Professional Documents

Culture Documents

#280 BBB 08-26-10 10

#280 BBB 08-26-10 10

Uploaded by

bmoakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

#280 BBB 08-26-10 10

#280 BBB 08-26-10 10

Uploaded by

bmoakCopyright:

Available Formats

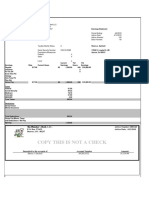

MAGNOLIA

CLIPPING SERVICE

(601) 856-0911 I (205) 758.8610

CLARION LEDGER

JACKSON, MS

Circulation =115223 .

DAILY

07/30/2010

II'"111111111 I1II1I1 11/1111111111111

New FTC rule aimed

Debt: Violations to cost firms $16K

Fr~B

rule apply to any debt relief will go after companies that

at debt·settlements

]\(

late tees and interest charges companies that sell services

continue piling up. over the phone. They do no

Customers are also often apply if the initial contact is

required to start setting aside in-person, or if the services

pose as nonprofits.

The Better Business

Bureatrcau~ersto

be-wal y of any organization

• Companies can Customers complained.

money in a separate account are rendered entirely online. that charges steep upfront

that they ended up deeper in

charge only after debt or were sued by credi maintained by the debt settle The new rule will cover the fees and makes promises that .

tors after failing to make ment company. vast majority of the debt set sound too good to be true.

debt is reduced This money is intended to tlement industry, however, The group also suggests

payments. The bureau did

The Associated Press not separately track com eventually payoff any remain because most companies use that struggling borrowers

NEW YORK - Compa plaints against the industry ingdebt. TVand radio ads to advertise first try contacting lenders

nies that promise to reduce prior to the recession. Under the new rule, how .toll-free phone numbers for directly to negotiate debt.

or eliminate credit card bal Debt settlement compa ever, companies will only be customers to call, said Allison Alternatively, borrowers

ances and other debt for cus nies often charge an upfront able to require such an Brown, an attorney with the can seek help from nonprofit

tomers will no longer be fee, typically a percentage of account if it's maintained at . FTC. credit counseling centers,

allowed to charge an upfront the customer's outstanding an independent financial Debt settlement compa which typically charge small

fee. balance. institution under a cus nies that step outside the nominal fees for help manag

The Federal Trade Com In exchange, the company tomer's name. rules will be subject to a ingdebt.

mission said Thursday that promises to negotiate with The customer also must be $16,000 fine per violation. Nonprofit credit coun

the new restrictions are a creditors to reduce or elimi able to withdraw the money The Federal Trade Com selors can be located on the

crack down on the debt set nate the debt, sOmetimes by at any time without penalty. mission's rules only apply to National Foundation for

tlement mdustry. which as much as half.

The amendments to the for-profit companies. Credit Counseling's website

flourished during the eco The new FTC regulations FTC's telemarketing sales The agency warned that it at www.nfcc.org.

nomic downturn as bor also require debt settlement

rowers struggled to pay companies to disclose to

bills. customers how long it will

Debt settlement compa take to get results, how

nies will now be able to much it will cost, and any

charge a fee only once a cus negative consequences that

toruer's debt has been could arise from the

reduced, settled or renegoti process.

ated. The rule goes into For example, customers

effect Oct. 27. can go deeper into debt

Since the start of the when they hire a debt settle

recession, the. Better Busi ment company.

ness Bureau has received This is because cus

moretllan 3,500 complaints tomers stop making pay

about debt settlement com ments on their loans, and

panies.

-

Se(DEBT,~B

..

You might also like

- Credit Sweeps 101Document80 pagesCredit Sweeps 101Burnett Shackleford100% (14)

- Section 609 of The Fair Credit Reporting Act LoopholeDocument7 pagesSection 609 of The Fair Credit Reporting Act LoopholeFreedomofMind98% (40)

- Debt SettlementDocument5 pagesDebt SettlementtintypeadherenthplaNo ratings yet

- Assignment#2Document3 pagesAssignment#2Kit KatNo ratings yet

- This MORTGAGE Is Made and Executed byDocument3 pagesThis MORTGAGE Is Made and Executed bylookalikenilongNo ratings yet

- #280 BBB 09-24-09 31Document1 page#280 BBB 09-24-09 31bmoakNo ratings yet

- Ask Ombudsman News: Q Q A ADocument20 pagesAsk Ombudsman News: Q Q A ASteven HamiltonNo ratings yet

- Self Credit RepairDocument4 pagesSelf Credit Repairahmal coaxum100% (1)

- HPDL Fraud Factoring Article 4Document4 pagesHPDL Fraud Factoring Article 4Frederick LinusNo ratings yet

- Lesson 9 - The Importance of LicensingDocument4 pagesLesson 9 - The Importance of LicensingroxanformillezaNo ratings yet

- Sa Oct08 Irons PDFDocument3 pagesSa Oct08 Irons PDFIfra38No ratings yet

- Consumer Credit 2021Document2 pagesConsumer Credit 2021Finn KevinNo ratings yet

- #280 BBB 03-25-10 119Document1 page#280 BBB 03-25-10 119bmoakNo ratings yet

- Starting and Managing A Collection AgencyDocument10 pagesStarting and Managing A Collection AgencyBryan Jacob CarrascoNo ratings yet

- Garbage GuideDocument2 pagesGarbage GuidesdfadfNo ratings yet

- #280 BBB 10-28-10 1Document1 page#280 BBB 10-28-10 1bmoakNo ratings yet

- Credit RepairDocument8 pagesCredit RepairsoyeaNo ratings yet

- Active & Passive BriberyDocument40 pagesActive & Passive Briberyماہم مبشرNo ratings yet

