Professional Documents

Culture Documents

Revenue Recognition

Revenue Recognition

Uploaded by

SourabhCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PZ-1 Quick Setup GuideDocument16 pagesPZ-1 Quick Setup GuideMiguel Angel Fernandez SerranoNo ratings yet

- New - Haven - FY 2015-16 Mayors Budget1Document419 pagesNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNo ratings yet

- Protection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsDocument151 pagesProtection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsKeerthana SNo ratings yet

- CardStatement 2024-04-12Document6 pagesCardStatement 2024-04-12110me0313No ratings yet

- Project CycleDocument123 pagesProject CycleTariq Waqar0% (1)

- SBLC Terms & ProcedureDocument2 pagesSBLC Terms & ProcedureDima RajaNo ratings yet

- Guide To Trusts: What Is A Trust?Document8 pagesGuide To Trusts: What Is A Trust?Nick AdamsNo ratings yet

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- Universal Standards On Social Performance ManagementDocument21 pagesUniversal Standards On Social Performance ManagementTherese MarieNo ratings yet

- 49390bosqp Inter p3 Cp2Document3 pages49390bosqp Inter p3 Cp2Pranav ThiteNo ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Chap 4 Open Economy MacroeconomicsDocument36 pagesChap 4 Open Economy MacroeconomicsDương Quốc TuấnNo ratings yet

- TomatoproductdsDocument8 pagesTomatoproductdsrahuldtcNo ratings yet

- Table of Cases The Indian Contract ActDocument39 pagesTable of Cases The Indian Contract ActpalashnikoseNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- 2015 Gea Insight ZmagsDocument104 pages2015 Gea Insight ZmagsArvind ShuklaNo ratings yet

- Indefinite Pronouns: Grammar WorksheetDocument6 pagesIndefinite Pronouns: Grammar Worksheetliceth marcela garcia baños100% (1)

- Indemnity and GuaranteeDocument15 pagesIndemnity and GuaranteeTariq RahimNo ratings yet

- Elective - I - 506 Financial Markets and Services (F)Document13 pagesElective - I - 506 Financial Markets and Services (F)dominic wurdaNo ratings yet

- RMC No 24-18 - Annexes B1-B5 - Required AttachmentsDocument3 pagesRMC No 24-18 - Annexes B1-B5 - Required AttachmentsGil PinoNo ratings yet

- Time Schedule Rooftop PLNDocument5 pagesTime Schedule Rooftop PLNMuhammad FharabiNo ratings yet

- DMCI Financial AssesmentDocument61 pagesDMCI Financial AssesmentRinna Jane Rivera BolandresNo ratings yet

- MBA Full Time (Core & Sectoral Program) Syllabus PDFDocument273 pagesMBA Full Time (Core & Sectoral Program) Syllabus PDF'Rohan NikamNo ratings yet

- Mike Wileman - LinkedInDocument2 pagesMike Wileman - LinkedInDonna SteenkampNo ratings yet

- Chapter 12 - Hand-Out 11Document9 pagesChapter 12 - Hand-Out 11Mahbub AlamNo ratings yet

- Google Drive Renewal Payment ReceiptDocument2 pagesGoogle Drive Renewal Payment Receiptchouhangovind302No ratings yet

- Summer Placement ReportDocument23 pagesSummer Placement Reportsowsan143No ratings yet

- Chapter7 Budgets and Preparing The MasteDocument44 pagesChapter7 Budgets and Preparing The MasteAnthony Corneau100% (1)

- Glen H Davidson Financial Disclosure Report For 2010Document6 pagesGlen H Davidson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Salient Features of The Revised Irr OF R.A. 9520Document21 pagesSalient Features of The Revised Irr OF R.A. 9520AJ NaragNo ratings yet

Revenue Recognition

Revenue Recognition

Uploaded by

SourabhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Recognition

Revenue Recognition

Uploaded by

SourabhCopyright:

Available Formats

Revenue Recognition

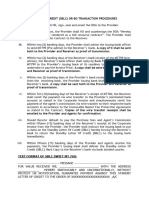

Mahindra & Mahindra is a $20.7 billion group with 150+ companies across 100+ countries. Mahindra

& Mahindra Ltd. (M&M) adheres to Ind AS 115 – Revenue from Contracts with Customers for

revenue recognition. The consolidated financial statement notes explain the revenue recognition for

its businesses across multiple industrial sectors.

1. Sale of Goods i.e. INR 78,005 cr. from manufacturing businesses like Mahindra & Mahindra Ltd.,

MVML is recognized when all the below conditions are satisfied:

a) the Group has transferred to the buyer the significant risks and rewards of ownership of

the goods;

b) the Group retains neither continuing managerial involvement to the degree usually

associated with ownership nor effective control over the goods sold;

c) the amount of revenue can be measured reliably;

d) it is probable that the economic benefits associated with the transaction will flow to the

entity; and

e) the costs incurred or to be incurred in respect of the transaction can be measured reliably

2. Income from vacation ownership

Income from vacation ownership business (Club Mahindra Ltd.) is classified as

i. Admissions fee: It is a non-refundable fee which is charged to new remembers and is

recognized as income subject to collection reliability.

ii. Entitlement fee: Entitlement fee shows the companies obligation to provide hospitality

services to its members based on the tenure of membership (33 years/25 years/10 years).

This income is recognized equally across the membership tenure and entitlement fees for

the future periods is accounted under other liabilities-Deferred income section.

iii. Annual subscription: Accounting for annual subscription fees follows accrual method and

fees for period beyond the date of balance sheet is accounted under Deferred Income.

iv. Room rents, food and beverages etc: Income is realised as and when services are

rendered.

3. Income from Dividends and Interest: INR 403 cr.

Income from dividends is recognized only when the right to receive the amount is confirmed. Interest

income is measured on probability basis when the company/group is sure that the economic benefits

will flow into the company and the amount of benefits can be measured reliably. Interest income also

takes in account the time value of money by reference to the outstanding principal and the applicable

rate of interest.

4. Income from financing business: INR 8353 cr.

The group follows the effective interest rate to recognize interest income from its financial services

business (Mahindra Finance Ltd.). The group segregates its assets based on credit impairment. For

assets which are out of credit impairment effective interest rate is calculated based on future cash

flows as per contractual terms. For credit impaired assets an adjusted effective interest rate is

calculated by estimating expected credit losses in future cash flows.

5. Income from construction contracts and property development:

When the outcome of the contract can be estimated reliably, revenue is recognised till the stage of

completion of contract activities when the financial statements are being prepared. The

measurement of revenue is based on the proportion of contract terms. Revenues which are received

before the work is performed are treated as a liability in advances received, whereas amount for

which the customer is already billed and are not received is accounted under trade receivables.

M&M follows the Accounting for Real Estate Transactions issues by the ICAI and recognises revenue

only when, the following conditions are met:

i. all critical approvals necessary for commencement of the project have been obtained,

ii. the actual construction and development cost incurred is at least 25% of the total construction

and development cost (without

considering land cost),

iii. when at least 10% of the sales consideration is realised, and

v. where 25% of the total saleable area of the project is secured by contracts of agreement

with buyers.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PZ-1 Quick Setup GuideDocument16 pagesPZ-1 Quick Setup GuideMiguel Angel Fernandez SerranoNo ratings yet

- New - Haven - FY 2015-16 Mayors Budget1Document419 pagesNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNo ratings yet

- Protection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsDocument151 pagesProtection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsKeerthana SNo ratings yet

- CardStatement 2024-04-12Document6 pagesCardStatement 2024-04-12110me0313No ratings yet

- Project CycleDocument123 pagesProject CycleTariq Waqar0% (1)

- SBLC Terms & ProcedureDocument2 pagesSBLC Terms & ProcedureDima RajaNo ratings yet

- Guide To Trusts: What Is A Trust?Document8 pagesGuide To Trusts: What Is A Trust?Nick AdamsNo ratings yet

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- Universal Standards On Social Performance ManagementDocument21 pagesUniversal Standards On Social Performance ManagementTherese MarieNo ratings yet

- 49390bosqp Inter p3 Cp2Document3 pages49390bosqp Inter p3 Cp2Pranav ThiteNo ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Chap 4 Open Economy MacroeconomicsDocument36 pagesChap 4 Open Economy MacroeconomicsDương Quốc TuấnNo ratings yet

- TomatoproductdsDocument8 pagesTomatoproductdsrahuldtcNo ratings yet

- Table of Cases The Indian Contract ActDocument39 pagesTable of Cases The Indian Contract ActpalashnikoseNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- 2015 Gea Insight ZmagsDocument104 pages2015 Gea Insight ZmagsArvind ShuklaNo ratings yet

- Indefinite Pronouns: Grammar WorksheetDocument6 pagesIndefinite Pronouns: Grammar Worksheetliceth marcela garcia baños100% (1)

- Indemnity and GuaranteeDocument15 pagesIndemnity and GuaranteeTariq RahimNo ratings yet

- Elective - I - 506 Financial Markets and Services (F)Document13 pagesElective - I - 506 Financial Markets and Services (F)dominic wurdaNo ratings yet

- RMC No 24-18 - Annexes B1-B5 - Required AttachmentsDocument3 pagesRMC No 24-18 - Annexes B1-B5 - Required AttachmentsGil PinoNo ratings yet

- Time Schedule Rooftop PLNDocument5 pagesTime Schedule Rooftop PLNMuhammad FharabiNo ratings yet

- DMCI Financial AssesmentDocument61 pagesDMCI Financial AssesmentRinna Jane Rivera BolandresNo ratings yet

- MBA Full Time (Core & Sectoral Program) Syllabus PDFDocument273 pagesMBA Full Time (Core & Sectoral Program) Syllabus PDF'Rohan NikamNo ratings yet

- Mike Wileman - LinkedInDocument2 pagesMike Wileman - LinkedInDonna SteenkampNo ratings yet

- Chapter 12 - Hand-Out 11Document9 pagesChapter 12 - Hand-Out 11Mahbub AlamNo ratings yet

- Google Drive Renewal Payment ReceiptDocument2 pagesGoogle Drive Renewal Payment Receiptchouhangovind302No ratings yet

- Summer Placement ReportDocument23 pagesSummer Placement Reportsowsan143No ratings yet

- Chapter7 Budgets and Preparing The MasteDocument44 pagesChapter7 Budgets and Preparing The MasteAnthony Corneau100% (1)

- Glen H Davidson Financial Disclosure Report For 2010Document6 pagesGlen H Davidson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Salient Features of The Revised Irr OF R.A. 9520Document21 pagesSalient Features of The Revised Irr OF R.A. 9520AJ NaragNo ratings yet