Professional Documents

Culture Documents

Insights Into AAC Blocks Manufacturing Space in India

Insights Into AAC Blocks Manufacturing Space in India

Uploaded by

saurabh323612Copyright:

Available Formats

You might also like

- Global Autoclaved Aerated Concrete AAC Market, 2020-2027Document202 pagesGlobal Autoclaved Aerated Concrete AAC Market, 2020-2027pazuzu100% (1)

- Autoclaved Aerated Concrete (AAC) Blocks Project - Brief ReportDocument12 pagesAutoclaved Aerated Concrete (AAC) Blocks Project - Brief ReportVishal Kansagra77% (31)

- AAC Sample Project Profile Universal-Ver-2Document7 pagesAAC Sample Project Profile Universal-Ver-2N Gangadhar Reddy100% (1)

- AdmixtureDocument7 pagesAdmixturevinay rodeNo ratings yet

- Fly Ash Bricks Mixing Proportion - 3 Important Formulas PDFDocument2 pagesFly Ash Bricks Mixing Proportion - 3 Important Formulas PDFsonianchal233No ratings yet

- SRD Project Doc FinalDocument65 pagesSRD Project Doc FinalRavi JoshiNo ratings yet

- CLC CostingDocument34 pagesCLC CostingpipestressNo ratings yet

- Yamaha Strategy in VietNamDocument16 pagesYamaha Strategy in VietNamLinh Jan100% (2)

- Magicrete PresentationDocument35 pagesMagicrete Presentationkareena23No ratings yet

- Autoclaved Aerated Concrete: A Sustainable Alternate of Clay Brick Masonry in Form of Light Weight ConcreteDocument6 pagesAutoclaved Aerated Concrete: A Sustainable Alternate of Clay Brick Masonry in Form of Light Weight ConcreteGRD JournalsNo ratings yet

- Report On AAC BlocksDocument8 pagesReport On AAC Blocksroan sthaNo ratings yet

- AAC Sample Prject Profile-CompleteDocument19 pagesAAC Sample Prject Profile-Completettpatel91No ratings yet

- Aac E - BrochureDocument10 pagesAac E - BrochureRahul AggarwalNo ratings yet

- QT8 FlyAsh Bricks Project Report May-2014 PDFDocument15 pagesQT8 FlyAsh Bricks Project Report May-2014 PDFesha108No ratings yet

- AAC Blocks Manufacturers - MagnaDocument6 pagesAAC Blocks Manufacturers - MagnaMagna GreenNo ratings yet

- Project Design Document (PDD) : CDM - Executive BoardDocument84 pagesProject Design Document (PDD) : CDM - Executive BoardParakh AgrawalNo ratings yet

- KERALITE BrochureDocument8 pagesKERALITE BrochurejayanthNo ratings yet

- Hdian Standard: Methods Off Test For Autoclaved Cellular Concrete ProductsDocument10 pagesHdian Standard: Methods Off Test For Autoclaved Cellular Concrete ProductsshailendraNo ratings yet

- Biltech Aac BlocksDocument4 pagesBiltech Aac BlocksManish PatelNo ratings yet

- CLC Plant DetailDocument17 pagesCLC Plant DetailSibiyarasu Rock RiderNo ratings yet

- 3.bom-Civil-Meghana Aac Blocks IndustryDocument15 pages3.bom-Civil-Meghana Aac Blocks IndustrytechnopreneurvizagNo ratings yet

- Manufacturing Process of Aac Block: Anurag WahaneDocument8 pagesManufacturing Process of Aac Block: Anurag Wahanemshabanero2359No ratings yet

- TilesDocument6 pagesTilesraja qammarNo ratings yet

- Project Report On Polycarboxylate Ether Superplasticizer (Pce)Document7 pagesProject Report On Polycarboxylate Ether Superplasticizer (Pce)EIRI Board of Consultants and PublishersNo ratings yet

- Birla Aerocon AAC Blocks - Literature V01 PDFDocument4 pagesBirla Aerocon AAC Blocks - Literature V01 PDFdhruvNo ratings yet

- The Fly Ash Brick Production TechnologyDocument18 pagesThe Fly Ash Brick Production TechnologyVishal KedarNo ratings yet

- Autotherm - AAC Plant Project Report - SimpleDocument9 pagesAutotherm - AAC Plant Project Report - SimpleAutotherm Equipments CorporationNo ratings yet

- Diploma 6TH Sem ProjectDocument34 pagesDiploma 6TH Sem ProjectlakhazapadaNo ratings yet

- Is 2645 (2003) - Integral Waterproofing Compounds For Cement Mortar and Concrete - SpecificationDocument16 pagesIs 2645 (2003) - Integral Waterproofing Compounds For Cement Mortar and Concrete - SpecificationMeet ChokshiNo ratings yet

- Is 15622 2006 PDFDocument20 pagesIs 15622 2006 PDFPatel SumitNo ratings yet

- Fly Ash FinalDocument38 pagesFly Ash FinalThahzeen KazifNo ratings yet

- BASF Introduces Smart Dynamic ConcreteDocument4 pagesBASF Introduces Smart Dynamic ConcreteNurul Hidayati100% (1)

- Aac Block Plants: WWW - Buildmate.InDocument12 pagesAac Block Plants: WWW - Buildmate.InAzmat Ali KhanNo ratings yet

- Eco-Friendly Walls: AAC BlocksDocument101 pagesEco-Friendly Walls: AAC Blockspoonam_ceNo ratings yet

- Study and Experimentation of Autoclaved Aerated Concrete by Using Fly AshDocument5 pagesStudy and Experimentation of Autoclaved Aerated Concrete by Using Fly AshInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Optimization of Ready Mix Concrete (RMC)Document6 pagesOptimization of Ready Mix Concrete (RMC)JuanCarlosCarrilloNo ratings yet

