Professional Documents

Culture Documents

Fintech and Financial Inclusion

Fintech and Financial Inclusion

Uploaded by

Habiba KausarCopyright:

You might also like

- Sample of Loan Agreement For NotaryDocument2 pagesSample of Loan Agreement For NotaryHannah Finuliar92% (12)

- CNA Study Guide PDFDocument494 pagesCNA Study Guide PDFjose_pallares9100% (3)

- SurveyorDocument2 pagesSurveyordtr170% (2)

- 1034430055-Home Health Aide EnglishDocument24 pages1034430055-Home Health Aide EnglishHabiba KausarNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Finance Dissertation TopicsDocument2 pagesFinance Dissertation Topicsmonabiswas100% (1)

- Over 190 Countries, 73 Million of Its Some 130 Million Subscribers Are Outside The U.SDocument3 pagesOver 190 Countries, 73 Million of Its Some 130 Million Subscribers Are Outside The U.SHabiba KausarNo ratings yet

- Merchant BankingDocument94 pagesMerchant BankingCliffton Kinny100% (7)

- Internet Banking Project DocumentationDocument23 pagesInternet Banking Project DocumentationDilip ChudasamaNo ratings yet

- Australia-Documents Checklist For Student Visa-ElodgementDocument17 pagesAustralia-Documents Checklist For Student Visa-ElodgementPunit Aswal0% (1)

- FintechDocument50 pagesFintechbirendraNo ratings yet

- Financial InclusionDocument134 pagesFinancial InclusionvimalbakshiNo ratings yet

- Project Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)Document43 pagesProject Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)AnkitNo ratings yet

- Innovation in Banking SectorDocument21 pagesInnovation in Banking Sectoruma2k10No ratings yet

- Review of LiteratureDocument4 pagesReview of Literaturemaha lakshmiNo ratings yet

- A Study On Customer Awareness Towards e Banking.. B. GopichandDocument11 pagesA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1No ratings yet

- Banking Sector ReformsDocument152 pagesBanking Sector ReformsManpreet SachdevaNo ratings yet

- Mohammad Fazal-1Document81 pagesMohammad Fazal-1Norma SanfordNo ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- HDFC NetBanking SynopsisDocument5 pagesHDFC NetBanking SynopsisPranavi Paul Pandey100% (1)

- A Study On Online Banking in India: Project ReportDocument77 pagesA Study On Online Banking in India: Project ReportParth ShahNo ratings yet

- Mobile Banking Project BithoraiDocument64 pagesMobile Banking Project BithoraiPrince Cious DaimariNo ratings yet

- A Brief Study On Role of Technology in BankingDocument65 pagesA Brief Study On Role of Technology in BankingGlobal printNo ratings yet

- Project Report: Post Garduate Diploma in Business Admnistration (PGDBM)Document55 pagesProject Report: Post Garduate Diploma in Business Admnistration (PGDBM)Aamir Khan100% (1)

- Loan & Credit Facility Provided by Different BanksDocument72 pagesLoan & Credit Facility Provided by Different Bankskaushal2442No ratings yet

- Financial InclutionDocument37 pagesFinancial InclutionPravash Poddar100% (1)

- Black Book GauriDocument107 pagesBlack Book Gauriyogesh kumbharNo ratings yet

- A Study On Risk Analysis On Personal Loans at Vijaya BankDocument90 pagesA Study On Risk Analysis On Personal Loans at Vijaya BankChethan.sNo ratings yet

- Innovation in Banking SectorDocument80 pagesInnovation in Banking SectorNavdeep Kaur67% (3)

- Project Report ON Brand Preference OF Two WheelerDocument79 pagesProject Report ON Brand Preference OF Two WheelerSahil GulatiNo ratings yet

- Internet Banking Advantages MBA ProjectDocument85 pagesInternet Banking Advantages MBA ProjectVishal Sanjay SamratNo ratings yet

- Traditional VS Modern BankingDocument10 pagesTraditional VS Modern BankingVandana PrajapatiNo ratings yet

- Project Mcom PDFDocument45 pagesProject Mcom PDFPriyanka SatamNo ratings yet

- Project On PSU BankDocument92 pagesProject On PSU BankAnshu BardhanNo ratings yet

- Consumer Behaviour On Mobile Banking - A Behavioural Reasoning TheoryDocument12 pagesConsumer Behaviour On Mobile Banking - A Behavioural Reasoning Theory02Mmr 02No ratings yet

- Fintech and Transformation in Financial Services: Seminar Report OnDocument25 pagesFintech and Transformation in Financial Services: Seminar Report Onrobert juniorNo ratings yet

- Mobile Banking - Wikipedia PDFDocument74 pagesMobile Banking - Wikipedia PDFpes 77No ratings yet

- BRM Project On Online Banking Customer SatisfactionDocument43 pagesBRM Project On Online Banking Customer Satisfactionprathamesh tawareNo ratings yet

- Credit RatingDocument83 pagesCredit Ratingnitudogradogra8No ratings yet

- Boro - Effect of Mobile Banking On Financial Inclusion in KenyaDocument61 pagesBoro - Effect of Mobile Banking On Financial Inclusion in Kenyaedu mainaNo ratings yet

- Co Opbanksfinal PDFDocument13 pagesCo Opbanksfinal PDFAJAY SHAHNo ratings yet

- Awareness of E-Banking Services Among Rural CustomersDocument10 pagesAwareness of E-Banking Services Among Rural CustomersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- SynopsisDocument12 pagesSynopsisVINIT RATANNo ratings yet

- CRM Complete ProjectDocument61 pagesCRM Complete ProjectPratik GosaviNo ratings yet

- Project Report On e Banking PDFDocument88 pagesProject Report On e Banking PDFSagarNo ratings yet

- Digital Banking in IndiaDocument12 pagesDigital Banking in Indiaahil XO1BDNo ratings yet

- Consumer Finance..yatith Poojari (Yp)Document67 pagesConsumer Finance..yatith Poojari (Yp)Yatith PoojariNo ratings yet

- Summer Internship Report - HDFC Digital BankingDocument32 pagesSummer Internship Report - HDFC Digital BankingMantosh SinghNo ratings yet

- Master of Business Administration Rajasthan Technical University, KOTADocument70 pagesMaster of Business Administration Rajasthan Technical University, KOTAHatim AliNo ratings yet

- A Study of Financial Performance Evaluation of Banks in IndiaDocument11 pagesA Study of Financial Performance Evaluation of Banks in IndiaRaghav AryaNo ratings yet

- Diksha Blackbook Mobile BankingDocument52 pagesDiksha Blackbook Mobile BankingDiksha YNo ratings yet

- Technology in BankingDocument98 pagesTechnology in BankingkarenNo ratings yet

- Customer Satisfaction of ATM Services inDocument11 pagesCustomer Satisfaction of ATM Services inEswari GkNo ratings yet

- Sanjana Ganpat Patil. Tybaf - Black BookDocument86 pagesSanjana Ganpat Patil. Tybaf - Black BookTasmay Enterprises100% (2)

- Mobile BankingDocument97 pagesMobile BankingsspmNo ratings yet

- A Study On E-Banking Services by Commercial Banks in Madurai DistrictDocument16 pagesA Study On E-Banking Services by Commercial Banks in Madurai DistrictSandyNo ratings yet

- ss1CRM SYNOPSISDocument51 pagesss1CRM SYNOPSISSatya SudhaNo ratings yet

- E00B0 Credit Risk Management - Axis BankDocument55 pagesE00B0 Credit Risk Management - Axis BankwebstdsnrNo ratings yet

- Personal Loan ProjectDocument8 pagesPersonal Loan Projectazeem483No ratings yet

- Comparative Study of The Public Sector Amp Private Sector BankDocument73 pagesComparative Study of The Public Sector Amp Private Sector BanksumanNo ratings yet

- Hul Eva PDFDocument2 pagesHul Eva PDFPraveen NNo ratings yet

- Retail Banking Literature ReviewDocument1 pageRetail Banking Literature ReviewAsh Jerk100% (1)

