Professional Documents

Culture Documents

2018 Q3 Earning Presentation Final

2018 Q3 Earning Presentation Final

Uploaded by

qosaiKDCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Syllabus: Project Management (EM 550) Term 191Document4 pagesSyllabus: Project Management (EM 550) Term 191qosaiKD0% (1)

- ISE - Quiz 1Document1 pageISE - Quiz 1qosaiKDNo ratings yet

- Student Clearance - Kfupm - Edu.saDocument1 pageStudent Clearance - Kfupm - Edu.saqosaiKDNo ratings yet

- ISE 529 - Quiz 1Document1 pageISE 529 - Quiz 1qosaiKDNo ratings yet

- CRP 534 Housing PoliciesDocument3 pagesCRP 534 Housing PoliciesqosaiKDNo ratings yet

- Almarai AR2017 ENG WebDocument156 pagesAlmarai AR2017 ENG WebqosaiKDNo ratings yet

- Marai EngDocument135 pagesMarai EngqosaiKDNo ratings yet

- Rubric For Individual AssignmentDocument3 pagesRubric For Individual AssignmentqosaiKDNo ratings yet

- DST Computation Attempt ReviewDocument4 pagesDST Computation Attempt Reviewella angelicalNo ratings yet

- Raymond AR 2020Document236 pagesRaymond AR 2020Ajay SinghNo ratings yet

- Receipt - 2 - 6 - 2024 12 - 00 - 00 AMDocument1 pageReceipt - 2 - 6 - 2024 12 - 00 - 00 AMak978420No ratings yet

- Monthly Portfolios For Apr 2019 - 0Document498 pagesMonthly Portfolios For Apr 2019 - 0RASHMIN GADHIYANo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyANISH KUMARNo ratings yet

- MP 14 Project Procurement Management 2020Document68 pagesMP 14 Project Procurement Management 2020wulanpipi9No ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Demonetization FinalDocument10 pagesDemonetization FinalShivani JadhavNo ratings yet

- Commercial Law Review QuizDocument2 pagesCommercial Law Review QuizPaul Dean MarkNo ratings yet

- Afar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesDocument31 pagesAfar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesMitch MinglanaNo ratings yet

- Finance 1 Assignment 2Document5 pagesFinance 1 Assignment 2lordNo ratings yet

- SUPERSTORE Social BusinessDocument52 pagesSUPERSTORE Social Businessjisanus5salehinNo ratings yet

- Pink GurlzDocument423 pagesPink Gurlzmygurlz1991No ratings yet

- Economics Project: Role of Rbi in Control of CreditDocument35 pagesEconomics Project: Role of Rbi in Control of CreditDhairya Tamta78% (18)

- Comparative Analysis of Mutual FundsDocument222 pagesComparative Analysis of Mutual Fundsmrinal_ms85% (27)

- Auditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions ManualDocument16 pagesAuditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions Manualterrysmithnoejaxfwbz100% (14)

- CONDITIONALS: Put The Verb in Brackets Into The Correct FormDocument1 pageCONDITIONALS: Put The Verb in Brackets Into The Correct FormLacassiapeiaNo ratings yet

- Road Development Agency.: Accounts Payable AccountantDocument6 pagesRoad Development Agency.: Accounts Payable AccountantNdokwaNo ratings yet

- Evaluation of Ethical Mutual FundDocument22 pagesEvaluation of Ethical Mutual Fundvineethkmenon100% (1)

- Bond YieldsDocument27 pagesBond YieldsSagar TanejaNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFJayesh ChandNo ratings yet

- Top 5-ITReFiling Companies IndiaDocument5 pagesTop 5-ITReFiling Companies IndiaLolitambika NeumannNo ratings yet

- International AccountingDocument118 pagesInternational AccountingThao ViNo ratings yet

- Aluminium - Extrusion - Ind - PLC Corporate - Actions - AnnounDocument1 pageAluminium - Extrusion - Ind - PLC Corporate - Actions - AnnounMouhammad BATHILYNo ratings yet

- Introduction To ACFI2070: Readings: Chapter 1, Peirson Et Al. 2015Document31 pagesIntroduction To ACFI2070: Readings: Chapter 1, Peirson Et Al. 2015ViviNo ratings yet

