Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsChapter 1 General Principles and Concepts of Taxation PDF

Chapter 1 General Principles and Concepts of Taxation PDF

Uploaded by

Zyrille PadillaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment 3Document12 pagesAssignment 3Zyrille PadillaNo ratings yet

- Intacc QuizDocument15 pagesIntacc QuizZyrille PadillaNo ratings yet

- The Girl and The Sailor Case StudyDocument3 pagesThe Girl and The Sailor Case StudyZyrille PadillaNo ratings yet

- To-Do List: Task Due Date FinishedDocument1 pageTo-Do List: Task Due Date FinishedZyrille PadillaNo ratings yet

- TCW Quiz PDFDocument3 pagesTCW Quiz PDFZyrille PadillaNo ratings yet

- Philippine Financial Reporting StandardsDocument4 pagesPhilippine Financial Reporting StandardsZyrille PadillaNo ratings yet

- OBLICONDocument12 pagesOBLICONZyrille PadillaNo ratings yet

- # Subject Code Description Faculty Name Units Sect Code Final Grade Grade StatusDocument1 page# Subject Code Description Faculty Name Units Sect Code Final Grade Grade StatusZyrille PadillaNo ratings yet

- Accounting Grades SampleDocument1 pageAccounting Grades SampleZyrille PadillaNo ratings yet

- HBO Chapter 3 and 4 PDFDocument11 pagesHBO Chapter 3 and 4 PDFZyrille PadillaNo ratings yet

Chapter 1 General Principles and Concepts of Taxation PDF

Chapter 1 General Principles and Concepts of Taxation PDF

Uploaded by

Zyrille Padilla0 ratings0% found this document useful (0 votes)

29 views26 pagesOriginal Title

Chapter-1-General-Principles-and-Concepts-of-Taxation.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

29 views26 pagesChapter 1 General Principles and Concepts of Taxation PDF

Chapter 1 General Principles and Concepts of Taxation PDF

Uploaded by

Zyrille PadillaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 26

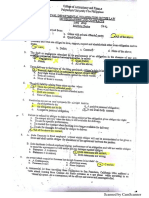

Chapter 01. General Principles and Concepts of Taxation

(Common Topies for Individuals and Corporations)

(Objectives: Learn, Understand the Following Topics)

General Principles of Taxation

BIR Organization, Powers and Funetions

Tax Remedies of Government and Taxpayers

Penalties /Additions to Tax

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION — 1

{ General Principles and Concepts of Taxation

Inherent Powers of the Government’State

1. Power of Taxation, - Refers to the inherent power of the state to exact an enforced contribution upon

persons, property or rights for the purpose of generating revenues for the use and support of the

‘government. This power is exercised only by the goverament or its political subdivision. fn taxation, there

is generally no limit to the amount cf tax that maybe imposed.

2. Power of Eminent Douain, - Refers (o the inherent power of the state to expropriate privaie property

for public purpese in return for a just or reasonable compensation. This power may be granted by the

government fo public service companies or public utilities.

3. Police Power, - Refers to the inherent power of the state to promote thee general welfare of the people

by limiting or regulating the rights or properties of any person. This power is relatively free from the

constitutional limitations and is superior to the non-impairment clause provisions on obligations of

contracts. Under this power, the rules on the imposition of a license fee is that; If the right or activity by

regulation is useful, the amount of the license fee shall be that which is /necessary to carry out its

regulation. But if said right or activity is not useful then the amount of the license fee is diseretionary to

the taxing authority.

ies among the Inherent Powers of the Government

1. They all underlie and exist independently with the constitution although the conditions for their

exercised maybe prescribed by the constitution and by law

2. They are ways or means by which the government interferes with private rights and properties

3, They all rest upon necessity because there can be no effective government without ¢hem

4. They all presupposes an equivalent compensation received, directly or indirectly, by the persons

affected by the exercise of uny of these governmental powers

5. They are legislative in nature and character although the actual exercise of the powers is delega-

ted (the executive branch, loca! or national

Distinctions between Power of Taxation and Power of Eminent Domain

1. The power of taxation is directed against persons, properties, or rights whereas, the power of

‘eminent domain is directed against zeal property.

2. The purpose of taxation is to raise revenues (0 support the government whereas, that of eminent

domain is to have the real property for public purpose.

3. In tavation, the taxpayer gives money representing his taxes in consideration for services and

protections presumed furnished by the government whereas, in eminent domain, taxpayer gi

away his real property in consideration for a just or reasonable monetarial consideration.

Distinctions between Power of Taxation and Police Power

1. The power of taxation is geared to raise revenues to support the government whereas, police

power is to regulate or limit the rights of persons for the public welfare.

2. The power of taxation is directed against persons, properties, or rights whereas, police power is

directed against the taxpayer's rights or property.

In the power of taxation, the amount of tax impo:

power, the amount of the regulation fee must be

regulation,

1m may be unlimited whereas, in the police

ited to what is needed to carry out the

Limitations on the Power of Taxation

1. Constitutional Limitations, - Refers to those limit:

the provisions of the Philippine Constitution, to wit:

jons which are sp

od or written in

ally

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION — 2

4. Due process of the law, -

No person shall be deprived of life, liberty or property without due process. Before a taxpayer is

made to Answer for eriminal offense, due process must be observed. The term “due process of

law" means a law which hears before it condemns, which precedes inquiry and renders judgment

only after triak

b, Equal Protection of the Law

No person shall be denied the equal protection of the law. ‘The term “Equal Protection of the

Law” means a law that prevents any taxpayer, a person or class, from being singled out as a

special subject of hostite or discriminating tax legislation. Every taxpayer should enjoy protection

against illegal or unreasonable tax assessments, searches and seizures.

¢. Nou imprisonment for Non-payment ofa Debt or a Poll Tax, -

No person shall be imprisoned for failure to pay a debt unless guilty of estafa (where there is

fraud or deceit). Likewise no one shall be sent to jail for failure to pay a poll tax.

4d. Non-impairmeat of the Provisions on Obligations of Contracts, -

No tax law impairing the obligations of contracts shall be passed. Any tax law that

changes into the express terms of a contract or its legal construction, or its val

discharge, or the remedy for its enforcement, impairs the contract.

troduce

e. The Rule of Taxation shall be Uniform and Equitabl

Congress shall evolve a progressive system of taxation. Uniformity has reference to taxing at the

same rate people or things belonging to the same class, thus avoiding class tax legislation. A tax is,

equitable if it is based on the ability to pay and reasonabte in amount taking into account certain

factors. A tax that is confiscatory is certainly not equitable.

{No Public Money or Property shall be Appropriated for a Religious or Private Purpose, -

‘The constitution prohibits the appropriations, applications or payments of public money, directly

or indirectly, for the use, benefit or support of any sect, church, denomination, sectarian

institution, or system of religious, or of any priest, preacher, minister or other religious teacher

or dignitary as such, exeept wien such person is assigned to the Armed Forces of the Philippines,

or to any penal institution or government orphanage or leprosarium.

g. Exemption from Taxation of Educational, Religious and Charitable Organizations, -

Charitable institutions, churches, parsonages, convents or appurtenant thereto, mosques,

Non-profit cemeteries, and all lands, buildings ard improvements used exclusively for religious,

educational or charitable purposes shall be exempt from taxation,

h, No Law Granting Any Tax Exemption shall be Passed without the Concurrence of a Majority of,

all the members of Congress. The majority of all members of the national assembly or cong

implied to a particular person, right or property, from a particular tax to which other persons

generally within the same class, taxing authority or territory are subjected fo.

