Professional Documents

Culture Documents

f7 Examreport j17

f7 Examreport j17

Uploaded by

Farman ShaikhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

f7 Examreport j17

f7 Examreport j17

Uploaded by

Farman ShaikhCopyright:

Available Formats

Examiner’s report

F7 Financial Reporting

June 2017

General comments

The F7 Financial Reporting exam is offered in both computer-based (CBE) and paper formats. The structure is

the same in both formats but our model of delivery for the CBE exam means that candidates do not all receive

the same set of questions. In this report, the examining team share their observations from the marking process

to highlight strengths and weaknesses in candidates’ performance, and to offer constructive advice for future

candidates.

Section A objective test questions – we focus on two specific questions that caused difficulty in this

sitting of the exam

Section B objective test case questions – here we look at the key challenge areas for this section in the

exam

Section C constructed response questions - here we provide commentary around some of the main

themes that have affected candidates’ performance in this section of the exam, identifying common

knowledge gaps and offering guidance on where exam technique could be improved, including in the use

of the CBE functionality in answering these questions.

Section A : sample objective test questions for review

The following two questions are reviewed with the aim of providing future candidates with an indication of the

types of questions asked, guidance on how to answer them and a technical analysis of the topics tested.

Example 1:

Which of the following should be accounted for as subsidiaries in the consolidated financial statements of Preece

Co?

(1) Gilber Co Preece Co currently owns 40% of the share capital of Gilber Co and holds options to

purchase another 20% which it can exercise immediately

(2) Grovez Co Preece Co owns 60% of Grovez Co and has appointed the majority of the board of directors

(3) Roge Co Preece Co owns 80% of Roge Co. Roge Co is loss-making and Preece Co is considering

selling it in the near future

A 1 and 2 only

B 2 and 3 only

C 1 and 3 only

D 1, 2 and 3

What does this test?

This tests a candidates understanding of the definition of a subsidiary. The candidate is expected to apply that

knowledge in three simple scenarios.

What is the correct answer?

The correct answer is D because the options are exercisable immediately in (1), control is established in (2)

because of Preece Co’s ability to appoint the board and in (3), Preece Co still has control even though it is

Examiner’s report – F7 June 2017 1

considering the sale of the subsidiary. Most candidates ignored the options even though they were exercisable

immediately.

Example 2:

A 60% owned subsidiary sold goods to its parent for $150,000 at a mark-up of 25% on cost during the year

ended 30 June 20X5. One fifth of these goods remained unsold as at 30 June 20X5.

What is the debit adjustment to be made to group retained earnings to reflect the unrealised profit in inventory at

30 June 20X5?

A $6,000

B $3,600

C $2,400

D $4,500

What does this test?

This tests the effect of intra-group trading in the consolidated financial statements.

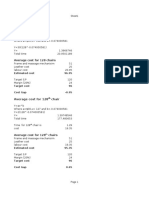

What is the correct answer?

The correct answer is B:

150,000/125 x 15 = 30,000

30,000/5 x 60% = $3,600

Why the correct answer is none of the other options?

Option A does not take account of the 40% NCI adjustment

Option C uses a 60% NCI adjustment

Option D uses a margin as opposed to a cost-plus approach

Most candidates did not take account of the 40% NCI adjustment. Candidates need to be able to think about

these consolidation adjustments in isolation ie not necessarily as part of a full set of consolidated financial

statements.

Section B

Section B has three case-based scenarios, each of which has five (two mark) objective test questions. The cases

in the June 2017 paper-based exam were based on IAS 38 Intangible assets and IAS 36 Impairment of assets;

IAS 8 Accounting policies, changes in accounting estimates and errors and IFRS 5 Non-current assets held for

sale and discontinued operations and IFRS 15 Revenue from contracts with customers. These questions are

written to test the candidates’ depth of knowledge on a particular topic and their ability to apply that knowledge

to a particular set of circumstances. Each case will therefore contain a balance of knowledge and application-

based questions that use both computation and narrative type questions. Performance in case-based questions

was encouraging. Candidates should be prepared for the knowledge based questions will draw from all areas in

the syllabus. To perform well in the application-based questions, candidates should practice these case questions

in materials provided by Approved Content Providers, specimen exams and past exams.

Section C

Candidates were presented with the following question types:

- Single entity accounts preparation

- Analysis of consolidated financial statements

- Preparation of consolidated financial statements

Examiner’s report – F7 June 2017 2

- Analysis of single entity financial statement

Single entity accounts preparation

This area of the syllabus requires candidates to prepare a set of financial statements for a single entity. This is a

fundamental skill for an accountant, and has been a large part of the F7 syllabus for many years. Performances

in this area were generally good, with this often being the area students performed best on across the exam.

As in previous diets, candidates were required to produce financial statements from a trial balance and set of

adjustments. This tests the candidates’ knowledge of the presentation of financial statements, their ability to

identify the correct elements accordingly and also tests knowledge of a variety of accounting standards.

Candidates still find it difficult when not asked to complete a full set of financial statements, and are instead

asked for calculations based on adjusting profit or retained earnings. The September 2016 question Triage Co is

a good example to look at in terms of how questions of this type could be attempted and laid out.

Questions requiring the preparation of statements of changes in equity can also be an area candidates find

difficult, and there was again evidence of a significant number of candidates omitting this statement from their

answer. This is one of the primary financial statements, and candidates must ensure they are comfortable with

the layout and contents of this. Candidates who produced statements of changes in equity often picked up the

majority of the marks, but only a small minority were able to identify that a prior year error must be corrected

through the opening retained earnings of an entity.

Candidates continue to show a solid understanding of the accounting around non-current assets, but struggled

over accounting for financial instruments, particularly around those held at amortised cost where the effective

interest rate differs from the coupon rate. Candidates must work to understand the principles of these

instruments as these are likely to be examined in more detail at the professional level.

Students continued to layout the answers well, showing good workings, enabling them to score marks even when

the final answer was not completely correct. Candidates who did not provide workings are likely to lose marks, as

it is essential that markers can follow the work done on the question, rather than simply the final total.

There were a wide variety of layouts used by CBE candidates. CBE candidates should ensure that all workings

are easy to link together, and writing the formula in the cell is completely acceptable. A small minority completed

workings many rows beneath (or to the right) of their financial statements. This should be avoided, and workings

should be done either next to or below the main answer.

Analysis of consolidated financial statements

Candidates will be asked to analyse financial information in F7, and the analysis is constantly the weakest area

of the exam for many candidates. In questions where the analysis is based on group issues, candidates may be

asked for minor calculations, such as goodwill or the gain/loss on disposal of a subsidiary. These are core items

that candidates should be able to produce.

Examiner’s report – F7 June 2017 3

Candidates continue to be able to score well on the calculation of ratios, but the calculation of net asset turnover

is one which appears to be a significant weakness. It is crucial to show workings for the calculation of these

ratios so that markers are able to see the figures used by the candidate. In recent sittings it has been noted that

CBE candidates are significantly more likely to put the ratios without workings, possibly due to the answer being

in a word processing format rather than a spreadsheet. It is good practice for students to show their workings

behind each ratio, and the candidates that showed these, whether in a table or just over several lines, scored

much higher than those simply writing the percentage figure calculated.

The analysis surrounding consolidated financial statements must involve comments on group-related issues.

Some students answer this type of question without reference to any differing margins earned by the companies

within the group or considering the elements of removing a subsidiary from a set of consolidated financial

statements. Generic statements about whether expenses have been managed well will continue to score very few

marks, as the question is looking for the candidate to bring in the information provided in the scenario,

particularly focusing their answers on group-related topics.

Candidates should look at the September 2016 question Gregory Co as an example of how to incorporate

knowledge of consolidations into an answer. Also, Tangier Co, one of the additional constructed response

questions available here will show how this can be examined. This type of question is one which can often divide

candidates. Those who are well prepared can often score good marks, but sadly far too many individuals are

picking up either very limited marks or no marks at all for their discussion. A minority continue to attempt ratios

with no attempt at discussion, which highlights that further question practice is required.

Preparation of consolidated financial statements

The core principles of the preparation of consolidated financial statements remain an area that candidates

perform well on. Candidates with clear workings often scored highly on this area. Again, it was noted that CBE

students had less workings displayed, instead showing the total consolidated figure with no guidance to how that

figure had been calculated.

Candidates demonstrated a good ability to remove intra-group adjustments from financial statements and

continue to perform well in relation to fair value adjustments. It was slightly disappointing to see candidates

being less able to deal with consideration for the acquisition of a subsidiary being in shares. This is a topic which

has been frequently examined in the past and one which has traditionally been done quite well. Quite often the

calculation as part of goodwill was correct, but only a minority of candidates considered the impact on the equity

section of the statement of financial position, following the issue of new shares.

Very few candidates were able to identify that contingent liabilities need to be recognised in consolidated

financial statements at fair value, either completely ignoring them or incorrectly stating that these should simply

be a disclosure. This demonstrated that while candidates understand the principles of contingent liabilities

consistent with IAS 37, they lacked the understanding that these need to be recognised within the process of

producing consolidated financial statements.

Analysis of single entity financial statements

Many of the problems already discussed in the analysis of consolidated financial statements are also relevant in

the analysis of single entity financial statements. As noted above, CBE students appear less likely to show

Examiner’s report – F7 June 2017 4

workings for ratio calculations, therefore potentially losing out on marks which could be given for individual

components of the calculation.

Candidates did demonstrate an improvement in using the narrative information from the scenario here, which

was pleasing to see. A significant minority continue to ignore all narrative information from the scenario, instead

simply commenting on increased margins being a result of better performance rather than attempting to explain

how this better performance had arisen.

While the analysis of consolidated financial statements was often disappointing in that candidates failed to

identify group issues, the performance in analysing a single entity financial statements did improve on previous

diets as candidates were able to demonstrate their ability to bring the scenario into the answer more and more.

After providing similar comments for numerous sittings, this was an encouraging sign and one which we hope

continues.

Exam technique

Good exam technique is vital for success in F7. Strong candidates continue to use good workings for the

preparation of financial statements, enabling them to maximise the marks gained here. As stated earlier,

candidates who failed to provide workings often scored much lower marks on both the preparation of financial

statements and the calculation of ratios.

The analysis discussion points should be laid out clearly, using headings for each area requested, such as

‘performance’ and ‘position’. Candidates should only be making one or two points per paragraph and leaving

space between paragraphs. Too many candidates attempt to make all of their points in one block of text, which is

difficult to mark and not a professional layout.

Candidates should also ensure they include a conclusion on the analysis discussion. A sensible conclusion

summarising the main points of the analysis is important, and marks will be given here.

The completion rate of questions continues to be high, suggesting that many candidates are able to manage time

well. The majority of candidates attempted all sections. The most commonly omitted sections tended to be areas

where candidates were asked to explain issues. The F7 exam will involve elements of discussion, so candidates

cannot afford to neglect these sections as they practise questions.

Word processing and spreadsheet technique

As stated earlier, candidates using the word processing tool for the analysis question were less likely to show

their workings for calculating ratios than those sitting the paper-based exam, which needs to be improved so that

marks are not lost.

Conversely, the narrative answers were often well presented, with headings and spacing used well.

For the preparation of financial statements question, candidates often laid out the financial statements are

workings well. Some candidates tended to put figures in individual cells and add the cells across for the answer,

whereas others did the entire working in one cell using a formula. Both are perfectly acceptable as markers will

follow both methods.

Examiner’s report – F7 June 2017 5

There are resources on ACCA’s website giving more guidance on how to use the spreadsheet software. A video

introducing the main functionality and how to make best use of these in F7 can be accessed here.

Guidance and Learning Support resources to help you succeed in your exam

There are many resources available to candidates to help with the F7 exam. Many of the common themes

discussed in this report regarding exam technique and ways to improve are comments that are commonly made

across sittings. Previous examiner’s reports can be found here and will give good, consistent guidance in what the

examining team is looking for from well prepared candidates on F7.

One of the keys to success in the F7 exam is question practice, attempting questions and reviewing the answer to

see any areas you may have missed. This is particularly relevant on the analysis questions. Often on this question

candidates feel comfortable, but reviewing the answers can show the depth of discussion that is being sought

here. We strongly recommend that you use an up to date question and answer bank from one of our Approved

Content Providers but if this is not possible then work through the most recent past exams on the ACCA website.

However, please note if you are using the past exams that these are not updated for syllabus changes or changes

to the exam format and so should be used with caution – so check the latest syllabus and study guide for

changes.

Some of the more challenging areas of the F7 syllabus have specific articles describing them in more depth in the

technical articles section and these should provide greater understanding. The exam technique section also

provides guidance for approaching the analysis question, and further guidance for resit students.

Examiner’s report – F7 June 2017 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Original PDF Essential Communication by Ronald Adler PDFDocument41 pagesOriginal PDF Essential Communication by Ronald Adler PDFmary.burklow183100% (34)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Module 3.2 LD 4-Stage Compressor TMS CARDIFF-En 2014 - Rev02 PDFDocument40 pagesModule 3.2 LD 4-Stage Compressor TMS CARDIFF-En 2014 - Rev02 PDFiuliiulianNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Folk Violin SongbookDocument19 pagesFolk Violin SongbookTyler Swinn100% (1)

- International Aspects of Personal Taxation For ATX-UK - ACCA GlobalDocument5 pagesInternational Aspects of Personal Taxation For ATX-UK - ACCA GlobalFarman ShaikhNo ratings yet

- Spreadsheet Functionality TemplateDocument41 pagesSpreadsheet Functionality TemplateFarman ShaikhNo ratings yet

- Inheritance Tax and Capital Gains Tax For ATX-UK - ACCA GlobalDocument2 pagesInheritance Tax and Capital Gains Tax For ATX-UK - ACCA GlobalFarman ShaikhNo ratings yet

- StatementDocument3 pagesStatementFarman ShaikhNo ratings yet

- Strategic Business Reporting - International (SBR - Int)Document7 pagesStrategic Business Reporting - International (SBR - Int)Farman ShaikhNo ratings yet

- Section-A: Consolidated Statement of Profit and LossDocument5 pagesSection-A: Consolidated Statement of Profit and LossFarman ShaikhNo ratings yet

- Question-1: Investment in Peppers CoDocument6 pagesQuestion-1: Investment in Peppers CoFarman ShaikhNo ratings yet

- P4 ACCA Summary + Revision Notes 2021Document139 pagesP4 ACCA Summary + Revision Notes 2021Farman ShaikhNo ratings yet

- Make or Buy Decisions: (B) Limiting FactorDocument2 pagesMake or Buy Decisions: (B) Limiting FactorFarman ShaikhNo ratings yet

- PM - Dec 2012.odsDocument3 pagesPM - Dec 2012.odsFarman ShaikhNo ratings yet

- Throughput Accounting Ratio: 1462500 2362500 Bottleneck ProcessDocument2 pagesThroughput Accounting Ratio: 1462500 2362500 Bottleneck ProcessFarman ShaikhNo ratings yet

- PM - Dec 2011.odsDocument2 pagesPM - Dec 2011.odsFarman ShaikhNo ratings yet

- Learning Curve: Average Cost For 128 ChairsDocument5 pagesLearning Curve: Average Cost For 128 ChairsFarman ShaikhNo ratings yet

- Day 1 Audit Report (Day 1)Document31 pagesDay 1 Audit Report (Day 1)Farman Shaikh100% (1)

- SP43Document352 pagesSP43Umar MohammadNo ratings yet

- HAQ Instructions (ARAMIS) 6-30-09Document16 pagesHAQ Instructions (ARAMIS) 6-30-09nurasyikahNo ratings yet

- YL Clarity - Chromatography SW: YOUNG IN ChromassDocument4 pagesYL Clarity - Chromatography SW: YOUNG IN Chromasschâu huỳnhNo ratings yet

- Fan TRO 2830Document106 pagesFan TRO 2830dwr234100% (4)

- D - 03 Pre Departure Checklist (Bridge) - 14.05.2009 NewDocument1 pageD - 03 Pre Departure Checklist (Bridge) - 14.05.2009 NewSantoso WahyudiNo ratings yet

- Chapter 1 To 6Document96 pagesChapter 1 To 6Nga Lê Nguyễn PhươngNo ratings yet

- Green Light HPS Laser Operator ManualDocument81 pagesGreen Light HPS Laser Operator ManualPhillip V Mitchell0% (1)

- Xenforo JsDocument39 pagesXenforo JsjaaritNo ratings yet

- Warman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q PDocument2 pagesWarman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q Pyoel cueva arquinigoNo ratings yet

- 5) BL Corrector y Manifiesto de CargaDocument3 pages5) BL Corrector y Manifiesto de CargaKevin Yair FerrerNo ratings yet

- Module 17 TAI - TC.MTO Basic Knowledge Examination Summary DataDocument27 pagesModule 17 TAI - TC.MTO Basic Knowledge Examination Summary DataChatchai PrasertsukNo ratings yet

- 9479 Inst ManualDocument8 pages9479 Inst ManualfdkaNo ratings yet

- Bosch Solar Cell M 3BB EnglischDocument2 pagesBosch Solar Cell M 3BB EnglischAlberto AbsantNo ratings yet

- History of UniverseDocument1 pageHistory of UniversemajdaNo ratings yet

- Abroad Work Experience On ResumeDocument5 pagesAbroad Work Experience On Resumeafmrdrpsbbxuag100% (1)

- Knowledge, Creativity and Communication in Education: Multimodal DesignDocument11 pagesKnowledge, Creativity and Communication in Education: Multimodal DesignMartín VillagraNo ratings yet

- Group 3 CW - Role of NGOs in Socio EconomicDocument9 pagesGroup 3 CW - Role of NGOs in Socio EconomicKisyenene JamusiNo ratings yet

- Kinematics Free Fall SolsDocument5 pagesKinematics Free Fall SolsDean JezerNo ratings yet

- Is 4031 5 1988 PDFDocument7 pagesIs 4031 5 1988 PDFRamesh Subramani Ramachandran100% (1)

- Brochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Document4 pagesBrochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Kaushal ParmarNo ratings yet

- Digital Control Systems (Elective) : Suggested ReadingDocument1 pageDigital Control Systems (Elective) : Suggested ReadingBebo DiaNo ratings yet

- Garmin Oregon 750Document6 pagesGarmin Oregon 750Rihit kumarNo ratings yet

- RachRootSequence PlanningDocument8 pagesRachRootSequence Planningpraneeth900No ratings yet

- Enforcement of IPRs at Border Book No.03Document32 pagesEnforcement of IPRs at Border Book No.03dhriti tutejaNo ratings yet

- WELDING Book AWSD1.1 Rev-3ADocument35 pagesWELDING Book AWSD1.1 Rev-3AFerdie OS100% (1)

- BIG ASS FAN Element CustomerDocument10 pagesBIG ASS FAN Element CustomerJesus David Muñoz RoblesNo ratings yet

- Topic:: SolidsDocument8 pagesTopic:: SolidsDhanBahadurNo ratings yet