Professional Documents

Culture Documents

SN Date Wipro Kotak Bank Techmahindr

SN Date Wipro Kotak Bank Techmahindr

Uploaded by

nav0 ratings0% found this document useful (0 votes)

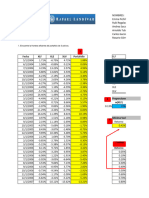

52 views7 pagesThe document contains monthly total return data for 5 stocks - Wipro, Kotak Bank, TechMahindra, Asian Paints and Reliance from September 2014 to September 2019. It also provides the expected returns, variance-covariance matrix, equally weighted portfolio return and risk, portfolio optimization with and without short selling. The optimal portfolio using long only positions achieved a return of 18.67% with risk of 18.11% and Sharpe ratio of 0.75506. Allowing short positions led to higher return of 28.67% but also higher risk of 25.99% and Sharpe ratio of 0.91058.

Original Description:

how to selct stock and portfolio

Original Title

Stock selection

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains monthly total return data for 5 stocks - Wipro, Kotak Bank, TechMahindra, Asian Paints and Reliance from September 2014 to September 2019. It also provides the expected returns, variance-covariance matrix, equally weighted portfolio return and risk, portfolio optimization with and without short selling. The optimal portfolio using long only positions achieved a return of 18.67% with risk of 18.11% and Sharpe ratio of 0.75506. Allowing short positions led to higher return of 28.67% but also higher risk of 25.99% and Sharpe ratio of 0.91058.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

52 views7 pagesSN Date Wipro Kotak Bank Techmahindr

SN Date Wipro Kotak Bank Techmahindr

Uploaded by

navThe document contains monthly total return data for 5 stocks - Wipro, Kotak Bank, TechMahindra, Asian Paints and Reliance from September 2014 to September 2019. It also provides the expected returns, variance-covariance matrix, equally weighted portfolio return and risk, portfolio optimization with and without short selling. The optimal portfolio using long only positions achieved a return of 18.67% with risk of 18.11% and Sharpe ratio of 0.75506. Allowing short positions led to higher return of 28.67% but also higher risk of 25.99% and Sharpe ratio of 0.91058.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

(Assuming: It is total return series)

