Professional Documents

Culture Documents

0%(1)0% found this document useful (1 vote)

93 viewsAss 3

Ass 3

Uploaded by

Jayanthi HeeranandaniBy next Monday at 11:59pm, email an Excel file to qw18zt@brocku.ca with your group's calculations and analysis of four different stock portfolios - equally weighted, equal volatility scaled, minimum variance, and maximum Sharpe ratio - based on the given Sharpe ratios, standard deviations, and correlation of stocks A and B. The document provides instructions to calculate portfolio weights and performance measures for each type of portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Zeta Spenza Project: GivenDocument26 pagesZeta Spenza Project: GivenMashaal FNo ratings yet

- Data Analyst - Assignment PDFDocument3 pagesData Analyst - Assignment PDFXyz AbcNo ratings yet

- EEB443 Test 1 & Solutions - April 6, 2023-1Document7 pagesEEB443 Test 1 & Solutions - April 6, 2023-1Jakisee Kavezeri100% (1)

- In Class ProblemsDocument5 pagesIn Class Problemsishu0% (1)

- Allied Food Products: A Case StudyDocument18 pagesAllied Food Products: A Case StudyMikey MadRatNo ratings yet

- DMS Demo - Job Card FlowDocument25 pagesDMS Demo - Job Card Flowapi-3858425No ratings yet

- What Are The Types of Media Used To Connect DevicesDocument1 pageWhat Are The Types of Media Used To Connect DevicesGemma AlonzoNo ratings yet

- Assignment Sample Business Strategy of An Organization PDFDocument25 pagesAssignment Sample Business Strategy of An Organization PDFJayanthi HeeranandaniNo ratings yet

- Heizer Om10 Ism 06s 150711191232 Lva1 App6892Document10 pagesHeizer Om10 Ism 06s 150711191232 Lva1 App6892Jayanthi HeeranandaniNo ratings yet

- Python L1 Assignments Topgear Hima 284446Document10 pagesPython L1 Assignments Topgear Hima 284446subhani shaik100% (1)

- File 2Document5 pagesFile 2A KarthikNo ratings yet

- Important MS201Document3 pagesImportant MS201Saheb PalNo ratings yet

- This Study Resource Was: Station WRCH in RichmondDocument4 pagesThis Study Resource Was: Station WRCH in RichmondFajar Palguna wijayaNo ratings yet

- Binary Multiplication Twos Complement Multiplication (Booths Algorithm)Document9 pagesBinary Multiplication Twos Complement Multiplication (Booths Algorithm)Riajimin100% (1)

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- Network Models - Part 9Document20 pagesNetwork Models - Part 9VishnuNo ratings yet

- Design and Innovation Fundamental QuizzesDocument25 pagesDesign and Innovation Fundamental QuizzesUsman100% (5)

- Perceptons Neural NetworksDocument33 pagesPerceptons Neural Networksvasu_koneti5124No ratings yet

- Analysis of The Finance Bill 2023 by SMAC Advisory-1Document81 pagesAnalysis of The Finance Bill 2023 by SMAC Advisory-1Abu TayeabNo ratings yet

- Team Name: Beatles College: IIFT Delhi Finance Challenge: PublicDocument4 pagesTeam Name: Beatles College: IIFT Delhi Finance Challenge: PublicAkhil RajNo ratings yet

- CS605 Final Term Comprehensive Notes by Muhammad SaeedDocument30 pagesCS605 Final Term Comprehensive Notes by Muhammad SaeedShahid Omer ToorNo ratings yet

- MidTerm AI PDFDocument4 pagesMidTerm AI PDFTalha Mansoor100% (1)

- CRC Cards For ATM ExampleDocument5 pagesCRC Cards For ATM ExampleRiajiminNo ratings yet

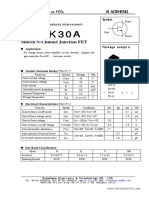

- K30a PDFDocument1 pageK30a PDFVictorManuelBernalBlancoNo ratings yet

- Class Statistics Practice QuestionsDocument12 pagesClass Statistics Practice QuestionsRaman KulkarniNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- GenC Hiring - Student BrochureDocument5 pagesGenC Hiring - Student BrochureSweety QuotesNo ratings yet

- FA DBMS Objective FINALDocument16 pagesFA DBMS Objective FINALPramod SrivastavaNo ratings yet

