Professional Documents

Culture Documents

HG NEW Proposal Form PPI PROPOSAL FORM PDF

HG NEW Proposal Form PPI PROPOSAL FORM PDF

Uploaded by

rajvansh katiyarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HG NEW Proposal Form PPI PROPOSAL FORM PDF

HG NEW Proposal Form PPI PROPOSAL FORM PDF

Uploaded by

rajvansh katiyarCopyright:

Available Formats

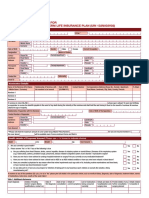

Bajaj Allianz General Insurance Co.

Ltd

G.E. Plaza, Airport Road, Yerawada,Pune - 411006.

Relationship Beyond Insurance IRDA Reg No.: 113 | CIN: U66010PN2000PLC015329 | UIN: IRDAI/HLT/BAGI/P-H/V.II/113/16-17

For Office Use Only : For Agent Use Only :

Scrutiny No. Receipt No. Policy No. Loan Account Number Emp/LG Code IMD Code Sub IMD Code IMD Name Mobile No.

HEALTH GUARD : PROPOSAL FORM

Instructions For Filling Up The Form:-

1. Please answer all questions in BLOCK letters.

2. The Liability of the Company does not commence until this Proposal has been accepted by the Company and premium has been paid.

3. This Proposal will be the basis of any subsequent policy that the Company issues to you. It is therefore essential that you provide all the information in this Proposal FULLY AND

ACCURATELY and that you provide the Company with any and all additional information relevant to risk to be insured or its decision as to acceptance of the risk or the terms

upon which it should be accepted.

Proposer Details

1. Full Name: Title First Name

Middle Name Surname

Is your name mentioned above as per your Aadhaar Card? : YES NO If No, Please mention the Name as per Aadhaar Card__________________________________

___________________________________________________________________________________________________________________________________

2. Are you an existing Bajaj Allianz Customer: Y es / No If yes, please mention the Policy No: OG___________________________________________________________

3. Gender: ☐ Male ☐ F emale ☐ Other 4. Date of Birth

5. PAN No. 6. UID/Aadhaar no.

7. Bajaj Allianz Employee Code, if Proposer is BAGIC/BALIC Employee

8. Marital Status: ☐ Married ☐ Single ☐ Divorced ☐ Widowed 9. No. of Children ______Sons ______Daughters

10. Occupation ☐ Business ☐ Salaried ☐ Professional ☐ Student ☐ House Wife ☐ Retired ☐ Others

11. a) Permanent / Residential Address 11 b) Correspondence Address: (All the communications will be sent to the below address)

House No. House No.

House Name House Name

Landmark/Locality Landmark/Locality

Road/Area Name Road/Area Name

City/District City/District

State State

Pin Code Pin Code

Tel. Tel.

Mobile Mobile

Email Email

12. Educational Qualification: ☐ Matriculate ☐ Under Graduate ☐ Graduate ☐ Post Graduate ☐ Professionally Qualified

13. Family Monthly Income: ☐ Up to Rs. 20,000 ☐ Rs. 20,001 to Rs. 50,000 ☐ Rs. 50,001 to Rs. 1 lakh ☐ Above Rs. 1 lakh

14. In case of any Offer, you would prefer to be contacted by: ☐ Phone ☐ Email

15. Nationality 16. Policy Period: ☐ 1 year ☐ 2 year ☐ 3 year

17. Plan: ☐ Silver ☐ Gold

18. Sum Insured Options

a) Health Guard Individual Sum insured: ☐ Please mention the member wise sum insured in the member details table

b) Health Guard Family Floater Sum Insured – please select the sum insured option from below

☐ 1.5 lacs ☐ 2 lacs ☐ 3 lacs ☐ 4 lacs ☐ 5 lacs ☐ 7.5 lacs ☐ 10 lacs ☐ 15 lacs ☐ 20 lacs ☐ 25 lacs ☐ 30 lacs ☐ 35 lacs ☐ 40 lacs ☐ 45 lacs ☐ 50 lacs

19. Premium Payment Zone: ☐ Zone A ☐ Zone B

There are Two Zones for Premium payment

Zone A: “Following cities has been clubbed in Zone A:-

Delhi / NCR, Mumbai including Navi Mumbai, Thane and Kalyan, Hyderabad and Secunderabad, Bangalore, Kolkata, Ahmedabad, Vadodara and Surat.

Zone B: Rest of India apart from Zone A cities are classified as Zone B.

Note:-

Policyholders paying Zone A premium rates can avail treatment allover India without any co-payment.

But, those, who pay zone B premium rates and avail treatment in Zone A city will have to pay 20% co-payment on admissible claim amount. This Co – payment will not be

applicable for Accidental Hospitalization cases.”

Policyholder residing in Zone B can choose to pay premium for Zone A and avail treatment all over India without any co-payment.

20. Co pay Discount: ☐ Yes ☐ No (If yes please choose from below options)

☐ 10% ☐ 20%

Note:If opted voluntarily by the Insured then Insured will be eligible of additional 10% or20% discount respectively on the policy premium. In case of a claim has been

admitted under In-patient Hospitalisation Treatment then, the insured person shall bear 10% or 20% respectively of the eligible claim amount payable under this cover.

21. DETAILS OF PERSONS TO BE INSURED

Relationship Date of Birth Gender Sum Nominee

Member Details Age Height Weight Nominee Relationship

with Proposer DD/MM/YYYY (M/ F) Insured with Insured

22. Has any of the persons to be insured suffer from/or investigated for any of the following?

Disorder of the heart, or circulatory system, chest pain, high blood pressure, stroke, asthma any respiratory conditions, cancer tumor lump of any kind, diabetes, hepatitis,

disorder of urinary tract or kidneys, blood disorder, any mental or psychiatric conditions, any disease of brain or nervous system, fits (epilepsy) slipped disc, backache, any

congenital/ birth defects/ urinary diseases, AIDS or positive HIV, If yes, indicate in the table given below. ☐ Yes/ ☐ No

If yes please provide details

_______________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________

23. Do you or any of the family members to be covered have/had any health complaints/met with any accident in the past and have been taking treatment/ hospitalization?

(Please provide details in the table given below)

Name of the Illness/injury suffered / Current Status

Sr. No Name of the person Treatment details Date first treated

suffering in the past of the Illness/Diseases/Injury

Declaration*

1. I hereby declare, on my behalf and on behalf of all persons proposed to be insured, that the above statements, answers and/or particulars given by me are true and

complete in all respects to the best of my knowledge and that I am authorised to propose on behalf of these other persons.

2. I understand that the information provided by me will form the basis of the insurance policy, is subject to the Board approved underwriting policy of the insurer and that the

policy will come into force only after full payment of the premium chargeable.

3. I further declare that I will notify in writing any change occurring in the occupation or general health of the life to be insured/proposer after the proposal has been submitted

but before communication of the risk acceptance by the company.

4. I declare that I consent to the company seeking medical information from any doctor or hospital who/which at any time has attended on the person to be insured/proposer

DECLARATION

or from any past or present employer concerning anything which affects the physical or mental health of the person to be insured/proposer and seeking information from any

insurer to whom an application for insurance on the person to be insured /proposer has been made for the purpose of underwriting the proposal and/or claim settlement.

5. I authorize the company to share information pertaining to my proposal including the medical records of the insured/proposer for the sole purpose of underwriting the

proposal and/or claims settlement and with any Governmental and/or Regulatory authority.

Date ____ / ____/ _________

Signature/ Thumb Impression of the Proposer

Place :__________________

Certified that the contents of the Proposal Form and documents have been fully explained to the Proposer and that he/they have fully understood the significance of the proposed

contract**

Date ____ / ____/ ____

Place: __________________ Signature (On behalf of Proposer)

*Please read declaration wordings carefully before signing the proposal form.

