Professional Documents

Culture Documents

Juris - Ka Rosa

Juris - Ka Rosa

Uploaded by

Vladimir ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Juris - Ka Rosa

Juris - Ka Rosa

Uploaded by

Vladimir ReyesCopyright:

Available Formats

RULE 73

Venue and Process

Section 1. Where estate of deceased persons settled. — If the decedent is an

inhabitant of the Philippines at the time of his death, whether a citizen or

an alien, his will shall be proved, or letters of administration granted, and

his estate settled, in the Court of First Instance in the province in which he

resides at the time of his death, and if he is an inhabitant of a foreign

country, the Court of First Instance of any province in which he had estate.

The court first taking cognizance of the settlement of the estate of a

decedent, shall exercise jurisdiction to the exclusion of all other courts. The

jurisdiction assumed by a court, so far as it depends on the place of

residence of the decedent, or of the location of his estate, shall not be

contested in a suit or proceeding, except in an appeal from that court, in the

original case, or when the want of jurisdiction appears on the record.

RULE 78

Letters Testamentary and of Administration, When and to Whom Issued

Section 1. Who are incompetent to serve as executors or administrators. — No

person in competent to serve as executor or administrator who:

(a) Is a minor;

(b) Is not a resident of the Philippines; and

(c) Is in the opinion of the court unfit to execute the duties of the trust

by reason of drunkenness, improvidence, or want of understanding

or integrity, or by reason of conviction of an offense involving moral

turpitude.

Section 6. When and to whom letters of administration granted. — If no

executor is named in the will, or the executor or executors are incompetent,

refuse the trust, or fail to give bond, or a person dies intestate,

administration shall be granted:

(a) To the surviving husband or wife, as the case may be, or next of

kin, or both, in the discretion of the court, or to such person as such

surviving husband or wife, or next of kin, requests to have

appointed, if competent and willing to serve;

(b) If such surviving husband or wife, as the case may be, or next of

kin, or the person selected by them, be incompetent or unwilling, or if

the husband or widow, or next of kin, neglects for thirty (30) days

after the death of the person to apply for administration or to request

that administration be granted to some other person, it may be

granted to one or more of the principal creditors, if may be granted to

one or more of the principal creditors, if competent and willing to

serve;

(c) If there is no such creditor competent and willing to serve, it may

be granted to such other person as the court may select.

Section 33. Jurisdiction of Metropolitan Trial Courts, Municipal Trial Courts

and Municipal Circuit Trial Courts in civil cases. – Metropolitan Trial Courts,

Municipal Trial Courts, and Municipal Circuit Trial Courts shall exercise:

(1) Exclusive original jurisdiction over civil actions and probate

proceedings, testate and intestate, including the grant of provisional

remedies in proper cases, where the value of the personal property,

estate, or amount of the demand does not exceed One hundred

thousand pesos (P100,000.00) or, in Metro Manila where such

personal property, estate, or amount of the demand does not exceed

Two hundred thousand pesos (P200,000.00) exclusive of interest

damages of whatever kind, attorney's fees, litigation expenses, and

costs, the amount of which must be specifically alleged: Provided,

That where there are several claims or causes of action between the

same or different parties, embodied in the same complaint, the

amount of the demand shall be the totality of the claims in all the

causes of action, irrespective of whether the causes of action arose out

of the same or different transactions;

RULE 86

Claims Against Estate

Section 1. Notice to creditors to be issued by court. — Immediately after

granting letters testamentary or of administration, the court shall issue a

notice requiring all persons having money claims against the decedent to

file them in the office of the clerk of said court.

Section 5. Claims which must be filed under the notice. If not

filed, barred; exceptions. — All claims for money against the decedent,

arising from contract, express or implied, whether the same be due, not

due, or contingent, all claims for funeral expenses and expense for the last

sickness of the decedent, and judgment for money against the decent, must

be filed within the time limited in the notice; otherwise they are barred

forever, except that they may be set forth as counterclaims in any action

that the executor or administrator may bring against the claimants. Where

an executor or administrator commences an action, or prosecutes an action

already commenced by the deceased in his lifetime, the debtor may set

forth by answer the claims he has against the decedent, instead of

presenting them independently to the court as herein provided, and mutual

claims may be set off against each other in such action; and if final

judgment is rendered in favor of the defendant, the amount so determined

shall be considered the true balance against the estate, as though the claim

had been presented directly before the court in the administration

proceedings. Claims not yet due, or contingent, may be approved at their

present value.

