Professional Documents

Culture Documents

Courier C112348 R6 TEK0 CA

Courier C112348 R6 TEK0 CA

Uploaded by

Saransh KansalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Courier C112348 R6 TEK0 CA

Courier C112348 R6 TEK0 CA

Uploaded by

Saransh KansalCopyright:

Available Formats

Round: 6

Dec. 31, C112348

2025

Andrews Baldwin Chester

Priyanshi Agarwal Onkar Vengurlekar Deepak Bora

Abhishek Deokar RAHUL NAIR

Tanya Dhingra Shashank Nanjundesw

Vamini Madan shashank nuti

Vamini Madan Anup Reddy

Vivek Raj Arsh Prit Singh

Digby Erie Ferris

Aranya . Naman Bhatia Rhythm Aggarwal

Shreya Agarwal Atharv Chitnis MAYASREE GOSWAMI

Nirvika Ahuja Gourav Dadhich Pallav Kumar

Japna Chawla Saransh Kansal Vithal Lakhotia

Animesh Goyal Swecchha Kumari Ankita Nair

Ridhima Kalra Shilpy Siwach Abhishek Singh

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS 4.4% 5.1% 4.2% -7.9% 5.5% -9.2%

Asset Turnover 2.25 0.86 1.03 0.74 1.15 0.93

ROA 9.9% 4.4% 4.4% -5.9% 6.3% -8.5%

Leverage 5.6 2.1 1.9 4.6 2.1 32.2

ROE 55.2% 9.4% 8.4% -26.9% 13.1% -274.7%

Emergency Loan $33,483,454 $0 $0 $79,101,359 $0 $70,262,677

Sales $262,170,587 $234,864,927 $257,795,484 $120,883,461 $222,276,137 $164,150,310

EBIT $31,057,695 $36,176,925 $30,927,797 $4,490,127 $30,339,810 $2,223,007

Profits $11,557,772 $12,042,155 $10,933,052 ($9,607,502) $12,182,314 ($15,058,392)

Cumulative Profit ($23,819,189) $61,735,406 $44,456,098 ($24,161,384) $45,447,734 ($45,162,904)

SG&A / Sales 9.8% 8.7% 17.4% 16.7% 11.4% 14.4%

Contrib. Margin % 27.4% 34.0% 42.7% 29.5% 36.2% 33.7%

CAPSTONE ® COURIER Page 1

Round: 6

Stock & Bonds C112348 Dec. 31, 2025

Stock Market Summary

MarketCap Book Value

Company Close Change Shares EPS Dividend Yield P/E

($M) Per Share

Andrews $13.94 $12.94 2,995,029 $42 $6.99 $3.86 $0.00 0.0% 3.6

Baldwin $72.90 $3.71 2,527,431 $184 $50.81 $4.76 $0.62 0.8% 15.3

Chester $63.30 $5.82 3,145,236 $199 $41.24 $3.48 $0.00 0.0% 18.2

Digby $1.00 $0.00 3,842,055 $4 $9.28 ($2.50) $0.00 0.0% -0.4

Erie $65.57 $6.60 2,444,503 $160 $38.09 $4.98 $6.30 9.6% 13.2

Ferris $1.00 $0.00 4,129,392 $4 $1.33 ($3.65) $0.00 0.0% -0.3

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

11.3S2030 $5,000,000 13.4% 84.03 DDD 11.3S2030 $15,000,000 13.4% 84.03 DDD

13.8S2031 $10,000,000 15.1% 91.20 DDD 13.6S2031 $2,000,000 15.0% 90.47 DDD

14.3S2032 $7,056,000 15.5% 92.37 DDD 14.1S2032 $5,000,000 15.4% 91.57 DDD

14.8S2033 $8,000,000 15.8% 93.96 DDD Erie

Baldwin 11.3S2030 $6,571,000 12.7% 89.14 CCC

12.6S2033 $35,984,745 13.9% 90.91 CCC 11.7S2031 $13,430,000 13.1% 89.26 CCC

13.6S2034 $20,411,312 14.3% 95.16 CCC 12.7S2032 $8,070,000 13.7% 92.40 CCC

13.9S2035 $26,554,898 14.4% 96.43 CCC 12.8S2033 $6,780,000 13.9% 92.24 CCC

Chester 13.3S2034 $13,000,000 14.1% 94.17 CCC

11.3S2030 $7,000,000 12.5% 90.41 B 13.3S2035 $21,042,000 14.2% 93.86 CCC

13.3S2033 $14,000,000 13.8% 96.30 B Ferris

13.2S2034 $26,000,000 13.8% 95.56 B 11.3S2030 $3,300,000 13.5% 83.74 DDD

13.1S2035 $40,000,000 13.8% 94.80 B 12.0S2031 $10,570,000 14.2% 84.28 DDD

13.6S2032 $1,500,000 15.2% 89.19 DDD

14.7S2033 $11,000,000 15.8% 93.12 DDD

15.3S2034 $15,000,000 16.0% 95.44 DDD

15.8S2035 $20,000,000 16.2% 97.61 DDD

Next Year's Prime Rate10.00%

CAPSTONE ® COURIER Page 2

Round: 6

Financial Summary C112348 Dec. 31, 2025

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) $11,558 $12,042 $10,933 ($9,608) $12,182 ($15,058)

Adjustment for non-cash items:

Depreciation $9,081 $18,180 $21,200 $11,080 $13,829 $12,510

Extraordinary gains/losses/writeoffs $0 $0 $0 $0 $0 $0

Changes in current assets and liablilities

Accounts payable ($2,972) ($1,587) $4,270 ($839) ($546) $11,941

Inventory ($4,462) $12,768 ($13,649) ($33,227) $3,369 ($38,010)

Accounts Receivable ($4,625) ($1,549) ($4,490) $1,811 ($2,243) $4,729

Net cash from operations $8,580 $39,854 $18,264 ($30,782) $26,592 ($23,888)

Cash flows from investing activities

Plant improvements(net) ($6,760) ($24,700) ($66,400) $0 ($24,900) ($17,404)

Cash flows from financing activities

Dividends paid $0 ($1,557) $0 $0 ($15,400) $0

Sales of common stock $499 $0 $20,000 $0 $8,420 $688

Purchase of common stock $0 $0 $0 $0 ($7,144) $0

Cash from long term debt issued $0 $26,555 $40,000 $0 $21,042 $20,000

Early retirement of long term debt $0 $0 $0 $0 $0 $0

Retirement of current debt ($35,802) ($33,039) $0 ($48,319) $0 ($49,659)

Cash from current debt borrowing $0 $29,320 $0 $0 $0 $0

Cash from emergency loan $33,483 $0 $0 $79,101 $0 $70,263

Net cash from financing activities ($1,820) $21,279 $60,000 $30,782 $6,918 $41,292

Net change in cash position $0 $36,433 $11,864 $0 $8,610 $0

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $0 $70,807 $12,643 $0 $54,207 $0

Accounts Receivable $21,548 $19,304 $21,189 $9,936 $24,359 $8,995

Inventory $46,417 $10,063 $15,385 $84,294 $10,386 $79,067

Total Current Assets $67,965 $100,174 $49,217 $94,230 $88,953 $88,061

Plant and equipment $136,220 $272,700 $318,000 $166,200 $207,440 $187,656

Accumulated Depreciation ($87,903) ($99,747) ($116,547) ($97,800) ($102,272) ($98,947)

Total Fixed Assets $48,317 $172,953 $201,453 $68,400 $105,168 $88,709

Total Assets $116,282 $273,127 $250,670 $162,630 $194,121 $176,770

Accounts Payable $15,560 $11,587 $13,116 $13,352 $11,277 $18,806

Current Debt $49,737 $50,170 $20,850 $91,606 $20,850 $91,113

Total Current Liabilities $65,297 $61,757 $33,966 $104,958 $32,127 $109,919

Long Term Debt $30,056 $82,951 $87,000 $22,000 $68,893 $61,370

Total Liabilities $95,352 $144,708 $120,966 $126,958 $101,020 $171,288

Common Stock $19,356 $50,881 $61,960 $34,440 $43,252 $25,251

Retained Earnings $1,574 $77,538 $67,745 $1,232 $49,849 ($19,769)

Total Equity $20,930 $128,419 $129,704 $35,672 $93,101 $5,482

Total Liabilities & Owners Equity $116,282 $273,127 $250,670 $162,630 $194,121 $176,770

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $262,171 $234,865 $257,795 $120,883 $222,276 $164,150

Variable Costs(Labor,Material,Carry) $190,416 $154,950 $147,774 $85,185 $141,816 $108,760

Contribution Margin $71,755 $79,915 $110,021 $35,698 $80,460 $55,390

Depreciation $9,081 $18,180 $21,200 $11,080 $13,829 $12,510

SGA(R&D,Promo,Sales,Admin) $25,790 $20,481 $44,893 $20,128 $25,411 $23,623

Other(Fees,Writeoffs,TQM,Bonuses) $5,825 $5,078 $13,000 $0 $10,880 $17,034

EBIT $31,058 $36,177 $30,928 $4,490 $30,340 $2,223

Interest(Short term,Long term) $12,914 $17,272 $13,764 $19,271 $11,215 $25,390

Taxes $6,350 $6,617 $6,007 ($5,173) $6,694 ($8,108)

Profit Sharing $236 $246 $223 $0 $249 $0

Net Profit $11,558 $12,042 $10,933 ($9,608) $12,182 ($15,058)

CAPSTONE ® COURIER Page 3

Round: 6

Production Analysis C112348 Dec. 31, 2025

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Trad 1,851 2,164 6/10/2025 1.7 19000 9.2 10.7 $27.00 $9.24 $9.96 20% 83% 4.3 1,800 182%

Acre Low 3,106 0 7/28/2023 4.6 14000 4.7 15.3 $18.60 $5.01 $7.17 29% 7% 5.3 1,500 106%

Adam High 1,664 186 6/8/2025 1.7 23500 13.5 6.5 $37.00 $13.15 $11.81 32% 78% 3.0 900 176%

Aft Pfmn 1,176 28 6/1/2025 1.5 27000 14.6 12.4 $32.90 $13.00 $12.10 24% 100% 3.1 700 198%

Agape Size 1,188 0 6/1/2025 1.5 21000 7.6 5.4 $33.00 $11.40 $12.10 29% 100% 3.1 700 198%

Amaze Low 693 0 2/22/2025 2.3 13000 4.8 15.2 $21.50 $4.81 $9.08 35% 100% 5.0 450 198%

Baker Low 1,665 0 3/19/2024 3.3 16000 6.5 13.5 $19.50 $7.51 $6.66 26% 32% 7.0 1,100 129%

Bead Low 2,028 148 7/19/2025 5.5 14000 5.2 14.8 $19.50 $5.98 $3.32 54% 0% 9.0 2,500 67%

Bid High 1,714 225 6/23/2025 1.4 24000 14.6 5.4 $37.00 $15.69 $8.87 32% 6% 5.0 1,550 104%

Bold Trad 1,874 82 10/12/2025 1.4 19000 10.1 9.9 $27.00 $10.98 $8.24 30% 37% 6.0 1,500 134%

Buddy Trad 1,809 86 10/21/2025 1.4 19000 10.1 9.9 $27.00 $10.98 $8.17 31% 33% 6.0 1,500 131%

Cake Trad 1,915 364 6/30/2025 1.5 19000 8.5 11.5 $27.00 $8.71 $4.90 48% 4% 7.0 2,100 103%

Cedar Low 2,811 754 6/20/2025 1.7 14000 4.2 15.8 $19.00 $4.66 $4.19 52% 33% 8.0 2,700 132%

Cid High 492 201 2/7/2026 3.6 23500 11.6 8.4 $37.00 $11.87 $5.89 49% 0% 6.0 900 77%

Coat Pfmn 1,678 5 7/14/2025 1.5 27000 14.4 12.5 $32.00 $12.82 $7.04 38% 70% 6.0 1,200 168%

Cure Size 1,683 0 7/14/2025 1.5 21000 7.5 5.6 $32.00 $11.23 $7.04 43% 70% 6.0 1,200 168%

Caesar High 304 0 3/26/2025 0.8 24000 12.8 7.2 $36.50 $12.76 $13.26 28% 100% 3.0 500 152%

Cool Trad 342 0 2/19/2025 0.9 19000 8.0 12.0 $26.50 $8.39 $13.26 18% 100% 3.0 1,000 171%

Coke Low 368 0 1/26/2025 0.9 14500 4.0 16.0 $18.50 $4.67 $13.26 2% 100% 3.0 1,000 184%

Daze Trad 1,037 1,212 3/18/2024 2.9 19000 7.5 12.6 $27.49 $9.08 $8.48 26% 0% 5.0 1,800 83%

Dell Low 2,406 108 2/13/2023 6.1 15000 3.5 16.5 $20.00 $5.06 $4.81 50% 41% 8.0 1,900 132%

Dixie High 204 1,380 7/27/2024 2.4 20000 11.7 8.0 $38.49 $12.53 $9.89 -7% 0% 4.0 1,000 65%

Dot Pfmn 447 611 6/17/2024 3.7 27000 12.5 13.9 $33.49 $13.32 $11.94 11% 14% 3.0 700 106%

Dune Size 659 583 5/3/2024 2.7 21000 6.4 8.0 $32.49 $11.34 $12.84 16% 42% 3.0 700 133%

Eat Trad 1,592 267 7/22/2025 1.4 19000 9.4 10.8 $26.90 $9.70 $5.73 41% 0% 6.8 1,800 95%

Ebb Low 2,204 405 7/19/2025 1.5 17000 5.8 15.5 $18.90 $6.43 $4.23 39% 21% 8.3 1,650 120%

Echo High 1,287 0 8/10/2025 1.4 25000 13.4 6.8 $37.10 $14.04 $10.49 34% 44% 3.5 900 143%

Edge Pfmn 1,210 78 7/19/2025 1.4 27000 14.4 12.7 $32.60 $13.46 $8.39 33% 44% 6.0 900 143%

Egg Size 1,177 0 7/28/2025 1.4 21000 7.3 5.8 $32.60 $11.70 $8.45 37% 48% 6.0 900 146%

Elliot Pfmn 379 1 5/11/2025 0.6 26000 13.8 13.1 $32.30 $12.85 $12.08 22% 100% 4.0 500 126%

Fast Trad 1,603 1,141 6/16/2025 1.7 19000 8.6 11.5 $26.97 $8.78 $6.36 38% 0% 6.0 1,800 95%

Feat Low 2,639 686 5/3/2025 2.8 14000 4.5 15.5 $18.96 $4.87 $6.99 35% 78% 6.5 1,800 170%

Fist High 608 1,505 10/8/2025 1.6 25000 12.9 7.1 $36.97 $13.15 $8.26 26% 66% 5.5 901 159%

Foam Pfmn 772 373 8/31/2025 1.8 27000 13.8 13.0 $32.48 $12.55 $8.60 32% 100% 5.5 600 191%

Fume Size 729 714 9/13/2025 1.8 21000 7.0 6.2 $31.98 $10.95 $8.60 33% 100% 5.5 601 191%

Fuffy 0 0 11/19/2025 1.0 14000 5.1 15.5 $18.97 $0.00 $0.00 0% 0% 1.0 600 0%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C112348 Round: 6

Dec. 31, 2025

Traditional Statistics

Total Industry Unit Demand 12,526

Actual Industry Unit Sales |12,526

Segment % of Total Industry |26.5%

Next Year's Segment Growth Rate |9.2%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $17.00 - 27.00 23%

3. Ideal Position Pfmn 9.2 Size 10.8 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cake 15% 1,915 6/30/2025 8.5 11.5 $27.00 19000 1.55 $1,500 100% $3,000 93% 57

