Professional Documents

Culture Documents

Time Value of Money Seatwork With Answers 10aug

Time Value of Money Seatwork With Answers 10aug

Uploaded by

Anna GuilingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value of Money Seatwork With Answers 10aug

Time Value of Money Seatwork With Answers 10aug

Uploaded by

Anna GuilingCopyright:

Available Formats

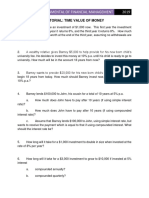

TIME VALUE OF MONEY

What's the present value of a 4-year ordinary annuity of $2,250 per year plus an additional $2,950 at the

end of Year 4 if the interest rate is 5%?

Answer is 10,405

Your company has just taken out a 1-year installment loan for $72,500 at a nominal rate of 18.5% but

with equal end-of-month payments. What percentage of the 2nd monthly payment will go toward the

repayment of principal?

Answer is 84.51%

After graduation, you plan to work for Dynamo Corporation for 12 years and then start your own

business. You expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and

$15,000 annually for the following 6 years (t = 7 through t = 12). The first deposit will be made a year

from today. In addition, your grandfather just gave you a $25,000 graduation gift which you will deposit

immediately (t = 0). If the account earns 9% compounded annually, how much will you have when you

start your business 12 years from now?

Answer is 277,791

Solution:

There are 3 cash flow streams: the gift and the two annuities. The gift will grow for 12 years. Then

there is a 6-year annuity whose FV at the end of year 6 will compound for an additional 6 years. Finally,

there is a second 6-year annuity. The sum of the compounded values of those three sets of cash flows is

the final amount.

Interest rate 9.0%

1st annuity $7,500

2nd annuity $15,000

Gift $25,000

Total years 12

Annuity years 6

Amount at Amount at end of

end of Year 6 Year 12

$56,425 Compound @ 9% $94,630

NA $112,850

NA $70,317

Final amt: $277,797

Suppose you are buying your first condo for $220,000, and you will make a $15,000 down payment. You

have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6.5%

nominal interest rate, with the first payment due in one month. What will your monthly payments be?

$1,295.74

You might also like

- Time Value of Money Sample ProblemsDocument7 pagesTime Value of Money Sample Problemsbanti198733% (3)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Optional Maths Revision Tutorial Questions: X X X A A A A A ADocument44 pagesOptional Maths Revision Tutorial Questions: X X X A A A A A ASaizchiNo ratings yet

- Solution Chapter 4 - Time Value of Money and DCF Analysis - Finance BodieDocument20 pagesSolution Chapter 4 - Time Value of Money and DCF Analysis - Finance Bodielehoangthuchien100% (4)

- Another Solution and QuestionDocument28 pagesAnother Solution and QuestionradislamyNo ratings yet

- Assignment - Ethical DilemmaDocument3 pagesAssignment - Ethical DilemmaAnna Guiling90% (10)

- Tutorial 2Document3 pagesTutorial 2jhagantiniNo ratings yet

- TUTORIAL TVM SolutionDocument5 pagesTUTORIAL TVM Solutionphuonganechan53No ratings yet

- Tutorial Questions AnnuitiesDocument2 pagesTutorial Questions AnnuitiesThomasaquinos msigala JrNo ratings yet

- Bus Math Sample Problem in HandoutsDocument7 pagesBus Math Sample Problem in HandoutsAria & Kira CatzNo ratings yet

- TVM ChallengingDocument5 pagesTVM Challengingnabeelarao100% (1)

- Problems1 - Time Value of MoneyDocument6 pagesProblems1 - Time Value of MoneyEconomist Octavian OctaviusNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Week 1 - Time Value of Money - MCQDocument10 pagesWeek 1 - Time Value of Money - MCQmail2manshaa100% (1)

- FIN 438 Practice ProblemsDocument5 pagesFIN 438 Practice ProblemstayyabNo ratings yet

