Professional Documents

Culture Documents

B2B Group 3 Case 3 Analysis

B2B Group 3 Case 3 Analysis

Uploaded by

Arpan GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B2B Group 3 Case 3 Analysis

B2B Group 3 Case 3 Analysis

Uploaded by

Arpan GhoshCopyright:

Available Formats

Case Analysis

Doosan Infracore International: Portable

Power Brand Transformation (A)

Prepared by

Section B

Group-03

Moumita Majumdar 2014PGP208

Shatabdee Tripathy 2014PGP351

Kakde Sumedh Kamalakar 2014PGP151

Ankita Verma 2014PGP045

Lasya Chandrika E L 2014PGP180

Shikha Gandhi 2014PGP354

Identification of the problem

Korean conglomerate Doosan had acquired the Bobcat compact equipment, the utility

Equipment and Attachment Business from Ingersoll Rand to form Doosan Intracore

International (DII). The acquisition was a means to become a global, full-line manufacturer

and marketer of construction equipment.

While the full ownership of Bobcat brand was transferred to DII, however the 100 year old IR

brand with strong brand equity was licensed to DII for maximum of five years. Hence, the

challenge is how to go for rebranding of the IR brand which is now under Portable Power

Division.

Analysis of the situation and the problem

Following are the four options to be considered:

1. Keep the IR brand as long as possible (possibly renegotiate brand use agreement)

2. Begin co-branding strategy over 12-24 months, then transition to Doosan

3. Retain the brand for the full five years, then transition to Doosan

4. Immediate transition to Doosan

Options Advantages Disadvantages

Keep the IR brand as long as Doosan can leverage It is not in line with the

possible (possibly renegotiate the brand equity of IR Doosan’s philosophy

brand use agreement) to generate more to transition acquired

revenue brand as quickly as

It won’t disturb the possible

distributor’s network It was highly unlikely

that IR will renegotiate

the agreement

This will contribute to

brand equity of IR and

does not benefit

Doosan

Begin co-branding strategy Gives opportunity to End user’s association

over 12-24 months, then the end users to adapt with IR and its

transition to Doosan to the transition products may continue

Due to small despite strong

incremental transition, branding efforts from

it is easier to gauge Doosan

the market response

Distributors will be

more willing to partner

this change

Retain the brand for the full Doosan can benefit It would be difficult for

five years, then transition to from IR brand equity Doosan to transition

Doosan for five years after five years

It may erode profits

and revenue because

of abrupt transition

after five years

Distributors won’t be

willing to partner and

may switch to other

brands

Immediate transition to line with the Doosan’s Doosan may lose out

Doosan philosophy to an opportunity to

transition acquired benefit from IR brand

brand as quickly as equity

possible It will disturb the

extensive dealer

network acquired

through IR

Recommendations

It is recommended that Doosan should go with the second option i.e. Begin co-branding

strategy over 12-24 months, then transition to Doosan. No brand transition is required for

Bobcat. As IR portable power equipment has significant source of brand equity, across end-

user and geographic markets, it makes sense to leverage on its brand equity. Also, the

extensive dealer network which is a main influencer of user’s decision, won’t be disturbed. It

would give ample time to dealers and users to adapt to the transition.

Also the offerings by Doosan are standardised and the firm follows decentralization approach.

Hence, the firm should follow Brand Park architecture. This approach has the benefit of

leveraging the equity of the family brand to the whole portfolio, while retaining the equity in

the line brands.

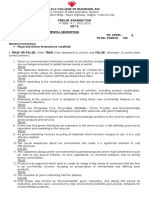

Standardized Umbrella

Brand Park

Brand Stack

Family Family

Centralization Decentralization

Brand Silos

Brand Tower

Customized

Ref: B2B Brand Architecture - Steve Muylle, Niraj Dawar and Deva Rangarajan

You might also like

- Payroll Project Chapter 7 - 2019Document79 pagesPayroll Project Chapter 7 - 2019Andrea Cox88% (135)

- INV91509602 Zoom KSKK Juli 2021 PDFDocument3 pagesINV91509602 Zoom KSKK Juli 2021 PDFSamsul Arifin0% (1)

- Case B 1Document5 pagesCase B 1rderijkNo ratings yet

- Consumerism and Prestige: The Materiality of Literature in the Modern AgeFrom EverandConsumerism and Prestige: The Materiality of Literature in the Modern AgeAnthony EnnsNo ratings yet

- Durian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)Document18 pagesDurian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)muhd fadhliNo ratings yet

- Branch Details:: Account Statement For The Account: 7997000100055573Document6 pagesBranch Details:: Account Statement For The Account: 7997000100055573Parth YadavNo ratings yet

- Bausch and Lomb-Group9Document10 pagesBausch and Lomb-Group9Nikita KhandujaNo ratings yet

- WAC-P16052 Dhruvkumar-West Lake Case AnalysisDocument7 pagesWAC-P16052 Dhruvkumar-West Lake Case AnalysisDHRUV SONAGARANo ratings yet

- Worldcom ScamDocument15 pagesWorldcom ScamVishal ZavariNo ratings yet

- Case 4 Garrick Oil and LubricantsDocument1 pageCase 4 Garrick Oil and LubricantsRuchika SinghNo ratings yet

- GSRTC Presentation BY RAHESH - BKMIBA-HLBBADocument49 pagesGSRTC Presentation BY RAHESH - BKMIBA-HLBBArahesh sutariyaNo ratings yet

- Bsbfia401 Ass4Document10 pagesBsbfia401 Ass4wanyuan gaoNo ratings yet

- Lumiere Lumiere: Supporting A Virtual Workspace On Cloud Supporting A Virtual Workspace On CloudDocument13 pagesLumiere Lumiere: Supporting A Virtual Workspace On Cloud Supporting A Virtual Workspace On CloudKhushi JainNo ratings yet

- Mother Dairy PresentationDocument5 pagesMother Dairy PresentationAKANSHANo ratings yet

- Land Rover North America Inc.Document14 pagesLand Rover North America Inc.rachitbhatnagar9038No ratings yet

- A Project Report On Nature Valley Growth and OpportunitiesDocument11 pagesA Project Report On Nature Valley Growth and Opportunitiesqwerty123ytrewqNo ratings yet

- Dominion Motors & Controls LTDDocument15 pagesDominion Motors & Controls LTDAmil BansalNo ratings yet

- Case Study: Dell Inc.-2005: Strategic ManagementDocument8 pagesCase Study: Dell Inc.-2005: Strategic ManagementMahmudul Hasan100% (1)

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Document9 pagesTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaNo ratings yet

- Asian PaintsDocument13 pagesAsian PaintsGOPS000No ratings yet

- Sakshee Sheetal Suchita Geetanjali Deepali RohitDocument18 pagesSakshee Sheetal Suchita Geetanjali Deepali Rohitsheetalsamant100% (1)

- Vertical NetDocument35 pagesVertical NetAkshay TalrejaNo ratings yet

- 231 0106Document18 pages231 0106api-27548664No ratings yet

- Consumer Relationship Management Case Submission: Group - 12Document13 pagesConsumer Relationship Management Case Submission: Group - 12Rakesh SethyNo ratings yet

- Group4 CMRDocument11 pagesGroup4 CMRTarun N. O'Brain GahlotNo ratings yet

- Dominion Motors & Controls, LTDDocument6 pagesDominion Motors & Controls, LTDdileepNo ratings yet

- Module 01 Class 01: Introduction To SCMDocument10 pagesModule 01 Class 01: Introduction To SCMVINAYAKA G P MECH.No ratings yet

- Group3 ABB&CaterpillarDocument3 pagesGroup3 ABB&CaterpillarmonikaNo ratings yet

- Seminar Applications of Management Accounting and Control: Cottle-Taylor: Expanding The Oral Care Group in IndiaDocument22 pagesSeminar Applications of Management Accounting and Control: Cottle-Taylor: Expanding The Oral Care Group in IndiaLukasNo ratings yet

- RBFI EndTerm 1811343Document3 pagesRBFI EndTerm 1811343nirupamap96No ratings yet

- DMB2B Assignment Shreya 2018PGP355Document5 pagesDMB2B Assignment Shreya 2018PGP355SHREYA PGP 2018-20 BatchNo ratings yet

- GEP Gameplan: Team Fire - Iim TrichyDocument6 pagesGEP Gameplan: Team Fire - Iim TrichyTinesh Kumar SNo ratings yet

- Case Analysis: Netflix: Pricing Decision 2011: Group 3Document7 pagesCase Analysis: Netflix: Pricing Decision 2011: Group 3vedant thakreNo ratings yet

- Supply Chain Management of Brand FactoryDocument23 pagesSupply Chain Management of Brand FactoryAkarshaNo ratings yet

- Dominion MotorsDocument9 pagesDominion MotorsSakura2709No ratings yet

- Official Finocontrol Brochure 2020Document23 pagesOfficial Finocontrol Brochure 2020pavan kalyan50% (2)

- Siemens CerberusEco in ChinaDocument8 pagesSiemens CerberusEco in ChinaHarun Rasheed100% (1)

- Hero Honda Motors (India) LTD.: Is It Honda That Made It A Hero?Document17 pagesHero Honda Motors (India) LTD.: Is It Honda That Made It A Hero?JatinMahaJanNo ratings yet

- HasbroPOX (A)Document6 pagesHasbroPOX (A)Parnamoy DuttaNo ratings yet

- Assignment: Individual Assignment 4 - Philips: Lighting Up Eden GardensDocument5 pagesAssignment: Individual Assignment 4 - Philips: Lighting Up Eden GardensVinayNo ratings yet

- Marketing Assingment: Dominion Motors & Controls Case StudyDocument4 pagesMarketing Assingment: Dominion Motors & Controls Case StudyParas JatanaNo ratings yet

- Atlantic Computer:: A Bundle of Pricing OptionsDocument6 pagesAtlantic Computer:: A Bundle of Pricing OptionsApoorva SonthaliaNo ratings yet

- JSW ShoppeDocument6 pagesJSW ShoppeNeha PandeNo ratings yet

- Jaguar Land Rover Acquisition Part 1Document12 pagesJaguar Land Rover Acquisition Part 1Ankur Dinesh PandeyNo ratings yet

- Metro Cash & CarryDocument9 pagesMetro Cash & CarrySaurav SanganeriaNo ratings yet

- Company Customers Competitors Collaborators ContextDocument3 pagesCompany Customers Competitors Collaborators ContextSanjay SankhalaNo ratings yet

- FreeMove Alliance Group5Document10 pagesFreeMove Alliance Group5Annisa MoeslimNo ratings yet

- IBM LINUX QuestionsDocument3 pagesIBM LINUX QuestionsNischal UpretiNo ratings yet

- AakashBookStore ClassDocument16 pagesAakashBookStore Classharshit100% (1)

- Index: Case Summary 3Document6 pagesIndex: Case Summary 3Nabarun PalNo ratings yet

- 12 1 Estylar Full Team PDFDocument20 pages12 1 Estylar Full Team PDFAugusto ChesiniNo ratings yet

- Dominion Case StudyDocument2 pagesDominion Case StudyANKIT AGARWALNo ratings yet

- Multivariate Data Analysis Assignment: Discriminant Analysis (3 Groups)Document6 pagesMultivariate Data Analysis Assignment: Discriminant Analysis (3 Groups)Niharika MondalNo ratings yet

- WESCO Distribution IncDocument10 pagesWESCO Distribution IncSugandha GuptaNo ratings yet

- Group3 Spacemaker PlusDocument3 pagesGroup3 Spacemaker PlusSabyasachi SahuNo ratings yet

- A Bomb in Your PocketDocument8 pagesA Bomb in Your PocketDeepti AhujaNo ratings yet

- Case Analysis Fevikwik and The Gurgaon Market: 1 - PidiliteDocument5 pagesCase Analysis Fevikwik and The Gurgaon Market: 1 - PidiliteDhruv MishraNo ratings yet

- Groups Analysis Case Submission: SAP Building A Leading Technology BrandDocument3 pagesGroups Analysis Case Submission: SAP Building A Leading Technology BrandAbhi MNo ratings yet

- Wipro C20-083 PDFDocument7 pagesWipro C20-083 PDFLokesh KātnamNo ratings yet

- CRM Assignment 19PT2-38 Vipul BhagatDocument12 pagesCRM Assignment 19PT2-38 Vipul BhagatVipul BhagatNo ratings yet

- Wipro RebrandingDocument5 pagesWipro RebrandingektankitNo ratings yet

- GEP Gameplan - ISB Hyderabad - ProdigoDocument7 pagesGEP Gameplan - ISB Hyderabad - ProdigoVarsha SinghalNo ratings yet

- Uber: Moving Away From Surge Pricing: Case 516-0216-1Document6 pagesUber: Moving Away From Surge Pricing: Case 516-0216-1Syeda Sana AliNo ratings yet

- CaseDocument4 pagesCaseYaswanth R K SurapureddyNo ratings yet

- B2B - Group 3 - Case 3 AnalysisDocument4 pagesB2B - Group 3 - Case 3 AnalysisSumedh KakdeNo ratings yet

- Performance Data #1: Rachel's Previous Discussions With NickDocument3 pagesPerformance Data #1: Rachel's Previous Discussions With NickArpan GhoshNo ratings yet

