Professional Documents

Culture Documents

Why Cost Cutting Fails To Deliver: by J de Vries

Why Cost Cutting Fails To Deliver: by J de Vries

Uploaded by

eisaacmaxCopyright:

Available Formats

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment Effectivenesscabro_chicoNo ratings yet

- 2002 ASSET Management Implementation Group SHELLDocument10 pages2002 ASSET Management Implementation Group SHELLalfredo j eloy100% (1)

- Optimising Costs in The Current Environment: IPA09-E-203Document8 pagesOptimising Costs in The Current Environment: IPA09-E-203REandoNo ratings yet

- Cost Estimating SurfaceDocument15 pagesCost Estimating Surfacenicholas.landry-st-onge.1No ratings yet

- Systems Approach To Integrating Cost and Technical DataDocument9 pagesSystems Approach To Integrating Cost and Technical DataAbdelmadjid djibrineNo ratings yet

- Spe-0419-0057-Jpt CompletionsDocument1 pageSpe-0419-0057-Jpt CompletionsquiruchiNo ratings yet

- SPE 110805 Use of Advanced Optimization Techniques To Manage A Complex Drilling ScheduleDocument9 pagesSPE 110805 Use of Advanced Optimization Techniques To Manage A Complex Drilling ScheduleAnonymous VNu3ODGavNo ratings yet

- Cost Management Optimisation: B KingDocument5 pagesCost Management Optimisation: B KingUriel Placido Jacho PachaNo ratings yet

- 2014 11 24 King Cost Management Optimisation - Orebody2014Document5 pages2014 11 24 King Cost Management Optimisation - Orebody2014Claudia AndradeNo ratings yet

- Rel APMDocument20 pagesRel APMoptisearch100% (1)

- Optimizing The Design To Cost CycleDocument4 pagesOptimizing The Design To Cost Cycleluz marina silvaNo ratings yet

- Drilling Cost Engineering and EstimateDocument13 pagesDrilling Cost Engineering and EstimatenappyNo ratings yet

- RC WP Operational Readiness For New AssetsDocument10 pagesRC WP Operational Readiness For New AssetssedianpoNo ratings yet

- Optimum Equipment Management Through: Life Cycle CostingDocument4 pagesOptimum Equipment Management Through: Life Cycle CostingCarlos ChacónNo ratings yet

- SPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelDocument16 pagesSPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelRayner SusantoNo ratings yet

- CS4 DimensionDocument6 pagesCS4 DimensionNay Htoo ZawNo ratings yet

- ManagementaspectsDocument7 pagesManagementaspectsYudhi Nur ArifiantoNo ratings yet

- Techno-Economic Analysis For New Technology Development: Chris Burk, PE Burk Engineering LLC, Salt Lake City, UT, USADocument4 pagesTechno-Economic Analysis For New Technology Development: Chris Burk, PE Burk Engineering LLC, Salt Lake City, UT, USAlorenaNo ratings yet

- White Paper OPEX 2018Document12 pagesWhite Paper OPEX 2018Helena AraujoNo ratings yet

- Application of Value Stream Mapping (VSM) For Lean and Cycle Time Reduction in Complex Production Environments: A Case StudyDocument23 pagesApplication of Value Stream Mapping (VSM) For Lean and Cycle Time Reduction in Complex Production Environments: A Case Studybatlord9No ratings yet

- Mantenimiento PreventivoDocument7 pagesMantenimiento Preventivoadri oleasNo ratings yet

- Design For ManufacturingDocument3 pagesDesign For ManufacturingMohamed HabibullahNo ratings yet

- SPE 91570 Economic Evaluation R&UDocument16 pagesSPE 91570 Economic Evaluation R&UJose TorresNo ratings yet

- Maintenance Management DissertationDocument8 pagesMaintenance Management DissertationBuyPaperOnlineSingapore100% (1)

- Activity-Based Costing Management and Its Implications For Operations Management - M. Gupta, K. Galloway - 2003Document8 pagesActivity-Based Costing Management and Its Implications For Operations Management - M. Gupta, K. Galloway - 2003PacoPicassoNo ratings yet

- Extending The Life of Aging Assets: Asset ManagementDocument3 pagesExtending The Life of Aging Assets: Asset ManagementRRANo ratings yet

- An Approach To Improve Airframe Conceptual Design ProcessDocument10 pagesAn Approach To Improve Airframe Conceptual Design Processst05148No ratings yet

- Integrated Strategy Optimsation For Complex OperationsDocument8 pagesIntegrated Strategy Optimsation For Complex OperationsCarlos A. Espinoza MNo ratings yet

- Lean Management Framework For Improving Maintenance Operation Development and Application in The Oil and Gas IndustryDocument19 pagesLean Management Framework For Improving Maintenance Operation Development and Application in The Oil and Gas IndustryJulia De Oliveira MoraisNo ratings yet

- JurnalDocument19 pagesJurnalDelicia SalsabilaNo ratings yet

- Lean Management Framework For Improving Maintenance Operation: Development and Application in The Oil and Gas IndustryDocument20 pagesLean Management Framework For Improving Maintenance Operation: Development and Application in The Oil and Gas IndustryLê Ngọc LoanNo ratings yet

- Design For AssemblyDocument6 pagesDesign For AssemblyGonzalo Hernández MelladoNo ratings yet

- McKinsey On Oil & GasDocument8 pagesMcKinsey On Oil & Gasgweberpe@gmailcomNo ratings yet

- Asset Management Decision-MakingDocument13 pagesAsset Management Decision-MakingBambang KarditoNo ratings yet

- Cost Leadership StrategyDocument2 pagesCost Leadership StrategyWWZNo ratings yet

- Shutdown MaintenanceDocument5 pagesShutdown MaintenanceAmirRazviNo ratings yet

- A Case Study of LEAN Application For ShoDocument8 pagesA Case Study of LEAN Application For Sholiza annaNo ratings yet

- Process Costing and Management Accounting: in Today's Business EnvironmentDocument8 pagesProcess Costing and Management Accounting: in Today's Business Environmentمحمد زرواطيNo ratings yet

