Professional Documents

Culture Documents

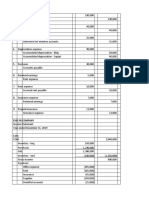

Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct Costs

Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct Costs

Uploaded by

Gurucharan Bhat0 ratings0% found this document useful (0 votes)

9 views6 pagesThe document provides financial information for DuOQuiD for the year 2020, including an income statement, cash flow projections, balance sheet, and return on investment plan. The income statement shows total revenue of $16.5 million and net income of $9.255 million. Cash flow projections forecast cash revenues and disbursements monthly. The balance sheet lists total assets of $16.24 million against total liabilities and equity. The return on investment plan assumes $7.5 million was invested in 2019-2020 and generated a 23.4% return.

Original Description:

fin of fin in fin of fins

Original Title

Financials

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for DuOQuiD for the year 2020, including an income statement, cash flow projections, balance sheet, and return on investment plan. The income statement shows total revenue of $16.5 million and net income of $9.255 million. Cash flow projections forecast cash revenues and disbursements monthly. The balance sheet lists total assets of $16.24 million against total liabilities and equity. The return on investment plan assumes $7.5 million was invested in 2019-2020 and generated a 23.4% return.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct Costs

Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct Costs

Uploaded by

Gurucharan BhatThe document provides financial information for DuOQuiD for the year 2020, including an income statement, cash flow projections, balance sheet, and return on investment plan. The income statement shows total revenue of $16.5 million and net income of $9.255 million. Cash flow projections forecast cash revenues and disbursements monthly. The balance sheet lists total assets of $16.24 million against total liabilities and equity. The return on investment plan assumes $7.5 million was invested in 2019-2020 and generated a 23.4% return.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

YOUR COMPANY NAME DUOQUID

Income Statement for the year 2020 Amount

REVENUE from sales 18,000,000

(-) COGS 1,500,000

TOTAL REVENUE 16,500,000

EXPENSES

Direct Costs

warehouse and maintainance 15,000

Salary 1,200,000

Wages 500,000

Total Direct Costs 1,715,000

General and Administration (G&A)

Accounting and Legal Fees 49,000

Depreciation 15,000

Advertising and Promotion 70,000

Bad Debts 80,000

Bank Charges 60,000

Distribution & transportation 1,500,000

Interest 65,000

Office Rent 600,000

Telephone 6,000

Total G&A 2,445,000

TOTAL EXPENSES 4,160,000

NET INCOME BEFORE INCOME TAXES 12,340,000

INCOME TAXES 3085000

NET INCOME 9,255,000

CASH FLOW PROJECTIONS Jan Feb

CASH REVENUE

1,500,000 1,650,000

Revenue from Product Sales (average of one year sales)

Received from AR (Avg per month) 0 600,000

TOTAL CASH REVENUES 1,500,000 1,050,000

CASH DISBURSEMENTS

Cash Payments to Trade Suppliers 250,000 400,000

Salaries and Wages 140000 140000

Rent/Mortgage Payments 50000 50000

Telecommunications Payment 500 500

Utilities Payments 1250 1250

TOTAL CASH DISBURSEMENTS 441,750 591,750

CASH FLOW 1,058,250 458,250

Mar Apr May Jun

1,750,000 1,950,000 2,100,000 2,175,000

720,000 780,000 920,000 980,000

1,030,000 1,170,000 1,180,000 1,195,000

575,000 620,000 650,000 675,000

140000 140000 140000 140000

50000 50000 50000 50000

500 500 500 500

1250 1250 1250 1250

766,750 811,750 841,750 866,750

263,250 358,250 338,250 328,250

Balance Sheet DuOQuiD

ASSETS AMOUNT LIABILITIES AMOUNT

Current Assets Current Liabilities

Cash in Bank 620,000 Accounts Payable 400,000

Petty Cash 0 Income Tax Payable 3,085,000

Inventory 1,800,000 Total Current Liabilities 3,485,000

Accounts Receivable 900,000

Prepaid Insurance 0 Long-term Liabilities

Total Current Assets 3,320,000 Long-term Loans 3,500,000

Total Long-term Liabilities 3,500,000

Fixed Assets:

Land 0 TOTAL LIABILITIES

Buildings 4,100,000 EARNINGS

Less Depreciation 120000 Retained Earnings 0

Net Land & Buildings 3,980,000 Current Earnings 9,255,000

Investment 7,500,000 Total Earnings 9,255,000

Equipment 1,500,000

Less Depreciation 60000

Net Equipment 1,440,000

TOTAL ASSETS 16,240,000 LIABILITIES AND EQUITY 16,240,000

Return on Investment Plan

Amount Invested (Assumption) : 7500000 (75 lakhs) for Fy 2019-2020

Amount Returned ( Assumption) : Total Units sold in a year = 8500 units

Average units sold in a Month = 708 Units

1 Liter Bottles 5000 * 2500 =

750ml Bottles 2000 * 2000 =

150ml bottles 1000 * 1500 =

Amount Received after tax : 9,255,000.00

Gain or Loss on investment :- 92,55,000 - 75,00,000

= 17,55,000

Investment term :- 1 Year

Percentage Gain or Loss :- 17,55,000 / 75,00,000

= 0.234 or 23.4%

1,25,00,000.00

4,000,000.00

1,500,000.00

1,80,00,000.00

You might also like

- Coral Bay Hospital Solution Excel WorkingsDocument21 pagesCoral Bay Hospital Solution Excel Workingsalka murarka63% (16)

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Chapter 25 - PPEDocument16 pagesChapter 25 - PPETurks67% (3)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Fusion Fa SlaDocument41 pagesFusion Fa SlaVemula Durgaprasad100% (2)

- Principle of Account January 2019Document28 pagesPrinciple of Account January 2019Ãryfa Hamid100% (1)

- Property and Facilities ManagementDocument8 pagesProperty and Facilities ManagementCOT Management Training Insitute100% (2)

- Total Project Cost Fixed Assets/ Capital InvestmentsDocument8 pagesTotal Project Cost Fixed Assets/ Capital InvestmentsLorna BacligNo ratings yet

- Gross Profit 80,000,000: Projected P&L Account of Xent Zeal Meraki LTDDocument4 pagesGross Profit 80,000,000: Projected P&L Account of Xent Zeal Meraki LTDSrikanth P School of Business and ManagementNo ratings yet

- Start-Up Costs Start-Up Assets: Emergency Funds MiscellaneousDocument4 pagesStart-Up Costs Start-Up Assets: Emergency Funds MiscellaneousJudith Atienza HugoNo ratings yet

- Pre F.chap.5 NewDocument9 pagesPre F.chap.5 NewVee Gabiana GoNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- Chapter 5Document7 pagesChapter 5Daniel MwendwaNo ratings yet

- JKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyDocument2 pagesJKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyHazel Gumapon100% (2)

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- Partnership Formation Problem No. 1Document8 pagesPartnership Formation Problem No. 1tide podsNo ratings yet

- Kasus PT Sowhat GitolhooDocument22 pagesKasus PT Sowhat GitolhooAnas ThaciaNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Comedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Document6 pagesComedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Alili DudzNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Adjustment Entry PrecticleDocument1 pageAdjustment Entry Precticlevihanjangid223No ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Review Test FarDocument10 pagesReview Test FarEli PinesNo ratings yet

- Chapter Five Format and ExampleDocument8 pagesChapter Five Format and Examplechris mutungaNo ratings yet

- Working Capital Suggested SolutionsDocument7 pagesWorking Capital Suggested SolutionsBulelwa HarrisNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- AFM Solution SumitDocument4 pagesAFM Solution SumitSumitNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Bhieee Company Statement of Financial Position 31-Dec-19Document6 pagesBhieee Company Statement of Financial Position 31-Dec-19Ace ClarkNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- 8-9 Mecca Copy Budget Balance SheetDocument5 pages8-9 Mecca Copy Budget Balance SheetAli Hassan SukheraNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Generales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Document12 pagesGenerales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Kirstelle VelezNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Cash Budget Example BUS242Document2 pagesCash Budget Example BUS242İrem AksoyNo ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Persfin 5&6Document3 pagesPersfin 5&6Vicente BerdanNo ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- Financial Plan: and Economic ChallengesDocument5 pagesFinancial Plan: and Economic ChallengesEmmanuel AkoloNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- IAS 7 Statement of Cash Flows: ABC Co. Balance Sheet 31.12.2010/2011Document5 pagesIAS 7 Statement of Cash Flows: ABC Co. Balance Sheet 31.12.2010/2011Safa GönenNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- New AFU 07407 CF Slides 2022Document73 pagesNew AFU 07407 CF Slides 2022janeth pallangyoNo ratings yet

- Anticipated Pro Forma For Cash Flow of Dimka Mart Account Titles Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow From Operating ActivitiesDocument6 pagesAnticipated Pro Forma For Cash Flow of Dimka Mart Account Titles Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow From Operating ActivitiesM VNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- FRA Assignment 1Document23 pagesFRA Assignment 1VallabhRemaniNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Hul PDFDocument6 pagesHul PDFGurucharan BhatNo ratings yet

- PM ESTIMATES ShareDocument46 pagesPM ESTIMATES ShareGurucharan BhatNo ratings yet

- Investor Presentation 12 09 2018 - tcm1255 526257 - enDocument64 pagesInvestor Presentation 12 09 2018 - tcm1255 526257 - enGurucharan BhatNo ratings yet

- Pointers and Methods: Project Management OverviewDocument21 pagesPointers and Methods: Project Management OverviewGurucharan BhatNo ratings yet

- SC-Introductory Slides On Project ManagementDocument34 pagesSC-Introductory Slides On Project ManagementGurucharan Bhat100% (1)

- A Path-Analytic Exploration of Retail Patronage Influences: Kent B. Monroe Joseph P. Gull TinanDocument10 pagesA Path-Analytic Exploration of Retail Patronage Influences: Kent B. Monroe Joseph P. Gull TinanGurucharan BhatNo ratings yet

- Chumbak RetailDocument13 pagesChumbak RetailGurucharan BhatNo ratings yet

- Consumer Durables Industry OverviewDocument10 pagesConsumer Durables Industry OverviewGurucharan BhatNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- MGTS 301 2018 PDFDocument5 pagesMGTS 301 2018 PDFsubash shresthaNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Problem No. 1: QuestionsDocument9 pagesProblem No. 1: QuestionsApril Ross TalipNo ratings yet

- TST CSECPoag 01239020 January2022Document28 pagesTST CSECPoag 01239020 January2022Ashleigh Jarrett100% (1)

- Test Bank For Financial Accounting Theory and Analysis Text and Cases Tenth 10th by Richard G Schroeder Myrtle W Clark Jack M Cathey Full DownloadDocument9 pagesTest Bank For Financial Accounting Theory and Analysis Text and Cases Tenth 10th by Richard G Schroeder Myrtle W Clark Jack M Cathey Full Downloadmasonandersonphdkpgtrenxwf100% (26)

- COA CIRCULAR NO. 2024 006 March 14 2024Document21 pagesCOA CIRCULAR NO. 2024 006 March 14 2024Jen IgnacioNo ratings yet

- Robin Nepal EnglishDocument1 pageRobin Nepal EnglishgpdharanNo ratings yet

- Practice Note On Repairs and Improvement of Depreciable AssetsDocument6 pagesPractice Note On Repairs and Improvement of Depreciable AssetsmemphixxNo ratings yet

- PPE Lecture NotesDocument54 pagesPPE Lecture Notesmacmac29No ratings yet

- 16 Leases (Lessee) s19 FinalDocument35 pages16 Leases (Lessee) s19 FinalNosipho NyathiNo ratings yet

- MYOB Chapter 4 Recording Journal EntriesDocument5 pagesMYOB Chapter 4 Recording Journal EntriesRio Anthony AntangNo ratings yet

- PG DCF ReportDocument28 pagesPG DCF Reportapi-515224062No ratings yet

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaNo ratings yet

- RelevantCosts Handouts 2021Document20 pagesRelevantCosts Handouts 2021DUMLAO, ALPHA CYROSE M.No ratings yet

- Management InformationDocument10 pagesManagement InformationTanjil AhmedNo ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Makati City Revenue CodeDocument25 pagesMakati City Revenue CodeJuan Dela CruzNo ratings yet

- Questions On Cash Flow StatementDocument5 pagesQuestions On Cash Flow StatementFaizSheikhNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- Annual Report & Financial StatementsDocument76 pagesAnnual Report & Financial StatementsCorneliusNo ratings yet

- SAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyDocument124 pagesSAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyAbhinav Kalra100% (1)

- A21 Ipsas 13Document36 pagesA21 Ipsas 13riska putri utamiNo ratings yet

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocument9 pagesCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (31)

- Recent Income Tax Case LawsDocument65 pagesRecent Income Tax Case LawsMADHAVNo ratings yet