- Lean & Agile Systems in WiproDocument10 pagesLean & Agile Systems in WiproShreshth Gupta100% (1)

- Digital Integrated Circuit Tester IeeeDocument5 pagesDigital Integrated Circuit Tester Ieeeashwin_nakman100% (2)

- Quiz It 430Document3 pagesQuiz It 430saqib_hakeemNo ratings yet

- MTH601-FinalTerm-By Rana Abubakar KhanDocument89 pagesMTH601-FinalTerm-By Rana Abubakar KhanAleena RajputNo ratings yet

- Chapter 2 Linear ProgramingDocument163 pagesChapter 2 Linear ProgramingKing HeniNo ratings yet

- Oracle Form Report Developer SQL PLSQL Solved McqsDocument33 pagesOracle Form Report Developer SQL PLSQL Solved McqsYasmeen LiaqatNo ratings yet

- Write With Con Dence: Quality 101 - Quality Assurance Mock TestDocument43 pagesWrite With Con Dence: Quality 101 - Quality Assurance Mock TestRohit VNo ratings yet

- DR Revision Pack 2011-12rrDocument17 pagesDR Revision Pack 2011-12rrrounak333No ratings yet

- Ex - No. 2 Student Faculty DatabaseDocument12 pagesEx - No. 2 Student Faculty DatabaseDr. Parameswaran TNo ratings yet

- M 14 IPCC Cost FM Guideline AnswersDocument12 pagesM 14 IPCC Cost FM Guideline Answerssantosh barkiNo ratings yet

- Mid Term Paper - CS-321-Software EngineeringDocument2 pagesMid Term Paper - CS-321-Software EngineeringMuhammad ShahbazNo ratings yet

- Cocubes Placements PaperDocument27 pagesCocubes Placements PapersurekhaNo ratings yet

- Quantile NPCIDocument4 pagesQuantile NPCIsusy mNo ratings yet

- Cir CBS EbsDocument1 pageCir CBS EbsAnshul RatnaNo ratings yet

- Chapter 16. CH 16-07 Build A Model: Step 1Document4 pagesChapter 16. CH 16-07 Build A Model: Step 1Tanya NdlovuNo ratings yet

- Two Stage OpampDocument14 pagesTwo Stage OpampJafar HussainNo ratings yet

- Steel Cost WorksheetDocument2 pagesSteel Cost WorksheetRohimNo ratings yet

- Elements of Tensor Calculus: AppendixDocument50 pagesElements of Tensor Calculus: AppendixsandokantygruNo ratings yet

- Assignment Financial Economics Sem5 (2021)Document2 pagesAssignment Financial Economics Sem5 (2021)shamsuzNo ratings yet

- Accounts Guru Conclave - Sample PaperDocument7 pagesAccounts Guru Conclave - Sample PaperMitaliNo ratings yet

- Week 3 Tutorials - PDF PDFDocument9 pagesWeek 3 Tutorials - PDF PDFDaniel NgoNo ratings yet

- Scalar Resolute AnswersDocument4 pagesScalar Resolute AnswersMax TennerNo ratings yet

- Basic 3Document2 pagesBasic 3Venky DNo ratings yet

- Risk and Return QUESTIONSDocument4 pagesRisk and Return QUESTIONSJulianNo ratings yet

- Bloomberg - Term Structure of RiskDocument42 pagesBloomberg - Term Structure of RiskMarkus SchantaNo ratings yet

- Minimum Variance Efficient PortfolioDocument7 pagesMinimum Variance Efficient PortfoliohatemNo ratings yet

- 435 Problem Set 1Document3 pages435 Problem Set 1Md. Mehedi Hasan100% (1)

- Korchia Calcul RhoDocument12 pagesKorchia Calcul RhosamichaouachiNo ratings yet

- Final Exam Sample 1 NOsolutions1Document14 pagesFinal Exam Sample 1 NOsolutions1alexandre.stalensNo ratings yet

- Kappa Estimator: Table of Agreement FrequenciesDocument2 pagesKappa Estimator: Table of Agreement FrequenciesscjofyWFawlroa2r06YFVabfbajNo ratings yet

- Analysing Surface Texture by Stratification Using R Parameters of Bearing Area Curve of Roughness ProfileDocument7 pagesAnalysing Surface Texture by Stratification Using R Parameters of Bearing Area Curve of Roughness ProfilesahasanNo ratings yet