- Benchmarks of Performance For Truck and Loader FleetsDocument8 pagesBenchmarks of Performance For Truck and Loader FleetsLeo Manaure Rada100% (2)

- Emma 0909Document4 pagesEmma 0909dhickmNo ratings yet

- Taking The Next Leap Forward in Semiconductor SHORTDocument16 pagesTaking The Next Leap Forward in Semiconductor SHORTGerard StehelinNo ratings yet

- Maintenance Practices in Cement IndustryDocument12 pagesMaintenance Practices in Cement IndustryHarshil AdodariyaNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment EffectivenessFelipe JimenezNo ratings yet

- Ricardo Vargas West McelroyDocument6 pagesRicardo Vargas West McelroyAnxo X. FerreirósNo ratings yet

- Wing Design IonDocument10 pagesWing Design IonXavi VergaraNo ratings yet

- Spe 128716 MsDocument13 pagesSpe 128716 MsIskander KasimovNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment Effectivenesslovepishga,No ratings yet

- A Model For Integrating Cost Management and Production Planning and Control in ConstructionDocument16 pagesA Model For Integrating Cost Management and Production Planning and Control in ConstructionChetali SinghNo ratings yet

- MEGA White Paper - Application Portfolio ManagementDocument28 pagesMEGA White Paper - Application Portfolio ManagementIsmanto Semangoen100% (1)

- A Monte Carlo Methodological Approach To Plant Availability Modeling - Trabajo Confiabilidad - Articulo3Document13 pagesA Monte Carlo Methodological Approach To Plant Availability Modeling - Trabajo Confiabilidad - Articulo3danilo sotoNo ratings yet

- An Index For Operational Flexibility in Chemical Process DesignDocument10 pagesAn Index For Operational Flexibility in Chemical Process Designmauricio colomboNo ratings yet

- Maintenance Practices in Cement IndustryDocument12 pagesMaintenance Practices in Cement IndustryNayan DwivediNo ratings yet

- 2 - A Hybrid Model For Process Quality CostingDocument16 pages2 - A Hybrid Model For Process Quality CostingJuan AdityaNo ratings yet

- Heliyon: Okpala Charles Chikwendu, Anozie Stephen Chima, Mgbemena Chika EdithDocument9 pagesHeliyon: Okpala Charles Chikwendu, Anozie Stephen Chima, Mgbemena Chika EdithDIEGO FERNANDO HUAMANI TORRESNo ratings yet

- Managing Cost Escalation. The Case of Grade One Marine ShipyardDocument5 pagesManaging Cost Escalation. The Case of Grade One Marine ShipyardMohd ZaidNo ratings yet

- MMG Generates Large Return by Focusing On Continous ImprovementDocument5 pagesMMG Generates Large Return by Focusing On Continous ImprovementFLORENS CAROLINENo ratings yet

- Improving Asset Peformance Roy WhittDocument7 pagesImproving Asset Peformance Roy Whittابزار دقیقNo ratings yet

- Guide for Asset Integrity Managers: A Comprehensive Guide to Strategies, Practices and BenchmarkingFrom EverandGuide for Asset Integrity Managers: A Comprehensive Guide to Strategies, Practices and BenchmarkingNo ratings yet

- Brooks 3e PPT 09Document73 pagesBrooks 3e PPT 09Israa RamadanNo ratings yet

- Tpg23 08 NSW Government Guide To Cost Benefit Analysis 202304Document116 pagesTpg23 08 NSW Government Guide To Cost Benefit Analysis 202304Hassan ElmiNo ratings yet

- NPV Irr CaseDocument22 pagesNPV Irr Casealim shaikhNo ratings yet

- Financial Analysis & Modelling Using ExcelDocument2 pagesFinancial Analysis & Modelling Using Excel360 International Limited33% (3)

- Learner Guide Business Management 2 2024Document22 pagesLearner Guide Business Management 2 2024mashabaemotionNo ratings yet

- How Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Document28 pagesHow Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Ishtiaq Ahmed82% (11)

- CCI Feasibility Study For 500 KV AC Underground CablesDocument310 pagesCCI Feasibility Study For 500 KV AC Underground Cableserkamlakar2234100% (1)

- Practice Assessment 2: Assessment Book and Data: Advanced Diploma Synoptic (AQ2016)Document7 pagesPractice Assessment 2: Assessment Book and Data: Advanced Diploma Synoptic (AQ2016)Tlamelo KennedyNo ratings yet

- FM Examiner's Report M20Document10 pagesFM Examiner's Report M20Isavic AlsinaNo ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- AFM Individual Assignment 1Document5 pagesAFM Individual Assignment 1RajeswariRameshNo ratings yet

- Financial Management Theory and Practice Brigham 13th Edition Test Bank DownloadDocument33 pagesFinancial Management Theory and Practice Brigham 13th Edition Test Bank Downloadelainecannonjgzifkyxbe100% (26)

- How To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Document50 pagesHow To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Gaurav SainiNo ratings yet

- Langfield Smith 7 CH 21 - Answers To TB QuestionsDocument33 pagesLangfield Smith 7 CH 21 - Answers To TB QuestionsAllyNo ratings yet

- Review in Financial Management - Students Activity SheetDocument30 pagesReview in Financial Management - Students Activity SheetDJ yanaNo ratings yet

- Dairy Farm 50 Cows Rs. 83.89 Million Sep-2023Document33 pagesDairy Farm 50 Cows Rs. 83.89 Million Sep-2023Mohsin JameelNo ratings yet

- Business Plan On Electronic and Communication Equipments Operation Repair and Maintenance ServiceDocument19 pagesBusiness Plan On Electronic and Communication Equipments Operation Repair and Maintenance Servicebiru mulugetaNo ratings yet

- 13 Exam Guide - MCQs - A.D. Cost Recruitment Under ICoAS-2022 V.1Document274 pages13 Exam Guide - MCQs - A.D. Cost Recruitment Under ICoAS-2022 V.1bujhadungaNo ratings yet

- International Capital BudgetingDocument24 pagesInternational Capital BudgetingQuoc AnhNo ratings yet

- Sample Questions BMS SEM VI Orderwise PDFDocument41 pagesSample Questions BMS SEM VI Orderwise PDFAasim TajNo ratings yet

