Professional Documents

Culture Documents

Patient Medical Debt Protection Act One Pager

Patient Medical Debt Protection Act One Pager

Uploaded by

Community Service Society of New York0 ratings0% found this document useful (0 votes)

435 views1 pageThe Patient Medical Debt Protection Act aims to address several issues patients face regarding medical bills. [Part A] proposes requiring hospitals to provide a single itemized bill within 7 days of a visit to reduce confusing duplicate bills. [Part B] bans facility fees that charge patients for hospital overhead. [Part C] standardizes waiver forms to prevent patients being liable for unexpected expenses. [Part D] requires hospitals allow insurance companies report cost data and patients easily compare prices. The Act overall seeks to make the medical billing process more transparent and protect patients from unexpected costs.

Original Description:

Patient Medical Debt Protection Act One Pager

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Patient Medical Debt Protection Act aims to address several issues patients face regarding medical bills. [Part A] proposes requiring hospitals to provide a single itemized bill within 7 days of a visit to reduce confusing duplicate bills. [Part B] bans facility fees that charge patients for hospital overhead. [Part C] standardizes waiver forms to prevent patients being liable for unexpected expenses. [Part D] requires hospitals allow insurance companies report cost data and patients easily compare prices. The Act overall seeks to make the medical billing process more transparent and protect patients from unexpected costs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

435 views1 pagePatient Medical Debt Protection Act One Pager

Patient Medical Debt Protection Act One Pager

Uploaded by

Community Service Society of New YorkThe Patient Medical Debt Protection Act aims to address several issues patients face regarding medical bills. [Part A] proposes requiring hospitals to provide a single itemized bill within 7 days of a visit to reduce confusing duplicate bills. [Part B] bans facility fees that charge patients for hospital overhead. [Part C] standardizes waiver forms to prevent patients being liable for unexpected expenses. [Part D] requires hospitals allow insurance companies report cost data and patients easily compare prices. The Act overall seeks to make the medical billing process more transparent and protect patients from unexpected costs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

UNDERSTANDING THE

PATIENT MEDICAL DEBT PROTECTION ACT

PROBLEM EXAMPLE SOLUTION

Chandak G. went to the hospital for

One itemized bill, written in plain

Hospitals send patients unnecessarily kidney stones and got 27 different bills

language, delivered within 7 days after

confusing and duplicative bills. from the ER, radiologist, and

every hospital visit. [Part A]

many others.

A patient was sued over five years after Reduce the statute of limitations for

Non-profit hospitals sue patients for

his hospital stay; his bill totaled almost medical bills from six years to two years

outstanding bills long after a hospital

$25,0000, including nearly $7,000 and reduce the maximum interest rate

visit, charging 9% interest rates.

in interest. to 3%. [Part F]

Claudia K. scheduled what she thought

Patients are still on the hook for was an in-network visit because her

Hold patients harmless for provider and

surprise bills that result from provider provider directory told her the doctor

plan misinformation. [Part G]

and plan misinformation. was in-network, and she was stuck

with a $101,000 medical bill.

Sintora S. went in for a mammogram,

Patients are charged for hospital expecting to be charged a Ban facility fees; patients should not be

overhead, known as facility fees. co-pay, but then received a charged for hospital overhead. [Part B]

surprise $149 facility fee.

With no standardized form, patients

There is no uniform hospital financial

must go through different financial One uniform hospital financial

aid form, forcing financially needy

aid processes and forms when they form to be used by all hospitals in

patients to jump through hoops to get

go to different hospitals, creating New York. [Part E]

the assistance they need.

confusion and barriers to access.

Waiver forms leave patients Patients are on the hook for

Standardize patient financial liability

responsible for unspecified and expensive medical care when

waiver forms. [Part C]

unanticipated expenses. their rights are waived.

To control costs, NY seeks to Some hospitals claim insurance

Require hospitals to allow insurance

establish a consumer-friendly website companies cannot report cost data

carriers report cost data and allow

to search and compare prices on saying it’s “proprietary,” leaving

patients to easily compare prices on

common procedures, known as an all patients disempowered to

common procedures. [Part D]

payer database. make well-informed choices.

ENACT S.6757/A.8639 & PROTECT PATIENTS!

You might also like

- INQUIRY REMOVAL-UPDATE PI by NEIL YEAGLEYDocument3 pagesINQUIRY REMOVAL-UPDATE PI by NEIL YEAGLEYgabby maca100% (1)

- Testimony: City Council Hearing On Hospital Costs and Access To Care, 10/15/2021Document7 pagesTestimony: City Council Hearing On Hospital Costs and Access To Care, 10/15/2021Community Service Society of New YorkNo ratings yet

- Fraud: The Following Concepts Will Be Developed in This ChapterDocument24 pagesFraud: The Following Concepts Will Be Developed in This ChapterAnonymous SmPtG2AHNo ratings yet

- Consent For Background Screening: Certification & Release - AcceptedDocument9 pagesConsent For Background Screening: Certification & Release - AcceptedpragmsNo ratings yet

- CFPB Debt Collection Letter 2 More InformationDocument5 pagesCFPB Debt Collection Letter 2 More InformationAnthony DavisNo ratings yet

- Convergent Outsourcing Collection Letter FDCPADocument1 pageConvergent Outsourcing Collection Letter FDCPAghostgripNo ratings yet

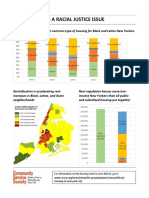

- Rent Justice As Racial JusticeDocument2 pagesRent Justice As Racial JusticeCommunity Service Society of New YorkNo ratings yet

- Identity Theft in PennsylvaniaDocument2 pagesIdentity Theft in PennsylvaniaJesse WhiteNo ratings yet

- Sample Subpoena Policy - HIPPA-PHIDocument6 pagesSample Subpoena Policy - HIPPA-PHITheresa WalkerNo ratings yet

- Chapter 8: Hold or Fold - BankruptcyDocument28 pagesChapter 8: Hold or Fold - BankruptcyJafari SelemaniNo ratings yet

- Credit Dispute Letter2 - TransUnionDocument2 pagesCredit Dispute Letter2 - TransUniondiversified1No ratings yet

- How To Dispute Credit Report Errors: October 2011Document6 pagesHow To Dispute Credit Report Errors: October 2011hello98023No ratings yet

- Donna Soutter v. Equifax Information Services, 4th Cir. (2012)Document19 pagesDonna Soutter v. Equifax Information Services, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- US Internal Revenue Service: p15 - 1999Document64 pagesUS Internal Revenue Service: p15 - 1999IRSNo ratings yet

- Safe GoodwillLetters123Document4 pagesSafe GoodwillLetters123gabby macaNo ratings yet

- Final Borrower Defense Multistate LetterDocument5 pagesFinal Borrower Defense Multistate LetterBethanyNo ratings yet

- CFPB Consumer Reporting Companies List 2023Document41 pagesCFPB Consumer Reporting Companies List 2023Marquita HunterNo ratings yet

- Lauren Glassman Motion To Compel On CrossFit Inc. Over Cirrus SR22 PurchaseDocument10 pagesLauren Glassman Motion To Compel On CrossFit Inc. Over Cirrus SR22 Purchasetucker_malcolmNo ratings yet

- Hospital's Legal Opinion On Chapter 55ADocument8 pagesHospital's Legal Opinion On Chapter 55AEmily Featherston GrayTvNo ratings yet

- Statement Responding To False Allegations by Lena ScloveDocument1 pageStatement Responding To False Allegations by Lena ScloverbertscheNo ratings yet

- 2 - Notice of Appeal Instructions PDFDocument4 pages2 - Notice of Appeal Instructions PDFSola Travesa100% (1)

- Pedro Cooper: 3588 Plymouth #258, Ann Arbor, MI 48105 248-509-4811 Plcooper@umich - EduDocument1 pagePedro Cooper: 3588 Plymouth #258, Ann Arbor, MI 48105 248-509-4811 Plcooper@umich - EduPedro CooperNo ratings yet

- Debt Validation LetterDocument4 pagesDebt Validation Letterwestryrebecca4No ratings yet

- Equifax Credit Information Services, Inc. PO Box 740256 Atlanta, GA 30374 Information Update LetterDocument1 pageEquifax Credit Information Services, Inc. PO Box 740256 Atlanta, GA 30374 Information Update LetterBAZNo ratings yet

- Maratime DissertationDocument35 pagesMaratime DissertationMayank MahlaNo ratings yet

- EBT NotesDocument36 pagesEBT NotesSuruchi ShrivastavaNo ratings yet

- Bankruptcy Removal LetterDocument2 pagesBankruptcy Removal LetterAl DelkNo ratings yet

- In The Magistrate Court of Dekalb CountyDocument10 pagesIn The Magistrate Court of Dekalb CountyJanet and JamesNo ratings yet

- United States District Court Northern District of California San Jose DivisionDocument2 pagesUnited States District Court Northern District of California San Jose Divisionnathangrayson100% (1)

- Amazon Flex ComplaintDocument12 pagesAmazon Flex ComplaintTechCrunchNo ratings yet

- DV LetterDocument2 pagesDV LetterbrocgiddensNo ratings yet

- USCODE 2011 Title15 Chap41 Subchapv Sec1692gDocument2 pagesUSCODE 2011 Title15 Chap41 Subchapv Sec1692gAlex LagunesNo ratings yet

- Complaint US Ex Rel - Barron and Scheel V Deloitte and Touche Consulting, False Claims ActDocument53 pagesComplaint US Ex Rel - Barron and Scheel V Deloitte and Touche Consulting, False Claims ActRick ThomaNo ratings yet

- Got Tickets EnglishDocument20 pagesGot Tickets EnglishJan TronNo ratings yet

- Debt Validation LetterDocument1 pageDebt Validation LetterRichardNo ratings yet

- The Conclusive Presumption Doctrine - Equal Process or Due ProtecDocument38 pagesThe Conclusive Presumption Doctrine - Equal Process or Due ProtecYolanda LewisNo ratings yet

- Alabama Lawsuit Against Former Cape Coral CoupleDocument22 pagesAlabama Lawsuit Against Former Cape Coral CoupleMichael BraunNo ratings yet

- Specific Relief ActDocument7 pagesSpecific Relief Actankit rocksNo ratings yet

- Schneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt LetterDocument9 pagesSchneider Sent First American A RESPA Qualified Written Request, Complaint, and Dispute of Debt and Validation of Debt Letterlarry-612445No ratings yet

- Sample Thailand Usufruct ContractDocument7 pagesSample Thailand Usufruct ContractGayle Opsima-BiraoNo ratings yet

- Consumer Credit File RightsDocument3 pagesConsumer Credit File RightsBridget May CruzNo ratings yet

- Drew v. Equifax, C07-00726 SI (N.D. Cal. Dec. 3, 2010)Document22 pagesDrew v. Equifax, C07-00726 SI (N.D. Cal. Dec. 3, 2010)Venkat BalasubramaniNo ratings yet

- CreditDocument62 pagesCreditapi-262728967No ratings yet

- CFPB Arbitration Letter 08.03.16Document8 pagesCFPB Arbitration Letter 08.03.16MarkWarnerNo ratings yet

- What Is FCRADocument3 pagesWhat Is FCRAJorge AndrésNo ratings yet

- Petty v. Equifax Information Services, LLCDocument5 pagesPetty v. Equifax Information Services, LLCSamuelNo ratings yet

- CFPB Sample Letter To Your Bank or Credit Union To Dispute Information It Provided About Your Checking Account HistoryDocument4 pagesCFPB Sample Letter To Your Bank or Credit Union To Dispute Information It Provided About Your Checking Account HistoryWagner AdugnaNo ratings yet

- Complaint Smallman v. MGMDocument30 pagesComplaint Smallman v. MGMAshley ForestNo ratings yet

- Personal - ChexSystems Request For Investigation FormDocument1 pagePersonal - ChexSystems Request For Investigation FormEmpresarioNo ratings yet

- Small Claim PKTDocument10 pagesSmall Claim PKTsafewaycaseNo ratings yet

- Next Steps, Instructions, and Service Forms - Santa ClaraDocument11 pagesNext Steps, Instructions, and Service Forms - Santa Claraimnotbncre8iveNo ratings yet

- Uber Fair Credit Class ActionDocument20 pagesUber Fair Credit Class Actionjeff_roberts881No ratings yet

- Sample Pay For Delete LetterDocument1 pageSample Pay For Delete LetterRyan TomatuchiNo ratings yet

- Cushman v. Trans Union CorporationDocument11 pagesCushman v. Trans Union CorporationKenneth SandersNo ratings yet

- Send This Letter To The Bureau To Dispute Unauthorized Inquiries On Your ReportDocument2 pagesSend This Letter To The Bureau To Dispute Unauthorized Inquiries On Your ReportTiya JohnsonNo ratings yet

- CTSJP Complaint v2Document33 pagesCTSJP Complaint v2Gabriel PiemonteNo ratings yet

- Letter of Cease and DesistDocument1 pageLetter of Cease and Desistwinona mae marzoccoNo ratings yet

- Master Opt Out Letter Revised 3Document4 pagesMaster Opt Out Letter Revised 3Erika EsquivelNo ratings yet

- Debt Dispute LetterDocument1 pageDebt Dispute LetterArmond TrakarianNo ratings yet

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- Converted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)From EverandConverted: Uncover the Hidden Strategies You Need to Easily Achieve Massive Credit Score Success (Business Edition)No ratings yet

- COVID-19 Financial Tips June 2020Document9 pagesCOVID-19 Financial Tips June 2020Community Service Society of New YorkNo ratings yet

- COVID-19 Financial Tips April 2021Document11 pagesCOVID-19 Financial Tips April 2021Community Service Society of New YorkNo ratings yet

- New York Housing Fact Sheet - NYC SenateDocument25 pagesNew York Housing Fact Sheet - NYC SenateCommunity Service Society of New YorkNo ratings yet

- New York Housing Fact Sheet - Senate (Non NYC)Document38 pagesNew York Housing Fact Sheet - Senate (Non NYC)Community Service Society of New YorkNo ratings yet

- Making College More Affordable For New Yorkers Who Need The Most SupportDocument17 pagesMaking College More Affordable For New Yorkers Who Need The Most SupportCommunity Service Society of New YorkNo ratings yet

- Making College More Affordable For New Yorkers Who Need The Most Support - Unheard Third ChartsDocument7 pagesMaking College More Affordable For New Yorkers Who Need The Most Support - Unheard Third ChartsCommunity Service Society of New YorkNo ratings yet

- Health Professionals in Support of Paid Family LeaveDocument3 pagesHealth Professionals in Support of Paid Family LeaveCommunity Service Society of New YorkNo ratings yet

- New Yorkers Weigh in On Top Priorities For The New MayorDocument1 pageNew Yorkers Weigh in On Top Priorities For The New MayorCommunity Service Society of New YorkNo ratings yet

- Timeline: A Legacy of HopeDocument6 pagesTimeline: A Legacy of HopeCommunity Service Society of New York100% (1)

- CSS Reentry RoundtableDocument2 pagesCSS Reentry RoundtableCommunity Service Society of New YorkNo ratings yet

- Response To The Proposed NYCHA Draft FY2011 Annual PlanDocument14 pagesResponse To The Proposed NYCHA Draft FY2011 Annual PlanCommunity Service Society of New YorkNo ratings yet

- CSS Urban AgendaDocument1 pageCSS Urban AgendaCommunity Service Society of New YorkNo ratings yet

- FHI360 EpiC Liberia - Technical Officer-HIV Testing JDDocument2 pagesFHI360 EpiC Liberia - Technical Officer-HIV Testing JDAEG EntertainmentNo ratings yet

- Clinical Teaching Purposes of Clinical Laboratory: ST NDDocument3 pagesClinical Teaching Purposes of Clinical Laboratory: ST NDyoonie catNo ratings yet

- Allianz - Employee Benefit GuideDocument70 pagesAllianz - Employee Benefit GuidesanjeevnnNo ratings yet

- Principles of MNGT QuizzesDocument16 pagesPrinciples of MNGT QuizzesCharles DebrahNo ratings yet

- Emergency Department Congestion at Saintemarie University HospitalDocument17 pagesEmergency Department Congestion at Saintemarie University HospitalzhengzinanNo ratings yet

- JRCALC Guidelines v3 2004Document341 pagesJRCALC Guidelines v3 2004Anitamanusama0% (1)

- Elder CareDocument3 pagesElder Caresushmma swarajaNo ratings yet

- Daily Plan of Activites 1Document2 pagesDaily Plan of Activites 1Rene John FranciscoNo ratings yet

- HOSP SIBU Policy FebDocument79 pagesHOSP SIBU Policy Febdanial78100% (1)

- Cv-Europass - Iyapo Omolabake PeaceCV 20L PDFDocument8 pagesCv-Europass - Iyapo Omolabake PeaceCV 20L PDFiyapo kamoru olarewajuNo ratings yet

- Letter of Invitation For The ReactorDocument2 pagesLetter of Invitation For The ReactorImmah PinedaNo ratings yet

- Full Download Ebook Ebook PDF Medical Surgical Nursing Clinical Reasoning in Patient Care PDFDocument41 pagesFull Download Ebook Ebook PDF Medical Surgical Nursing Clinical Reasoning in Patient Care PDFgregory.love731100% (41)

- St. Paul University Dumaguete College of Nursing Dumaguete CityDocument12 pagesSt. Paul University Dumaguete College of Nursing Dumaguete Cityzoie ziazzetteNo ratings yet

- NMNC 5104 Assignment 1 (Noorhaliza Ali)Document21 pagesNMNC 5104 Assignment 1 (Noorhaliza Ali)Sarah Al-QadriNo ratings yet

- Book Reviews: Mental Health and Homelessness: Evidence of Failed Policy? by Leslie J.ScalletDocument5 pagesBook Reviews: Mental Health and Homelessness: Evidence of Failed Policy? by Leslie J.ScalletChi ChiNo ratings yet

- Saudi TelemedicineDocument80 pagesSaudi TelemedicineVenkata KrishnaNo ratings yet

- Materi Drarjaty Webinar020720 PDFDocument29 pagesMateri Drarjaty Webinar020720 PDFDevinaarNo ratings yet

- Clinical Objectives PDFDocument4 pagesClinical Objectives PDFYhuhan James TejadaNo ratings yet

- Role Mental Health NurseDocument42 pagesRole Mental Health Nurseblessed23100% (1)

- Eroding Public Medicare: Update On For-Profit Health Care in B.C.Document32 pagesEroding Public Medicare: Update On For-Profit Health Care in B.C.The Georgia Straight100% (1)

- Digital Patient Profiling SystemDocument19 pagesDigital Patient Profiling SystemMohammad Arif HasanNo ratings yet

- Individual Medicalim - Gen PDFDocument337 pagesIndividual Medicalim - Gen PDFavinashNo ratings yet

- Bad 20 NewsDocument26 pagesBad 20 Newsعلي سرحان عليوي عليبNo ratings yet

- My SHN CompilationDocument57 pagesMy SHN Compilationapi-3718174100% (2)

- Peer ReviewDocument24 pagesPeer ReviewSimon Dzokoto100% (1)

- Nursing Plan of Care ErDocument6 pagesNursing Plan of Care Erapi-642989736No ratings yet

- Managing An Angry PatientDocument15 pagesManaging An Angry Patientmasa.dalati.1No ratings yet

- Two Way Fixed Effect ModelsDocument116 pagesTwo Way Fixed Effect ModelsRitesh Kumar DubeyNo ratings yet

- 15 Define Process To Whom The Patient Record Can Be ReleasedDocument8 pages15 Define Process To Whom The Patient Record Can Be ReleasedSanjay KadamNo ratings yet

- The Perception of Pregnant Women Towards Antenatal Care at Madina Polyclinic-Ghana: A Descriptive Exploratory StudyDocument13 pagesThe Perception of Pregnant Women Towards Antenatal Care at Madina Polyclinic-Ghana: A Descriptive Exploratory StudyP'Babe Cece AdumoahNo ratings yet