- Bank of Baroda Po Exam 30-05-2010 Question PaperDocument16 pagesBank of Baroda Po Exam 30-05-2010 Question PaperAshwinReaderNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Sno Name of The Fund Sector Seed / Early / GrowthDocument6 pagesSno Name of The Fund Sector Seed / Early / GrowthamandeepNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

2018 Q3 Earning Presentation Final

2018 Q3 Earning Presentation Final

Uploaded by

qosaiKDCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 Q3 Earning Presentation Final

2018 Q3 Earning Presentation Final

Uploaded by

qosaiKDCopyright:

Available Formats

Almarai Company

Interim Results – 3rd Quarter 2018

Disclaimer

Information contained in this presentation is subject to change without further notice, its accuracy is not

guaranteed and it may not contain all material information concerning the company. Neither we nor our

advisors make any representation regarding, and assume no responsibility or liability for, the accuracy or

completeness of, or any errors or omissions in, to any information contained herein.

In addition, the information contains projections and forward-looking statements that reflect the company’s

current views with respect to future events and financial performance. These views are based on current

assumptions which are subject to various risks and may change over time. No assurance can be given that

future events will occur, that projections will be achieved, or that the company’s assumptions are correct.

Actual results may differ materially from those projected.

This presentation is strictly not to be distributed without the explicit consent of Almarai Company

management under any circumstances.

Almarai Company 2018 Q3 Earnings Presentation 2

Macro Environment

Main Events Q3, 2018

• Growth in the quarter remained relatively flattish compared to the corresponding quarter due to contraction in the overall market

and change in demographics

• Market continues to be impacted by multiple reforms and macroeconomic changes

• Good progress made against the strategic objectives set out in Almarai 2025

• On target for breakeven for infant nutrition segment by end of fiscal year 2018

• On track for 100% importation of alfalfa feed from 4th November 2018

• Continued cost optimization and efficiency projected to achieve SAR 200M savings for 2018 in response to a higher cost

environment

• Notably strong performance in the Poultry Segment

• Positive Free Cash Flow of SAR 425 million, a decrease of SAR 179 million due to feed stock build up to be ready for green fodder

production ban in KSA on 4th November 2018

• Increase in the price of milk by 5% on July 2nd 2018, the first price increase in ten years. Price increases were made to offset higher

costs impact as describe above

• The company continues strong product innovation and significant transformational efforts to offset this downward trending

pressure by introducing a value added brand known as Albashyer which now includes frozen chicken, mozzarella and feta

cheeses. The company will expand this value added category going forward which will serve the food service and retail sectors.

• The company managed to gain and maintain GCC market share in most categories. Within the regions we operate, it’s worth

highlighting, the company has consistent gain in market share in Egypt.

Almarai Company 2018 Q3 Earnings Presentation 4

Almarai Gaining Market Share Despite Declining KSA Dairy and

Food Market

MAT Category Almarai MAT Value Almarai Rank • Almost all of the Dairy and Foods categories are

Growth (Value) % Share Change (Value) declining in KSA in MAT August 2018 compared to

PLAIN REGULAR LABAN -4.6% +0.7 1

MAT August 2017.

PLAIN FRESH MILK -5.0% +0.8 1

FLAVORED FRESH MILK -32.7% +3.7 1

UHT MILK -2.8% +2.4 2 • Despite the categories decline, Almarai gained

ZABADI -4.0% -0.4 1 share in most of the categories in KSA on MAT

FRESH GISHTA -11.2% +2.5 1 basis.

FRUIT JUICE BOTTLES -16.1% +4.7 1

BUTTER +1.8% -1.2 1

CHEESE JARS -2.3% -2.2 1

• Most of the categories, Almarai stands at #1 position

CHEESE SLICES -4.4% +2.6 1

in the KSA market.

