Professional Documents

Culture Documents

2.6 Session 04

2.6 Session 04

Uploaded by

smfi4490Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.6 Session 04

2.6 Session 04

Uploaded by

smfi4490Copyright:

Available Formats

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

OVERVIEW

Objective

To explain the ethical base of auditing.

PROFESSIONAL

CODES

Introduction ACCA RULES OF

Overseas members PROFESSIONAL IFAC CODE OF

CONDUCT ETHICS

Students

Fundamental principles Introduction

Objectives

Fundamental principles

The Code

Other services

INTEGRITY,

OBJECTIVITY & CONFIDENTIALITY CONFLICTS OF

INDEPENDENCE INTEREST

Principle Improper disclosure Member v client

Undue dependence Improper use Client v client

Overdue fees

Relationships

Beneficial interests

Audit appointments

Loans

Hospitality

Other services

Review procedures

Second opinions

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0401

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

1 RULES OF PROFESSIONAL CONDUCT

1.1 Introduction

Members of the Association are required to observe proper standards of

professional conduct and refrain from misconduct

Failure to observe standards may result in disciplinary proceedings.

1.2 Overseas members

May adhere to local guidance where profession is controlled by a reputable

body or by law.

1.3 Students

Students, as affirmed by their signature to the application forms to be

enrolled as registered students, are bound by the ethical requirements of the

Association.

1.4 Fundamental Principles

Integrity In all professional, business and personal

financial relationships

Implies honesty, fair dealing and truthfulness.

Objectivity In all professional and business judgements

A state of mind which has regard to all

considerations relevant to the task but no other

Presupposes intellectual honesty.

Competence Should not accept work which cannot be

competently undertaken .

Due skill and care Professional work should be carried out with

due skill, care, diligence and expedition

With proper regard for technical and

professional standards expected.

Courtesy and consideration Towards all with whom they come into contact

while performing work.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0402

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

2 INTEGRITY, OBJECTIVITY AND INDEPENDENCE

2.1 Principle

A member’s objectivity must be beyond question. Objectivity can only be assured if

the member is, and is seen to be, independent.

2.2 Area of risk – undue dependence on an audit client

2.2.1 Examples

The desire not to lose a prestigious client.

Fee income – for audit and other recurring work paid by one client (or a

group of connected clients) should not exceed the following extreme % of

gross practice income.

Initiate Extreme

review

Listed and other public interest companies 5% 10%

Other clients 10% 15%

Criterion does not apply to new practices.

The propriety of accepting or retaining clients should be reviewed

against lower % figures – and safeguards set up if engagement

accepted/retained.

A partner from another office in the practice may take final

reporting responsibility.

A company planning to seek a listing will be public interest before

it is listed (because publicity leading up to flotation will be “in the

public eye”).

Fee income – non-recurring assignments. If taken together with recurring

work, could give rise to dependency.

2.3 Area of risk – overdue fees

Can be a threat – akin to a loan (see below).

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0403

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

2.4 Area of risk – actual or threatened litigation

2.4.1 Examples

Issue of a writ for negligence

Allegations of fraud/deceit by officers of the company.

2.4.2 Discussion

Firm and client may be placed in adversarial positions, therefore

auditor unable to report impartially

client unwilling to disclose relevant information.

Auditor should have regard to circumstances where litigation might reasonably

be perceived by the public as in contemplation (eg where adverse publicity

affects a listed/public interest company and reference is made to reliance on

financial statements prepared by the firm).

2.5 Area of risk – family and other personal relationships

Legislation may prohibit an officer/employee of a company from accepting

appointment as auditor of that company (eg UK Companies Act 1989).

A member should not take part in the conduct of an audit of a company if he

has been an officer or employee of that company within the last 3 financial

years.

A practice should not report on a company if a company associated with the

practice fills the appointment of secretary to the client.

2.6 Area of risk – beneficial interests in shares and other investments

Shares acquired by a partner should be disposed of at the earliest practicable

date. Otherwise, disengage.

An auditor required to be a shareholder (eg by constitution should hold not

more than the minimum number of shares necessary to comply. The

shareholding should be disclosed in the accounts, in the directors’ report or

the auditor’s report.

A member should not have a Personal Equity Plan (PEP) which has among

its investments any audit client.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0404

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

2.7 Area of risk – voting on audit appointments

A partner or member of staff who holds shares in a company which is an

audit client of the practice should not vote at any general meeting in relation

to the auditor’s

− appointment

− removal

− remuneration.

2.8 Area of risk – loans

In respect of an audit client, a practice should not

− make a loan

− accept a loan

− guarantee borrowings.

Audit partners and employees may have overdraft facilities and have

mortgage loans with financial institution clients.

2.9 Area of risk – goods and services; hospitality

Should not be accepted unless value of any benefit is modest.

2.10 Area of risk – provision of other services to audit clients

2.10.1 Generally

There is no objection in principle to providing services additional to audit.

BUT, do not perform management functions/make management decisions.

2.10.2 Preparation of accounting records

It is common to provide a range of accountancy services including

preparation of accounting records.

For a public interest company audit clients, a practice should not participate

in preparing accounts and accounting records, except to assist in routine

clerical or emergency situations.

Safeguards (in all cases)

Client accepts responsibility for records as its own

Practice must not assume management role

Practice to make appropriate audit tests.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0405

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

2.10.3 Others

Recruitment of key financial/administrative staff – audit practice may advertise,

interview, “short list” and recommend but final decision must be client’s.

Specialist valuation (eg of a pension fund) – a practice should not audit financial

statements which include such a valuation carried out by the practice.

2.11 Review procedures

2.11.1 Annual review

To confirm that each engagement may be properly accepted or continued.

To identify situations where independence may be at risk and safeguards

need to be applied.

2.11.2 Safeguards

Inclusion of a manager or other qualified employee in the audit team.

Rotation of the engagement partner.

Rotation of senior members of staff.

Procedure to report to partner other than engagement partner as last resort.

Final reporting responsibility rests with a partner from another office.

Example 1

Required:

Comment and conclude on the following four situations.

Solution

(1) Petr, a recently qualified member of ACCA, has decided to go into practice

alone. He already has a small private portfolio of $150,000 gross fee income

but has now been approached by his cousin to take over the audit of her

company, the last audit fee for which was $120,000.

Comment –

Conclusion –

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0406

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

(2) Paine & Co has been requested by a long standing client to do a special

investigation into a foreign group of companies. The target group is based in

Turkey where the firm has no representation. The client is very keen to use the

firm and are prepared to pay not only for the cost of the investigation but also

the additional costs of the firm having to use temporary staff to service other

existing clients. The firm’s gross practice income is normally $7,500,000, the

audit fee for this client is normally $800,000. The extra service is expected to

cost the client $1,600,000.

Comment –

Conclusions –

(3) Ambit plc is preparing to apply for admission to a recognised stock market, at

the same time offering a proportion of its shares to the public. The directors

have asked Schilling & Co, as its auditors, to set up and maintain the

company’s share register on a computer database.

Comment –

Conclusion –

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0407

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

(4) Sean & Co are the auditors of Starck a.s. During 2001, Starck has expanded

rapidly, taken over three other companies and is currently preparing to float a

proportion of its shares on a recognised stock exchange. As a result of several

special assignments connected with these events, total fees from Starck amount

to 19% of the total fee income of Sean & Co in 2001.

In addition, Sean & Co’s senior tax manager owns a small number of shares in

Starck, acquired several years ago when the company issued shares under a

business expansion scheme.

Comment –

Conclusion –

2.12 Second opinions

When an entity approaches an accounting firm who is not its auditor for an opinion on

the application of accounting standards or principles.

2.12.1 Risks

The firm may express an opinion which is not based on the facts as known to

the auditor.

The second opinion may create undue pressure on the judgement and

objectivity of the appointed auditor.

2.12.2 Safeguards

The person or firm asked for a second opinion:

must obtain all relevant information by contacting the auditor and

asking for any relevant facts

should be prepared to provide the auditor with their opinion, given

the client’s permission.

If communication with the auditor is refused, a second opinion must not be given.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0408

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

3 CONFIDENTIALITY

Two aspects

3.1 Improper disclosure 3.2 Improper use

3.1 Improper disclosure

3.1.1 Principle

Information acquired in the course of professional work should not be disclosed to

third parties without first obtaining the client’s permission.

Exceptions

there is a statutory right or duty to disclose

under obligation of a court order.

3.1.2 General position

Confidentiality is an implied term of a contract between an auditor and client.

It is in the public interest that this professional duty of confidence exists.

Auditors are normally under NO legal obligation to disclose defaults or

unlawful acts (or suspicions thereof) to anyone other than the client’s

management.

Where there is a right (as opposed to a duty), disclosure should only be made

in pursuit of a public duty or professional obligation.

Members are strongly recommended to take legal advice.

3.1.3 Obligatory disclosure

UK examples include actual or suspected offences of

terrorism

treason

money laundering

drug trafficking.

3.1.4 Voluntary disclosure

In the “public interest” to a person having proper interest to receive

information eg the police

To protect the auditor’s interests eg in defending against ACCA disciplinary

proceedings

Authorised by statute

To non-governmental bodies.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0409

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

3.2 Improper use of information

3.2.1 Principle

A member acquiring information in the course of his or her professional work should

neither use nor appear to use that information for his personal advantage or for the

advantage of a third party.

3.2.2 Examples

When a member changes firm or employment he should distinguish between

− experience gained in the previous firm or employment; and

− confidential information acquired there.

A member should not deal in the shares of a company with which he has a

professional association as might make it appear that he was turning

information obtained in his professional capacity to his own advantage.

4 CONFLICTS OF INTEREST

4.1 Two types

4.2 Member v client 4.3 Client v client

The implications arising from possession and use of confidential information

are separate issues.

4.2 Member v client

4.2.1 Principle

Members should place clients’ interests before their own.

A firm should not accept or continue an engagement in which there is or is

likely to be a significant conflict of interests between the firm and the client.

Any financial gain which accrues or is likely to accrue to the firm as a result

of the engagement (other than properly earned fees etc) will ALWAYS

amount to a significant conflict of interest.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0410

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

4.2.2 Commission

Where any commission, fee or reward may be earned for the introduction of a

client, or as a result of advice given to a client, the client should be informed

in writing

− that such commission, etc will be received; and

− as soon as practicable, of its amount and terms.

4.3 Client v client

4.3.1 General

There is nothing improper in a firm having two or more clients whose

interests may be in conflict.

However, the firm’s work should be so managed to avoid the interests of one

client adversely affecting those of another.

Where the acceptance or continuance of an engagement would, even with

safeguards, materially prejudice the interests of any client the appointment

should not be accepted or continued.

4.3.2 Managing conflict between clients’ interests

All reasonable steps should be taken to ascertain whether any conflict of

interests exists or is likely to arise in the future.

Relationships with existing clients need to be considered before accepting a

new appointment and regularly thereafter.

A relationship which ended over 2 years before is unlikely to give rise to

conflict.

4.3.3 Disclosure

A material conflict of interests between existing or potential clients should be

sufficiently disclosed so that they may make an informed decision whether to

engage or continue their relationship with the firm.

4.3.4 Safeguards

Use different partners and teams of staff for different engagements.

Standing instructions etc to prevent leakage of confidential information

between different teams and sections within the firm.

Regular review of the situation by a senior partner or compliance officer not

personally involved with either client.

Advising at least one or all clients to seek additional independent advice.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0411

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

4.3.5 Disengagement

When necessary should be done as speedily as is compatible with the

interests of the clients concerned.

Example 2

Required:

Comment and conclude on the following situations:

Solution

(1) The audit senior of Neutron, a limited liability company, is having an affair

with the credit controller and is staying with her during the week and leaving

the audit files in the boot of his car overnight. There are no other audit staff

available that the client considers to be capable of replacing him on the

assignment.

Comment –

Conclusion –

(2) A part-time partner in Spoils & Co is also a councillor in the local authority.

She has been acting for Radnor Ltd whose business venture now requires

planning permission from the local authority. The partner sits on the planning

committee and recently vigorously opposed a similar application.

Comment –

Conclusion –

(3) In an effort to reduce audit fees your client, Finders Ltd, has employed an

accountant on a temporary basis to assist you with your audit work. The client

feels that it will be cheaper for the temporary accountant to perform some of the

audit testing, replacing one member of your staff.

Comment –

Conclusion –

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0412

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

(4) Trainees of Porterhouse, a firm of Certified Accountants, have been offered

overdraft facilities up to $3,000, on student terms, by a client bank.

Comment –

Conclusion –

5 IFAC CODE OF ETHICS FOR PROFESSIONAL ACCOUNTANTS

5.1 Introduction

IFAC believes that member bodies (eg ACCA) are primarily responsible for

preparing detailed ethical requirement

implementing and enforcing such requirements.

The international code sets standards of conduct and states fundamental

principles to be the basis on which ethical requirements should be founded.

5.2 Objectives of the accountancy profession

To work to the highest standards of professionalism

To attain the highest levels of performance

To meet the public interest requirement.

5.3 Fundamental Principles

These are the same as the ACCA’s but described under the headings of

Integrity

Objectivity

Professional competence and due care

Confidentiality

Professional behaviour

Technical standards.

5.4 The Code

Provides guidance on the practical application of the objectives and

fundamental principles regarding typical situations concerning

Integrity and objectivity

Independence

Resolution of ethical conflicts

Professional competence

Confidentiality.

Guidance is not reproduced as all relevant considerations have been dealt with by the

ACCA’s “Rules of Professional Conduct”

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0413

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

5.5 Provision of other services

5.5.1 Arguments against prohibiting

It is economic for auditors to offer financial and management consultancy

services.

Many companies would be adversely affected if “other services” were

prohibited.

Providing advice on tax and the system of internal control is unavoidable in

the conduct of an audit.

6 INTERNAL AUDITORS

6.1 Professional bodies

There are many national and international associations, institutes and other professional

bodies of internal auditors. For example:

The Institute of Internal Auditors (IIA); and

The IIA-UK and Ireland.

6.2 Codes of Ethics

Like many recognised professions, internal auditing has developed codes of

professional ethics. These codes are comparable to those of independent auditors. A

code of ethics is necessary and appropriate for the profession of internal auditing,

founded as it is on the trust placed in its objective assurance about risk, control, and

governance.

The purpose of the Code of Ethics of The Institute of Internal Auditors (IIA) is to

promote an ethical culture in the global profession of internal auditing. It applies to

both individuals and entities that provide internal audit services.

The IIA’s Code (adopted June 2000) has two essential components:

Principles ; and

Rules of Conduct (which provide guidance on practical application of the Principles).

6.2.1 Integrity

Principle – establishes trust which provides the basis for reliance on their

judgment.

Rules of Conduct:

to perform work with honesty, diligence and responsibility;

to observe the law and the profession;

to not knowingly be a party to any illegal activity, or engage in acts

discreditable to the profession or the organization;

to respect and contribute to the legitimate and ethical objectives of

the organization.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0414

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

6.2.2 Objectivity

Objectivity An unbiased mental attitude that requires internal auditors to perform

—

engagements in such a manner that they have an honest belief in their work product and

that no significant quality compromises are made. Objectivity requires internal auditors

not to subordinate their judgement on audit matters to that of others.

Principle – judgements are not unduly influenced by the interests of the

internal auditor or others.

Rules of Conduct:

not to participate in any activity or relationship (including conflicts

of interest) that may (presume to) impair an unbiased assessment;

not to accept anything that may (presume to) impair professional

judgment;

to disclose all material facts known that, if not disclosed, may

distort the reporting of activities under review.

Impairments to individual objectivity and organizational independence may

include:

personal conflicts of interest;

scope limitations

restrictions on access to records, personnel and properties; and

resource limitations (funding).

6.2.3 Confidentiality

Principle – respecting the value and ownership of information received.

Rules of Conduct:

to be prudent in the use and protection of information acquired in

the course of duties;

not to use information for personal gain or in a manner contrary to the

law or detrimental to the organisation’s legitimate and ethical objectives.

6.2.4 Competency

Principle – applying the knowledge, skills, and experience needed.

Rules of Conduct:

to engage only in those services for which they have the necessary

knowledge, skills, and experience;

to perform internal auditing services in accordance with the

Standards for the Professional Practice of Internal Auditing;

to continually improve their proficiency and the effectiveness and

quality of services.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0415

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

FOCUS

You should now be able to

define the fundamental concepts of professional ethics

define the detailed requirements of, and illustrate and analyse the application of,

professional ethics in the context of independence, objectivity and integrity

define the detailed requirements of, and illustrate and analyse the application of,

professional ethics in the context of confidentiality and conflicts of interest

distinguish between the elements of professional ethics applicable to internal

auditors and those applicable to external auditors.

Session5 deals with ethical guidance relating to a change in professional appointment.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0416

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

EXAMPLE SOLUTIONS

Solution 1 – Undue dependence

(1) The 15% rule need not be applied when a practice is being established, but safeguards are

necessary.

Family relationship may cause a problem if a disagreement arises. Even if he is not very

close to his cousin, objectivity may appear to be threatened.

Possible safeguard – arrangement for consultation with another practitioner. In due course

Petr may have a qualified employee (for inclusion in the audit team) or enter into a

partnership (allowing rotation of engagement partner).

Conclusion – Decline, unless safeguards adequate, on “relationship” grounds.

(2) The 15% rule applies to recurring work. Nevertheless, objectivity should be reviewed with

respect to audit assignment as audit fee >10%. Total income from client in current year is

likely to create undue dependence: [(800k + 1,600k) ÷ (7,500k + 1,600k) ≈ 26%].

It is extremely unusual for the client to bear the additional costs to the practice caused by its

lack of resources. The partners must be absolutely convinced that they would be able to

resist any pressure that the client might exert before accepting.

Competence of temporary staff would need to be established.

Possible safeguard – different staff members/partner assigned to audit and special

investigation.

Conclusions – As existing clients, in particular, are likely to perceive undue dependence

special investigation should be declined. Engagement partner on audit should be rotated.

(3) Resources required to set up (and subsequently maintain) the database may affect service

offered to other existing clients. In particular, database expertise will be required.

Nature of additional service is unlikely to appear to threaten objectivity (eg no managerial

involvement).

As a plc, recurring fees (audit + maintenance) must not exceed 10% gross practice income.

Safeguards required if >5%.

Conclusion – Additional service is likely to be acceptable within ethical constraints.

(4) 19% of total fee income may not affect independence if recurring element is less than 10%.

(Company may have only recently become “public interest” thereby reducing a 15% fees limit

to 10%.) However, 19% may be undesirably high in appearing to detract from objectivity.

Beneficial interest in shares does not affect independence because holder is tax (not audit)

and manager (not partner). However, as the tax manager has an interest in understating the

tax charge, objectivity may appear to be impaired.

Staff involved in the special assignment should not be responsible for the audit as a special

relationship may be established.

Conclusion – If recurring element constitutes 5-10% gross practice income, can retain with

safeguards.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0417

PROFESSIONAL CODES OF ETHICS AND BEHAVIOUR

Solution 2 – Ethical issues

(1) Objectivity appears to be threatened by personal relationship. Even if credit controller is not

regarded as a senior employee the senior’s objectivity may be impaired, eg when reporting

weaknesses in credit control.

Senior is not keeping audit working papers in safe custody – could result in breach of duty of

confidentiality.

It is not up to the client to determine who is capable of undertaking the assignment –

otherwise this would constitute undue influence. No audit senior is irreplaceable.

Conclusion – Senior should be replaced immediately. Audit timetable may have to be put

back. The Senior's work should be reviewed as soon as possible and, if necessary, re-

performed.

(2) A conflict of interest has arisen between partner and client. She must declare her position to

the client. To abstain from debating or voting on this issue in council may be a breach of her

duty as councillor. Another partner within the firm may be able to assume responsibility to

act for Radnor Ltd in this matter.

Conclusion – Client may not accept that any safeguards will resolve the conflict ∴ partner

should disengage – if not removed.

(3) Qualifications held/previous experience of temporary accountant – is he competent? The

degree of supervision and review of his work required may stretch resource of more senior

audit staff.

Independence of temp may be impaired, eg if an employee of the client rather than a temping

agency.

His objectivity may be impaired, eg if he will be recording transactions to be audited.

Conclusion – If suitable (eg low risk) work could be allocated, the conduct of the audit may

not be impaired.

(4) Loans (including overdrafts) on normal commercial terms may be accepted by members of

staff (including trainees). (Only loans to audit practice are prohibited.)

“Student terms” may be “normal commercial” if the bank offers them to all accountancy

trainees – not just those of Porterhouse. If not “normal commercial”, is benefit more than

“modest”?

Conclusion – Engagement and compliance partners may decide that acceptance of the offer

will not appear to threaten objectivity even if the terms are special. However, as a safeguard

it should be confirmed that terms are no more favourable (or no less unfavourable!!) than

those offered to other trainees.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0418

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- GENENTECH - Capacity Planning Case AnalysisDocument30 pagesGENENTECH - Capacity Planning Case AnalysisJessica Marie85% (27)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mission Health-HCA Healthcare, Amended and Restated APA - Main Text (Public)Document160 pagesMission Health-HCA Healthcare, Amended and Restated APA - Main Text (Public)Dillon Davis67% (3)

- 2550m - ManuelDocument5 pages2550m - ManuelNhickey Gener100% (1)

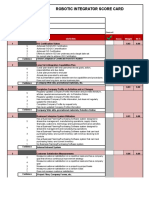

- Robotic Integrator Score Card: Item Rating Criteria Score Weight W+SDocument5 pagesRobotic Integrator Score Card: Item Rating Criteria Score Weight W+SdNo ratings yet

- Supply Chai ManagementDocument13 pagesSupply Chai ManagementPooja ShahNo ratings yet

- Fundamentals of Advanced Accounting Hoyle 6th Edition Test BankDocument37 pagesFundamentals of Advanced Accounting Hoyle 6th Edition Test Bankannealingterreenr7u591100% (14)

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- Good Luck and God Bless!: College of AccountancyDocument1 pageGood Luck and God Bless!: College of AccountancyALMA MORENANo ratings yet

- Managing Innovation Chapter 1Document72 pagesManaging Innovation Chapter 1Manuel uY100% (1)

- Metro Bank PDFDocument65 pagesMetro Bank PDFRhea May BaluteNo ratings yet

- Manufacturing Sector Hi Tech Aerospace Auto Industrial Medical Devices Chemicals & ProcessDocument9 pagesManufacturing Sector Hi Tech Aerospace Auto Industrial Medical Devices Chemicals & ProcessSambit RathNo ratings yet

- (40 Soal) Template-PKWU-UTAMADocument41 pages(40 Soal) Template-PKWU-UTAMASuwardoyo suwardoyoNo ratings yet

- JD Sports - Market Research For Decision MakingDocument4 pagesJD Sports - Market Research For Decision MakingTr. Ryan AsturiasNo ratings yet

- Nature, Scope and Objectives of PartnershipDocument4 pagesNature, Scope and Objectives of PartnershipKathleenNo ratings yet

- Some - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - RattibhaDocument8 pagesSome - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - Rattibhasami lyNo ratings yet

- Journal Entries For Loss of Goods On ConsignmentDocument1 pageJournal Entries For Loss of Goods On ConsignmentAnonymous duzV27Mx3No ratings yet

- 1000 PMP Questions PDFDocument256 pages1000 PMP Questions PDFdipendra100% (1)

- Questions & Answers Set-11Document2 pagesQuestions & Answers Set-11BikashNo ratings yet

- IE 457 Slides07-SupplyChain-Dr. Ammar Y. AlqahtaniDocument22 pagesIE 457 Slides07-SupplyChain-Dr. Ammar Y. AlqahtaniassaNo ratings yet

- Account Statement: Rai Singh MeenaDocument9 pagesAccount Statement: Rai Singh MeenaPraveen SainiNo ratings yet

- BSG PowerPoint Presentation - V3.0Document85 pagesBSG PowerPoint Presentation - V3.0Henry PamaNo ratings yet

- SBEC 2463 Cost Studies: - Cost Data - Cost Model Cost InformationDocument33 pagesSBEC 2463 Cost Studies: - Cost Data - Cost Model Cost InformationKEE JIE HOOI A21BE0102No ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- The Mis SyllabusDocument1 pageThe Mis SyllabusJanur Puspa WeningNo ratings yet

- 1822 Acct6137 Tdfa TK2 W5 S7 R0 Team1Document6 pages1822 Acct6137 Tdfa TK2 W5 S7 R0 Team1Sayang MeilyNo ratings yet

- Strategic Marketing Lecture 3Document13 pagesStrategic Marketing Lecture 3KhanMuhammadNo ratings yet

- Media Release - Singapore and Costa Rica Sign Free Trade AgreementDocument2 pagesMedia Release - Singapore and Costa Rica Sign Free Trade Agreementrocker199No ratings yet

- Developing Service Products and BrandsDocument22 pagesDeveloping Service Products and BrandsVishnu VNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Cross Cultural DiferencesDocument112 pagesCross Cultural DiferencesKatarina TešićNo ratings yet