Professional Documents

Culture Documents

Franchise p3

Franchise p3

Uploaded by

ace zero0 ratings0% found this document useful (0 votes)

58 views4 pagesFRANCHISE

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFRANCHISE

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

58 views4 pagesFranchise p3

Franchise p3

Uploaded by

ace zeroFRANCHISE

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

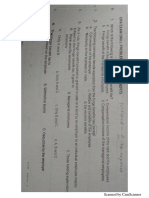

v4, 2000) Bt

att ica that Ie cu

Tale Fan matwity wt PL ar tse

at the Mrnctisce mast jy

FAURE U the tranche

oval Incurred indirect eu

Wek NSinber 30, 2020. The gross salen ported to 1

2020. The tr install payment was nde

ae much is the net

'. Assume the coltectibility of the note is ot tay Marureds ow much 6 the net

‘come for the year ended, December 31, 20207 Pv 6aasisey

FQ

& 326268 ld £44,%6q (liBAGD— 106; 04)

eo jitlast Aki, Sat TO” 4,344,460

© 2817268

4. 3,072'268 “ager el GF MAC, op0

¢ note is regsonably‘certain, how much is the net in

Xd Asn the collectibility of th

ha your endea: Decca oe aeser | 2 13%G, 269

———

& 9,438,880

b

ee.

The following expenses were incurred:

Litial services:

Direct cost 235,000" Fy,

Indirect cost agog {27 €e

Continuing Services:

Direet cost 23,9007 geqe0

Indirect cost 9,000 Sse

The management of AB has estimated that they can borrow loan at

equal to_2¥6 ofits monthly gross sales was also Specified in the contract, AB reported gross

the rate of 12% (PV ta

3.04), The franchisee commenced its operations on July 31, 2020, 4 continuing franchise te:

950,000 for the month,

— Ate

How much isthe net income to be reported on August 31, 20209

& 59,550 1Sb.a00 Iejcon =

b 83,450 SSa0m PY Nico Orman

&. 48,910 32,000 CCD 26

Gs AGO

d. 72,810 Gm (2sha0) x om

Ree Pex) pee, 01% Tall

“3B,3g0 35,100 Suse —

ae 243,64

6820

8508

3. MIRE reatmieant sold a patio

Jarwuary 2020 called for n P1000 hae

Ned for a P100,

ihe value of inital

required the Ganchisce te pe

carly in 2020 and its sulea for the vere

was 12% (PV factor was 1.6901).

BULL ENR: joy” ©

il revenue for 20207 ONE

eo, coo ‘Sar

‘ : ME

KPO Jo, Wo.) 28/8F9.40 Rat

1. On April 1, 2020, GOOD Inc. entered into a franchise agreement with

franchise fees agreed upon is P246,900, of which P46 900 ip payable unce sigan

to be covered, terest bearing note payable in fotir equal annual instal!

payment is, in 100 days, BEST Inc. has a high credit rating. the

note is ly assured. GOOD Inc. substantially performed all necessary re

incurred out-of-pocket costs of P125,331 and P1Z,345 for direct expenses and

respectively. Prevailing market rate is 9%. PV factor is 3.2397

For the fiscal year ended June 30, 2020, how much revenue from franchise fee ~ill the

franchisor recognize?

/ 0

b. 208,885

©. 246,900

6. 83,554

_S© Mejobee operates and franchises restaurants around the world. On January 1. 2

entered into a franchise agreement with a franchisee. As part of its franchise agree:

requires the franchisee to pay a non-refundable upfront franchise fee of P9S,000

restaurant and ongoing payment of royalties, based on 10% of Sanchisee’s sal

franchise agreement, Mejobee provides pre-opening services, including supply

cooking equipment and cash registers, valued 330.0081 waich is the the

of the pre-opening services. In addition, the franchise agreement includes a licer

Property such as Mejobee's trademerk and trad Sauchisce. Me!

that the licence provides a right t Intell P

determined the stand-alone sélling price of the licence is]? 70,000, The fanciuise

term of 10 years. On January 1, 2020, the franchisee paid the non-refundable up

of R95,000 to Mejobee. Poyaities on

Mejobee evaluates the arrangement and determines it meets the criteria to be

contract with a customer under IFRS 15. Mejobee determines its pre-opering

‘of intellectual Property are tach distinc!) and, therefore, need to be

performance obligations. AS"of December 31, 2020, M:

obligation to supply and install cooking equipment and’ cash registers t

ended December 31, 2020, the franchisee reported sales revenue of P100,000. ¥ ic = T=

‘Under IFRS 15, how much total revenue

December 31, 2020?

a 95,0007 en,

@ > 28,500 DFFe as,c05

Il be recognized by Mejobee for the year ended

60.09 “Ye x UWem = 28D

oa c > 66,021

Wemé AQP Yo «Alar Ge.0> 2

yar

toa GS

pranyicr = {222 - — agog

4059

at

Page 4

6

Be REND! 2020, an enity grated achive a anetae lnc ngreeroent

oF royalties equa en © Rontefindable upfront fee in the amount of CaNH000 aed Seen fa

Ont fee go aivalent {0 5% of the sales of the franchisee. The Tuinchisee puld theta

fee on January 1, 3020,

In relation to the nonref 7 si th .