- Financial Training - F2Document29 pagesFinancial Training - F2Swan ye ThutaNo ratings yet

- Assignment II - Quiz 2Document5 pagesAssignment II - Quiz 2tawfikNo ratings yet

- Internship Report: By-Rohit PatidarDocument24 pagesInternship Report: By-Rohit PatidarRohit PatidarNo ratings yet

- Semester 2-Question Bank For VivaDocument49 pagesSemester 2-Question Bank For Vivareckkit benckiserNo ratings yet

- CPChap 3Document33 pagesCPChap 3K59 Hoang Gia HuyNo ratings yet

- Chapter 3Document9 pagesChapter 3Karthik TambralliNo ratings yet

- Risk Management and Insurance - Chapter-4-Additional-Topics-In-Risk-ManagementDocument15 pagesRisk Management and Insurance - Chapter-4-Additional-Topics-In-Risk-ManagementHasan Bin HusainNo ratings yet

- Chapter 07Document14 pagesChapter 07casperNo ratings yet

- Project Investment AnalysisDocument46 pagesProject Investment AnalysisAbdul ManafNo ratings yet

Why Cost Cutting Fails To Deliver: by J de Vries

Why Cost Cutting Fails To Deliver: by J de Vries

Uploaded by

eisaacmaxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why Cost Cutting Fails To Deliver: by J de Vries

Why Cost Cutting Fails To Deliver: by J de Vries

Uploaded by

eisaacmaxCopyright:

Available Formats

de Vries J, 2002.

in Proceedings Underground Operators Conference 2002, pp 127-

132 (The Australasian Institute of Mining and Metallurgy: Melbourne). Reprinted

with permission of The Australasian Institute of Mining and Metallurgy

Why Cost Cutting Fails to Deliver

By J de Vries 1

Abstract

Over the past decade most, if not all participants in the resources sector have been involved in

initiatives to improve margins, reduce costs and improve business profitability. In many cases the

initiatives undertaken have fallen short of their stated objectives, and in some cases have resulted in

terminal declines of the underlying business. In reviewing why many such initiatives fail, a common

theme of arbitrary cost reduction and a focus on minimising cost as opposed to maximising value and

cashflow emerges.

This paper proposes a structured process that allows mine owners and managers to develop an

understanding of their cost structure and optimise production and cost outcomes from the business.

The broad objective of cost optimisation is to create value by getting more out of existing and new

assets by focussing on operational areas, particularly production and maintenance. The paper uses

practical examples to highlight the application of cost driver trees as a mine improvement tool.

Introduction Successful cost reduction and margin improvement is rigorous,

systematic and data intensive. It is only after the whole cost and

When observing what went wrong in failed margin productivity structure has been studied and modelled that

improvement and cost reduction programs, what emerges is a effective and organisationally safe improvement initiatives can

common theme of inadequate assessment of interconnectedness be undertaken.

between physical activities and their related costs. In many

cases actions taken reflect accounting decisions, as opposed to This paper reviews the use of cost and productivity driver trees

business decisions. to provide a systematic framework to highlight relationships

within cost structures. To highlight the methodology a case

Two distinct types of failure occur. The first type of failure is study is used.

simply making the wrong choice. Typically, this is due to

limited time or data to be able to complete the task. For The objective is not an attempt to discredit many initiatives in

example in a cost reduction program, the use of emulsion or place. Rather, it aims to present the use of cost and productivity

ANFO explosive in stope firings might arise. To make the right driver trees as a tool to assist mine management to take control

choice, a study should not only consider the direct cost of of their own destiny and act before somebody else does it for

explosive. The impact of hole size, drill spacing, cost to charge, them.

and blast induced dilution should be included in the assessment.

A more through analysis would include assessment of differing Over Time, Cost Structures Are Unstable

fragmentation on LHD bogging rates, truck damage, and Over time most mine and processing plant cost structures lose

crushing and milling cost and throughput. calibration with the activity or process that gives rise to cost

structure. Periodic reviews of the overall cost structure are

The second type of failure relates to arbitrary cost reduction. helpful in spotting early problems. This should not be confused

There is a very real probability that an across cost reduction with routine reporting of unit costs. Common causes of cost

will reduce physical capacity to below sustainable levels. This structure change are failed expansions, changes in operating

may have long term impacts on mine viability. The long term rates, increased depth, technology and management

negative impact of deferred mine development would be an restructuring.

experience familiar to many mine managers.

The impact of failed expansions, or the inability of a mine to

The common theme in both types of failure is an inability to reach design capacity can have important implications for cost

identify the bottleneck in the business. If a bottleneck is not structures. For example Ward and McCarthy (1999) observed

identified prior to restructuring, further operational capacity that only 50% of underground base metals mines and mills

reductions could further reduce the bottleneck, crippling the achieve nameplate capacity by Year 3, additionally 25% never

operation. achieve nameplate capacity. Yet it is reasonable to assume that

both manning and equipment levels are sufficient to achieve the

nameplate operating rates at the completion of construction. In

cost terms, we would observe that both fixed and capacity costs

in the above projects are underutilised.

1. MAusIMM, MMICA, Principal Mining Engineer, Australian Mining

Consultants Pty Ltd, 19/114 William Street, Melbourne Vic 3000 Recent implementations of Enterprise Resource Programs

Email: jdevries@ausmin.com.au

(ERP) such as SAP, GD Edwards etc have done little to

Why Cost Cutting Fails to Deliver

improve the transparency and calibration of mine cost Figure 2 – Detailed driver tree

structures. The common failure of many implementations is the

inability to readily reconcile the observed cost structure to Cost/ person

observed physical activities. Under such circumstances

management has very limited capacity to assess the relative

value for money being achieved. The lack of transparency also People

makes it difficult to understand the relationship between Productivity/

($/drifter m)

person

physical activities and the cost outcomes.

Cost/ rig

Unfortunately most ERP’s are accounting platforms and are

simply not designed as continuous improvement tools.

Additional software, involving data warehousing and similar Development

Equipment

processes needs to be integrated into the ERP before the drilling ($/drifter m)

($/drifter m) Productivity/

platform has enough data to be transparent. This next step is rig

still a few years away.