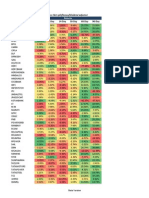

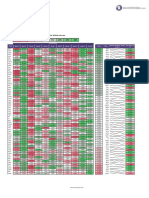

SN Date Wipro Kotak Bank TechMahindr

1 9/1/2014 5.47% -2.18% 5.32%

2 10/1/2014 -5.52% 10.42% 0.97%

3 11/1/2014 3.91% 7.43% 5.18%

4 12/1/2014 -5.41% 5.07% -1.90%

5 1/1/2015 9.48% 4.57% 11.06%

6 2/1/2015 8.73% 5.80% -0.46%

7 3/1/2015 -4.77% -6.03% -78.03%

8 4/1/2015 -14.22% 1.58% -0.98%

9 5/1/2015 4.28% 4.97% -11.05%

10 6/1/2015 -3.11% -0.89% -13.75%

11 7/1/2015 4.59% -49.87% 10.75%

12 8/1/2015 0.40% -6.43% -2.64%

13 9/1/2015 4.50% -0.32% 8.23%

14 10/1/2015 -3.99% 6.13% -3.43%

15 11/1/2015 -0.10% 0.52% -1.02%

16 12/1/2015 -2.25% 3.81% -2.21%

17 1/1/2016 0.25% -5.03% -3.84%

18 2/1/2016 -7.36% -7.64% -17.25%

19 3/1/2016 8.36% 8.05% 14.55%

20 4/1/2016 -1.71% 5.08% 2.47%

21 5/1/2016 -1.35% 4.35% 10.51%

22 6/1/2016 2.22% 2.20% -5.94%

23 7/1/2016 -2.34% -0.16% -3.89%

24 8/1/2016 -10.05% 5.89% -3.70%

25 9/1/2016 -2.62% -3.46% -10.41%

26 10/1/2016 -2.65% 5.35% 4.67%

27 11/1/2016 0.02% -7.83% 10.44%

28 12/1/2016 1.91% -4.91% 0.68%

29 1/1/2017 -3.57% 7.44% -7.56%

30 2/1/2017 6.87% 3.68% 10.65%

31 3/1/2017 5.50% 8.88% -8.05%

32 4/1/2017 -4.12% 3.38% -9.28%

33 5/1/2017 8.71% 6.98% -6.49%

34 6/1/2017 -51.83% -0.94% -2.19%

35 7/1/2017 11.69% 6.73% 1.02%

36 8/1/2017 3.48% -4.30% 11.11%

37 9/1/2017 -6.05% 2.66% 6.82%

38 10/1/2017 4.64% 2.26% 5.27%

39 11/1/2017 -0.75% -2.38% 1.65%

40 12/1/2017 7.40% 0.89% 2.97%

41 1/1/2018 -2.79% 9.97% 21.24%

42 2/1/2018 -3.89% -1.89% 0.28%

43 3/1/2018 -3.88% -3.69% 4.20%

44 4/1/2018 -0.96% 15.43% 5.21%

45 5/1/2018 -6.04% 10.46% 6.02%

46 6/1/2018 -0.19% 0.36% -7.80%

47 7/1/2018 5.89% -2.42% 3.63%

48 8/1/2018 8.98% -1.83% 12.39%

49 9/1/2018 7.48% -11.04% -2.57%

50 10/1/2018 2.25% -2.23% -0.11%

51 11/1/2018 -2.01% 10.23% -5.19%

52 12/1/2018 1.66% 1.82% 2.21%

53 1/1/2019 11.82% -0.12% 1.63%

54 2/1/2019 0.19% -3.26% 13.53%

55 3/1/2019 -31.15% 10.17% -6.71%

56 4/1/2019 17.13% 3.84% 7.54%

57 5/1/2019 -3.97% 9.56% -8.90%

58 6/1/2019 -2.15% -2.84% -7.12%

59 7/1/2019 -5.37% 2.88% -9.87%

60 8/1/2019 -4.15% -5.75% 9.28%

61 9/1/2019 -3.99% 1.22% 3.03%

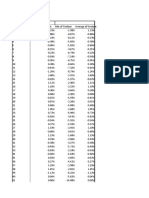

Asian Paints Reliance Stock Expected Return

0.84% -5.39% Wipro -9.14%

4.25% 5.70% KotakBank 12.32%

13.34% -0.84% TechMahindra -5.47%

1.08% -10.06% Asian Paints 20.16%

14.06% 2.72% Reliance 11.16%

-4.56% -5.36%

-1.17% -4.80% Riskfree rate 5%

-5.67% 4.63%

3.16% 1.66%

-4.14% 14.06% Variance-Covariance Matrix

16.83% 0.12% Wipro

-3.73% -14.46% Wipro 0.1118362833

-0.88% 0.43% KotakBank -0.0081588765

-1.47% 10.15% TechMahindra 0.0025043554

1.42% 2.13% Asian Paints 0.0077282917

5.16% 4.61% Reliance 0.0110200846

-1.70% 2.22%

-2.34% -6.62%

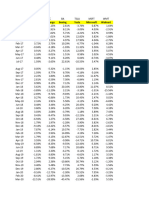

2.37% 8.14% a) when short selling is not allowed

-0.07% -6.00% weight matrix

13.36% -2.40% Wipro 0

1.99% 1.09% KotakBank 0.1896488998

11.06% 4.75% TechMahindra 0

4.00% 4.19% Asian Paints 0.8103511002

0.25% 2.28% Reliance 0

-7.46% -2.86% sum 1

-9.81% -5.56%

-8.09% 8.80% Return Matrix

8.91% -3.40% Wipro -0.0913979625

5.53% 18.67% KotakBank 0.1231868852

4.56% 6.54% TechMahindra -0.054747541

4.52% 5.73% Asian Paints 0.2015803279

2.95% -3.89% Reliance 0.1116

-4.20% 2.96%

5.01% 16.92% Equally weighted matrix

0.75% -1.26% Wipro 0.2

-4.37% -50.92% KotakBank 0.2

5.70% 20.28% TechMahindra 0.2

-2.79% -1.93% Asian Paints 0.2

0.88% -0.17% Reliance 0.2

-2.32% 4.35% sum 1

-1.08% -0.91%

0.17% -7.31%

7.09% 9.10%

8.79% -4.34%

-3.18% 5.61%

14.57% 21.88%

-5.33% 4.65%

-5.62% 1.39%

-5.16% -15.64%

9.59% 10.06%

2.14% -4.04%

2.84% 9.46%

-0.54% 0.36%

6.18% 10.68%

-1.94% 2.11%

-3.85% -4.46%

-3.49% -5.85%

12.05% -6.87%

6.18% 7.06%

-4.15% -3.42%

Volatility

33.72%

29.86%

44.07%

21.29%

35.35%

KotakBank TechMahindra Asian Paints Reliance

-0.008158876 0.0025043554 0.0077282917 0.011020085

0.087717871 0.0025394477 0.0011284813 0.011327599

0.0025394477 0.1910110865 0.008746244 0.008600191

0.0011284813 0.008746244 0.0445913331 0.022052984

0.0113275987 0.0086001915 0.0220529843 0.122886771

not allowed

Portfolio Optimization using Return and Sigma Matrices

Portfolio Return 18.67%

Portfolio Risk 18.11%

Sharpe Ratio 0.75506

(Assuming Risk-free rate of 5%)

