Professional Documents

Culture Documents

FAR - Estimating Inventory - Student

FAR - Estimating Inventory - Student

Uploaded by

PamelaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR - Estimating Inventory - Student

FAR - Estimating Inventory - Student

Uploaded by

PamelaCopyright:

Available Formats

ESTIMATING INVENTORY 2019

LECTURE NOTES

When the cost to retail ratio is computed after net

Gross profit method markups (markups less markup cancellations) have

been added, the retail inventory method approximates

The gross profit method is an inventory estimation lower of cost or market. This is known as the

technique based on a relationship between gross profit conventional retail inventory method. If both net

and sales that is assumed to be fairly stable. Its use is markups and net markdowns are included before the

not appropriate for financial reporting purposes; cost to retail ratio is computed, the retail inventory

however, it can serve a useful purpose when an method approximates cost.

approximation of ending inventory is needed. Such

approximations are sometimes required by auditors or The retail inventory method becomes more

when inventory and inventory records are destroyed complicated when such items as freight-in, purchase

by fire or some other catastrophe. The gross profit returns and allowances, and purchase discounts are

method should never be used as a substitute for a involved. In essence, the treatment of the items

yearly physical inventory unless the inventory has affecting the cost column of the retail inventory

been destroyed. approach follows the computation of cost of goods

available for sale. Freight costs are treated as a part

The gross profit method is based on the assumptions of the purchase cost; purchase returns and allowances

that (a) the beginning inventory plus purchases equal are ordinarily considered both a reduction of the price

total goods to be accounted for; (b) goods not sold at both cost and retail; and purchase discounts usually

must be on hand; and (c) if sales, reduced to cost, are are considered as a reduction of the cost of purchases.

deducted from the sum of the opening inventory plus

purchases, the result is the ending inventory. Other items that require careful consideration include

transfers-in, normal shortages, abnormal shortages,

In developing a reliable gross profit percentage, and employee discounts. Transfers-in from another

reference is made to past years and adjustments are departments should be reported in the same way as

made for current circumstances. purchases from an outside enterprise. Normal

shortages should reduce the retail column because

these goods are no longer available for sale. Abnormal

Techniques for the Measurement of Cost under PAS 2 shortages should be deducted from both the cost and

Techniques for the measurement of the cost of retail columns and reported as a special inventory

inventories, such as the standard cost method or the amount or as a loss. Employee discounts should be

retail method, may be used for convenience if the deducted from the retail column in the same way as

results approximate cost. sales.

Standard cost method The retail inventory method is widely used (a) to

permit the computation of net income without a

Standard costs take into account normal levels of physical count of inventory, (b) as a control measure

materials and supplies, labor, efficiency and capacity in determining inventory shortages, (c) in regulating

utilization. They are regularly reviewed and, if quantities of inventory on hand, and (d) for insurance

necessary, revised in the light of current conditions. information.

Retail method The retail method is often used in the retail industry

for measuring inventories of large numbers of rapidly

The retail inventory method is an inventory estimation

changing items with similar margins for which it is

technique based upon an observable pattern between

impracticable to use other costing methods.

cost and sales price that exists in most retail concerns.

The percentage used takes into consideration

This method requires that a record be kept of (a) the

inventory that has been marked down to below its

total cost and retail of goods purchased, (b) the total

original selling price.

cost and retail value of the goods available for sale,

An average percentage for each retail department

and (c) the sales for the period.

is often used.

Basically, the retail method requires the computation

of the cost-to-retail ratio of inventory available for

sale. This ratio is computed by dividing the cost of the

goods available for sale by the retail value (selling

price) of goods available for sale. Once the ratio is

determined, total sales for the period are deducted

from the retail value of inventory available for sale.

The resulting amount represents ending inventory

priced at retail. When this amount is multiplied by the

cost to retail ratio, an approximation of the cost of

ending inventory results. Use of this method

eliminates the need for a physical count of inventory

each time an income statement is prepared. However,

physical counts are made at least yearly to determine

the accuracy of the records and to avoid

overstatements due to theft, loss, and breakage.

To obtain the appropriate inventory figures under the

retail inventory method, proper treatment must be

given to markups, markup cancellations, markdowns,

and markdown cancellations.

FEU – IABF Page 1

ESTIMATING INVENTORY 2019

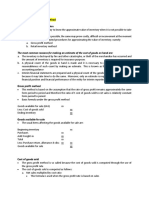

PROBLEMS Summary on previous years’ sales:

2016 2017 2018

1. On May 6, 2019 a flash flood caused damage to Sales P626,000 P705,000 P680,000

the merchandise stored in the warehouse of Gross Profit 187,800 183,300 231,200

Cabanatuan Co. You were asked to submit an GPR 30% 26% 34%

estimate of the merchandise destroyed in the

warehouse. The following data were established: Determine the inventory loss suffered as a result of

a. Net sales for 2018 were P800,000, matched the fire.

against cost of P560,000.

b. Merchandise inventory, Jan. 1, 2019 was

P200,000, 90% of which was in the warehouse 4. The work-in-process inventory of Burp Company

and 10% in downtown showrooms. were completely destroyed by fire on June 1,

c. For Jan. 1, 2019 to date of flood, you 2019. You were able to establish physical

ascertained invoice value of purchases (all inventory figures as follows:

stored in the warehouse), P100,000; freight January 1, 2019 June 1, 2019

inward, P4,000; purchases returned, P6,000. Raw materials P 60,000 P120,000

d. Cost of merchandise transferred from the Work-in-process 200,000 -

warehouse to show-rooms was P8,000, and Finished goods 280,000 240,000

net sales from January 1 to May 6, 2019 (all

Sales from January 1 to May 31, were P546,750.

warehouse stock) were P320,000.

Purchases of raw materials were P200,000 and

Assuming gross profit rate in 2019 to be the same freight on purchases, P30,000. Direct labor during

as in the previous year, the estimated merchandise the period was P160,000. It was agreed with

destroyed by the flood was insurance adjusters that an average gross profit

rate of 35% based on cost be used and that direct

labor cost was 160% of factory overhead.

2. The Bayambang Corporation was organized on

The work in process inventory destroyed by fire is

January 1, 2018. On December 31, 2019, the

corporation lost most of its inventory in a

warehouse fire just before the year-end count of

Use the following information for the next two

inventory was to take place. Data from the

questions.

records disclosed the following:

2018 2019 Pugo uses the retail inventory method. The following

Beginning inventory, information is available for the current year:

January 1 P 0 P1,020,000 Cost Retail

Purchases 4,300,000 3,460,000 Beginning inventory P 1,300,000 P 2,600,000

Purchases returns and Purchases 18,000,000 29,200,000

allowances 230,600 323,000 Freight in 400,000

Sales 3,940,000 4,180,000 Purchase returns 600,000 1,000,000

Sales returns and Purchase allowances 300,000

allowances 80,000 100,000 Departmental transfer 400,000 600,000

On January 1, 2019, the Corporation’s pricing in

policy was changed so that the gross profit rate Net markups 600,000

would be three percentage points higher than the Net markdowns 2,000,000

one earned in 2018. Sales 24,700,000

Sales returns 350,000

Salvaged undamaged merchandise was marked to Sales discounts 200,000

sell at P120,000 while damaged merchandise was Employee discounts 600,000

marked to sell at P80,000 had an estimated Loss from breakage 50,000

realizable value of P18,000.

How much is the inventory loss due to fire? 5. The estimated cost of inventory at the end of the

current year using the conventional (lower of cost

or market) retail inventory method is

3. Luna Manufacturing began operations 5 years ago.

On August 13, 2019, a fire broke out in the 6. The estimated cost of inventory at the end of the

warehouse destroying all inventory and many current year using the average retail inventory

accounting records relating to the inventory. The method is

information available is presented below. All sales

and purchases are on account. 7. The estimated cost of inventory at the end of the

January August current year using the FIFO retail inventory

1, 2019 13, 2019 method is

Inventory P143,850

Accounts Receivable 130,590 P128,890

Accounts Payable 88,140 122,850

Collections on accounts rec.,

Jan. 1- Aug. 13 753,800

Payments to suppliers,

Jan. 1- Aug. 13 487,500

Goods out on consignment at

Aug. 13, at cost 52,900

FEU – IABF Page 2

ESTIMATING INVENTORY 2019

The records of Binmaley’s Department Store report the

following data for the month of January:

Beginning inventory at cost 440,000

Beginning inventory at sales price 800,000

Purchases at cost 4,500,000

Initial markup on purchases 2,900,000

Purchase returns at cost 240,000

Purchase returns at sales price 350,000

Freight on purchases 100,000

Additional mark up 250,000

Mark up cancellations 100,000

Mark down 600,000

Mark down cancellations 100,000

Net sales 6,500,000

Sales allowance 100,000

Sales returns 500,000

Employee discounts 200,000

Theft and other losses 100,000

Using the average retail inventory method,

Binmaley’s ending inventory is

FEU – IABF Page 3

You might also like

- Financial Accounting and Reporting - Problems ReviewDocument5 pagesFinancial Accounting and Reporting - Problems ReviewARIS100% (1)

- CH 08Document83 pagesCH 08时家欣100% (1)

- Ch03 Suppl Case AccentureDocument2 pagesCh03 Suppl Case AccenturePamela0% (1)

- FAR Estimating Inventory StudentDocument3 pagesFAR Estimating Inventory StudentMary Aquino0% (1)

- P1.002 Estimating Inventories.Document2 pagesP1.002 Estimating Inventories.Patrick Kyle Agraviador100% (1)

- This Study Resource Was: Lecture NotesDocument3 pagesThis Study Resource Was: Lecture NotesWymple Kate Alexis FaisanNo ratings yet

- Lecture Notes On Inventory Estimation - 000Document4 pagesLecture Notes On Inventory Estimation - 000judel ArielNo ratings yet

- Inventories Wit Ans Key (Pria)Document22 pagesInventories Wit Ans Key (Pria)Samantha Marie Arevalo100% (2)

- NAME: Elva Yulines NIM: 1910533019Document2 pagesNAME: Elva Yulines NIM: 1910533019Syafri iNo ratings yet

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Unit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesDocument17 pagesUnit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesNesru SirajNo ratings yet

- Inventory ValuationDocument1 pageInventory Valuationarmor.coverNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document22 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- IntaccDocument15 pagesIntaccMelita CarriedoNo ratings yet

- Inventories - Inventory Estimation MethodsDocument17 pagesInventories - Inventory Estimation MethodsmarkNo ratings yet

- Chapter 10 - InventoriesDocument70 pagesChapter 10 - InventoriesJohn RellonNo ratings yet

- Other Cost Incurred in Bringing The Inventories To Their Present Location andDocument3 pagesOther Cost Incurred in Bringing The Inventories To Their Present Location andMarianne SironNo ratings yet

- Section VI: NRV Vs Fair Value: ExampleDocument5 pagesSection VI: NRV Vs Fair Value: ExamplebinuNo ratings yet

- NIC 2 (2021) - 2023 V CICLO en-USDocument6 pagesNIC 2 (2021) - 2023 V CICLO en-USMj264No ratings yet

- A2 Sample Chapter Inventory Valuation PDFDocument19 pagesA2 Sample Chapter Inventory Valuation PDFRafa BentolilaNo ratings yet

- Ringkas CHPTR 6Document8 pagesRingkas CHPTR 6Yuli TambarikiNo ratings yet

- CR Notes OnlineDocument655 pagesCR Notes OnlineThomas100% (1)

- Inventories: Indian Accounting Standard (Ind AS) 2Document11 pagesInventories: Indian Accounting Standard (Ind AS) 2aman2645No ratings yet

- Chapter 8 PDFDocument6 pagesChapter 8 PDFMAMTA KHARISMANo ratings yet

- 67171bos54090 cp4Document28 pages67171bos54090 cp4NISHANT SOINNo ratings yet

- Unit 1 InventoriesDocument28 pagesUnit 1 Inventoriesvijay panchalNo ratings yet

- Inventories IAS2Document9 pagesInventories IAS2SOhailNo ratings yet

- IAS 2 InventoriesDocument6 pagesIAS 2 Inventorieskazitasnim007 HVCNo ratings yet

- Inventories: Sri Lanka Accounting Standard - LKAS 2Document7 pagesInventories: Sri Lanka Accounting Standard - LKAS 2Saranga FonsekaNo ratings yet

- Inventories: Sri Lanka Accounting Standard - LKAS 2Document7 pagesInventories: Sri Lanka Accounting Standard - LKAS 2Saranga FonsekaNo ratings yet

- Chapter 28 - Gross Profit and Retail Method: ANSWER 28-1Document12 pagesChapter 28 - Gross Profit and Retail Method: ANSWER 28-1Cyrus IsanaNo ratings yet

- Inventories: International Accounting Standard 2Document6 pagesInventories: International Accounting Standard 2Shibli ShaidNo ratings yet

- Unit 2Document31 pagesUnit 2Nigussie BerhanuNo ratings yet

- Study Note-1.3, Page 33-46Document14 pagesStudy Note-1.3, Page 33-46s4sahithNo ratings yet

- Chapter 7Document11 pagesChapter 721Vân KhánhNo ratings yet

- Unit 2Document30 pagesUnit 2yebegashet100% (1)

- Chapter 18 Standard Costing Incorporating Standards Into The Accounting RecordDocument1 pageChapter 18 Standard Costing Incorporating Standards Into The Accounting RecordZunaira ButtNo ratings yet

- Accounting English IIDocument14 pagesAccounting English IIJaprax LailyasNo ratings yet

- IndAS 2 (Inventories)Document3 pagesIndAS 2 (Inventories)Meera GopalNo ratings yet

- ch09 PDFDocument40 pagesch09 PDFerylpaez100% (2)

- Chapter 9 PDFDocument40 pagesChapter 9 PDFJoshua GibsonNo ratings yet

- Activity - Based - Costing F5 NotesDocument13 pagesActivity - Based - Costing F5 NotesSiddiqua KashifNo ratings yet

- Act CH 9 QuizDocument4 pagesAct CH 9 QuizLamia AkterNo ratings yet

- Ind As 2Document14 pagesInd As 2mohd52No ratings yet

- Chapter 18 IAS 2 InventoriesDocument6 pagesChapter 18 IAS 2 InventoriesKelvin Chu JYNo ratings yet

- Accounting Standards .Document48 pagesAccounting Standards .Chirag MalhotraNo ratings yet

- Intermediate-Accounting Handout Chap 13Document2 pagesIntermediate-Accounting Handout Chap 13Joanne Rheena BooNo ratings yet

- Safari - 2 Oct 2019 at 11:49 PMDocument1 pageSafari - 2 Oct 2019 at 11:49 PMShaina Santiago AlejoNo ratings yet

- Inventories: Additional Valuation Issues: Chapter Learning ObjectiveDocument40 pagesInventories: Additional Valuation Issues: Chapter Learning ObjectiveBig BossNo ratings yet

- Chapter 8 Student Lecture NotesDocument18 pagesChapter 8 Student Lecture NotesRanessa NurfadillahNo ratings yet

- International Accounting Standard 2 International Accounting Standard 2Document6 pagesInternational Accounting Standard 2 International Accounting Standard 2Rahib JaskaniNo ratings yet

- (Valuation of Inventories) : Accounting Standard 2Document4 pages(Valuation of Inventories) : Accounting Standard 2Aniruddha MohitkarNo ratings yet

- AS 2 Valuation of InventoriesDocument18 pagesAS 2 Valuation of InventoriesRENU PALINo ratings yet

- CH 9 Intermediate Accounting Test BankDocument40 pagesCH 9 Intermediate Accounting Test Bankhisyam kinciNo ratings yet

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- IAS 2 InventoriesDocument7 pagesIAS 2 Inventoriesecho fateNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Applied Auditing: Students' Feedback About The Learning OutcomesDocument1 pageApplied Auditing: Students' Feedback About The Learning OutcomesPamelaNo ratings yet

- Students' Feedback About The Learning OutcomesDocument1 pageStudents' Feedback About The Learning OutcomesPamelaNo ratings yet

- Accounting Information Systems: Students' Feedback About The Learning OutcomesDocument1 pageAccounting Information Systems: Students' Feedback About The Learning OutcomesPamelaNo ratings yet

- FAR - PPE (Depreciation and Derecognition) - StudentDocument3 pagesFAR - PPE (Depreciation and Derecognition) - StudentPamelaNo ratings yet

- FAR - PPE (Revaluation) - StudentDocument2 pagesFAR - PPE (Revaluation) - StudentPamela0% (1)

- Ch03 Suppl Case AlegentDocument2 pagesCh03 Suppl Case AlegentPamela100% (1)

- Conditions of Termination by Employer: Post EmploymentDocument3 pagesConditions of Termination by Employer: Post EmploymentPamelaNo ratings yet

- Case StudyDocument4 pagesCase StudyPamelaNo ratings yet

- Ch02 Suppl Case BodiesDocument2 pagesCh02 Suppl Case BodiesPamelaNo ratings yet

- Ch02 Suppl Case XeroxDocument2 pagesCh02 Suppl Case XeroxPamela50% (2)

- LARDINO, Pamela D. BM 213 Test Results: Personality Type: Individual Traits: ExtravertedDocument1 pageLARDINO, Pamela D. BM 213 Test Results: Personality Type: Individual Traits: ExtravertedPamelaNo ratings yet

- (DIGEST) PBOAP vs. DOLE, G.R. No. 202275, July 17, 2018Document2 pages(DIGEST) PBOAP vs. DOLE, G.R. No. 202275, July 17, 2018Harold Q. GardonNo ratings yet

- Bitcoin Us $350,000 Palm Beach Research GroupDocument56 pagesBitcoin Us $350,000 Palm Beach Research GroupJose Castillo71% (7)

- National Artist in Philippine Cinema (Report)Document30 pagesNational Artist in Philippine Cinema (Report)selwynNo ratings yet

- Social Advocacy and National Development State The Definition/nature of Social AdvocacyDocument7 pagesSocial Advocacy and National Development State The Definition/nature of Social Advocacyjoe100% (1)

- View Full-Featured Version: Send To PrinterDocument5 pagesView Full-Featured Version: Send To PrinteremmanjabasaNo ratings yet

- Chapter 2 LAW ON PARTNERSHIPDocument22 pagesChapter 2 LAW ON PARTNERSHIPApril Ann C. GarciaNo ratings yet

- Accounting 1 Module 3Document20 pagesAccounting 1 Module 3Rose Marie Recorte100% (1)

- To Canadian Horse Defence Coalition Releases DraftDocument52 pagesTo Canadian Horse Defence Coalition Releases DraftHeather Clemenceau100% (1)

- ANC 103rd Birthday Transport PlanDocument6 pagesANC 103rd Birthday Transport PlanCityPressNo ratings yet

- SV - ComplaintDocument72 pagesSV - ComplaintĐỗ Trà MyNo ratings yet

- 3 MicroDocument4 pages3 MicroDumitraNo ratings yet

- Mindanao Development Authority v. CADocument14 pagesMindanao Development Authority v. CAKadzNitura0% (1)

- AC Checklist of ToolsDocument4 pagesAC Checklist of ToolsTvet AcnNo ratings yet

- The Effects of Monetary Policy:: A SummaryDocument43 pagesThe Effects of Monetary Policy:: A SummaryhumaidjafriNo ratings yet

- Opening SalvoDocument6 pagesOpening SalvoMark James MarmolNo ratings yet

- Manual For Conflict AnalysisDocument38 pagesManual For Conflict AnalysisNadine KadriNo ratings yet

- Education USADocument35 pagesEducation USAPierrecassanNo ratings yet

- The Prayer of The Prophet (Sallallaho Alaihe Wa Sallam)Document13 pagesThe Prayer of The Prophet (Sallallaho Alaihe Wa Sallam)Dawah ChannelNo ratings yet

- Modul Berbicara 1Document49 pagesModul Berbicara 1Alif Satuhu100% (1)

- Documents in Credit TransactionsDocument6 pagesDocuments in Credit Transactionsgeofrey gepitulanNo ratings yet

- Last 6 Months RBI in News Part 2 NiharDocument6 pagesLast 6 Months RBI in News Part 2 NiharbuhhbubuhgNo ratings yet

- Drug Crimes StatisticsDocument5 pagesDrug Crimes StatisticsRituNo ratings yet

- Landscape of The SoulDocument2 pagesLandscape of The Soulratnapathak100% (1)

- LLM Advice - All You Need To Know About Statement of Purpose (SOP)Document20 pagesLLM Advice - All You Need To Know About Statement of Purpose (SOP)Seema ChauhanNo ratings yet

- Swift PDF DataDocument618 pagesSwift PDF DataSaddam Hussaian Guddu100% (1)

- Revival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthorityDocument19 pagesRevival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthoritySnowman KingNo ratings yet

- Kakori ConspiracyDocument8 pagesKakori ConspiracyAvaneeshNo ratings yet

- NDTDocument2 pagesNDTTiến TrungNo ratings yet

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- Faculty Development Programme: Security and Privacy in Big Data AnalyticsDocument2 pagesFaculty Development Programme: Security and Privacy in Big Data AnalyticsBhedivya PanchNo ratings yet