Professional Documents

Culture Documents

Adjusting Entry Drill

Adjusting Entry Drill

Uploaded by

Jezeil DimasCopyright:

Available Formats

You might also like

- Worksheet 1 PrelimDocument8 pagesWorksheet 1 PrelimGetteric obafial90% (20)

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Solution Laubausa CateringDocument5 pagesSolution Laubausa Cateringjessamae gundan100% (6)

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Closing Entries (Step 7) & Post Closing Trial Balance (Step 8)Document1 pageClosing Entries (Step 7) & Post Closing Trial Balance (Step 8)Eunice Villacacan33% (3)

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Account Transactions: Kareen LeonDocument13 pagesAccount Transactions: Kareen LeonPaula BautistaNo ratings yet

- Performance TaskDocument3 pagesPerformance TaskAnne Esguerra80% (5)

- Accounting ProblemsDocument3 pagesAccounting ProblemsKeitheia Quidlat67% (3)

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Prob-1 - AFCAR Chapter 3Document2 pagesProb-1 - AFCAR Chapter 3kakao100% (1)

- Emerging Players in Indian Startup Funding Landscape: Micro VC Funds in IndiaDocument23 pagesEmerging Players in Indian Startup Funding Landscape: Micro VC Funds in Indiasarvagya vermaNo ratings yet

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- Exercises II - Adjusting TransactionsDocument2 pagesExercises II - Adjusting TransactionsJowjie TV80% (5)

- Account Transactions: Winnie VillanuevaDocument14 pagesAccount Transactions: Winnie VillanuevaPaula Bautista100% (7)

- Jeizel Concepcion PR 4-1 To 4-5Document7 pagesJeizel Concepcion PR 4-1 To 4-5Concepcion Family100% (2)

- Adjusting EntriesDocument16 pagesAdjusting EntriesClarice Guintibano50% (6)

- Chapter 6Document15 pagesChapter 6Yumi kosha75% (4)

- FAR-Questionnaire 1Document71 pagesFAR-Questionnaire 1Jilian Kate Alpapara Bustamante40% (5)

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Abueg Clarence Angela R. Bsa1cDocument8 pagesAbueg Clarence Angela R. Bsa1cAnonnNo ratings yet

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Assignment1 M1 Transaction AnalysisDocument2 pagesAssignment1 M1 Transaction AnalysisAngel DIMACULANGANNo ratings yet

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Abm Q4Document3 pagesAbm Q4Brandon Choi100% (1)

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- VICTORINODocument6 pagesVICTORINODenise Ortiz Manolong100% (2)

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Chapter 6 Win Ballada 2019Document7 pagesChapter 6 Win Ballada 2019Rea Mariz JordanNo ratings yet

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- WORKSHEETDocument36 pagesWORKSHEETNe Il100% (3)

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Document3 pagesPaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- John Bala MapsDocument3 pagesJohn Bala MapsRonnie Lloyd Javier71% (14)

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADocument8 pagesElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- AlisuagDocument5 pagesAlisuagAgatha Alcid100% (1)

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- Acctg Problem 7Document5 pagesAcctg Problem 7Salvie Perez Utana82% (11)

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Total: Adjusting EntriesDocument8 pagesTotal: Adjusting EntriesLj BesaNo ratings yet

- Dasmarinas Duplicators VDocument29 pagesDasmarinas Duplicators VBlesh MacusiNo ratings yet

- ASP Notes Page 16Document2 pagesASP Notes Page 16Jeizel ConcepcionNo ratings yet

- ACCA101 Leah May SantiagoDocument9 pagesACCA101 Leah May SantiagoNicole FidelsonNo ratings yet

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- PostingandTrialBalance Kareen LeonDocument7 pagesPostingandTrialBalance Kareen LeonMerdwindelle AllagonesNo ratings yet

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- Elements of Financial StatementsDocument6 pagesElements of Financial StatementsAngelAnneDeJesus86% (7)

