Professional Documents

Culture Documents

JHJKH

JHJKH

Uploaded by

Jitesh SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JHJKH

JHJKH

Uploaded by

Jitesh SharmaCopyright:

Available Formats

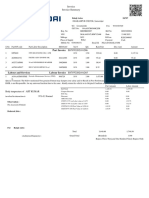

Original : For Receipient

Duplicate : for Transporter

Triplicate : For Supplier

GSTIN : 09AABCA3711C1ZB

Tax Invoice PAN : AABCA3711C

(Issued under GST Invoice Rules)

Trade Certificate No.T-111/ALIGARH/2003 (VALID UP TO 08/03/2020)

To,

HIMANSHU Invoice no : ALC-0373/19

Son/Wife/Daughter of : MR UMESH CHANDRA

Date : 17-Dec-2019

R/O- SURIR

MATHURA

Financer's Name : CHOLAMANDALAM

INVESTMENT & FINANCE CO. LTD.

GSTIN :

Pan No. / Form 60/ AIQPH1127H

PAR TICULARS Amount (Rs.)

To Cost of one New TATA Chassis of Model HSN : 8704.21.90 311125.00

IRISH_CREAM-ACE GOLD BS-IV

Completed With standard accessories as per

Specification

Chessis No MAT445075KVK59401

Engine No 275IDI07KPYSD9638

Colour Colour

Taxable Value After Consession 311125.00

TCS @ 0.00% 0.00

CGST 14.00 % 43557.00

SGST 14.00 % 43557.00

IGST 0.00 % 0.00

GSTCess 0.00% 0.00

Round Off 0.00

* G/TOTAL * 398340.00

Rs.THREE LAKH EIGHTY THREE THOUSAND THREE HUNDRED FOURTY ONLY.

Tax Payable under Reverse Charge - No

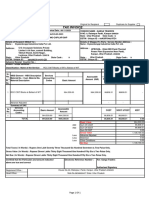

Terms and Condition E. & O. E.

1) Above prices are current ex-showroom prices. Buyers will have to pay prices prevailing at the time of delivery.

2) Optionals, accessories, insurance, registration, taxes, octroi, other levies etc. will be charged extra as applicable.

3) Prices are for current specifications and are subject to change without notice.

4) Prices and additional charges as above will have to be paid completely, to conclude the sales.

5) Payments by Cheques /Demand Drafts may be in favor of Ashok Auto Sales-Aligarh -Payable at Agra.

6) Acceptance of advance / deposits by the seller is merely an indication of an intention to sell and does not result into a contract of sale.

7) All disputes arising between the parties hereto shall be referred to arbitration according to the arbitration laws of the country.

8) Only the courts of Agra shall have jurisdiction in any proceedings relating to this contract.

9) The company shall not be liable due to any prevention, hindrance, or delay in manufacture, delivery of vehicles or accessories/optional due

to shortage of material, strike, riot, civil commotion, accident, machinery breakdown, government policies, acts of god and nature and all

events beyond the control of the company.

10) The seller shall have a general lien on the goods for all moneys due to the seller from the buyer on account of this, or other transaction.

11) Taxes as applicable.

12) TCS is calculated on sum of taxable value and GST.

Received the vehicle to my entire satisfaction &

completion in all respects Ashok Auto Sales-Aligarh

Customer Signature AUTH. SIGNATORY

You might also like

- Thirty Under 30 FreebieDocument16 pagesThirty Under 30 Freebiemariav.test.02No ratings yet

- CHED CMO On Bachelor of Science in EntrepreneurshipDocument34 pagesCHED CMO On Bachelor of Science in EntrepreneurshipFernan Fangon Tadeo100% (3)

- Quizzes - Chapter 4 - Types of Major Accounts.Document4 pagesQuizzes - Chapter 4 - Types of Major Accounts.Amie Jane Miranda100% (3)

- Tax Invoice Duplicate: Adventure Auto Car India LTDDocument2 pagesTax Invoice Duplicate: Adventure Auto Car India LTDKushal KarNo ratings yet

- Job Card Retail - Tax InvoiceDocument1 pageJob Card Retail - Tax InvoiceMittu Rajan100% (1)

- JCB 191 Bill Bidkin June 19Document1 pageJCB 191 Bill Bidkin June 19arjun dalvi0% (1)

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- Part Invoice S8437G202309119Document2 pagesPart Invoice S8437G202309119Jotish SutharNo ratings yet

- BR 23000127Document2 pagesBR 23000127azharNo ratings yet

- Billing Invoice Summary ReportDocument2 pagesBilling Invoice Summary ReportBalaji HyundaiNo ratings yet

- tazmeenDocument2 pagestazmeenbirajbania278No ratings yet

- Airlogix PiDocument1 pageAirlogix PiAmit KumarNo ratings yet

- PVBU Tax Invoice(e) - 2024-07-11T150833.375Document2 pagesPVBU Tax Invoice(e) - 2024-07-11T150833.375backoffice.shiroliNo ratings yet

- Sales AJ 033 24-25Document1 pageSales AJ 033 24-25A J INDUSTRIESNo ratings yet

- Shah Tyres Pandhurna 58MTDocument1 pageShah Tyres Pandhurna 58MTliladharkhode2025No ratings yet

- LaborParts RJC FACF24 000173Document2 pagesLaborParts RJC FACF24 000173vractivaNo ratings yet

- TAX Invoice: Meqte Sales & Services PVT LTDDocument2 pagesTAX Invoice: Meqte Sales & Services PVT LTDVicky KumarNo ratings yet

- 0818 Bill 1Document1 page0818 Bill 1Anurag KhannaNo ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax Invoicegeorgy wilsonNo ratings yet

- BC23000123Document1 pageBC23000123azharNo ratings yet

- Tax Invoice: Gstin PAN Drug Licence No FssaiDocument1 pageTax Invoice: Gstin PAN Drug Licence No FssaiAayush SinghNo ratings yet

- DEPREEDocument1 pageDEPREEAkhil DasNo ratings yet

- Billing Pre Invoice Summary Report (Accidental Repair)Document1 pageBilling Pre Invoice Summary Report (Accidental Repair)kdixit8588No ratings yet

- Car Service InvoiceDocument2 pagesCar Service InvoiceVivek AnandNo ratings yet

- 1 2S9C355Document1 page1 2S9C355diptajyotiroyNo ratings yet

- Part Invoice: PRE Invoice Invoice SummaryDocument1 pagePart Invoice: PRE Invoice Invoice SummarymayurkuhateNo ratings yet

- Invoice To: Despatch ToDocument1 pageInvoice To: Despatch ToAYUSH PRADHANNo ratings yet

- Tax Invoice: GSTIN:09AQRPD0775E1ZQDocument1 pageTax Invoice: GSTIN:09AQRPD0775E1ZQshreekailamotrs workshopNo ratings yet

- OD331239799725809100Document1 pageOD331239799725809100Yäsh JãdhâvNo ratings yet

- Job Card Retail - Tax InvoiceDocument1 pageJob Card Retail - Tax Invoicenirmal.kunwarNo ratings yet

- Miscellaneous Invoice (MVI00001525)Document1 pageMiscellaneous Invoice (MVI00001525)dctourstravelsNo ratings yet

- Invoice To: Despatch ToDocument1 pageInvoice To: Despatch ToAYUSH PRADHANNo ratings yet

- Sales PI 167 24-25Document1 pageSales PI 167 24-25A J INDUSTRIESNo ratings yet

- Gti 31Document1 pageGti 31mohitmishra9210No ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax Invoicenirmal.kunwarNo ratings yet

- BillInvoiceDocument1 pageBillInvoicePrabhu RajanNo ratings yet

- Chakr Innovation 10.04.2024Document1 pageChakr Innovation 10.04.2024Deepak LambaNo ratings yet

- BC23000122Document1 pageBC23000122azharNo ratings yet

- Invoice 1Document1 pageInvoice 1S.K.ENGINEERING & TRADING CONo ratings yet

- AramexDocument1 pageAramexkapil.chauhanNo ratings yet

- Tax Invoice Mh14jm4331Document1 pageTax Invoice Mh14jm4331Amol ZambareNo ratings yet

- Just Dial Limited: Tax InvoiceDocument2 pagesJust Dial Limited: Tax InvoicePushpendu RajNo ratings yet

- Invoice PDF6839Document1 pageInvoice PDF6839Chandrawati Enterprises Patna-14No ratings yet

- LTRMH 240Document1 pageLTRMH 240anil.chauhanNo ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- Einv BD052142Document2 pagesEinv BD052142balaji nobelNo ratings yet

- Monu ShakyaDocument1 pageMonu ShakyaYadav yadavNo ratings yet

- Sun Earth Painting - Proforma InvoiceDocument1 pageSun Earth Painting - Proforma Invoicebhikam jainNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- ARVINDDocument1 pageARVINDprashant singhNo ratings yet

- Proforma Invoice: MumbaiDocument1 pageProforma Invoice: MumbaiSimran DhamoonNo ratings yet

- Invoice 2023Document2 pagesInvoice 2023Ankit GuptaNo ratings yet

- Shagufta ParveenDocument1 pageShagufta Parveenbasudebkrishna237No ratings yet

- Sales AJ 029 24-25Document1 pageSales AJ 029 24-25A J INDUSTRIESNo ratings yet

- BCL 025 Inv 9677Document2 pagesBCL 025 Inv 9677Sanjay LoyalkaNo ratings yet

- Gstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Document2 pagesGstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Subhash SainiNo ratings yet

- Party:: Issan Machinary (Hmy)Document1 pageParty:: Issan Machinary (Hmy)Legal tax & financial servicesNo ratings yet

- Tax Invoice: Original For RecipientDocument3 pagesTax Invoice: Original For RecipientS V ENTERPRISESNo ratings yet

- InvoiceDocument1 pageInvoiceawanish639No ratings yet

- BR23000128Document1 pageBR23000128azharNo ratings yet

- 1 2S6ZQ2GDocument1 page1 2S6ZQ2GdiptajyotiroyNo ratings yet

- Makalkanya EntDocument1 pageMakalkanya Entavm schoolNo ratings yet

- Daily Stock 08.06.2020....Document5 pagesDaily Stock 08.06.2020....Jitesh SharmaNo ratings yet

- NEW PRICE LIST As On 20.05.2020 ......Document1 pageNEW PRICE LIST As On 20.05.2020 ......Jitesh SharmaNo ratings yet

- HIMANSHU Ins 123 PDFDocument3 pagesHIMANSHU Ins 123 PDFJitesh SharmaNo ratings yet

- Speed Governor For Bus Chassis No 04764Document1 pageSpeed Governor For Bus Chassis No 04764Jitesh SharmaNo ratings yet

- ISP GovernanceDocument12 pagesISP GovernanceFrancis Leo Gunseilan100% (1)

- Marketing Plan - SiantechDocument47 pagesMarketing Plan - SiantechAhmed NasrNo ratings yet

- Abm 1-W6.M2.T1.L2Document5 pagesAbm 1-W6.M2.T1.L2mbiloloNo ratings yet

- Answer To The Question No: 4.17: Summary InputDocument1 pageAnswer To The Question No: 4.17: Summary Inputtjarnob13No ratings yet

- Hidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Document3 pagesHidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Siva ReddyNo ratings yet

- 1st Module AssessmentfmDocument6 pages1st Module AssessmentfmMansi GuptaNo ratings yet

- Woori Bank 2011 Annual ReportDocument210 pagesWoori Bank 2011 Annual ReportManpreet Singh RekhiNo ratings yet

- Internal Control ChecklistDocument5 pagesInternal Control ChecklistPHILLIT CLASSNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Ifrs 8Document11 pagesIfrs 8Huzaifa WaseemNo ratings yet

- Course Title: Entrepreneurship and Enterprise DevelopmentDocument2 pagesCourse Title: Entrepreneurship and Enterprise DevelopmentDemeke GedamuNo ratings yet

- Summary of Should You Take Your Brand To Where Tha Action IsDocument3 pagesSummary of Should You Take Your Brand To Where Tha Action Isrhydama khadgiNo ratings yet

- EssayDocument10 pagesEssaySonu KumarNo ratings yet

- Pricing Analytics: Creating Linear & Power Demand CurvesDocument48 pagesPricing Analytics: Creating Linear & Power Demand CurvesAbhijeetNo ratings yet

- Statemant HSBCDocument1 pageStatemant HSBCVera DedkovskaNo ratings yet

- Animated Scrolling Dashboard PPT by Gemo EditsDocument12 pagesAnimated Scrolling Dashboard PPT by Gemo Editssantaanaalfie137No ratings yet

- 1.4 StakeholdersDocument20 pages1.4 StakeholdersRODRIGO GUTIERREZ HUAMANINo ratings yet

- Consumer Staples (Food & Beverage) : Henry Fund ResearchDocument7 pagesConsumer Staples (Food & Beverage) : Henry Fund Researchashrafherzalla100% (1)

- Intended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsDocument10 pagesIntended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsAbdurahman shuaibNo ratings yet

- AmalgamationDocument14 pagesAmalgamationKrishnakant Mishra100% (1)

- Concept Paper ThesisDocument5 pagesConcept Paper ThesisSteven Z. CondeNo ratings yet

- Income Tax Officers Rank HierarchyDocument7 pagesIncome Tax Officers Rank Hierarchyganesh bhaiNo ratings yet

- New OpenDocument TextDocument24 pagesNew OpenDocument TextSonia GabaNo ratings yet

- Macroeconomics 6th Edition Williamson Solutions ManualDocument36 pagesMacroeconomics 6th Edition Williamson Solutions Manualstirrupsillon.d8yxo100% (42)

- Annual Work Accident - Illness Exposure Data ReportDocument1 pageAnnual Work Accident - Illness Exposure Data ReportJon Allan Buenaobra100% (1)

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet