Professional Documents

Culture Documents

Trade Surveillance PDF

Trade Surveillance PDF

Uploaded by

BaluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Surveillance PDF

Trade Surveillance PDF

Uploaded by

BaluCopyright:

Available Formats

Case Study – Trade Surveillance

© 2017 CRISIL Ltd. All rights reserved.

Case Study: Trade Surveillance

Business Challenge

Trade Surveillance Platform

• New Market Abuse Regulations (MAR) to further strengthen UK

market abuse framework by extending it scope to new markets,

Create and Define New Improving and refining

new platforms and new behaviors

Scenario Parameter / Existing Scenarios

rules for risk alerts Parameter \ rules for Solution Approach

risk alerts • CRISIL team reviewed the client’s existing trade surveillance

Market Manipulation model, conducted the gap analysis (on regulatory changes) and

© 2017 CRISIL Ltd. All rights reserved.

implemented the changes to make the solution more efficient

Trade Data and effective

• Analyzed the parameters in current scenarios and further

refined them to generate more meaningful alerts in market and

Suspicious Transaction

trade risk activities

• Involved in developing new scenarios and parameters to

Alert Reports generate alerts on Market and Trade risks which includes:

Market manipulation Risk: Algo trading, Wash Trades

Trade Data Risk: Stop Loss triggers, Fix Manipulation

Report 1 Report 2 Report 3 Report 4

Suspicious Transactions: Insider Dealing, Partial Fills,

Front Running, Best Execution

• Also, the team worked in designing the automated system

where alert reports can be directly loaded into integrated

New Integrated Dashboard for Alert Reports Matrix dashboard to monitor and investigate the trade alerts easily

Client Impact

• Helped the client in meeting the market abuse guidelines

Trading Head of Trading defined by FCA and improve their governance framework

COO’s around trade surveillance in short span of time

Supervisors Desk

• Integrated Dashboard for alerts reports matrix helped in driving

review efficiency and micro-analyses on trade risk alerts

16

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Gurit Product Catalogue - AunzseaDocument76 pagesGurit Product Catalogue - AunzseaElenaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 1409 Thiruvasagam Lyrics Tamil ThiruvasagamDocument133 pages1409 Thiruvasagam Lyrics Tamil ThiruvasagamSivasangar Seenivasagam67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FM 5-250 Explosives & DemolitionsDocument395 pagesFM 5-250 Explosives & DemolitionsZO100% (9)

- First Periodical Test ProgrammingDocument4 pagesFirst Periodical Test ProgrammingMay Ann GuintoNo ratings yet

- House of QualityDocument8 pagesHouse of QualityAudreyNo ratings yet

- Versahandler Attachment Service Manual: Angle BroomDocument64 pagesVersahandler Attachment Service Manual: Angle BroommikeNo ratings yet

- Crompton Greaves (CG Power) Single Phase Motors Catalogue and Price List 2020 PDFDocument10 pagesCrompton Greaves (CG Power) Single Phase Motors Catalogue and Price List 2020 PDFRamkumar SundaramNo ratings yet

- Vx86: x86 Assembler Simulated in C Powered by Automated Theorem ProvingDocument15 pagesVx86: x86 Assembler Simulated in C Powered by Automated Theorem ProvingTanzeel ShakeelNo ratings yet

- Size Reduction: Department of Chemical Engineering University of Engineering & Technology PeshawarDocument60 pagesSize Reduction: Department of Chemical Engineering University of Engineering & Technology PeshawarRavid GhaniNo ratings yet

- Injectors and Fuel Lines - OverviewDocument17 pagesInjectors and Fuel Lines - Overviewjose_saugo2601100% (1)

- Tost Catalogue Engl 2021Document138 pagesTost Catalogue Engl 2021MaiconNo ratings yet

- Handbook in WoodworkDocument138 pagesHandbook in WoodworkEsequiel YakueczikNo ratings yet

- Perform Freehand DrawingDocument49 pagesPerform Freehand DrawingBerlin AlcaydeNo ratings yet

- Full FormsDocument6 pagesFull Formsathul aswanthNo ratings yet

- Karthik CVDocument4 pagesKarthik CVBharath Sr RajkumarNo ratings yet

- Composite Bridge DesignDocument23 pagesComposite Bridge DesignHarold Jackson MtyanaNo ratings yet

- DSP Assignment 3Document11 pagesDSP Assignment 3anoopk778No ratings yet

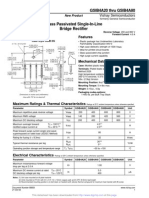

- Gsib4a60 PDFDocument2 pagesGsib4a60 PDFanon_395768043No ratings yet

- Phys 112 (Physics 1) SyllabusDocument3 pagesPhys 112 (Physics 1) SyllabusHarold TaylorNo ratings yet

- Univesity List-Normal, Uniassit, AdressesDocument6 pagesUnivesity List-Normal, Uniassit, AdressesGajanan JadhavNo ratings yet

- Applicant Details: Applicant Photo Applicationid:2122Sjs1002147815Document8 pagesApplicant Details: Applicant Photo Applicationid:2122Sjs1002147815vinayak tiwariNo ratings yet

- 1 Unified Application For BLDG PermitDocument2 pages1 Unified Application For BLDG PermitJoven MagnoNo ratings yet

- Kingspan - Air-Cell Permifloor 6ppDocument6 pagesKingspan - Air-Cell Permifloor 6ppMacNo ratings yet

- Engineering Design Calculation - Dennis Kirk Centrifugal Fan Performance CharacteristicsDocument1 pageEngineering Design Calculation - Dennis Kirk Centrifugal Fan Performance CharacteristicsAnonymous EarAM2100% (1)

- AG 3095 1208AgroLogicClimateControlsEMDocument4 pagesAG 3095 1208AgroLogicClimateControlsEMphamnhonNo ratings yet

- Design Engineer - Memory Circuit DesignDocument2 pagesDesign Engineer - Memory Circuit Designravindarsingh0% (1)

- CS197 SyllabusDocument8 pagesCS197 SyllabusGrantham UniversityNo ratings yet

- DSPICDocument245 pagesDSPICJose Gavidia Ulloa100% (1)

- Form Inspeksi CraneDocument2 pagesForm Inspeksi CraneDaengkulle Firmansyah PuteraNo ratings yet

- Multifunction Strobe Instruction Manual For Looms With NCP System Rapier and Air JetDocument23 pagesMultifunction Strobe Instruction Manual For Looms With NCP System Rapier and Air Jetpacheco bNo ratings yet