- TCDN Quiz 2 Quiz 3Document2 pagesTCDN Quiz 2 Quiz 3nguyenyen231700No ratings yet

- Annuity QuestionsDocument6 pagesAnnuity QuestionsSankar Ranjan0% (1)

- EJERCICIOS EQUIVALENCIAS Libros Varios v2Document4 pagesEJERCICIOS EQUIVALENCIAS Libros Varios v2SAID ALEJANDRO MELENDEZ ALBARRACINNo ratings yet

- Fundamental of Financial Management January 1, 2015: Tutorial: Time Value of MoneyDocument5 pagesFundamental of Financial Management January 1, 2015: Tutorial: Time Value of MoneyNgoc HuynhNo ratings yet

- Fin Assigment 2Document2 pagesFin Assigment 2noor badarnehNo ratings yet

- Chapter 2 QDocument4 pagesChapter 2 QKiều LinhNo ratings yet

- Chapter 03, Math SolutionDocument8 pagesChapter 03, Math SolutionSaith UmairNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- FINMA1 - Time Value of Money Practice ProblemsDocument1 pageFINMA1 - Time Value of Money Practice Problemseath__No ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- FIN220 - Time Value of Money Practice QuestionsDocument2 pagesFIN220 - Time Value of Money Practice QuestionsMatt ZaheadNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia PiusNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia Pius100% (1)

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Annuity, Sinking Fund, AmortizationDocument6 pagesAnnuity, Sinking Fund, AmortizationClydeLisboaNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- TvmextraDocument8 pagesTvmextragl620054545No ratings yet

- 1b) Extra Financial Maths Practice QuestionsDocument5 pages1b) Extra Financial Maths Practice Questionsdong000416No ratings yet

- AnnuityDocument10 pagesAnnuityJiru Kun0% (1)

- Concepts 'N' Clarity: Time Value of MoneyDocument11 pagesConcepts 'N' Clarity: Time Value of MoneyKarla CorreaNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Lecture 13 - Annuities and MortgagesDocument15 pagesLecture 13 - Annuities and MortgagesM. Amin QureshiNo ratings yet

- Discussion Topics: AnnuitiesDocument15 pagesDiscussion Topics: AnnuitiesM. Amin QureshiNo ratings yet

- Sinking Funds & AnnuitiesDocument8 pagesSinking Funds & AnnuitiesRawlinson TolentinoNo ratings yet

- Handout2 PDFDocument2 pagesHandout2 PDFTheresiaVickaaNo ratings yet

- Assignment # 3: Chapter 3-The Time Value of MoneyDocument9 pagesAssignment # 3: Chapter 3-The Time Value of MoneyGenesis E. CarlosNo ratings yet

- FInalDocument7 pagesFInalRyan Martinez0% (1)

- Time Value of MoneyDocument16 pagesTime Value of MoneyneerajgangaNo ratings yet

- HW 2-SolnDocument9 pagesHW 2-SolnZhaohui ChenNo ratings yet

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDocument3 pagesDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngNo ratings yet

- Tutorial For Time Value of MoneyDocument4 pagesTutorial For Time Value of MoneyKim NgânNo ratings yet

- TUTORIAL TVM Feb17Document15 pagesTUTORIAL TVM Feb17Phong DươngNo ratings yet

- Chapter5 HW QuestionsDocument4 pagesChapter5 HW QuestionsAshish Bhalla0% (1)

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Vacation Dividends: Use Dividends to Pay for the Rest of Your Vacations: Financial Freedom, #56From EverandVacation Dividends: Use Dividends to Pay for the Rest of Your Vacations: Financial Freedom, #56No ratings yet

- CG - Exercise 3Document4 pagesCG - Exercise 3Anna Guiling0% (2)

- Stocks DrillsDocument1 pageStocks DrillsAnna GuilingNo ratings yet

- Semis Reviewer STSDocument3 pagesSemis Reviewer STSAnna GuilingNo ratings yet