Professional Documents

Culture Documents

AFISCO v. CA

AFISCO v. CA

Uploaded by

SophiaFrancescaEspinosaCopyright:

Available Formats

You might also like

- Digest - Evangelista vs. CIRDocument1 pageDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- AFISCO Insurance Corporation Vs CADocument2 pagesAFISCO Insurance Corporation Vs CAstickygum08100% (2)

- Pascual VS Cir Case DigestDocument1 pagePascual VS Cir Case DigestSheena Juarez100% (2)

- Delpher Trades Corporation V Iac Case DigestDocument2 pagesDelpher Trades Corporation V Iac Case Digestrobby100% (1)

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- 17 CIR v. Tours SpecialistsDocument3 pages17 CIR v. Tours SpecialistsChedeng KumaNo ratings yet

- CIR v. BenedictoDocument2 pagesCIR v. BenedictoMagi Del Rosario100% (1)

- Bank of America v. CA and CIR DigestDocument2 pagesBank of America v. CA and CIR DigestNichole Lanuza50% (2)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- Digest LIM TONG LIM Vs Phil FishingDocument1 pageDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- CIR Vs General Foods DigestDocument1 pageCIR Vs General Foods DigestCJNo ratings yet

- The United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionDocument36 pagesThe United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionJoseph DanaNo ratings yet

- M&ADocument7 pagesM&AAntónio CaleiaNo ratings yet

- SCM Ashok LeylandDocument17 pagesSCM Ashok LeylandDiksha Badoga100% (1)

- (Digest) Obillos V CIRDocument2 pages(Digest) Obillos V CIRGR100% (3)

- Ona Vs CIR DigestDocument2 pagesOna Vs CIR Digestannamariepagtabunan86% (7)

- Gatchalian Vs CirDocument2 pagesGatchalian Vs Cirmitsudayo_100% (3)

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- 94 M.E. Holdings V CIRDocument3 pages94 M.E. Holdings V CIRMatt LedesmaNo ratings yet

- #20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsDocument1 page#20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsClaire Derecho100% (1)

- CM Hoskins V CIRDocument2 pagesCM Hoskins V CIRSui100% (4)

- CIR V Marubeni CorpDocument2 pagesCIR V Marubeni CorpJaz Sumalinog75% (8)

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedDocument2 pagesAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonNo ratings yet

- 18 CIR V Wander PhilippinesDocument1 page18 CIR V Wander PhilippinesMark Anthony Javellana SicadNo ratings yet

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- Esso Standard V CIRDocument2 pagesEsso Standard V CIRSui100% (1)

- Domingo vs. GarlitosDocument2 pagesDomingo vs. GarlitosMichelleNo ratings yet

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Gutierrez vs. CIR 1957: Taxation I Case Digest CompilationDocument2 pagesGutierrez vs. CIR 1957: Taxation I Case Digest CompilationGyrsyl Jaisa GuerreroNo ratings yet

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocument2 pagesMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationDocument2 pagesCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (4)

- Madrigal Vs RaffertyDocument2 pagesMadrigal Vs RaffertyKirs Tie100% (1)

- Atlas Vs CIRDocument2 pagesAtlas Vs CIRRoyalhighness18No ratings yet

- 26 - Davao Gulf Lumber v. CIR, GR No. 117359Document2 pages26 - Davao Gulf Lumber v. CIR, GR No. 117359Lloyd LiwagNo ratings yet

- CIR Vs CA, CTA, and GCL Retirement Plan TAXDocument2 pagesCIR Vs CA, CTA, and GCL Retirement Plan TAXLemuel Angelo M. Eleccion100% (1)

- Case 4 CIR Vs Fortune TobaccoDocument1 pageCase 4 CIR Vs Fortune TobaccolenvfNo ratings yet

