Professional Documents

Culture Documents

2011-04-05 002819 Campbell

2011-04-05 002819 Campbell

Uploaded by

Wasil ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011-04-05 002819 Campbell

2011-04-05 002819 Campbell

Uploaded by

Wasil ShahCopyright:

Available Formats

Solutions Guide: This is meant as a solutions guide.

Please try reworking the

questions and reword the answers to essay type parts so as to guarantee that your

answer is an original. Do not submit as your own.

12-4) The Campbell Company is evaluating the proposed acquisition of a new milling

machine. The machine's base price is $108,000, and it would cost another $12,500 to

modify it for special use. The machine falls into the MACRS 3- year, and it would be

sold after 3 years for $65,000. The machine would require an increase in net working

capital (inventory) of $5,500. The milling machine would have no effect on revenues, but

it is expected to save the firm $44,000 per year in before tax operating costs, mainly

labor. Campbell's marginal tax rate is 35%.

a) What is the net cost of the machine for capital budgeting purposes? (That is, what is

the year 0 net cash flow?)

b) What are the net operating cash flows in Years 1,2, and 3?

c) What is the additional Year 3 cash flow (that is, the after-tax salvage and the return of

working capital)?

d) If the project's cost of capital is 12%, should the machine be purchased?

a. The net cost is $126,000:

Price ($108,000)

Modification (12,500)

Increase in NWC (5,500)

Cash outlay for new machine ($126,000)

b. The operating cash flows follow:

Year 1 Year 2 Year 3

1. After-tax savings $28,600 $28,600 $28,600

2. Depreciation tax savings 13,918 18,979 6,326

Net cash flow $42,518 $47,579 $34,926

Notes:

1. The after-tax cost savings is $44,000(1 - T) = $44,000(0.65)

= $28,600.

2. The depreciation expense in each year is the depreciable basis, $120,500,

times the MACRS allowance percentages of 0.33, 0.45, and 0.15 for Years

1, 2, and 3, respectively. Depreciation expense in Years 1, 2, and 3 is

$39,765, $54,225, and $18,075. The depreciation tax savings is calculated

as the tax rate (35%) times the depreciation expense in each year.

c. The terminal year cash flow is $50,702:

Salvage value $65,000

Tax on SV* (19,798)

Return of NWC 5,500

$50,702

BV in Year 4 = $120,500(0.07) = $8,435.

*Tax on SV = ($65,000 - $8,435)(0.35) = $19,798.

d. The project has an NPV of $10,841; thus, it should be accepted.

Year Net Cash Flow PV @ 12%

0 ($126,000) ($126,000)

1 42,518 37,963

2 47,579 37,930

3 85,628 60,948

NPV = $ 10,841

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- Rent ReceiptDocument1 pageRent Receiptbathyal28% (43)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adventure by IsabelDocument1 pageAdventure by IsabelWasil ShahNo ratings yet

- Wind On The HillDocument1 pageWind On The HillWasil ShahNo ratings yet

- Being Brave at NightDocument1 pageBeing Brave at NightWasil ShahNo ratings yet

- Dentist and The Crocodile by Roald DahlDocument1 pageDentist and The Crocodile by Roald DahlWasil ShahNo ratings yet

- An Empirical Investigation On The Effect of Brand Loyalty: Tariq Jalees Nimra Shahid Huma TariqDocument19 pagesAn Empirical Investigation On The Effect of Brand Loyalty: Tariq Jalees Nimra Shahid Huma TariqWasil ShahNo ratings yet

- Good GovernanceDocument3 pagesGood GovernanceWasil ShahNo ratings yet

- SickDocument1 pageSickmadhu63No ratings yet

- Water Crises in Pakistan - EssayDocument7 pagesWater Crises in Pakistan - EssayWasil Shah100% (1)

- Human Rights: Quran:: Nelson MandelaDocument3 pagesHuman Rights: Quran:: Nelson MandelaWasil ShahNo ratings yet

- Name Shah Mohammad (46) Class Teacher Subject TopicDocument18 pagesName Shah Mohammad (46) Class Teacher Subject TopicWasil ShahNo ratings yet