- Advanced Finanacial Management NotesDocument42 pagesAdvanced Finanacial Management NotesNyaramba DavidNo ratings yet

- Assignment 2 - (ML) (MSE)Document2 pagesAssignment 2 - (ML) (MSE)Saurabh LomteNo ratings yet

- Sem StatsDocument12 pagesSem StatsSudipta ChatterjeeNo ratings yet

- CFA - ProbDocument3 pagesCFA - ProbJayanthi HeeranandaniNo ratings yet

- Learning With Cases: MBAB 5P06Document24 pagesLearning With Cases: MBAB 5P06Jayanthi HeeranandaniNo ratings yet

- GD - DetailsDocument2 pagesGD - DetailsJayanthi HeeranandaniNo ratings yet

- Reichard Maschinen, GMBH: Nonnal MaintenanceDocument4 pagesReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniNo ratings yet

- Bags:: Available) or Proceed ToDocument2 pagesBags:: Available) or Proceed ToJayanthi HeeranandaniNo ratings yet

- Philips Versus Matsushita: A New Century, A New Round Global Business: Case 1Document11 pagesPhilips Versus Matsushita: A New Century, A New Round Global Business: Case 1Jayanthi HeeranandaniNo ratings yet

- MBA College InfoDocument1 pageMBA College InfoJayanthi HeeranandaniNo ratings yet

- Does IT MatterDocument1 pageDoes IT MatterJayanthi HeeranandaniNo ratings yet

Ass 3

Ass 3

Uploaded by

Jayanthi Heeranandani0%(1)0% found this document useful (1 vote)

93 views1 pageBy next Monday at 11:59pm, email an Excel file to qw18zt@brocku.ca with your group's calculations and analysis of four different stock portfolios - equally weighted, equal volatility scaled, minimum variance, and maximum Sharpe ratio - based on the given Sharpe ratios, standard deviations, and correlation of stocks A and B. The document provides instructions to calculate portfolio weights and performance measures for each type of portfolio.

Original Description:

Original Title

Ass3 (2).doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBy next Monday at 11:59pm, email an Excel file to qw18zt@brocku.ca with your group's calculations and analysis of four different stock portfolios - equally weighted, equal volatility scaled, minimum variance, and maximum Sharpe ratio - based on the given Sharpe ratios, standard deviations, and correlation of stocks A and B. The document provides instructions to calculate portfolio weights and performance measures for each type of portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0%(1)0% found this document useful (1 vote)

93 views1 pageAss 3

Ass 3

Uploaded by

Jayanthi HeeranandaniBy next Monday at 11:59pm, email an Excel file to qw18zt@brocku.ca with your group's calculations and analysis of four different stock portfolios - equally weighted, equal volatility scaled, minimum variance, and maximum Sharpe ratio - based on the given Sharpe ratios, standard deviations, and correlation of stocks A and B. The document provides instructions to calculate portfolio weights and performance measures for each type of portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

Due Date: by 11:59pm next Monday

Email your group assignment as an Excel attachment to qw18zt@brocku.ca

S&P (A) 2-year Bond (B)

Sharpe Ratio (SR) 0.3 1.0

Standard Deviation () 20% 2%

Correlation (AB) 0.3

Based on the above information, do the following for each portfolio:

1. Calculate WA and WB for equally weighted portfolio, MCTR and PCTR.

2. Calculate WA and WB for equal volatility scaled portfolio, MCTR and PCTR.

3. Calculate WA and WB for minimum variance portfolio, MCTR and PCTR. Verify that

MCTRA = MCTRB and A = B

4. Calculate WA and WB for maximum Sharpe ratio portfolio, MCTR and PCTR.

5. Interpret your results for each portfolio.

You might also like

- Zeta Spenza Project: GivenDocument26 pagesZeta Spenza Project: GivenMashaal FNo ratings yet

- Data Analyst - Assignment PDFDocument3 pagesData Analyst - Assignment PDFXyz AbcNo ratings yet

- EEB443 Test 1 & Solutions - April 6, 2023-1Document7 pagesEEB443 Test 1 & Solutions - April 6, 2023-1Jakisee Kavezeri100% (1)

- In Class ProblemsDocument5 pagesIn Class Problemsishu0% (1)

- Allied Food Products: A Case StudyDocument18 pagesAllied Food Products: A Case StudyMikey MadRatNo ratings yet

- DMS Demo - Job Card FlowDocument25 pagesDMS Demo - Job Card Flowapi-3858425No ratings yet

- What Are The Types of Media Used To Connect DevicesDocument1 pageWhat Are The Types of Media Used To Connect DevicesGemma AlonzoNo ratings yet

- Assignment Sample Business Strategy of An Organization PDFDocument25 pagesAssignment Sample Business Strategy of An Organization PDFJayanthi HeeranandaniNo ratings yet

- Heizer Om10 Ism 06s 150711191232 Lva1 App6892Document10 pagesHeizer Om10 Ism 06s 150711191232 Lva1 App6892Jayanthi HeeranandaniNo ratings yet

- Python L1 Assignments Topgear Hima 284446Document10 pagesPython L1 Assignments Topgear Hima 284446subhani shaik100% (1)

- File 2Document5 pagesFile 2A KarthikNo ratings yet

- Important MS201Document3 pagesImportant MS201Saheb PalNo ratings yet

- This Study Resource Was: Station WRCH in RichmondDocument4 pagesThis Study Resource Was: Station WRCH in RichmondFajar Palguna wijayaNo ratings yet

- Binary Multiplication Twos Complement Multiplication (Booths Algorithm)Document9 pagesBinary Multiplication Twos Complement Multiplication (Booths Algorithm)Riajimin100% (1)

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- Network Models - Part 9Document20 pagesNetwork Models - Part 9VishnuNo ratings yet

- Design and Innovation Fundamental QuizzesDocument25 pagesDesign and Innovation Fundamental QuizzesUsman100% (5)

- Perceptons Neural NetworksDocument33 pagesPerceptons Neural Networksvasu_koneti5124No ratings yet

- Analysis of The Finance Bill 2023 by SMAC Advisory-1Document81 pagesAnalysis of The Finance Bill 2023 by SMAC Advisory-1Abu TayeabNo ratings yet

- Team Name: Beatles College: IIFT Delhi Finance Challenge: PublicDocument4 pagesTeam Name: Beatles College: IIFT Delhi Finance Challenge: PublicAkhil RajNo ratings yet

- CS605 Final Term Comprehensive Notes by Muhammad SaeedDocument30 pagesCS605 Final Term Comprehensive Notes by Muhammad SaeedShahid Omer ToorNo ratings yet

- MidTerm AI PDFDocument4 pagesMidTerm AI PDFTalha Mansoor100% (1)

- CRC Cards For ATM ExampleDocument5 pagesCRC Cards For ATM ExampleRiajiminNo ratings yet

- K30a PDFDocument1 pageK30a PDFVictorManuelBernalBlancoNo ratings yet

- Class Statistics Practice QuestionsDocument12 pagesClass Statistics Practice QuestionsRaman KulkarniNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- GenC Hiring - Student BrochureDocument5 pagesGenC Hiring - Student BrochureSweety QuotesNo ratings yet

- FA DBMS Objective FINALDocument16 pagesFA DBMS Objective FINALPramod SrivastavaNo ratings yet

- Lean & Agile Systems in WiproDocument10 pagesLean & Agile Systems in WiproShreshth Gupta100% (1)

- Digital Integrated Circuit Tester IeeeDocument5 pagesDigital Integrated Circuit Tester Ieeeashwin_nakman100% (2)

- Quiz It 430Document3 pagesQuiz It 430saqib_hakeemNo ratings yet

- MTH601-FinalTerm-By Rana Abubakar KhanDocument89 pagesMTH601-FinalTerm-By Rana Abubakar KhanAleena RajputNo ratings yet

- Chapter 2 Linear ProgramingDocument163 pagesChapter 2 Linear ProgramingKing HeniNo ratings yet

- Oracle Form Report Developer SQL PLSQL Solved McqsDocument33 pagesOracle Form Report Developer SQL PLSQL Solved McqsYasmeen LiaqatNo ratings yet

- Write With Con Dence: Quality 101 - Quality Assurance Mock TestDocument43 pagesWrite With Con Dence: Quality 101 - Quality Assurance Mock TestRohit VNo ratings yet

- DR Revision Pack 2011-12rrDocument17 pagesDR Revision Pack 2011-12rrrounak333No ratings yet

- Ex - No. 2 Student Faculty DatabaseDocument12 pagesEx - No. 2 Student Faculty DatabaseDr. Parameswaran TNo ratings yet

- M 14 IPCC Cost FM Guideline AnswersDocument12 pagesM 14 IPCC Cost FM Guideline Answerssantosh barkiNo ratings yet

- Mid Term Paper - CS-321-Software EngineeringDocument2 pagesMid Term Paper - CS-321-Software EngineeringMuhammad ShahbazNo ratings yet

- Cocubes Placements PaperDocument27 pagesCocubes Placements PapersurekhaNo ratings yet

- Quantile NPCIDocument4 pagesQuantile NPCIsusy mNo ratings yet

- Cir CBS EbsDocument1 pageCir CBS EbsAnshul RatnaNo ratings yet

- Chapter 16. CH 16-07 Build A Model: Step 1Document4 pagesChapter 16. CH 16-07 Build A Model: Step 1Tanya NdlovuNo ratings yet

- Two Stage OpampDocument14 pagesTwo Stage OpampJafar HussainNo ratings yet

- Steel Cost WorksheetDocument2 pagesSteel Cost WorksheetRohimNo ratings yet

- Elements of Tensor Calculus: AppendixDocument50 pagesElements of Tensor Calculus: AppendixsandokantygruNo ratings yet

- Assignment Financial Economics Sem5 (2021)Document2 pagesAssignment Financial Economics Sem5 (2021)shamsuzNo ratings yet

- Accounts Guru Conclave - Sample PaperDocument7 pagesAccounts Guru Conclave - Sample PaperMitaliNo ratings yet

- Week 3 Tutorials - PDF PDFDocument9 pagesWeek 3 Tutorials - PDF PDFDaniel NgoNo ratings yet

- Scalar Resolute AnswersDocument4 pagesScalar Resolute AnswersMax TennerNo ratings yet

- Basic 3Document2 pagesBasic 3Venky DNo ratings yet

- Risk and Return QUESTIONSDocument4 pagesRisk and Return QUESTIONSJulianNo ratings yet

- Bloomberg - Term Structure of RiskDocument42 pagesBloomberg - Term Structure of RiskMarkus SchantaNo ratings yet

- Minimum Variance Efficient PortfolioDocument7 pagesMinimum Variance Efficient PortfoliohatemNo ratings yet

- 435 Problem Set 1Document3 pages435 Problem Set 1Md. Mehedi Hasan100% (1)

- Korchia Calcul RhoDocument12 pagesKorchia Calcul RhosamichaouachiNo ratings yet

- Final Exam Sample 1 NOsolutions1Document14 pagesFinal Exam Sample 1 NOsolutions1alexandre.stalensNo ratings yet

- Kappa Estimator: Table of Agreement FrequenciesDocument2 pagesKappa Estimator: Table of Agreement FrequenciesscjofyWFawlroa2r06YFVabfbajNo ratings yet

- Analysing Surface Texture by Stratification Using R Parameters of Bearing Area Curve of Roughness ProfileDocument7 pagesAnalysing Surface Texture by Stratification Using R Parameters of Bearing Area Curve of Roughness ProfilesahasanNo ratings yet

- Advanced Finanacial Management NotesDocument42 pagesAdvanced Finanacial Management NotesNyaramba DavidNo ratings yet

- Assignment 2 - (ML) (MSE)Document2 pagesAssignment 2 - (ML) (MSE)Saurabh LomteNo ratings yet

- Sem StatsDocument12 pagesSem StatsSudipta ChatterjeeNo ratings yet

- CFA - ProbDocument3 pagesCFA - ProbJayanthi HeeranandaniNo ratings yet

- Learning With Cases: MBAB 5P06Document24 pagesLearning With Cases: MBAB 5P06Jayanthi HeeranandaniNo ratings yet

- GD - DetailsDocument2 pagesGD - DetailsJayanthi HeeranandaniNo ratings yet

- Reichard Maschinen, GMBH: Nonnal MaintenanceDocument4 pagesReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniNo ratings yet

- Bags:: Available) or Proceed ToDocument2 pagesBags:: Available) or Proceed ToJayanthi HeeranandaniNo ratings yet

- Philips Versus Matsushita: A New Century, A New Round Global Business: Case 1Document11 pagesPhilips Versus Matsushita: A New Century, A New Round Global Business: Case 1Jayanthi HeeranandaniNo ratings yet

- MBA College InfoDocument1 pageMBA College InfoJayanthi HeeranandaniNo ratings yet

- Does IT MatterDocument1 pageDoes IT MatterJayanthi HeeranandaniNo ratings yet