- PAL Vs EDUDocument2 pagesPAL Vs EDUCamille Benjamin RemorozaNo ratings yet

- Hospital de San Juan de Dios, Inc., Petitioner, vs. Commissioner of Internal REVENUE, Respondent. FactsDocument1 pageHospital de San Juan de Dios, Inc., Petitioner, vs. Commissioner of Internal REVENUE, Respondent. FactsKarla Mae AustriaNo ratings yet

- Atlas Consolidated Mining Development Corp. v. CIRDocument1 pageAtlas Consolidated Mining Development Corp. v. CIRIshNo ratings yet

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Document3 pagesCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- Madrigal V RaffertyDocument2 pagesMadrigal V RaffertyiptrinidadNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- II. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Document37 pagesII. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Polo MartinezNo ratings yet

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- TAX-CREBA VS Executive Secretary RomuloDocument2 pagesTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- Zamora V CIRDocument2 pagesZamora V CIRSuiNo ratings yet

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Lozana v. Depakakibo, 107 Phil. 728, April 27, 1960Document2 pagesLozana v. Depakakibo, 107 Phil. 728, April 27, 1960IanNo ratings yet

- 11 NDC V CIRDocument3 pages11 NDC V CIRTricia MontoyaNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- c.11. Filipinas Synthetic Fiber Corp v. CADocument1 pagec.11. Filipinas Synthetic Fiber Corp v. CAArbie LlesisNo ratings yet

- 9 - Commissioner vs. PalancaDocument1 page9 - Commissioner vs. Palancacmv mendozaNo ratings yet

- CIR vs. St. Luke's Medical CenterDocument2 pagesCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- Cir v. Pal DigestDocument4 pagesCir v. Pal DigestkathrynmaydevezaNo ratings yet

- Republic V CaguioaDocument3 pagesRepublic V CaguioaViolet Parker100% (2)

- The Manila Banking Corporation Vs CirDocument1 pageThe Manila Banking Corporation Vs CironlineonrandomdaysNo ratings yet

- 129 Cyanamid Philippines, Inc. v. CADocument3 pages129 Cyanamid Philippines, Inc. v. CAJustin Paras33% (3)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- 52 CIR V LedesmaDocument4 pages52 CIR V LedesmaMiggy CardenasNo ratings yet

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Fisher Vs Trinidad DigestDocument3 pagesFisher Vs Trinidad DigestKT100% (1)

- Afisco Insurance Corporation, Et. Al. vs. Court of AppealsDocument2 pagesAfisco Insurance Corporation, Et. Al. vs. Court of AppealsJahn Avery Mitchel DatukonNo ratings yet

- Florentina L. Baclayon, vs. Judge Mutia: Relevant FactsDocument2 pagesFlorentina L. Baclayon, vs. Judge Mutia: Relevant FactsSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacDocument2 pagesUniversity of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacSophiaFrancescaEspinosaNo ratings yet

- People V TolentinoDocument2 pagesPeople V TolentinoSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: RelevantDocument3 pagesUniversity of The Philippines College of Law: RelevantSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- People v. SanidadDocument3 pagesPeople v. SanidadSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument3 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Us, V. Catalino ApostolDocument2 pagesUniversity of The Philippines College of Law: Us, V. Catalino ApostolSophiaFrancescaEspinosa100% (1)

- Pan v. PenaDocument2 pagesPan v. PenaSophiaFrancescaEspinosaNo ratings yet

- Clemente v. CADocument2 pagesClemente v. CASophiaFrancescaEspinosaNo ratings yet

- 14 Lecaroz V SandiganbayanDocument3 pages14 Lecaroz V SandiganbayanSophiaFrancescaEspinosaNo ratings yet

- Associated Bank, vs. Ca and Lorenzo Sarmiento JRDocument4 pagesAssociated Bank, vs. Ca and Lorenzo Sarmiento JRSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Dee Ping Wee v. Lee Hiong WeeDocument3 pagesDee Ping Wee v. Lee Hiong WeeSophiaFrancescaEspinosa100% (1)