Driver Tree Analysis Supplies

($/drifter m)

The objective of using a driver tree as an analysis tool is to

highlight the relationship between physical activities and the Cost Behaviour

resulting expenditure within a cost structure. Properly

structured, driver trees drill down from high-level Key Most managers are familiar with fixed and variable cost

Performance Indicators (KPIs) to detailed operational cost analysis. However when assessing the potential for

drivers. For the purpose of most analyses, the author has found restructuring, it is useful to consider a third type which may be

the maximum sensible level of precision of the driver tree is to described as a capacity cost.

be one level below the cost centre. This allows the behaviour of

different cost types within the cost centre to be recognised and Capacity costs may be thought of as being short run fixed costs.

modelled. They are independent of the level of utilisation of a cost centre.

However, an essential distinction between a capacity cost and a

For example, the analysis might involve identifying drill fixed cost is management’s discretion to change the level of

consumable costs in production drilling. The impact of capacity available, and hence total cost at relatively short

increases or decreases in production drilling rates can then notice. In effect capacity costs are discretionary fixed costs.

modelled, while unit ($/metre) costs are held steady.

Capacity costs represent the real cost of having an increment of

Figures 1 and 2 illustrate the relationship between high level capacity available for production, but not necessarily used.

and detailed cost trees.

Capacity costs can be thought of as representing an option to

High level KPIs are important as they explain what is going on increase physical activity within a cost centre with the only

with the business, while low level detailed KPI’s explain why increase in total cost being the variable cost component.

those things are happening. Being able to relate the two types of Alternatively, being able to identify excess capacity is good

KPI is a fundamental first step in extracting value for money first step in a structured margin improvement program.

from a cost structure.

Individual increments of capacity can be small, and can be

A further very useful outcome from driver tree analysis is the thought of as additional items of plant such as trucks, loaders

establishment of agreed definition of metrics. Rigidly defined and drills. As utilisation rises, the capacity of the fleet remains

metrics are useful when comparing cost and productivity constant, until at full utilisation, additional capacity is

differences between different mines, and across time periods. introduced, and the cost of supporting the increased capacity

Rigid metrics form the basis of any continuous improvement rises.

process.

A detailed cost driver tree will involve splitting out components

Figure 1 – High level driver tree of a cost centre and catagorising behaviour into the three cost

types. The process allows incremental capacity additions and

Drilling re-engineering options to be tested against capacity utilisation.

Access to databases of industry performances makes this

Loading process particularly powerful.

Development

Ground

support

Production Figure 3 illustrates the behaviour of the three cost types.

Services

Revenue Ore handling

Mine Back-fill Capital Costs

Margin Mill Services &

Mgt Most ERP platforms report depreciation and amortisation as a

Return Costs Site component of total cost. While not important in terms of most

on

capital Admin restructuring, depreciation and amortisation are important

Capital considerations when assessing owner mining or expansion

decisions.

To avoid confusion over the cost definition, depreciation and

amortisation should be shown as a separate branch of the driver

AMC Reference Library – www.ausmin.com.au 2

Why Cost Cutting Fails to Deliver

tree. Where depreciation and amortisation are associated with However, the cash flow must make adequate provision for

ongoing expenditure such as fleet replacement, they should be future capital.

considered as cash proxies ensuring the full cost of operations

are recognised. A final word on expansions. It is more important to consider if

a proposed expansion is simply making an inefficient mine a

Expansion or contraction options pose unique issues for bigger inefficient mine, or is the expansion doing something

inclusion or exclusion of depreciation and amortisation. A at about structural inefficiencies within the mine. It is not possible

times heated debate exists over inclusion or exclusion of to answer this question without a detailed review of the cost

historical capital is assessing future mine options. structure.

Figure 3 – Cost behaviour types Volatility, Capacity Costs and Scales of Economy.

A premise articulated by many mine owners is that expansion

30

or simply being big will permit better utilisation of fixed and

capacity costs. With capacity costs typically representing 60%

20 to 70% of total cost for most underground mines, the

Total cash

expensed “economics of scale” argument is reasonable.

10

Even those mines with a “schedule of rates” contractor have a

0 significant capacity cost. This normally becomes apparent as

0 20 40 variance claims or stand by charges when operating rates fall

Unit of production below some agreed level.

The use of expansion strategies to reduce costs poses two risks.

The first relates to the ore grade of the expansion. The grade of

70 additional production must pay back the capital and operating

60 costs of expansion without lowering the returns to the existing

50 mine. To do otherwise will marginalise the business. Inclusion

Total cash 40 of the existing capital base is critical in making the right

expensed

assessment.

A good example of the relationship between mining rate and

head grade is illustrated in Figure 4. (Mikula and Lee 2000).

Unit of production McCarthy (2002) reviewed a number of such time based

tonnage grade curves and concludes that in most cases it is

quite common for a significant reduction in grade to occur as a

mine increases production rate.

Figure 4 – Mt Charlotte annual production 1966-2000

(Lee & Mikula 2000)

Total cash

expensed 6

Unit of production Head grade

(g/t) 3

Most mine owners use Net Present Value (NPV) as a decision

tool. In an NPV analysis, sunk capital should be irrelevant to 2

the operational decision which is based on cash flows. Sunk

capital is important in tax calculations, and should only be 1

modelled in tax calculations and considered where tax impacts

cash flows. 0

0 500 1,000 1,500 2,000

An accounting view would suggest that undepreciated capital Annaul production (kt)

represents historical expenditure of shareholder funds. A

A second risk of expansion strategies is that working stocks are

decision to ignore this expenditure during an analysis of future

consumed at a rate faster than they can be replaced. As stocks

mine options is equivalent to writing the value off a mine’s

are diminished, production volatility rises, as ore available for

balance sheet. Conceptually, residual capital should be thought

production becomes increasingly scarce. These mines are

of as being the part of a loan advanced by equity holders that is

characterised by high instantaneous rates of production,

still outstanding. Depreciation and amortisation may be thought

interspersed with lengthy low production periods. In cost

of as the principal repayments of the loan, with profits forming

structure terms, these mines are paying for capacity, but not

the interest component.

using it. In such a scenario, industry practice of making a

marginal mine bigger will results in increased losses.