Section 9. How to file a claim. Contents thereof. Notice to executor or

administrator. — A claim may be filed by delivering the same with the

necessary vouchers to the clerk of court and by serving a copy thereof on

the executor or administrator. If the claim be founded on a bond, bill, note,

or any other instrument, the original need not be filed, but a copy thereof

with all indorsements shall be attached to the claim and filed therewith. On

demand, however, of the executor or administrator, or by order of the court

or judge, the original shall be exhibited, unless it be list or destroyed, in

which case the claimant must accompany his claim with affidavit or

affidavits containing a copy or particular description of the instrument and

stating its loss or destruction. When the claim is due, it must be supported

by affidavit stating the amount justly due, that no payments have been

made thereon which are not credited, and that there are no offsets to the

same, to the knowledge of the affiant. If the claim is not due, or is

contingent, when filed, it must also be supported by affidavits stating the

particulars thereof. When the affidavit is made by a person other than the

claimant, he must set forth therein the reason why it is not made by the

claimant. The claim once filed shall be attached to the record of the case in

which the letters testamentary or of administration were issued, although

the court, in its discretion, and as a matter of convenience, may order all

the claims to be collected in a separate folder.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- CEC Vs FREDocument3 pagesCEC Vs FRElawschool2013No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Watcher's Appointment FormDocument1 pageWatcher's Appointment FormVlad Reyes89% (36)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Certificate of ChallengeDocument1 pageCertificate of ChallengeVlad Reyes100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Retainer ContractDocument5 pagesSample Retainer ContractVlad Reyes100% (6)

- Oath of Voter Challenged For Illegal ActsDocument1 pageOath of Voter Challenged For Illegal ActsVlad Reyes100% (3)

- Sample Board ResoDocument2 pagesSample Board ResoVlad ReyesNo ratings yet

- Proposal - Annapolis HOADocument3 pagesProposal - Annapolis HOAVlad ReyesNo ratings yet

- Authority - IPMDocument1 pageAuthority - IPMVlad ReyesNo ratings yet

- Sample Sec CertDocument2 pagesSample Sec CertVlad ReyesNo ratings yet

- Midterms - Oblicon - 2019 - 1st SemDocument2 pagesMidterms - Oblicon - 2019 - 1st SemVlad ReyesNo ratings yet

- Embroidery ToolsDocument1 pageEmbroidery ToolsVlad ReyesNo ratings yet

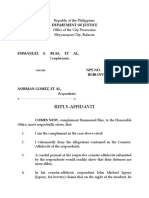

- Reply-Affidavit: Department of JusticeDocument4 pagesReply-Affidavit: Department of JusticeVlad ReyesNo ratings yet

- Securities Regulation Code - RA 8799Document70 pagesSecurities Regulation Code - RA 8799Vlad ReyesNo ratings yet

- Motion To Allow Accused To Appear Before The Office of The Provincial ProsecutorDocument3 pagesMotion To Allow Accused To Appear Before The Office of The Provincial ProsecutorVlad ReyesNo ratings yet

- Land Bank of The Philippines vs. WycocoDocument17 pagesLand Bank of The Philippines vs. WycocoRomNo ratings yet

- Direct Effect EU & WTODocument6 pagesDirect Effect EU & WTOZefanyaNo ratings yet

- BBC - Ethics - Capital Punishment - Arguments in Favour of Capital Punishment JUL 22 (7 COPIAS) PDFDocument3 pagesBBC - Ethics - Capital Punishment - Arguments in Favour of Capital Punishment JUL 22 (7 COPIAS) PDFAndrés MosqueraNo ratings yet