Non-impairment of the Jurisdiction of the Supreme Court on Tax Cases, ~

The Supreme Court is empowered to review, revise, modify or affirm an appeal or certiorari, as

the laws or the rules of court may provide, final judgments and orders of lower courts in all cases

involving the legality of any tax, impost, oF toll or any penalty imposed in relation thereto.

ine President has the Power to Approved or Veto a Tax Bill Approved and Passed by

ine Congress. Every bill passed by congress shall, before it becomes a law, be presented

pine President. The President shall have the power to approve or to veto, in full or

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION — 3,

any particular ifem in said tay bills. Congress may by lav, authorize the president (o fix within

specified limits, and subject to sueh limitations and restrictions as it may impose, tariff rates,

import and export quotas, tonnage and wharfage dues and other duties or imposts within the

framework of the national development of the government. In effeet the power of taxation is,

shared by the legislative and the executive branches of the government.

2. Inherent Limitations, - Refers to those timitations which are not and need not be specifically

cited oF expressed in the provisions of the Philippine Constitution, to wit:

a, ‘Taxes may be levied only for public purpose

. Non-delegation of the power to tax except to local government

c. Exemptions from taxation of government entities

d. Tay laws must be within the state’s territorial jurisdéction

e. Tax jaws must be subject to international comity, convention, or agreements

£. Prohibition of double taxation

Definitions of “Taxation”

1, Taxation, - Refers to the inherent power of the state to exact an enforced contribution upon persons

properties or rights for tie purpose of generating revenucs for the use of the government.

} Taxation, - Is a vay or means of apportioning the operational cosi of the government and all its

public needs among those who, in some measures are privileged to enjoy its benefits and therefore

must bear the burden.

ion, - Refers to the act of levying a tax or the process by which the government, through its law

making body, raises revenues to defray its necessary expewses,

Nature of Taxation

1 Aw = The power of taxation rests upon necessity and is inherent in every government or sover~

‘This power is legislative in nature and is essential to the existence of any independent gover

meat. The power of taxation is based upon the theory that government cannot exist without taxation,

thus taxation is an important neces:

2. Basis, - The theory is that taxes are imposed upon: persons, properties or rights for the support of the

government in return for the general udvantages and protections which the government affords the

taxpayers, their properties and rights. The principle is that, where there is no benefit, there is no

power to fax. The basis of the power (o tax therefore is the reciprocal duties of protection and support

‘between the state and those «hat are subject to its authority.

Purposes of Taxation

1. Primary Purpose, - It is a means to raise revenues for the use and support of the government to enable

it to carry out its appropriate functions. Example: Tax revenues are the main source of the yearly na-

tional budget that is appropriated to the different government instrumentalities and agencies in order

to defray their operational functions and activities that will benefit the country and its people.

2. Second:

Purpose, - It is a means to contend or promote the general welfare, social and economic

t foreign

development of a country and its people. Example: To protect the local industries ag

competitor the government imposes protective tariff on imported goods.

Scope of Taxation

The coverage of the power of taxation is plenary or wi

restricted only by the constitutional and inherent limitations.

ited, comprehensive and supreme and is

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 4

Nature of Tax Laws/Internai Revenue Laws

Tax laws or internal revenue laws ere not political in nature. They are deemed civil in nature and not

penal in nature although there are penalties provided for their violations. The National Internal Revenue

Code being a special law prevails over a general law.

Constructions of Tax Laws

‘Tax laws should receive a reasonable construction with a view of carrying out their purpose and intent.

Where the language of the statute/law is plain and there is no doubt as to the legislative intent, then the

words employed shall be given ordinary meanings.

No person is subject to taxaticn unless within the terms or plain import of the taxing authority. In every

case of doubt, tax laws/statutes are construed strictly against the government and liberally in favor of the

taxpayer. However, tax exemptions and deductions provisions are construed strictly against the taxpayer

asserting the claims for exemptions/deductions.

‘The power of taxation is the strongest among the inherent powers of the government. This taxation power

maybe construed as to include the power to create such as in the case of granting tax incentives,

exemptions and tax escapes, tax holidays or tax reliefs (o certain business organizations/taxpayers. It is

likewise construed as to include the power to destroy, like in the case of imposing higher taxes on sin

products, such as wines and cigarettes, and on imported goods from abroad so as (o protect our local

products.

Applications of Tax Laws

In general, tax laws are prospective in operation, however, these may operate retroactively provided

expressly declared or it is the legislative intent.

Basic Principles of Sound Tax System

1. . Fiseal Adequacy, - Meaus that the sources of revenues as a whole must be adequate to mect the expendi-

tures of the government regardless of business or economic conditions. The revenue should be elastic or

capable of expanding or contracting annually in response to variations in public or government

expenditures.

2. Equality or Theoret ice, - Means that there must be an equitable or proportionate distribution

of the tax burden, which means that the (ax burden shali be shouldered by those who have the ability to

pay. The ability to pay is gauged by the income earned or received by the taxpayer. Those persons with

greater income must pay’ more as they have greater ability to pay than those persons with lesser income,

3, Administrative Feasibility, - Means that the tax laws must be capable of reasonable and convenient enf-

orcement, just and effective administration. The tax laws must be capable of being conveniently enforced

by the administrative personnel and can be conveniently complied with by the taxpayers as to the time,

manner and procedures of filing tax returns and payment of taxes.

‘Tax, - It refers to the enforced burden or mandatory contribution imposed by the government based on

its power of taxation, upon persons, properties, or rights. Tax is the bread and butter or the lifeblood of

the government hence, no court shall be empowered to interfere with or restrain the collections of taxes.

Essential Characteristics of Tax

1. Itisan enforced contribution cae]

2, tis legislative in nature

3. Itis imposed in accordance with/or based on law

4. Itisimposed for public purpose

tis proportionate in character

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 5

rT

tis paid at regular intervals

[tis imposed to raise government revenues

Tis imposed upon persons, properties, or rights

Classifications of Taxes

Classes of Taxes as to Subject Matter

a. Personal Tax or Capitation Tax or Poll Tax, -

Refers to those fixed amounts of taxes imposed upon certain class of persons, oF upon persons

(orial jurisdiction of the state regardless of their property, professions

or occupations. Example: Community tax

Property Tax, -

Refers to those taxes imposed upon the taxpayer's assets/property, real or personal, situated

in the territorial jurisdiction of the state in proportion to its value or some other reasona-

ble method of apportionment, Example: Real property tax

© Privilege Tax or Exeise Tax, -

Refers to those taxes imposed on the taxpayers’ exercising their rights and privileges of perfor-

ming an act or engaging in an occupation, All taxes that do not fall under the personal, poll or

capitation tax, or property tax shall be deemed as excise taxes. Example: donor’ and estate tax

Classes of Taxes as to Scope or Authority

a. National Tax, -

Refers to those taxes imposed by tie national government, enforced by o through the BIR or

the Bureau of Customs, which are both under the Department of Finance.

Examples: income tax, customs duties and tariff.

b. Local Tax, -

Refers to those taxes imposed by the focal goverament such as barangays, cities, municipalities

or provinces. Examples: real estate tax, community tax

Classes of Taxes as to Purpose

a. General Tax, ~

Refers to those taxes imposed for general purposes, the proceeds of which go to the national or

general funds. Example: estate tax

b. Special Tax, -

Refers to those taxes imposed for special purpose, the proceeds of whieh go to special funds.