- A Bad Start: Addressing Poor PerformanceDocument1 pageA Bad Start: Addressing Poor PerformanceArpan GhoshNo ratings yet

- Formal Consequences: Addressing Poor PerformanceDocument1 pageFormal Consequences: Addressing Poor PerformanceArpan GhoshNo ratings yet

- Coaching Techniques: Seek and Leverage DataDocument2 pagesCoaching Techniques: Seek and Leverage DataArpan GhoshNo ratings yet

- 3-C - MessageDocument4 pages3-C - MessageArpan GhoshNo ratings yet

- PROSPECT RESTON POT CH en PDFDocument4 pagesPROSPECT RESTON POT CH en PDFArpan GhoshNo ratings yet

- Ultratech TDS Leaflet Powergrout NS1 PDFDocument1 pageUltratech TDS Leaflet Powergrout NS1 PDFArpan GhoshNo ratings yet

- FIP CodeDocument23 pagesFIP CodeArpan Ghosh100% (1)

- What Is BS en 10204, and The Differences Between EN10204-3Document7 pagesWhat Is BS en 10204, and The Differences Between EN10204-3Arpan GhoshNo ratings yet

- Commercial Roofing Help EbookDocument22 pagesCommercial Roofing Help EbookChoice Roof Contractor Group100% (1)

- Beps PPT Atad 3 1704896464Document30 pagesBeps PPT Atad 3 1704896464avnidikaNo ratings yet

- The Forum: Our New Comment SectionDocument36 pagesThe Forum: Our New Comment SectionCity A.M.No ratings yet

- Conquistadors On The Beach SPANISH COMPANIESDocument6 pagesConquistadors On The Beach SPANISH COMPANIESMazana ÁngelNo ratings yet

- 2 Emerald Article Meta-SWOT Introducing A New Strategic Planning ToolDocument11 pages2 Emerald Article Meta-SWOT Introducing A New Strategic Planning ToolDeny MahendraNo ratings yet

- Evidence of FundsDocument3 pagesEvidence of FundsFarukh AlamNo ratings yet

- Global Trade ManagementDocument11 pagesGlobal Trade ManagementFabricPainting KaraHoNo ratings yet

- Company ProfileDocument10 pagesCompany Profile1anupma0No ratings yet

- 2010 Revocation of BIR Ruling Nos DA 413 04 And20211004 12Document2 pages2010 Revocation of BIR Ruling Nos DA 413 04 And20211004 12HADTUGINo ratings yet

- Grundfos Pumps LTD.: Case StudyDocument39 pagesGrundfos Pumps LTD.: Case StudyGiorgos BabalisNo ratings yet

- Fiches CFA Level I - Ethics Mais Pas SeulementDocument19 pagesFiches CFA Level I - Ethics Mais Pas SeulementIkimasukaNo ratings yet

- Megaprojects and Risk Management Emaar PropertiesDocument21 pagesMegaprojects and Risk Management Emaar PropertieschineduNo ratings yet

- Country NotebookDocument21 pagesCountry NotebookNicolás VilladiegoNo ratings yet

- Computation On The PercentagesDocument3 pagesComputation On The PercentagesJRE LettingsNo ratings yet

- Chapter 11 MonitoringDocument37 pagesChapter 11 MonitoringRana LaeeqNo ratings yet

- Risk Management of Leasing CompanyDocument5 pagesRisk Management of Leasing CompanyRain FallingNo ratings yet

- Pengembangan Usaha PDFDocument142 pagesPengembangan Usaha PDFAndri DesuNo ratings yet

- Bharatiya KrishiDocument8 pagesBharatiya KrishiH Janardan PrabhuNo ratings yet

- Online Q 12014Document2 pagesOnline Q 12014Anonymous Feglbx5No ratings yet

- Causes of USSR DisintegrationDocument2 pagesCauses of USSR DisintegrationPragya PatelNo ratings yet

- Annual Procurement Plan For 2019: Division of BukidnonDocument15 pagesAnnual Procurement Plan For 2019: Division of BukidnonsgswNo ratings yet

- MR Muhammad Rafeek Offer Letter DomDocument2 pagesMR Muhammad Rafeek Offer Letter Domhzaib768No ratings yet

- Prelim Examination in Environmental MarketingDocument3 pagesPrelim Examination in Environmental MarketingArgie BayaNo ratings yet

- 4.1 The Role of MarketingDocument23 pages4.1 The Role of MarketingDanae Illia GamarraNo ratings yet

- Impact of Literacy Rate On UnemploymentDocument5 pagesImpact of Literacy Rate On UnemploymentNooruddin Chandio0% (1)