Professional Documents

Culture Documents

Banking Cash Transaction Tax

Banking Cash Transaction Tax

Uploaded by

S K MahapatraCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Certified Cheque and Cashier ChequeDocument2 pagesCertified Cheque and Cashier ChequeS K MahapatraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cadbury-Kraft Case AnalysisDocument2 pagesCadbury-Kraft Case AnalysisjustjadeNo ratings yet

- Types of Bank AccountDocument5 pagesTypes of Bank AccountS K MahapatraNo ratings yet

- Authority To Sell CompleteDocument5 pagesAuthority To Sell CompleteANNALENE OLITNo ratings yet

- NGO Internship Report (Law)Document20 pagesNGO Internship Report (Law)Manzur Husain88% (8)

- Types of ChequesDocument5 pagesTypes of ChequesS K MahapatraNo ratings yet

- Twin Balance Sheet Problems in IndiaDocument2 pagesTwin Balance Sheet Problems in IndiaS K MahapatraNo ratings yet

- Profit and GainDocument3 pagesProfit and GainS K MahapatraNo ratings yet

- Crossing of ChequesDocument3 pagesCrossing of ChequesS K MahapatraNo ratings yet

- Cheque Truncation SystemDocument5 pagesCheque Truncation SystemS K MahapatraNo ratings yet

- Credit Card VS Debit CardDocument3 pagesCredit Card VS Debit CardS K MahapatraNo ratings yet

- Money LaunderingDocument3 pagesMoney LaunderingS K MahapatraNo ratings yet

- Atm VS Debit CardDocument3 pagesAtm VS Debit CardS K MahapatraNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Final Draft Taxation LokeshDocument15 pagesFinal Draft Taxation Lokeshlokesh4nigamNo ratings yet

- Instant Download Test Bank For Quality Management For Organizational Excellence 8th Edition David L Goetsch Stanley Davis PDF ScribdDocument15 pagesInstant Download Test Bank For Quality Management For Organizational Excellence 8th Edition David L Goetsch Stanley Davis PDF ScribdBernard Dalessio100% (14)

- Ncnda - Cmi InstrakDocument7 pagesNcnda - Cmi InstrakTong SepamNo ratings yet

- Prospectus - SampleDocument338 pagesProspectus - Sampleप्रणव प्रकाशNo ratings yet

- Vices of Consent - LAW501Document2 pagesVices of Consent - LAW501eunjijungNo ratings yet

- Rose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Document11 pagesRose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Scribd Government DocsNo ratings yet

- Civil Rights Complaint - Zayer V City of New YorkDocument22 pagesCivil Rights Complaint - Zayer V City of New YorkC BealeNo ratings yet

- Agra Administrative Law Reviewer 10.27.17Document39 pagesAgra Administrative Law Reviewer 10.27.17juna luz latigayNo ratings yet

- Macias Vs ComelecDocument6 pagesMacias Vs ComelecAudreyNo ratings yet

- G.R. No. 194307 Birkenstock Orthopaedie Vs Phil. SHoe ExpoDocument16 pagesG.R. No. 194307 Birkenstock Orthopaedie Vs Phil. SHoe ExpoChatNo ratings yet

- Go Digit General Insurance LTD.: IRDAN158RP0003V01201718Document3 pagesGo Digit General Insurance LTD.: IRDAN158RP0003V01201718sarath potnuriNo ratings yet

- The Municipality of Hagonoy Bulacan Vs DumdumDocument3 pagesThe Municipality of Hagonoy Bulacan Vs DumdumThomas Vincent O. PantaleonNo ratings yet

- Jonsay vs. Solidbank Corporation (Now MetropolitanBank and Trust Company)Document26 pagesJonsay vs. Solidbank Corporation (Now MetropolitanBank and Trust Company)Vincent OngNo ratings yet

- Pcib V EscolinDocument122 pagesPcib V Escolinarianna0624No ratings yet

- MMDA Vs Viron TransitDocument3 pagesMMDA Vs Viron TransitJay CezarNo ratings yet

- The Architecture of Incarceration - Changing Paradigms in Prison Architecture-LibreDocument8 pagesThe Architecture of Incarceration - Changing Paradigms in Prison Architecture-LibreEnrico MichelettiNo ratings yet

- 41671999-Standing-Katz-Chart F PDFDocument1 page41671999-Standing-Katz-Chart F PDFJose Luis Diaz Carrizales100% (1)

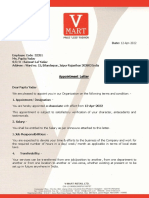

- V-Mart Offer Letter - Papita YadavDocument9 pagesV-Mart Offer Letter - Papita YadavKanchan Manhas50% (2)

- Cavite State University Indang/Imus Campus March 9, 2022: Internship Activity 1Document9 pagesCavite State University Indang/Imus Campus March 9, 2022: Internship Activity 1rin saotoNo ratings yet

- MMDA V Concerned Residents of Manila BayDocument8 pagesMMDA V Concerned Residents of Manila BayMyra MyraNo ratings yet

- G.R. No. 158907 February 12, 2007Document9 pagesG.R. No. 158907 February 12, 2007Jayson BasaNo ratings yet

- Labor Law Case DigestsDocument60 pagesLabor Law Case Digestsmhelei2luvla91% (11)

- Roxas & Company Inc Vs DAMBA NFSWDocument111 pagesRoxas & Company Inc Vs DAMBA NFSWabo8008No ratings yet

- Macariola vs. AsuncionDocument16 pagesMacariola vs. AsuncionCrisDBNo ratings yet

- Leaving Cert Physics Revision BookletDocument34 pagesLeaving Cert Physics Revision BookletNoel Cunningham100% (1)

- Property Law Unit 2Document12 pagesProperty Law Unit 2ayushisingla657No ratings yet

- Flow Chart On Court Proceeding, Copying, Decree ExecutionDocument4 pagesFlow Chart On Court Proceeding, Copying, Decree ExecutionS A H ZaidiNo ratings yet

Banking Cash Transaction Tax

Banking Cash Transaction Tax

Uploaded by

S K MahapatraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Cash Transaction Tax

Banking Cash Transaction Tax

Uploaded by

S K MahapatraCopyright:

Available Formats

Banking Cash Transaction Tax (BCTT):

Explained

Published on Tuesday, March 21, 2017

By Admin

Why BCTT is important?

Recently, the Committee of Chief Ministers on Digital Payments has recommended the

restoration of Banking Cash Transaction Tax(BCTT). It was recommended by the

Committee in order to promote digital payments in the country. This committee was

headed by Andhra Pradesh Chief Minister Chandrababu Naidu.

What is Banking Cash Transaction Tax (BCTT)?

o It is a type of Direct Tax which was levied(from 2005 to 2009) on cash

transactions exceeding a specific amount from the bank by a customer.

o Currently, Government is examining the recommendations of the high-powered

Committee of Chief Minister on Digital Payments. According to which, Banking

Cash Transaction Tax(BCTT) should be levied on cash deals of Rs. 50,000 and

above.

o Earlier, it was first introduced in 2005 by the UPA-1 government under the

Finance Act, 2005. But after four years it was rolled back on 1 April 2009. During

this period it was 0.1%. Also, it was not applicable in the state of Jammu and

Kashmir.

o Again, Tax Administration Committee headed by Parthasarathi Shome had also

recommended reinstating the BCTT in 2014.

Benefits of Banking Cash Transaction Tax (BCTT)

o It will be a positive step against Black Money, as all currency denominations

above a certain amount would be scrapped and it would force Black Money

hoarders to switch to electronic methods of transaction. And with electronic

transactions, a tax would be deducted straightway with every transaction at a

nominal rate. It will drastically reduce the scope of hoarding cash wealth and

evade taxes using the loopholes of Tax Laws.

o It will bring a large number of people under the taxation ambit.

o BCTT will help in achieving governments of making India a Cashless Economy.

Key Terms:

Direct Tax:

These are taxes which are directly paid to the government by the taxpayer. This tax is

directly levied by the government on individuals and organisations. For Example,

Income Tax, Wealth Tax, Corporation Tax, Banking Cash Transaction Tax(BCTT), etc.

Indirect Tax:

These taxes are levied on the manufacture or sale of goods and services. Indirect taxes

are not directly paid to the government, instead, they are initially paid to an intermediary

which transfer these taxes to the customer. For Example, sales tax, service tax, excise

duty etc.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Certified Cheque and Cashier ChequeDocument2 pagesCertified Cheque and Cashier ChequeS K MahapatraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cadbury-Kraft Case AnalysisDocument2 pagesCadbury-Kraft Case AnalysisjustjadeNo ratings yet

- Types of Bank AccountDocument5 pagesTypes of Bank AccountS K MahapatraNo ratings yet

- Authority To Sell CompleteDocument5 pagesAuthority To Sell CompleteANNALENE OLITNo ratings yet

- NGO Internship Report (Law)Document20 pagesNGO Internship Report (Law)Manzur Husain88% (8)

- Types of ChequesDocument5 pagesTypes of ChequesS K MahapatraNo ratings yet

- Twin Balance Sheet Problems in IndiaDocument2 pagesTwin Balance Sheet Problems in IndiaS K MahapatraNo ratings yet

- Profit and GainDocument3 pagesProfit and GainS K MahapatraNo ratings yet

- Crossing of ChequesDocument3 pagesCrossing of ChequesS K MahapatraNo ratings yet

- Cheque Truncation SystemDocument5 pagesCheque Truncation SystemS K MahapatraNo ratings yet

- Credit Card VS Debit CardDocument3 pagesCredit Card VS Debit CardS K MahapatraNo ratings yet

- Money LaunderingDocument3 pagesMoney LaunderingS K MahapatraNo ratings yet

- Atm VS Debit CardDocument3 pagesAtm VS Debit CardS K MahapatraNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Final Draft Taxation LokeshDocument15 pagesFinal Draft Taxation Lokeshlokesh4nigamNo ratings yet

- Instant Download Test Bank For Quality Management For Organizational Excellence 8th Edition David L Goetsch Stanley Davis PDF ScribdDocument15 pagesInstant Download Test Bank For Quality Management For Organizational Excellence 8th Edition David L Goetsch Stanley Davis PDF ScribdBernard Dalessio100% (14)

- Ncnda - Cmi InstrakDocument7 pagesNcnda - Cmi InstrakTong SepamNo ratings yet

- Prospectus - SampleDocument338 pagesProspectus - Sampleप्रणव प्रकाशNo ratings yet

- Vices of Consent - LAW501Document2 pagesVices of Consent - LAW501eunjijungNo ratings yet

- Rose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Document11 pagesRose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Scribd Government DocsNo ratings yet

- Civil Rights Complaint - Zayer V City of New YorkDocument22 pagesCivil Rights Complaint - Zayer V City of New YorkC BealeNo ratings yet

- Agra Administrative Law Reviewer 10.27.17Document39 pagesAgra Administrative Law Reviewer 10.27.17juna luz latigayNo ratings yet

- Macias Vs ComelecDocument6 pagesMacias Vs ComelecAudreyNo ratings yet

- G.R. No. 194307 Birkenstock Orthopaedie Vs Phil. SHoe ExpoDocument16 pagesG.R. No. 194307 Birkenstock Orthopaedie Vs Phil. SHoe ExpoChatNo ratings yet

- Go Digit General Insurance LTD.: IRDAN158RP0003V01201718Document3 pagesGo Digit General Insurance LTD.: IRDAN158RP0003V01201718sarath potnuriNo ratings yet

- The Municipality of Hagonoy Bulacan Vs DumdumDocument3 pagesThe Municipality of Hagonoy Bulacan Vs DumdumThomas Vincent O. PantaleonNo ratings yet

- Jonsay vs. Solidbank Corporation (Now MetropolitanBank and Trust Company)Document26 pagesJonsay vs. Solidbank Corporation (Now MetropolitanBank and Trust Company)Vincent OngNo ratings yet

- Pcib V EscolinDocument122 pagesPcib V Escolinarianna0624No ratings yet

- MMDA Vs Viron TransitDocument3 pagesMMDA Vs Viron TransitJay CezarNo ratings yet

- The Architecture of Incarceration - Changing Paradigms in Prison Architecture-LibreDocument8 pagesThe Architecture of Incarceration - Changing Paradigms in Prison Architecture-LibreEnrico MichelettiNo ratings yet

- 41671999-Standing-Katz-Chart F PDFDocument1 page41671999-Standing-Katz-Chart F PDFJose Luis Diaz Carrizales100% (1)

- V-Mart Offer Letter - Papita YadavDocument9 pagesV-Mart Offer Letter - Papita YadavKanchan Manhas50% (2)

- Cavite State University Indang/Imus Campus March 9, 2022: Internship Activity 1Document9 pagesCavite State University Indang/Imus Campus March 9, 2022: Internship Activity 1rin saotoNo ratings yet

- MMDA V Concerned Residents of Manila BayDocument8 pagesMMDA V Concerned Residents of Manila BayMyra MyraNo ratings yet

- G.R. No. 158907 February 12, 2007Document9 pagesG.R. No. 158907 February 12, 2007Jayson BasaNo ratings yet

- Labor Law Case DigestsDocument60 pagesLabor Law Case Digestsmhelei2luvla91% (11)

- Roxas & Company Inc Vs DAMBA NFSWDocument111 pagesRoxas & Company Inc Vs DAMBA NFSWabo8008No ratings yet

- Macariola vs. AsuncionDocument16 pagesMacariola vs. AsuncionCrisDBNo ratings yet

- Leaving Cert Physics Revision BookletDocument34 pagesLeaving Cert Physics Revision BookletNoel Cunningham100% (1)

- Property Law Unit 2Document12 pagesProperty Law Unit 2ayushisingla657No ratings yet

- Flow Chart On Court Proceeding, Copying, Decree ExecutionDocument4 pagesFlow Chart On Court Proceeding, Copying, Decree ExecutionS A H ZaidiNo ratings yet