Portfolio Optimization using Return and Sigma Matrices

Portfolio Return 5.80%

Portfolio Risk 16.65%

Sharpe Ratio 0.04832

b) when short-selling is allowed

weighted matrix

Wipro -0.28825099 Portfolio Optimization using Return

KotakBank 0.346770877

TechMahindra-0.13575423

Asian Paints 1

Reliance 0.077234341 (Assuming Risk-free rate of 5%)

sum 1

(Assuming Risk-free rate of 5%)

rtfolio Optimization using Return and Sigma Matrices

Portfolio Return 28.67%

Portfolio Risk 25.99%

Sharpe Ratio 0.91058

ssuming Risk-free rate of 5%)

You might also like

- Fin 213 Assignment ExcelDocument47 pagesFin 213 Assignment ExcelMICHEALA JANICE JOSEPHNo ratings yet

- Dissertation Report of Mutual FundsDocument71 pagesDissertation Report of Mutual FundsShailesh Bandooni50% (2)

- Covivio Hotels Bond Investor PresentationDocument57 pagesCovivio Hotels Bond Investor PresentationTung NgoNo ratings yet

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocument12 pagesCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONo ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- 3) LabS 03 2023 First Part - RIFATTADocument11 pages3) LabS 03 2023 First Part - RIFATTAgiovanni lazzeriNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Portofolio Efficient Frontier - Kaunang, MarioDocument3 pagesPortofolio Efficient Frontier - Kaunang, Mariomario kaunangNo ratings yet

- Administración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina GarciaDocument7 pagesAdministración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina Garciaflavio buenoNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- Mutual Fund Student DataDocument10 pagesMutual Fund Student DataJANHVI HEDANo ratings yet

- Investment SettingDocument41 pagesInvestment SettingAnju tpNo ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- IE SurveyDocument28 pagesIE SurveyJonathanNo ratings yet

- Topicos Lucastorres UssDocument10 pagesTopicos Lucastorres UssCaslu MontanaNo ratings yet

- Lap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Document4 pagesLap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Reinn DayiNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Apuntes 29-Oct-2020Document13 pagesApuntes 29-Oct-2020Gabriel D. Diaz VargasNo ratings yet

- I Bond Rate ChartDocument1 pageI Bond Rate ChartRandy MarmerNo ratings yet

- Solución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Document6 pagesSolución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Yessica MacedaNo ratings yet

- s&p500 Rentab S&P Date Bancolombia Rentab BancolDocument4 pagess&p500 Rentab S&P Date Bancolombia Rentab Bancolanonimo centenarioNo ratings yet

- Monthly Returns Excess ReturnsDocument4 pagesMonthly Returns Excess ReturnsSagar KansalNo ratings yet

- Portafolios JimmyDocument178 pagesPortafolios Jimmyjeferson parradoNo ratings yet

- Determinacion de Portafolio OptimoDocument8 pagesDeterminacion de Portafolio OptimoDanie RomaniNo ratings yet

- Date Crisil Sunpharma Crisil SunpharmaDocument9 pagesDate Crisil Sunpharma Crisil SunpharmaBerkshire Hathway coldNo ratings yet

- Teoria PortafolioDocument71 pagesTeoria PortafolioMR 2No ratings yet

- Portafolio 5 Acciones EFDocument17 pagesPortafolio 5 Acciones EFRegina Morales MourraNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- Nifty Beat 02 Nov 2010Document1 pageNifty Beat 02 Nov 2010FountainheadNo ratings yet

- QuanticoDocument7 pagesQuanticoAbdelrahman AkeedNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- UntitledDocument9 pagesUntitledFernanda DelgadoNo ratings yet

- Weekly DataDocument22 pagesWeekly DataAshishNo ratings yet

- DAFNA FactSheetDocument2 pagesDAFNA FactSheetfxarb098No ratings yet

- Total Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixDocument12 pagesTotal Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixLorenaNo ratings yet

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- Index PerformanceDocument2 pagesIndex PerformanceghodababuNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Cost of Capital 2023Document29 pagesCost of Capital 2023Mohit ChaudhariNo ratings yet

- India Inflation Rate 1960 - 2022Document3 pagesIndia Inflation Rate 1960 - 2022GouravNo ratings yet

- Calculators - Percentiles de Circunferencia Cefálica para La Edad de La OMS para Lactantes ( - Manual MSD Versión para ProfesionalesDocument1 pageCalculators - Percentiles de Circunferencia Cefálica para La Edad de La OMS para Lactantes ( - Manual MSD Versión para ProfesionalesSolhana MendietaNo ratings yet

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Ifi 5Document334 pagesIfi 5MARCO DAVID COPATITI ULURINo ratings yet

- Vix Hedges: Institute of Trading & Portfolio ManagementDocument9 pagesVix Hedges: Institute of Trading & Portfolio ManagementHakam DaoudNo ratings yet

- October 2022 Monthly Gold CompassDocument84 pagesOctober 2022 Monthly Gold CompassburritolnxNo ratings yet

- Ejercicio Portafolio Óptimo A (DESARROLLO)Document5 pagesEjercicio Portafolio Óptimo A (DESARROLLO)Valeria MaldonadoNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- Ejercicio Frontera Eficiente Activos MúltiplesDocument6 pagesEjercicio Frontera Eficiente Activos MúltiplesChaito GomezNo ratings yet

- Reporte de Ratios ArgentinaDocument15 pagesReporte de Ratios Argentinawalter_lezcano164501No ratings yet

- Healing From the Heart: Short inspirational poems and quotes about life and the love of GodFrom EverandHealing From the Heart: Short inspirational poems and quotes about life and the love of GodNo ratings yet

- Accounting Principles & Procedures MCQs (Set-I) For FPSC Senior Auditor TestsDocument11 pagesAccounting Principles & Procedures MCQs (Set-I) For FPSC Senior Auditor TestssangaYNo ratings yet

- Oil DerivativesDocument91 pagesOil DerivativesNobi TairoNo ratings yet

- Risk Aversion and Capital AllocationDocument38 pagesRisk Aversion and Capital AllocationVishwak SubramaniamNo ratings yet

- Cash and Accrual Basis & Single Entry - OUTLINEDocument3 pagesCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNo ratings yet

- Background and LiteratureDocument79 pagesBackground and LiteraturechuchuNo ratings yet

- MGT401 PaperDocument10 pagesMGT401 PaperQaiser WaseemNo ratings yet

- Credit Management: by Prof Sameer LakhaniDocument50 pagesCredit Management: by Prof Sameer LakhaniDarshana Thakkar100% (3)

- Implementing Sustainable Bio-Fuels in Africa - Arrigo Della GherardescaDocument61 pagesImplementing Sustainable Bio-Fuels in Africa - Arrigo Della GherardescaArrigo della GherardescaNo ratings yet

- Creative Accounting: A Literature ReviewDocument13 pagesCreative Accounting: A Literature ReviewthesijNo ratings yet

- Pemi Psei Col Fact SheetDocument1 pagePemi Psei Col Fact SheetSum Aaron AvilaNo ratings yet

- Te Connectivity 2012 Annual ReportDocument177 pagesTe Connectivity 2012 Annual ReportNguyễn Trọng VinhNo ratings yet

- D MartDocument3 pagesD MartdonaldNo ratings yet

- Receivables ManagementDocument33 pagesReceivables ManagementArjun SanalNo ratings yet

- No Deposit Bonus Terms and ConditionsDocument4 pagesNo Deposit Bonus Terms and ConditionsJaka TingNo ratings yet

- Legal LiabilityDocument32 pagesLegal Liabilitynurhoneyz100% (1)

- Sunbeam CaseDocument9 pagesSunbeam CaseMani KanthNo ratings yet

- Drafting Irrevocable Medicaid Trusts: Sharon Kovacs Gruer, P.C. Great NeckDocument50 pagesDrafting Irrevocable Medicaid Trusts: Sharon Kovacs Gruer, P.C. Great NecktaurushoNo ratings yet

- An Is Perspective of Mergers and AcquisitionsDocument54 pagesAn Is Perspective of Mergers and AcquisitionsSonia BenitoNo ratings yet

- Hedge Fund Book V5Document133 pagesHedge Fund Book V5whackz100% (3)

- Real Estate & IndiaDocument5 pagesReal Estate & IndiaDeb TumbinNo ratings yet

- Assignment 3Document3 pagesAssignment 3Anisa0% (1)

- IFRS-Opportunities & Challenges For IndiaDocument5 pagesIFRS-Opportunities & Challenges For IndiaTincy KurianNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- AB Savings AccountsDocument26 pagesAB Savings AccountsTejaswi Joshyula ChallaNo ratings yet

- Helios Exits Equity With Sale of Final Stake To The NSSF: Private Equity Firm More Than Quadruples Its InvestmentDocument31 pagesHelios Exits Equity With Sale of Final Stake To The NSSF: Private Equity Firm More Than Quadruples Its InvestmentmrNo ratings yet

- Income From Business: (A Quick Introduction)Document4 pagesIncome From Business: (A Quick Introduction)haroonameerNo ratings yet

- Asymmetric Information in Financial InstitutionDocument28 pagesAsymmetric Information in Financial InstitutionMonzurul HaqueNo ratings yet