**This is required only where, for any reason, the Proposal Form and other connected papers are not filled by the Prospect/Proposer.

Section 41 of Insurance Act 1938 as amended by Insurance Laws Amendment Act, 2015 (Prohibition of Rebates):

No person shall allow or offer to allow either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives

or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing a policy

accept any rebate, except such rebate as may be allowed in accordance with the published prospectus or tables of the insurer. Any person making default in complying with the provisions

of this section shall be punishable with fine which may extend to rupees ten lakh.

ACKNOWLEDGEMENT:

Received from Ms. / Mrs. / Mr: ________________________________________________________________________________________________________________________________

sum of Rs. _________________________________through Cash# / Cheque / DD / Credit Card / Debit Card No. _______________________________against your proposal for Health Policy.

Signature of Bajaj Allianz Official/ Intermediary:__________________________________________________________Date:__________________Time:_______Place:___________________

Bajaj Allianz Official / Intermediary Name: _______________________________________________________________________________________________________________________

Note: Neither the submission of a completed proposal for insurance or any payment for any policy sought oblige the Company to agree to issue a policy, which decision is and always shall be in the Company's sole and absolute discretion

You might also like

- Relationship Beyond Insurance: Health Guard: Proposal FormDocument2 pagesRelationship Beyond Insurance: Health Guard: Proposal FormAmardeep SinghNo ratings yet

- Criti Care PFDocument3 pagesCriti Care PFAlina Fatma0% (1)

- Group Mediclaim Insurance-Proposal Form: Bajaj Allianz General Insurance Co. LTDDocument3 pagesGroup Mediclaim Insurance-Proposal Form: Bajaj Allianz General Insurance Co. LTDDenver SaldanhaNo ratings yet

- Health Guard Proposal Form PrintDocument4 pagesHealth Guard Proposal Form Printrock_on_rupz99No ratings yet

- Optima Restore Proposal Form OfflineDocument9 pagesOptima Restore Proposal Form OfflinemanohargudNo ratings yet

- HDFC ERGO General Insurance Company Limited: Easy Health - Proposal FormDocument8 pagesHDFC ERGO General Insurance Company Limited: Easy Health - Proposal FormDilip ManiyarNo ratings yet

- Bajaj Allianz My Home Insurance Proposal Form PDFDocument7 pagesBajaj Allianz My Home Insurance Proposal Form PDFMohamed IbrahimNo ratings yet

- Premier Proposal 5f2bd12e92Document5 pagesPremier Proposal 5f2bd12e92bajaj enterprisesNo ratings yet

- GEMI Application Form - Two Wheeler LoansDocument5 pagesGEMI Application Form - Two Wheeler LoansLuckyNo ratings yet

- Og 24 2303 6401 00003687Document5 pagesOg 24 2303 6401 00003687riddhikesharwani04No ratings yet

- PRP 23 7000179227PRP 23 7000179227Document7 pagesPRP 23 7000179227PRP 23 7000179227Arvind KumarNo ratings yet

- National Insurance Varistha Proposal FormDocument5 pagesNational Insurance Varistha Proposal FormAnirBanerjee0% (1)

- Future Vector Care-Proposal Form (Single Member)Document2 pagesFuture Vector Care-Proposal Form (Single Member)Arup GhoshNo ratings yet

- Iob Health Care Plus Policy Proposal FormDocument2 pagesIob Health Care Plus Policy Proposal FormPritamjit RoutNo ratings yet

- Application Form: Tata Aia Life Insurance Company LimitedDocument6 pagesApplication Form: Tata Aia Life Insurance Company LimitedpritamNo ratings yet

- IP Enrollment FormDocument2 pagesIP Enrollment FormSrigandh's WealthNo ratings yet