CHEESE TRIANGLES -4.6% +6.7 2

FETA CHEESE -7.8% +2.6 1

TOTAL WHIP & COOKG CREAM +13.9% -2.9 1

SLICED BREAD -10.9% -4.5 1

PUFFS -5.7% +1.2 1

CROISSANTS -0.8% +1.8 1

CUP CAKES -4.9% -0.8 1

WHOLE CHICKEN (FRESH) -8.7% -4.1 1

Source: Nielsen Company MAT Aug 18

Almarai Company 2018 Q3 Earnings Presentation 5

Business Highlights

Highlights

Revenue Operating Income

3.80 3.73 1.00 0.76

0.78 0.76

3.60 3.42

SAR in Billion

3.37 0.60

SAR in Billion

3.37 0.48

3.40 3.23

0.50

3.20

3.00

2.80 -

Q3, 2017 Q4, 2017 Q1, 2018 Q2, 2018 Q3, 2018 Q3, 2017 Q4, 2017 Q1, 2018 Q2, 2018 Q3, 2018

2013 Last 5 Quarters Last 5 Quarters

SAR 11.2 B +12.4%

Free Cash Flow

0.80 0.70

0.60 0.42

SAR in Billion

0.37

0.40

0.20 0.06 (0.00)

-

(0.20) Q3, 2017 Q4, 2017 Q1, 2018 Q2, 2018 Q3, 2018

Last 5 Quarters

Profit Attributable to Shareholders Employees

0.80

0.67 0.66 0.63 44 43.2 43.0

0.51 42.7

SAR in Billion

0.60 42.6

In Thousand

43

0.34 42.3

0.40 43

0.20 42

- 42

Q3, 2017 Q4, 2017 Q1, 2018 Q2, 2018 Q3, 2018 Q3, 2017 Q4, 2017 Q1, 2018 Q2, 2018 Q3, 2018

Last 5 Quarters Last 5 Quarters

Almarai Company 2018 Q3 Earnings Presentation 7

Revenue Breakdown

Revenue Analysis by Product – YTD Q3, 2018

By Product 2017 By Product 2018

-1% +3%

Poultry Poultry

Bakery Bakery +1%

1,072 1,314

1,340 1,262 13%

Cheese, 10% Other Sales Other Sales

13% 12%

Butter & 119 Cheese, 164

Cream 1% Butter & 2%

=

1,497 Cream

14% 1,480

SAR 10,517 14% SAR 10,334

Fruit Juice Million Million

1,234 Fruit Juice Fresh Dairy

Fresh Dairy 3,957

12% 1,176

4,364 38%

Long-Life 11% Long-Life

42% -1% -4%

Dairy Dairy

889 982

8% 10%

+2%

Almarai Company 2018 Q3 Earnings Presentation 9

Revenue Analysis by Product – YTD Q3, 2018 Growth Co nt rib ut io n o f

Net Sales in SAR Million SAR in Million To t al % Gro wt h

2018 vs 2017

10,517 10,334 Fresh Dairy (407) (4%)

( YoY -9.3%)

Cheese, Butter & Cream (18) (0%)

( YoY -1.2%)

42% 38%

Bakery (78) (1%)

( YoY -5.8%)

Poultry 242 2%

14% ( YoY +22.5%)

14%

Fruit Juice (59) (1%)

12% ( YoY -4.7%)

13%

13% Long Life Dairy 93 1%

10% ( YoY +10.4%)

12% 11%

Other Sales 45 0%

( YoY +37.3%)

8% 10%

1% 2% Total (183) (2%)

YTD Q3 2017 YTD Q3 2018 ( YoY-1.7%)

Almarai Company 2018 Q3 Earnings Presentation 10

Revenue Analysis by Country – YTD Q3, 2018

By Geography 2017 By Geography 2018

Jordan

218 Bahrain = = +1%

Bahrain

Kuwait Jordan 250

Egypt 2% 233

Oman 530 Qatar Oman Egypt 209

554 5% 326

467 2% Export / = 555

Kuwait 577 2%

2% Export /

Others

5% 3%

5% Others

163 UAE

5%

509 6% == = 192

UAE 2%

2% 1,039 5%

1,039

10%

10%

SAR 10,517 SAR 10,334

Million Million

KSA KSA

6,987 7,003

66% 68%

+2%

Almarai Company 2018 Q3 Earnings Presentation 11

Revenue Analysis by Country – YTD Q3, 2018 Growth Co nt rib ut io n o f

Net Sales in SAR Million SAR in Million 2018 vs 2017 To t al % Gro wt h

KSA 16 0%

10,517 10,334 ( YoY +0.2%)

UAE 0 0%

( YoY +0.0%)

Oman 2 0%

( YoY +0.3%)

Kuwait (20) (0%)

66% 68% ( YoY -3.9%)

Egypt 110 1%

( YoY +23.5%)

Qatar (326) (3%)

( YoY -100%)

Bahrain 17 0%

10% 10% ( Yoy +7.1%)

5% 5% Jordan (9) (0%)

5% 5% ( YoY -4.2%)

5% 6%

3% 2% Others 28 0%

2% 2% 2%

2% 2% ( YoY +17.3%)

YTD Q3 2017 YTD Q3 2018 Total (183) (2%)

( YoY -1.7%)

Almarai Company 2018 Q3 Earnings Presentation 12

Innovation Pipeline Q3, 2018

Almarai Company 2018 Q3 Earnings Presentation 13

Financial Highlights

Operating Performance – YTD Q3, 2018

Gross Profit Operating Income Profit Attributable to

Shareholders

% to Sales 40.4% 40.7% 0.3 pp 18.9% 19.3% 0.4 pp 15.9% 15.9% 0.0 pp

SAR Million SAR Million

SAR Million

4,248 4,211

1,985 1,995

1,669 1,639

-38 +11

-0.9% +0.5% -30

-1.8%

YTD Q3, 2017 YTD Q3, 2018 YTD Q3, 2017 YTD Q3, 2018 YTD Q3, 2017 YTD Q3, 2018

Almarai Company 2018 Q3 Earnings Presentation 15

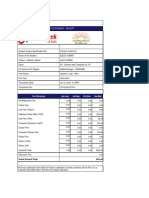

Statement of Income – 9 months and Q3, 2018

3rd Quarter YTD 3rd Quarter

SAR million

2017 2018 Change 2017 2018 Change

Revenue 3,373 10 0 .0 % 3,371 10 0 .0 % (0.1%) 10,517 10 0 .0 % 10,334 10 0 .0 % (1.7%)

Cost of sales (1,857) (55.1%) (1,919) (56.9%) (3.3%) (6,268) (59.6%) (6,123) (59.3%) 2.3%

Gross Profit 1,516 4 4 .9 % 1,452 4 3.1% (4.2%) 4,248 4 0 .4 % 4,211 4 0 .7% (0.9%)

Selling and Distribution Expenses (600) (17.8%) (596) (17.7%) 0.8% (1,810) (17.2%) (1,813) (17.5%) (0.1%)

General and Administration Expenses (81) (2.4%) (79) (2.4%) 2.5% (304) (2.9%) (275) (2.7%) 9.6%

Other Expense, net (40) (1.2%) (46) (1.4%) (14.1%) (123) (1.2%) (124) (1.2%) (1.2%)

Impairment (Reversal) / Loss on Financial Assets (18) (0.5%) 24 0.7% n.a (26) (0.3%) (3) (0.0%) 88.2%

Operating Income 776 23.0 % 755 22.4 % (2.6%) 1,985 18 .9 % 1,995 19 .3% 0.5%

Exchange Gain / (Loss) (1) (0.0%) (5) (0.1%) (466.2%) 11 0.1% 2 0.0% (76.8%)

Finance Costs - net (97) (2.9%) (94) (2.8%) 3.1% (296) (2.8%) (284) (2.7%) 4.0%

Share of Results of Associates and Joint Ventures 6 0.2% 1 0.0% (81.2%) 4 0.0% (6) (0.1%) n.a

Profit Before Zakat and Income Tax 683 20 .3% 657 19 .5% (3.8%) 1,703 16 .2% 1,707 16 .5% 0.3%

Zakat and Foreign IncomeTax (18) (0.5%) (16) (0.5%) 9.4% (51) (0.5%) (65) (0.6%) (25.9%)

Profit for the Period 665 19 .7% 641 19 .0 % (3.7%) 1,652 15.7% 1,643 15.9 % (0.5%)

Profit Attributable to Non Controlling Interest 2 0.1% (6) (0.2%) n.a 18 0.2% (4) (0.0%) n.a

Profit Attributable to Shareholders 667 19 .8 % 634 18 .8 % (4.9%) 1,669 15.9 % 1,639 15.9 % (1.8%)

Earnings Per Share (Basic) 0.66 0.62 (5.2%) 1.63 1.60 (1.9%)

Profit Attributable to Shareholders % 19.8% 18.8% 15.9% 15.9%

Almarai Company 2018 Q3 Earnings Presentation 16

Segment Reporting – 9 months and Q3, 2018

Almarai

SAR Million Dairy & Juice Bakery Poultry Other Activities

Consolidated

Q3 YTD 2018

Revenue 7,594 1,262 1,314 164 10,334

Depreciation and Amortisation (948) (189) (267) (142) (1,546)

Profit Attributable to Shareholders 1,352 146 144 (2) 1,639

Percent to Revenue of Profit Attributable to Shareholders 17.8% 11.6% 10.9% (1.3%) 15.9%

Total Assets 20,449 2,440 5,574 3,416 31,880

Growth versus YTD Q3, 2017

- Revenue - 2017 7,985 1,340 1,072 119 10,517

- Revenue Growth (4.9%) (5.8%) 22.5% 37.3% (1.7%)

- Profit Attributable to Shareholders - 2017 1,551 221 (42) (60) 1,669

- Profit Attributable to Shareholders Growth (12.8%) (33.9%) n.a 96.4% (1.8%)

Q3 2018

Revenue 2,431 435 457 49 3,371

Profit Attributable to Shareholders 525 59 52 (1) 634

Percent to Revenue of Profit Attributable to Shareholders 21.6% 13.6% 11.3% (1.2%) 18.8%

Growth versus Q3, 2017

- Revenue - 2017 2,570 437 328 38 3,373

- Revenue Growth (5.4%) (0.5%) 39.1% 28.9% (0.1%)

- Profit Attributable to Shareholders - 2017 613 68 (7) (8) 667

- Profit Attributable to Shareholders Growth (14.5%) (13.8%) n.a 92.6% (4.9%)

Almarai Company 2018 Q3 Earnings Presentation 17

Net Income by Segment (9 Months)

Basic EPS* (SAR) 1.63 1.60

1,800

1,669 (199)

58 1,639

186

1,600

SAR Million (75)

1,400

1,200

1,000

YTD Q3, 2017 Dairy & Juice Bakery Poultry Other YTD Q3, 2018

Revenue Growth (4.9%) (5.8%) 22.5% 37.3% (1.7%)

Net Income Growth (12.8%) (33.9%) n.a. 96.4% (1.8%)

Net Income % 17.8% 11.6% 10.9% (1.3%) 15.9%

Q1 Net Income 328 (62) (27) 55 50 344 +16

Q2 Net Income 674 (48) (38) 73 (0) 661 (14)

Q3 Net Income 667 (89) (9) 58 7 634 (33)

*EPS – Earnings Per Share

Almarai Company 2018 Q3 Earnings Presentation 18

Investing Cash Flows continue the downward trend in line with

revised 5 year Business Plan

CAPEX spend for the 3rd Quarter Year to Date 2018 was SAR 1.4 Billion.

• Manufacturing and Farming spent CAPEX of SAR ~0.6 Billion for various capacity expansion projects.

• Sales Depot, Poultry and Logistics expansion accounted for SAR ~0.4 Billion.

• Replacement and other CAPEX including IDJ accounted for another SAR ~0.4 Billion.

6,000

45%

50 %

39%

40 %

5,000 29% 32% 33%

31% 32%

30%

33% 25%

30 %

4,900 24%

29% 4,409 19%

4,000

20 %

SAR in Millions

3,575

3,000 3,284 3,302 3,312 10 %

3,115

2,567 0%

2,000

2,189

1,711

-10%

1,488 1,572

1,000

-20 %

824

- -30 %

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Last 12

Months

Net Cash Used in Investing Activities Investment as a % of Net Sales

Almarai Company 2018 Q3 Earnings Presentation 19

Cash Flow Bridge – Rolling 12 Months

YTD Q3,2018 Free Cash Flow = SAR 425M (SAR179M lower than 2017)

3,678 (771)

(2,567)

Loans Issues /

Payments /

Charges

(746)

660

CAPEX / Biological 248

(5)

Assets

Operating Cash Flow

Dividend

Cash at 30

Others

Cash at 30

Sept 2017 (SAR 412 Million) Sept 2018

Almarai Company 2018 Q3 Earnings Presentation 20

Key Trends

Net Debt

14,000 350%

3.1x 3.1x

3.0x

12,000 2.8x 2.8x 2.7x 2.8x 300%

2.7x 2.7x

10,000 250%

8,000 200%

SAR Million

6,000 150%

98% 101% 95%

4,000 75% 75% 74% 81% 81% 73% 100%

2,000 50%

6,653 8,237 8,053 8,762 9,344 10,889 10,883 10,910 13,275

0 0%

2011 2012 2013 2014 2015 2016 2016 2017 Last 12

Months

SOCPA IFRS

Net Debt Net Debt / Equity Ratio Net Debt / EBITDA

Almarai Company 2018 Q3 Earnings Presentation 22

Quarterly Performance – Net Income Trend Analysis

2018 versus 2017

800

Q2 = (2.0%)

Q3 = (4.9%)

700 674 661

664 667

658 # 634

#

600 595 655

629

530 539

536 513

500 476 484 #

450 489

433

SAR Million

Q1 = 4.8% 430 428

398

400 380 369 373

344 349

328

306 309 *

300 274 # 284 286

255

235 242

289

200

100

# IFRS revaluation adjustments * Capital gain of SAR 47m in 2012

Please note that 2016 and subsequent years are based on IFRS however earlier years are based on SOCPA accounting standards

Almarai Company 2018 Q3 Earnings Presentation 23

EBIT and EBITDA margins are starting to improve…

Revenue, EBITDA and EBIT Evolution

CAGR 2011 – 2018: 8.5% (w/o impact of acquisitions 4.4%)

Net Sales

EBIT % to Net Sales

14,699 14,339

EBITDA % to Net Sales 13,795 13,936 13,753

24.4% 12,606 29.3%

28.1%

SAR Million

25.6% 11,219 25.3% 26.0%

24.2% 23.9% 24.2%

9,883

19.1% 18.9%

17.3% 18.5%

16.9% 16.0% 16.4% 17.6%

7,951 15.8%

2011 2012 2013 2014 2015 2016 2016 2017 Last 12 Months

SOCPA IFRS

Almarai Company 2018 Q3 Earnings Presentation 24

Key Share Data

Key Statistics for Almarai (30 September 2018) Year to date total shareholder's

30% return since listing

Share Price (SAR) 49.90 Savola

25%

Current P/E Ratio (ttm) 31.19 20% 16%

25%

Earnings Per Share (SAR) (ttm) 1.95 HHPrince 15%

35%

Market Cap (SAR Million) 49,900 Sultan bin 10%

Mohammed

Dec-11

Dec-12

Dec-07

Dec-08

Dec-10

Dec-09

Dec-13

Dec-14

Dec-15

Dec-17

Dec-16

Sep-18

Shares Outstanding (Million) 1,000 PIF

Dividend Yield 1.50%

450%

16%

Others

24%

400%

350%

300%

250%

200%

150%

100%

50%

0%

Jan-17

Sep-16

May-17

Jan-09

Jan-06

Jan-07

Sep-10

Sep-11

Sep-12

Sep-13

Sep-14

Sep-15

Sep-17

Sep-18

May-06

May-07

Jan-08

May-08

May-09

Sep-05

Sep-06

Sep-07

Sep-08

Sep-09

Jan-10

May-10

Jan-11

May-11

Jan-12

May-12

Jan-13

Jan-14

May-13

May-14

Jan-15

May-15

Jan-16

May-16

Jan-18

May-18

Almarai TASI

Almarai Company 2018 Q3 Earnings Presentation 25

For Investor Relations matters please contact:

investor.relations@almarai.com

“We will encourage our major corporations to expand across borders

and take their rightful place in global markets”

QR Code for Almarai IR App.

www.almarai.com

Thank you

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Syllabus: Project Management (EM 550) Term 191Document4 pagesSyllabus: Project Management (EM 550) Term 191qosaiKD0% (1)

- ISE - Quiz 1Document1 pageISE - Quiz 1qosaiKDNo ratings yet

- Student Clearance - Kfupm - Edu.saDocument1 pageStudent Clearance - Kfupm - Edu.saqosaiKDNo ratings yet

- ISE 529 - Quiz 1Document1 pageISE 529 - Quiz 1qosaiKDNo ratings yet

- CRP 534 Housing PoliciesDocument3 pagesCRP 534 Housing PoliciesqosaiKDNo ratings yet

- Almarai AR2017 ENG WebDocument156 pagesAlmarai AR2017 ENG WebqosaiKDNo ratings yet

- Marai EngDocument135 pagesMarai EngqosaiKDNo ratings yet

- Rubric For Individual AssignmentDocument3 pagesRubric For Individual AssignmentqosaiKDNo ratings yet

- DST Computation Attempt ReviewDocument4 pagesDST Computation Attempt Reviewella angelicalNo ratings yet

- Raymond AR 2020Document236 pagesRaymond AR 2020Ajay SinghNo ratings yet

- Receipt - 2 - 6 - 2024 12 - 00 - 00 AMDocument1 pageReceipt - 2 - 6 - 2024 12 - 00 - 00 AMak978420No ratings yet

- Monthly Portfolios For Apr 2019 - 0Document498 pagesMonthly Portfolios For Apr 2019 - 0RASHMIN GADHIYANo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyANISH KUMARNo ratings yet

- MP 14 Project Procurement Management 2020Document68 pagesMP 14 Project Procurement Management 2020wulanpipi9No ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Demonetization FinalDocument10 pagesDemonetization FinalShivani JadhavNo ratings yet

- Commercial Law Review QuizDocument2 pagesCommercial Law Review QuizPaul Dean MarkNo ratings yet

- Afar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesDocument31 pagesAfar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesMitch MinglanaNo ratings yet

- Finance 1 Assignment 2Document5 pagesFinance 1 Assignment 2lordNo ratings yet

- SUPERSTORE Social BusinessDocument52 pagesSUPERSTORE Social Businessjisanus5salehinNo ratings yet

- Pink GurlzDocument423 pagesPink Gurlzmygurlz1991No ratings yet

- Economics Project: Role of Rbi in Control of CreditDocument35 pagesEconomics Project: Role of Rbi in Control of CreditDhairya Tamta78% (18)

- Comparative Analysis of Mutual FundsDocument222 pagesComparative Analysis of Mutual Fundsmrinal_ms85% (27)

- Auditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions ManualDocument16 pagesAuditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions Manualterrysmithnoejaxfwbz100% (14)

- CONDITIONALS: Put The Verb in Brackets Into The Correct FormDocument1 pageCONDITIONALS: Put The Verb in Brackets Into The Correct FormLacassiapeiaNo ratings yet

- Road Development Agency.: Accounts Payable AccountantDocument6 pagesRoad Development Agency.: Accounts Payable AccountantNdokwaNo ratings yet

- Evaluation of Ethical Mutual FundDocument22 pagesEvaluation of Ethical Mutual Fundvineethkmenon100% (1)

- Bond YieldsDocument27 pagesBond YieldsSagar TanejaNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFJayesh ChandNo ratings yet

- Top 5-ITReFiling Companies IndiaDocument5 pagesTop 5-ITReFiling Companies IndiaLolitambika NeumannNo ratings yet

- International AccountingDocument118 pagesInternational AccountingThao ViNo ratings yet

- Aluminium - Extrusion - Ind - PLC Corporate - Actions - AnnounDocument1 pageAluminium - Extrusion - Ind - PLC Corporate - Actions - AnnounMouhammad BATHILYNo ratings yet

- Introduction To ACFI2070: Readings: Chapter 1, Peirson Et Al. 2015Document31 pagesIntroduction To ACFI2070: Readings: Chapter 1, Peirson Et Al. 2015ViviNo ratings yet

- Bank of Baroda Po Exam 30-05-2010 Question PaperDocument16 pagesBank of Baroda Po Exam 30-05-2010 Question PaperAshwinReaderNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Sno Name of The Fund Sector Seed / Early / GrowthDocument6 pagesSno Name of The Fund Sector Seed / Early / GrowthamandeepNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet