Professional Documents

Culture Documents

Economic Survey 2012-13 - Copy 70

Economic Survey 2012-13 - Copy 70

Uploaded by

jamalCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Deed of Absolute SaleDocument3 pagesDeed of Absolute Saleramel4uNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Plan of Pasteurized Milk Production in PakistanDocument20 pagesBusiness Plan of Pasteurized Milk Production in Pakistanjamal0% (1)

- Golf Resort Trend & ChallengesDocument8 pagesGolf Resort Trend & ChallengesAzmi Che LehNo ratings yet

- Republic Act No. 10533Document6 pagesRepublic Act No. 10533Jecky Josette AsentistaNo ratings yet

- Published MRC ME Report 2019 ICMPD Dec 2019Document55 pagesPublished MRC ME Report 2019 ICMPD Dec 2019jamalNo ratings yet

- Policy Dialogue The 18 Constitutional Amendment, Provincial Autonomy and Khyber Pakhtunkhwa: Lessons Learnt and Way ForewordDocument2 pagesPolicy Dialogue The 18 Constitutional Amendment, Provincial Autonomy and Khyber Pakhtunkhwa: Lessons Learnt and Way ForewordjamalNo ratings yet

- Water: Groundwater Governance in Pakistan: From Colossal Development To Neglected ManagementDocument19 pagesWater: Groundwater Governance in Pakistan: From Colossal Development To Neglected ManagementjamalNo ratings yet

- Sustainable Agriculture and Rural Development in The Kingdom of Saudi Arabia: Implications For Agricultural Extension and EducationDocument17 pagesSustainable Agriculture and Rural Development in The Kingdom of Saudi Arabia: Implications For Agricultural Extension and EducationjamalNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Public SectorDocument3 pagesPublic SectorAdebowaleIsmailGaniyuNo ratings yet

- Introduction To AuditingDocument24 pagesIntroduction To AuditingVinayak SaxenaNo ratings yet

- Business and Education Advisory MembersDocument1 pageBusiness and Education Advisory MembersMichelle StubbsNo ratings yet

- Quality Control and Quality Assurance SystemDocument9 pagesQuality Control and Quality Assurance SystemSathi shNo ratings yet

- Tang Dhong Tech - Pitch Deck FinalDocument14 pagesTang Dhong Tech - Pitch Deck FinalAgung RNo ratings yet

- MicroStrategy Education Catalog PDFDocument72 pagesMicroStrategy Education Catalog PDFgeoinsys100% (1)

- Summary SuitDocument4 pagesSummary SuitThomas BergNo ratings yet

- Voucher & Other FormsDocument30 pagesVoucher & Other FormsLeonorBagnisonNo ratings yet

- 2.0 Element of Conversion (Latest)Document5 pages2.0 Element of Conversion (Latest)b2utifulxxxNo ratings yet

- Marketing - Section ADocument15 pagesMarketing - Section AArchana NeppolianNo ratings yet

- KAMDAR-Annualreport2009 (1.7MB)Document87 pagesKAMDAR-Annualreport2009 (1.7MB)Kee_Mei_Chwen_2087No ratings yet

- CC Unit 5, Orders and Cover Letters of OrdersDocument36 pagesCC Unit 5, Orders and Cover Letters of OrdersReikoAiNo ratings yet

- 10-11-2016 - The Hindu - Shashi ThakurDocument26 pages10-11-2016 - The Hindu - Shashi ThakurSunilSainiNo ratings yet

- Inverse Optimization - A New Perspective On The Black-Litterman ModelDocument15 pagesInverse Optimization - A New Perspective On The Black-Litterman ModelJulio José100% (1)

- Marketing Final ReportDocument70 pagesMarketing Final Reportsatya0% (1)

- FLENDER D20-1 English HELICAL AND BEVEL GEARDocument25 pagesFLENDER D20-1 English HELICAL AND BEVEL GEARParcela Pinares NorteNo ratings yet

- Baker Tilly International Corporate Identity Guidelines January 2013Document243 pagesBaker Tilly International Corporate Identity Guidelines January 2013zanNo ratings yet

- PCB Quote 1003Document1 pagePCB Quote 1003rhedmishNo ratings yet

- Call Centre Agent: Posted 6 Days Ago Salary: - Closes: July 11, 2021Document3 pagesCall Centre Agent: Posted 6 Days Ago Salary: - Closes: July 11, 2021joanmubzNo ratings yet

- Whitt, Louis Nikkolai San Pedro: #591 Saturn St. Airlane Road Naia Pasay City 639611832255Document4 pagesWhitt, Louis Nikkolai San Pedro: #591 Saturn St. Airlane Road Naia Pasay City 639611832255Aryl LyraNo ratings yet

- Franchise ProjectDocument3 pagesFranchise ProjectNicollete Limguangco SablaonNo ratings yet

- MBA's Class of 2014: Amity UniversityDocument2 pagesMBA's Class of 2014: Amity UniversityAnuj HandaNo ratings yet

- QAWithUL 60601-3rdeditionDocument18 pagesQAWithUL 60601-3rdeditionMonart PonNo ratings yet

- SSC Model Test 01Document9 pagesSSC Model Test 01nikhilam.comNo ratings yet

- Curriculum Vitae: Karishma Bhardwaj Permanent AddressDocument3 pagesCurriculum Vitae: Karishma Bhardwaj Permanent AddressKarishma BhardwajNo ratings yet

- Industrial Sickness in India & Case StudyDocument35 pagesIndustrial Sickness in India & Case StudyNeha Singh100% (4)

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence Loplop0% (1)

Economic Survey 2012-13 - Copy 70

Economic Survey 2012-13 - Copy 70

Uploaded by

jamalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Survey 2012-13 - Copy 70

Economic Survey 2012-13 - Copy 70

Uploaded by

jamalCopyright:

Available Formats

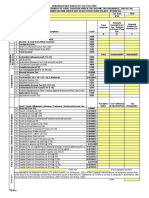

72 Pakistan Economic Survey 2012-13

Box-3: Program Initiatives

To complement policy measures & promote financial inclusion, SBP also undertakes implementation of government

and donor funded programs. The updates on government programs and SBP market interventions are as follows:

To promote financial inclusion in the country, SBP has been implementing the DFID-funded Financial Inclusion

Program (FIP) with the aim to promote inclusive growth and to improve income and livelihoods opportunities for poor

and marginalized groups in Pakistan. The progress and details on account of different interventions of FIP are given

below:

a) Microfinance Credit Guarantee Facility: The £10 million MCGF is a credit enhancement facility launched by SBP

in December 2008 under FIP to cover partial risks against the loans extended to microfinance providers by the

commercial banks. The facility has helped develop the market and introduce poor borrowers to mainstream financial

institutions. So far 25 guarantees have mobilized Rs.7.075 billion from commercial bank for onward lending to around

350,000 new micro borrowers. The scope of the facility has been enhanced to mobilize non-bank financing from capital

markets, further diversifying sources of financing for micro borrowers.

b) Institutional Strengthening Fund (ISF): In December 2008, SBP launched £10million ISF facility with the

objective to provide grants for strengthening the institutional and human resource capacity of the microfinance

providers (MFPs). Up till now, Rs.638 million have been approved for 13 MFPs which cover 20 projects addressing

institutional strengthening needs of the grantee institutions for Capacity Building/ HR Training, IT development,

Business Plan/ Strategic reviews, Market Research, Branchless Banking, Corporate Governance, Credit Ratings,

Remittances, and Treasury functions etc.

c) Credit Guarantee Scheme for small and rural borrowers (CGS): CGS worth £10million was launched in March

2010 to facilitate credit to small and rural businesses for greater outreach. Under CGS, limits worth PKR 4.830 billion

have been assigned to 12 banks for 2012 and the Guarantees of Rs. 1,231 million have been issued against sanctioned

loans of Rs. 2,923 million for providing new loans of 4,861 to Agri. & Small Enterprises

d) Financial Innovation Challenge Fund (FICF): a £10 million facility that aims to foster innovations and test new

markets, lower cost of delivery, enable systems and procedures to be more efficient and provide new ways of meeting

the unmet demand for financial services. The first round of the Fund which was held on Government to Person (G2P)

Payments has now been successfully concluded by deciding to award Rs. 505 Million to six applicant institutions. The

2nd FICF Round would be held on Rural Financial services including agricultural finance and broad based Financial

Services Projects using telecommunication infrastructure to promote micro payment for people who are not part of

financial services

e) Technical Assistance (TA) worth £10 million was launched for providing support to improve market Information

and Infrastructure, such as

I) Support to Systemic Areas

` National Microfinance Credit Information Bureau

` Anti-Money Laundering: Strengthening of FMU’s information systems and analytical capabilities

` Pakistan Remittance Initiative (PRI)

` Third party transparency initiative for MF industry

` Strengthening Consumer protection monitoring vis-à-vis global benchmarks

II) Surveys and Assessments such as G2P payments, Islamic: KAP Survey, SME Cluster Surveys, Hybrid Value

Chain financing study, Branchless Banking Survey and development plan Access to Finance survey -2, Agriculture

Finance Study etc.

Lack of financial literacy has been a major constraint to enhance financial inclusion in the country. In order to address

this challenge, SBP launched Pakistan's first-ever Nationwide Financial Literacy Program (NFLP) on 20th January 2012

to assist financial inclusion and poverty alleviation efforts to facilitate economic growth and stability across the country

The dissemination of the pilot program has now been completed successfully. The program focused on disseminating

basic education about financial concepts, products and services to masses focusing on Budgeting, Savings, Investments,

Banking Products and Services, Debt Management and Consumer Right and Responsibilities etc. As a way forward, the

program will further be scaled up based on the evaluation of the pilot project to reach out to more than 500,000 poor

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Deed of Absolute SaleDocument3 pagesDeed of Absolute Saleramel4uNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Plan of Pasteurized Milk Production in PakistanDocument20 pagesBusiness Plan of Pasteurized Milk Production in Pakistanjamal0% (1)

- Golf Resort Trend & ChallengesDocument8 pagesGolf Resort Trend & ChallengesAzmi Che LehNo ratings yet

- Republic Act No. 10533Document6 pagesRepublic Act No. 10533Jecky Josette AsentistaNo ratings yet

- Published MRC ME Report 2019 ICMPD Dec 2019Document55 pagesPublished MRC ME Report 2019 ICMPD Dec 2019jamalNo ratings yet

- Policy Dialogue The 18 Constitutional Amendment, Provincial Autonomy and Khyber Pakhtunkhwa: Lessons Learnt and Way ForewordDocument2 pagesPolicy Dialogue The 18 Constitutional Amendment, Provincial Autonomy and Khyber Pakhtunkhwa: Lessons Learnt and Way ForewordjamalNo ratings yet

- Water: Groundwater Governance in Pakistan: From Colossal Development To Neglected ManagementDocument19 pagesWater: Groundwater Governance in Pakistan: From Colossal Development To Neglected ManagementjamalNo ratings yet

- Sustainable Agriculture and Rural Development in The Kingdom of Saudi Arabia: Implications For Agricultural Extension and EducationDocument17 pagesSustainable Agriculture and Rural Development in The Kingdom of Saudi Arabia: Implications For Agricultural Extension and EducationjamalNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Public SectorDocument3 pagesPublic SectorAdebowaleIsmailGaniyuNo ratings yet

- Introduction To AuditingDocument24 pagesIntroduction To AuditingVinayak SaxenaNo ratings yet

- Business and Education Advisory MembersDocument1 pageBusiness and Education Advisory MembersMichelle StubbsNo ratings yet

- Quality Control and Quality Assurance SystemDocument9 pagesQuality Control and Quality Assurance SystemSathi shNo ratings yet

- Tang Dhong Tech - Pitch Deck FinalDocument14 pagesTang Dhong Tech - Pitch Deck FinalAgung RNo ratings yet

- MicroStrategy Education Catalog PDFDocument72 pagesMicroStrategy Education Catalog PDFgeoinsys100% (1)

- Summary SuitDocument4 pagesSummary SuitThomas BergNo ratings yet

- Voucher & Other FormsDocument30 pagesVoucher & Other FormsLeonorBagnisonNo ratings yet

- 2.0 Element of Conversion (Latest)Document5 pages2.0 Element of Conversion (Latest)b2utifulxxxNo ratings yet

- Marketing - Section ADocument15 pagesMarketing - Section AArchana NeppolianNo ratings yet

- KAMDAR-Annualreport2009 (1.7MB)Document87 pagesKAMDAR-Annualreport2009 (1.7MB)Kee_Mei_Chwen_2087No ratings yet

- CC Unit 5, Orders and Cover Letters of OrdersDocument36 pagesCC Unit 5, Orders and Cover Letters of OrdersReikoAiNo ratings yet

- 10-11-2016 - The Hindu - Shashi ThakurDocument26 pages10-11-2016 - The Hindu - Shashi ThakurSunilSainiNo ratings yet

- Inverse Optimization - A New Perspective On The Black-Litterman ModelDocument15 pagesInverse Optimization - A New Perspective On The Black-Litterman ModelJulio José100% (1)

- Marketing Final ReportDocument70 pagesMarketing Final Reportsatya0% (1)

- FLENDER D20-1 English HELICAL AND BEVEL GEARDocument25 pagesFLENDER D20-1 English HELICAL AND BEVEL GEARParcela Pinares NorteNo ratings yet

- Baker Tilly International Corporate Identity Guidelines January 2013Document243 pagesBaker Tilly International Corporate Identity Guidelines January 2013zanNo ratings yet

- PCB Quote 1003Document1 pagePCB Quote 1003rhedmishNo ratings yet

- Call Centre Agent: Posted 6 Days Ago Salary: - Closes: July 11, 2021Document3 pagesCall Centre Agent: Posted 6 Days Ago Salary: - Closes: July 11, 2021joanmubzNo ratings yet

- Whitt, Louis Nikkolai San Pedro: #591 Saturn St. Airlane Road Naia Pasay City 639611832255Document4 pagesWhitt, Louis Nikkolai San Pedro: #591 Saturn St. Airlane Road Naia Pasay City 639611832255Aryl LyraNo ratings yet

- Franchise ProjectDocument3 pagesFranchise ProjectNicollete Limguangco SablaonNo ratings yet

- MBA's Class of 2014: Amity UniversityDocument2 pagesMBA's Class of 2014: Amity UniversityAnuj HandaNo ratings yet

- QAWithUL 60601-3rdeditionDocument18 pagesQAWithUL 60601-3rdeditionMonart PonNo ratings yet

- SSC Model Test 01Document9 pagesSSC Model Test 01nikhilam.comNo ratings yet

- Curriculum Vitae: Karishma Bhardwaj Permanent AddressDocument3 pagesCurriculum Vitae: Karishma Bhardwaj Permanent AddressKarishma BhardwajNo ratings yet

- Industrial Sickness in India & Case StudyDocument35 pagesIndustrial Sickness in India & Case StudyNeha Singh100% (4)

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence Loplop0% (1)