Bold 15% 1,868 10/12/2025 10.1 9.9 $27.00 19000 1.40 $1,800 100% $1,200 90% 41

Able 15% 1,851 6/10/2025 9.2 10.7 $27.00 19000 1.66 $1,400 100% $2,500 69% 58

Buddy 14% 1,803 10/21/2025 10.1 9.9 $27.00 19000 1.39 $1,800 100% $1,200 90% 41

Fast 13% 1,602 6/16/2025 8.6 11.5 $26.97 19000 1.71 $1,550 100% $2,400 74% 52

Eat 13% 1,592 7/22/2025 9.4 10.8 $26.90 19000 1.43 $1,500 100% $2,000 64% 47

Daze 8% 1,037 3/18/2024 7.5 12.6 $27.49 19000 2.90 $1,800 100% $2,200 74% 19

Baker 4% 518 3/19/2024 YES 6.5 13.5 $19.50 16000 3.26 $1,800 100% $1,200 90% 2

Cool 3% 340 2/19/2025 YES 8.0 12.0 $26.50 19000 0.86 $2,000 70% $3,000 93% 22

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C112348 Round: 6

Dec. 31, 2025

Low End Statistics

Total Industry Unit Demand 17,404

Actual Industry Unit Sales |17,404

Segment % of Total Industry |36.8%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $12.00 - 22.00 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 4.7 Size 15.3 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Acre 18% 3,106 7/28/2023 YES 4.7 15.3 $18.60 14000 4.63 $1,400 100% $1,600 80% 33

Cedar 16% 2,811 6/20/2025 4.2 15.8 $19.00 14000 1.66 $1,500 100% $3,000 91% 19

Feat 15% 2,639 5/3/2025 4.5 15.5 $18.96 14000 2.77 $1,500 100% $1,700 48% 17

Dell 14% 2,406 2/13/2023 3.5 16.5 $20.00 15000 6.10 $1,800 100% $1,500 49% 13

Ebb 13% 2,204 7/19/2025 5.8 15.5 $18.90 17000 1.51 $1,500 100% $2,000 61% 15

Bead 12% 2,028 7/19/2025 5.2 14.8 $19.50 14000 5.52 $1,800 100% $1,200 43% 22

Baker 7% 1,147 3/19/2024 YES 6.5 13.5 $19.50 16000 3.26 $1,800 100% $1,200 43% 9

Amaze 4% 693 2/22/2025 YES 4.8 15.2 $21.50 13000 2.30 $1,800 100% $1,200 80% 10

Coke 2% 368 1/26/2025 YES 4.0 16.0 $18.50 14500 0.93 $2,000 70% $3,000 91% 16

Cool 0% 2 2/19/2025 YES 8.0 12.0 $26.50 19000 0.86 $2,000 70% $3,000 91% 0

CAPSTONE ® COURIER Page 6

High End Segment Analysis C112348 Round: 6

Dec. 31, 2025

High End Statistics

Total Industry Unit Demand 6,286

Actual Industry Unit Sales |6,286

Segment % of Total Industry |13.3%

Next Year's Segment Growth Rate |16.2%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 14.3 Size 5.7 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $27.00 - 37.00 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Bid 27% 1,714 6/23/2025 14.6 5.4 $37.00 24000 1.42 $1,800 100% $1,200 39% 42

Adam 26% 1,664 6/8/2025 13.5 6.5 $37.00 23500 1.70 $1,800 100% $1,800 52% 36

Echo 20% 1,287 8/10/2025 YES 13.4 6.8 $37.10 25000 1.36 $1,500 100% $1,800 50% 40

Fist 10% 608 10/8/2025 12.9 7.1 $36.97 25000 1.65 $1,500 95% $1,500 48% 26

Cid 8% 492 2/7/2026 11.6 8.4 $37.00 23500 3.60 $1,500 100% $3,000 85% 8

Caesar 5% 304 3/26/2025 YES 12.8 7.2 $36.50 24000 0.77 $2,000 70% $3,000 85% 39

Dixie 3% 204 7/27/2024 11.7 8.0 $38.49 20000 2.41 $1,650 100% $1,800 41% 2

Buddy 0% 6 10/21/2025 10.1 9.9 $27.00 19000 1.39 $1,800 100% $1,200 39% 0

Bold 0% 6 10/12/2025 10.1 9.9 $27.00 19000 1.40 $1,800 100% $1,200 39% 0

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C112348 Round: 6

Dec. 31, 2025

Performance Statistics

Total Industry Unit Demand 5,662

Actual Industry Unit Sales |5,662

Segment % of Total Industry |12.0%

Next Year's Segment Growth Rate |19.8%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 15.4 Size 11.8 29%

3. Price $22.00 - 32.00 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Coat 30% 1,678 7/14/2025 14.4 12.5 $32.00 27000 1.49 $1,500 100% $3,000 84% 66

Edge 21% 1,210 7/19/2025 14.4 12.7 $32.60 27000 1.42 $1,500 100% $1,800 62% 45

Aft 21% 1,176 6/1/2025 14.6 12.4 $32.90 27000 1.55 $1,400 100% $2,200 51% 44

Foam 14% 772 8/31/2025 13.8 13.0 $32.48 27000 1.78 $1,500 100% $1,500 45% 33

Dot 8% 447 6/17/2024 12.5 13.9 $33.49 27000 3.68 $2,000 97% $2,200 33% 13

Elliot 7% 379 5/11/2025 13.8 13.1 $32.30 26000 0.64 $1,000 46% $1,000 62% 22

CAPSTONE ® COURIER Page 8

Size Segment Analysis C112348 Round: 6

Dec. 31, 2025

Size Statistics

Total Industry Unit Demand 5,437

Actual Industry Unit Sales |5,437

Segment % of Total Industry |11.5%

Next Year's Segment Growth Rate |18.3%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 8.2 Size 4.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $22.00 - 32.00 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cure 31% 1,683 7/14/2025 YES 7.5 5.6 $32.00 21000 1.49 $1,500 100% $3,000 85% 58

Agape 22% 1,188 6/1/2025 YES 7.6 5.4 $33.00 21000 1.54 $1,500 100% $2,000 48% 40

Egg 22% 1,177 7/28/2025 YES 7.3 5.8 $32.60 21000 1.43 $1,800 100% $2,000 53% 33

Fume 13% 729 9/13/2025 7.0 6.2 $31.98 21000 1.76 $1,600 100% $1,900 60% 29

Dune 12% 659 5/3/2024 6.4 8.0 $32.49 21000 2.66 $1,650 100% $1,800 46% 12

CAPSTONE ® COURIER Page 9

Round: 6

Market Share C112348 Dec. 31, 2025

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 12,526 17,404 6,286 5,662 5,437 47,315 Units Demanded 12,526 17,404 6,286 5,662 5,437 47,315

% of Market 26.5% 36.8% 13.3% 12.0% 11.5% 100.0% % of Market 26.5% 36.8% 13.3% 12.0% 11.5% 100.0%

Able 14.8% 3.9% Able 14.5% 3.8%

Acre 17.8% 6.6% Acre 20.0% 7.4%

Adam 26.5% 3.5% Adam 20.4% 2.7%

Aft 20.8% 2.5% Aft 20.9% 2.5%

Agape 21.9% 2.5% Agape 24.9% 2.9%

Amaze 4.0% 1.5% Amaze 5.9% 2.2%

Total 14.8% 21.8% 26.5% 20.8% 21.9% 20.5% Total 14.5% 25.9% 20.4% 20.9% 24.9% 21.4%

Baker 4.1% 6.6% 3.5% Baker 4.1% 5.5% 3.1%

Bead 11.7% 4.3% Bead 9.2% 3.4%

Bid 27.3% 3.6% Bid 21.2% 2.8%

Bold 14.9% 4.0% Bold 14.7% 3.9%

Buddy 14.4% 3.8% Buddy 14.2% 3.8%

Total 33.4% 18.2% 27.5% 19.2% Total 32.9% 14.7% 21.3% 17.0%

Cake 15.3% 4.0% Cake 15.0% 4.0%

Cedar 16.2% 5.9% Cedar 13.1% 4.8%

Cid 7.8% 1.0% Cid 6.1% 0.8%

Coat 29.6% 3.5% Coat 30.6% 3.7%

Cure 31.0% 3.6% Cure 34.2% 3.9%

Caesar 4.8% 0.6% Caesar 23.0% 3.1%

Cool 2.7% 0.7% Cool 4.3% 1.2%

Coke 2.1% 0.8% Coke 12.1% 4.4%

Total 18.0% 18.3% 12.7% 29.6% 31.0% 20.3% Total 19.3% 25.3% 29.2% 30.6% 34.2% 25.9%

Daze 8.3% 2.2% Daze 8.2% 2.2%

Dell 13.8% 5.1% Dell 11.3% 4.2%

Dixie 3.3% 0.4% Dixie 2.6% 0.3%

Dot 7.9% 0.9% Dot 7.4% 0.9%

Dune 12.1% 1.4% Dune 10.4% 1.2%

Total 8.3% 13.8% 3.3% 7.9% 12.1% 10.1% Total 8.2% 11.3% 2.6% 7.4% 10.4% 8.8%

Eat 12.7% 3.4% Eat 12.5% 3.3%

Ebb 12.7% 4.7% Ebb 10.3% 3.8%

Echo 20.5% 2.7% Echo 18.9% 2.5%

Edge 21.4% 2.6% Edge 20.9% 2.5%

Egg 21.6% 2.5% Egg 19.1% 2.2%

Elliot 6.7% 0.8% Elliot 7.3% 0.9%

Total 12.7% 12.7% 20.5% 28.1% 21.6% 16.6% Total 12.5% 10.3% 18.9% 28.2% 19.1% 15.2%

Fast 12.8% 3.4% Fast 12.6% 3.3%

Feat 15.2% 5.6% Feat 12.4% 4.6%

Fist 9.7% 1.3% Fist 7.6% 1.0%

Foam 13.6% 1.6% Foam 12.9% 1.5%

Fume 13.4% 1.5% Fume 11.5% 1.3%

Total 12.8% 15.2% 9.7% 13.6% 13.4% 13.4% Total 12.6% 12.4% 7.6% 12.9% 11.5% 11.8%

CAPSTONE ® COURIER Page 10

Round: 6

Perceptual Map C112348 Dec. 31, 2025

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 9.2 10.7 6/10/2025 Baker 6.5 13.5 3/19/2024 Cake 8.5 11.5 6/30/2025

Acre 4.7 15.3 7/28/2023 Bead 5.2 14.8 7/19/2025 Cedar 4.2 15.8 6/20/2025

Adam 13.5 6.5 6/8/2025 Bid 14.6 5.4 6/23/2025 Cid 11.6 8.4 2/7/2026

Aft 14.6 12.4 6/1/2025 Bold 10.1 9.9 10/12/2025 Coat 14.4 12.5 7/14/2025

Agape 7.6 5.4 6/1/2025 Buddy 10.1 9.9 10/21/2025 Cure 7.5 5.6 7/14/2025

Amaze 4.8 15.2 2/22/2025 Caesar 12.8 7.2 3/26/2025

Cool 8.0 12.0 2/19/2025

Coke 4.0 16.0 1/26/2025

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 7.5 12.6 3/18/2024 Eat 9.4 10.8 7/22/2025 Fast 8.6 11.5 6/16/2025

Dell 3.5 16.5 2/13/2023 Ebb 5.8 15.5 7/19/2025 Feat 4.5 15.5 5/3/2025

Dixie 11.7 8.0 7/27/2024 Echo 13.4 6.8 8/10/2025 Fist 12.9 7.1 10/8/2025

Dot 12.5 13.9 6/17/2024 Edge 14.4 12.7 7/19/2025 Foam 13.8 13.0 8/31/2025

Dune 6.4 8.0 5/3/2024 Egg 7.3 5.8 7/28/2025 Fume 7.0 6.2 9/13/2025

Elliot 13.8 13.1 5/11/2025 Fuffy 5.1 15.5 11/19/2025

CAPSTONE ® COURIER Page 11

Round: 6

HR/TQM Report C112348 Dec. 31, 2025

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 1,425 950 1,042 868 890 970

Complement 1,425 950 1,042 880 889 970

1st Shift Complement 835 780 734 749 673 620

2nd Shift Complement 590 170 308 131 216 350

Overtime Percent 0.1% 0.0% 0.0% 0.0% 0.1% 0.0%

Turnover Rate 9.6% 9.5% 6.7% 9.9% 8.2% 8.2%

New Employees 477 90 376 87 73 368

Separated Employees 0 217 0 0 78 0

Recruiting Spend $2,000 $2,000 $3,000 $1,500 $2,000 $2,000

Training Hours 40 30 80 40 80 80

Productivity Index 102.5% 106.9% 114.3% 105.4% 113.3% 110.9%

Recruiting Cost $1,431 $270 $1,505 $217 $218 $1,105

Separation Cost $0 $1,083 $0 $0 $390 $0

Training Cost $1,140 $570 $1,667 $704 $1,422 $1,552

Total HR Admin Cost $2,571 $1,923 $3,172 $921 $2,031 $2,657

Labor Contract Next Year

Wages $29.25 $29.74 $30.00 $29.04 $29.00 $28.78

Benefits 2,700 2,625 2,750 2,625 2,675 2,688

Profit Sharing 2.2% 2.1% 2.2% 2.1% 2.2% 2.2%

Annual Raise 5.3% 5.3% 5.5% 5.3% 5.3% 5.4%

Starting Negotiation Position

Wages $28.50 $26.81 $30.00 $25.53 $28.00 $27.55

Benefits 2,650 2,500 2,750 2,500 2,600 2,625

Profit Sharing 2.1% 2.0% 2.2% 2.0% 2.1% 2.1%

Annual Raise 5.2% 5.0% 5.5% 5.0% 5.2% 5.3%

Ceiling Negotiation Position

Wages $31.35 $29.49 $33.00 $28.08 $30.80 $30.31

Benefits 2,915 2,750 3,025 2,750 2,860 2,888

Profit Sharing 2.3% 2.2% 2.4% 2.2% 2.3% 2.3%

Annual Raise 5.7% 5.5% 6.1% 5.5% 5.7% 5.8%

Adjusted Labor Demands

Wages $30.00 $30.00 $30.00 $30.00 $30.00 $30.00

Benefits 2,750 2,750 2,750 2,750 2,750 2,750

Profit Sharing 2.2% 2.2% 2.2% 2.2% 2.2% 2.2%

Annual Raise 5.5% 5.5% 5.5% 5.5% 5.5% 5.5%

Strike Days 0 4 0 13 0 0

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $0 $0 $1,000 $0 $800 $1,500

VendorJIT $0 $0 $1,000 $0 $900 $1,500

Quality Initiative Training $0 $0 $1,000 $0 $0 $1,500

Channel Support Systems $1,200 $750 $1,000 $0 $750 $2,000

Concurrent Engineering $1,200 $750 $1,000 $0 $850 $1,500

UNEP Green Programs $1,200 $0 $1,000 $0 $0 $1,500

TQM Budgets Last Year

Benchmarking $1,200 $750 $1,000 $0 $1,500 $1,500

Quality Function Deployment Effort $0 $750 $1,000 $0 $1,500 $2,000

CCE/6 Sigma Training $1,000 $750 $1,000 $0 $1,500 $1,500

GEMI TQEM Sustainability Initiatives $0 $0 $1,000 $0 $1,500 $1,500

Total Expenditures $5,800 $3,750 $10,000 $0 $9,300 $16,000

Cumulative Impacts

Material Cost Reduction 11.12% 0.28% 11.68% 0.31% 7.03% 11.27%

Labor Cost Reduction 13.61% 1.17% 13.96% 0.98% 5.21% 11.72%

Reduction R&D Cycle Time 39.15% 38.78% 40.01% 13.54% 36.24% 40.01%

Reduction Admin Costs 59.27% 44.30% 60.02% 4.66% 51.38% 60.02%

Demand Increase 12.42% 7.43% 14.40% 3.62% 6.16% 14.02%

CAPSTONE ® COURIER Page 12

Round: 6

Ethics Report C112348 Dec. 31, 2025

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

Total

Other (Fees, Writeoffs, etc.) $0 $0 $0 $0 $0 $0 $0

Demand Factor 100% 100% 100% 100% 100% 100% 100%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

Annual Report

Round: 6

Annual Report Erie C112348

Dec. 31, 2025

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2025 2024

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $54,207 27.9% $45,597

current value of your inventory across all products. A zero

Account Receivable $24,359 12.5% $22,116

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $10,386 5.4% $13,756

Equipment: The current value of your plant. Accum Total Current Assets $88,952 45.8% $81,469

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $207,440 107.0% $182,540

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($102,272) -52.7% ($88,443)

of operations. It includes emergency loans used to keep Total Fixed Assets $105,168 54.2% $94,097

your company solvent should you run out of cash during Total Assets $194,121 100.0% $175,567

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $11,277 5.8% $11,823

instead of paying to shareholders as dividends.

Current Debt $20,850 10.7% $0

Long Term Debt $68,893 35.5% $68,701

Total Liabilities $101,020 52.0% $80,524

Common Stock $43,252 22.3% $38,040

Retained Earnings $49,849 25.7% $57,003

Total Equity $93,101 48.0% $95,043

Total Liab. & O. Equity $194,121 100.0% $175,567

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2025 2024

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) $12,182 $9,144

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $13,829 $11,809

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 $0

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable ($546) $2,053

are bad and you find yourself carrying an abundance of excess inventory,

Inventory $3,369 ($9,555)

the report would show the increase in inventory as a huge negative cash

Accounts Receivable ($2,243) ($3,755)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $26,592 $9,697

afloat. Cash Flows from Investing Activities

Plant Improvements ($24,900) ($19,940)

Cash Flows from Financing Activities

Dividends paid ($15,400) $0

Sales of common stock $8,420 $7,000

Purchase of common stock ($7,144) $0

Cash from long term debt $21,042 $13,000

Retirement of long term debt ($20,850) $0

Change in current debt(net) $20,850 ($13,900)

Net cash from financing activities $6,918 $6,100

Net change in cash position $8,610 ($4,143)

Closing cash position $54,207 $45,597

Annual Report Page 14

Round: 6

Annual Report Erie C112348

Dec. 31, 2025

2025 Income Statement

2025 Common

(Product Name) Eat Ebb Echo Edge Egg Elliot

Total

Size

Sales $42,817 $41,665 $47,755 $39,442 $38,364 $12,233 $0 $0 $222,276 100.0%

Variable Costs:

Direct Labor $9,205 $9,898 $13,500 $10,152 $10,197 $4,576 $0 $0 $57,528 25.9%

Direct Material $15,457 $14,807 $17,858 $16,198 $13,801 $4,922 $0 $0 $83,042 37.4%

Inventory Carry $496 $545 $0 $203 $0 $2 $0 $0 $1,246 0.6%

Total Variable $25,157 $25,249 $31,358 $26,553 $23,998 $9,500 $0 $0 $141,816 63.8%

Contribution Margin $17,660 $16,415 $16,398 $12,889 $14,366 $2,733 $0 $0 $80,460 36.2%

Period Costs:

Depreciation $3,984 $4,312 $1,200 $1,800 $1,800 $733 $0 $0 $13,829 6.2%

SG&A: R&D $561 $553 $614 $554 $579 $361 $0 $0 $3,224 1.5%

Promotions $1,500 $1,500 $1,500 $1,500 $1,800 $1,000 $0 $0 $8,800 4.0%

Sales $2,000 $2,000 $1,800 $1,800 $2,000 $1,000 $0 $0 $10,600 4.8%

Admin $537 $522 $599 $495 $481 $153 $0 $0 $2,787 1.3%

Total Period $8,582 $8,888 $5,713 $6,149 $6,660 $3,248 $0 $0 $39,240 17.7%

Net Margin $9,077 $7,528 $10,684 $6,740 $7,705 ($515) $0 $0 $41,220 18.5%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $10,880 4.9%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $30,340 13.6%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $2,481 1.1%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $8,734 3.9%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes $6,694 3.0%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $249 0.1%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit $12,182 5.5%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Full Download Test Bank For Investments Analysis and Behavior 2nd Edition Mark Hirschey PDF Full ChapterDocument36 pagesFull Download Test Bank For Investments Analysis and Behavior 2nd Edition Mark Hirschey PDF Full Chaptergomeerrorist.g9vfq6100% (23)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Banking Laws Bar Q - ADocument18 pagesBanking Laws Bar Q - ANurRjObeidat100% (2)

- NMIMS Hyd - DM End Sem PaperDocument2 pagesNMIMS Hyd - DM End Sem PaperSaransh KansalNo ratings yet

- MCQS InvestmentDocument3 pagesMCQS Investmentaashir chNo ratings yet

- Advertisement For Guest Faculty 2019-20Document3 pagesAdvertisement For Guest Faculty 2019-20Saransh KansalNo ratings yet

- Marketing Analysis & SWOT AnalysisDocument1 pageMarketing Analysis & SWOT AnalysisSaransh KansalNo ratings yet

- How Uber Can Satisfy Its Customers As Well As Its Drivers Simultaneously?Document2 pagesHow Uber Can Satisfy Its Customers As Well As Its Drivers Simultaneously?Saransh KansalNo ratings yet

- FA Mid 2022Document5 pagesFA Mid 2022Saransh KansalNo ratings yet

- About The BrandDocument10 pagesAbout The BrandSaransh KansalNo ratings yet

- SaranshKansal - 80303180090 (Content Marketing)Document10 pagesSaranshKansal - 80303180090 (Content Marketing)Saransh KansalNo ratings yet

- Group-11 Saransh Kansal (80303180090) Sambhav Mehta (80303180119) Swecchha Kumari (80303180101) Suparnika Das (80303180041) Isha Mohanty (80303180123)Document12 pagesGroup-11 Saransh Kansal (80303180090) Sambhav Mehta (80303180119) Swecchha Kumari (80303180101) Suparnika Das (80303180041) Isha Mohanty (80303180123)Saransh KansalNo ratings yet

- INTRODUCTIONDocument1 pageINTRODUCTIONSaransh KansalNo ratings yet

- Submitted in Partial Fulfilment of PGDM 2018-20 in SVKM'S Nmims School of Business Management, HyderabadDocument13 pagesSubmitted in Partial Fulfilment of PGDM 2018-20 in SVKM'S Nmims School of Business Management, HyderabadSaransh KansalNo ratings yet

- Amta AssignmentDocument20 pagesAmta AssignmentSaransh KansalNo ratings yet

- Decisions TakenDocument5 pagesDecisions TakenSaransh KansalNo ratings yet

- IA Infosys ReportDocument34 pagesIA Infosys ReportSaransh KansalNo ratings yet

- Suave FinalDocument43 pagesSuave FinalSaransh Kansal100% (1)

- Market Structure of Indian IT Industry InFOSYS PDFDocument20 pagesMarket Structure of Indian IT Industry InFOSYS PDFSaransh KansalNo ratings yet

- IA Infosys ReportDocument34 pagesIA Infosys ReportSaransh KansalNo ratings yet

- Retail Management: Team-Grey Saransh Kansal Kartik Shandaliya Manasvi Goel Yashica MotwaniDocument11 pagesRetail Management: Team-Grey Saransh Kansal Kartik Shandaliya Manasvi Goel Yashica MotwaniSaransh KansalNo ratings yet

- DR - Kavita Sasidharan Kulkarni, Supervisor, NMIMS School of Business, HyderabadDocument10 pagesDR - Kavita Sasidharan Kulkarni, Supervisor, NMIMS School of Business, HyderabadSaransh KansalNo ratings yet

- FSM AssignmentDocument50 pagesFSM AssignmentHardik PatelNo ratings yet

- BPCL Annual Report FY 2014-15Document244 pagesBPCL Annual Report FY 2014-15Mahendra ThengNo ratings yet

- BSL Frontline Equity Fund GrowthDocument2 pagesBSL Frontline Equity Fund Growthanon-294068No ratings yet

- Pcea Questions: A Paid-Up PolicyDocument13 pagesPcea Questions: A Paid-Up PolicyUmabaran Murugiah100% (1)

- Small and Medium Enterprises in PakistanDocument15 pagesSmall and Medium Enterprises in PakistanAftabahmedrashidNo ratings yet

- Chapter 2Document9 pagesChapter 2Mikaela LacabaNo ratings yet

- Chapter Buying and Selling SecuritiesDocument11 pagesChapter Buying and Selling SecuritiesMd. Jahangir AlamNo ratings yet

- NIDHI CementpVT LTD MBA Project Report Prince DudhatraDocument50 pagesNIDHI CementpVT LTD MBA Project Report Prince DudhatrapRiNcE DuDhAtRaNo ratings yet

- MB 201201 enDocument200 pagesMB 201201 ena pNo ratings yet

- Li Lu On Investing 2010Document25 pagesLi Lu On Investing 2010Navin GoyalNo ratings yet

- VOO FactsheetDocument2 pagesVOO FactsheetmartijnNo ratings yet

- Life Insurance Products & Terms PDFDocument16 pagesLife Insurance Products & Terms PDFSuman SinhaNo ratings yet

- Chapter 2Document35 pagesChapter 2Demise WakeNo ratings yet

- Business Insider V February 2018Document124 pagesBusiness Insider V February 2018Mayank Saigal100% (1)

- Voss Capital Book Review The Match King Kreuger Genius and SwindlerDocument7 pagesVoss Capital Book Review The Match King Kreuger Genius and SwindlermirceaNo ratings yet

- Security Investment Slide Notes W4-W8Document213 pagesSecurity Investment Slide Notes W4-W8priyaNo ratings yet

- Grouppresentation 090328142047 Phpapp02Document24 pagesGrouppresentation 090328142047 Phpapp02Satish BetadpurNo ratings yet

- Bst. Class Xii. Assgn.2013-14Document21 pagesBst. Class Xii. Assgn.2013-14puneetkhurana2007No ratings yet

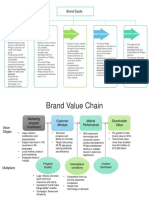

- Aaker's Model + BVCDocument2 pagesAaker's Model + BVCSangeeta KumariNo ratings yet

- 4th Industrial RevolutionDocument36 pages4th Industrial RevolutionNarciz BalasoiuNo ratings yet

- Theories InterestDocument61 pagesTheories InterestNikita GulguleNo ratings yet

- Corporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisDocument9 pagesCorporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisPuttu Guru PrasadNo ratings yet

- Conceptual Map of The Mexican Financial SystemDocument2 pagesConceptual Map of The Mexican Financial SystemJuan BautistaNo ratings yet

- Stocks: Mumbai - Tuesday, 15 August 2017Document1 pageStocks: Mumbai - Tuesday, 15 August 2017Priya AnandNo ratings yet

- Ecos Plastics CompanyDocument2 pagesEcos Plastics CompanyRAJUNo ratings yet

- Var PresentationDocument10 pagesVar PresentationTyler CantaranoNo ratings yet

- Guar Seed UpdateDocument5 pagesGuar Seed UpdateVishal KackarNo ratings yet