Professional Documents

Culture Documents

Special Resident Retiree Visa

Special Resident Retiree Visa

Uploaded by

Mary Heide H. Amora0 ratings0% found this document useful (0 votes)

8 views7 pagesOriginal Title

SPECIAL RESIDENT RETIREE VISA.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views7 pagesSpecial Resident Retiree Visa

Special Resident Retiree Visa

Uploaded by

Mary Heide H. AmoraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

SPECIAL RESIDENT RETIREE’S VISA (SRRV)

The Special Resident Retiree’s Visa (SRRV) is a special

non-immigrant resident visa that provides its holders with

multiple-entry and indefinite stay status in the Philippines. It

also grants Tax-Free incentives and privileges as well as

value-added services and benefits that they can avail of from

our partner establishments such as hotels, resorts, retirement

facilities, and restaurants.

It is a “lifestyle” visa for those who enjoy perks and privileges,

a “hassle-free” visa for the frequent business traveler, and a

“retirement visa” for the elderly who need special care for

their special needs.

SRRVisa Benefits and Features

A. You can live here!

The option to reside permanently…or for as long as you

want. Our Special non-immigrant visa gives you the right

to have another home away from home.

B. The SRRVisa provides you with Multiple-Entry

Privileges

Allowing you to go in or out of the country - anytime at

any Philippine port of entry

C. The SRRVisa exempts you from securing the Exit &

Re-Entry Clearances from the Bureau of Immigration

Makes your “Multiple-entry” status more convenient and

comfortable and likewise beneficial for businessman and

frequent travelers

D. No need for Travel Taxes!

Exemption from Travel Tax, provided that the SRRVisa

holder has not stayed in the Philippines for more than a

year from date of last entry.

E. Business and Pleasure

-You can work her upon issuance of the Alien

Employment Permit (AEP), to which PRA can assist you.

Or start your own business.

Convert your deposit into an active investment!

F. New Home for your Family

SRRVisa entitles you to bring two (2) of your

dependents. Possibly your children, 20 years of age

and below, and unmarried, without having to remit an

additional dollar investment

G. Easy access to Quality Education for your Children

With SRRVisa, no need for a Special Study Permit or

Student’s Visa!

H. Build your very own Home!

With your deposit, you can purchase and own your

condominium unit or lease a parcel of land anywhere in the

Philippines.

I. Bring your belongings to your new home

Tax-free importation of household goods/personal effects

worth US$7,000.00 (i.e, Furniture and Appliances)

J. Other SRRVisa Features

• Conversion of your Time Deposit Requirements into Active

Investment

• Convert your Time Dollar Deposit into Philippine Peso Time

Deposit or Euro Money after

the issuance of the SRRVisa

• Get your money back!

• Guaranteed repatriation of the Dollar Time Deposit once

the visa holder withdraws from

the Program.

REQUIREMENTS

PRINCIPAL APPLICANT

1. Duly accomplished Philippine Retirement Authority

Application Form

2. Original Passport with Valid Entry Status (i.e. Tourist

Visa) For Applicants holding other types of visa, please downgrade

your existing visa to Tourist Visa before applying to the program.

3. Medical Examination Clearance

Can be obtained from any local licensed physician in the

Philippines or from a PRA-accredited clinic may also choose

to have the medical examination done in your home country

provided that it has an English translation (if necessary)

then duly authenticated at the Philippine Embassy or

Consulate nearest you.

4. National Bureau of Investigation (NBI) Clearance from the

Philippines or police clearance from the applicant’s country of

origin Police Clearance obtained in your home country must

include an English translation (if necessary) and duly

authenticated at the Philippine Embassy or Consulate nearest

you.

5. 6 copies of 1"x1" and 6 copies 2"x2" pictures

6. Bank Certification of Dollar Time Deposit – Inward

Remittance to PRA Accredited Banks

Required Dollar Time Deposit:

US$10,000 – If you have a pension.

US$20,000 – No pension

7. Fees (One-time only):

a. US$1, 400 - PRA Fee

B. US$360 – Annual

FREQUENTLY ASKED QUESTIONS

Q. HOW CAN ONE APPLY IN THE PROGRAM?

A. If you are based in the Philippines, secure an application

form from the following:

PHILIPPINE RETIREMENT AUTHORITY 29/F Citibank Tower

8741 Paseo de Roxas Makati City, PHILIPPINES Tel.Nos.:

+63.2.848.1412 Fax No. : +63.2.848.1411 or from duly

accredited Marketers of the PRA

If you are based abroad, secure an application form from the

Philippine Embassy or from PRA General Sales Agents.

Q. WHERE CAN THE RETIREE APPLICANT PAY THE

APPLICATION FEE?

A. At the PRA office in Cash or remit directly to:

LAND BANK OF THE PHILIPPINES For the account of: (Name

of the Retiree/Applicant)

PHILIPPINE RETIREMENT AUTHORITY FCDU Account No.

2204-0086-82 Buendia Branch #319 Sen. Gil J. Puyat

Avenue, Makati City, Philippines

Q. WHAT ARE MY PRIVILEGES AS AN SRRVisa HOLDER?

A. A resident retiree or holder of the SRRV is accorded the

following privileges/benefits

• Permanent, non-immigrant status with multiple entry

privileges through the Special Resident Retiree's Visa;

• Exemption from customs duties and taxes for the

importation of personal effects, appliances and household

furniture worth US$7,000.00;

• Exemption from Bureau of Immigration (BI) exit clearance

and re-entry permit;

• Exemption from payment of travel tax provided the

retiree has not stayed in the Philippines for more than one

year from date of his last entry into the country;

• Conversion of the requisite deposit into active investment,

including purchase of a condominium unit;

• Foreign currency time deposit can be converted into

Philippine Peso deposit, but interest is subject to withholding

tax;

• Pension, annuities remitted to the Philippines are tax-free

and;

• Guaranteed repatriation of the requisite deposit including

invested profits, capital gains and dividends accrued from

investments, upon compliance with Bangko Sentral rules and

regulations.

Special Resident Retiree’s Visa (SRRV) Page 5 / 6

Q. WHAT ARE MY OBLIGATIONS AS AN SRRVisa HOLDER?

A. An SRRVisa holder has the following obligations as a

member of the PRA Retirement Program:

• To give a written notice of any change of information

supplied in the Application Form (e.g. status, name or

address) within thirty (30) days from such change;

• To give a written thirty (30) day notice of termination of

his participation in the Program;

• To pay by way of Visitorial/Monitoring fee, the amount

equivalent to one (1%) percent of the total amount in

Philippine Peso equivalent of the foreign currency deposit

converted into investment or 1.5% (applicable only to

retiree members using the preexisting investment scheme -

for the first year only) to be paid annually on the date of

withdrawal/conversion of deposit into investment.

• To secure an Alien Employment Permit (AEP) from the

Department of Labor & Employment;

• To comply with the rules and regulations of the Authority.

Q. CAN I DIVIDE/SPREAD MY DOLLAR DEPOSIT

REQUIREMENT TO ANY OF PRA’S ACCREDITED BANK?

A. Yes, for a minimum deposit of US$10,000.00.

Q. AM I REQUIRED TO CONVERT MY DOLLAR DEPOSIT INTO

AN ACTIVE INVESTMENT? OR CAN I JUST LEAVE IT

INDEFINITELY AS AN INTEREST BEARING ACCOUNT?

A. The retiree has the option to convert the required foreign

currency deposit after six (6) months from date of deposit to

any of the currently approved investment outlets or leave it

indefinitely in an interest bearing account either in US dollar

or peso time deposit with any of the accredited banks.

Q. WHAT IS VISITORIAL/MONITORING FEE?

A. It is a fee for services rendered by the Authority to the

resident retiree from the time he withdraws his requisite

deposit into investment. The annual Visitorial/Monitoring fee

is equivalent to one (1%) percent of the total amount

invested. This is payable by the retiree-investor upon receipt

by the Authority of the certified true copy or Photocopy of

the original of the contracts, documents or instruments

evidencing the investment.

Q. IS IT POSSIBLE FOR AN SRRVisa HOLDER TO SET UP A

BUSINESS OR WORK IN THE PHILIPPINES?

A. Yes, he can set up his business provided it is not

limited/prohibited by the Constitution, existing laws or by

the Philippine Foreign Investment Act of 1991 (R.A. 7042).

Working in the Philippines is allowed provided one has the

necessary Alien Employment Permit (AEP) from the

Department of Labor and Employment.

Q. CAN FOREIGN NATIONALS WHO ARE MEMBERS OF THE

PRA PROGRAM ACQUIRE LAND?

A. No. The Constitution of the Republic of the Philippines

prohibits foreigners to acquire land. However, under the

existing investment policy of the Philippines and subject to

foreign equity restrictions, foreigners are allowed to invest in

corporations registered with the Securities and Exchange

Commission. The corporation may then purchase/acquire

land. He can also acquire land through hereditary

succession.

Special Resident Retiree’s Visa (SRRV) Page 6 / 6

Q. ARE NON-RESIDENT ALIENS ENGAGED IN TRADE OR

BUSINESS SUBJECT TO TAX?

A. Non-resident aliens engaged in trade or business in the

Philippines are subject to Philippine income tax in the same

manner as resident citizen and aliens taxable income

received from all sources within the Philippines.

Q. AS AN SRRVisa HOLDER, CAN I ALSO APPLY FOR

PHILIPPINE CITIZENSHIP?

A. Yes. In accordance with the Naturalization Law of the

Philippines. One of the basic requirements for naturalization

is the continuous residency in the Philippines for a period of

ten (10) years. The period may be reduced to five (5) years

if the applicant has any of the following qualifications:

• Has honorably held office under the Government of the

Philippines or under that of any of the provinces, cities,

municipalities or political subdivision thereof; • Has

established a new industry or introduced a useful invention

in the Philippines; • Has been married to a Filipino citizen; •

Has been engaged as a teacher in the Philippines for a

period of at least two (2) years; • Has been born in the

Philippines.

Note: For Former Filipino citizens, the Citizenship Retention

and Reacquisition Act of 2003 apply.

Q. HOW CAN ONE WITHDRAW FROM THE PROGRAM?

A. If the resident retiree wishes to terminate his

membership in the Program, he has to accomplish the Exit

Interview Form, surrender his original/valid passport with

the stamped SRR Visa for the cancellation of the visa and his

PRA Identification (ID) Card. He also has to pay all taxes

and duties due if he availed of the tax-free importation

privilege, if he was a member of the program for less than

three (3) years, and other financial obligations, if any

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Answer FdaDocument3 pagesAnswer FdaMary Heide H. Amora100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cancellation of Contract To SellDocument2 pagesCancellation of Contract To SellMary Heide H. Amora100% (4)

- Affidavit - Glenn PergesDocument1 pageAffidavit - Glenn PergesMary Heide H. AmoraNo ratings yet

- Special Resident Retirees Visa SRRV InfoDocument6 pagesSpecial Resident Retirees Visa SRRV InfoMary Heide H. AmoraNo ratings yet

- Affidavit of DepositDocument2 pagesAffidavit of DepositMary Heide H. AmoraNo ratings yet

- Affidavit Jenol MclinnDocument1 pageAffidavit Jenol MclinnMary Heide H. AmoraNo ratings yet

- ATS (Chang)Document2 pagesATS (Chang)Mary Heide H. AmoraNo ratings yet

- Affidavit of Adjoining OwnersDocument2 pagesAffidavit of Adjoining OwnersMary Heide H. AmoraNo ratings yet

- Formal Offer of Exhibits (Divingking)Document5 pagesFormal Offer of Exhibits (Divingking)Mary Heide H. AmoraNo ratings yet

- Chanrobles Lawnet, Inc.: de La Salle University (Dlsu) - College of LawDocument3 pagesChanrobles Lawnet, Inc.: de La Salle University (Dlsu) - College of LawMary Heide H. AmoraNo ratings yet

- Secretary's Certificate To Purchase Property (Red Sky)Document1 pageSecretary's Certificate To Purchase Property (Red Sky)Mary Heide H. AmoraNo ratings yet

- Notice of Appearance With Compliance (Osufsen)Document1 pageNotice of Appearance With Compliance (Osufsen)Mary Heide H. AmoraNo ratings yet

- AFFIDAVIT of Where To BuiltDocument1 pageAFFIDAVIT of Where To BuiltMary Heide H. AmoraNo ratings yet

- Deed of Absolute Sale - Lapez MarcianoDocument2 pagesDeed of Absolute Sale - Lapez MarcianoMary Heide H. AmoraNo ratings yet

- Letter To HLURB (Cabacis)Document1 pageLetter To HLURB (Cabacis)Mary Heide H. Amora100% (1)

- Letter To LTFRB (Hernando)Document1 pageLetter To LTFRB (Hernando)Mary Heide H. AmoraNo ratings yet

- Laura Zapatería Lougon - UNIT 8-VOCABULARY EXERCISES ON BANKINGDocument4 pagesLaura Zapatería Lougon - UNIT 8-VOCABULARY EXERCISES ON BANKINGLaura ZapateríaNo ratings yet

- Maintenance Charge Invoice 27738302 1673794489Document1 pageMaintenance Charge Invoice 27738302 1673794489srinivas20000No ratings yet

- Annual Income Tax ReturnDocument6 pagesAnnual Income Tax Returnirene deiparineNo ratings yet

- Tax CompiledDocument379 pagesTax Compiledlayla scotNo ratings yet

- Invoice Ihr20230046Document1 pageInvoice Ihr20230046ozel tekstilNo ratings yet

- Digital PaymentsDocument7 pagesDigital Paymentspragya pathakNo ratings yet

- Taxation - Agricultural IncomeDocument5 pagesTaxation - Agricultural IncomeAmogha GadkarNo ratings yet

- Maitry Research TybafDocument40 pagesMaitry Research TybafMaitry VasaNo ratings yet

- Hilado v. CIR, 100 Phil. 288Document5 pagesHilado v. CIR, 100 Phil. 288mhickey babonNo ratings yet

- SH Bill 10 PDFDocument2 pagesSH Bill 10 PDFanishNo ratings yet

- Hidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Document3 pagesHidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Siva ReddyNo ratings yet

- Government of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryDocument2 pagesGovernment of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryPratik JainNo ratings yet

- Sheikh Law Associates: SubjectDocument5 pagesSheikh Law Associates: SubjectYour AdvocateNo ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- PO PrintoutDocument7 pagesPO Printoutihpco websiteNo ratings yet

- Best Practices For Better Usage of Response Codes Version 2.0 Effective April 2021 - ENGDocument28 pagesBest Practices For Better Usage of Response Codes Version 2.0 Effective April 2021 - ENGFacundo AlvarezNo ratings yet

- Flights - Booking - EasyJetDocument2 pagesFlights - Booking - EasyJetDiogoCamacho100% (1)

- Bright Steel InvoiceDocument1 pageBright Steel InvoicePradeepta PatraNo ratings yet

- Tax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocument3 pagesTax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due Datenithin itikalaNo ratings yet

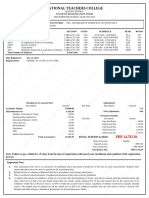

- National Teachers College: Student Registration FormDocument1 pageNational Teachers College: Student Registration FormMaurice TanoteNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- IB PPT-1 (ReplDocument12 pagesIB PPT-1 (ReplKunal M CNo ratings yet

- Ibrahim Calling Report Tuition Fee ECE 024-047Document1 pageIbrahim Calling Report Tuition Fee ECE 024-047Shashikanth MohrirNo ratings yet

- Corporate Tax in India: An Overview: Nitisha Jarugumilli - 17010324107Document7 pagesCorporate Tax in India: An Overview: Nitisha Jarugumilli - 17010324107Samyutha SamudhralaNo ratings yet

- RuPay-Online Switching Interface Specification - V1.8.3Document245 pagesRuPay-Online Switching Interface Specification - V1.8.3deepakshttgr33No ratings yet

- Central Bank Form No 1Document1 pageCentral Bank Form No 1Audithya KahawattaNo ratings yet

- 64442508318019502Document48 pages64442508318019502Prabhat SharmaNo ratings yet

- Goods-And-Services-Tax-Mcq AnsDocument20 pagesGoods-And-Services-Tax-Mcq Ansanish narayanNo ratings yet

- Avanzado BRDocument2 pagesAvanzado BRCristian Diaz KooNo ratings yet

- BookingReceipt 3Document2 pagesBookingReceipt 3qd4r6c7px7No ratings yet