- DCF Valuation Report On IrctcDocument16 pagesDCF Valuation Report On Irctcshivam tripathiNo ratings yet

- Fast Formula The Key To Simplifying Your Users LifeDocument38 pagesFast Formula The Key To Simplifying Your Users Lifehossam160100% (2)

- Aranda Vs Republic (G.R. No. 172331)Document10 pagesAranda Vs Republic (G.R. No. 172331)MaryNo ratings yet

- Guide On IT ServicesDocument9 pagesGuide On IT ServicesEqbal GubranNo ratings yet

- Gilbert CompanyDocument15 pagesGilbert CompanyThricia Mae IgnacioNo ratings yet

- Surgical Suture TenderDocument40 pagesSurgical Suture TenderAhmed MoeenNo ratings yet

- Accountancy Mock Pre Board XIIDocument12 pagesAccountancy Mock Pre Board XIIAmanbir SinghNo ratings yet

- Yousaf Weaving Mills LTD - 2003: Balance Sheet As at September 30, 2003Document8 pagesYousaf Weaving Mills LTD - 2003: Balance Sheet As at September 30, 2003Anonymous pCZJ4KhNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- IDFC Personal Loan AgreementDocument20 pagesIDFC Personal Loan AgreementKanchan tanpureNo ratings yet

- Drivers of Current Food Waste Generation Threats of Future Increase and Opportunities For ReductionDocument189 pagesDrivers of Current Food Waste Generation Threats of Future Increase and Opportunities For ReductionSanaullah SharNo ratings yet

- Nuri - Fractional Reserve Banking As Economic Parasitism - A Scientific, Mathematical and Historical Expose, Critique and Manifesto (2002)Document62 pagesNuri - Fractional Reserve Banking As Economic Parasitism - A Scientific, Mathematical and Historical Expose, Critique and Manifesto (2002)Indianhoshi HoshiNo ratings yet

- Assignment (Pre-Answers) PDFDocument63 pagesAssignment (Pre-Answers) PDFRussell KeyesNo ratings yet

- Technizer-Java8-Online - Invoice - 8Document4 pagesTechnizer-Java8-Online - Invoice - 8Srinivasa HelavarNo ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- Year 11 Business Studies - Nature of BusinessDocument80 pagesYear 11 Business Studies - Nature of BusinessMohamed JebaraNo ratings yet

- Crypto PDFDocument7 pagesCrypto PDFNikhil MohiteNo ratings yet

- Book Release 080104Document3 pagesBook Release 080104aslam844No ratings yet

- Inv 000070Document1 pageInv 000070prasanth mkNo ratings yet

- ProQuest The First Law of PetropoliticsDocument12 pagesProQuest The First Law of PetropoliticsPeggy W SatterfieldNo ratings yet

- Ghaziabad Telecom District: Account SummaryDocument1 pageGhaziabad Telecom District: Account SummaryVinee SharmaNo ratings yet

- BBS - 2nd - Macroeconomics (By Study Material YT Channel)Document14 pagesBBS - 2nd - Macroeconomics (By Study Material YT Channel)KushalNo ratings yet

- Jun 2006 - Qns Mod BDocument13 pagesJun 2006 - Qns Mod BHubbak KhanNo ratings yet

- Penalty TAX: Ax Distinguished From Other ChargesDocument4 pagesPenalty TAX: Ax Distinguished From Other Chargesmaria cruzNo ratings yet

- Business Model Case Study - Fintech Part IDocument28 pagesBusiness Model Case Study - Fintech Part IRaj KumarNo ratings yet

- National Income AnalysisDocument58 pagesNational Income AnalysisharshNo ratings yet

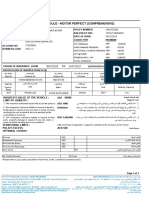

- AXA Renewal ScheduleDocument3 pagesAXA Renewal Schedulegeorge mathewNo ratings yet

- Return On Capital EmployedDocument6 pagesReturn On Capital EmployedFrankie LamNo ratings yet

- 5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A DifferenceDocument30 pages5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A Differenceemriz pratamaNo ratings yet