRaj ChoudharyNo ratings yet

- Hydrocarbon Potential of Jabo FieldDocument8 pagesHydrocarbon Potential of Jabo FieldFurqanButtNo ratings yet

- Ie Delhi 23 06 2023Document20 pagesIe Delhi 23 06 2023Vishal AdityaNo ratings yet

- Parcial InglesDocument1 pageParcial InglesMaría AguirreNo ratings yet

- (GIS - 23) Lecture 2 - GeoreferncingDocument29 pages(GIS - 23) Lecture 2 - GeoreferncingPhilip WagihNo ratings yet

- Engleski - Strucni Centralni TerminiDocument56 pagesEngleski - Strucni Centralni TerminivjakovljevicNo ratings yet

- New Approach To Innovation ProjectsDocument7 pagesNew Approach To Innovation ProjectsNordsci ConferenceNo ratings yet

- How Things WorkDocument7 pagesHow Things WorkDayana ErasoNo ratings yet

- Serie K (ENG) Sydex Bomba ProgresivaDocument3 pagesSerie K (ENG) Sydex Bomba ProgresivaROBERT DAVID CLAVIJO MURILLONo ratings yet

- Online Matrimonial Website System Script FeaturesDocument4 pagesOnline Matrimonial Website System Script Featuresreduanullah nawshadNo ratings yet

- Ee2404 Set1 PDFDocument22 pagesEe2404 Set1 PDFsivagamiNo ratings yet

- Extract - DR Bawumia Speaks On NDC Claims On Projects & Use of ResourcesDocument7 pagesExtract - DR Bawumia Speaks On NDC Claims On Projects & Use of ResourcesMahamudu Bawumia100% (2)

- 9a. Failure TheoriesDocument3 pages9a. Failure TheoriesadnandjNo ratings yet

- Centinal CollgeDocument17 pagesCentinal CollgeAdit KadakiaNo ratings yet

- Electronic Ticket Receipt, February 09 For MS DAMARIS JEROP SAMOEYDocument3 pagesElectronic Ticket Receipt, February 09 For MS DAMARIS JEROP SAMOEYjanjannice453No ratings yet

- Materi CaptionDocument27 pagesMateri CaptionMuna IzzatiNo ratings yet

- UntitledDocument56 pagesUntitledsolomon kpayehNo ratings yet

- Grp3 SM2Document8 pagesGrp3 SM2Kapil boratNo ratings yet

- Fixed Wireless Data WM550Document2 pagesFixed Wireless Data WM550Sv KoNo ratings yet

- Emd "H" in House Training Catalogue 2013 H-Station P3Document2 pagesEmd "H" in House Training Catalogue 2013 H-Station P3zaibtouqeetNo ratings yet

- Planning II Chapter I-1Document130 pagesPlanning II Chapter I-1solish manNo ratings yet