- Some Trends in The Use of Concrete: Indian ScenarioDocument6 pagesSome Trends in The Use of Concrete: Indian ScenarioHarry SidhuNo ratings yet

- Role of Chemical Admixtures in Sustainability - The OpportunityDocument28 pagesRole of Chemical Admixtures in Sustainability - The OpportunityThiagoMaronNo ratings yet

- Orilite AAC Block FAQDocument16 pagesOrilite AAC Block FAQAshish JainNo ratings yet

- Auto Aerated ConcreteDocument6 pagesAuto Aerated ConcreteLeo GohNo ratings yet

- Use of Bottom Ash As Fine Aggregate in Concrete A Review Ijariie3297Document10 pagesUse of Bottom Ash As Fine Aggregate in Concrete A Review Ijariie3297Sphero CastilloNo ratings yet

- Paver Block Manufacturing UnitDocument12 pagesPaver Block Manufacturing UnitMusic & ArtNo ratings yet

- Analysis of Autoclaved Aerated Concrete (AAC) Blocks With Reference To Its Potential and SustainabilityDocument12 pagesAnalysis of Autoclaved Aerated Concrete (AAC) Blocks With Reference To Its Potential and SustainabilityDheeraj RanganathNo ratings yet

- Autoclaved Aerated Concrete BlockDocument53 pagesAutoclaved Aerated Concrete BlocksharanyaNo ratings yet

- Literature Review On Technical Aspect of Sustainable ConcreteDocument9 pagesLiterature Review On Technical Aspect of Sustainable ConcreteAnneLabacoNo ratings yet

- IS 15622 (2006) - Pressed Ceramic TilesDocument20 pagesIS 15622 (2006) - Pressed Ceramic TilesTAJAMULNo ratings yet

- Jindal Air Aac BlockDocument12 pagesJindal Air Aac BlockAmit BhattNo ratings yet

- High Early Strength ConcreteDocument29 pagesHigh Early Strength ConcreteHadeer HosnyNo ratings yet

- Project Profile On Fly Ash BricksDocument15 pagesProject Profile On Fly Ash BricksHarshit JajuNo ratings yet

- Presents: Flyash Brick - An Entrepreneur'S ApproachDocument35 pagesPresents: Flyash Brick - An Entrepreneur'S ApproachAbdulHannan PatwegarNo ratings yet

- MYK Arment PresentationDocument31 pagesMYK Arment PresentationPrince PandeyNo ratings yet

- Non-Autoclaved Aerated Concrete (NAAC) Blocks: An Alternative Building Construction MaterialDocument5 pagesNon-Autoclaved Aerated Concrete (NAAC) Blocks: An Alternative Building Construction MaterialIJRASETPublicationsNo ratings yet

- Autoclaved Areated Concrete or Light Weight ConcreteDocument16 pagesAutoclaved Areated Concrete or Light Weight ConcreteMohammed Khaja NaseerNo ratings yet

- Studies On Quarry Dust As Partial Replacement of Fine Aggregates in ConcreteDocument3 pagesStudies On Quarry Dust As Partial Replacement of Fine Aggregates in ConcreteEditor IJLTEMASNo ratings yet

- Admixture PPT For CMT G-2Document39 pagesAdmixture PPT For CMT G-2Marinella Garingan100% (1)

- Autoclaved Aerated Concret11Document5 pagesAutoclaved Aerated Concret11Ahmed SaberNo ratings yet

- 17.sec.1700 (Structural Concrete)Document16 pages17.sec.1700 (Structural Concrete)aalignup arc & const. pvt ltdNo ratings yet

- Wall PannelsDocument5 pagesWall PannelsGaurav MallaNo ratings yet

- Revenue RevenueDocument5 pagesRevenue RevenuekishanmehrotraNo ratings yet

- AAC Block - Conquering Brick by Brick PDFDocument10 pagesAAC Block - Conquering Brick by Brick PDFAkshayNo ratings yet

- Model Project: Iccmrt College LucknowDocument40 pagesModel Project: Iccmrt College LucknowPrabhakar SinghNo ratings yet

- Relaxation of Norms - Startups - Medium - Enterprises - PublicProcurementDocument3 pagesRelaxation of Norms - Startups - Medium - Enterprises - PublicProcurementsaurabh323612No ratings yet

- Sales PlanDocument26 pagesSales Plansaurabh323612No ratings yet

- Dewan Akshay - CV PDFDocument2 pagesDewan Akshay - CV PDFsaurabh323612No ratings yet

- ALL3Document144 pagesALL3saurabh323612No ratings yet

- GS36J04A10-01E - 020 (Exaquantum)Document10 pagesGS36J04A10-01E - 020 (Exaquantum)Tran DinhNo ratings yet

- Erection Manual-Pc PipingDocument219 pagesErection Manual-Pc Pipingalinor_tn100% (2)

- Spanish Logistics Sector: Supply ChainDocument7 pagesSpanish Logistics Sector: Supply ChainMorvinNo ratings yet

- Diagram of ISO 17025:2017 Implementation ProcessDocument1 pageDiagram of ISO 17025:2017 Implementation ProcessraquelNo ratings yet

- Lesson 5: The Basics of ProcurementDocument38 pagesLesson 5: The Basics of ProcurementJanica PacificoNo ratings yet

- Der 354 PDFDocument4 pagesDer 354 PDFTamer BidakNo ratings yet

- Vice President Sales Marketing in Southeast USA Resume Glen MichalskeDocument2 pagesVice President Sales Marketing in Southeast USA Resume Glen MichalskeGlenMichalskeNo ratings yet