- Optima RestoreDocument6 pagesOptima RestoreYOGESH SHARMANo ratings yet

- Saral Suraksha Bima, Plan - Preposal Form - v1Document3 pagesSaral Suraksha Bima, Plan - Preposal Form - v1rajeshNo ratings yet

- Welcome To Bajaj Allianz Family: Jasleen KaurDocument8 pagesWelcome To Bajaj Allianz Family: Jasleen Kaurbawa sagguNo ratings yet

- Health Statement FormDocument2 pagesHealth Statement FormRose Ann DuqueNo ratings yet

- Ab Arogyadaan Proposal FormDocument2 pagesAb Arogyadaan Proposal FormMurthy0% (1)

- Proposal Form 1Document4 pagesProposal Form 1Game star BunnyNo ratings yet

- Enrolment Form - Group Credit Secure Plus: 1. Proposer'S InformationDocument2 pagesEnrolment Form - Group Credit Secure Plus: 1. Proposer'S Informationirfan shamaNo ratings yet

- Form 300 - Feb 2021Document13 pagesForm 300 - Feb 2021PREM MURUGANNo ratings yet

- Lic DocsDocument11 pagesLic DocsRahul ChauhanNo ratings yet

- 12 9910 0000196216 00 PDFDocument7 pages12 9910 0000196216 00 PDFHarsh ShethNo ratings yet

- 23 ArogyaDocument3 pages23 ArogyaAmeya Singh RajputNo ratings yet

- 9910 Travel Endorsement Schedule 32535487Document6 pages9910 Travel Endorsement Schedule 32535487Arbaaz DossaniNo ratings yet

- Welcome To Bajaj Allianz FamilyDocument9 pagesWelcome To Bajaj Allianz FamilyHIMANSHU MEHTANo ratings yet

- Name: Mr. Ms. M/S: Proposer DetailsDocument6 pagesName: Mr. Ms. M/S: Proposer DetailsBose GRNo ratings yet

- IHP Proposal FormDocument9 pagesIHP Proposal FormDeepakNo ratings yet

- Medical Insurance Application Form - FillableDocument12 pagesMedical Insurance Application Form - FillablevolauruciNo ratings yet

- Application For Individual Insurance FormDocument2 pagesApplication For Individual Insurance FormShenna RojasNo ratings yet

- I Pru SPC - Member Consent Form - ICICI Bank COVID-19Document2 pagesI Pru SPC - Member Consent Form - ICICI Bank COVID-19Raj ANo ratings yet

- Health Edge Insurance: Policy ScheduleDocument7 pagesHealth Edge Insurance: Policy Schedulearun saiNo ratings yet

- Member Enrolment Form-GTL-without Addendum-19 Nov 2018Document2 pagesMember Enrolment Form-GTL-without Addendum-19 Nov 2018Rajesh MukkavilliNo ratings yet

- Colour Photo of The Life To Be AssuredDocument10 pagesColour Photo of The Life To Be AssuredRAKTIM PUJARINo ratings yet

- Star Medi Classic FormDocument4 pagesStar Medi Classic FormranchipkcNo ratings yet

- Arogya Top UpDocument3 pagesArogya Top UpSiddharthNo ratings yet

- Kutumb Swasthya Bima Policy - GroupDocument4 pagesKutumb Swasthya Bima Policy - Grouprohit kakkarNo ratings yet

- Bjaz GC Policy ScheduleDocument4 pagesBjaz GC Policy Schedulesohanpatra000No ratings yet

- LVGI Policy ProposalDocument2 pagesLVGI Policy Proposals KollaNo ratings yet

- Dental Reimbursement 2010Document6 pagesDental Reimbursement 2010marcelo galarzaNo ratings yet

- Bjaz GC Policy ScheduleDocument5 pagesBjaz GC Policy ScheduleAbhishekNo ratings yet

- UCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedDocument2 pagesUCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedRahulSinghNo ratings yet