- Chua v. CADocument2 pagesChua v. CASophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- BLTB v. BitangaDocument2 pagesBLTB v. BitangaSophiaFrancescaEspinosaNo ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- Agilent v. IntegratedDocument2 pagesAgilent v. IntegratedSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- 2010 Preqin Infrastructure Review Sample PagesDocument18 pages2010 Preqin Infrastructure Review Sample PagesNoamanNo ratings yet

- LARA Investor PresentationDocument17 pagesLARA Investor PresentationEdgard DiazNo ratings yet

- Annual-Report-of The Wuerth Group 2018-EN PDFDocument208 pagesAnnual-Report-of The Wuerth Group 2018-EN PDFRachita RamNo ratings yet

- NPV Other Investment CriteriaDocument2 pagesNPV Other Investment CriteriaЕлена Атоян100% (1)

- Week 1 Case DigestDocument4 pagesWeek 1 Case DigestIrisValerianoNo ratings yet

- 4Document10 pages4uddinnadeemNo ratings yet

- 4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActDocument8 pages4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActSantosh SinghNo ratings yet

- Provisions of Companies Act 1956 FinalDocument9 pagesProvisions of Companies Act 1956 FinalDiwahar Sunder100% (1)

- CNHA Investor Fact SheetDocument2 pagesCNHA Investor Fact SheetMattNo ratings yet

- Meaning and Definition of Capital StructureDocument6 pagesMeaning and Definition of Capital Structureveeresh_patil05No ratings yet

- Tata Chemicals LTD Reply To Clarification Sought by The Exchange (Company Update)Document2 pagesTata Chemicals LTD Reply To Clarification Sought by The Exchange (Company Update)Shyam SunderNo ratings yet

- Corporate Governance in IndiaDocument9 pagesCorporate Governance in IndiaRama KrishnanNo ratings yet

- Company LawDocument6 pagesCompany LawJayagowri SelvakumaranNo ratings yet

- IADR Report On Maruti SuzukiDocument59 pagesIADR Report On Maruti SuzukiHardik AgarwalNo ratings yet

- Bpo - Business Processing UnitDocument24 pagesBpo - Business Processing UnitArpitaNo ratings yet

- Indigo AirlineDocument23 pagesIndigo AirlineSayali DiwateNo ratings yet

- Dissolution of FirmDocument3 pagesDissolution of FirmAqeel AhmadNo ratings yet

- Annual ReportDocument164 pagesAnnual ReportJupe JonesNo ratings yet

- 162 - Aguirre V FQBDocument2 pages162 - Aguirre V FQBColee StiflerNo ratings yet

- Funnel April 2016Document10 pagesFunnel April 2016Hangerage. comNo ratings yet

- Plat IndexDocument298 pagesPlat Indexdannyf09No ratings yet

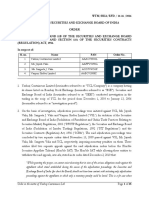

- Order in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedDocument15 pagesOrder in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedShyam SunderNo ratings yet

- Saln Ammy 2017Document4 pagesSaln Ammy 2017KarissaNo ratings yet

- HCL TechnologiesDocument8 pagesHCL TechnologiesSai VasudevanNo ratings yet

- The Real Deals (22-11-2012)Document9 pagesThe Real Deals (22-11-2012)SG PropTalkNo ratings yet

- Nature of Advertising WritingDocument12 pagesNature of Advertising WritingNkoli OgboluNo ratings yet

- Cacho and North Star VsDocument2 pagesCacho and North Star VsYeyen M. EvoraNo ratings yet

AFISCO v. CA

AFISCO v. CA

Uploaded by

SophiaFrancescaEspinosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFISCO v. CA

AFISCO v. CA

Uploaded by

SophiaFrancescaEspinosaCopyright:

Available Formats

University of the Philippines College of Law

3D

Topic Power of CIR to interpret

Case No. G.R. No. 112675. January 25, 1999.

Case Name AFISCO v CA

Ponente Panganiban, j.

Note: This case did not expressly discuss that CIR has the power to interpret rules on taxation. But the case

illustrates that it did do the same when it assessed the petitioner. The Court ruled the CIR’s interpretation is

correct. Hence, it is implied that CIR has the power to interpret.

RELEVANT FACTS

The petitioners are 41 local non-life insurance corporations. Upon their issuance of Erection, Machinery

Breakdown, Boiler Explosion and Contractors All Risk insurance policies, the petitioners entered into a Quota

Share Reinsurance Treaty and a Surplus Reinsurance Treaty with the foreign insurance corporation, Munchener

Ruckversicherungs-Gesselschaft (Munich). The reinsurance treaties required petitioners to form a pool which

was created on the same day. Subsequently, the pool of insurers submitted a financial statement and filed an

“Information Return of Organization Exempt from Income Tax” for the year ending in 1975, on the basis of

which, it was assessed by the Commissioner of Internal Revenue a deficiency in corporate taxes in the amount of

P1,843,273.60, and withholding taxes in the amount of P1,768,799.39 and P89,438.68 on dividends paid to

Munich and to the petitioners, respectively.

The petitioners filed a protest which the Commissioner of Internal Revenue denied. The Court of Tax Appeals

affirmed this decision. Concurrently, the CA ruled that the pool of insurers was considered as a partnership

taxable as a corporation, and that the latter’s collection of premiums on behalf of its members was taxable

income.

ISSUE AND RATIO DECIDENDI

Issue Ratio

W/N the pool is a partnership YES, the pool is taxable as a corporation.

whose dividends are subject

to tax Section 24 of the NIRC, provides:

SEC. 24. Rate of tax on corporations. -- (a) Tax on domestic corporations. -- A

tax is hereby imposed upon the taxable net income received during each

taxable year from all sources by every corporation organized in, or existing

under the laws of the Philippines, no matter how created or organized, but

not including duly registered general co-partnership (compaias colectivas),

general professional partnerships, private educational institutions, and

building and loan associations xxx.

In Evangelista v. Collector of Internal Revenue the Court held that Section 24

covered in its definition these unregistered partnerships and even

associations or joint accounts, which had no legal personalities apart from

their individual members. The Court said that the term partnership includes a

syndicate, group, pool, joint venture or other unincorporated organization,

University of the Philippines College of Law

3D

through or by means of which any business, financial operation, or venture is

carried on.

Article 1767 of the Civil Code recognizes the creation of a contract of

partnership when two or more persons bind themselves to contribute money,

property, or industry to a common fund, with the intention of dividing the

profits among themselves. Its requisites are: (1) mutual contribution to a

common stock, and (2) a joint interest in the profits. Meanwhile, an

association implies associates who enter into a joint enterprise for the

transaction of a business.

In the case before us, the companies entered into a Pool Agreement or an

association that would handle all the insurance businesses covered under

their quota-share reinsurance treaty and surplus reinsurance treaty with

Munich. The following unmistakably indicates a partnership or an association

covered by Section 24 of the NIRC:

(1) The pool has a common fund, consisting of money and other valuables

that are deposited in the name and credit of the pool. This common fund pays

for the administration and operation expenses of the pool.

(2) The pool functions through an executive board, which resembles the

board of directors of a corporation, composed of one representative for each

of the ceding companies.

(3) True, the pool itself is not a reinsurer and does not issue any insurance

policy; however, its work is indispensable, beneficial and economically useful

to the business of the insurance companies and Munich, because without it

they would not have received their premiums. The insurance companies

share in the business ceded to the pool and in the expenses according to a

Rules of Distribution annexed to the Pool Agreement. Profit motive or

business is, therefore, the primordial reason for the pools formation. As aptly

found by the CTA: “The fact that the pool does not retain any profit or income

does not obliterate an antecedent fact that of the pool being used in the

transaction of business for profit. It is apparent, and petitioners admit, that

their association or coaction was indispensable to the transaction of the

business. If together they have conducted business, profit must have been

the object as, indeed, profit was earned. Though the profit was apportioned

among the members, this is only a matter of consequence, as it implies that

profit actually resulted.”

RULING

WHEREFORE, the petition is DENIED. The Resolutions of the Court of Appeals dated October 11, 1993 and

November 15, 1993 are hereby AFFIRMED. Costs against petitioners.

You might also like

- Digest - Evangelista vs. CIRDocument1 pageDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- AFISCO Insurance Corporation Vs CADocument2 pagesAFISCO Insurance Corporation Vs CAstickygum08100% (2)

- Pascual VS Cir Case DigestDocument1 pagePascual VS Cir Case DigestSheena Juarez100% (2)

- Delpher Trades Corporation V Iac Case DigestDocument2 pagesDelpher Trades Corporation V Iac Case Digestrobby100% (1)

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- 17 CIR v. Tours SpecialistsDocument3 pages17 CIR v. Tours SpecialistsChedeng KumaNo ratings yet

- CIR v. BenedictoDocument2 pagesCIR v. BenedictoMagi Del Rosario100% (1)

- Bank of America v. CA and CIR DigestDocument2 pagesBank of America v. CA and CIR DigestNichole Lanuza50% (2)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- Digest LIM TONG LIM Vs Phil FishingDocument1 pageDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- CIR Vs General Foods DigestDocument1 pageCIR Vs General Foods DigestCJNo ratings yet

- The United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionDocument36 pagesThe United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionJoseph DanaNo ratings yet

- M&ADocument7 pagesM&AAntónio CaleiaNo ratings yet

- SCM Ashok LeylandDocument17 pagesSCM Ashok LeylandDiksha Badoga100% (1)

- (Digest) Obillos V CIRDocument2 pages(Digest) Obillos V CIRGR100% (3)

- Ona Vs CIR DigestDocument2 pagesOna Vs CIR Digestannamariepagtabunan86% (7)

- Gatchalian Vs CirDocument2 pagesGatchalian Vs Cirmitsudayo_100% (3)

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- 94 M.E. Holdings V CIRDocument3 pages94 M.E. Holdings V CIRMatt LedesmaNo ratings yet

- #20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsDocument1 page#20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsClaire Derecho100% (1)

- CM Hoskins V CIRDocument2 pagesCM Hoskins V CIRSui100% (4)

- CIR V Marubeni CorpDocument2 pagesCIR V Marubeni CorpJaz Sumalinog75% (8)

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedDocument2 pagesAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonNo ratings yet

- 18 CIR V Wander PhilippinesDocument1 page18 CIR V Wander PhilippinesMark Anthony Javellana SicadNo ratings yet

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- Esso Standard V CIRDocument2 pagesEsso Standard V CIRSui100% (1)

- Domingo vs. GarlitosDocument2 pagesDomingo vs. GarlitosMichelleNo ratings yet

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Gutierrez vs. CIR 1957: Taxation I Case Digest CompilationDocument2 pagesGutierrez vs. CIR 1957: Taxation I Case Digest CompilationGyrsyl Jaisa GuerreroNo ratings yet

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocument2 pagesMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationDocument2 pagesCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (4)

- Madrigal Vs RaffertyDocument2 pagesMadrigal Vs RaffertyKirs Tie100% (1)

- Atlas Vs CIRDocument2 pagesAtlas Vs CIRRoyalhighness18No ratings yet

- 26 - Davao Gulf Lumber v. CIR, GR No. 117359Document2 pages26 - Davao Gulf Lumber v. CIR, GR No. 117359Lloyd LiwagNo ratings yet

- CIR Vs CA, CTA, and GCL Retirement Plan TAXDocument2 pagesCIR Vs CA, CTA, and GCL Retirement Plan TAXLemuel Angelo M. Eleccion100% (1)

- Case 4 CIR Vs Fortune TobaccoDocument1 pageCase 4 CIR Vs Fortune TobaccolenvfNo ratings yet

- PAL Vs EDUDocument2 pagesPAL Vs EDUCamille Benjamin RemorozaNo ratings yet

- Hospital de San Juan de Dios, Inc., Petitioner, vs. Commissioner of Internal REVENUE, Respondent. FactsDocument1 pageHospital de San Juan de Dios, Inc., Petitioner, vs. Commissioner of Internal REVENUE, Respondent. FactsKarla Mae AustriaNo ratings yet

- Atlas Consolidated Mining Development Corp. v. CIRDocument1 pageAtlas Consolidated Mining Development Corp. v. CIRIshNo ratings yet

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Document3 pagesCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- Madrigal V RaffertyDocument2 pagesMadrigal V RaffertyiptrinidadNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- II. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Document37 pagesII. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Polo MartinezNo ratings yet

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- TAX-CREBA VS Executive Secretary RomuloDocument2 pagesTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- Zamora V CIRDocument2 pagesZamora V CIRSuiNo ratings yet

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Lozana v. Depakakibo, 107 Phil. 728, April 27, 1960Document2 pagesLozana v. Depakakibo, 107 Phil. 728, April 27, 1960IanNo ratings yet

- 11 NDC V CIRDocument3 pages11 NDC V CIRTricia MontoyaNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- c.11. Filipinas Synthetic Fiber Corp v. CADocument1 pagec.11. Filipinas Synthetic Fiber Corp v. CAArbie LlesisNo ratings yet

- 9 - Commissioner vs. PalancaDocument1 page9 - Commissioner vs. Palancacmv mendozaNo ratings yet

- CIR vs. St. Luke's Medical CenterDocument2 pagesCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- Cir v. Pal DigestDocument4 pagesCir v. Pal DigestkathrynmaydevezaNo ratings yet

- Republic V CaguioaDocument3 pagesRepublic V CaguioaViolet Parker100% (2)

- The Manila Banking Corporation Vs CirDocument1 pageThe Manila Banking Corporation Vs CironlineonrandomdaysNo ratings yet

- 129 Cyanamid Philippines, Inc. v. CADocument3 pages129 Cyanamid Philippines, Inc. v. CAJustin Paras33% (3)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- 52 CIR V LedesmaDocument4 pages52 CIR V LedesmaMiggy CardenasNo ratings yet

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Fisher Vs Trinidad DigestDocument3 pagesFisher Vs Trinidad DigestKT100% (1)

- Afisco Insurance Corporation, Et. Al. vs. Court of AppealsDocument2 pagesAfisco Insurance Corporation, Et. Al. vs. Court of AppealsJahn Avery Mitchel DatukonNo ratings yet

- Florentina L. Baclayon, vs. Judge Mutia: Relevant FactsDocument2 pagesFlorentina L. Baclayon, vs. Judge Mutia: Relevant FactsSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacDocument2 pagesUniversity of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacSophiaFrancescaEspinosaNo ratings yet

- People V TolentinoDocument2 pagesPeople V TolentinoSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: RelevantDocument3 pagesUniversity of The Philippines College of Law: RelevantSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- People v. SanidadDocument3 pagesPeople v. SanidadSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument3 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Us, V. Catalino ApostolDocument2 pagesUniversity of The Philippines College of Law: Us, V. Catalino ApostolSophiaFrancescaEspinosa100% (1)

- Pan v. PenaDocument2 pagesPan v. PenaSophiaFrancescaEspinosaNo ratings yet

- Clemente v. CADocument2 pagesClemente v. CASophiaFrancescaEspinosaNo ratings yet

- 14 Lecaroz V SandiganbayanDocument3 pages14 Lecaroz V SandiganbayanSophiaFrancescaEspinosaNo ratings yet

- Associated Bank, vs. Ca and Lorenzo Sarmiento JRDocument4 pagesAssociated Bank, vs. Ca and Lorenzo Sarmiento JRSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Dee Ping Wee v. Lee Hiong WeeDocument3 pagesDee Ping Wee v. Lee Hiong WeeSophiaFrancescaEspinosa100% (1)

- Chua v. CADocument2 pagesChua v. CASophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- BLTB v. BitangaDocument2 pagesBLTB v. BitangaSophiaFrancescaEspinosaNo ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- Agilent v. IntegratedDocument2 pagesAgilent v. IntegratedSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- 2010 Preqin Infrastructure Review Sample PagesDocument18 pages2010 Preqin Infrastructure Review Sample PagesNoamanNo ratings yet

- LARA Investor PresentationDocument17 pagesLARA Investor PresentationEdgard DiazNo ratings yet

- Annual-Report-of The Wuerth Group 2018-EN PDFDocument208 pagesAnnual-Report-of The Wuerth Group 2018-EN PDFRachita RamNo ratings yet

- NPV Other Investment CriteriaDocument2 pagesNPV Other Investment CriteriaЕлена Атоян100% (1)

- Week 1 Case DigestDocument4 pagesWeek 1 Case DigestIrisValerianoNo ratings yet

- 4Document10 pages4uddinnadeemNo ratings yet

- 4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActDocument8 pages4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActSantosh SinghNo ratings yet

- Provisions of Companies Act 1956 FinalDocument9 pagesProvisions of Companies Act 1956 FinalDiwahar Sunder100% (1)

- CNHA Investor Fact SheetDocument2 pagesCNHA Investor Fact SheetMattNo ratings yet

- Meaning and Definition of Capital StructureDocument6 pagesMeaning and Definition of Capital Structureveeresh_patil05No ratings yet

- Tata Chemicals LTD Reply To Clarification Sought by The Exchange (Company Update)Document2 pagesTata Chemicals LTD Reply To Clarification Sought by The Exchange (Company Update)Shyam SunderNo ratings yet

- Corporate Governance in IndiaDocument9 pagesCorporate Governance in IndiaRama KrishnanNo ratings yet

- Company LawDocument6 pagesCompany LawJayagowri SelvakumaranNo ratings yet

- IADR Report On Maruti SuzukiDocument59 pagesIADR Report On Maruti SuzukiHardik AgarwalNo ratings yet

- Bpo - Business Processing UnitDocument24 pagesBpo - Business Processing UnitArpitaNo ratings yet

- Indigo AirlineDocument23 pagesIndigo AirlineSayali DiwateNo ratings yet

- Dissolution of FirmDocument3 pagesDissolution of FirmAqeel AhmadNo ratings yet

- Annual ReportDocument164 pagesAnnual ReportJupe JonesNo ratings yet

- 162 - Aguirre V FQBDocument2 pages162 - Aguirre V FQBColee StiflerNo ratings yet

- Funnel April 2016Document10 pagesFunnel April 2016Hangerage. comNo ratings yet

- Plat IndexDocument298 pagesPlat Indexdannyf09No ratings yet

- Order in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedDocument15 pagesOrder in Respect of Yashraj Containeurs Limited, Mr. Jayesh Valia, Ms. Sangeeta J. Valia and Vasparr Shelter LimitedShyam SunderNo ratings yet

- Saln Ammy 2017Document4 pagesSaln Ammy 2017KarissaNo ratings yet

- HCL TechnologiesDocument8 pagesHCL TechnologiesSai VasudevanNo ratings yet

- The Real Deals (22-11-2012)Document9 pagesThe Real Deals (22-11-2012)SG PropTalkNo ratings yet

- Nature of Advertising WritingDocument12 pagesNature of Advertising WritingNkoli OgboluNo ratings yet

- Cacho and North Star VsDocument2 pagesCacho and North Star VsYeyen M. EvoraNo ratings yet