- Manleo E-CatalogueDocument10 pagesManleo E-CatalogueabhijithbhatnNo ratings yet

- DS C20 Call Session Controller 0715Document3 pagesDS C20 Call Session Controller 0715kaz7878No ratings yet

- Catalogo Miller Safety Cat132016Document80 pagesCatalogo Miller Safety Cat132016Jimy BarronNo ratings yet

- 年产60万吨丙烷脱氢制丙烯装置的丙烯丙烷精馏模拟优化 邓生鑫Document77 pages年产60万吨丙烷脱氢制丙烯装置的丙烯丙烷精馏模拟优化 邓生鑫Grey DaveNo ratings yet

- Common Sucker Rod SpecificationsDocument1 pageCommon Sucker Rod SpecificationsMichelangeloTiberiiNo ratings yet

- Egnatia Rom G: Romania RomaniaDocument12 pagesEgnatia Rom G: Romania RomaniaThomas MelitsisNo ratings yet

- Spare Parts Master N (8105.181)Document20 pagesSpare Parts Master N (8105.181)Julian M. AndrettiNo ratings yet

- Cit 743 Past QuestionsDocument3 pagesCit 743 Past QuestionsBukola BukkyNo ratings yet

- What Does PLC' Mean?: Disadvantages of PLC ControlDocument2 pagesWhat Does PLC' Mean?: Disadvantages of PLC Controlmanjunair005No ratings yet

- Online Shopping Mall Software Requirements SpecificationDocument7 pagesOnline Shopping Mall Software Requirements SpecificationKumaran SgNo ratings yet

- Baljeet ResumeDocument3 pagesBaljeet ResumeBaljeet BeetaNo ratings yet

- Mini ProjectDocument22 pagesMini ProjectAshutosh PandeyNo ratings yet

- Sol 11 3 Repo Md5sumsDocument2 pagesSol 11 3 Repo Md5sumsramalingam_decNo ratings yet

- Sweekar E Rickshaw - ProposalDocument14 pagesSweekar E Rickshaw - ProposalAishna SenguptaNo ratings yet

- Iso 9001 CRMDocument6 pagesIso 9001 CRMNavnath TamhaneNo ratings yet

- Wartsila Annual Report 2008 En.Document144 pagesWartsila Annual Report 2008 En.Uhrin ImreNo ratings yet

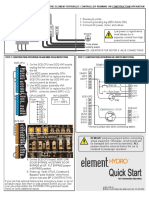

- 42-QR-1P26 B3 Element Hydro Quick StartDocument1 page42-QR-1P26 B3 Element Hydro Quick StartElputoAmo XDNo ratings yet

- Spectra Encryption User GuideDocument100 pagesSpectra Encryption User GuideMarcos Vinicius SilvaNo ratings yet

- Dental Chair: A-Dec Service Guide, Vol. IIDocument40 pagesDental Chair: A-Dec Service Guide, Vol. IIQuang Định ĐinhNo ratings yet

- Outline The Goals For Your Website Project ReportDocument2 pagesOutline The Goals For Your Website Project ReportKapil ChawlaNo ratings yet

- What Are The Best Websites For PROJECT MANAGEMENTDocument26 pagesWhat Are The Best Websites For PROJECT MANAGEMENTRajarathinam ThangaveluNo ratings yet

- Demand Factor-Diversity Factor-Utilization Factor-Load Factor - Electrical Notes & ArticlesDocument20 pagesDemand Factor-Diversity Factor-Utilization Factor-Load Factor - Electrical Notes & ArticlesRashid M AnsariNo ratings yet

Insights Into AAC Blocks Manufacturing Space in India

Insights Into AAC Blocks Manufacturing Space in India

Uploaded by

saurabh323612Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insights Into AAC Blocks Manufacturing Space in India

Insights Into AAC Blocks Manufacturing Space in India

Uploaded by

saurabh323612Copyright:

Available Formats

Background to the Note

AAC Blocks manufacturing is gaining prominence in the Indian market and a large number of plants

are being set up across the country. We at Sparrow Business Solutions LLP have researched the space

and present our findings in this note. We have taken some of the data from the marketing material of

AAC Block manufacturers in India. This is to give CLIENT an idea (in however far incase unknown to

you with regard to India) as to how the concept is currently being marketed by the manufacturers

and consultants in the segments. The information on the competitors, equipment suppliers and

potential deals is based on our primary research.

Introduction

The face of realty market in India has changed rapidly over the past few years. Large number of

Integrated Townships, Mass Housings (for Urban Poor, Slum Rehabilitation etc.), IT/ITES parks,

High rise buildings and SEZs’ are commonly seen these days and the growth in the segment will

only increase exponentially in the years to come.

Majority of such projects are still being constructed using the conventional methods, construction

in-situ. Thus the inherent advantage of repetitions and huge volume turnover remain unexploited.

In addition, these large scale projects constructed using conventional methods complicate the

project management in terms of speed, consistency and quality of the construction.

Shortage of urban labor and high interest costs have forced developers and construction

companies to look for faster and more efficient building materials.

Why AAC has been gaining prominence in India?

The key commercial reason for the growing popularity of the AAC technology is the low capital

investment and quick pay-back period. This key reason has prompted over fifteen companies

setting up single location AAC block manufacturing factories in India in the last three years.

Low capital investment makes it suitable for smaller and medium sized builders and developers to

get into this business.

The larger serious manufacturers with multiple locations have chosen this over Precast concrete or

Prefabricated structures due to the following other reasons:

1. Eco-friendly

Makes productive use of recycled industrial waste (fly ash).

Non-polluting manufacturing process – the only by-product is steam.

Made of non-toxic ingredients.

Does not exude gases.

Total energy consumption for producing AAC is less than ½ of what it takes to produce

other building material.

2. Lightweight

Insights into the Indian AAC Block manufacturing industry

3-4 times lighter than traditional bricks, therefore, easier and cheaper to transport; AAC

block weigh approximately 50% less than a standard CMU block and approximately 30% of

standard cast-in-place concrete.

Usage reduces overall dead load of a building, thereby allowing construction of taller

buildings.

3. Thermally Insulated & Energy Efficient

Tiny air pores and thermal mass of blocks provide excellent thermal insulation, thus

reducing heating and air conditioning costs of a building.

4. Fire Resistant

Non-combustible and fire resistant up to 1600° C and can withstand up to 6 hours of direct

exposure.

5. Acoustic Performance

Superior sound absorption qualities due to porous structure of blocks.

Offers sound attenuation of about 42 dB, blocking out all major sounds and disturbances.

Ideal for schools, hospitals, hotels, offices, multi-family housing and other structures that

require acoustic insulation.

6. Easy Workability and Design Flexibility

Blocks can be easily cut, drilled, nailed, milled and grooved to fit individual requirements.

Available in custom sizes.

Simplifies hydro-sanitary and electrical installations, such as pipes or ducts, which can be

installed after the main construction is complete.

7. Sustainable

Retains properties over time.

Made of non-allergenic material.

Use of AAC improves indoor air quality.

8. Earthquake Resistant

Lightweight blocks reduce mass of a structure, thus decreasing the impact of an

earthquake on a building.

Non-combustible nature provides an advantage against fires, which commonly accompany

earthquakes.

9. Precision

Available in exact sizes.

Results in smooth walls with perfect contact between different elements.

Reduces cement and steel usage.

10. Termite/Pest Resistant

Due to structure of blocks, AAC blocks cannot be damaged or infested by termites and

other pests.

11. Cost Effective

Insights into the Indian AAC Block manufacturing industry

Reduces operating cost by 30% to 40%.

High-insulation blocks save up to 30% in energy costs.

Variety in sizes of blocks helps increase carpet area.

Wall painting and plastering last longer as almost nil efflorescence affects AAC. This

translates into lower maintenance costs.

12. Faster Construction

Reduces construction time by 20% or more.

Different sizes of blocks help reduce the number of joints in wall masonry.

Lighter blocks make construction easier and faster.

Easy to install. Sets and hardens quickly.

13. Carbon Credits

AAC Block manufacturing is eligible for Carbon credits and it is safe to consider carbon

credits revenue to be around 2 Euros/m3.

14. Financially Attractive Investment

Average Profit after taxation is 20% currently.

Payback period of capital investment is less than 30 months currently.

Select on the ground feedbacks

1) 24 out of the 26 AAC concrete blocks manufacturing plants set up are with foreign equipment

suppliers. The key equipment suppliers in the Indian market include

a) Hess Group http://www.hessgroup.com/en/hess-group/locations/

b) Jiangsu Teeyer Engineer Machinery CO.,LTD http://www.teeyer.com/enindex.asp

c) Masa Group http://www.masa-group.com/en/group/masa-india.html

2) The duty structure for the manufacture and sales of AAC Blocks is :

a) Excise duty payable on manufacture 12.36%

b) Value Added Tax payable on sales ~ 4% (varies across states)

3) Raw Material

a) Fly Ash or Sand Key ingredient for manufacturing AAC blocks is silica rich material like fly

ash or sand. Most of the AAC companies in India use fly ash to manufacture AAC blocks.

95% of the plants in India use fly ash as the raw material. There are large number of

thermal power plants across the country and fly ash produced by them is readily available.

A typical 800 MW power plant produces 4,000TPD of fly ash.

b) Lime Powder Lime powder required for AAC production is obtained either by crushing

limestone to fine powder at AAC factory or by directly purchasing it in powder form.

Insights into the Indian AAC Block manufacturing industry

c) Cement 53-grade Ordinary Portland Cement (OPC) from reputed manufacturer is required

for manufacturing AAC blocks. Cement supplied by ‘mini plants’ is not recommended due

to drastic variations in quality over different batches.

d) Gypsum Gypsum is easily available in the market and is used in powder form.

e) Aluminium Powder/Paste Aluminium powder/paste is easily available from various

manufacturers. As very small quantity of Aluminium powder/paste is required to be added

to the mixture, it is usually weighed manually and added to the mixing unit.

4) Unlike Europe where 300 Km. radius is the limit for sale of AAC Blocks, in India currently due to

lack of sufficient capacity and competition, it is seen that AAC Blocks are sold even 500 km.

away from the manufacturing locations. However the radial distance in states like Gujarat

where AAC Blocks manufacturing plants are located within 200 Km of each other, is much less.

5) The capital cost for a 160,000 m3 per annum capacity plant excluding land is about Euro 1.5

Million. This is a minimum capacity plant and some of the Indian companies have a plant with

this capacity. The economically feasible plant with capacity of 500,000 m 3 per annum costs

about Euro 2.5 Million.

6) Land: A plant requires an area of 21,000 square meters for smooth operations based on a

planned capacity of 160,000 m3.

7) Each plant requires 3-4 senior level trained employees and a large number of skilled and

trained labourers. Such skilled labour is currently not available in India but there are a large

number of Indian origin labourers in Middle East (Saudi Arabia, UAE) who are coming back to

India (due to expiry of their work permits and change in regulations).

Key manufacturers of AAC Blocks in India

There are 26 manufacturers of AAC Blocks in India currently. Majority of them are located in the

state of Gujarat in Western India where one finds an AAC plant within a distance of less than 100

Km. A significant majority of these plants are set up by using imported equipment, either European

or Chinese.

Insights into the Indian AAC Block manufacturing industry

A select list of AAC block manufacturer is as under:

Name of Company # Plants Website Remarks

Cement Manufacturers

Ultratech Cements 2 http://www.ultratechbuil Ultratech Cement is one of the largest cement

dingproducts.com/ manufacturers in India. Their brand is called XTRALITE

JK Lakshmi Cement 1 www.jklakshmi.com/ The cement manufacturing capacity for the company is

5.3 Million Tons per annum

Building material companies

Biltech Building 5 http://www.biltechindia. An Avantha Group Company is engaged in mechanized

Elements Limited com/ manufacture of AAC building material in India.

Currently Biltech has over 40% of the market share

with a capacity of 470,000m3 per annum

Magicrete 2 http://magicrete.in/ Incorporated in 2008, is the second largest

manufacturer of AAC blocks and recently forayed into

offering gypsum plaster and dry mortar. Company also

recently raised USD 7 Million from an Indian Private

Equity fund.

Others (Unrelated diversification)

Ecolite by JVS 1 http://www.ecolite.in/ Their flagship Company is Sahyadri Industries Ltd.

Comatsco Industries which manufactures the Swastik brand Fibre Cement

Pvt Ltd Sheets.

Siporex 2 http://www.lccsiporex.co Use sand as the key ingredient

m/

Laxmi En-fab 1 http://www.aacplant.co.i Located in the state of Gujarat

n/index.html

Insights into the Indian AAC Block manufacturing industry

Future potential triggers

1. Rationalization of the excise and sales tax structure to bring down the cost of sales.

2. Change in the building construction norms which mandates use of Pre-cast technology in

certain types of construction.

3. Higher awareness and appreciation of the advantages of the Pre-cast technology over the

conventional method.

Options for CLIENT

CLIENT will need to have a manufacturing presence in India to be cost competitive. The two options

CLIENT can consider for setting up a manufacturing presence in India include

Option 1 Greenfield manufacturing plant

The key factors to consider when setting up the plant would include

Location and availability of land / industrial parks

Land must be correctly zoned for manufacturing. Often purchase of land in zones designated

residential or commercial is of no use and re-zoning is very complicated. Land can often not be

purchased freehold but leased for long periods (30 years to 99 years). Purchasing land can be

complicated as title searches are not always comprehensive and future claims troublesome.

Industrial parks can be the easier way forward, but even here key terms and facilities need to be

investigated.

Cost of land

Land prices have been increasing in all countries in ASEAN and in India. Increasing populations

and scarcity of land make this an emotive issue. We often advise companies to avoid sensitive

areas and select more readily available non contentious land even if the price is higher.

Negotiations on pricing are nevertheless expected and necessary.

Utilities – power, water, gas, telecommunications availability and consistency

There are usually shortages of power or water and gas. Business plans must take into account

back up electricity generation. Power costs are also usually high. Telecommunications are

usually excellent, including high speed data transfer facilities.

Accessibility and roads / Proximity and connectivity to ports / Ease of logistics and transport /

Connectivity to rail network

Logistics and transport infrastructure is key and issues here can severely impact the work flow.

Proximity to efficient and internationally connected ports is perhaps the most crucial aspect to

look into.

Insights into the Indian AAC Block manufacturing industry

The location of the plant(s); Proximity to a major city / Location

This is important for human resources reasons (ability to attract both local talent and expats) as

well as for access to decision makers and customers in the selected country.

Operations

o Raw material availability and proximity will depend on distance to power plants (for fly

ash) or river or sea ( for sand).

o Component and supplier availability and proximity

o Other competitors in the area

Labour

o Shop floor and middle management

o Cost

o Skills

o Unions / protests and labour relations

Senior Management and Expats

o Location is liveable and attractive to senior management and expats

o Location is liveable for ex pat families

Whether single or multiple locations; Size and capacities. Two strategies to compare are:

o Big Leap. Set up a major manufacturing facility

o Small Step. Set up a small assembly operation or even consider outsourced contract

manufacturing

Often much depends on human resource constraints and not just capital requirements.

Sparrow Advisory is well experienced in offering a full set of advisory services across the

entire chain of processes from strategy formulation to actual greenfield manufacturing plant

set up.

Option 2 JV with potential customers in the market

Potential JV partners

1. Thermal Power Plant Operators: All the thermal power plant operators produce large quantity

of fly ash. A typical 800 MW power plants produces 4,000TPD of fly ash. Further some of the

below mentioned power companies are also infrastructure development companies (airports,

highways, malls) and can be both raw material suppliers and end customers.

NTPC

Lanco Infratech

Insights into the Indian AAC Block manufacturing industry

GMR Infrastructure

GVK Power

DB Power

Adani Power

India Bulls Power

2. Real Estate Developers and Construction Companies

These are the potential customers and often have enough captive business to justify setting up

an AAC block manufacturing unit themselves. These companies would however be happy to set

up a Joint Venture with an industry expert who can run the plant and ensure they get their

supplies on schedule.

Real Estate Developers

DLF Limited

Parsavnath Developers

Prestige Estates

Kumar Builders

Sobha Developers

Mantri Realty

Kalpataru Realty

Omaxe Developers

Construction Companies

Shapoorji Pallonji

HCC

IVRCL

Sadbhav Engineering

Jaypee Infratech

Simplex Infrastructure

Nagarjuna Construction

Option 3 Acquisition of an existing competitor

This may not be an easy option as there are very few quality AAC blocks manufacturing companies. The

industry in India is only 3-4 years old and hence M&A may not be possible option. However we can

explore this option too.

Insights into the Indian AAC Block manufacturing industry

Annexure 1 Comparison between Autoclaved Aerated Concrete (AAC) blocks and clay bricks

# Parameter AAC Blocks Clay Bricks

1 Soil Consumption Uses fly ash which is a thermal power One sq ft of carpet area with clay brick

plant waste product & thus no walling will consume 25.5 kg of top soil

consumption of top soil

2 Fuel One sq ft of carpet area with AAC One sq ft of carpet area with clay bricks

Consumption blocks will consume 1 kg of coal will consume 8 kg of coal

3 CO2 Emission One sq ft of carpet area will emit 2.2 kg One sq ft of carpet area will emit 17.6

of CO2 kg of CO2

4 Labour Organized sector with proper HR Unorganized sector with rampant use

practices of child labour

5 Production State-of-the-art factory facility Unhealthy working conditions due to

Facility toxic gases

6 Tax Contribution Contributes to government taxes in Does not contribute to government

form of Central Excise, VAT and Octroi exchequer

7 Size 625 mm x 240 mm x 100-300 mm 225 mm x 100 mm x 65 mm

8 Variation in Size 1.5 mm (+/-) 5 mm (+/-)

9 Compressive 3.5-4 N/m2 2.5-3 N/m2

Strength

10 Dry Density 550-700 kg/m3 1800 kg/ m3

11 Fire Resistance Up to 7 hours Around 2 hours

(8” wall)

12 Cost Benefit Reduction in dead weight leading to None

savings in steel and concrete

13 Energy Saving Approximately 30% for heating and None

cooling

14 Price INR 3500-4400 per m3 i.e. Euro 45-56 INR 2400-2500 per m3 i.e. Euro 31-32

Insights into the Indian AAC Block manufacturing industry

Annexure 2 SWOT analysis of the AAC Blocks technology in Indian context

Strengths Weakness

Speed, Quality, Economy Lack of awareness, acceptability & availability

Low Maintenance Resistance to Change

Seismic Resistant Fear of Unknown

Fast payback of investments Unfamiliarity of Architects and Engineers

Universal Application Lack of Exposure to the technology in Technical

Institutes

Opportunities Threats

Huge Requirement of Affordable Houses Govt. Tax Policy, Lack of Govt. Support &

Shortage of Skilled Labor encouragement

Large Size Projects Vested Interests

Exposure to Global Market Lack of Standardization

Demand for Quality Construction

Insights into the Indian AAC Block manufacturing industry

You might also like

- Global Autoclaved Aerated Concrete AAC Market, 2020-2027Document202 pagesGlobal Autoclaved Aerated Concrete AAC Market, 2020-2027pazuzu100% (1)

- Autoclaved Aerated Concrete (AAC) Blocks Project - Brief ReportDocument12 pagesAutoclaved Aerated Concrete (AAC) Blocks Project - Brief ReportVishal Kansagra77% (31)

- AAC Sample Project Profile Universal-Ver-2Document7 pagesAAC Sample Project Profile Universal-Ver-2N Gangadhar Reddy100% (1)

- AdmixtureDocument7 pagesAdmixturevinay rodeNo ratings yet

- Fly Ash Bricks Mixing Proportion - 3 Important Formulas PDFDocument2 pagesFly Ash Bricks Mixing Proportion - 3 Important Formulas PDFsonianchal233No ratings yet

- SRD Project Doc FinalDocument65 pagesSRD Project Doc FinalRavi JoshiNo ratings yet

- CLC CostingDocument34 pagesCLC CostingpipestressNo ratings yet

- Yamaha Strategy in VietNamDocument16 pagesYamaha Strategy in VietNamLinh Jan100% (2)

- Magicrete PresentationDocument35 pagesMagicrete Presentationkareena23No ratings yet

- Autoclaved Aerated Concrete: A Sustainable Alternate of Clay Brick Masonry in Form of Light Weight ConcreteDocument6 pagesAutoclaved Aerated Concrete: A Sustainable Alternate of Clay Brick Masonry in Form of Light Weight ConcreteGRD JournalsNo ratings yet

- Report On AAC BlocksDocument8 pagesReport On AAC Blocksroan sthaNo ratings yet

- AAC Sample Prject Profile-CompleteDocument19 pagesAAC Sample Prject Profile-Completettpatel91No ratings yet

- Aac E - BrochureDocument10 pagesAac E - BrochureRahul AggarwalNo ratings yet

- QT8 FlyAsh Bricks Project Report May-2014 PDFDocument15 pagesQT8 FlyAsh Bricks Project Report May-2014 PDFesha108No ratings yet

- AAC Blocks Manufacturers - MagnaDocument6 pagesAAC Blocks Manufacturers - MagnaMagna GreenNo ratings yet

- Project Design Document (PDD) : CDM - Executive BoardDocument84 pagesProject Design Document (PDD) : CDM - Executive BoardParakh AgrawalNo ratings yet

- KERALITE BrochureDocument8 pagesKERALITE BrochurejayanthNo ratings yet

- Hdian Standard: Methods Off Test For Autoclaved Cellular Concrete ProductsDocument10 pagesHdian Standard: Methods Off Test For Autoclaved Cellular Concrete ProductsshailendraNo ratings yet

- Biltech Aac BlocksDocument4 pagesBiltech Aac BlocksManish PatelNo ratings yet

- CLC Plant DetailDocument17 pagesCLC Plant DetailSibiyarasu Rock RiderNo ratings yet

- 3.bom-Civil-Meghana Aac Blocks IndustryDocument15 pages3.bom-Civil-Meghana Aac Blocks IndustrytechnopreneurvizagNo ratings yet

- Manufacturing Process of Aac Block: Anurag WahaneDocument8 pagesManufacturing Process of Aac Block: Anurag Wahanemshabanero2359No ratings yet

- TilesDocument6 pagesTilesraja qammarNo ratings yet

- Project Report On Polycarboxylate Ether Superplasticizer (Pce)Document7 pagesProject Report On Polycarboxylate Ether Superplasticizer (Pce)EIRI Board of Consultants and PublishersNo ratings yet

- Birla Aerocon AAC Blocks - Literature V01 PDFDocument4 pagesBirla Aerocon AAC Blocks - Literature V01 PDFdhruvNo ratings yet

- The Fly Ash Brick Production TechnologyDocument18 pagesThe Fly Ash Brick Production TechnologyVishal KedarNo ratings yet

- Autotherm - AAC Plant Project Report - SimpleDocument9 pagesAutotherm - AAC Plant Project Report - SimpleAutotherm Equipments CorporationNo ratings yet

- Diploma 6TH Sem ProjectDocument34 pagesDiploma 6TH Sem ProjectlakhazapadaNo ratings yet

- Is 2645 (2003) - Integral Waterproofing Compounds For Cement Mortar and Concrete - SpecificationDocument16 pagesIs 2645 (2003) - Integral Waterproofing Compounds For Cement Mortar and Concrete - SpecificationMeet ChokshiNo ratings yet

- Is 15622 2006 PDFDocument20 pagesIs 15622 2006 PDFPatel SumitNo ratings yet

- Fly Ash FinalDocument38 pagesFly Ash FinalThahzeen KazifNo ratings yet

- BASF Introduces Smart Dynamic ConcreteDocument4 pagesBASF Introduces Smart Dynamic ConcreteNurul Hidayati100% (1)

- Aac Block Plants: WWW - Buildmate.InDocument12 pagesAac Block Plants: WWW - Buildmate.InAzmat Ali KhanNo ratings yet

- Eco-Friendly Walls: AAC BlocksDocument101 pagesEco-Friendly Walls: AAC Blockspoonam_ceNo ratings yet

- Study and Experimentation of Autoclaved Aerated Concrete by Using Fly AshDocument5 pagesStudy and Experimentation of Autoclaved Aerated Concrete by Using Fly AshInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Optimization of Ready Mix Concrete (RMC)Document6 pagesOptimization of Ready Mix Concrete (RMC)JuanCarlosCarrilloNo ratings yet

- Some Trends in The Use of Concrete: Indian ScenarioDocument6 pagesSome Trends in The Use of Concrete: Indian ScenarioHarry SidhuNo ratings yet

- Role of Chemical Admixtures in Sustainability - The OpportunityDocument28 pagesRole of Chemical Admixtures in Sustainability - The OpportunityThiagoMaronNo ratings yet

- Orilite AAC Block FAQDocument16 pagesOrilite AAC Block FAQAshish JainNo ratings yet

- Auto Aerated ConcreteDocument6 pagesAuto Aerated ConcreteLeo GohNo ratings yet

- Use of Bottom Ash As Fine Aggregate in Concrete A Review Ijariie3297Document10 pagesUse of Bottom Ash As Fine Aggregate in Concrete A Review Ijariie3297Sphero CastilloNo ratings yet

- Paver Block Manufacturing UnitDocument12 pagesPaver Block Manufacturing UnitMusic & ArtNo ratings yet

- Analysis of Autoclaved Aerated Concrete (AAC) Blocks With Reference To Its Potential and SustainabilityDocument12 pagesAnalysis of Autoclaved Aerated Concrete (AAC) Blocks With Reference To Its Potential and SustainabilityDheeraj RanganathNo ratings yet

- Autoclaved Aerated Concrete BlockDocument53 pagesAutoclaved Aerated Concrete BlocksharanyaNo ratings yet

- Literature Review On Technical Aspect of Sustainable ConcreteDocument9 pagesLiterature Review On Technical Aspect of Sustainable ConcreteAnneLabacoNo ratings yet

- IS 15622 (2006) - Pressed Ceramic TilesDocument20 pagesIS 15622 (2006) - Pressed Ceramic TilesTAJAMULNo ratings yet

- Jindal Air Aac BlockDocument12 pagesJindal Air Aac BlockAmit BhattNo ratings yet

- High Early Strength ConcreteDocument29 pagesHigh Early Strength ConcreteHadeer HosnyNo ratings yet

- Project Profile On Fly Ash BricksDocument15 pagesProject Profile On Fly Ash BricksHarshit JajuNo ratings yet

- Presents: Flyash Brick - An Entrepreneur'S ApproachDocument35 pagesPresents: Flyash Brick - An Entrepreneur'S ApproachAbdulHannan PatwegarNo ratings yet

- MYK Arment PresentationDocument31 pagesMYK Arment PresentationPrince PandeyNo ratings yet

- Non-Autoclaved Aerated Concrete (NAAC) Blocks: An Alternative Building Construction MaterialDocument5 pagesNon-Autoclaved Aerated Concrete (NAAC) Blocks: An Alternative Building Construction MaterialIJRASETPublicationsNo ratings yet

- Autoclaved Areated Concrete or Light Weight ConcreteDocument16 pagesAutoclaved Areated Concrete or Light Weight ConcreteMohammed Khaja NaseerNo ratings yet

- Studies On Quarry Dust As Partial Replacement of Fine Aggregates in ConcreteDocument3 pagesStudies On Quarry Dust As Partial Replacement of Fine Aggregates in ConcreteEditor IJLTEMASNo ratings yet

- Admixture PPT For CMT G-2Document39 pagesAdmixture PPT For CMT G-2Marinella Garingan100% (1)

- Autoclaved Aerated Concret11Document5 pagesAutoclaved Aerated Concret11Ahmed SaberNo ratings yet

- 17.sec.1700 (Structural Concrete)Document16 pages17.sec.1700 (Structural Concrete)aalignup arc & const. pvt ltdNo ratings yet

- Wall PannelsDocument5 pagesWall PannelsGaurav MallaNo ratings yet

- Revenue RevenueDocument5 pagesRevenue RevenuekishanmehrotraNo ratings yet

- AAC Block - Conquering Brick by Brick PDFDocument10 pagesAAC Block - Conquering Brick by Brick PDFAkshayNo ratings yet

- Model Project: Iccmrt College LucknowDocument40 pagesModel Project: Iccmrt College LucknowPrabhakar SinghNo ratings yet

- Relaxation of Norms - Startups - Medium - Enterprises - PublicProcurementDocument3 pagesRelaxation of Norms - Startups - Medium - Enterprises - PublicProcurementsaurabh323612No ratings yet

- Sales PlanDocument26 pagesSales Plansaurabh323612No ratings yet

- Dewan Akshay - CV PDFDocument2 pagesDewan Akshay - CV PDFsaurabh323612No ratings yet

- ALL3Document144 pagesALL3saurabh323612No ratings yet

- GS36J04A10-01E - 020 (Exaquantum)Document10 pagesGS36J04A10-01E - 020 (Exaquantum)Tran DinhNo ratings yet

- Erection Manual-Pc PipingDocument219 pagesErection Manual-Pc Pipingalinor_tn100% (2)

- Spanish Logistics Sector: Supply ChainDocument7 pagesSpanish Logistics Sector: Supply ChainMorvinNo ratings yet

- Diagram of ISO 17025:2017 Implementation ProcessDocument1 pageDiagram of ISO 17025:2017 Implementation ProcessraquelNo ratings yet

- Lesson 5: The Basics of ProcurementDocument38 pagesLesson 5: The Basics of ProcurementJanica PacificoNo ratings yet

- Der 354 PDFDocument4 pagesDer 354 PDFTamer BidakNo ratings yet

- Vice President Sales Marketing in Southeast USA Resume Glen MichalskeDocument2 pagesVice President Sales Marketing in Southeast USA Resume Glen MichalskeGlenMichalskeNo ratings yet

- Manleo E-CatalogueDocument10 pagesManleo E-CatalogueabhijithbhatnNo ratings yet

- DS C20 Call Session Controller 0715Document3 pagesDS C20 Call Session Controller 0715kaz7878No ratings yet

- Catalogo Miller Safety Cat132016Document80 pagesCatalogo Miller Safety Cat132016Jimy BarronNo ratings yet

- 年产60万吨丙烷脱氢制丙烯装置的丙烯丙烷精馏模拟优化 邓生鑫Document77 pages年产60万吨丙烷脱氢制丙烯装置的丙烯丙烷精馏模拟优化 邓生鑫Grey DaveNo ratings yet

- Common Sucker Rod SpecificationsDocument1 pageCommon Sucker Rod SpecificationsMichelangeloTiberiiNo ratings yet

- Egnatia Rom G: Romania RomaniaDocument12 pagesEgnatia Rom G: Romania RomaniaThomas MelitsisNo ratings yet

- Spare Parts Master N (8105.181)Document20 pagesSpare Parts Master N (8105.181)Julian M. AndrettiNo ratings yet

- Cit 743 Past QuestionsDocument3 pagesCit 743 Past QuestionsBukola BukkyNo ratings yet

- What Does PLC' Mean?: Disadvantages of PLC ControlDocument2 pagesWhat Does PLC' Mean?: Disadvantages of PLC Controlmanjunair005No ratings yet

- Online Shopping Mall Software Requirements SpecificationDocument7 pagesOnline Shopping Mall Software Requirements SpecificationKumaran SgNo ratings yet

- Baljeet ResumeDocument3 pagesBaljeet ResumeBaljeet BeetaNo ratings yet

- Mini ProjectDocument22 pagesMini ProjectAshutosh PandeyNo ratings yet

- Sol 11 3 Repo Md5sumsDocument2 pagesSol 11 3 Repo Md5sumsramalingam_decNo ratings yet

- Sweekar E Rickshaw - ProposalDocument14 pagesSweekar E Rickshaw - ProposalAishna SenguptaNo ratings yet

- Iso 9001 CRMDocument6 pagesIso 9001 CRMNavnath TamhaneNo ratings yet

- Wartsila Annual Report 2008 En.Document144 pagesWartsila Annual Report 2008 En.Uhrin ImreNo ratings yet

- 42-QR-1P26 B3 Element Hydro Quick StartDocument1 page42-QR-1P26 B3 Element Hydro Quick StartElputoAmo XDNo ratings yet

- Spectra Encryption User GuideDocument100 pagesSpectra Encryption User GuideMarcos Vinicius SilvaNo ratings yet

- Dental Chair: A-Dec Service Guide, Vol. IIDocument40 pagesDental Chair: A-Dec Service Guide, Vol. IIQuang Định ĐinhNo ratings yet

- Outline The Goals For Your Website Project ReportDocument2 pagesOutline The Goals For Your Website Project ReportKapil ChawlaNo ratings yet

- What Are The Best Websites For PROJECT MANAGEMENTDocument26 pagesWhat Are The Best Websites For PROJECT MANAGEMENTRajarathinam ThangaveluNo ratings yet

- Demand Factor-Diversity Factor-Utilization Factor-Load Factor - Electrical Notes & ArticlesDocument20 pagesDemand Factor-Diversity Factor-Utilization Factor-Load Factor - Electrical Notes & ArticlesRashid M AnsariNo ratings yet