- 46 Gonzales v. CFIDocument5 pages46 Gonzales v. CFIBerenice Joanna Dela CruzNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument16 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- G.R. No. 195726 MARCELINO DELA PAZ, Petitioner Republic of The Philippines, Respondent Decision Martires, J.Document8 pagesG.R. No. 195726 MARCELINO DELA PAZ, Petitioner Republic of The Philippines, Respondent Decision Martires, J.Hannah VictoriaNo ratings yet

- Torts - Selmi (Spring 2008)Document40 pagesTorts - Selmi (Spring 2008)Min OhNo ratings yet

- 255 Maximo Cortes Vs Yu-TiboDocument1 page255 Maximo Cortes Vs Yu-TibonimkiNo ratings yet

- Presentation On Case Flow Management System: An Efficient and Transparent Means To Deliver Justice by GN - NthomiwaDocument13 pagesPresentation On Case Flow Management System: An Efficient and Transparent Means To Deliver Justice by GN - NthomiwaSolomon EmiruNo ratings yet

- Code of Professional ResponsibilityDocument5 pagesCode of Professional ResponsibilityStella LynNo ratings yet

- 19Document17 pages19The Supreme Court Public Information OfficeNo ratings yet

- Complaint Against Kansas Attorney Dennis Depew of Kansas AGs OfficeDocument25 pagesComplaint Against Kansas Attorney Dennis Depew of Kansas AGs OfficeConflict GateNo ratings yet

- Krissia Rosibel Paz-Avalos, A200 123 950 (BIA Dec. 6, 2012)Document6 pagesKrissia Rosibel Paz-Avalos, A200 123 950 (BIA Dec. 6, 2012)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Jurisdiction in Criminal CasesDocument6 pagesJurisdiction in Criminal CasesAthena GarridoNo ratings yet

- Constitutional Law 2: Lyceum of The Philippines (C C) S S, SY 2019-2020Document15 pagesConstitutional Law 2: Lyceum of The Philippines (C C) S S, SY 2019-2020JasminFallejoNo ratings yet

- Kelson Pure TheoryDocument2 pagesKelson Pure TheorySavikarjit Singh ThindNo ratings yet

- Criminal - Law - Outline ExamDocument124 pagesCriminal - Law - Outline Examikea wongNo ratings yet

- Seares Jr. Vs Atty Gonzales - AlzateDocument3 pagesSeares Jr. Vs Atty Gonzales - AlzateClint D. LumberioNo ratings yet

- Article 12 and 13 of The Constitution of IndiaDocument4 pagesArticle 12 and 13 of The Constitution of IndiajaimeettNo ratings yet

- Gorospe vs. NolascoDocument2 pagesGorospe vs. NolascoNeil MayorNo ratings yet

- King v. Hernaez - Stat. Con. - CabreaDocument9 pagesKing v. Hernaez - Stat. Con. - CabreazeynNo ratings yet

- Succession TSN 3rd Exam (Based On The Lectures of Atty. Leilanie Espejo)Document49 pagesSuccession TSN 3rd Exam (Based On The Lectures of Atty. Leilanie Espejo)Boy Kakak Toki100% (1)

- Barbara I. Morey, Etc. v. United States, 903 F.2d 880, 1st Cir. (1990)Document5 pagesBarbara I. Morey, Etc. v. United States, 903 F.2d 880, 1st Cir. (1990)Scribd Government DocsNo ratings yet

- Philam Vs ArnaldoDocument2 pagesPhilam Vs Arnaldokarl doceoNo ratings yet

- M S. Afcons Infra. Ltd. & Anr Vs M S Cherian Varkey Constn ... On 26 July, 2010Document19 pagesM S. Afcons Infra. Ltd. & Anr Vs M S Cherian Varkey Constn ... On 26 July, 2010Vinayak SNo ratings yet

- Reyes Vs Sta MariaDocument2 pagesReyes Vs Sta MariaLoren SeñeresNo ratings yet

- Platte Chemical Company v. Fuzion Et. Al.Document6 pagesPlatte Chemical Company v. Fuzion Et. Al.PriorSmartNo ratings yet

- EvidenceDocument202 pagesEvidenceMoi Warhead100% (1)

- People Vs DalisayDocument2 pagesPeople Vs DalisayKarl Estacion IVNo ratings yet