7 fundable upfront fee, the franchise agreement required the entity w rende

the following performance obligations:

stand-alone selling price of P200,000.

* To .construct the franchisee's stall and

© To deliver 10,000 units of raw materials to the franchisce yd-alone selling price of

250,000,

* To allow the franchisee to use the entity tradename for a period of 10 yeurs starting January |

2020 with stand-alone selling price of P50,000,

isce's stall. On December 3},

On June 30, 2020, the entit leted the construction of the franchi On Docember 3),

2020, the entity was ble to deliver 3,000. units of raw materials to the frames, For the yt

ended December 31, 2020, the franchisee reported sales revenue amounting to P100,000.

The entity had determined that the performance obligations arc separate and distinct from one

anc bh

jocated to the construct

A. What is the amount of nonrefundable upigyat fee to be allocat

Pind alee de

ranchisee’s stall? .

Beec Goven) ~ 16208

y maa aes —=

160,

"eee mee

4. 120,000 mos

it f delivery of raw

2. What is the amount of revenue to be recognized in relation to the use of :

‘materials forthe year ended December 31, 2020? oe OD OE es a

a. 100,000 od 48 rae 2,

& 200000 Loo ~BerGa@7 28 “a 7 gonus 120! “ ZF

« 600%" b= GOO aco

4. 75,0007

3. What is the amount of revenue to be recognized in relation to the use of entity's

tradename for the year ended December 31, 2020? >

See be Lyoo2

> 000% A/D ocGe yoo * oupnes > BS

e. 50,000 oo

4. 10,000 sation

foo

. —

Sal RW wr, ye doaa+ (Cae

Ru AMM 24,

Tata o> hd » Faav + 20700 + 1e~20 y 200 Cee)

oe . 7 Wass FAD » toys Giccn > a

a A SE les i hd woo

A en Ie ete wi rece y ‘tat

Aesement, Starbeans requires tranchisce “iat acta rancher the

stitch Sea nt :

yable inual instalments every December franchises issued a hon

rn Sane ic OF 10% for the Balance of the inact franchise fee 1

Soin nw wide -

proven aie of the notes Sg ren ini ten

Sears prvi papa ncluhng supply and nea

cas pac el eek aE ag DY in

"rformance obligation that need nat be.

Mbeya pcre gai serpy an il cote eu

crite etree arn nn eS a Whe fanc

‘les teen ne snout oF 00000 ce

\

Sear

of the note receivable is Feasonably assured? Accyuod

a eee

wre ice fee eee tee i

ore ans Sty, 203

WR AR ~ 454, 994 G21. 26E SS ==" ecw:

220.20 ~ (385,

Starbeans for the year ended December 31, “vale

“12420 +

ion ofthe note receivabte is ROL reasonably assured? nclalinert SO,

Ooch,

a>

G24 (e¢a5 4g)

m den

2 ps Chie9 20 = 96 13) B44, 39a

or 24

oe Perc

FC 6888 ASF)

i , 2018 and reported sales

ar ended December 31 2018. The franchi

sevenue amounting to P50,000

isee paid the first de

installment on its

sured what isthe Yros: profi iv he

er BH, 208. in relation to tin twitiut

66,028 Rea ¥240, (AT ~ 44Q,103 882,146 Se, DID)

44,014, ae

22,009

88037

2. If the collection

coud

Of the note receivable fs reasonab Gosu what i the et income tobe

"eorted by the entity for the year endda Decemes Seana

LE 98,850 $, 037

. 94,50

& 10.028 ae)

4. 92,037 © cep

28-8886 ENDY tons Puen, 8508

96 BO Lesucae

ee 6 Peuner) )

= Scanned by Cams

18) 80

Pittman

Cait

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MAS MidtermDocument6 pagesMAS Midtermace zeroNo ratings yet

- Quiz p2Document6 pagesQuiz p2ace zeroNo ratings yet

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- MAS QUant Tech PDFDocument4 pagesMAS QUant Tech PDFace zeroNo ratings yet

- Int AssetDocument21 pagesInt Assetace zeroNo ratings yet

- p2 Home OfficeDocument9 pagesp2 Home Officeace zeroNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularace zeroNo ratings yet

- AssoccDocument20 pagesAssoccace zero100% (2)

- Q19 - Audit Procedures, Evidence and DocumentationDocument7 pagesQ19 - Audit Procedures, Evidence and Documentationace zero0% (1)

- CVPDocument4 pagesCVPace zeroNo ratings yet

- AccountingDocument21 pagesAccountingace zeroNo ratings yet

- Developing Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFDocument1 pageDeveloping Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFace zeroNo ratings yet

- Inc Tax CGT PDFDocument15 pagesInc Tax CGT PDFace zeroNo ratings yet

- Statements 3Document69 pagesStatements 3ace zeroNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument21 pagesIntermediate Examination: Suggested Answers To Questionsace zeroNo ratings yet

- PromoDocument1 pagePromoace zeroNo ratings yet

- Rit ExclusionDocument21 pagesRit Exclusionace zeroNo ratings yet

- Scanned by CamscannerDocument9 pagesScanned by Camscannerace zeroNo ratings yet