Example; gasoline (ax.

Classes of Taxes as to Liabilities

a. Direct Tax, -

Refers to those taxes imposed upon persons directly bound to pay the tax, which eannot be

passed on or shifted to other person for payment. Example: income tax

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 6.

b, Indirect Tax, -

Refers fo those taxes imposed upon persons liable to pay said taxes but which are permitted

by law te be shified or passed on to other persons for payment. Example: Value added tax

5. Classes of Taxes as to Determination of Amounts

2. Specific Tax, -

Refers to those taxes imposed upon property or /rights which amounts are determined based

on weight or volume capacity or any physical unit of measurements. Example: excise tax on

liquors and cigerettes

b. Adwalorem Tax,

Refers (o those {axes imposed upon property or rights, which amounts are determined based

‘on the sales price or other specified values of the properties. Example: Value added tax

6. Classes of Taxes as to Graduation or Rates

a. Progressive or Graduated Tax, -

Refers to those taxes imposed upon persons, properties, rights which amount of tax increases

as the bracket/layer increases. Examples: gift (ax, estate tax

Regressive Tax, -

Refers to those taxes imposed upon persons, properties,

as the bracket/layer increases. AC present, there is no regress

ts, which amount of tax decreases

tax in the Philippine

Proportionate Tax, -

Refers fo those taxes imposed upon persons, properties or rights which amount of tax may be

higher or lower depending upon the bracket or classification,

Distinctions Between Tax and License Fee

1. A taxis imposed for the purpose of raising revenues, whereas, a license fee is imposed for the pur-

pose of regulation.

2A tax is imposed 6

police power.

3. A direct authority from congress levies a tax, whereas, a license fee is imposed under a delegate

power to the local government.

4. ‘The amount of tax is usually big whereas, a license fee is usually small, enough only to cover the

cost of services or regulation,

Failure to pay the tex does not render the business or occupation illegal whereas, failure to pay

the license fee renders a business or occupation illegal.

‘on the power of taxation, whereas, a license fee is imposed based on the

Distinctions Between Tax and Toll

1, A tax represents a demand of sovereignty, whereas a toll represents a demand of proprietorship.

2. The government imposes a tax, whereas, the government or private person imposes a toll

3. A taxis imposed to raise revenues for the support and use of the government whereas; a toll is

imposed mainly to recover the cost of property and its improvements.

Toll, - Refers to the compensation charged by the owner for the use of his property and improvements.

Distinctions Between Tax and Special Assessment

1, A taxis imposed upon persons, properties, or rights, whereas a special assessment is imposed only

‘on land and its improvements.

2. The national or local government imposes a tax whereas, only the local government can impose a

special assessment.

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 7

3. A taxis an enforced contribution for the use and support of the government, whereas a special

assessment is an enforced contribution to recover the cost of the public improvements.

4. A taxis ordinary and of general application whereas, special assessment is extra ordinary and

situational as to time and locality.

Distinctions Between Tax and Tariff (Customs Dut

1, Taxhas a broader meaning than tarifficustoms duties. All tarifV/eustoms duties are taxes whereas,

not all taxes are tariff customs duties.

2. A tax is imposed upon persons, properties, or rights whereas, tarifVeustoms duties are imposed

only upon artictes imported to or exported from the country.

Distinctions Between Tax and Debt

1. A tax is bused on law whereas; a debt is based on contract,

2. A taxis non-assignable whereas, a debt is assignable

3. A tax is generally payable in terms of money whereas, a debt is in terms of money or in property

4. In the ease of non-peyment of tax, (except poll tax) there is a possibility of imprisonment whereas

in the ease of non-payment of debt there is no possibility of imprisonment

A tax may not be subject to the right of offset whereas; a debt is subject (o the right of offset,

Lax Situs or Place of Taxation, ~

This refers to the territorial jurisdiction of the government where it has the authority to impose its taxa-

tion power whieh is to levy and collect taxes on persons, properties or rights. It literally means the place

of taxation. The basic rule is that the state where the subject to be taxed has a situs may rightfully levy

and collect the tax; and thie situs is necessarily in the state which has jurisdiction or which exercises domi

rion over the subject in question. Thus the person maybe subject to taxation in several taxing juris

‘The situs or place of taxation depends on the following factors: domicile or residence of the person;

enship oF nationality of the person; location or source of the income, property or right.

1. Persons, - Poll tax may be properly levied upon persons who are inhabitants or residents of the state

whether citizens or not.

Real Property, - With respect to real property taxes, real estate is subject to taxation in the state in

which itis located, whether the owner isa resident or a non-resident,

Tangible Personal Property, - The modern rule is that a tangible personal property is taxable in the

state where it has actual situs, where it is physically located, although the owner resides in another

Jurisdiction,

4, Intangible Personal Property, - Intangible personal property, such as cash, money, credits, bills,

receivables, bank deposits, bonds, promissory notes, mortgage loans, judgments and corporate stocks,

does not admit of actual location, and as to such property, the general rule is that the situs for purposes

of property taxation is at the domicile of the owner.

Income, - Income tax may be properly exacted from persons who are residents or citizens in the taxing

jurisdiction and even from those who are neither residents nor citizens provided that the income is

derived from sources within the taxing state.

6. Business, Occupation, and Transaction, - The general rule is that the power to levy excise tax depends

upon the place where the business is done, or where the occupation is engaged in, or where the

transaction took place,

CHAPTER 01, GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 8

7. Gratuitous Transfer of Property, - The transmission of property for without consideration may be

subject to taxation in the state where the transferor is a citizen or resident, or where the property is

located.

Phases or Aspects of Taxation

1. Levying or Imposition of Tax, - Refers to the legistative process of determining the persons, properties,

transactions or rights to be taxed, the purpose of said tax so long as itis for public purpose, the sum to he

raised, the tax rate to be imposed.

2. Assessment and Collections of Tax, -Refers to the manners or procedures of enforeing the tax obliga:

tions of the taxpayers, It i essentially administrative in character with the powers vested iu the

Department of Finance thru the Bureau of Internal Revenue, the Bureau of Customs and the Local

Governmental Units.

International Comity, - Refers to the fundamental rule of taxation that no law shall be passed to impose

taxation on the property owned by 2 foreign government or sovereignty.

Categories of Double Taxation

Double Taxation, - Means the act of taxing the same (axpayer, person, property or right, twice by the

same kind and character of tax, by the same taxing authority within the same jurisdiction or taxing

district, for the same purpose and during the same taxable period.

1. Direct Double Taxation, - In its strict sense, it means the direct act of taxing the same taxpayer,

person, property or right, twice by the same kind and character of tax, by the same taxing authority

within the seme jurisdiction or taxing district, for the same purpose and during the same period.

2. Indirect Double Taxation, - In its broadest sense, it means a double taxation other than direct double

taxation, It extends to al! eases in which there is a burden of two or more pecuniary impositions.

It means the indirect act of taxing the same taxpayer, person, property or right, twice by the same

Kind and character of tax, by the same taxing authority within the same jurisdiction or taxing

distriet, for the same purpose and during the same taxable period.

There

hence,

the uniformity rule of tax:

no constitutional limitation on double taxation. Itis merely subject to the inherent limitation;

is not prohibited legally speaking. If double taxation occurs, the taxpayer may seek relief under

ion or under the equal protection of the law guaranty under the constitution.

Classifications of Tax Escapes

These are ways and means that can be availed of by the taxpayers in order to reduce their tax liabilities,

or payments:

1. Tax eredit, - These are tax payments directly made by the taxpayer or through withholding agents,

that are expressly allowed by law as deductions direetly against the basic taxes due.

2, Tax Exemption, - Its a grant of immunity, express or implied, o a particular person, right, transact

tion or property, from a particular tax to which other persons generally within the same taxing

authority or territory is subjected to.

‘1. Express or Affirmative Tax Exemption, - This tax exemption benefiting certain person, property,

transaction or right is expressly written or cited under the provisions of the constitution, statute,

treaty, ordinance or franchise.

b. By Omission or Implied Tax Exemption, ~ This tax exemption occurs when a particular tax is

levied on certain classes of persons, properties, transactions or rights without mentioning (or by

omitting) other particular classes. Hence, all those omitted or not mentioned under the law are

deemed tax exempted

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 9

3. Tax Evasion or Tax Dodi It is the fraudulent act of using pretenses or forbidden devices in

order to lessen the tax liability or payment. This is an illegal means of reducing / avoiding taxes, is

prohibited and punishable by law.

4. Tax Avoidance, - it is the act of using legitimate or lawful means permitted by our tax laws in order

to minimize or totally avoid one’s tax liability/payment.

5, Tax Shifting, - It is the act of legitimately passing cf one’s tax liability for payment (0 another person

in zecordance with the provisions of the tax laws.

Sources of National ‘Tax Laws

National Interns! Revenue Code of the Phitippines

BIR Revenue Rulings and Regulations

Philippine Special Laws or Statutes

Decisions of the Philippine Courts: higher ecurts or lower courts

Opinions/Rulings of Secretary of Justice

Philippine Constitution

Presidentiat Decrees

C _ BIR Organizations, Powers, Functions

‘The Bureau of internal Revenue is the government agency that is authorized and tasked to administer and

execute internal revenue laws and regulations. The BIR is imbued with its mission to render services to the

public with justize and honor at al times, and fo maintain public confidence in the integrity and efficiency

of the revenue service. The BIR is organizationally a part and under the supervision and control of the

Department of Finance.

Primary Officials of the BIR

Chief Commissioner

Four Deputy Commissioners

Revenue Regional Directors

Assistant Revenue Regional Directors

Revenue District Officers

Department feads of the Assessment, Collection, Legal, Administrative Groups; and

Other BIR Officials of various Operationa! / Functionai Support Offices

‘The BIR consists of the Central Office and the Regional Offices. The Central Office is basically confined

‘on national policy formulation, proper planning, execution of internal revenue laws and rules and the

general direction and control of the entire internal revenue service.

‘The regional offices are further subdivided into various revenue district offices. Each regional office is,

headed by a Revenue Regional Director who is directly responsible to the Commissioner of Internal

Revenue and to the Deputy Commissioners. The Assistant Revenue Directors assist the Revenue Regional

Directors in the discharge of the latter's responsibilities and dui

‘The Bureau of Internal Revenue is divided into two working groups, namely:

1, Assessment and Collection Group, and

2. Legal and Administrative Group.

BIR Powers and Authorities

1. Assessment and collection of all national revenue taxes, fees and charges

2. Enforcements of all forfeitures, penalties and fines connected therewith

3. Execution of judgments in all cases decided in its favor by various courts

4. Effect and administer the supervisory and police powers conferred to it by laws

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 10

BIK Commissioner's Powers and Authorities

re

2

3

4.

Interpret tax laws and decides tax cases

Obtain information, summons, examine, administer oath and take test

Make assessments and prescribe additional requirements for tax ad

Delegate his powers.

BIR Powers that Cannot be Delegated

Commissioner's Powers to Make: Assessments, Addit

“The power to recommend the promulgation of rules and regulations by the Finance Secretary

‘The power to issue rulings of first impression or fo reverse, revoke or modify any existing ruling

of the Bureau of Internal Revenue

The power (o compromise or abate any (ax liability or refund tax credits

‘The power to assign or reassign internal revenue officers to establishments where

to excise tax are produced or kept

icles subject

ional Requirements for Tax Administration and

Enforcement

Examination of tax returas and determination of taxes due;

‘Assess the proper tax on the best evidence obtainable on taxpayer’s failure to submit required tax

returns, statements, reports and other document

‘Conduct inventory-taking, surveillance and (o prescribe presumptive gross sales/receipts;

‘Terminate taxable period;

Prescribe real property values;

Inquire into bank deposit accounts;

Accredit and register tax agents3,

Prescribe additional procedural or documentary requirements.

Commissioner's Powers to Compromise, Abate Taxes, Refund Tax Credits

A.

TI

BIR Compromise Settlement Program

program aims to give opportunities (0 taxpayers with outstanding accounts payables or receivables

and disputed assessments with the BIR, including those already fiied in courts, to settle their tax

liabilities through compromise settlement.

5

2

3

Persons Who Can Avail of the Compromise Settlement Program

Taxpayers who have any of the following eases may avail ofthis program:

a. Delinquent accounts

b. Cases under administrative protest pending in the Revenue Offices, Revenue Distriet Offices,

Legal Service, Large Taxpayer Service, Enforcement Service, Excise Taxpayers Service and

Collection Service

Civil tax eases disputed before the Courts

4. Collections cases filed in court

Criminal violations, except those already filed in court or those involving tax fraud

Cases Not Covered by the Compromise Settlement Program,

‘a. Withholding fax cases

b. Criminal tax fraud eases

¢. Criminal violations already filed in courts

d. Delinquent accounts with duly approved schedule of installment payments

Grounds or Basis for Tax Compromise

a, There is a reasonable doubt as to the validity of the tax claim against the taxpayer. The

compromise penalty is equal to atleast 40% of the basic assessed tax

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 11

b. Financial incapacity of the taxpayer to pay the tax due. The compromise penalty is equal to at

least 10% of the basic assessed tax

4, Ground: or Basis for Tax Abatement

‘a. Unjust or excessive assessment of tax claim or due

b. Administrative and collection cost do not justify the collections of the tax claim or due

5. Grounds or Basis for fax Refund or Tax Credit

‘a. Taxes are erroneously or illegally received or penalties are paid without authority

. Taxpayer files in writing within two (2 ) years after the payment of taxes or penalties

BIR Commissioner's Duties, Functions

1. Ensure tie provision, distribution of BIR forms, receipts, certifieates and appliances and the acknow-

Jedgment of payment of taxes

2. Divide the country to such required aumber of revenue districts

3. Make arrests and seizures for violation of the penal laws in the tax code

4. Make assignments of Internal Revenue officers involved in excise tax functions to establishments where

articles subject to excise taxes are produced or kept

5, Make assignment of Internal Revenue officers and other emptoyees to ether duties

6. Submission of the Commissioner's Annual Report and other pertinent information

BIR Jurisdiction, Authority on National Taxes

1. Individual income tax 5, Percentage tax

2. Corporate income tax 6 Value added tax

3. Estate tax 7, Excise tax

4, Donor’s tax 8, Documentary stamp tax

Such other taxes as are or hereafter may be imposed and collected ty the BIR.

Tax Remedies of Government and Taxpayers

I, Remedies of Government, In General

Section 203. Period of Limitations Upon Assessment and Collection of Taxes

Except as provided in Section 222, internal revenue taxes shall be assessed within three (3) years after the

last day prescribed by law for the filing of the tax return and no proceeding in court without assessment

for the collection of stich taxes shall be begun after the expiration of such period

Provided, that, in the ease where a tax return is filed beyond the period prescribed by law, the three (3)

years period shall be counted from the day the fax return was filed. For purposes of this section, a tax

return filed before the last day prescribed by law for the filing thereof shall be considered as filed on such

last day for filing,

Section 222. Exceptions as to Period of Limitations of Assessment and Collection of Taxes

1. Inthe ease of a false or fraudulent tax return with intent to evade tax or of failure to file a tax return,

the tax may be assessed, or a proceeding in court for the collection of such tax may be filed without

assessment, at any time within (en (10) years after the discovery of the falsity, fraud or omission

2. Ifbefore the expiration of the time prescribed in Section 203 for the assessment of the tax both the

BIR Commissioner and the taxpayer have agreed in writing to its assessment after such time, the tax may

be assessed within the period agreed upon

3, Any internal revenue tax which has been assessed within the period of limitation as preseribed in

parageaph (a) and (b) hereof, and in section 203 may be collected by distraint or levy or by a proceeding

in court within five (5) years following the assessment of the tax

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 12

Section 223. Suspension or Non - Suspension of Running of the Stacute of Limitations

1. Suspension of the running of the statute of limitation in section 203 and 222, on the making of

assessment and the beginning of the distraint or levy or a proceeding in court for collection, in respect of

any deficiency, shall be suspended:

a. for the period during which che BIR Commissioner is prohibited from making the assessment, or

beginuing the distraint or levy or a proceeding in court ard for sixty (60) days thereafter

b. when the taxpayer request for a reinvestigation which is granted by the Commissioner

when the taxpayer cannot be located in the address given by him in the tax return filed, upon

which a tax is being assessed and collected, without subsequently giving a change of address

2. Non-susp2nsion of the running of the statute of limitation in sections 203 and 222, on the making of

assessment and the beginning of the distraint or levy or a proceeding in court for coliection, in respect of

any deficiency, shall not be suspended when:

a. The warrant of distraint and levy is duly served upon the taxpayer, his authorized representative

or a member of his household with sufficient discretion, and no property ean be located, or

b. The taxpayer is out of the Philippines, or

€ The taxpayer cannot be located in the address given by him in the tax return but has informed

the BIR of a change of address.

IL. Civil Remedies of Government for Collection of Taxes

Section 265/207. Government's Remedies for tite Collection of Taxes

The civil remedics, available to the government, for the collection of internal revenue taxes, fees, or

charges, and any increment thereto resulting from delinquency shalt ive;

1. Summary Remedies hy the Government

a. Section 207. By Distraint of Personal Property.

Upon the failure of the person owing any delinquent tax er delinquent revenue to pay the same at

the time required, the BIR Commissioner or his duly authorized representative, if the amount

invoive is in excess of one million pesos (1,000,000), or the Revenue District Otficer, if the

amount involved is one million pesos (P1,000,000} or less, sitll seize and distraint any goods,

cchatells, or effects, and the personal property, including stocks and other securities, debts,

credits, bank accounts, and interests in and rights to persoual property of such persons

sufficient quantity. to satisfy the tax, or charge, together with any increment thereto incident (0

delinquency, and the expenses of the distraint and the cost of the subsequent sale.

Constructive Distraint, - To safeguard the interest of the government, the BIR Commissioner

may place under constructive distraint the personal property of a delinquent taxpayer or any

taxpayer who in his opinion:

a) is retiring from any business subject to tax, or

) is intending to leave the Philippines, or

©) is intending to remove his property there from, or

4) is intending to hide or conceal his property, or

©) is intending to perform any act of tending to obstruct the proceedings for the collection

of the tax due or which maybe due from him,

‘The constructive distraint of personal property shall be affected by requiring the taxpayer or any

person having possession or control of such property to sign a receipt covering the property

distrained and obligate himself to preserve the same intact and unaltered and not to dispose of

the same in any manner whatever, without the express authority of the BIR Commissioner.

CHAPTER 01, GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 13

b._ Seetion 207. By Levy Upon Rea! Property

After the expiration of the time required to pay the delinquent tax or delinquent revenue, real

property may be levied upon, before, simultaneously or after the distraint of personal property

belonging to the delinquent taxpayer.

Levy shall be effected by writing upon and said certificate a description of the property upon

whieh tevy is made, At the same time, written notice of the levy shall be mailed or served upon the

Registry of Deeds of the province or eity where the property is located and upon the delinquent

taxpayer, or if he is absent from the Philippines, to his ageut or the manager of his business in

respect to which the liability arose, if there be none, to the occupant of the property in question.

Section 217. Further Distraint or Levy

‘The remedy by distraint of personal property and levy on real property may be repeated if

necessary until the full amount of tax due, ineluding all expenses is collected.

Judicial Remedies by the Government

a. By Civil Action

The government files a case for collection of taxes before the courts requiring the taxpayer (0

pay his taxes.

b. By Criminal Action

‘The government files a case for collection of taxes and imposing penalty (fines and imprison

ment) against the taxpayer

Either of these remedies or both simultaneously may be pursued in the discretion of the

authorities charged with the collection of such taxes. Provided, however, that the remedies of

distraint and levy shall not be availed of if the amount of tax involved is not more than one

hundred pesos (P100.00).

‘The judgment on the criminal case shall not only impose the penalty but shall also order payment

of the tax subject of the criminal case as finally decided by the Commissioner.

‘Taxpayer's Remedies of Protesting an Assessment, Asking for Tax Refunds

Section 228. Protesting of Assessment of Taxes

When the BIR Commissioner or his duly authorized representative finds that proper taxes should be

assessed, he shall first notify the taxpayer of his tax audit findings; Provided, However, that such a Pre-

‘Assessment Notice (PAN) shall not be required in the following eases:

1 i

‘The taxpayer shall be informed in

which the assessment was made, otherwise the assessment is void.

. When a taxpayer who opted to claim a refund of tax credit

|. When the ex

When an arti

When the findings for any deficiency (ax is the result of a mathematical error in the eomputati

the tax as appearing on the face of the tax return

When a discrepancy has been determined between the tax withheld and the amount actually remitted

by the withholding agent

excess creditable withholding tax for a

taxable period was determined to have carried over and automatically applied the same amount

claimed against the estimated tax liabilities for the taxable quarter/s of the succeeding taxable year.

¢ tax due on exeisable articles has not been paid

fe locally purehased or imported by an exempt person, such as, but not limited to vehi

dies, eapital equipment, machineries and spare parts, has been sold, traded or transferred to non-

exempt persons.

ing by the Bureau of Internal Revenue of the laws and faets on

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 14

Within the period to be prescribed by implementing rules and regulations, the taxpayer shall be required

to respond (o such pre - assessment notice. If the taxpayer fails to respond, the BIR Commissioner or his

thorized representative shall issue a Final Assessment Notice and Demand (FAND) based on his

audit findings.

Such assessment may be protested administratively by filing a request for consideration or

eluvestigation within thirty 30) duy from receipt of the assessment in suck form and manner as may be

prescried by implementing rules and regulations,

Within sixty (60) days from filing of the protest, all relevant supporting documents shall have been

submitted, otherwise, the assessment shail become final.

If the protest is denied in whole or in part, or is not zeted upon within one hundred eighty (180) days

from submission of documents, the taxpayer adversely affected by tle decision or inaction may appeal to

the Court of Tax Appeal within thirty (30) days from receipt of the said decision, or trom the apse of the

fone hundred eighty (180) days period; otherwise, the decision shall become final, executory and

demandable.

Appeal to the Court of Tax Appeal and Supreme Court

Ifthe protest to the Court of Tax Appeal is denied, as a last resort, the taxpayer adversely affected by the

decision of the Court of Tax Appesl may still appeal /protest to the Supreme Court within the prescribed

date ‘period after the receipt of the Court of Tax Appeal’s decision. The decision of the Supreme Court

shalt be become final, executory and demandable.

_ low ‘Sequence of Protest /Appeal by Taxpayer:

Commissioner | COTA ‘SC Any Decision is

| BIR Examiner | Decision if Protest | Oecision- If Final,

PAN is Denied, 25 Protest is Denied, | Executory, and

> Demandable

Section 229, Recovery of Tax Erroneously or liegally Collected

No suit or proceeding shall be maintained in any court for the recovery of any national internal revenue

tax hercafter alleged to have been erroneously or illegally assessed or collected, or of aay penalty claimed

to have been collected without authority, or of any sum alleged to have been excessively or in any manner

wrongfully collected, until a claim for refund or eredit had been dely filed with the BIR Commissioner;

but such suit or proceeding may be maintained, whether or uot such tax, penalty or sum has been paid

under protest or duress

In any case, no such suit or proceeding shall be filed after the expiration of two (2) years from the date of

payment of the tax or penalty regardless of any supervening clause that may arise after payment;

Provided, However, That the BIR Commissioner may, even without a written claim therefore, refund or

‘credit any tax where on the face of the fax return upon whieh payment was made, such payment appear

clearly to have een erroneously paid.

Section 230. Forfeiture of Cash Refund and of Tax Credit

1, Forfeiture of Tax Refund

‘A refund check or warrant issued in accordance with the pertinent provisions of the Tax Code,

Which shall remain unclaimed or un-cashed within five (5) years from the date the said warrant or

check was mailed or delivered shall be forfeited in favor of the government and the amount thereof

shall revert to the general fund.

CHAPTER 01, GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 15

2. Forfeiture of Tax Credit

\ tax credit certificate issued in accordance with the pertixent provisions of the Tax Code, which

shal! remain unutilized after five (5) years from the date of issue, shall unless revalidated, be consid

ered invalid, and shall not be allowed as payments for internal revenue tax liabilities of the taxpay

cr, and the amount covered by the certificate shall revert to the general fund.

i are _ Penalties /Additions to Taxes al

When there is failure to file the income tax return, or if such was filed after the prescribed due

date, o* the amount shown by the taxpayer as income tax on the income fax return or part of

such amount was not paid on or before the date prescribed for its payment, or there was

underpayment of the quarterly or final adjustment income tax, there shail be imposed penalties

prescribed under the Tax Code.

1, Surcharge of Twenty Five Percent (25%)

There shall be imposed, in addition (o the tax required to be paid, a penalty on the following

cases

a, Failure to file any tax return and pay the tax due thereon as required on the date

prescribed

b. Untess otherwise authorized by the BIR Commissioner, filing a tax return with an inter-

nal revenue officer other than those with whom the return is required to be filed

c. Failure fo pay the deficiency or delinquency tax in the notice of assessment and demand.

. Failure to pay the full’ part of the amount of tax shown on tax return required to be filed,

or the full amount of tax due for which no tax return is required to be filed on or before

the date prescribed for its payment

2. Surcharge of Fifty Percent (50%)

‘There shall be imposed, in addition to the tax required to be paid, a penalty or surcharge

equivalent to fifty per cent (50%) of the amount due, in any of the following cases:

a. In case of wiliful neglect to file tax return within the period prescribed by law.

b. In case a false or fraudulent tax return is willfully made

Provided, that, a substantial under-declaration of taxable sales, receipts, income or substan-

tial over-statement of deductions, shall constitute prima facie evidence of a false or fraudulent

tax return:

Provided further, that failure to report sales, receipts of income in an amount exceeding thir~

ty per cent (30%) of that declared per tax return and a claim of deductions in an amount

exceeding thirty percent (30%) of actual deductions, shall render the taxpayer liable for

substantial under declaration of sales, receipts or income or for overstatement of deductions,

as mentioned herein.

3. Interest of Twelve Percent (12%) per annum

a. In gencral, there shall be assessed and collected on any unpaid amount of tax interest at

the rate of twelve percent (12%) per annum or such higher rate as may be prescribed by

rules and regulations from the date prescribed for payment until the amount is fully paid.

b. Deficiency Interest, -Any deficiency in the tax due, as the term is defined in the NIRC,

shall be subject to the 12% interest prescribed in paragraph (3) (a) hereof, which interest

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 16

shall be assessed and collected from the date prescribed for its payment until the full

payment thereof.

©. Delinquency Interest, - There shall be assessed and collected on the unpaid amount of

taxes, 12% interest rate preseribed in paragraph (3) (a) hereof until the amounts fully

paid which interest shall form part of the tax, in case of failure to pay any of the these:

1) The amount of tive tax due on any tax return required to be filed, cr

2) The amount of the tax due for which no tax return is required, or

3) A deficiency tax, or any surcharge or interest thereon on the due date appearing in

the final notice and demand of the BIR Commissioner.

4, Interest on Extended Payment, - There shali be assessed and collected 12% interest at

the rate herein above prescribed on the tax or deficiency tax or any part thereof unpaid

from the date of notice and demand until it is paid in the following case:

1) Ifany person required to pay the tax is qualified and elects to pay on instailment, but

fails to pay the tax or any installment hereof, or any part of such amount of

installment on or before the date prescribed for its payment; or

2) Where the BIR Commissioner has authorized a taxpayer an extension of time wit

which to pay tax or a deficiency tax or any part thereof, but fails to pay said tax

within the prescribed extension period.

General Provisions

1, The additions to the basic tax, delinquent tax or deficiency tax shall apply to all taxes,

fees, and charges imposed in the NIRC. The amount added to the tax skalll be collected at

the same time in the same manner and as part of the tax.

2. If the withholding tax agent is the government or any of its agencies, political subdivisions

or instrumentalities, or a government - owned or controlled corporation, the employee

thereof responsible for the withholding and remittance of the income tax shall be persona-

lly liable for the additions to the income tax prescribed herei

3. The term “person” includes an officer or employee of a corporation or partnership who as

such officer, employee or member is under duty to perform the act in respect to which the

violation occurs.

4, Income tax returns filed and taxes paid within the preseribed filing /payment period is pre-

sumed to have been filed and paid as of the last day of said filing period.

Formulas /Determination of the Additions (Penalties) to the Basic Tax

Formula 1. With delinquency tax but without willful neglect or fraud

Correct tax due per tax return filed. 150,000

ment of tax due per tax return (100,000)

quency tax 50,000

Additions to delinquency tax

1) 20% surcharge on delinquent tax

50,000 x 25% P12,500

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 17

2) 12% interest on delinquent tax

59,000 x 12% x 3 mos./12 mos. 1,500 14,000

Assessed amount of tax due per BIR notice and demand 264,000

. Assumed that unpaid period is three (3) months

2. If with willful neglect or fraud, the surcharge shall be fifty percent (50%) instead.

Not

Fonnula 2. With deficiency tax but without willful neglect or fraud

Correct tax due per BIR audit/assessment 250,000

Less: Payment of tax due per Tax Return (150,000)

Deficiency tax P100,000

Additions to deficiency tax

1) 25% surcharge on deficiency tax

P100,000 x 25% 25,000

2) 12% interest on deficiency tax

100,000 x 12% x 9 mos./i2 mos. 9,000 34,000

Assessed amount of tax due per BIR notice and demand P134,000,

Note: 1. Assumed that unpaid period is nine (9) months

2. If with willful negiect or fraud, the surcharge shall be fifty percent (50%).

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 18

QoL.

02,

03.

os.

05.

Q06.

07.

0s.

09.

Qui.

Qn.

Q13.

Qu.

aus.

Qu.

ais.

Qu.

Q20.

Qui.

Qn.

Qa.

Qs.

Questions in Chapter 01

(for class seatwork, recitation, homework)

Who are the primary officials ofthe Bureau of [nternal Revenue?

Enumerate the four powers aud authorities of the Bureau of Internat Revere.

Specify the mission of the Bureau of Internal Revenue.

Enumerate the duties or functions of the BIR Commissioner.

‘What are the features of the BIR compromise settlement program?

What are those national taxes that the BIR is empowered to collect?

of tax claims?

What are the grounds for the compro

What are the grounds for the abatement of tax claims and for the refund of tax eredit?

Define the word “Taxation ” and specify its purposes.

Distinguish the terms tax and toll

Discuss the “Judicial remedies” of the government,

‘What are the two kinds of limitations of the power of taxation? Define each,

Enumerate the three inherent powers of the government and define each,

Enumerate aud discuss the inherent linitations on the power of taxation

Enumerate the constitutional limitations on the power of taxation,

Enumerate the essential characteristics of a tax.

Classify taxes as to scope and as to subject matter.

‘What are the judicial remedies allowed to the government? Discuss.

Discuss the power of taxation and the power of eminent domain.

What are the three basie principies of a sound tax system? Discuss each.

Distinguish taxes from customs duties and define each,

What are the distinctions between tax and debt?

Distinguish tax from license fee

Discuss the two aspects or phases of tax:

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 19

25.

Q26.

Qu.

Q28.

29.

Q30.

Qur.

Q32.

33.

Qs.

3s.

Q36.

Q37.

Explain the implication of the tax situs/piace of taxation for elasses of individuals.

Enumerate the simitarities among the 3 inherent powers of the government.

What are the various sources of our tax laws/internal revenue tax laws?

Enumeraie/oxplain the “tay escapes” that can be availed of by the taxpayers

Define the word “Distraint”, diseuss.

Discuss the period of limitations upon assessment of taxes?

How can the government forfeit the tax refund and/or tax credit

Define the word “Levy” discuss.

What eases/situations can a compromise be made between the goverament and taxpayer?

What are the cases/situations where the suspension of the running of the period of

assessment and collection of tax, ean be made by the government?

Discuss the period of limitation upon coltection of taxes?

In what eases/situations can the government abate or lessen the taxpayer's tax liability?

What are the cases/situation where the running of the period of assessment and collection

of tax be made by the government, cannot be suspended?

What are the summary remedies allowed to the government? Discuss.

Distinguish “actual distraine” against “constructive distraint.”

Discuss the entire procedures of the taxpayer's protesting the government's assessment

and collection of taxes

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 20

CPABLES Multiple Choice Questions in Chapter 01

(for class recitation, seatwork or homework)

Q01. Which of the following powers of the BIR Commissioner shall not be delegated?

a. The power to compromise or abate auy tax liability

b. The power to recommend the promulgation of rules aud regelations by the Finance

Secretary

ce. The power to issue rulings of first impression or to reverse, revoke or modify any

‘existing BIR ruling

4. Allofthe above

02. 1* statement; the value added tax is a property tax.

2° statement; the estate tax is an excise tax.

a. true, false . false, true . true, true 4d. false, false

Q03. First Statement; In “constructive distraint,” the government prohibits the taxpayer/owner

to die of such personal property distrained.

Second Statement; In “actual distraint”, the government does not take possession of the

taxpayer's distrained personal property.

‘a, Truc, True b. False, False ¢. True, False. False, True

U4. Which of the following is a civil remedy by the government to collect National Internal

Revenue taxes, fees, other charges?

a) By levy of real property . By judicial eivil action

b) By judicial eriminal action 4d. Aliof the above

QOS. In general, the prescriptive period for assessment of tax, is after the last day for filing the

tax return:

a) 3years —b. Syears c W0years — d. 2years

Q06. All criminal acts in violation of the NIRC may be compromised except:

a. Those involving fraud c. Neither A or B

b. Those already filed in court 4d, Both A and B

Q07. The BIR Commissioner may compromise payment of internal revenue taxes when:

1 ground: When the tax or any portion thereof appears to be unjustly or excessively

assessed.

2" ground: A reasonable doubt as to the validity of the claim against the taxpayer exists.

a. true, false b. false, true © true, true 4d. false, false

Q08. 1% statement: All taxes imposed, collected by the Bureau of Internal revenue are internal

revenue taxes

2" statement: The real estate tax is a local (ax

a. true, false b. false, true ce. true, true d. false, false

09. 1"'Statement: No court shall have the authority (0 grant an injunetion to restrain the

collection of any national internal revenue tax, fee or charge imposed by the NIRC

2°" Statement: Judicial proceedings for the collection of an internal revenue tax maybe

instituted even without a prior assessment of the tax on the taxpayer.

a.true, false b. false, true c. true, true 4. false, false

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION — 21

QUO. Which of the following is not a source of tax laws?

a. International Agreement or Treaty b. BIR Revenue Regulations

€. Supreme Court's Decisions d. Nogiven answer

QUI. fthe government erroneously or illegatly collected a tax, the taxpayer first exercise his

remedy by filing a request for tax refund or tax credit with the?

Q12. Which of the following violations cannot be subject to compromise penaities?

a, Failure to keep/preserve books cf accounts and accounting records.

b. Failure to keep books of accounts or records in a native language or English.

¢. Failure to have books of accounts audited and have financial statements attached to income

tax return certified by an independent CPA.

4d. Keeping two sets of books of accounts or records.

Q13. Ist statement: A compromise for a tay liability on the ground of financial incapacity to pay

shall still involve a payment of tax from the tax payer at a minimum compromise rate cf

40 % of the basic assessed tax.

2nd statement: The commissioner of internal revenue is authorized to inquire into the bank

deposits of a taxpayer who filed an application for compromise of his tax liability by

reason of financial incapacity to pay

a.true, false b, false, true c. true, true d. false, false

Q14, 1" statement: No suit or proceedings shail be brought for refund of tax after two years from

the date of payment regardless of any supervening clause that may arise after payment.

2nd statement: The BIR commissioner may refund a tax even without a claim for refund

from the taxpayer where on the face of the return upon which the payment was made;

such payment ciearly appears to have been erroneously made.

a.true, false b. false, true . true, true a. false, false

QIS. Which is correct? The Bureau of Internat Revenue shall have the following primary

officials:

a. Commissioner and one Deputy Commissioner

b. Commissioner and two Deputy Commissioners

c. Commissioner and three Deputy Commissioners

d. Commissioner and four Deputy Commissioners

Q16. Which one of the following is not a characteristic of the state’s power to tax?

a, It is inherent in the sovereignty

b, It is legislative in character

ec. It is based on the ability to pay

d. It is subject to the constitutional and inherent limitations

Q17. A-kind of tax system where tax rates increases as the tax base increases:

a. degressive ’. proportionate. regressive 4. progressive

QI8. The distinction ofa tax from a permit or a license fee is that a tax is:

a, Imposed for regulation

b. One which involve an exereise of police power

¢. One in which there is generally no limit on the amount that maybe imposed

dd. Answer not given

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 22

Qu.

Q20.

Qa.

Q22.

Qs.

24,

Qs.

226.

Q27.

Qs.

One of the characteristic of a tax is that itis generally:

‘a. based on contract b. payable in money ¢. assignable 4. mo answer

‘aracteristic of our internal revenue laws is that they are:

nature —b. penal in nature ¢. prospective in dno answer

nature

Ist statement: ‘The power to decide disputed assessments and refunds of internal revenue taxes is

vested in the Commissioner of Internal Revenue subject to the exclusive appellate jurisdiction of

the Court of Tax Appeals.

2" statement: The power to interpret provisions of the National Internal Revenue Cede and other

tax laws shall be under the exclusive and original jurisdiction of the Commissioner of Internal

Revenue, subject to review by the Secretary of Finance.

a. true, false b, false, true true, true d. false, false

One of the

a political

1" statement: The power of the Commissioner of Internal Revenue to issue rulings of 1"

impression or to reverse, revoke or modify any existing ruling of the Bureau of Internat

Revenue may not be delegated.

statement: The power of the Commissioner of Internai Revenue to recommend the promul-

gation of rules and regulations by the Secretary of Finance may not be delegated.

a. true, false . false, true «. true, true 4d. false, false

‘The following except one, are basic principles of a sound tax system:

¢. Ii should be capable of being effectively enforced

£ It must be progressive

g. Sources of revenue must be sufficient to meet government expenditures and public needs

h. It should be exercised to promote public welfare

1" statement: Our constitution does not prohibit double taxation.

2™ statement: If double taxation occurs, the tax payer may seek relief under the uniformi-

ty rule or the equal protection guarantee.

a. correct, wrong b. wrong, correct . wrong, wrong correct, correct

The following are constitutional limitations on the power of taxation except one:

a. Due process of law

b. No imprisonment for non-payment of a debt or a poll tax

©. Equal protection of law

d. Prohibition of double taxation

Police Power as distinguished from the Power of Eminent Domain is:

Just compensation is received by the owner of the property

b, Maybe exercised by private individuals

¢. Superior to the non-impairment clause provisions on obligations and contracts

d._ Property is taken by the government for public purpose

‘A tax wherein both the incidence of or the liability for the payment of the tax as well as the

burden of the tax falls on the same person.

a. direct tax b. personal; tax © indirect tax d. property tax

‘One of the following is not a direct tax;

‘a. immigration tax. transfer tax . income tax d. value added tax

CHAPTER 01, GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 23

9.

30.

Qat.

32.

933.

Qa.

Q36.

Q37.

‘One is not a characteristic or element of a tax:

a. levied by the legislation b. payable in money or in kind

¢. proportional in character d. enforced contribution

If there is a conflict between the tax laws (NIRC) and the generally accepted accounting

principles (GAAP):

a. Both (ax laws and GAAP shall be enforced —_¢. The issue is resolved by the courts

b. GAAP shall prevail over the tax law 4. Tax law shal prevail over the GAAP

Which one of the following is not among the basic principles of a sound tax system?

a. Theoretical Justice

b. Fiscal Adequacy

c. Administrative Feasibility

d._ Assessment and Collection of Taxes

‘The Commissioner, with the intention of safeguarding the interest of the government, may

place under constructive distraint, the personal property of te delinquent taxpayer who in

his opinion is intending to;

a) Leave the Philippines ©) Retire from business

b) Conceal/hide his property 4) Aliof the above

First Statement: In general, assessment of national internal reveaue taxes shall be made

within two (2) years from the last day prescribed for filing the tax return

Second Statement: There shall be no court proceeding (without assessment for the collec-

tion of taxes) shall be begun after the expiration of such prescribed period for filing

such tax return:

a. True, True

Faise, False. True, False d. False, True

First Statement: Unless revalidated, a tax credit certificate issued which rentained unused

after five (5) years from its date of issuance, shall be deemed invalid not allowed as pay~

ment for any tax liability in the NIRC

Second Statement: The taxpayer may administratively protest a tax assessment by filing a

request for reconsideration or reinvestigation within sixty (60) days from the receipt of

the notice of assessment, provided all required documents shall have been submitted.

a. True, True b. False, False True, False d. False, True

{ statement: Tax cash refund or warrant which were unclaimed or unused within

sree (3) years from date of mailing or delivery of such checks/warrants, shall be for-

feited in favor of the government.

Second Statement: The BIR Commissioner is authorized to inquire into the bank accounts

of the taxpayer whose given reason for his application to compromise is by reason of

financial ineapaci

a. True, True

¢. True, False d. False, True

Limited to cover cost of regulation.

b. A regulatory measure.

c, Non-payment does not necessarily render the business illegal.

d. Imposed in the exercise of Police Power.

One of the following has no power to tax:

a. province b.

©. barangay barrio

CHAPTER 01. GENERAL PRINCIPLES AND CONCEPTS OF TAXATION 24

38. WI

tn of the following is not ar. example of an exeise tax?

a. transfer (ax b, real property (ax €. percentage tax di. incomie tax

39. The following are similarities of Power of Taxation, Power of Eminent Domain and Police

Power except:

Are necessary attributes of sovereignty _-b,_ Interfere with private rights, property

. Affect all persons or the public 4d. Are legislative in implementation

Q40. Tax of a fixed proportion of the value of the property with respect to which the tax 1s ass

essed and requires the intervention of assessors or appraisers (o estimate the value of such

property before the amount due from each taxpayer can be determined is known as:

a. specific tax b. regulatory (axe adyalorem (ax d. no answer

QUI. Statement One: The BIR Commissioner may compromise tite payment of any national

internal revenue tax if there exist a reasonable doubt as to the validity of the tax

claims against the taxpayer.

Statement Two: All criminal violations of the taxpayer maybe compromise

a. True, True b. False, False & True, False d. False,

True

Q42, Statement One: ‘The BIR Commissfoner may compromise the payment of any national

internal revenue tax if the financial position of the texpayer shows his inability te

pay the tax due.

Statement Two: The BIR Commissioner may abate or cancel a tax liability when said tax

is said to be excessively or unjustly assessed.

a, True, True b. False, False True, False d. False,

True

QU3. First Stacement; Tax eredit or tax reflund shall be allowed if the taxpayer files in writing

with tite BIR Conmissioner, a claim for tax eredit or tax refund within two (2) years

from tax payment.

Second Statement: The BIR Commissioner may abate or cancel tax liability if the cost of

collection involved is much larger than the tax liability.

a. True, True b. False, False True, False d. False,

True

Q44, The government cannot exercise its remedy of distraint or levy if the amount of tax

liability is not over:

a. P10,000 b. P1000 ec. P100,000 d. Pt00

Q45. The notice provided to the taxpayer, by the government, requiring him to pay his assessed