Professional Documents

Culture Documents

Case Gilbert Entreprises - Stock Valuation PDF

Case Gilbert Entreprises - Stock Valuation PDF

Uploaded by

Limbolimbo RotaCopyright:

Available Formats

You might also like

- Company LawDocument3 pagesCompany LawArslan Akram0% (1)

- CH 1 Assignment - An Overview of Financial Management PDFDocument13 pagesCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonNo ratings yet

- Managerial Accounting Case ProblemDocument14 pagesManagerial Accounting Case ProblemFrancis SarmientoNo ratings yet

- United Housewares BlankDocument15 pagesUnited Housewares BlankSulaimanAl-Sulaimani0% (1)

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- Case 68 Sweet DreamsDocument12 pagesCase 68 Sweet Dreams3happy3No ratings yet

- Cost of CapitalDocument2 pagesCost of Capitalrachanagadekar0% (1)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Acca IfrsDocument109 pagesAcca Ifrsesam5278No ratings yet

- 655 Week 9 Notes PDFDocument75 pages655 Week 9 Notes PDFsanaha786No ratings yet

- Chapter 01Document13 pagesChapter 01Asim NazirNo ratings yet

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Chapter 5Document21 pagesChapter 5MorerpNo ratings yet

- Mutual Funds and Other Investment Companies: Prior Written Consent of Mcgraw-Hill EducationDocument51 pagesMutual Funds and Other Investment Companies: Prior Written Consent of Mcgraw-Hill EducationJOJONo ratings yet

- Question # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in PakistanDocument14 pagesQuestion # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in Pakistanayub_balticNo ratings yet

- CIMA Masters Gateway F2 MCQDocument27 pagesCIMA Masters Gateway F2 MCQObaidul Hoque NomanNo ratings yet

- Abubaker Muhammad Haroon 55127Document4 pagesAbubaker Muhammad Haroon 55127Abubaker NathaniNo ratings yet

- Chapter 6Document24 pagesChapter 6sdfklmjsdlklskfjd100% (2)

- Chapter 6 (CF)Document51 pagesChapter 6 (CF)Hossain BelalNo ratings yet

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenNo ratings yet

- Delta Oil Company Uses The Successful Efforts Method To Account ForDocument1 pageDelta Oil Company Uses The Successful Efforts Method To Account ForFreelance WorkerNo ratings yet

- TOEFL iBT-The Test AdministrationDocument10 pagesTOEFL iBT-The Test AdministrationIemo LuHerreraNo ratings yet

- Team Management - Quiz 5Document12 pagesTeam Management - Quiz 5Prawin Manoharan100% (1)

- Group Account Week 1Document8 pagesGroup Account Week 1Omolaja IbukunNo ratings yet

- Module 3 Multiple Choice QuizDocument6 pagesModule 3 Multiple Choice QuizMag9191No ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Module 6: Corporate Governance and Business Ethics 10 HoursDocument6 pagesModule 6: Corporate Governance and Business Ethics 10 HoursCVRNo ratings yet

- Chapter 4 IMSM Hoyle11eDocument43 pagesChapter 4 IMSM Hoyle11echimmy29100% (1)

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Exam June 2009 SolutionsDocument15 pagesExam June 2009 SolutionsesaNo ratings yet

- Practice Questions: Problem 1.1Document6 pagesPractice Questions: Problem 1.1Chekralla HannaNo ratings yet

- Finance Homework 1Document6 pagesFinance Homework 1Ardian Widi100% (1)

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI Solutionssyeda hifzaNo ratings yet

- STR 581 Capstone Final Exam Part Two Latest Question AnswersDocument12 pagesSTR 581 Capstone Final Exam Part Two Latest Question AnswersaarenaddisonNo ratings yet

- Seven Cs ExamplesDocument5 pagesSeven Cs ExamplesFaizan Ahmed KiyaniNo ratings yet

- A R I M: Ccounts Eceivable AND Nventory AnagementDocument33 pagesA R I M: Ccounts Eceivable AND Nventory AnagementtennimNo ratings yet

- FINMAN TB Chapter13 Capital Structure and LeverageDocument32 pagesFINMAN TB Chapter13 Capital Structure and Leveragechin mohammadNo ratings yet

- Philippine Seven Corporation Corporate InformationDocument5 pagesPhilippine Seven Corporation Corporate InformationJenne LeeNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3anonymathieu50% (2)

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Accounting FEEPDocument25 pagesAccounting FEEPFOONG MIN JIE MBS221008100% (1)

- Edexcel Business Key TermsDocument3 pagesEdexcel Business Key Termskark youngNo ratings yet

- 9706 w11 QP 21Document12 pages9706 w11 QP 21Diksha KoossoolNo ratings yet

- Performance 6.10Document2 pagesPerformance 6.10George BulikiNo ratings yet

- GM588 - Practice Quiz 1Document4 pagesGM588 - Practice Quiz 1Chooy100% (1)

- MCQs of AccountsDocument23 pagesMCQs of AccountsShruti NaikNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- Answer Mini CaseDocument11 pagesAnswer Mini CaseJohan Yaacob100% (3)

- ACC 304 Week 3 Quiz 02 Chapter 09Document6 pagesACC 304 Week 3 Quiz 02 Chapter 09LereeNo ratings yet

- Transfer Pricing MethodsDocument5 pagesTransfer Pricing MethodsApatheticWarNo ratings yet

- Business CombinationDocument48 pagesBusiness CombinationbilalyasirNo ratings yet

- CMA P3 Finance 4Document23 pagesCMA P3 Finance 4Hamza Lutaf UllahNo ratings yet

- Ip RelVal01Document3 pagesIp RelVal01Liew Chee KiongNo ratings yet

- Quiz 2 - Business ValuationDocument17 pagesQuiz 2 - Business ValuationJacinta Fatima ChingNo ratings yet

- Grade: 16: - Midterm ExaminationDocument7 pagesGrade: 16: - Midterm Examinationra.manriquedNo ratings yet

- Stock Valuation Case Study SaudiDocument11 pagesStock Valuation Case Study SaudiGunaseelan Ramasamy100% (1)

- Company AnalysisDocument11 pagesCompany AnalysisRamesh Chandra DasNo ratings yet

- Apple - Analyzing Valuation Multiples - CaseDocument5 pagesApple - Analyzing Valuation Multiples - CaseShuting QinNo ratings yet

Case Gilbert Entreprises - Stock Valuation PDF

Case Gilbert Entreprises - Stock Valuation PDF

Uploaded by

Limbolimbo RotaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Gilbert Entreprises - Stock Valuation PDF

Case Gilbert Entreprises - Stock Valuation PDF

Uploaded by

Limbolimbo RotaCopyright:

Available Formats

Required

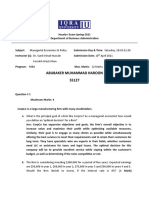

1. Using the approach for the valuation of a supernormal growth firm (shown as variable

growths in class), compute the value of the Gilbert Enterprises’ stock. Round all values

in the computation to two places to the right of the decimal point.

Does the firm appear to be under or overvalued in the market?

2. Examine the data in Figure 1 and indicate whether the firm’s P/E ratio (Price (per share)

divided by Earnings (per share)) appears to be appropriate in light of other firms in the

same industry. Explain and argue.

3. Based on the answers to questions 1 and 2, what recommendation would you suggest

that Albert Roth make?

You might also like

- Company LawDocument3 pagesCompany LawArslan Akram0% (1)

- CH 1 Assignment - An Overview of Financial Management PDFDocument13 pagesCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonNo ratings yet

- Managerial Accounting Case ProblemDocument14 pagesManagerial Accounting Case ProblemFrancis SarmientoNo ratings yet

- United Housewares BlankDocument15 pagesUnited Housewares BlankSulaimanAl-Sulaimani0% (1)

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- Case 68 Sweet DreamsDocument12 pagesCase 68 Sweet Dreams3happy3No ratings yet

- Cost of CapitalDocument2 pagesCost of Capitalrachanagadekar0% (1)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Acca IfrsDocument109 pagesAcca Ifrsesam5278No ratings yet

- 655 Week 9 Notes PDFDocument75 pages655 Week 9 Notes PDFsanaha786No ratings yet

- Chapter 01Document13 pagesChapter 01Asim NazirNo ratings yet

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Chapter 5Document21 pagesChapter 5MorerpNo ratings yet

- Mutual Funds and Other Investment Companies: Prior Written Consent of Mcgraw-Hill EducationDocument51 pagesMutual Funds and Other Investment Companies: Prior Written Consent of Mcgraw-Hill EducationJOJONo ratings yet

- Question # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in PakistanDocument14 pagesQuestion # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in Pakistanayub_balticNo ratings yet

- CIMA Masters Gateway F2 MCQDocument27 pagesCIMA Masters Gateway F2 MCQObaidul Hoque NomanNo ratings yet

- Abubaker Muhammad Haroon 55127Document4 pagesAbubaker Muhammad Haroon 55127Abubaker NathaniNo ratings yet

- Chapter 6Document24 pagesChapter 6sdfklmjsdlklskfjd100% (2)

- Chapter 6 (CF)Document51 pagesChapter 6 (CF)Hossain BelalNo ratings yet

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenNo ratings yet

- Delta Oil Company Uses The Successful Efforts Method To Account ForDocument1 pageDelta Oil Company Uses The Successful Efforts Method To Account ForFreelance WorkerNo ratings yet

- TOEFL iBT-The Test AdministrationDocument10 pagesTOEFL iBT-The Test AdministrationIemo LuHerreraNo ratings yet

- Team Management - Quiz 5Document12 pagesTeam Management - Quiz 5Prawin Manoharan100% (1)

- Group Account Week 1Document8 pagesGroup Account Week 1Omolaja IbukunNo ratings yet

- Module 3 Multiple Choice QuizDocument6 pagesModule 3 Multiple Choice QuizMag9191No ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Module 6: Corporate Governance and Business Ethics 10 HoursDocument6 pagesModule 6: Corporate Governance and Business Ethics 10 HoursCVRNo ratings yet

- Chapter 4 IMSM Hoyle11eDocument43 pagesChapter 4 IMSM Hoyle11echimmy29100% (1)

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Exam June 2009 SolutionsDocument15 pagesExam June 2009 SolutionsesaNo ratings yet

- Practice Questions: Problem 1.1Document6 pagesPractice Questions: Problem 1.1Chekralla HannaNo ratings yet

- Finance Homework 1Document6 pagesFinance Homework 1Ardian Widi100% (1)

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI Solutionssyeda hifzaNo ratings yet

- STR 581 Capstone Final Exam Part Two Latest Question AnswersDocument12 pagesSTR 581 Capstone Final Exam Part Two Latest Question AnswersaarenaddisonNo ratings yet

- Seven Cs ExamplesDocument5 pagesSeven Cs ExamplesFaizan Ahmed KiyaniNo ratings yet

- A R I M: Ccounts Eceivable AND Nventory AnagementDocument33 pagesA R I M: Ccounts Eceivable AND Nventory AnagementtennimNo ratings yet

- FINMAN TB Chapter13 Capital Structure and LeverageDocument32 pagesFINMAN TB Chapter13 Capital Structure and Leveragechin mohammadNo ratings yet

- Philippine Seven Corporation Corporate InformationDocument5 pagesPhilippine Seven Corporation Corporate InformationJenne LeeNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3anonymathieu50% (2)

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Accounting FEEPDocument25 pagesAccounting FEEPFOONG MIN JIE MBS221008100% (1)

- Edexcel Business Key TermsDocument3 pagesEdexcel Business Key Termskark youngNo ratings yet

- 9706 w11 QP 21Document12 pages9706 w11 QP 21Diksha KoossoolNo ratings yet

- Performance 6.10Document2 pagesPerformance 6.10George BulikiNo ratings yet

- GM588 - Practice Quiz 1Document4 pagesGM588 - Practice Quiz 1Chooy100% (1)

- MCQs of AccountsDocument23 pagesMCQs of AccountsShruti NaikNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- Answer Mini CaseDocument11 pagesAnswer Mini CaseJohan Yaacob100% (3)

- ACC 304 Week 3 Quiz 02 Chapter 09Document6 pagesACC 304 Week 3 Quiz 02 Chapter 09LereeNo ratings yet

- Transfer Pricing MethodsDocument5 pagesTransfer Pricing MethodsApatheticWarNo ratings yet

- Business CombinationDocument48 pagesBusiness CombinationbilalyasirNo ratings yet

- CMA P3 Finance 4Document23 pagesCMA P3 Finance 4Hamza Lutaf UllahNo ratings yet

- Ip RelVal01Document3 pagesIp RelVal01Liew Chee KiongNo ratings yet

- Quiz 2 - Business ValuationDocument17 pagesQuiz 2 - Business ValuationJacinta Fatima ChingNo ratings yet

- Grade: 16: - Midterm ExaminationDocument7 pagesGrade: 16: - Midterm Examinationra.manriquedNo ratings yet

- Stock Valuation Case Study SaudiDocument11 pagesStock Valuation Case Study SaudiGunaseelan Ramasamy100% (1)

- Company AnalysisDocument11 pagesCompany AnalysisRamesh Chandra DasNo ratings yet

- Apple - Analyzing Valuation Multiples - CaseDocument5 pagesApple - Analyzing Valuation Multiples - CaseShuting QinNo ratings yet