- Impact of E-Banking Service Quality On Customer SatisfactionDocument2 pagesImpact of E-Banking Service Quality On Customer SatisfactionKainath FarheenNo ratings yet

- Thesis On Mutual FundDocument185 pagesThesis On Mutual Fundsidhantha83% (6)

- Keywords:: Financial Technology, Peer To Peer Lending, TAM, IDT, KepercayaanDocument22 pagesKeywords:: Financial Technology, Peer To Peer Lending, TAM, IDT, KepercayaanDestianaRahmawatiDewiNo ratings yet

- Research PaperDocument19 pagesResearch Paperhimanshu bhattNo ratings yet

- Science and Business: Factors Affecting Adoption of Fintech in BangladeshDocument9 pagesScience and Business: Factors Affecting Adoption of Fintech in BangladeshAsifNo ratings yet

- Reliability Statistics: Cronbach's Alpha Nof ItemsDocument4 pagesReliability Statistics: Cronbach's Alpha Nof ItemsHabiba KausarNo ratings yet

- Use of Microfinance Institutions To EnhaDocument10 pagesUse of Microfinance Institutions To EnhaHabiba KausarNo ratings yet

- Chemical Oxygen DemandDocument4 pagesChemical Oxygen DemandHabiba KausarNo ratings yet

- International Accounting and MNC'S: Consolidated Financial StatementsDocument7 pagesInternational Accounting and MNC'S: Consolidated Financial StatementsHabiba KausarNo ratings yet

- Medicare & Home Health Care: Centers For Medicare & Medicaid ServicesDocument32 pagesMedicare & Home Health Care: Centers For Medicare & Medicaid ServicesHabiba KausarNo ratings yet

- Medicare and Home Health CareDocument32 pagesMedicare and Home Health CareHabiba KausarNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisHabiba KausarNo ratings yet

- Title of Your EssayDocument4 pagesTitle of Your EssayHabiba KausarNo ratings yet

- International Accounting and MNC'S: Consolidated Financial StatementsDocument7 pagesInternational Accounting and MNC'S: Consolidated Financial StatementsHabiba KausarNo ratings yet

- Microfinance A New For Social and Financial Inclusion: ApproachDocument12 pagesMicrofinance A New For Social and Financial Inclusion: ApproachHabiba KausarNo ratings yet

- Practice Based Evidence AssignmentDocument2 pagesPractice Based Evidence AssignmentHabiba KausarNo ratings yet

- Industry/Market FeasibilityDocument6 pagesIndustry/Market FeasibilityHabiba KausarNo ratings yet

- Subject: Application For Bonafide CertificateDocument1 pageSubject: Application For Bonafide CertificateHabiba KausarNo ratings yet

- MusafDocument7 pagesMusafHabiba KausarNo ratings yet

- My Final ListDocument1 pageMy Final ListHabiba KausarNo ratings yet

- The Structure of The CompanyDocument1 pageThe Structure of The CompanyHabiba KausarNo ratings yet

- Entrepreneurship: Impact of Cultural Diversity and Quality Financial Reporting On Firms PerformanceDocument12 pagesEntrepreneurship: Impact of Cultural Diversity and Quality Financial Reporting On Firms PerformanceHabiba KausarNo ratings yet

- Biafo Industries LTDDocument1 pageBiafo Industries LTDHabiba KausarNo ratings yet

- The Structure of The CompanyDocument1 pageThe Structure of The CompanyHabiba KausarNo ratings yet

- Human Resource Management: Job DescriptionDocument3 pagesHuman Resource Management: Job DescriptionHabiba KausarNo ratings yet

- Entrepreneurship AssignmentDocument12 pagesEntrepreneurship AssignmentHabiba KausarNo ratings yet

- Principle of Marketing: Consumer BehaviorDocument8 pagesPrinciple of Marketing: Consumer BehaviorHabiba KausarNo ratings yet

- Pakistan Reinsurance Company Limited: Shifa International Hospitals LimitedDocument1 pagePakistan Reinsurance Company Limited: Shifa International Hospitals LimitedHabiba KausarNo ratings yet

- Scotia Bank BookletDocument84 pagesScotia Bank BookletTuhin Mishuk PaulNo ratings yet

- SEBI Crackdown On Unregistered Investment Advisory PMS SMS Service ProvidersDocument2 pagesSEBI Crackdown On Unregistered Investment Advisory PMS SMS Service ProvidersJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSNo ratings yet

- The Cat Level 1 CompressDocument1 pageThe Cat Level 1 CompressJenbert SantiagoNo ratings yet

- Royal Mail PLCDocument12 pagesRoyal Mail PLCtengkuNo ratings yet

- DBP Vs Register of Deeds of Nueva Ecija, UDK No. 7671, June 23, 1998Document7 pagesDBP Vs Register of Deeds of Nueva Ecija, UDK No. 7671, June 23, 1998cherdynNo ratings yet

- Help Bank Info FormDocument1 pageHelp Bank Info FormRone ShaahNo ratings yet

- BCR-0-744-2022 - SM Store Installment Offer For Year 2023Document3 pagesBCR-0-744-2022 - SM Store Installment Offer For Year 2023Vivienne MarchelineNo ratings yet

- Belgium PDFDocument2 pagesBelgium PDFBrandon HaleNo ratings yet

- PresentationDocument16 pagesPresentationShilpa SabbarwalNo ratings yet

- 3.2 Letters of Credit 7-7-6Document10 pages3.2 Letters of Credit 7-7-6Moniruzzaman JurorNo ratings yet

- Bloomberg Global MA Financial Rankings 1H 2018 PreliminaryDocument17 pagesBloomberg Global MA Financial Rankings 1H 2018 PreliminaryPierreNo ratings yet

- Foreign ExchangeDocument20 pagesForeign ExchangeASHWINI SINHANo ratings yet

- SCRA Is An Acronym For Servicemembers Civil Relief ActDocument3 pagesSCRA Is An Acronym For Servicemembers Civil Relief ActDan HarrisNo ratings yet

- Insurance Products ENGDocument22 pagesInsurance Products ENGAndrej AndrejNo ratings yet

- Quiz Nos. 6 7 8 Answers BDocument14 pagesQuiz Nos. 6 7 8 Answers BkennethquenanoNo ratings yet

- Presentation - Payment BanksDocument14 pagesPresentation - Payment BanksAstral HeightsNo ratings yet

- Policy Wording ArchDocument132 pagesPolicy Wording Archalahsalam32No ratings yet

- Invoice: Nila CardsDocument1 pageInvoice: Nila Cardschiranjevi rajaNo ratings yet

- Executive Summary (Autosaved) .Docx 1Document9 pagesExecutive Summary (Autosaved) .Docx 1Mahesh AllannavarNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- PDF BahramDocument3 pagesPDF Bahramxfzm99mr8rNo ratings yet

- Eastern Shipping Vs CA GR No. 97412, 12 July 1994 234 SCRA 78 Facts Eastern Shipping Lines, Inc V. Court of AppealsDocument11 pagesEastern Shipping Vs CA GR No. 97412, 12 July 1994 234 SCRA 78 Facts Eastern Shipping Lines, Inc V. Court of AppealsCharm Divina LascotaNo ratings yet

- HR Administrator Resume SampleDocument2 pagesHR Administrator Resume Sampleresume7.com100% (2)

- Bank Branch Management Retail Banking PDFDocument5 pagesBank Branch Management Retail Banking PDFSameesh cdluNo ratings yet

Fintech and Financial Inclusion

Fintech and Financial Inclusion

Uploaded by

Habiba KausarOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Fintech and Financial Inclusion

Fintech and Financial Inclusion

Uploaded by

Habiba KausarCopyright:

ADALYA JOURNAL ISSN NO: 1301-2746

Fintech and Adoption Model: A User Perspective

Dr. Charmi Shah

Professor, IFIM Business School, Bangalore

charmi@ifimbschool.com

Arihant Jain

PGDM Student, IFIM Business School, Bangalore

arihant.jain@ifimbschool.com

Suhail Ahmed P.

PGDM Student, IFIM Business School, Bangalore

suhail.ahmed@ifimbschool.com

Niharika Khandelwal

PGDM Student, IFIM Business School, Bangalore

niharika.khadelwal@ifimbschool.com

Dr. Siddharth Misra*

Adjunct Professor, IFIM Business School, Bangalore

siddharth.misra@ifim.edu.in

Abstract

Purpose: The present research aims to understand the user’s perspective of fintech services

namely payment, planning, lending and borrowing. In line with this, identify the satisfaction

of fintech users by considering safety, expectation and perception behind adapting.

Volome 8, Issue 12, December 2019 488 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Design/ Methodology/ Approach: The research design of this research is exploratory and

descriptive. The primary data were collected from 200 responses through structured

questionnaire. The data is analysis is done through SPSS by using regression test.

Findings: The research reveals maximum people are more satisfied with the payments rather

than financial planning and lending and borrowing. The present study shows that youngster

are tech friendly and using more fintech services while fintech planning services ae used by

middle age people to some extent.

Practical Implication: The research says that most of the youngster are using the technology

so company should provide more payment and financial planning options

Originality/ Value: The present empirical research measures the satisfaction of adopting

fintech services in India.

Keywords: Fintech services, TRA, Satisfaction, Acceptance, Trust

Introduction

In 1990s, The term “FinTech” originated from the name “Financial Services Technology

Consortium” which was an assessment undertaken with Citicorp, antecedent to today’s

During the time of Citicorp’s project, the bank was to resist technological collaboration with

outsiders so as to overcome reputation in their market segment (Hochstein, 2015). Fintech is

defined as convergence of finance and advanced technology of the phrase financial

technology and it represents organisations or representatives of that combine financial

services with advanced technology. In other words, “Financial technology” or “Fintech”

simply means application of technology while delivering financial services. In line with this,

Fintech is aligning the technology to improve the services effectively, such as financial

proficiency, banking, lending and borrowing, payments. Data Analysis revealed that 50% of

people use money transfer and payments, 24% of people use insurance, 20% users for

saving and investments, 10% for borrowing and 10% for financial planning (EY Fintech

adoption index, 2017)

Due to advancement in the technology & convenience, the users tend to rely on financial

services which are tech-friendly. EY report supports this, according to their study 46% of

emerging countries accepts fintech which is more than global acceptance of people i.e. 33%.

Volome 8, Issue 12, December 2019 489 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Hence, Fintech is modifying the manner user think about accessing, investing, saving and

spending money to achieve their demand of financial service at minimum cost.

According to PWC (2017)’s report on their research “Fintech’s growing influence on

financial services” 77% of people are ready to adopt block chain as part of a production

system or process by 2020. Fintech is the most convenient option for the users because of that

they rely on online networks and new technologies like big data analytics, block chain. It is

been observed that the trend from good old days, individuals have diversified their wealth

from a few options to various multiple options. Individuals have the liberty to choose their

combination and can decide the weightage on each of them. Unlike earlier, where people

used to keep their every wealth in the form of gold or at saving account, people have started

creating new ways of managing finance which is generating employment in various

multinational companies. Youngsters are moving towards technology and in India adoption

rate of fintech is 52% ( EY reports , 2017S).

The adoption of fintech in payments segment in Indian economy is growing at a high pace

and India is becoming a digital country. Financial plan is in-depth estimation between present

and future financial state by application of recent variables to forecast future revenue, asset

values and withdrawal plan (Investopedia, 2018). It is a key to long term survival. In line

with this, present study reflects how users have adapted fintech payments and other services,

with channels used for fintech and evolution of digital payments, and trends transforming

digital India.

Literature Review

Financial services which has been traditionally used have confronted a radical evolution with

combination of technology and innovation in the sector. It is visible to naked eye the growth

of finance sector, there are a plenty of FinTech start-ups popped up in the market and the

industry is highly likely to pace its growth in the near future. Indian economy which was a

cash driven economy has been now edged with the help of FinTech.

The Theory of Reasoned Action (TRA) is a eminent theory which was developed by Ajzen

and Fishbein in the year 1980. It endorses that user acceptance or rejection of an innovation

or system is influenced by attitudes, subjective norms and behavioural intention. The study

also hypothesized that it is important to have high degree of connection between measures of

attitude, norm, perceived control, intention and behaviour in terms of action. There is an

emerging body of academic finding particularly concentrated on supervising the factors of

Volome 8, Issue 12, December 2019 490 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

computer technology, acceptance and utility among users (Davis et al, 1989;Davis, 1989;

Mathieson, 1991; Moore and Benbasat, 1991; Taylor and Todd, 1995). However, Agarwal

and Prasal (1998) countered it by conveying that it is individuals’ level of innovativeness

which influence perception towards an innovation and its acceptance (Jugurnath et al., 2018).

Many researches have shown keen interest in studying about use of Technology and have

lately taken different methods to defining the reliance which contribute to individuals’

attitude towards using technology (Moore, 2010). Researchers prefer and suggest to follow

Ajzen and Fishbein (1980) theory to identify relevant beliefs of users and customers. Lucas et

al. (1990) investigated the foundations for their model of implementation, refer to attitude

models, including TRA and diffusion models.

Technology advancement in this era have lowered the efforts of the customers and improved

technology and the convenience delivered through technology have gained the hearts of the

younger generation users. The greatest hindrance to the success of new information systems

is lack of user acceptance. As discussed above, user acceptance is directly related to attitude

and behavioural intention of users.

Amalgamation of finance and technology and have led to evolution of Fintech. It is defined

as products or services in financial service companies that were created on highly innovative

and disruptive service technologies (Sweeney et al., 2015). As Fintech is fresh to everyone, it

is very important to know users’ point of view and their experience. User point of view and

their experience are directly dependent on their attitude and behavior. Youngsters who fall

within the age limit of 18-25 have readily accepted fintech because of their increased

adaptability to technology whereas people belonging to 35-60 finds it hard to swap from

traditional service because of their perception. Extend of adoption level is transparently more

than the puff. As per the survey conducted in 6 different markets, a weighted average of

15.5% of enthusiastic digital service users are fintech users (EY, 2015). Moreover, In Indian

context both Indian customers (both consumer and enterprise) have felt a steady rate of

adoption to Fintech offerings. With usage pattern dependent on cash, banking and user

relationship-driven service necessities are completely with larger composition of cashless

transactions, mobile banking and customer centric financial advice and services regardless of

place, language and diversifications. The disruption is felt from various fronts, such as:

Mobile and Internet availability. India has seen drastic growth in both the number of

smartphone users and internet users over the last few years. Though slowly still India is

moving up the Fintech growth staircase, mostly reinforced by its vigorous Fintech ecosystem

Volome 8, Issue 12, December 2019 491 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

where few players are game changers predominantly helpful in terms of providing monetary

assistance as well as building techie mindset and expertise entrepreneurship skills. . A strong

talented work force of a less costly economy and easy-to-hire tech workforce is one of the

key factors of a successful fintech driven economy.

There are a lot of studies and researches conducted on fintech, but there are only limited

researches on the user perspective of FinTech in different sectors. Hence, It is important to

learn users point of view and their acceptance of fintech in different sectors. There are

research papers by superior companies in Information Technology and Finance industries on

fintech such as World Fintech Report 2017 (Capgemini), Fintech in India-A global growth

Industry (KPMG), Digital Payments 2020 (Boston Consultancy Group), Customer

Experience: Innovate like FinTech ( EY) etcetera. Most of these studies and researches

signifies that there will be high degree of acceptance of FinTech services in the future.

Presently, Fintech is improving the method in which the financial services are delivered and

users will be availing benefits not only from user point of view or convenient form but also

one of access and cost reduction. Humans are unwilling to change but technology drives the

right tone to which one has to adapt to the change. Most of the young investors were likely to

go for fully automated advice and other automated financial tools (FPSB, 2015). Adoption

measures is another barrier which reduces innovation and changing user behaviour needs

intensive marketing and user awareness forums which reduces the gap between FinTech and

user individuals. A weighted average of 15.5% of digitally active consumers are finTech

users (EY, 2015). Majority of the FinTech adopters tend to be young generations, high

income groups and high value customers. Just like the flip side of coin there are certain

factors that pulls back the mankind for being non-users.

Volome 8, Issue 12, December 2019 492 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Figure 1:

*Source –“EY FinTech Adoption Index”

The above graph depict the FinTech Adoption Index 56.6% of users does not feel ease in

setting up an account and biggest hindrance is trust issue. Majority of the respondents in their

survey are more satisfied and inclined towards their traditional institution (EY Fintech

adoption index, 2017).

*Source- Capgemini Financial Service Analysis 2016

On the other hand, Capgemini have conducted a survey on fintech adoption country wise,

according the response in that survey India being a developing country ranks 2nd overcoming

countries like UAE, Hong Kong, Spain, Singapore, Turkey, UK, US, Australia, Japan,

Volome 8, Issue 12, December 2019 493 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Canada, France, Belgium and Netherlands. Mobile banking in India has been growing

drastically as years are passing by. Indian economy is growing immensely at a high pace and

India is becoming a digital country. Post demonetisation (08th October 2016, 08:00 P.M.)

Indian government have been motivating people to access digital payment. “The year 2015

was a developmental year for the Indian fintech sector, which saw the rise of various fintech

start-ups, hatcheries and ventures from open and private speculators” (KPMG, 2015). As

indicated by Boston Consultancy Group, India as of now positions #2 on the planet with more

than 1 billion versatile memberships likewise with increments in 3G and 4G entrance even in

the remotest standards of the nation. In the course of the most recent couple of years,

computerized exchange have demonstrated consistent development of 50%. India has seen

noteworthy instalments movement in the last 3-4 years. During the time of 2000-2014 fintech

instalment was finished utilizing just single channel by utilizing PCs and web were the

regularly utilized instalment entries in the year 2000-2014.Later in the year 2015-19, multi-

channel and open fragmented modes were utilized with the assistance of cell phones and PC

and online channels. It was when e-wallets, for example, apple pay, Samsung pay, android

pay came into the picture.

During the period of 2000-2014 fintech instalment was finished with just single channel by

utilizing PCs and web were the regularly utilized instalment entries in the year 2000-

2014.Later in the year 2015-19, multi-channel and open fragmented modes were utilized with

the assistance of cell phones and PC and online channels. It was when outsider wallets, for

example, apple pay, Samsung pay, android pay came into the scene. As indicated by EY,

Consumers are winding up progressively alright with online only financial service providers.

Almost 40% of respondents and 52% of the most digitally smart buyers portrayed themselves

along these lines.

There exist three main segments in finTech – Payment, Planning, Insurance, lending &

borrowing. According to Fintech 17 report 50% of consumers use FinTech money transfer

and payments services, and 65% anticipate doing so in the future.

Financial Planning

Financial Planning came into the picture since the creation of coins and takes into the account

of overall clients background such as financial status, legal environments, social factors and

economic factors and leads to adoption of strategies (Warschauer,2002). According to the

author in his definition, and suggests that financial planners not only need to possess

Volome 8, Issue 12, December 2019 494 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

technical skills but should possess relational and strategic skills as well. From the period of

2010, financial advisors have been sounding the alarm over the fintech revolution that has

spawned robo-advisors (Best,2016).

According to FPSB report 2015 most of the young investor were likely to go for fully

automated advice and financial tool. Even many of the middle and aged people are not going

for automatic financial service but they ‘ll adapt soon because its cheap as compare to

customised financial planner and opportunity to improve communication between client and

their financial advisor. Even it says that it is appropriate for middle and lower-income client.

This report is also talking that fully automatic services limits the scope of activities like

investments , mortgage etc. as they are unable to meet the needs of High net worth

individual .HNWI demand for automated advisory service increased from 48.6 percent

in2015 to 66.9 percent and 47.5 percent HNWI using online peer to peer platform to lean

about investment idea(Capgemini report, 2016).People have lack of confidence on financial

advisor or planner so they want to do it themselves and for them its less expensive and better

option (FPSB report, 2016).

Financial payment

Fintech financial payment is a system of payment that does not depend on traditional methods

of payment & plastic money. Evolution of new payment modes with the support of

technology have made human life easier and convenient. There are a lot of FinTech payment

application emerged in the Indian market post demonetisation such as PhonePe, Paytm, Tez

etcetera. Among all the FinTech e-payment service provider the most accepted service

provider is Paytm that topped with 200 million users in February 2017 (Variyar,2017). Non-

cash transaction globally have notched to 358 million in the year 2013, an increase of 7.6%

over 2012(Capgemini, 2017). Ashish Das and Rakhi Agarwal (2010) in their research article

“Cashless Payment System in India- A Roadmap” conveys mode of payment through liquid

cash is an expensive affair for government. Country and its public should start adopting

cashless payment system and move away from cash based payment This will aid in reducing

currency management cost & fraudulent activities.

Fintech Lending and borrowing

The origin of banks vestige back to the ancient Babylon, with the subsistence of merchandise

loan. In the year of 1151 at Venice, Italy first bank came into existence. Monetary loans and

deposits have come to the picture since the creation of coins (Nabil Naimy, 2018).

Volome 8, Issue 12, December 2019 495 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Advancement in Technology have impacted financial sector all over the world and it lead to

popping up of FinTech lending and borrowing along the line. Among the four most important

financial services affected by FinTech lending is one among it (KPMG and H2 Ventures,

2015). Technology plays an important role in allowing banks to reach a wider group of

borrowers. Technology plays an important role in allowing banks to reach a wider group of

borrowers (Jagtiani and Lemieux, 2016). From the above literature, the identified research

gap is to investigate the user perceptive towards fintech services. The adaptation of

technology in financial context is been explored limited, thus present study address users

demographic profiling along with the acceptance and satisfaction towards fintech services.

Objectives of the study

The present study aims to identify which target age group acts as popular user of

fintech services as well as which age group is more prone towards which type of

financial service.

It reveals which type of fintech services is widely accepted and satisfied among users.

It aims to measure the degree of satisfaction of users with specified financial services

like financial planning, payments, lending and borrowing.

Methodology

The research design comprised of structured data around both descriptive which reveals

situation based approach and exploratory research. In exploratory research fintech users were

the target base who are willing to use fintech. Primary data was been taken which mainly

concentrated on students, employees, business class, house wife and retired individuals.

First, by starting with a structured questionnaire which are quantitative method of research

which included high number of respondents and more information from the target population.

The questionnaire was based on Likert scaling which has a scale of five starting from

strongly agree to strongly disagree in an order which was more appropriate for research

whereby also helped in analysing fintech user perspective. The questionnaire involved a

briefing of demographic profile thereafter three financial services that is financial planning,

payments, lending and borrowing were focused upon to observe which specified service is

widely used provides user friendly approach. Moreover it figured out trust component of

users on fintech as well as acceptability of them. Application of simple random technique

Volome 8, Issue 12, December 2019 496 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

was done where a group of subjects were only chosen from a larger group (population).While

understanding fintech perception, sample size consisted of 200 people as a sample from the

entire population. Simple Random sampling is being used because everyone from the sample

has the entire chance to get selected. Ease of use and accurate analysis of total population is

also done. The target population consisted working professionals, finance students, retired

people, business man and housemaker.

The study involved the method of regression analysis method as a statistical technique using

correlation regression and ANOVA which has the advantage of understanding the

relationship between dependent and independent variable and also getting an assurance on

reliability of the data. The factors used in this study include satisfaction, reliability and

responsiveness which can affect user awareness and perception. Dependent variables

involves satisfaction variable which defines user satisfaction relationship with the use of

Fintech. The independent variables were financial planning, payment, lending and borrowing

is to provide segmentation of fintech services. Analysis of variance (ANOVA) is been used

under regression analysis which is a group of statistical model and their related approximate

procedures used to observe the dissimilarity among group mean in a given sample.

Accordingly research study was formed in a specific manner which analyzed which type of

target age group had higher adoption rate for specified type of financial services. It also

established a relationship between dependent and independent variable to measure user

satisfaction for the mentioned financial service.

Volome 8, Issue 12, December 2019 497 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Data Analysis

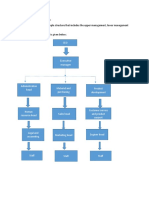

Figure3: Demographic Profiling

According to present study, among the age group of 18-25 and who are students use

payments and they have comparatively more user than remaining 4 occupation groups

salaried employee, retired, house maker and business. But once it comes to business person in

this age group they use financial planning & payments. Under the age group of 26-45, here

also students use more of payments which implies that students use more of financial

payment in all age groups.

Volome 8, Issue 12, December 2019 498 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Source: Author’s own calculation

Figure 4: Demographic Profiling

The above graph implies that surveyed users belonging to the age group of 46-55 and who are

Salaried Employees use more of FinTech services in that particular age group and following

the Salaried Employees are the individuals doing Business. Furthermore, the study shows that

people in this age group are more inclined to FinTech Planning because this is the age period

when individual starts planning to make wise decisions to manage their hard earned savings

and maximise their wealth in the future.

Regression Analysis

Table 1: Model Summary

R R Square Adjusted R Square Std. Error of the

Estimate

FP-Sat. .869 .756 .751 .3203274

Pay-sat .814 .662 .655 .4198464

Lb-sat .677 .459 .439 .4782194

Volome 8, Issue 12, December 2019 499 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

a. Predictors: (Constant), fp4, fp1, fp5, fp6

a. Predictors: (Constant), p4, p-1, p5, p6

b. Predictors: (Constant), lb9, lb1, lb4, lb2, lb7, lb5, lb3

The table no.1 shows the regression analysis using dependent variable of satisfaction of using

this services with independent variable financial planning, payment and lending and

borrowing. The statistical sign R square gives the evaluated result, which reveals that the

value of 0.756 shows the relationship between the dependent variable satisfaction and

independent variable financial planning. The R square value derived from dependent

variable satisfaction and independent variable financial payment is .662 which reveals

moderate relationship between variables. At last the R square value between dependent

variable satisfaction and independent variable lending and borrowing is .459 which is

showing less .strength between them.

Table 2- ANOVA Analysis of Financial Planning

Model Sum of df Mean Square F Sig.

Squares

Regression 61.920 4 15.480 150.863 .000b

1 Residual 20.009 195 .103

Total 81.929 199

Dependent Variable: V39

This above table 2 shows the output of the ANOVA analysis and whether there is a

statistically significant difference between group means. The result reveals that the

significance value is 0.000 (i.e., p = 0.000), which is below 0.05. And, therefore, there is a

statistically significant difference between the samples. This is good to know because if the

samples are different from each other then its good because we can derive at some

conclusion based on outcomes. The F value is a value you get when you run an ANOVA test

or a regression analysis to find out if the means between two populations are significantly

different. F value- 150.683- Represents the differences of samples. If the samples are

different form each other then its good because it gives conclusion based on outcomes. The

more f statistics less is error.

Volome 8, Issue 12, December 2019 500 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Table 3: Coefficient of Financial Planning

Model Unstandardized Coefficients Standardized T Sig.

Coefficients

B Std. Error Beta

(Constant ) .351 .159 2.202 .029

FP1 .032 .022 .051 1.418 .158

FP5 .174 .027 .236 6.397 .000

FP6 .406 .040 .555 10.089 .000

FP4 .320 .043 .402 7.396 .000

The above table represents the satisfaction level outcome which is a dependent variable. The

value .555 represents 55% contribution to the outcome and is considered best among all beta

values. The Sig. values (p value) .029 and .158 is not so important but the next two values

are considered because .000 is considered.

Table 4: ANOVA analysis of Paymentsa

Model Sum of Df Mean Square F Sig.

Squares

Regression 67.386 4 16.847 95.572 .000b

1 Residual 34.373 195 .176

Total 101.759 199

a. Dependent Variable: V40

The f value is 95.572 represents that the difference between samples is not much

compared to earlier example. The p value .000 is significant. It is to determine whether

any of the differences between the means are statistically significant, compare the p-

value to your significance level to assess the null hypothesis. Usually, a significance

level (denoted as α or alpha) of 0.05 works well.

Volome 8, Issue 12, December 2019 501 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Table 5: Coefficient of Payment

Model Unstandardized Coefficients Standardized t Sig.

Coefficients

B Std. Error Beta

(Constant ) 1.167 .213 5.475 .000

P1 -.034 .036 -.039 -.938 .349

P5 .052 .026 .084 1.974 .050

P6 .386 .043 .524 8.913 .000

P4 .261 .042 .365 6.154 .000

The above table represents the satisfaction level outcome which is a dependent variable. The

value .555 represents 55% contribution to the outcome and is considered best among all beta

values. The Sig. values (p value) .029 and .158 is not so important but the next two values

are considered because .000 is considered.

Table 6: ANOVA Analysis of Lending and Borrowing a

Model Sum of df Mean Square F Sig.

Squares

Regression 37.219 7 5.317 23.250 .000b

1 Residual 43.909 192 .229

Total 81.128 199

a. Dependent Variable: V41

The f value is 23.250 represents that the differences between the mean of the two samples is

not much. The p value .000 is very significant which suggests that samples are different from

each other and it is very good to come at results.

Volome 8, Issue 12, December 2019 502 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Table 7 Coefficient of Lending and Borrowing

Model Unstandardized Coefficients Standardized T Sig.

Coefficients

B Std. Error Beta

(Constant ) .887 .238 3.719 .000

LB1 -.007 .026 -.014 -.257 .798

LB2 .151 .051 .240 2.962 .003

LB3 .068 .070 .089 .973 .332

LB4 .195 .039 .284 4.978 .000

LB5 .232 .070 .304 3.327 .001

LB7 -.123 .072 -.144 -1.712 .089

LB9 .198 .079 .222 2.490 .014

a. Dependent Variable: V41

The beta values .304 represents that the 30 % contribution is there to the outcome which is

preferred among other beta values which are less than that. Constants lb1, lb4 have p values

.000 which are significant because these are having statistical difference which is good

because more the difference more it is easy to come with outcomes.

Discussion

Financial technology has become most disruptive still most innovative part in financial

ecosystem. Examining from above interpretation the demographic content of this research

reveals that millennial that is young population are active users of fintech application. In

Indian context it is been observed that young age users are most likely to accept fintech in

day to day lives. Some obvious reasons of it are that they are comfortable with technology

and their age group requires wide range of financial services. The young generation goal set

requires fintech which makes things fast and efficient. Older generations and Retired people

depends on financial planning services of fintech because their age group demands planned

investment for their responsibilities for their children as well as for their wellbeing. The

business class people is been examined to use more of lending and borrowing fintech services

Volome 8, Issue 12, December 2019 503 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

because of their working capital need and loan requirements for the overall growth

perspective of business. Adoption rate of payment services is much higher compared to other

segments because it has been widely improved with the application of technology as in 2019

the number of mobile phone users is forecast to reach 4.68 billion. Along with it its user

friendly attribute with time saving approach is well organized which makes it a popular

segment used by all age groups. Payment transfer comes along with set of incentives with

quick transfer of funds thus making it a preferable option among all other segments. For

example Paytm a money transfer application which is reliable and less documentation work is

required with good wallet limit to minimum KYC (Rs.20,000) wallet while Full KYC (Rs.1

lakh) wallet users can transfer up to Rs. 25,000 per month. Users are not required to carry any

debit or credit card which means there are fewer chances for being fraud. Easy availability of

cashback is available which further boosts users for more transactions via paytm. In case of

Financial planning ET is well renowned is used for managing expenses, investing in

securities as well purchase of health/ vehicle insurance with no documentation. Its artificially

customized expense manager smartly categorizes users spend. While in Financial Lending

and borrowing Faircent is been used most prominently because it gives information about

loan period, loan amount and interest rate in comparison with borrowers profile which also

indicate about Borrower credit worthiness. Both borrowers and lenders can strike deals with

multiple members.

Considering the satisfaction variable fintech application used in payment services provides

high degree of relationship between satisfaction level and payment service obviously because

users been more satisfied using on account of ease of use and flexibility. The most important

concern been that traditional payment were expensive and time consuming unlike fintech

which revolutionized money transfer process. Research Analysis that users feel very

convenient which applying it unlike standing in long queues at banks. Thus payment service

is been accepted at a much wider range than other segment. Thereby both needs and

convenience are been fulfilled of users which fintech very popular. Understanding the

problems faced by users like high service charges, slow transfers and lack of transparency

required the need of a system which eradicates all above issues. These needs brought the

necessity of Fintech which simplified the whole process resulting in efficiency of financial

ecosystem. While in view of financial planning in fintech it’s observed that it has not

experienced wider acceptability because of lack of awareness and trust concerns. The age

group of millennial is not active towards financial planning because of their tendency of

Volome 8, Issue 12, December 2019 504 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

excess spending. Lending and borrowing segment has experienced its use with medium scale

traders but still is not popular in Indian markets due to lack of awareness and customized

approach of it towards users. Still in near future there would be increased demand from retail

borrower’s and small/medium scale enterprises to meet their working capital

requirements. Thus it totally depends on the Indian investors how they actually benefit from

fintech in various field of services.Thus with a three dimensional approach of Financial

Planning, Payments and Lending Borrowing all the three are exclusively designed to cater to

different needs in the financial ecosystem. From payments to planning to lending and

borrowing a set of new generation is shaping the financial technology ecosystem. As India is

dominantly a service market thus fintech plays a pivotal role in modifying the financial

industry.

Conclusion

India is currently experiencing a renaissance in the financial markets with the application of

technology. The research illustrated aware, accept and adaptation of Fintech through three

financial segments that is financial planning, payments, lending and borrowing business etc.

The intention to identify which user groups for the most popular user is been revealed by

providing us information that millennial or young users has the higher adoption rate

compared to other age group. Payment segment was identified to be most popular reason

being ease of use and less time involved. The idea of innovation with technology has taken

dominant role in the Indian FinTech ecosystem, and it is been that widely accepted in

upcoming years. Expertise Collaboration is the requirement of the day for start-ups and

corporates, and investors as technological modification makes its way through the economy,

there is extension of collaboration between start-ups and companies, as well as repeated

efforts from banks and other financial intermediaries to increase user satisfaction. The

analysis of research helped in understanding different user perception with particular

financial segment. The implication derived from understanding the behaviour will further

help in modifying the financial services which suits best for users obviously because user

approach towards fintech services is key important determinant while discussing its

feasibility in the current scenario. While millennial preferred payment services whereas

financial planning was done by professionals and retired persons. Lending and borrowing had

increased use with the small and medium scale organizations. Ultimately, fintech is created to

leverage data, AI, and technology to deliver a user friendly experience for all parties. The

Volome 8, Issue 12, December 2019 505 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

satisfaction variable measured in payment segment has higher relationship thus giving higher

satisfaction rate. The efficiency of mobile devices and advancement of artificial intelligence

have developed into Finance which creates a new market place for growth and opportunity

for fintech. It also helps in reducing long-standing business problems, meets under banked

people and countries for financial inclusion, and acceptability, personalization, and

transparency. The limitation of the study is the sample size of the research and location

determinant. The sample size can be extended although it was aimed to get maximum number

of responses from fintech users only to understand their response. The location is limited to

Bangalore because of time constraints but with further time and resource the research will be

conducted with including users of other metropolitan cities. Future resources and conditions

allow more expertise analysis is expected by increasing number of sample size and location

involved in the research. The future research will be more be advanced involving the

involvement of more expertise analysis to derive efficient relationship between other key

variables.

Acknowledgement

The satiation and euphoria that accompany the successful completion of this research would

be incomplete without the mention of the people who made it possible. We thank the research

team of Accendere Knowledge Management Services, CL Educate Ltd. for their unflinching

guidance, continuous encouragement and support to successfully complete this research

work.

References

Agarwal, R., & Prasad, J. (1998). A conceptual and operational definition of personal

innovativeness in the domain of information technology. Information systems

research, 9(2), 204-215.

American Banker ,(2015) Bank Think Fintech (the word, that is) evolves accessed from

https://www.americanbanker.com/opinion/fintech-the-word-that-is-evolves

Arner, D. W., Barberis, J., & Buckley, R. P. (2015). The evolution of Fintech: A new post-

crisis paradigm. Geo. J. Int'l L., 47, 1271.

Volome 8, Issue 12, December 2019 506 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Best Richard (2016). 4 reasons why financial advisors should use fintech. Investopedia

Retrieved From https://www.investopedia.com/articles/markets-economy/081916/4-

reasons-why-financial-advisors-should-use-fintech.asp

Capgemini, (2016) Financial services trend 2016 accessed from

https://www.capgemini.com/service/2016-trends-insights-for-financial-services/

Capgemini, (2017) World payments report 2017 accessed from

https://www.capgemini.com/fr-fr/wp-content/uploads/sites/2/2017/10/world-

payments-report-2017_year-end_final_web-002.pdf

CapGemini, M. L. (2014). World wealth report. Pobrano z: https://www. worldwealthreport.

com (3.02. 2015).

Chuang, L. M., Liu, C. C., & Kao, H. K. (2016). The adoption of fintech service: TAM

perspective. Int J Manag Adm Sci, 3, 1-15.

Das, A., & Agarwal, R. (2010). Cashless payment system in India-A roadmap.

Davis, F.D. (1989), “Perceived usefulness, perceived ease of use, and user acceptance of

information technology”, MIS Quarterly, Vol. 13 No. 3, pp. 318-39.

Davis, L.D., Bagozzi, R.P. and Warshaw, P.R. (1989), “User acceptance of computer

technology: a comparison of two theoretical models”, Management Science, Vol. 35

No. 8, pp. 982-1003

FPSB report, (2016-17) Fintech and the Future of Financial Planning accessed from

https://www.fpsb.org/wpcontent/uploads/2016/10/161005_rpt_FintechPaper_FINAL

_REV.pdf

Gulamhuseinwala, I., Bull, T., & Lewis, S. (2015). FinTech is gaining traction and young,

high-income users are the early adopters.

Hochstein Marc (2015). Bank Think Fintech (the word that is) Evolves. American Banker

Retrieved from https://www.americanbanker.com/opinion/fintech-the-word-that-is-

evolves

Volome 8, Issue 12, December 2019 507 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Index, E. F. A. (2017). The rapid emergence of FinTech. URL: http://www. ey.

com/Publication/vwLUAssets/ey-fintech-adoption-index-2017/$ FILE/ey-fintech-

adoptionindex-2017. pdf [in English].

Jagtiani, J., & Lemieux, C. (2017). Fintech Lending: Financial Inclusion, Risk Pricing, and

Alternative Information.

Joshi, M. (2017). Digital Payment System: A Feat Forward of India.

Jugurnath, B., Bissessur, R., Ramtohul, P., & Mootooganagen, R. Fintech And Digital

Banking: Perception And Usage In Mauritius, A Logistic Regression Approach.

Leong, C., Tan, B., Xiao, X., Tan, F. T. C., & Sun, Y. (2017). Nurturing a FinTech

ecosystem: The case of a youth microloan startup in China. International Journal of

Information Management, 37(2), 92-97.

Moore, G. C., & Benbasat, I. (1996). Integrating diffusion of innovations and theory of

reasoned action models to predict utilization of information technology by end-users.

In Diffusion and adoption of information technology (pp. 132-146). Springer, Boston,

MA.

Moore, G.C. and Benbasat, I. (1991), “Development of instrument to measure the perceptions

of adopting an information technology innovation”, Information Systems Research,

Vol. 2 No. 3, pp. 192-222.

Omarini, A. (2017). The digital transformation in banking and the role of FinTechs in the

new financial intermediation scenario.

PWC (2017). Redrawing the lines; Fintech’s Growing influence on Financial services. Global

Fintech Report Retrieved from https://www.pwc.com/jg/en/publications/pwc-global-

fintech-report-17.3.17-final.pdf

Ryu, H. S. (2018, January). Understanding Benefit and Risk Framework of Fintech Adoption:

Comparison of Early Adopters and Late Adopters. In Proceedings of the 51st Hawaii

International Conference on System Sciences.

Volome 8, Issue 12, December 2019 508 http://adalyajournal.com/

ADALYA JOURNAL ISSN NO: 1301-2746

Shah, A., Kaushik, V., Roongta, P., Jain, C., & Awadhiya, A. (2016). Digital payments 2020:

The making of a $500 billion ecosystem in India. The Boston Consulting Group.

Taylor, S. and Todd, P.A. (1995), “Understanding information technology usage: a test of

competing models”, Information Systems Research, Vol. 6 No. 2, pp. 144-76.

The Paypers , (2018) How fintechs are changing the payment landscape accessed from

https://www.thepaypers.com/expert-opinion/how-fintechs-are-changing-the-

payment-landscape/772147

Warschauer, T. (2002). The role of universities in the development of the personal financial

planning profession. Financial Services Review, 11(3), 201.

Volome 8, Issue 12, December 2019 509 http://adalyajournal.com/

You might also like

- Sample of Loan Agreement For NotaryDocument2 pagesSample of Loan Agreement For NotaryHannah Finuliar92% (12)

- CNA Study Guide PDFDocument494 pagesCNA Study Guide PDFjose_pallares9100% (3)

- SurveyorDocument2 pagesSurveyordtr170% (2)

- 1034430055-Home Health Aide EnglishDocument24 pages1034430055-Home Health Aide EnglishHabiba KausarNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Finance Dissertation TopicsDocument2 pagesFinance Dissertation Topicsmonabiswas100% (1)

- Over 190 Countries, 73 Million of Its Some 130 Million Subscribers Are Outside The U.SDocument3 pagesOver 190 Countries, 73 Million of Its Some 130 Million Subscribers Are Outside The U.SHabiba KausarNo ratings yet

- Merchant BankingDocument94 pagesMerchant BankingCliffton Kinny100% (7)

- Internet Banking Project DocumentationDocument23 pagesInternet Banking Project DocumentationDilip ChudasamaNo ratings yet

- Australia-Documents Checklist For Student Visa-ElodgementDocument17 pagesAustralia-Documents Checklist For Student Visa-ElodgementPunit Aswal0% (1)

- FintechDocument50 pagesFintechbirendraNo ratings yet

- Financial InclusionDocument134 pagesFinancial InclusionvimalbakshiNo ratings yet

- Project Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)Document43 pagesProject Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)AnkitNo ratings yet

- Innovation in Banking SectorDocument21 pagesInnovation in Banking Sectoruma2k10No ratings yet

- Review of LiteratureDocument4 pagesReview of Literaturemaha lakshmiNo ratings yet

- A Study On Customer Awareness Towards e Banking.. B. GopichandDocument11 pagesA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1No ratings yet

- Banking Sector ReformsDocument152 pagesBanking Sector ReformsManpreet SachdevaNo ratings yet

- Mohammad Fazal-1Document81 pagesMohammad Fazal-1Norma SanfordNo ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- HDFC NetBanking SynopsisDocument5 pagesHDFC NetBanking SynopsisPranavi Paul Pandey100% (1)

- A Study On Online Banking in India: Project ReportDocument77 pagesA Study On Online Banking in India: Project ReportParth ShahNo ratings yet

- Mobile Banking Project BithoraiDocument64 pagesMobile Banking Project BithoraiPrince Cious DaimariNo ratings yet

- A Brief Study On Role of Technology in BankingDocument65 pagesA Brief Study On Role of Technology in BankingGlobal printNo ratings yet

- Project Report: Post Garduate Diploma in Business Admnistration (PGDBM)Document55 pagesProject Report: Post Garduate Diploma in Business Admnistration (PGDBM)Aamir Khan100% (1)

- Loan & Credit Facility Provided by Different BanksDocument72 pagesLoan & Credit Facility Provided by Different Bankskaushal2442No ratings yet

- Financial InclutionDocument37 pagesFinancial InclutionPravash Poddar100% (1)

- Black Book GauriDocument107 pagesBlack Book Gauriyogesh kumbharNo ratings yet

- A Study On Risk Analysis On Personal Loans at Vijaya BankDocument90 pagesA Study On Risk Analysis On Personal Loans at Vijaya BankChethan.sNo ratings yet

- Innovation in Banking SectorDocument80 pagesInnovation in Banking SectorNavdeep Kaur67% (3)

- Project Report ON Brand Preference OF Two WheelerDocument79 pagesProject Report ON Brand Preference OF Two WheelerSahil GulatiNo ratings yet

- Internet Banking Advantages MBA ProjectDocument85 pagesInternet Banking Advantages MBA ProjectVishal Sanjay SamratNo ratings yet

- Traditional VS Modern BankingDocument10 pagesTraditional VS Modern BankingVandana PrajapatiNo ratings yet

- Project Mcom PDFDocument45 pagesProject Mcom PDFPriyanka SatamNo ratings yet

- Project On PSU BankDocument92 pagesProject On PSU BankAnshu BardhanNo ratings yet

- Consumer Behaviour On Mobile Banking - A Behavioural Reasoning TheoryDocument12 pagesConsumer Behaviour On Mobile Banking - A Behavioural Reasoning Theory02Mmr 02No ratings yet

- Fintech and Transformation in Financial Services: Seminar Report OnDocument25 pagesFintech and Transformation in Financial Services: Seminar Report Onrobert juniorNo ratings yet

- Mobile Banking - Wikipedia PDFDocument74 pagesMobile Banking - Wikipedia PDFpes 77No ratings yet

- BRM Project On Online Banking Customer SatisfactionDocument43 pagesBRM Project On Online Banking Customer Satisfactionprathamesh tawareNo ratings yet

- Credit RatingDocument83 pagesCredit Ratingnitudogradogra8No ratings yet

- Boro - Effect of Mobile Banking On Financial Inclusion in KenyaDocument61 pagesBoro - Effect of Mobile Banking On Financial Inclusion in Kenyaedu mainaNo ratings yet

- Co Opbanksfinal PDFDocument13 pagesCo Opbanksfinal PDFAJAY SHAHNo ratings yet

- Awareness of E-Banking Services Among Rural CustomersDocument10 pagesAwareness of E-Banking Services Among Rural CustomersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- SynopsisDocument12 pagesSynopsisVINIT RATANNo ratings yet

- CRM Complete ProjectDocument61 pagesCRM Complete ProjectPratik GosaviNo ratings yet

- Project Report On e Banking PDFDocument88 pagesProject Report On e Banking PDFSagarNo ratings yet

- Digital Banking in IndiaDocument12 pagesDigital Banking in Indiaahil XO1BDNo ratings yet

- Consumer Finance..yatith Poojari (Yp)Document67 pagesConsumer Finance..yatith Poojari (Yp)Yatith PoojariNo ratings yet

- Summer Internship Report - HDFC Digital BankingDocument32 pagesSummer Internship Report - HDFC Digital BankingMantosh SinghNo ratings yet

- Master of Business Administration Rajasthan Technical University, KOTADocument70 pagesMaster of Business Administration Rajasthan Technical University, KOTAHatim AliNo ratings yet

- A Study of Financial Performance Evaluation of Banks in IndiaDocument11 pagesA Study of Financial Performance Evaluation of Banks in IndiaRaghav AryaNo ratings yet

- Diksha Blackbook Mobile BankingDocument52 pagesDiksha Blackbook Mobile BankingDiksha YNo ratings yet

- Technology in BankingDocument98 pagesTechnology in BankingkarenNo ratings yet

- Customer Satisfaction of ATM Services inDocument11 pagesCustomer Satisfaction of ATM Services inEswari GkNo ratings yet

- Sanjana Ganpat Patil. Tybaf - Black BookDocument86 pagesSanjana Ganpat Patil. Tybaf - Black BookTasmay Enterprises100% (2)

- Mobile BankingDocument97 pagesMobile BankingsspmNo ratings yet

- A Study On E-Banking Services by Commercial Banks in Madurai DistrictDocument16 pagesA Study On E-Banking Services by Commercial Banks in Madurai DistrictSandyNo ratings yet

- ss1CRM SYNOPSISDocument51 pagesss1CRM SYNOPSISSatya SudhaNo ratings yet

- E00B0 Credit Risk Management - Axis BankDocument55 pagesE00B0 Credit Risk Management - Axis BankwebstdsnrNo ratings yet

- Personal Loan ProjectDocument8 pagesPersonal Loan Projectazeem483No ratings yet

- Comparative Study of The Public Sector Amp Private Sector BankDocument73 pagesComparative Study of The Public Sector Amp Private Sector BanksumanNo ratings yet

- Hul Eva PDFDocument2 pagesHul Eva PDFPraveen NNo ratings yet

- Retail Banking Literature ReviewDocument1 pageRetail Banking Literature ReviewAsh Jerk100% (1)

- Impact of E-Banking Service Quality On Customer SatisfactionDocument2 pagesImpact of E-Banking Service Quality On Customer SatisfactionKainath FarheenNo ratings yet

- Thesis On Mutual FundDocument185 pagesThesis On Mutual Fundsidhantha83% (6)

- Keywords:: Financial Technology, Peer To Peer Lending, TAM, IDT, KepercayaanDocument22 pagesKeywords:: Financial Technology, Peer To Peer Lending, TAM, IDT, KepercayaanDestianaRahmawatiDewiNo ratings yet

- Research PaperDocument19 pagesResearch Paperhimanshu bhattNo ratings yet

- Science and Business: Factors Affecting Adoption of Fintech in BangladeshDocument9 pagesScience and Business: Factors Affecting Adoption of Fintech in BangladeshAsifNo ratings yet

- Reliability Statistics: Cronbach's Alpha Nof ItemsDocument4 pagesReliability Statistics: Cronbach's Alpha Nof ItemsHabiba KausarNo ratings yet

- Use of Microfinance Institutions To EnhaDocument10 pagesUse of Microfinance Institutions To EnhaHabiba KausarNo ratings yet

- Chemical Oxygen DemandDocument4 pagesChemical Oxygen DemandHabiba KausarNo ratings yet

- International Accounting and MNC'S: Consolidated Financial StatementsDocument7 pagesInternational Accounting and MNC'S: Consolidated Financial StatementsHabiba KausarNo ratings yet

- Medicare & Home Health Care: Centers For Medicare & Medicaid ServicesDocument32 pagesMedicare & Home Health Care: Centers For Medicare & Medicaid ServicesHabiba KausarNo ratings yet

- Medicare and Home Health CareDocument32 pagesMedicare and Home Health CareHabiba KausarNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisHabiba KausarNo ratings yet

- Title of Your EssayDocument4 pagesTitle of Your EssayHabiba KausarNo ratings yet

- International Accounting and MNC'S: Consolidated Financial StatementsDocument7 pagesInternational Accounting and MNC'S: Consolidated Financial StatementsHabiba KausarNo ratings yet

- Microfinance A New For Social and Financial Inclusion: ApproachDocument12 pagesMicrofinance A New For Social and Financial Inclusion: ApproachHabiba KausarNo ratings yet

- Practice Based Evidence AssignmentDocument2 pagesPractice Based Evidence AssignmentHabiba KausarNo ratings yet

- Industry/Market FeasibilityDocument6 pagesIndustry/Market FeasibilityHabiba KausarNo ratings yet

- Subject: Application For Bonafide CertificateDocument1 pageSubject: Application For Bonafide CertificateHabiba KausarNo ratings yet

- MusafDocument7 pagesMusafHabiba KausarNo ratings yet

- My Final ListDocument1 pageMy Final ListHabiba KausarNo ratings yet

- The Structure of The CompanyDocument1 pageThe Structure of The CompanyHabiba KausarNo ratings yet

- Entrepreneurship: Impact of Cultural Diversity and Quality Financial Reporting On Firms PerformanceDocument12 pagesEntrepreneurship: Impact of Cultural Diversity and Quality Financial Reporting On Firms PerformanceHabiba KausarNo ratings yet

- Biafo Industries LTDDocument1 pageBiafo Industries LTDHabiba KausarNo ratings yet

- The Structure of The CompanyDocument1 pageThe Structure of The CompanyHabiba KausarNo ratings yet

- Human Resource Management: Job DescriptionDocument3 pagesHuman Resource Management: Job DescriptionHabiba KausarNo ratings yet

- Entrepreneurship AssignmentDocument12 pagesEntrepreneurship AssignmentHabiba KausarNo ratings yet

- Principle of Marketing: Consumer BehaviorDocument8 pagesPrinciple of Marketing: Consumer BehaviorHabiba KausarNo ratings yet

- Pakistan Reinsurance Company Limited: Shifa International Hospitals LimitedDocument1 pagePakistan Reinsurance Company Limited: Shifa International Hospitals LimitedHabiba KausarNo ratings yet

- Scotia Bank BookletDocument84 pagesScotia Bank BookletTuhin Mishuk PaulNo ratings yet

- SEBI Crackdown On Unregistered Investment Advisory PMS SMS Service ProvidersDocument2 pagesSEBI Crackdown On Unregistered Investment Advisory PMS SMS Service ProvidersJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSNo ratings yet

- The Cat Level 1 CompressDocument1 pageThe Cat Level 1 CompressJenbert SantiagoNo ratings yet

- Royal Mail PLCDocument12 pagesRoyal Mail PLCtengkuNo ratings yet

- DBP Vs Register of Deeds of Nueva Ecija, UDK No. 7671, June 23, 1998Document7 pagesDBP Vs Register of Deeds of Nueva Ecija, UDK No. 7671, June 23, 1998cherdynNo ratings yet

- Help Bank Info FormDocument1 pageHelp Bank Info FormRone ShaahNo ratings yet

- BCR-0-744-2022 - SM Store Installment Offer For Year 2023Document3 pagesBCR-0-744-2022 - SM Store Installment Offer For Year 2023Vivienne MarchelineNo ratings yet

- Belgium PDFDocument2 pagesBelgium PDFBrandon HaleNo ratings yet

- PresentationDocument16 pagesPresentationShilpa SabbarwalNo ratings yet

- 3.2 Letters of Credit 7-7-6Document10 pages3.2 Letters of Credit 7-7-6Moniruzzaman JurorNo ratings yet

- Bloomberg Global MA Financial Rankings 1H 2018 PreliminaryDocument17 pagesBloomberg Global MA Financial Rankings 1H 2018 PreliminaryPierreNo ratings yet

- Foreign ExchangeDocument20 pagesForeign ExchangeASHWINI SINHANo ratings yet

- SCRA Is An Acronym For Servicemembers Civil Relief ActDocument3 pagesSCRA Is An Acronym For Servicemembers Civil Relief ActDan HarrisNo ratings yet

- Insurance Products ENGDocument22 pagesInsurance Products ENGAndrej AndrejNo ratings yet

- Quiz Nos. 6 7 8 Answers BDocument14 pagesQuiz Nos. 6 7 8 Answers BkennethquenanoNo ratings yet

- Presentation - Payment BanksDocument14 pagesPresentation - Payment BanksAstral HeightsNo ratings yet

- Policy Wording ArchDocument132 pagesPolicy Wording Archalahsalam32No ratings yet

- Invoice: Nila CardsDocument1 pageInvoice: Nila Cardschiranjevi rajaNo ratings yet

- Executive Summary (Autosaved) .Docx 1Document9 pagesExecutive Summary (Autosaved) .Docx 1Mahesh AllannavarNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- PDF BahramDocument3 pagesPDF Bahramxfzm99mr8rNo ratings yet

- Eastern Shipping Vs CA GR No. 97412, 12 July 1994 234 SCRA 78 Facts Eastern Shipping Lines, Inc V. Court of AppealsDocument11 pagesEastern Shipping Vs CA GR No. 97412, 12 July 1994 234 SCRA 78 Facts Eastern Shipping Lines, Inc V. Court of AppealsCharm Divina LascotaNo ratings yet

- HR Administrator Resume SampleDocument2 pagesHR Administrator Resume Sampleresume7.com100% (2)

- Bank Branch Management Retail Banking PDFDocument5 pagesBank Branch Management Retail Banking PDFSameesh cdluNo ratings yet