- Health Ensure PFDocument3 pagesHealth Ensure PFShobhit JainNo ratings yet

- Deed of Assignment - 102018Document5 pagesDeed of Assignment - 102018Kawaii YoshinoNo ratings yet

- Sukshma Hospi CashDocument4 pagesSukshma Hospi CashAdemuyiwa OlaniyiNo ratings yet

- Form 300 March 2020Document12 pagesForm 300 March 2020shahnawazNo ratings yet

- Form 300 Revised 01-02-2020 PDFDocument11 pagesForm 300 Revised 01-02-2020 PDFAnuj VatsNo ratings yet

- Sahil Sekh CLIDocument4 pagesSahil Sekh CLIbasudebkrishna237No ratings yet

- Motor Proposal FormDocument3 pagesMotor Proposal FormALOKNo ratings yet

- Hekima Plan Application Form-EDocument4 pagesHekima Plan Application Form-ExeniaNo ratings yet

- Common Proposal Forms Traditional PlansDocument7 pagesCommon Proposal Forms Traditional PlansShashi SinghNo ratings yet

- UBI Group Care 360 Application Form (UHS) Union Health SurakshaDocument4 pagesUBI Group Care 360 Application Form (UHS) Union Health Surakshanama nageswararao100% (2)

- Car Insurance PFDocument4 pagesCar Insurance PFSarabjit SinghNo ratings yet

- Common Application FormDocument4 pagesCommon Application Formanil1688No ratings yet

- Parivar Proposal FormDocument10 pagesParivar Proposal FormHANSDA DHIRENDRANATHANNo ratings yet

- Sponsorship: Who's Eligible & How to ApplyFrom EverandSponsorship: Who's Eligible & How to ApplyNo ratings yet

- Food Riders: Edit Uber Eats Foodora GrubhubDocument1 pageFood Riders: Edit Uber Eats Foodora Grubhubrajvansh katiyarNo ratings yet

- Insurance Due Dates DetailsDocument2 pagesInsurance Due Dates Detailsrajvansh katiyarNo ratings yet

- Rock 1Document10 pagesRock 1rajvansh katiyarNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument2 pagesBajaj Allianz General Insurance Company LTDrajvansh katiyarNo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument8 pagesBajaj Allianz General Insurance Company Limitedrajvansh katiyarNo ratings yet

- Reducing Air Pollution From: The Hospitality Industry (Lodging Sector)Document2 pagesReducing Air Pollution From: The Hospitality Industry (Lodging Sector)rajvansh katiyarNo ratings yet

- RajvanshDocument7 pagesRajvanshrajvansh katiyarNo ratings yet

- Shubh KatiyarDocument2 pagesShubh Katiyarrajvansh katiyarNo ratings yet

- 2nd Round Provissionally Selected List FLP 2019 20 Session 29-07-19Document5 pages2nd Round Provissionally Selected List FLP 2019 20 Session 29-07-19rajvansh katiyarNo ratings yet

- Shubh KatiyarDocument2 pagesShubh Katiyarrajvansh katiyarNo ratings yet

- Shubh KatiyarDocument2 pagesShubh Katiyarrajvansh katiyarNo ratings yet

- We Are Sure, You Would Spare Your Valuable Time To Grace The Occasion. Regards Rajvansh and Shubh KatiyarDocument2 pagesWe Are Sure, You Would Spare Your Valuable Time To Grace The Occasion. Regards Rajvansh and Shubh Katiyarrajvansh katiyarNo ratings yet

- Book SoftDocument318 pagesBook SoftBrian Takudzwa MuzembaNo ratings yet

- The Literary Comparison Contrast EssayDocument7 pagesThe Literary Comparison Contrast EssayThapelo SebolaiNo ratings yet

- Alice Becker-Ho, The Language of Those in The KnowDocument4 pagesAlice Becker-Ho, The Language of Those in The KnowIntothepill Net100% (1)

- Barcode Scanner, Wireless Barcode Scanner, DC5112 Barcode ScannerDocument3 pagesBarcode Scanner, Wireless Barcode Scanner, DC5112 Barcode ScannerdcodeNo ratings yet

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- Ordi 16 2014 Maternal Neonatal PublishedDocument15 pagesOrdi 16 2014 Maternal Neonatal PublishedAbraham AstoNo ratings yet

- Pe 3 2ND QTR W1 Folk DanceDocument41 pagesPe 3 2ND QTR W1 Folk DanceKiesha TataroNo ratings yet

- Great by Choice - Collins.ebsDocument13 pagesGreat by Choice - Collins.ebsShantanu Raktade100% (1)

- Maternal and Infant Care Beliefs Aeta Mothers in PhilippinesDocument8 pagesMaternal and Infant Care Beliefs Aeta Mothers in PhilippinesChristine Joy MolinaNo ratings yet

- Alternative Substrates As A Native Oyster (Crassostrea Virginica) Reef Restoration Strategy in Chesapeake BayDocument286 pagesAlternative Substrates As A Native Oyster (Crassostrea Virginica) Reef Restoration Strategy in Chesapeake BayMandi MynyddNo ratings yet

- Mode Lesson PlanDocument13 pagesMode Lesson PlandapitomaryjoyNo ratings yet

- WorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFDocument2 pagesWorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFArif MohmmadNo ratings yet

- December 2023 1Document14 pagesDecember 2023 1febri.putra7280No ratings yet

- KELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditDocument39 pagesKELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditAkuntansi 6511No ratings yet

- Case ReportDocument16 pagesCase ReportSabbir ThePsychoExpressNo ratings yet

- How To Cite A Research Paper in TextDocument8 pagesHow To Cite A Research Paper in Textafnkaufhczyvbc100% (1)

- Karakoram International University: TopicDocument56 pagesKarakoram International University: TopicNoor KhanNo ratings yet

- POLEFDNDocument10 pagesPOLEFDNcoolkaisyNo ratings yet

- Doctorine of Necessity in PakistanDocument14 pagesDoctorine of Necessity in Pakistandijam_786100% (9)

- KPI RepositoryDocument33 pagesKPI RepositoryBONo ratings yet

- Popular Dance: Isaac. Alexandra Nicole Q BSA-1CDocument5 pagesPopular Dance: Isaac. Alexandra Nicole Q BSA-1CAlexandra Nicole IsaacNo ratings yet

- Module 1Document17 pagesModule 1Richilien Teneso43% (14)

- Numerical Pattern Recognition TestDocument7 pagesNumerical Pattern Recognition Testmik.trovaoNo ratings yet

- Tata Projects Limited BTRS, SVS Road, Mayor's Bunglow, Shivaji Park, Dadar West Scope Matrix For Secant Piling WorksDocument1 pageTata Projects Limited BTRS, SVS Road, Mayor's Bunglow, Shivaji Park, Dadar West Scope Matrix For Secant Piling WorksSabyasachi BangalNo ratings yet

- Alzheimer's - Alzheimer's Disease - Kaj Blennow, Mony J de Leon, Henrik ZeterbergDocument17 pagesAlzheimer's - Alzheimer's Disease - Kaj Blennow, Mony J de Leon, Henrik ZeterbergCatinean DanielaNo ratings yet

- Onomasiology (From GreekDocument4 pagesOnomasiology (From GreekAnonymous hcACjq8No ratings yet

- Naet Basic 15 GuideDocument6 pagesNaet Basic 15 Guidesissicarranza100% (1)

- Petitioner vs. VS.: Third DivisionDocument12 pagesPetitioner vs. VS.: Third DivisionAnonymous QR87KCVteNo ratings yet

- Pgcet Environmental Engineering PaperDocument10 pagesPgcet Environmental Engineering PaperRamNo ratings yet

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet