Professional Documents

Culture Documents

Tandt 1.4.7

Tandt 1.4.7

Uploaded by

Stanley MunodawafaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tandt 1.4.7

Tandt 1.4.7

Uploaded by

Stanley MunodawafaCopyright:

Available Formats

Unit Trusts and Mutual Funds

- Collective Investment Schemes in Bermuda

and Luxembourg exchange. Such a listing gives

A

Collective Investment Scheme (CIS)

involves the pooling of cash from indi- access to the vast European market.

vidual investors for investment (for

In Bermuda the regulatory body is the Bermuda

example in equities, bonds, currency deposits,

Monetary Authority (“BMA”), a statutory author-

commodities or futures) according to declared

ity established by the Bermuda Monetary

investment objectives. 1]Advantages for the Authority Act 1969. This Act provides (in part)

investor include the creation of a pool of money that the principal objects of the BMA shall

“The off-shore CIS large enough to facilitate diversification, a spread include the supervision, regulation and inspection

of risk and the benefit of the on-going services of

may ... have as its of any “financial institution” 2]which operates in

a professional fund manager.

or from within Bermuda; the promotion of the

target market Many developed countries have available a vari- financial stability and soundness of financial insti-

sophisticated ety of “onshore” or domestically-domiciled tutions; the supervision, regulation or approval of

investment schemes. Investors will principally be the issue of financial instruments by financial

Downloaded from http://tandt.oxfordjournals.org/ at University of North Dakota on June 4, 2015

expatriate or

nationals and residents (both individual and cor- institutions; and the fostering of close relations

institutional and porate) of the country concerned. Such schemes between financial institutions themselves and

corporate are characterised by being subject to demanding government.

(and often costly) regulatory procedures. Further,

investors.” where such procedures are long drawn out, a mar-

This whole question of the nature, degree and

effectiveness of regulation is fundamental. A

ket may be missed, or a competitor gain an edge,

responsible and responsive off-shore jurisdiction

during the compliance process. Income and gains

will present a prestigious regulatory environment

will be taxable and there may be strictures which

providing protection for investors (thereby

prevent diversification into certain geographic

enhancing credibility and the marketing benefits

areas and/or classes of investment vehicle.

which accompany this) without excessive compli-

The off-shore CIS may, by contrast, have as its ance costs or burdensome restriction. Bermuda

target market sophisticated expatriate or institu- offers the off-shore CIS:

tional and corporate investors. Such a scheme

may offer the opportunity to an investor

“ ... environmental in country A to invest in country B by b y R o b e r t M i l l e r* and Robin Todd

factors, and factors facilitating capital transfers from A - B

without tax or foreign exchange conse- Richards, Francis & Francis, Bermuda

specific to the

quences in the domicile of the CIS.

promotion, International asset management requires an

When choosing an offshore domicile

administration and for the establishment of mutual funds understanding of the nature and regulation

regulation of such and unit trusts, “environmental” factors, of Collective Investment Schemes: the

and factors specific to the promotion,

schemes must be rules and practice of Bermuda illustrates

administration and regulation of such

considered.” schemes, must be considered. The the principles

“environmental” factors include politi-

cal and economic stability, an estab- * Robert Miller - now of ZI Labuan Trust Company Sdn.

lished and effective infrastructure Bhd, Labuan, Malaysia

(including first-class legal, accounting,

banking and custodian services), acces-

sibility and sophisticated communications facili- 1. Nil liability under current legislation to

ties. The specific factors, dealt with further below, taxes or other financial imposts, permitting gross

may be characterised as appropriate legislation growth within the CIS, and the opportunity for

and sensible regulation. tax-free distribution. Under the Exempted

Undertakings Tax Protection Act 1966 the

SECURITY FOR INVESTORS Minister of Finance can issue a letter confirming

An appropriate level of investor protection should tax-free status up to 2016.

“This whole question

apply to an offshore CIS. Where twenty-five years 2. A greater opportunity for investors to

of the nature, degree ago lack of regulation offshore was considered a achieve their investment goals, in particular diver-

and effectiveness of virtue, the investor of today should demand rea- sification and estate planning through an off-shore

sonable, effective and enforced regulation as a

regulation is private trust or corporate investment vehicle. For

sine qua non. example an investor whose citizenship/domicile

fundamental”

Bermuda is a well established offshore mutual might preclude investment in an offshore CIS

fund domicile with some of the larger funds being directly (under the rules of the CIS itself) may be

quoted (for example) on the London and Hong able, quite legitimately, to invest for the benefit of

Kong Stock Exchanges. Further, a fund registered himself or his family through such an offshore

in Bermuda is acceptable for listing on the Dublin structure.

TRUSTS & TRUSTEES and International Asset Management Page 7

3. Reasonable costs and prompt dispatch of provide for the calculation of net asset value per

the incorporation/settlement process and compli- unit and set out the terms for issue and redemption

ance procedures, (and therefore enhanced gain of units. It will also provide for the administration

brought about by cost-saving). and management of the affairs of the unit trust,

including provisions for an annual meeting of

4. The opportunity to operate free of

unit-holders, voting rights, audit and financial

exchange controls.

statements. The Bermuda-resident trustee(s) acts

5. First class infrastructure thoroughly famil- as custodian of the assets of the trust in addition to

iar with a wide range of offshore products. exercising other fiduciary duties owed to the

“ This leaves room unitholders.

UNIT TRUSTS

for the introduction A unit trust scheme is defined in the Stamp Duties

While a unit trust attracts no annual registration

fee, the Bermuda management company associat-

of some innovation, Act 1976 as meaning “any arrangements made for

ed with the unit trust is required to pay a fee of

in the trust deed ...” the purpose, or having the effect, of providing, for

BD$2,365 in respect of each unit trust scheme

persons having funds available for investment,

managed by it.

facilities for the participation by them as benefi-

ciaries under a trust, in profits or income arising General principles

from the acquisition, holding, management or dis-

A Unit Trust requires that the “three certainties”

posal of any property whatsoever”, and “unit”

(required of all trusts) of intention, object and

means, in relation to a unit trust scheme, a right or

subject matter be satisfied. Further, the same

interest (whether described as a unit, as a sub-unit,

Downloaded from http://tandt.oxfordjournals.org/ at University of North Dakota on June 4, 2015

principles of fiduciary administration that apply to

or otherwise) or a beneficiary under the trust any trust will also apply. Unlike, say, a discre-

instrument. Differences in tax treatment of returns tionary trust, the manager of a Unit Trust is not an

and greater freedom of procedures, including agent or employee of the trustee. Because the pro-

those to redeem units can render the unit trust a moter of a unit trust offers his management skills

preferred vehicle over a mutual fund. While the to the public, the trustee cannot have the same

latter is strictly bound by Companies Act, there is range of discretions a trustee would have under a

no legislative regime for unit trusts at present in private trust.

Bermuda. This leaves room for the introduction of

some innovation in the Trust Deed for both public The trustee and the manager each supply a mea-

“A unit trust sure of supervision of the other for the protection

and private or restricted applications.

requires that the of unitholders.

“three certainties” FEATURES OF A TYPICAL SIMPLE UNIT TRUST DEED

... be satisfied” Unit Trusts Parties to the deed

The manager and the trustee.

International Investors Constitution

(Beneficiaries)

The manager pays the trustee an initial subscrip-

tion for units to be issued to the manager. Further

Units units are created when subscribers application

monies are added to the trust fund or when ven-

Unit Trust $ dors of property acquired by the trust receive units

Deed

in exchange therefore.

Declaration of trust

Manager Trustee The trustee formally declares it holds the fund

upon trust for the unitholders.

owns Limitation of unitholders liability

A unitholder’s only liability is to pay the sub-

“Unlike, say, a scription for each unit. Unitholders thereby gain

Assets similar limited liability as that enjoyed by share-

discretionary trust,

Managers holders of a limited company. The limitation,

the manager of a unit however, arises out of the unitholders position

trust is not an agent under the Trust Deed rather than statutory compa-

For most practical purposes a unit trust will oper- ny law.

or employee of the

ate and be regulated in the same manner as a Units

trustee.” mutual fund. The matters later discussed relative

to mutual funds apply equally to the establishment The units are declared to confer on unitholders an

of a unit trust. There is an argument that the sub- interest in the trust fund as a whole, without any

mission of a prospectus or explanatory memoran- interest in any separate part of the fund. Usually a

dum relating to a unit trust to the BMA is not maximum number of units is stated. Where units

required. The better practice is to assume that are listed on a stock exchange a restriction will be

imposed on the issue of new units other than to

such a document (as appropriate to a public or pri-

existing unitholders in proportion to their existing

vate offering) must in fact be filed.

units or as sanctioned at a unitholders meeting.

Unit trusts are established by a Trust Deed made The number of new units is arrived at by dividing

with a Bermuda-resident trustee. The deed will the addition to the trust fund by the issue price.

Page 8 TRUSTS & TRUSTEES and International Asset Management

Unitholders interest auditor. Where the trustee reasonably considers

that the manager has failed to carry out any of its

The unitholders interest consists of (i) a fraction

obligations to the prejudice of the unitholders the

of the beneficial ownership of all the trust assets

trustee may appoint a receiver of the undertaking

and (ii) rights compelling the manager to buy

of the manager.

units back.

Trustee liability

Unitholders passive

The deed will limit trustee liability (arising with-

Unitholders normally cannot interfere with, or

out negligence or default) to the extent of the trust

question, the actions of, the trustee or manager in

property.

relation to the trust fund. Further, it is clear that

“The office of neither the trustee nor the manager is an agent of Amendment to the deed

the unitholders. Otherwise liabilities incurred by

trustee incorporates the trustee or the manager to third persons might Unit trust deeds commonly contain a provision

under which the deed may be altered; e.g. by the

many equitable be sheeted home to the unitholders thus prejudic-

ing their limited liability. trustee and the manager to satisfy the require-

duties.” ments of any new law. Other alterations are possi-

Trustees covenants ble, and a common provision is that the trustee

may seek the approval of unitholders in a general

The office of trustee incorporates many equitable

meeting to achieve any desirable alterations.

duties. In the deed however, the trustee further

covenants to exercise all due diligence and vigi- Winding up

Downloaded from http://tandt.oxfordjournals.org/ at University of North Dakota on June 4, 2015

lance, including the supervision of the manager.

This duty might not (in the absence of such a The deed will provide for winding up the trust.

covenant) otherwise arise, since the manager is Public unit trusts have a limited life. The trustee

not in general subordinate to the trustee. and the manager frequently have power to wind

up the trust in the event that conditions arise in

Manager covenants which to continue the trust would be undesirable

from the unitholders’ viewpoint.

The manager covenants to discharge its business

in a proper and efficient manner. As promoter the MUTUAL FUNDS

manager owes fiduciary duties generally equating

to the statutory duties of promoters of companies. A mutual fund is defined as a company limited by

shares and incorporated for the purpose of invest-

“The manager is Manager as buyer or redeemer of units ing the monies of its members for their mutual

also removable by benefit having the power to redeem or purchase

Unitholders need a market for their units The deed

the trustee ...” for cancellation its shares without reducing its

will contain a covenant binding the manager, on

authorised share capital and stating in its memo-

request, to buy units from the holder at a price cal-

randum that it is a mutual fund.

culated pursuant to the provisions of the deed.

Manager as administrator

Mutual Fund

Administration rests with the manager rather than

the trustee, and includes handling all investments, International Investors

borrowings and liabilities of the trust fund. The

Shareholders

trustee, as holder of trust property, must follow

the lawful directions of the manager. The manag-

er will also keep or cause to be kept a register of Redeemable

Shares $ Subscribe

unitholders, and will issue and administer unit

certificates.

Registrar &

Change of Manager Transfer Agent

(Public

Retirement on notice is provided for, and a

“Investor- Fund) Promoter

unitholder meeting may cause removal. The man- Auditors Mutual Fund

protection requires ager is also removable by the trustee, for example, Company Investment

that the trust fund where the manager goes into liquidation, ceases to Manager

carry on business or has, to the prejudice of Classes of Shares

should be vested in unitholders, failed in its duty to unitholders. The

a trustee rather manager is in a fiduciary relationship with the

than the manager.” unitholders and thereby liable to the extent the

trust deed does not properly exonerate it.

Custodian Assets

Trustee as titleholder

Investor-protection requires that the trust fund

should be vested in a trustee rather than the man-

ager. This provides an independent check on the Almost invariably, “exempted” companies,

conduct of the manager. The trust deed will nor- (formed in Bermuda to carry on business outside

mally give the trustee a range of powers over the Bermuda) are employed. 3]Section 156C(2)(b) of

trust property, including power to appoint custo- the Companies Act permits a mutual fund compa-

dians and sub-custodians. The manager will make ny to redeem its shares out of realised or unre-

available its books to the trustee or a company alised profits by reference to Net Asset Value.

TRUSTS & TRUSTEES and International Asset Management Page 9

Shares so redeemed by a mutual fund may subse- Exchange purposes and are free to acquire, hold

quently be re-issued to new subscribers. It is now and sell any foreign currencies and securities with-

some time since it was necessary to incorporate a out restriction.

Bermuda mutual fund by Private Act. The

MANAGEMENT

Companies Act 1981 (“the Act”) now facilitates

the formation and operation of mutual funds The Board of Directors is responsible for the man-

through an incorporation process saving time and agement of a mutual fund. Day-to-day administra-

costs. The Companies Act also permits the forma- tion is normally contracted to the management

tion of a Limited Duration Company (terminating company which, in turn, may subcontract.

on a specific event occurring or through lapse of a

specified period). This vehicle can provide tax The bye-laws of the MFC will provide for the cal-

advantages on the “transparency” principle. culation of net asset value per share, and the terms

“a Mutual Fund and conditions upon which issues and redemptions

CAPITAL will be effected. The initial subscription price is

Company (MFC)

The minimum issued share capital of any Bermuda usually set by directors. Section 35 of the Act pro-

must normally have vides that if the minimum subscription is not

company is US$12,000 or equivalent in another

associated with it currency. The power to redeem will be restricted achieved within 120 days, the funds received must

so that the aggregate value of outstanding shares be repaid.

a management

will remain at least $12,000. An alternative is to

company incorpo- Where a fund continuously offers shares to the

employ two classes of shares, (i) 12,000 $1

public, a prospectus must be issued and filed with

rated in Bermuda.” Manager’s or Founders’ Shares (with or without

the Registrar of Companies in Bermuda every 12

Downloaded from http://tandt.oxfordjournals.org/ at University of North Dakota on June 4, 2015

rights of participation) and (ii) investors’ shares.

months. Such a prospectus must contain audited

MONETARY AUTHORITY GUIDELINES financial statements as of a date not more than 120

days prior to the date of issue of the prospectus.

Include the following:

This requirement can be satisfied by attaching the

1. a Mutual Fund Company (MFC) must nor- most recent annual report to the current prospectus

mally have associated with it a management com- and issuing and filing the same within four months

pany incorporated in Bermuda. This is frequently of the financial year end.

owned by the promoters. Management and admin-

istrative functions are delegated by the MFC to the INVESTMENT

management company, which may further dele- A mutual fund or its manager may appoint an

gate them; investment adviser, which may be an affiliate of

2. while a local bank may be required to act as the promoters. The acquisition and disposal of

“Detailed references custodian of the assets of the fund, suitable alter- investments is usually the responsibility of the cus-

natives will be considered. Where a local bank is todian. Where it is intended to invest in income

and resumes will be required, a sub-custodian elsewhere may be producing assets, the bye-laws may provide for

required.” appointed; reinvestment in the acquisition of further invest-

ments, or for the distribution of such income by

3. a local registrar and transfer agent will be way of dividend with an option for reinvestment or

required;

in further shares of the mutual fund.

4. the promoters must satisfy the authorities as

OTHER JURISDICTIONS

to their investment management expertise (and, in

the case of public funds, evidence of experience as The offering of a Bermuda-domiciled mutual fund

mutual fund operators, especially administrative outside Bermuda is subject to the laws of the target

and advisory abilities). Detailed references and jurisdiction(s). Many mutual funds marketed out-

resumes will be required. It must be stated whether side the USA place restrictions on the ability of

a stock exchange listing will be sought, and if so “US persons” to hold shares or units of the CIS.

where; Breach will trigger compulsory redemption under

5. detailed business plan/draft prospectus/ the Bye-laws. It is however possible for a US citi-

explanatory memorandum will be required, and zen (subject to the rules of any particular fund and

“The acquisition and to applicable tax filings and compliance) to estab-

6. annual audits are mandatory only in the case lish a trust which will be a permitted investor.

disposal of invest-

of a signatory to the Collective Investment Scheme

ments is usually the Code of Conduct. UNITED KINGDOM CLASS SCHEMES

responsibility of the These requirements normally apply to any CIS Bermuda enjoys Designated Territory Status under

custodian.” including a unit trust, (mutatis mutandis). In the (UK) Financial Services Act 1986. An MFC which

case of commodity based funds, including those complies with the requirement of the Companies

dealing in financial and commodity futures, the Act 1981 and the Companies (United Kingdom

BMA may permit the appointment of co-custodi- Class Scheme Bye-laws) Regulations 1988, may

ans located outside Bermuda. apply to the Minister of finance for Certification as

a UK Class Scheme. If so certified, the fund may

TAXATION

apply to the Securities and Investment Board in the

Under the current legislation there is no Bermuda United Kingdom for authorisation to offer its

income, profits, withholding or other tax or finan- shares in the United Kingdom.

cial impost.

In addition to the regulatory requirements listed

EXCHANGE CONTROLS above, MFCs wishing to apply for UK Class

Scheme Certification must comply with the fol-

There are none. Exempted mutual fund companies

lowing:

are classified as non-resident for Foreign

Page 10 TRUSTS & TRUSTEES and International Asset Management

(a) the custodian must be a local bank; Company, for planning and producing new off-

shore solutions to satisfy the investment and plan-

(b) the manager must be a Bermuda-incorporated

ning strategies.

company, separate and apart from the custodian

bank and, as such, the manager and custodian FOOTNOTES:

must fulfil their respective duties at arms length; 1] See “Complex Fund Structures and Choice of

(c) the mutual fund must adopt as its bye-laws those Jurisdiction” (Peter Marshall) TRUSTS & TRUSTEES

provided for in the Companies Act (United and International Asset Management Volume 1 No 2 page

Kingdom Class Scheme Bye-laws) Regulations 17.

1988; 2] The definition of a “financial institution” includes

(d) evidence must be supplied that the officers and a “Collective Investment Scheme” which in turn is

directors of the fund are of good standing and defined as meaning a “mutual fund” within the meaning

repute, financially sound and sufficiently of the Companies Act 1981 or a “unit trust scheme” in

qualified and experienced to fulfil properly their terms of the Stamp Duties Act 1976 (there being at pre-

“ ... there is scope, respective roles; sent no specific statutory code dealing with unit trusts). In

particularly in the (e) the custodian and manager of the company are,

practice similar guidelines will apply to Limited

Partnerships or Limited Duration Companies offering

Unit Trust Area, or upon certification will be, participants in a

units/shares/securities to outside investors.

compensation agreement.

and that of the 3] “Exempted” signifies exemption from the manda-

Limited Duration POST-APPROVAL MONITORING

tory requirement applicable to “local” companies of at

Downloaded from http://tandt.oxfordjournals.org/ at University of North Dakota on June 4, 2015

Company, for Consents for the issue of shares or units of a CIS least sixty percent ownership and control by Bermudians.

are given conditionally. The CIS must seek further

planing and consent before it makes any change in its opera- by Robert Miller* and Robin Todd

producing new tions, including changes of manager, custodian,

investment adviser(s), or any other relevant party Richards, Francis & Francis,

off-shore

and for any material changes to the offering docu- Bermuda

solutions ...” ment or prospectus. Further, each custodian

Barristers & Attorneys

reports monthly to the BMA, on, inter alia, details

of the net asset value of the fund, price per share, Cedar Trust Co Ltd

analysis of performance over the previous one, six 48 Cedar Avenue, P O Box HM 148

and twelve month periods and the amounts sub-

scribed and redeemed. Hamilton HM AX, Bermuda

LAST WORD

Tel: (809) 292 0567

Fax: (809) 292 0732

The CIS market is expanding rapidly, whatever

form the launch vehicle might take. This author *Now of ZI Labuan Trust Company Sdn. Bhd

believes that there is scope, particularly in the Labuan, Malaysia - Tel: +60 87 451 688, Fax:

Unit Trust Area, and that of the Limited Duration +60 87 453 688

SCHEDULE

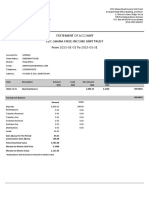

DESCRIPTION 31 March 1993 31 August 1994 30 November 1994

“ ... there is scope

... for planning Mutual Funds 210 292 30.7

and producing Umbrella Funds 26 33 36

new offshore

Sub-Funds operating under Umbrellas 92 172 180

solutions ...”

Total Mutual Funds 302 464 487

Unit Trusts 49 52 55

Umbrella Trusts 2 2 4

Sub-Trusts operating under Umbrellas 4 7 9

Total Unit Trusts 53 59 64

Partnerships 2 15 16

Feeder Trusts - 1 1

Grand Total CIS 356 539 568

Total Net Asset Value (N.A.V.) US$6.8b US$12.5b US$12.1b

Source: Bermuda Monetary Authority

TRUSTS & TRUSTEES and International Asset Management Page 11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- VUL Mock Exam 2 WITH EXPLANATIONS Answer KeyDocument16 pagesVUL Mock Exam 2 WITH EXPLANATIONS Answer KeyFranz JosephNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unit Trust Examination Mock QuestionsDocument67 pagesUnit Trust Examination Mock QuestionsDavie Cockett100% (2)

- Cute Exam Paper Set 4Document12 pagesCute Exam Paper Set 4Budak Baru BelajarNo ratings yet

- Integrating Sustainability Risks in Asset Management: The Role of ESG Exposures and ESG RatingsDocument37 pagesIntegrating Sustainability Risks in Asset Management: The Role of ESG Exposures and ESG RatingsStanley MunodawafaNo ratings yet

- Fcic Testimony Friedman 20100505 PDFDocument4 pagesFcic Testimony Friedman 20100505 PDFStanley MunodawafaNo ratings yet

- 7-Year Asset Class Real Return Forecasts : As of August 31, 2020Document1 page7-Year Asset Class Real Return Forecasts : As of August 31, 2020Stanley MunodawafaNo ratings yet

- Performance Attribution From Bacon: Matthieu Lestel February 5, 2020Document24 pagesPerformance Attribution From Bacon: Matthieu Lestel February 5, 2020Stanley MunodawafaNo ratings yet

- Hedge Fund Structures PDFDocument9 pagesHedge Fund Structures PDFStanley MunodawafaNo ratings yet

- A Guide To Alternative UcitsDocument10 pagesA Guide To Alternative UcitsStanley MunodawafaNo ratings yet

- Final Fund Accounting Study Manual PDFDocument295 pagesFinal Fund Accounting Study Manual PDFSankalp SinghNo ratings yet

- Edc Ghana Fixed Income Unit Trust Statement of Account: Redemptions Shall Be Based On Marked-to-Market ValueDocument2 pagesEdc Ghana Fixed Income Unit Trust Statement of Account: Redemptions Shall Be Based On Marked-to-Market ValueAdepa IdasonNo ratings yet

- Tetrad Investment ProductsDocument5 pagesTetrad Investment ProductsNyasha Nyaguwa WizNo ratings yet

- Chapter 03 - Test Bank: Multiple Choice QuestionsDocument24 pagesChapter 03 - Test Bank: Multiple Choice QuestionsKhang LeNo ratings yet

- Cute Q&a 1Document13 pagesCute Q&a 1alyadaudaNo ratings yet

- Sample Notes Low Chin Ann ACCA ATX Genesis OrigoDocument22 pagesSample Notes Low Chin Ann ACCA ATX Genesis OrigoLow Chin AnnNo ratings yet

- Asset Management - Portfolio Construction, Performance and ReturnsDocument389 pagesAsset Management - Portfolio Construction, Performance and Returnsfranky1000100% (1)

- Unit Trust Funds: Frequently Asked QuestionsDocument2 pagesUnit Trust Funds: Frequently Asked QuestionsJoseph OsakoNo ratings yet

- Old Mutual PortfolioDocument12 pagesOld Mutual PortfolioshabsuNo ratings yet

- Variable Mock ExamDocument9 pagesVariable Mock ExamaileensambranoNo ratings yet

- OMWealth OldMutualWealthLinkedRetirementIncomeDocument2 pagesOMWealth OldMutualWealthLinkedRetirementIncomeJohn SmithNo ratings yet

- TA Global Technology Fund - July 2020Document3 pagesTA Global Technology Fund - July 2020mulder95No ratings yet

- CUTE Tutorial - Zoom Training - 11.03.21Document146 pagesCUTE Tutorial - Zoom Training - 11.03.21Hema KrishnanNo ratings yet

- FIMM Pre-Investment FormDocument1 pageFIMM Pre-Investment FormCik SuNo ratings yet

- Sample Unit Trust Ledger - ImportantDocument2 pagesSample Unit Trust Ledger - ImportantSuhaili YahyaNo ratings yet

- IBIS US Industry ReportDocument35 pagesIBIS US Industry ReportJonathan RolfsenNo ratings yet

- Topic1 Introductionto Financial Market and SecuritiesDocument19 pagesTopic1 Introductionto Financial Market and SecuritiesMirza VejzagicNo ratings yet

- FC V23 Sample PaperDocument21 pagesFC V23 Sample PaperJuan_Car100% (1)

- December 2013Document4 pagesDecember 2013Heather PageNo ratings yet

- Chapter 1: Introduction of The Study: Phase 1: Establishment and Growth of Unit Trust of India - 1964-87Document17 pagesChapter 1: Introduction of The Study: Phase 1: Establishment and Growth of Unit Trust of India - 1964-87ebyNo ratings yet

- Maksud Unit TrustDocument6 pagesMaksud Unit TrusthusainiNo ratings yet

- Variable IC Mock Exam Version 2 10022023Document16 pagesVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- Variable Mock Exam UpdatedDocument14 pagesVariable Mock Exam UpdatedOliver papaNo ratings yet

- ADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Document197 pagesADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Ashlee JingNo ratings yet

- Isb656 (Islamic Capital Market) Lesson Plan (SEPT 2016 - DEC 2016)Document3 pagesIsb656 (Islamic Capital Market) Lesson Plan (SEPT 2016 - DEC 2016)Roslina IbrahimNo ratings yet

- Unit TrustDocument3 pagesUnit TrustEd RockyNo ratings yet

- Tables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletDocument9 pagesTables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletMinh LeNo ratings yet