The authors experience is that at the end of the day “cash is

king”. Models should consider cash flow on an after tax basis.

AMC Reference Library – www.ausmin.com.au 3

Why Cost Cutting Fails to Deliver

Production volatility may be defined in a number of ways. A million tonnes per annum. Maximum monthly production

definition used by the author is simply the ratio of actual to achieved was 110 kt. On an annualised basis, capacity (as

planned outcomes. Such a ratio measures the stress induced on defined by the best monthly hoist) was 32% above the annual

management by production shortfalls. production rate. Historical development requirements were

approximately 180 metres per month. Poor productivity in

Production volatility is related to both stock levels and development required a combination of owner mining and short

distribution of stocks. Where adequate stocks exist, and are term contracts.

appropriately distributed, a mine is able to cover a production

shortfall from any one source by supplementing production Owner jumbo development was characterised as being both

from other sources. slow and expensive. Monthly advance averaged 140 metres per

month, with occasional peaks of up to 200 metres per month.

Figures 5 and 6 illustrate the relationship between total stock Owner development costs were in the order of $3 100 per

availability and its distribution and the capacity to maintain metre. Distributed overheads contributed another $600 per

production. Clearly, having alternative sources of ore available metre. Development shortfalls were made up with short-term

is an important cost management strategy for a mine. contracts. Contractor unit costs were similar, however after

amortisation of mobilisation charges and allocation of owner

Reducing volatility to an acceptable level is an ideal avenue for supplied ground support, contract costs on an equivalent basis

reducing costs. If volatility can be lowered, capacity can be were estimated to be $3 900 per m.

reduced, or utilisation increased, resulting in lower unit costs.

As part of the re-engineering, a significant short term increase

When an expansion is considered there must be a planned in development rates was required. Development rates were

increase in working capital (ie developed and drilled ore) to required to rise to 400 metres per month for six months, and

sustain the increased production rate. then drop to 150 metres per month, for the next couple of years.

Figure 5 – Metal output volatility vs mine inventory Ground conditions ranged from moderate outside of sheared

levels ground to very poor in and around fault and shear zones. The

mine is deep, and subject to closure in and around zones of

Metal Volatility poor ground. Ground support methodology involved jumbo

80.0% scaling, meshing and subsequent rockbolting.

70.0%

60.0% The key decision in the restructure was a change in the primary

50.0%

ground support methodology. Primary support was altered to

install surface control first. This involved fibrecreteing

40.0%

followed by split sets. Mesh is only applied where required.

30.0%

Scaling was limited to large slabs and obviously loose rocks.

20.0%

The revised support methodology was applied to all headings in

10.0% ore and waste with the exception of the decline.

0.0%

0 50 100 150 200

The results of the re-engineering are illustrated in Figure 7.

Inventory or Mine Stocks weeks Average monthly advance increased from 140 metres per

month to 250 metres per month. Direct costs fell from $3 100 to

$2 500 per metre advance.

Figure 6 – Tonnage outcomes as function of stope

availability Figure 7 – Restructuring impact on monthly advance

350

140.0%

Actual tonnage

as a percentage 300

Monthly advance (m)

120.0%

of budget

100.0% 250

80.0% 200

60.0% 150

40.0% 100

20.0% 50

0.0%

0

0 2 4 6 8 10 12

Aug- Dec-99 Mar-00 Jun-00 Oct-00 Jan-01 Apr-01 Jul-01 Nov-01 Feb-02

Average number of stopes on line during study period

99

Case Study The operational impact of the decision was as follows:

The case study relates to restructuring of jumbo development • Ground support cycle involving the jumbo reduced

for a medium to large underground mine in Australia. It from 4.0 to 5.0 hours to approximately 1.0 to 1.5

examines the use of driver trees to isolate problems with the hours. This effectively doubled the time available for

productivity and cost structure of jumbo development. face drilling;

• Elimination of jumbo scaling and rockfall during the

The mine in question, budgeted approximately 1.2 million ground support component of the cycle. This in turn

tonnes per annum yet achieved an anualised production of 1.0

AMC Reference Library – www.ausmin.com.au 4

Why Cost Cutting Fails to Deliver

eliminated the need to re-bog the heading prior to gaps to be identified. Typical gaps include poor operator

face drilling; productivity, high maintenance costs, and poor utilisation.

• Rockfall damage to jumbo reduced, lowering

maintenance costs and increasing availability; While the mine in question had all of the above, the most

important feature identified was the high percentage of drilling

• Shotcrete reduced rock surface deterioration, effort devoted to rock bolting. Close examination of the data

lowering re-support requirements, increasing the suggested that not only did the jumbo spent a lot of time

amount of time available for face drilling. rockbolting in development headings, it also spent a lot of time

rehabilitating older development. It was estimated that 37% of

In developing the solution the cost structure was mapped. Costs drilled metres were devoted to rockbolting. Of this

within the jumbo development cost centre were broken down approximately one third was associated with rehabilitation.

into individual behaviour types. With the cost centre now

dismantled into its individual components, the impact of Another feature of the data was high unit drilling costs ($ per

increased development rates and alternative operating scenarios metre drilled). Drilling costs are related to rockbolting effort.

could be readily modelled and communicated to mine Figure 9 is illustrates the relationship between unit drilling

management. A summary of the cost structure prior to costs and rockbolting effort. The relationship simply states that

restructuring illustrated in Figure 8. jumbo tramming, scaling, and single boom drilling is clearly

less productive for a jumbo than development drilling.

After mapping the cost and productivity structure, it was

compared to peer mines. Comparison to peer mines permits

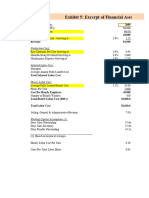

Figure 8 – Detailed development cost driver tree before restructure. Zcost components are grouped by behaviour type

Metres Drilled

Cost / person ( 110,866 m per annum )

( 90,554.0 $ per person ) ( 1,441.2 $ per person )

People

( 6.53 $/m drilled )

Productivity / person People ( 8 )

( 13,858 m per annum ) Operator ( 8 )

Nipper ( )

Maintenance labour Other ( )

Jumbo drilling ( 2.27 $/m drilled )

( 13.56 $/m drilled ) Maintenance

Jumbo development ( 746 $ per m advance ) ( 4.31 $/m drilled )

( 3,158 $ per m advance ) Parts / supplies & contracts

( 2.04 $/m drilled )

Blasting

( 111 $ per m advance )

Supplies & Consumables

( 2.72 $/m drilled )

Materials handling

( 348 $ per m advance )

Allocated drilling

( 34.18 $ rockbolt )

Services & supplies

( 769 $ per m advance ) Rockbolts Rock bolts

( 635 $ per m advance ) ( 38.77 $ rockbolt )

Ground support Mesh Bolt rate

( 1,184 $ per m advance ) ( 188 $ per m advance ) ( 8.70 bolts per metre )

Cablebolts

( 224 $ per m advance ) Shotcrete

( 550 $ cubic metre )

Shotcrete

( 138 $ per m advance )

Application rate

( .25 cubuc m per m advance )

Figure 9 – Relationship between jumbo cash cost and Similarly, maintenance costs are related to rockbolting effort.

rockbolting effort The key conclusion here is that maintenance costs for jumbos

are driven by the amount of rockfall damage the machine

experiences.

Jumbo cash cost ($\m drilled)

18

16

14 While it is obvious the rockbolting rate was high and was

12 contributing to the high unit cost of development, the solution

10 was less obvious.

8

6 On a high level, rockbolting was costing $635 per metre, or $73

4 per installed bolt. Applying a 25mm layer of fibrecrete was

2

estimated to cost $140 per metre. To break even, application of

0

fibrecrete would have to reduce rockbolting from 8.7 bolts per

0% 10% 20% 30% 40% 50%

metre to 6.7 bolts per metre. Most mines would stop the

Percentage of jumbo drill effort related to rockbolting analysis at this point. The decision to proceed would be

assessed as marginal. Adoption of fibrecrete would be a 50/50

AMC Reference Library – www.ausmin.com.au 5

Why Cost Cutting Fails to Deliver

proposition, or alternatively a contractor would have been Conclusion

brought in.

To maximise the potential benefit of cost cutting and

The process adopted in this case was to review the behaviour of restructuring, a through analysis of relationships between

each branch of the driver tree. Once the behaviour was differing cost types and their physical drivers is a primary first

identified, the branch could be scaled according to the proposed step. Failure to complete a through analysis before embarking

change. on restructuring can lead to unexpected outcomes, and

potentially threaten the viability of the mine being restructured.

Labour costs were modelled as a capacity cost. Total labour Cost driver trees are a useful method of increasing the

costs were assumed to remain constant. Under the proposed transparency of cost structures and assessing alternative

change, jumbo productivity (metres drilled per operator year), operating scenarios. The transparency generated using cost

was estimated to rise by 40%. This was estimated to reduce driver trees is further enhanced when rigidly defined metrics

labour costs from $6.53 per metre drilled to $3.92. are compared between differing mines. Such comparisons

generate insights not normally available within a single mine

Supplies and consumables were assumed to be totally variable

and remain constant at $2.72 per metre drilled. The analysis

neglected to examine drill costs in sufficient detail and missed References

the relationship between consumable cost and scaling. In

hindsight it is estimated that jumbo scaling contributed between 1. McCarthy, P, 2002. Setting plant capacity, in

25% to 40% of drill consumable costs. Proceedings Metallurgical Plant Design and

Operating Strategies, (CD ROM) pp 21-30 (The

Maintenance costs were split into labour and supplies. Labour Australasian Institute of Minng and Metallurgy:

costs were further divided into owner and contractor costs. Melbourne).

Owner labour costs are again assumed to be a capacity cost, and 2. Mikula, P A and Lee, M F, 2000. Bulk low-grade

were held constant. Maintenance costs were re-estimated with mining at Mount Charlotte Mine, in Proceedings

reduced maintenance contractor costs and reduced maintenance MassMin 2000, pp 623-635 (The Australasian

supplies, as a result of reduced scaling. Institute of Mining and Metallurgy: Melbourne).

Ground control costs were assumed to be variable, and a 3. Ward, D and McCarthy, P, 1999. Startup

function of metres developed. Unit ground support costs were Performance of New Base Metal Projects, in Adding

estimated using 5.7 bolts per metre, 20% of existing mesh rates Value to the Carpentaria Mineral Province,

and 0.30 m3 of fibrecrete per metre developed. Total ground Australian Journal of Mining, April.

support costs were estimated to fall from $1 184 per metre to

$780 per metre

The study estimated that total costs would fall by between $500

to $600 per metre and development rates rise to between 200 to

220 metres per month. The result was a drop of almost $600 per

metre, and development rates rose to 250 metres per month.

AMC Reference Library – www.ausmin.com.au 6

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment Effectivenesscabro_chicoNo ratings yet

- 2002 ASSET Management Implementation Group SHELLDocument10 pages2002 ASSET Management Implementation Group SHELLalfredo j eloy100% (1)

- Optimising Costs in The Current Environment: IPA09-E-203Document8 pagesOptimising Costs in The Current Environment: IPA09-E-203REandoNo ratings yet

- Cost Estimating SurfaceDocument15 pagesCost Estimating Surfacenicholas.landry-st-onge.1No ratings yet

- Systems Approach To Integrating Cost and Technical DataDocument9 pagesSystems Approach To Integrating Cost and Technical DataAbdelmadjid djibrineNo ratings yet

- Spe-0419-0057-Jpt CompletionsDocument1 pageSpe-0419-0057-Jpt CompletionsquiruchiNo ratings yet

- SPE 110805 Use of Advanced Optimization Techniques To Manage A Complex Drilling ScheduleDocument9 pagesSPE 110805 Use of Advanced Optimization Techniques To Manage A Complex Drilling ScheduleAnonymous VNu3ODGavNo ratings yet

- Cost Management Optimisation: B KingDocument5 pagesCost Management Optimisation: B KingUriel Placido Jacho PachaNo ratings yet

- 2014 11 24 King Cost Management Optimisation - Orebody2014Document5 pages2014 11 24 King Cost Management Optimisation - Orebody2014Claudia AndradeNo ratings yet

- Rel APMDocument20 pagesRel APMoptisearch100% (1)

- Optimizing The Design To Cost CycleDocument4 pagesOptimizing The Design To Cost Cycleluz marina silvaNo ratings yet

- Drilling Cost Engineering and EstimateDocument13 pagesDrilling Cost Engineering and EstimatenappyNo ratings yet

- RC WP Operational Readiness For New AssetsDocument10 pagesRC WP Operational Readiness For New AssetssedianpoNo ratings yet

- Optimum Equipment Management Through: Life Cycle CostingDocument4 pagesOptimum Equipment Management Through: Life Cycle CostingCarlos ChacónNo ratings yet

- SPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelDocument16 pagesSPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelRayner SusantoNo ratings yet

- CS4 DimensionDocument6 pagesCS4 DimensionNay Htoo ZawNo ratings yet

- ManagementaspectsDocument7 pagesManagementaspectsYudhi Nur ArifiantoNo ratings yet

- Techno-Economic Analysis For New Technology Development: Chris Burk, PE Burk Engineering LLC, Salt Lake City, UT, USADocument4 pagesTechno-Economic Analysis For New Technology Development: Chris Burk, PE Burk Engineering LLC, Salt Lake City, UT, USAlorenaNo ratings yet

- White Paper OPEX 2018Document12 pagesWhite Paper OPEX 2018Helena AraujoNo ratings yet

- Application of Value Stream Mapping (VSM) For Lean and Cycle Time Reduction in Complex Production Environments: A Case StudyDocument23 pagesApplication of Value Stream Mapping (VSM) For Lean and Cycle Time Reduction in Complex Production Environments: A Case Studybatlord9No ratings yet

- Mantenimiento PreventivoDocument7 pagesMantenimiento Preventivoadri oleasNo ratings yet

- Design For ManufacturingDocument3 pagesDesign For ManufacturingMohamed HabibullahNo ratings yet

- SPE 91570 Economic Evaluation R&UDocument16 pagesSPE 91570 Economic Evaluation R&UJose TorresNo ratings yet

- Maintenance Management DissertationDocument8 pagesMaintenance Management DissertationBuyPaperOnlineSingapore100% (1)

- Activity-Based Costing Management and Its Implications For Operations Management - M. Gupta, K. Galloway - 2003Document8 pagesActivity-Based Costing Management and Its Implications For Operations Management - M. Gupta, K. Galloway - 2003PacoPicassoNo ratings yet

- Extending The Life of Aging Assets: Asset ManagementDocument3 pagesExtending The Life of Aging Assets: Asset ManagementRRANo ratings yet

- An Approach To Improve Airframe Conceptual Design ProcessDocument10 pagesAn Approach To Improve Airframe Conceptual Design Processst05148No ratings yet

- Integrated Strategy Optimsation For Complex OperationsDocument8 pagesIntegrated Strategy Optimsation For Complex OperationsCarlos A. Espinoza MNo ratings yet

- Lean Management Framework For Improving Maintenance Operation Development and Application in The Oil and Gas IndustryDocument19 pagesLean Management Framework For Improving Maintenance Operation Development and Application in The Oil and Gas IndustryJulia De Oliveira MoraisNo ratings yet

- JurnalDocument19 pagesJurnalDelicia SalsabilaNo ratings yet

- Lean Management Framework For Improving Maintenance Operation: Development and Application in The Oil and Gas IndustryDocument20 pagesLean Management Framework For Improving Maintenance Operation: Development and Application in The Oil and Gas IndustryLê Ngọc LoanNo ratings yet

- Design For AssemblyDocument6 pagesDesign For AssemblyGonzalo Hernández MelladoNo ratings yet

- McKinsey On Oil & GasDocument8 pagesMcKinsey On Oil & Gasgweberpe@gmailcomNo ratings yet

- Asset Management Decision-MakingDocument13 pagesAsset Management Decision-MakingBambang KarditoNo ratings yet

- Cost Leadership StrategyDocument2 pagesCost Leadership StrategyWWZNo ratings yet

- Shutdown MaintenanceDocument5 pagesShutdown MaintenanceAmirRazviNo ratings yet

- A Case Study of LEAN Application For ShoDocument8 pagesA Case Study of LEAN Application For Sholiza annaNo ratings yet

- Process Costing and Management Accounting: in Today's Business EnvironmentDocument8 pagesProcess Costing and Management Accounting: in Today's Business Environmentمحمد زرواطيNo ratings yet

- Benchmarks of Performance For Truck and Loader FleetsDocument8 pagesBenchmarks of Performance For Truck and Loader FleetsLeo Manaure Rada100% (2)

- Emma 0909Document4 pagesEmma 0909dhickmNo ratings yet

- Taking The Next Leap Forward in Semiconductor SHORTDocument16 pagesTaking The Next Leap Forward in Semiconductor SHORTGerard StehelinNo ratings yet

- Maintenance Practices in Cement IndustryDocument12 pagesMaintenance Practices in Cement IndustryHarshil AdodariyaNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment EffectivenessFelipe JimenezNo ratings yet

- Ricardo Vargas West McelroyDocument6 pagesRicardo Vargas West McelroyAnxo X. FerreirósNo ratings yet

- Wing Design IonDocument10 pagesWing Design IonXavi VergaraNo ratings yet

- Spe 128716 MsDocument13 pagesSpe 128716 MsIskander KasimovNo ratings yet

- Understanding and Assessment of Mining Equipment EffectivenessDocument6 pagesUnderstanding and Assessment of Mining Equipment Effectivenesslovepishga,No ratings yet

- A Model For Integrating Cost Management and Production Planning and Control in ConstructionDocument16 pagesA Model For Integrating Cost Management and Production Planning and Control in ConstructionChetali SinghNo ratings yet

- MEGA White Paper - Application Portfolio ManagementDocument28 pagesMEGA White Paper - Application Portfolio ManagementIsmanto Semangoen100% (1)

- A Monte Carlo Methodological Approach To Plant Availability Modeling - Trabajo Confiabilidad - Articulo3Document13 pagesA Monte Carlo Methodological Approach To Plant Availability Modeling - Trabajo Confiabilidad - Articulo3danilo sotoNo ratings yet

- An Index For Operational Flexibility in Chemical Process DesignDocument10 pagesAn Index For Operational Flexibility in Chemical Process Designmauricio colomboNo ratings yet

- Maintenance Practices in Cement IndustryDocument12 pagesMaintenance Practices in Cement IndustryNayan DwivediNo ratings yet

- 2 - A Hybrid Model For Process Quality CostingDocument16 pages2 - A Hybrid Model For Process Quality CostingJuan AdityaNo ratings yet

- Heliyon: Okpala Charles Chikwendu, Anozie Stephen Chima, Mgbemena Chika EdithDocument9 pagesHeliyon: Okpala Charles Chikwendu, Anozie Stephen Chima, Mgbemena Chika EdithDIEGO FERNANDO HUAMANI TORRESNo ratings yet

- Managing Cost Escalation. The Case of Grade One Marine ShipyardDocument5 pagesManaging Cost Escalation. The Case of Grade One Marine ShipyardMohd ZaidNo ratings yet

- MMG Generates Large Return by Focusing On Continous ImprovementDocument5 pagesMMG Generates Large Return by Focusing On Continous ImprovementFLORENS CAROLINENo ratings yet

- Improving Asset Peformance Roy WhittDocument7 pagesImproving Asset Peformance Roy Whittابزار دقیقNo ratings yet

- Guide for Asset Integrity Managers: A Comprehensive Guide to Strategies, Practices and BenchmarkingFrom EverandGuide for Asset Integrity Managers: A Comprehensive Guide to Strategies, Practices and BenchmarkingNo ratings yet

- Brooks 3e PPT 09Document73 pagesBrooks 3e PPT 09Israa RamadanNo ratings yet

- Tpg23 08 NSW Government Guide To Cost Benefit Analysis 202304Document116 pagesTpg23 08 NSW Government Guide To Cost Benefit Analysis 202304Hassan ElmiNo ratings yet

- NPV Irr CaseDocument22 pagesNPV Irr Casealim shaikhNo ratings yet

- Financial Analysis & Modelling Using ExcelDocument2 pagesFinancial Analysis & Modelling Using Excel360 International Limited33% (3)

- Learner Guide Business Management 2 2024Document22 pagesLearner Guide Business Management 2 2024mashabaemotionNo ratings yet

- How Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Document28 pagesHow Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Ishtiaq Ahmed82% (11)

- CCI Feasibility Study For 500 KV AC Underground CablesDocument310 pagesCCI Feasibility Study For 500 KV AC Underground Cableserkamlakar2234100% (1)

- Practice Assessment 2: Assessment Book and Data: Advanced Diploma Synoptic (AQ2016)Document7 pagesPractice Assessment 2: Assessment Book and Data: Advanced Diploma Synoptic (AQ2016)Tlamelo KennedyNo ratings yet

- FM Examiner's Report M20Document10 pagesFM Examiner's Report M20Isavic AlsinaNo ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- AFM Individual Assignment 1Document5 pagesAFM Individual Assignment 1RajeswariRameshNo ratings yet

- Financial Management Theory and Practice Brigham 13th Edition Test Bank DownloadDocument33 pagesFinancial Management Theory and Practice Brigham 13th Edition Test Bank Downloadelainecannonjgzifkyxbe100% (26)

- How To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Document50 pagesHow To Calculate Present Values?: Abhinav Anand (IIM Bangalore)Gaurav SainiNo ratings yet

- Langfield Smith 7 CH 21 - Answers To TB QuestionsDocument33 pagesLangfield Smith 7 CH 21 - Answers To TB QuestionsAllyNo ratings yet

- Review in Financial Management - Students Activity SheetDocument30 pagesReview in Financial Management - Students Activity SheetDJ yanaNo ratings yet

- Dairy Farm 50 Cows Rs. 83.89 Million Sep-2023Document33 pagesDairy Farm 50 Cows Rs. 83.89 Million Sep-2023Mohsin JameelNo ratings yet

- Business Plan On Electronic and Communication Equipments Operation Repair and Maintenance ServiceDocument19 pagesBusiness Plan On Electronic and Communication Equipments Operation Repair and Maintenance Servicebiru mulugetaNo ratings yet

- 13 Exam Guide - MCQs - A.D. Cost Recruitment Under ICoAS-2022 V.1Document274 pages13 Exam Guide - MCQs - A.D. Cost Recruitment Under ICoAS-2022 V.1bujhadungaNo ratings yet

- International Capital BudgetingDocument24 pagesInternational Capital BudgetingQuoc AnhNo ratings yet

- Sample Questions BMS SEM VI Orderwise PDFDocument41 pagesSample Questions BMS SEM VI Orderwise PDFAasim TajNo ratings yet

- Financial Training - F2Document29 pagesFinancial Training - F2Swan ye ThutaNo ratings yet

- Assignment II - Quiz 2Document5 pagesAssignment II - Quiz 2tawfikNo ratings yet

- Internship Report: By-Rohit PatidarDocument24 pagesInternship Report: By-Rohit PatidarRohit PatidarNo ratings yet

- Semester 2-Question Bank For VivaDocument49 pagesSemester 2-Question Bank For Vivareckkit benckiserNo ratings yet

- CPChap 3Document33 pagesCPChap 3K59 Hoang Gia HuyNo ratings yet

- Chapter 3Document9 pagesChapter 3Karthik TambralliNo ratings yet

- Risk Management and Insurance - Chapter-4-Additional-Topics-In-Risk-ManagementDocument15 pagesRisk Management and Insurance - Chapter-4-Additional-Topics-In-Risk-ManagementHasan Bin HusainNo ratings yet

- Chapter 07Document14 pagesChapter 07casperNo ratings yet

- Project Investment AnalysisDocument46 pagesProject Investment AnalysisAbdul ManafNo ratings yet