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Chapter 3Document14 pagesChapter 3Anjelika ViescaNo ratings yet

- Problem 14 - Group 4Document26 pagesProblem 14 - Group 4Francine TorresNo ratings yet

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocument3 pagesMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- SM Investments Corporation Budgeted Income Statement For Years 2021-2025Document1 pageSM Investments Corporation Budgeted Income Statement For Years 2021-2025Jezeil DimasNo ratings yet

- Lesson 8 - Presentation SkillsDocument30 pagesLesson 8 - Presentation SkillsJezeil DimasNo ratings yet

- IT Current Trends, Issues, and ChallengesDocument43 pagesIT Current Trends, Issues, and ChallengesJezeil Dimas100% (1)

- Spreadsheet SkillsDocument70 pagesSpreadsheet SkillsJezeil DimasNo ratings yet

- Lesson 1Document18 pagesLesson 1Jezeil DimasNo ratings yet

- 06 LESSON 6 - JIT Costing2Document10 pages06 LESSON 6 - JIT Costing2Jezeil DimasNo ratings yet

- Seminar 1 Global Integration Vs Regional Integration1Document15 pagesSeminar 1 Global Integration Vs Regional Integration1Jezeil DimasNo ratings yet

- Government AccountingDocument1 pageGovernment AccountingJezeil DimasNo ratings yet

- Growing & Internationalizing The Entrepreneurial FirmDocument25 pagesGrowing & Internationalizing The Entrepreneurial FirmJezeil Dimas100% (1)

- 4 Modifiers of Human Acts - Pdf3bfilename 3DUTF-8272742520modifiers2520of2520human2520acts PDFDocument4 pages4 Modifiers of Human Acts - Pdf3bfilename 3DUTF-8272742520modifiers2520of2520human2520acts PDFJezeil DimasNo ratings yet

- Obe FinalDocument10 pagesObe FinalJezeil DimasNo ratings yet

- AISDocument11 pagesAISJezeil DimasNo ratings yet

- SONIADocument7 pagesSONIAJezeil Dimas50% (2)

- 12 Essential Dimension of FaithDocument5 pages12 Essential Dimension of FaithJezeil DimasNo ratings yet

- 10 Commandments of Personal FinanceDocument13 pages10 Commandments of Personal FinanceJezeil DimasNo ratings yet

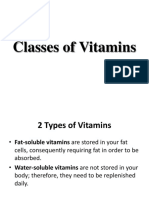

- Classes of VitaminsDocument7 pagesClasses of VitaminsJezeil DimasNo ratings yet

- Great BooksDocument9 pagesGreat BooksJezeil DimasNo ratings yet

- Body ShamingDocument2 pagesBody ShamingJezeil Dimas100% (3)

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Persistent System - With Historic Data-Unsolved - IMS ProschoolDocument47 pagesPersistent System - With Historic Data-Unsolved - IMS ProschoolShubham TitvilasiNo ratings yet

- Assignment Question For Marketing ManagementDocument2 pagesAssignment Question For Marketing ManagementDipti Baghel100% (1)

- The Role of Islamic Crowdfunding Mechanisms in Business andDocument14 pagesThe Role of Islamic Crowdfunding Mechanisms in Business andSalman Abdurrubi PerwiragamaNo ratings yet

- Activity 2 Merino Designs SolutionDocument2 pagesActivity 2 Merino Designs SolutionTran NguyenNo ratings yet

- SCX Is A 2 Billion Chemical Company With A PlasticsDocument2 pagesSCX Is A 2 Billion Chemical Company With A Plasticstrilocksp SinghNo ratings yet

- Nonstate Institution-Cooperative and Trade UnionsDocument23 pagesNonstate Institution-Cooperative and Trade UnionsEisenhower Saba0% (1)

- Tokenomics BlueprintDocument20 pagesTokenomics BlueprintCristian CotarceaNo ratings yet

- SCO Refinery TTT ProcedureDocument3 pagesSCO Refinery TTT ProceduresunlogosenergygroupNo ratings yet

- 2 MCQ - Prof Prac of Accty-An OverviewDocument1 page2 MCQ - Prof Prac of Accty-An OverviewRAISA LIDASANNo ratings yet

- Chapter 1 - Introduction To Strategic Anagement: J. K. Shah Classes Inter C.A. - S.MDocument19 pagesChapter 1 - Introduction To Strategic Anagement: J. K. Shah Classes Inter C.A. - S.MSmriti SahuNo ratings yet

- Weathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaDocument21 pagesWeathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaJeslyn TanNo ratings yet

- Why Venture Studios Are The Launchpads For Tomorrow's AI Heroes - A Look at PanScience InnovationsDocument2 pagesWhy Venture Studios Are The Launchpads For Tomorrow's AI Heroes - A Look at PanScience InnovationsR VishalNo ratings yet

- Cristopher Rico Antaran Delgado: Personal ProfileDocument4 pagesCristopher Rico Antaran Delgado: Personal ProfileCristopher Rico DelgadoNo ratings yet

- GST ChallanDocument2 pagesGST ChallanRohitNo ratings yet

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Tugas Bahasa Inggris-Piki Efrianto-2155201049Document2 pagesTugas Bahasa Inggris-Piki Efrianto-2155201049Smkn I BangkinangNo ratings yet

- Franchising Lesson 5Document4 pagesFranchising Lesson 5Christel Mae S. BoseoNo ratings yet

- Framing and Positioning Examples: Some of of These Can Also Be Used in The Opening ParagraphDocument4 pagesFraming and Positioning Examples: Some of of These Can Also Be Used in The Opening ParagraphMatthew AdoNo ratings yet

- CIPLADocument20 pagesCIPLAPrashant YadavNo ratings yet

- TNFD Management and Disclosure Framework v0-3 BDocument31 pagesTNFD Management and Disclosure Framework v0-3 BPorshe56No ratings yet

- 2022 TsangDocument21 pages2022 TsangKiều Lê Nhật ĐôngNo ratings yet

- Social Media Effects On Emirates AirlineDocument9 pagesSocial Media Effects On Emirates AirlineCamillaNo ratings yet

- Trans7 CareerDocument5 pagesTrans7 CareerMuhammad YazidNo ratings yet

- Ecological BricksDocument3 pagesEcological BricksSebastian Tovar GarciaNo ratings yet

- ABKA350a - Full Year Case Study Assessment 1 Question Paper v2Document9 pagesABKA350a - Full Year Case Study Assessment 1 Question Paper v2Basant BhattaNo ratings yet

- Alberton Ekhurleni Contact DetailsDocument3 pagesAlberton Ekhurleni Contact DetailscunnincnNo ratings yet

- Chapter 9 Part1Document90 pagesChapter 9 Part119071499 Đỗ Phương ThảoNo ratings yet

- II.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Document1 pageII.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Jin AghamNo ratings yet

Adjusting Entry Drill

Adjusting Entry Drill

Uploaded by

Jezeil DimasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entry Drill

Adjusting Entry Drill

Uploaded by

Jezeil DimasCopyright:

Available Formats

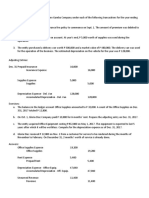

Adjusting Entry Drill:

PATROCINIO ABAD CLAIMS ADJUSTER

TRIAL BALANCE

December 31, 2018

Cash 20,000

Accounts Receivable 50,000

Prepaid Insurance 5,000

Supplies 15,000

Office Equipment 40,000

Accumulated Depreciation –

Office equipment 20,000

Accounts Payable 30,000

Abad, capital 60,000

Service Revenues 50,000

Salaries Expenses 10,000

Rent Expenses 20,000

P160,000 P160,000

1. If on December 31, 2018, supplies on hand were P2,000, the adjusting entry would contain a

a. Credit to supplies expense for P13,000 Adjusting Entry:

b. Credit to supplies for P2,000 Supplies Expense 13,000

c. Debit to Supplies Expense for P13,000 Supplies 13,000

d. Debit to Supplies for P2,000

2. If on December 31, 2018, the insurance still unexpired amounted to P2,000, the adjusting entry

would contain a

a. Credit to Prepaid Insurance for 2,000

b. Credit to Prepaid Insurance for 3,000

c. Debit to Insurance Expense for P2,000

d. Debit to Prepaid Insurance for 3,000

3. If the estimated depreciation for office equipment were 20,000, the adjusting entry would contain a

a. Credit to Accumulated Depreciation- Office Equipment for P20,000

b. Credit to Depreciation Expense- Office Equipment for 20,000

c. Credit to Office Equipment for 20,000

d. Debit accumulated depreciation-Office Equipment for 20,000

4. If as of December 31, 2018 the rent of 10,000 for December had not been recorded or paid, the

adjusting entry would include a

a. Credit to Accumulated Rent for 10,000

b. Credit to Cash for 10,000

c. Debit to Rent Expense for 10,000

d. Debit to Rent Payable for 10,000

5. If services totaling 12,500 had been performed but not yet billed, the adjusting entry to record this

would include a

a. Credit to Service Revenue for 12,500

b. Credit to Service Revenues for 62,500

c. Credit to Unearned Service Revenue for 12,500

d. Debit to Service Revenues for 12,500

You might also like

- Worksheet 1 PrelimDocument8 pagesWorksheet 1 PrelimGetteric obafial90% (20)

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Solution Laubausa CateringDocument5 pagesSolution Laubausa Cateringjessamae gundan100% (6)

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Closing Entries (Step 7) & Post Closing Trial Balance (Step 8)Document1 pageClosing Entries (Step 7) & Post Closing Trial Balance (Step 8)Eunice Villacacan33% (3)

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Account Transactions: Kareen LeonDocument13 pagesAccount Transactions: Kareen LeonPaula BautistaNo ratings yet

- Performance TaskDocument3 pagesPerformance TaskAnne Esguerra80% (5)

- Accounting ProblemsDocument3 pagesAccounting ProblemsKeitheia Quidlat67% (3)

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Prob-1 - AFCAR Chapter 3Document2 pagesProb-1 - AFCAR Chapter 3kakao100% (1)

- Emerging Players in Indian Startup Funding Landscape: Micro VC Funds in IndiaDocument23 pagesEmerging Players in Indian Startup Funding Landscape: Micro VC Funds in Indiasarvagya vermaNo ratings yet

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- Exercises II - Adjusting TransactionsDocument2 pagesExercises II - Adjusting TransactionsJowjie TV80% (5)

- Account Transactions: Winnie VillanuevaDocument14 pagesAccount Transactions: Winnie VillanuevaPaula Bautista100% (7)

- Jeizel Concepcion PR 4-1 To 4-5Document7 pagesJeizel Concepcion PR 4-1 To 4-5Concepcion Family100% (2)

- Adjusting EntriesDocument16 pagesAdjusting EntriesClarice Guintibano50% (6)

- Chapter 6Document15 pagesChapter 6Yumi kosha75% (4)

- FAR-Questionnaire 1Document71 pagesFAR-Questionnaire 1Jilian Kate Alpapara Bustamante40% (5)

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Abueg Clarence Angela R. Bsa1cDocument8 pagesAbueg Clarence Angela R. Bsa1cAnonnNo ratings yet

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Assignment1 M1 Transaction AnalysisDocument2 pagesAssignment1 M1 Transaction AnalysisAngel DIMACULANGANNo ratings yet

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Abm Q4Document3 pagesAbm Q4Brandon Choi100% (1)

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- VICTORINODocument6 pagesVICTORINODenise Ortiz Manolong100% (2)

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Chapter 6 Win Ballada 2019Document7 pagesChapter 6 Win Ballada 2019Rea Mariz JordanNo ratings yet

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- WORKSHEETDocument36 pagesWORKSHEETNe Il100% (3)

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Document3 pagesPaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- John Bala MapsDocument3 pagesJohn Bala MapsRonnie Lloyd Javier71% (14)

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADocument8 pagesElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- AlisuagDocument5 pagesAlisuagAgatha Alcid100% (1)

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- Acctg Problem 7Document5 pagesAcctg Problem 7Salvie Perez Utana82% (11)

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Total: Adjusting EntriesDocument8 pagesTotal: Adjusting EntriesLj BesaNo ratings yet

- Dasmarinas Duplicators VDocument29 pagesDasmarinas Duplicators VBlesh MacusiNo ratings yet

- ASP Notes Page 16Document2 pagesASP Notes Page 16Jeizel ConcepcionNo ratings yet

- ACCA101 Leah May SantiagoDocument9 pagesACCA101 Leah May SantiagoNicole FidelsonNo ratings yet

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- PostingandTrialBalance Kareen LeonDocument7 pagesPostingandTrialBalance Kareen LeonMerdwindelle AllagonesNo ratings yet

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- Elements of Financial StatementsDocument6 pagesElements of Financial StatementsAngelAnneDeJesus86% (7)

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Chapter 3Document14 pagesChapter 3Anjelika ViescaNo ratings yet

- Problem 14 - Group 4Document26 pagesProblem 14 - Group 4Francine TorresNo ratings yet

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocument3 pagesMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- SM Investments Corporation Budgeted Income Statement For Years 2021-2025Document1 pageSM Investments Corporation Budgeted Income Statement For Years 2021-2025Jezeil DimasNo ratings yet

- Lesson 8 - Presentation SkillsDocument30 pagesLesson 8 - Presentation SkillsJezeil DimasNo ratings yet

- IT Current Trends, Issues, and ChallengesDocument43 pagesIT Current Trends, Issues, and ChallengesJezeil Dimas100% (1)

- Spreadsheet SkillsDocument70 pagesSpreadsheet SkillsJezeil DimasNo ratings yet

- Lesson 1Document18 pagesLesson 1Jezeil DimasNo ratings yet

- 06 LESSON 6 - JIT Costing2Document10 pages06 LESSON 6 - JIT Costing2Jezeil DimasNo ratings yet

- Seminar 1 Global Integration Vs Regional Integration1Document15 pagesSeminar 1 Global Integration Vs Regional Integration1Jezeil DimasNo ratings yet

- Government AccountingDocument1 pageGovernment AccountingJezeil DimasNo ratings yet

- Growing & Internationalizing The Entrepreneurial FirmDocument25 pagesGrowing & Internationalizing The Entrepreneurial FirmJezeil Dimas100% (1)

- 4 Modifiers of Human Acts - Pdf3bfilename 3DUTF-8272742520modifiers2520of2520human2520acts PDFDocument4 pages4 Modifiers of Human Acts - Pdf3bfilename 3DUTF-8272742520modifiers2520of2520human2520acts PDFJezeil DimasNo ratings yet

- Obe FinalDocument10 pagesObe FinalJezeil DimasNo ratings yet

- AISDocument11 pagesAISJezeil DimasNo ratings yet

- SONIADocument7 pagesSONIAJezeil Dimas50% (2)

- 12 Essential Dimension of FaithDocument5 pages12 Essential Dimension of FaithJezeil DimasNo ratings yet

- 10 Commandments of Personal FinanceDocument13 pages10 Commandments of Personal FinanceJezeil DimasNo ratings yet

- Classes of VitaminsDocument7 pagesClasses of VitaminsJezeil DimasNo ratings yet

- Great BooksDocument9 pagesGreat BooksJezeil DimasNo ratings yet

- Body ShamingDocument2 pagesBody ShamingJezeil Dimas100% (3)

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Persistent System - With Historic Data-Unsolved - IMS ProschoolDocument47 pagesPersistent System - With Historic Data-Unsolved - IMS ProschoolShubham TitvilasiNo ratings yet

- Assignment Question For Marketing ManagementDocument2 pagesAssignment Question For Marketing ManagementDipti Baghel100% (1)

- The Role of Islamic Crowdfunding Mechanisms in Business andDocument14 pagesThe Role of Islamic Crowdfunding Mechanisms in Business andSalman Abdurrubi PerwiragamaNo ratings yet

- Activity 2 Merino Designs SolutionDocument2 pagesActivity 2 Merino Designs SolutionTran NguyenNo ratings yet

- SCX Is A 2 Billion Chemical Company With A PlasticsDocument2 pagesSCX Is A 2 Billion Chemical Company With A Plasticstrilocksp SinghNo ratings yet

- Nonstate Institution-Cooperative and Trade UnionsDocument23 pagesNonstate Institution-Cooperative and Trade UnionsEisenhower Saba0% (1)

- Tokenomics BlueprintDocument20 pagesTokenomics BlueprintCristian CotarceaNo ratings yet

- SCO Refinery TTT ProcedureDocument3 pagesSCO Refinery TTT ProceduresunlogosenergygroupNo ratings yet

- 2 MCQ - Prof Prac of Accty-An OverviewDocument1 page2 MCQ - Prof Prac of Accty-An OverviewRAISA LIDASANNo ratings yet

- Chapter 1 - Introduction To Strategic Anagement: J. K. Shah Classes Inter C.A. - S.MDocument19 pagesChapter 1 - Introduction To Strategic Anagement: J. K. Shah Classes Inter C.A. - S.MSmriti SahuNo ratings yet

- Weathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaDocument21 pagesWeathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaJeslyn TanNo ratings yet

- Why Venture Studios Are The Launchpads For Tomorrow's AI Heroes - A Look at PanScience InnovationsDocument2 pagesWhy Venture Studios Are The Launchpads For Tomorrow's AI Heroes - A Look at PanScience InnovationsR VishalNo ratings yet

- Cristopher Rico Antaran Delgado: Personal ProfileDocument4 pagesCristopher Rico Antaran Delgado: Personal ProfileCristopher Rico DelgadoNo ratings yet

- GST ChallanDocument2 pagesGST ChallanRohitNo ratings yet

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Tugas Bahasa Inggris-Piki Efrianto-2155201049Document2 pagesTugas Bahasa Inggris-Piki Efrianto-2155201049Smkn I BangkinangNo ratings yet

- Franchising Lesson 5Document4 pagesFranchising Lesson 5Christel Mae S. BoseoNo ratings yet

- Framing and Positioning Examples: Some of of These Can Also Be Used in The Opening ParagraphDocument4 pagesFraming and Positioning Examples: Some of of These Can Also Be Used in The Opening ParagraphMatthew AdoNo ratings yet

- CIPLADocument20 pagesCIPLAPrashant YadavNo ratings yet

- TNFD Management and Disclosure Framework v0-3 BDocument31 pagesTNFD Management and Disclosure Framework v0-3 BPorshe56No ratings yet

- 2022 TsangDocument21 pages2022 TsangKiều Lê Nhật ĐôngNo ratings yet

- Social Media Effects On Emirates AirlineDocument9 pagesSocial Media Effects On Emirates AirlineCamillaNo ratings yet

- Trans7 CareerDocument5 pagesTrans7 CareerMuhammad YazidNo ratings yet

- Ecological BricksDocument3 pagesEcological BricksSebastian Tovar GarciaNo ratings yet

- ABKA350a - Full Year Case Study Assessment 1 Question Paper v2Document9 pagesABKA350a - Full Year Case Study Assessment 1 Question Paper v2Basant BhattaNo ratings yet

- Alberton Ekhurleni Contact DetailsDocument3 pagesAlberton Ekhurleni Contact DetailscunnincnNo ratings yet

- Chapter 9 Part1Document90 pagesChapter 9 Part119071499 Đỗ Phương ThảoNo ratings yet

- II.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Document1 pageII.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Jin AghamNo ratings yet