Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

40 viewsMsme Segment

Msme Segment

Uploaded by

Vignesh KrishnamoorthyThank you

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Form Spice Moa (Inc-33) - 30082017Document1 pageForm Spice Moa (Inc-33) - 30082017Vignesh KrishnamoorthyNo ratings yet

- Saaral Information DeckDocument23 pagesSaaral Information DeckVignesh KrishnamoorthyNo ratings yet

- NCT 10470634Document3 pagesNCT 10470634Vignesh KrishnamoorthyNo ratings yet

- NCT 10456642Document1 pageNCT 10456642Vignesh KrishnamoorthyNo ratings yet

- Linked Execution Report - RPTDocument930 pagesLinked Execution Report - RPTVignesh KrishnamoorthyNo ratings yet

- CompReg 7AUGUST2022Document2,133 pagesCompReg 7AUGUST2022Vignesh KrishnamoorthyNo ratings yet

- India Professionals - 120141Document8,010 pagesIndia Professionals - 120141Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 47095Document3,141 pagesWorking Professionals - 47095Vignesh KrishnamoorthyNo ratings yet

- Time Management Handbook For EntrepreneursDocument6 pagesTime Management Handbook For EntrepreneursVignesh KrishnamoorthyNo ratings yet

- Working Professionals - 98444Document4,376 pagesWorking Professionals - 98444Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 95790Document4,258 pagesWorking Professionals - 95790Vignesh KrishnamoorthyNo ratings yet

- T.Nagar StreetsDocument14 pagesT.Nagar StreetsVignesh KrishnamoorthyNo ratings yet

- India Professionals - 100296Document6,687 pagesIndia Professionals - 100296Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 96948Document4,310 pagesWorking Professionals - 96948Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 98452Document4,376 pagesWorking Professionals - 98452Vignesh KrishnamoorthyNo ratings yet

- India Professionals - 73685Document4,914 pagesIndia Professionals - 73685Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 88400Document3,930 pagesWorking Professionals - 88400Vignesh Krishnamoorthy0% (1)

- Working Professionals - 95742Document4,256 pagesWorking Professionals - 95742Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 79838Document3,550 pagesWorking Professionals - 79838Vignesh Krishnamoorthy0% (1)

- Working Professionals - 48792Document2,170 pagesWorking Professionals - 48792Vignesh KrishnamoorthyNo ratings yet

- Annual Report 2017-18 eDocument81 pagesAnnual Report 2017-18 eVignesh KrishnamoorthyNo ratings yet

- Working Professionals - 47090Document2,094 pagesWorking Professionals - 47090Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 9100Document406 pagesWorking Professionals - 9100Vignesh KrishnamoorthyNo ratings yet

- Tanstia AssociationsDocument21 pagesTanstia AssociationsVignesh KrishnamoorthyNo ratings yet

- Chennai Members Dairy 2014 2015Document82 pagesChennai Members Dairy 2014 2015Vignesh KrishnamoorthyNo ratings yet

- ATMA Tyres AssociationDocument10 pagesATMA Tyres AssociationVignesh KrishnamoorthyNo ratings yet

- Chennai Car Model NumbersDocument3 pagesChennai Car Model NumbersVignesh KrishnamoorthyNo ratings yet

- Membership - TanstiaDocument66 pagesMembership - Tanstiavgvppl50% (2)

Msme Segment

Msme Segment

Uploaded by

Vignesh Krishnamoorthy0 ratings0% found this document useful (0 votes)

40 views12 pagesThank you

Original Title

MSME SEGMENT

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThank you

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

40 views12 pagesMsme Segment

Msme Segment

Uploaded by

Vignesh KrishnamoorthyThank you

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 12

$

{

Moil fo: SSL Gravbdy Crancs

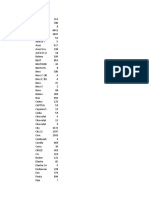

UNION BANK OF INDIA

FGMO CHENNAI Branch

[NATURE OF BUSINESS:

manufacturing of PLC

‘electrical panels, home ups

‘and industria! automation

JCONFIDENTE

aL.

‘SANCTION ADVICE

To,

GUINDY - SSI

‘-10/A, THIRU VIKA INDUSTRIAL ESTATE,

GGUINDY, CHENNAL, PIN =

CHE TW 600032

OCCUPATION: “As per

BSR CODES.

LocaTron: Metro

ORGANISATION: Private

Limited

Company

[AD

status:

MEANS/REPORTED | BORROWER'S SUN INDUSTRIAL AUTOMATION AND

|SECTORIAL/CATEGORY

Nerworri NAME: SOLUTIONS PvT LTD ee eeee ies

AMOUNT(RS.in [ADDRESS: O95, Devseped Po, Elecrore Indust

ete : eel a2 82 c2 oe

3) Etat, i henna,

sunt ytd oni woulewmas TTT ea tates

3 1156.99 : 7 a4 B64 C4 D4

MONTH oF

Jcuances necisrene> esto ‘CONSTITUTION femew_[SANeTtoNeD Bv

DATE AMOUNT(Re in Las) icc

osjo3/2018 _Pivate Limited Company _ August 2019

your rer

JOUR NO: SARAL/233/2018-19 DATED 31-07-2018 | DATE: 06/08/2018

No:ss26310001079

Dated:31/07/2018 SAOV: Sree: 384 Aid obfoPf20t@ as intacs)

iNew) jLIMIT(S) |SECURE |UNSECURE |MARGI |INT/COM (%) |DOCUMENT |SECURITY(GIV

Renewal/ ID ID IN (%) Is |E BRIEF EE

Modincatio loerans)

a

New |WCTL WORKING 78.00) 19.65% |sD-01, |Hypo of stocks: :

lcaprraL tL sos, _fenatos

s0-20, % ©

so-216),

}SD-23¢A),

s0-25,

Jana,

|AD-09(M),_

oo,

JAD-32,

ay

T oon

\ lunoeRAKIN

t [GS

new lcccenerat! 400.00 25% [Maui +4.40% /s0-01, | Hypothecation of

JStock }-1.00% ~~ |SD-21(G), | Stocks and BDs

50% Bos s0-2200,

' so,

‘ |AD-02(A),

: Jao-09069, a

\ Jao-10,

1 Jan-12,

jao-u,

1 [aon

lunoeracin

los

|+>Sub uimits \

New |USANCE BILL ; }(200.00) J25% MCLLY + 4.40% |SD-01, [Receivables

prscounTeD(io 100% |so21(@),

JR LC) |AD-02(A),_

7 lao-09400)

new fusoyuoee unpeR |¢400.00) 1036 [apptable main |so-01, Receivables

Lc oF PME 8 215% - |so2x@),

|AD-02(A),,

a0-05¢)

New luerteroF =, | 00.00 25% — |asaprcale _[s0-01, —_|ypethecation of

lcneorr mma Jn0-02, stocks purchased

loas20 vars | Janos, funder Lc,

: Jao-12 len on depost

| eid a margin

>>Sub Limits i Ee ee 7

New Jwrw import 1c |(200.00) 25% as aptcable —|s0-01, | ypothecation of

10-02, |stocs purchases

| Jao-04, funder Lc,

Ja0-12 —_|en on depose

| Jheld as margin:

ew luerrer oF 200.0 25% — fasapnicasle ~ |s0-01, | ypothecaton of

lcuaRaNTees, lao.02, stocks purchase

FC i; JAD-03, junder LG,

penronvance | Jose, fueron dest

lsecure> Jao-14, ree as margin

roar

I aa

i

<>

-20 > cena Tor oth fenin ge +

|contater

1

ral Security:

Factory land and Industral building situated at plot no.95 5.No 4 part Neelangaraiviage, Temberam Village,

Kancheepuram District, Developed Plots, Industral estate for electrical and electronics instrument industries,

perungucl, Chennai -€00 096 with an extent of 15565.20sq,(t standing in the name of M/s Sun industrial

‘Automation & Solutions.

MEANS

‘OF GUARANTOR(S) |Terms & Conditions:

Imeans|

(Rs.

hn

5 On

crores} NOTE:

{LIMITS SANCTIONED ARE SUBJECT TO ALL. GENERAL INSTRUCTIONS ADVISED FROM TIME

/o7} | |T0 TIME.

12.00

STARA 6/

[rows s 018 _| 2, OTHER TERMS & CONDITION/SPECIAL INSRUCTIONS AS PER ENCLOSED ANNEXURES.

6/

[ew fon

lor}

018

[PA No.

TOTAL haze

‘Authorised Signatory

on ar

——L

pri

opera aa Union Bank

ts star of india

tanh ee, ORAL OFEE CEN

bate %8

soonest

stncrd Tere Canin or TUE and come

ETAL OF LIT WT MARGNANTERETSECUREY

‘The limits are sanctioned on the following terms and conditions unless otherwise approved

{CONDITIONS PRECEDENT TO DISBURSEMENT :

4. KYC Compliance and Due Diligence

+ Branch to confirm that KYC norms have been complied with and due cfligence exercise carried

YO ‘out and report submitted before release of credit limits.

2, Site Visits

‘= Technical Officer/Bank Officials of bank to inspect the unit and his report be held on record

‘relating to technical feasibility and economic viability of the project.

© In case of existing limits, the report also to cover detail on project implementation and progress

of the project/unit.

Environmental clearances

‘© In case of industrial units, permission and clearances to be obtained from pollution control

board.

‘+ Necessary clearances to be obtained from industry department and local authorities as

applicable.

4. Documentation

3 ‘* Branch shall obtain the confidential report about the borrower from existing bankers and the

same should be found satisfactory before release of the facility.

Branch head to inspect the property and due diligence report and inspection report be kept on

record.

‘+ Branch to obtain latest valuation reports on the properties offered as collateral security from

our Bank’s.Panel Valuer 4 5

Security documents to be obtained from the borrower and guarantors.

Effective Mortgage to be created on the properties as per stipulation after obtaining search

report for 30 years & non-encumbrance certificate from empanelled advocate and valuation,

from empanelled valuer.

In case of companies/trust/societies, documents to be executed by-authorized persons as per

resolution. :

‘Common Seal of the company be affixed on the documents as per authorization.

© Certified copies of memorandum of association and articles of association of thescompany be

kept on record.

© The Borrower and the Guarantors shall furnish a consent letter to the Bank in the prescribed

format authorising the Bank for disclosure of their names, in the event of the Borrower

becoming defaulter, to CIBIL or other agencies as per RBI guidelines.

In case of company, the borrower and the guarantors shall submit an undertaking that no

consideration whether it be by way of commission, fee, brokerage or in any other form shall be

paid by the formet or received by the latter either directly or indirectly in regard to the

personal guarantee furnished by directors of the borrower company.

‘* Fresh valuation of mortgaged property to be taken once in three years. In case of property

valued Rs.25.00 Grores and above, two valuations to be obtained and lower of the same to be

considered.

5. Warranties, undertaka 3s & guarantees to be made by the Borrower

© Borrower to subnitt undertaking as per annexure -lll

+ Share apptication!{noney to be converted into equity. Borrower to give undertaking giving

specific date by Which it is to be converted into equity.

+ Statutory dues, if hny, to be paid by borrower before disbursement of the loan.

+ Declaration to be dbtained from the borrower that the level of unsecured loans will be

‘maintained at thé existing level in the business on a long term basis during the currency of the

Bank's loan.

+ Personal Guarantdls of pariners/promoters/drectors/quarantors/onners of mortgaged

property to be sbtpined 2 per stipulation,

°

Creation of security interests and charge

‘+ Search to be conducted from ROC in case of companies for ascertaining the charges on its assets

and report to be held on records.

+ Our bank's charge-to be registered with ROC within 30 days of documentation for limits &

securities and certificates to be held on record.

© Our Charge with cpssal be registered on mortgaged properties.

Vetting

‘+ Security documents to be vetted by law officer/Bank’s advocate/Branch Head as per extant

guidelines,

8. CPA ( Credit Process Audit °

+ In case exposure ills.1.00 Crores or above, CPA (Credit Process Aut) to be conducted and

compliance of all pre-disbursement sanction stipulations be confirmed before disbursement.

\

‘ZInsurance '

» The borrower's assets offered as security (prime and collateral) for the facility to be kept fully

insured comprehensively for 110% of assets value. A copy of the policy to be submitted to the

bank. A list of the current insurance policies alongwith copies thereof to be submitted to the

bank detailing therpin the names and adresses of the insurer, brief particulars of goods

covered, type of ever, amount of caver and date of expiry of exch otiy. Insurance polices to

contain the agreed bank's clause.

10. Tie up for Equity

*+ Borrower to demonstrate to the bank that satisfactory arrangements have been made for tie-up

by way of equity fe rm the promoters / private equity players / strategic investors / other

investors/ internal/pccruals.

eee

‘+ Borrower to submit satisfactory evidence viz. quotation/ proforma invoice for assets to be

purchased/created with Bank finance.

+ Borrower to demonstrate the availability and sufficiency of raw material to the satisfaction of

the bank required for smooth running of the plant

The disbursement to be made alongwith stipulated margin by way of demand draft/pay

order/RTGS/NEFT directly to the suppliers of goods and services.

+ Branch to obtain copies of original blls/cash memos, certified by promoters in respect of all

fixed assets/machinery items financed with bank loan, for records.

+ The loan to be released in stages depending upon the progress of the work.

= Ateach stage, the branch officials to carry out the inspection and verify the actual procurement

of assets.

«CA certificate to be obtained regarding equity contribution and end use of bank finance on each

stage of disbursement where loan is above Rs. 50 Lacs.

‘© Final post disbursement inspection to be conducted for physical verification of assets and report

be prepared and held on records on complete disbursement of loan.

‘Commitment Charges In case of limits of Rs. 5 crore and above, the borrower shall pay

commitment fee at 0.50% p.a. if average utilization is less than 75%, Branch to follow the extant,

guidelines,

S.CONDITIONS SUCCEEDING DISBURSEMENT.

* Compliance Certificate

© Branch to submit compliance certificate for having complied with all the terms of

sanction to controlling office within 10 days from the date of release of the credit limits

©. The borrower to display a board in prominent place in the project/office premises

indicating that the assets/ stocks are hypothecated to bank,

+ Interest Servicing

‘© Interest will be charged on monthly rests and is to be serviced as and when charged in

the account.

© Incase the borrower pays higher rate of interest/charges/commission to any other

financing bank/Fl in the consortium, the same shall be patd to our Bank also, All other

terms and conditions stipulated by other financing banks/Fls shall also apply “mutates

mutandis” for our share of credit facilities. Branch to obtain the copies of sanction

letters from other Banks in the consortium for comparison of sanction terms

© Interest as stipulated will be / will continue to be charged with monthly rests. The bank

reserves the right to give notice at any time and theréaifter to charge such other rate of

interest as the Bank may decide depending upon revised credit rating of the borrower

based on its audited annual balance sheet.

‘© Interest, Commission and other charges are subject to variation as may be notified by

‘our Bank from time to time.

4.REPAYMENT OF TERM LOAN

1. Project must achieve COD as projected.

2. Moratorium of months will be allowed from first disbursement.

3. Term loan to be repaid by the borrower in

interest. First installment to fall due on

monthly/quarterly instatlemts alongwith

(date/month/year).

+ The Borrower shal submit the monthly stock and book debt statement, to the Bank by 15th of

subsequent month. The delay in submission of Stock Statement attracts penal interest.@2% over

‘and above the interest rate charged.

The stock and book debt statement shall contain the full details of stocks, debtors (agewise),

creditors (actuat level) acceptances & details of usance LCs opened and insurance details, as on

date of stock stat

‘The book debt statement shall indicate the debts outstanding up to 90 days and above for

different stabs separately. Book debts statement to be certified by C.A once in every six months.

‘The outstanding borrowings at alt times be fully covered by the drawing power based on monthly

Stock and Book Debts Statement. ifat any time, the drawing power falls below the amount

borrowed, the Boryower shall forthwith adjust such excess borrowings.

Letter of no tien atid free access be obtained from the owner of premises in case the goods are

pacsianaltatie ©

Yearly stock audit Will be conducted by outside qualified chartered accountants as per bank's

decision and the expenses be borne by the borrower, in case of limit of Rs. 1.00 Crores and

above for proprietolship concern and Rs. 2.00 crores and above for partnership/companies.

Basis of Valuation of Stock

Raw materials, Po aay spares at cost price or market price or Govt. controlled rate, invoice

rate; whichever is

+ Stock-in-process at conversion cost plus raw material cost or realizable value; whichever is

lower. A

+ Finished goods at cost of sale, invoice price or market price / export prices; whichever is the

lowest. :

+ Book Debts: At “ value

3.Drawing Power

‘+ DP to be allowed against paid up stock and eligible book debts. O°

‘© Book debts for more'than 90 days will not be considered for the purpose of DP. Book debts more

than 90 days/unpaid stocks will continue to be the part of the prime security. The stock under

D.A.LC shall not be réckoned for arriving drawing power. The creditors/ acceptance(unpald

stock) shatl be reduc while arriving at drawing power.

© Drawing power octet by lead bank to be ascertained monthly in case of consortium advance.

4.End use of funds

‘+ Cash credit limit to be utilized only for working capital purpose for genuine business

vena ile pry Ss

‘+ No diversion of fundslto be allowed for non business transactions or creation of fixed assets,

'* Branch to ensure proper end use of funds.

‘CASH CREDIT- GENERAL

1, Commitment Charges

In case of limits of RS. 5 crore and above, the borrower shall pay commitment fee at 0.50%

p.a. if average utilization is less than 75%. Branch to follow the extant guidelines.

2. Intra group transfers,not to be allowed untess and until i s 2 genuine trade transaction in

which the borrower deals.

No excess over limits to be allowed

Borrower under sole Banking to exclusively Bank with us and shall submit an undertaking to

this effect.

Borrower to maintain adequate books of accounts which should correctly reflect tts financial

position & scale of operations and not to radically change fts accounting system without prior

notice to the Bank.

Penal interest @1% p.a each wilt be charged on each of the following default. Maximum penal

interest not to exceed 28.

‘+ Delayed submission of CMA/Renewal data for the perfod beyond 1 month from due

date.

+ Non compliance of term of sanction.

In following cases the penal interest will be 28 p.a.

‘© Non submission/delayed submission of QPR

Non submission of audited balance sheet of previous financial year by 14th

November,

‘+ Excess over limit/drawing power.

‘© Non submission of stock and book debt statement before 15th of next month.

7. OPERATION OF - EXPORT ADVANCE (EPC/PCFC/FDBP/FUDBP/FDBD Facil) :

1

9%.

10.

Tenor

© PC + maximum tenor of 180 days unless otherwise permitted,

© Usance Bills - Maximum tenor of 180 days unless otherwise permitted.

‘Advances to be covered under WTPCG and WTPSCG

2) All the norms of ECGC to be followed.

b) Limits sanctioned to be notified to ECGC.

¢) Payment of fee be made to ECGC regularly and in time.

6) ECGC fees for PC limits be recovered from the borrower.

‘The Borrower shall submit a statement of stocks relating to the export orders at monthly

intervals.

Bills drawn on sister / associate concerns will not be accepted for purchase / negotiation /

dicount.

The Bank to call for opinion report on drawees from Dun and Bradstreet or any other such

agency. The Borrower shall bear / incur the cost in such cases.

Bills drawn on sister / associate concems will not be accepted for purchase / negotiation /

discount,

In case the Borrower is not able to liquidate the packing credit drawals within 180 days,

interest rate at general rate plus penal rate of interest will be charged unless otherwise

permitted,

Bills presented/ discounted should represent bonafide / genuine trade transactions.

Documents to the title of goods are to be drawn in the name of the Bank.

Drawing power in the packing credit account will be permitted to the FOB value of the export

corders/contracts or letter of credit deposited with the Bank less our stipulated margin

subject however to the condition that the outstanding in the export packing credit accounts

11

2

13,

14,

15.

16.

17.

18,

9. OPERATION OF - LETTER OF GYARANTEE :

1

|

H

i

are fully covered by the advances for stock/value of stocks less stipulated margin.

Forward exchange cover in respect of export transactions will be booked by the Borrower.

‘ny advance-sayment-received by the Borrower in respect of the export contracts/orders

financed by us will be credited by the Borrower to EPC account and the DP wili be reduced!

suitably.

As per available DP, packing credit funds will be transferred to the Borrower's operative

current/Cash tredit account for utilization and meeting working capital needs for exports.

Funds will be ttilised for the purpose for which the PC is sanctioned. The proceeds of the

bills negotiated, however, will be credited to the EPC account,

Bills negotiated/purchased will be crystallised by us in the event of non- realisation of the

‘within 30 days from the expiry period of the transit period/due date. The foreign

‘currency amount of the bills will be converted into rupees on the 30th day at the prevailing

ready TT selting rate and the transaction will be treated as ready sale.

Foreign exchange business will be routed, through our bank's branch on proportionate basis.

The documents|lill be sent for realisation only through the Bank's correspondents .

In case of overdye bills, the full amount of the bills wil be recovered and the interest

thereon will be charged at normal rate of interest prevailing at that time for the full period.

Other terms and conditions as applicable to CC facility will be applicable.

8. OPERATION OF IMPORT/INLAND LETTER OF CREDIT :

1

The goods procured under DA LCs shall be released to the borrower on execution of trust

document in favoyy of the bank.

‘The borrower shall furnish an undertaking to provide funds for payment of the ills under the

C3 on the due dates from their own sources. Funds in cash credit can be utilised for the

purpose subject to availability of limit and drawing power.

The borrower shall indicate separately the stocks covered by DA bills in the monthly stock.

statement for cash credit typothecation facility and such stocks shall not be included for the

purpose of computing drawing power til the relative bills are patd.

Import letters of credit to be established against valid import only.

Al the import trade, exchange control regulations/ FEMA stipulations/ RBI guidelines to be

complied with.

LCs shall not be estbished in favour of associate/group concerns.

Counter Indemnity £0 be obtained from borrower.

Duly discharged FORE for margin along with letter of lien be kept on Bank record and lien be

noted for the FDRs fy Bank's Books.

Branch should ensur® that there should not be any onerous clause in the LG Proforma.

ur usval limitation clause be added at the end of LG.

Party to submit satistactory performance report from the beneficfary before

renewing/extendinglthe guarantee letter.

410, CREDIT MONITORING

Branch/RO to monitor the account regularly. ;

Periodic inspection to be carried out by the branch officials to satisfy themselves about end use

9°

8

of funds and to ensure project implementation as per schedule and hold report on record. Alert

tobe exercised and corrective measures be taken immediately in situations where progress is.

not as planned or any misuse of funds is noticed.

Quarterly technical and financial progress reports to be submitted by the borrower to bank until

the completion of the Project.

Borrower to submit the audited annual financial statements at the end of the Financial Year

during the currency of the loan, but not later than 15th Nov every year.

Branch to carry out periodic inspection of securities regularly and submit report to the

controlling office. Q-4 Godown inspection report must be submitted on quarterly basis.

Party to submit QPR (Quarterly Progress Report) as per schedule where limit is Rs. 1 crore or

more. Non-submission will attract penal rate @ 2% p.a.

Branch to submit MMR as per bank's guidelines to the respective authority.

© External credit rating to be obtained annually from accredited Rating Agency viz CRISIL,

ICRA, CARE or FITCH where exposure is Rs. 5 crore and above.

Yearly Debit Balance Confirmation to be obtained.

© Branch to carry out necessary action to rectify the Audit irregularities and send

confirmation to controlling office.

Yearly review of the credit facilities to be carried out and borrower to submit all requisite

Papers one month in advance

Financial covenants and testing

DER following any disbursement to not exceed the Project DER.

‘The financial covenants shall be tested on an annual basis from the financial year in which the

principal repayment commences. It should be ensured that FACR/DER/CR/TOL to TNW/DSCR are

maintained as projected.

114, DEFAULT AND RECOVERY

‘epayments of Term Loan

‘The Borrower shall have the option to prepay the Facility in part or full within 30 days after

each Reset Date(s) without payment of prepayment premium. Such prepayment shall be made

by giving an irrevocable notice within 15 business days after each Reset Date.

Prepayment charges of 1% p.a shall be applicable in case the prepayment is done on any other,

dates.

Prepayment penalty will also be payable @ 1% in case the borrower prepays the debt by way of

funds other than fresh equity or internal accruals.

vents of Default (EOD)

Each of the following events shall, inter alia, constitute an Event of Default

Failure by the Borrower to pay any amount due and payable to banks e.g installment of term

‘oan, servicing of interest on term loan/working capital limit.

Delay in achieving commercial operations beyond the estimated COD

‘The borrower ceasing or threatening to cease to carry on its business

Non compliance of any term or condition stipulated by bank.

ences of EOD

Upon the occurrencejand continuance of an EOD, all amounts outstanding under the facility shall be

immediately due ang payable and the Bank may:

+ Impose pendity @ 1% p.a on each default subject to maximum penalty of 2% over and above

the stipulateld interest rate on entire toan amount for the period of default.

+ Exercise povlers to recall the advance and take recovery action including action under the

SARFAESI Act 2002

* Suspend of terminate all undravwn commitments and enforce the Security

+ dom of ofthe deta

4.The Bank also reserves the absolute right to recall the advance in case of:

+ Limits not bing utilized by borrower, misutilised or,

© Deterioratiod in the loan accounts in any manner whatsoever, and/or

+ Non-compttahce of terms and conditions of sanction

+ Continuous jxcess in the cash credit/other working capita limits

‘© Unsatisfactory operations in the account

12. ACCEPTANCE OF TERMS AND CONDITIONS BY BORROWER,

© Borrower td Teturn a copy of the Terms and Conditions duly signed by authorized signatory in

token of haflng accepted the stipulations of sanction.

1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Form Spice Moa (Inc-33) - 30082017Document1 pageForm Spice Moa (Inc-33) - 30082017Vignesh KrishnamoorthyNo ratings yet

- Saaral Information DeckDocument23 pagesSaaral Information DeckVignesh KrishnamoorthyNo ratings yet

- NCT 10470634Document3 pagesNCT 10470634Vignesh KrishnamoorthyNo ratings yet

- NCT 10456642Document1 pageNCT 10456642Vignesh KrishnamoorthyNo ratings yet

- Linked Execution Report - RPTDocument930 pagesLinked Execution Report - RPTVignesh KrishnamoorthyNo ratings yet

- CompReg 7AUGUST2022Document2,133 pagesCompReg 7AUGUST2022Vignesh KrishnamoorthyNo ratings yet

- India Professionals - 120141Document8,010 pagesIndia Professionals - 120141Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 47095Document3,141 pagesWorking Professionals - 47095Vignesh KrishnamoorthyNo ratings yet

- Time Management Handbook For EntrepreneursDocument6 pagesTime Management Handbook For EntrepreneursVignesh KrishnamoorthyNo ratings yet

- Working Professionals - 98444Document4,376 pagesWorking Professionals - 98444Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 95790Document4,258 pagesWorking Professionals - 95790Vignesh KrishnamoorthyNo ratings yet

- T.Nagar StreetsDocument14 pagesT.Nagar StreetsVignesh KrishnamoorthyNo ratings yet

- India Professionals - 100296Document6,687 pagesIndia Professionals - 100296Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 96948Document4,310 pagesWorking Professionals - 96948Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 98452Document4,376 pagesWorking Professionals - 98452Vignesh KrishnamoorthyNo ratings yet

- India Professionals - 73685Document4,914 pagesIndia Professionals - 73685Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 88400Document3,930 pagesWorking Professionals - 88400Vignesh Krishnamoorthy0% (1)

- Working Professionals - 95742Document4,256 pagesWorking Professionals - 95742Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 79838Document3,550 pagesWorking Professionals - 79838Vignesh Krishnamoorthy0% (1)

- Working Professionals - 48792Document2,170 pagesWorking Professionals - 48792Vignesh KrishnamoorthyNo ratings yet

- Annual Report 2017-18 eDocument81 pagesAnnual Report 2017-18 eVignesh KrishnamoorthyNo ratings yet

- Working Professionals - 47090Document2,094 pagesWorking Professionals - 47090Vignesh KrishnamoorthyNo ratings yet

- Working Professionals - 9100Document406 pagesWorking Professionals - 9100Vignesh KrishnamoorthyNo ratings yet

- Tanstia AssociationsDocument21 pagesTanstia AssociationsVignesh KrishnamoorthyNo ratings yet

- Chennai Members Dairy 2014 2015Document82 pagesChennai Members Dairy 2014 2015Vignesh KrishnamoorthyNo ratings yet

- ATMA Tyres AssociationDocument10 pagesATMA Tyres AssociationVignesh KrishnamoorthyNo ratings yet

- Chennai Car Model NumbersDocument3 pagesChennai Car Model NumbersVignesh KrishnamoorthyNo ratings yet

- Membership - TanstiaDocument66 pagesMembership - Tanstiavgvppl50% (2)