Professional Documents

Culture Documents

02 - Tax Rate Card 2019-2020

02 - Tax Rate Card 2019-2020

Uploaded by

aadil002Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 - Tax Rate Card 2019-2020

02 - Tax Rate Card 2019-2020

Uploaded by

aadil002Copyright:

Available Formats

Tax Rate Chart – Tax Year 2020

Withholding tax for salary individuals u/s 149 Other important withholding tax rates

Salary income (Rupees) Tax rates Contacts u/s 153 Active Inactive

Up to 600,000 0% By company 7% 14%

600,001 to 1,200,000 5% exceeding 600,000 By individual and AOP 7.5% 15%

1,200,001 to 1,800,000 30,000 + 10% exceeding 1,200,000 Brokerage and commission u/s 233 Active Inactive

1,800,001 to 2,500,000 90,000 + 15% exceeding 1,800,000 Advertisement agents 10% 20%

2,500,001 to 3,500,000 195,000 + 17.5% exceeding 2,500,000 Life insurance (less than 0.5 M) 8% 16%

3,500,001 to 5,000,000 370,000 + 20% exceeding 3,500,000 Other cases 12% 24%

5,000,001 to 8,000,000 670,000 + 22.5% exceeding 5,000,000 Tax at import stage u/s 148 Filer Non-filer

8,000,001 to 12,000,000 1,345,000 + 25% exceeding 8,000,000 Coal Importers 4% 8%

12,000,001 to 30,000,000 2,345,000 + 27.5% exceeding 12,000,000 Industrial undertaking 5.5% 11%

30,000,001 to 50,000,000 7,295,000 + 30% exceeding 30,000,000 Other companies 5.5% 11%

50,000,001 to 75,000,000 13,295,000 + 32.5% exceeding Other tax payers 6% 12%

50,000,000 Profit on debt u/s 151 Active Inactive

Above 75,00,000 21,420,000 + 35% exceeding 75,00,000 Up to 500,000 10% 20%

Up to 5 M 15% 30%

Withholding of tax @ 20% against payment of directorship fee or fee From 5 M to 25 M 17.5% 35%

for attending board meeting u/s 149(3) Above 25 M 20% 40%

Dividend u/s 150 Active Inactive

Withholding tax for income from property u/s 155 Dividend paid by independent power 7.5% 15%

purchasers

Business income (Rs) Tax rates

General rate and rate for mutual funds 15% 30%

Individuals and AOPs Where company’s profit is exempt 15% 30%

Up to 200,000 Nil Immoveable property

200,001 to 600,000 5% exceeding 200,000 On seller u/s 236C 1% 2%

600,001 to 1,000,000 20,000 + 10% exceeding 600,000 On buyer u/s 236K 1% 2%

1,00,001 to 2,000,000 60,000 + 15% exceeding 1,000,000 On issue of bonus shares 0% 0%

2,000,001 to 4,000,000 210,000 + 20% exceeding 2,000,000 On sale by auctions u/s 236A 10% 20%

4,000,001 to 6,000,000 610,000 + 25% exceeding 4,000,000 Charge by local educational institutes 5% 5%

6,000,001 to 8,000,000 1,110,000 + 30% exceeding 6,000,000 u/s 236I

Above 8,000,000 1,710,000 + 35% exceeding 8,000,000 Charge by foreign educational institute 5% 5%

u/s 236R

Companies 15% of gross rent On non-resident royalty and technical 15% 15%

services u/s 152

Other important withholding tax rates Use of machinery & equipment u/s 236Q 10% 10%

Tax on sale – specified sectors Active Inactive On prize bonds u/s 156 15% 30%

Purchase of air ticket – domestic u/s 5% 5%

Sale to distributors, dealers and 0.7% 1.4%

236B

wholesalers – Fertilizers – 236G

Purchase of air ticket – international

Sale to distributors, dealers and 0.1% 0.2%

u/s 236L

wholesalers – others – 236G

Tax on sale to retailers – electronics – 1% 2% Economy class 0%

236H Executive/ first class Rs 16,000 per person

Tax on sale to retailers – others – 236H 0.5% 1% Others excluding economy Rs 12,000 per person

(Electronics, sugar, cement, iron and steel products, motorcycles, Mineral extraction u/s 236V 0% 5%

pesticides, cigarettes, glass, textile, beverages, paint or foam sector) Services/ contracts outside Pakistan 50% rebate on tax rates

under section 153

CNG Stations u/s 234A 4% 8%

Sale of goods u/s 153 Active Inactive General insurance premium u/s 236U 4%

By company 4% 8% Life insurance premium over 0.3M 1%

By individual and AOP 4.5% 9% Foreign payments through credit cards 1% 2%

Rice, cotton seed and edible oils 1.5% 3% u/s 236Y

Dealers and sub-dealers of sugar, 0.25% 0.5% Gain on sale of immovable property

cement, edible oil

Gain on sale of immoveable property Active

Fast moving consumer goods Company 2% 4%

Fast moving consumer goods others 2.5% 5% Where gain < 5,000,000 5%

Where gain > 5,000,000 < 10,000,000 10%

Services u/s 153 Active Inactive Where gain > 10,000,000 < 15,000,000 15%

By company 8% 16% Where gain > 15,000,000 20%

By individual and AOP 10% 20% Taxability of gain for open plots (sale price – cost)

Royalty to resident persons 15% 30% Where holding period is less than 1 year – 100%

Transport services, freight forwarding 3% 6% Where holding period is > 1 year < 8 years – 75%

services, air cargo services, courier Where holding period is > 8 years – 0%

services, manpower outsourcing services, Taxability of gain for constructed property (sale price – cost)

hotel services, security guard services, Where holding period is less than 1 year – 100%

software development services, IT Where holding period is > 1 year < 4 years – 75%

services, tracking services, advertising Where holding period is > 4 years – 0%

services, share registrar services, Where the property has sold in the same year, 1% is the minimum tax

engineering services, car rental services, of the sale consideration.

building maintenance services, Capital derived by original allottee of government servant, tax shall be

inspection, testing and training services. reduced by fifty percent. (9A Part-III, 2nd schedule)

Offshore digital services 152(1C) 5% 10% Due care has been exercised to prepare this document. However, where

Electronic/ print media for advertisement 1.5% 3% any error or omission is found, the same may please be communicated at

(non-filer company/ other) shahzad@princeps.com.pk

Disclaimer: The information contained in this chart is of a general nature for guidance of staff and clients of Princeps Consulting and is not intended to address the

circumstances of any particular individual or entity. Before making any decision or taking any action, please consult for a professional advice.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Ein Letter RyanDocument2 pagesEin Letter Ryanphillip davisNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

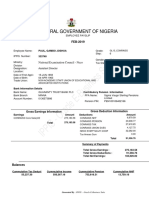

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument18 pagesIPPIS - Oracle E-Business Suite: Federal Government of Nigeriamustapha kamilu100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Emotional Intelligence and Leadership Effectiveness: The Mediating Influence of Collaborative BehaviorsDocument30 pagesEmotional Intelligence and Leadership Effectiveness: The Mediating Influence of Collaborative Behaviorsaadil002No ratings yet

- Pro Omer MasoodDocument73 pagesPro Omer Masoodaadil002No ratings yet

- Sales Tax Act, 1990Document122 pagesSales Tax Act, 1990aadil002100% (1)

- Import Policy Order, 2008Document112 pagesImport Policy Order, 2008Asad SultaniNo ratings yet

- ESSO v. CIR, 175 SCRA 149 (1989)Document13 pagesESSO v. CIR, 175 SCRA 149 (1989)citizenNo ratings yet

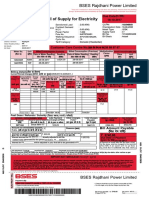

- Airtel Broadband Bill - DecDocument1 pageAirtel Broadband Bill - DecSubhani NaniNo ratings yet

- Etaxguide - Cit - Tax Exemption Under Section 13 (12) - (8th Edition)Document34 pagesEtaxguide - Cit - Tax Exemption Under Section 13 (12) - (8th Edition)LomomivNo ratings yet

- Upgrade MID Non HNW Classic Customer Version PDFDocument2 pagesUpgrade MID Non HNW Classic Customer Version PDFRamboNo ratings yet

- Pointers To Review BUSINESS TAXATIONDocument4 pagesPointers To Review BUSINESS TAXATIONFaizal MutiaNo ratings yet

- Biologicla Assets PDFDocument2 pagesBiologicla Assets PDFMjhayeNo ratings yet

- Indwdhi 20231031Document9 pagesIndwdhi 20231031AKMA SAUPINo ratings yet

- Environmental Services Inc Performs Various Tests On Wells and SepticDocument1 pageEnvironmental Services Inc Performs Various Tests On Wells and Septictrilocksp SinghNo ratings yet

- Congratulations On The Bonus Accrued!: Gajbhiye AmitkumarDocument2 pagesCongratulations On The Bonus Accrued!: Gajbhiye Amitkumaramit gajbhiyeNo ratings yet

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument4 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedHema KatiyarNo ratings yet

- Scan 3 Mar 2020Document1 pageScan 3 Mar 2020Sandeep ChoudharyNo ratings yet

- Section A: 40, Main Street, GeorgetownDocument1 pageSection A: 40, Main Street, GeorgetownKatty DeFreitasNo ratings yet

- VAT-Computation 2Document28 pagesVAT-Computation 2Alvin Dagohoy100% (1)

- This Study Resource Was: F, Sold The Following Capital AssetsDocument2 pagesThis Study Resource Was: F, Sold The Following Capital AssetsDheyreil Eden Kaylah ParaisoNo ratings yet

- Message Grammar School Message Grammar School Message Grammar SchoolDocument1 pageMessage Grammar School Message Grammar School Message Grammar SchoolUMW BrosNo ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and Managementarchana_anuragi100% (1)

- Tax InvoiceDocument1 pageTax InvoiceAsif IqbalNo ratings yet

- URSP - Billing Invoice - Homeworld Surveillance 2021Document1 pageURSP - Billing Invoice - Homeworld Surveillance 2021Julie Ann TolosaNo ratings yet

- CitiBank-Statement Jan01-Jan30Document2 pagesCitiBank-Statement Jan01-Jan30hzservices70No ratings yet

- Government Accounting: Accounting For Income and Other Cash ReceiptsDocument18 pagesGovernment Accounting: Accounting For Income and Other Cash ReceiptsJoan May PeraltaNo ratings yet

- Akhil June ExpenseDocument4 pagesAkhil June ExpenseNitinkiet103No ratings yet

- IBBL Contact Center: Born To SmileDocument1 pageIBBL Contact Center: Born To SmilerubelNo ratings yet

- AP-AR Netting SetupDocument45 pagesAP-AR Netting Setupchandra_wakarNo ratings yet

- DJBBill 098235179545Document3 pagesDJBBill 098235179545Arijit paulNo ratings yet

- May 2018 SGV SDGSDDocument26 pagesMay 2018 SGV SDGSDBien Bowie A. CortezNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRahul Giri (Logistics)No ratings yet

- The Good, The Bad, and The UglyDocument13 pagesThe Good, The Bad, and The UglyTanvir AhmedNo ratings yet

- SAP BPC Dimensions MembersDocument22 pagesSAP BPC Dimensions MembersMahesh Reddy MNo ratings yet