- Cacc 1Document52 pagesCacc 1Michael BenzingerNo ratings yet

- Stone County Enterprise, Feb 11 2010Document1 pageStone County Enterprise, Feb 11 2010bmoakNo ratings yet

- Debt RecoveryDocument5 pagesDebt RecoveryTanushree100% (1)

- Factoring Project ReportDocument15 pagesFactoring Project ReportSiddharth Desai100% (3)

- Finance Update - August 2003: Financial AssistanceDocument8 pagesFinance Update - August 2003: Financial AssistanceAllen ZhangNo ratings yet

- DBN Sheet Recovery BoN V2023 04dDocument1 pageDBN Sheet Recovery BoN V2023 04dvictoria upindiNo ratings yet

- Tavonga Banking Law and PracticeDocument6 pagesTavonga Banking Law and PracticeTavonga Enerst MasweraNo ratings yet

- Special Event (Rangkuman)Document4 pagesSpecial Event (Rangkuman)FACIA ADINDA Mahasiswa PNJNo ratings yet

- Capital Structure Limit To Usage of DebtDocument28 pagesCapital Structure Limit To Usage of DebtAlisha SharmaNo ratings yet

- BAO3404 PayDay Lending 20211Document13 pagesBAO3404 PayDay Lending 20211Senuri AlmeidaNo ratings yet

- Vendor Finance, Loan Against Invoice - Purchase Order - Work Order, Apply Online - FlexiLoansDocument5 pagesVendor Finance, Loan Against Invoice - Purchase Order - Work Order, Apply Online - FlexiLoansCissé AssaneNo ratings yet

- Avoid Being Scammed By A Credit Repair CompanyFrom EverandAvoid Being Scammed By A Credit Repair CompanyRating: 3 out of 5 stars3/5 (1)

- Metro Inc v. CIRDocument2 pagesMetro Inc v. CIRJahn Avery Mitchel DatukonNo ratings yet

- #280 BBB 01-28-10 27Document1 page#280 BBB 01-28-10 27bmoakNo ratings yet

- #280 BBB 01-28-10 15Document1 page#280 BBB 01-28-10 15bmoakNo ratings yet

- AMS Carrier DownloadsDocument12 pagesAMS Carrier Downloadshsong92No ratings yet

- Ilovepdf MergedDocument180 pagesIlovepdf MergedIshan vermaNo ratings yet

- Chapter 7-9 Reviewer Semi FinalsDocument10 pagesChapter 7-9 Reviewer Semi FinalsAngel FuentesNo ratings yet

- Metro Inc v. CIRDocument2 pagesMetro Inc v. CIRJahn Avery Mitchel DatukonNo ratings yet

- Q 1 So MapleDocument2 pagesQ 1 So MapleabcNo ratings yet

- CH 8 - MergedDocument30 pagesCH 8 - MergedIshan vermaNo ratings yet

- Cases Mancon 10-12Document2 pagesCases Mancon 10-12Teresa RevilalaNo ratings yet

- Personal Insolvency - BankruptcyDocument2 pagesPersonal Insolvency - BankruptcyZoita MandilaNo ratings yet

- CASE STUDY Ignore Waving Red Flags Pay The Cost JMatthews StoneTurnDocument6 pagesCASE STUDY Ignore Waving Red Flags Pay The Cost JMatthews StoneTurnChristian M Nino-Moris FANo ratings yet

- 5Document2 pages5Bea SantillanNo ratings yet

- ScoreDocument7 pagesScoreprevailboluwaduroNo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Resource GuideDocument4 pagesResource GuideNasir ZahidNo ratings yet

- Resolving Insolvency - APPG On Fair Business BankingDocument32 pagesResolving Insolvency - APPG On Fair Business BankinghyenadogNo ratings yet

- Cash Plus Personal Loan PdsDocument2 pagesCash Plus Personal Loan PdsVaishnavi KrishnanNo ratings yet

- Press Releases 2010 - OFT Requires MBNA To Improve Debt Collection PracticesDocument2 pagesPress Releases 2010 - OFT Requires MBNA To Improve Debt Collection PracticesSimply Debt SolutionsNo ratings yet

- The High Cost of Small BribesDocument20 pagesThe High Cost of Small BribesO_____oNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument256 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationRaoul TurnierNo ratings yet

- Business Finance IiDocument5 pagesBusiness Finance Iiznd6cyzskmNo ratings yet

- CPBM QuestionaireDocument133 pagesCPBM QuestionaireRamesh SharmaNo ratings yet

- Accounting FinanceDocument2 pagesAccounting FinanceJane DizonNo ratings yet

- How Some Attorneys Can Turn R500 Debt Into R10 000 - Fin24Document3 pagesHow Some Attorneys Can Turn R500 Debt Into R10 000 - Fin24William HumphreysNo ratings yet

- Maxwell-Johnson Funeral Homes CorporationDocument13 pagesMaxwell-Johnson Funeral Homes CorporationteriusjNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument262 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationBhargavVithalani100% (1)

- Examples of Active BriberyDocument44 pagesExamples of Active BriberyAmeer HamzaNo ratings yet

- Reportg6 Soft Copy CreditfinancepracticesDocument10 pagesReportg6 Soft Copy CreditfinancepracticesCEA CardsNo ratings yet

- #280 BBB 04-29-10 188Document1 page#280 BBB 04-29-10 188bmoakNo ratings yet

- #280 BBB 12-30-10 21Document1 page#280 BBB 12-30-10 21bmoakNo ratings yet

- #280 BBB 12-30-10 59Document1 page#280 BBB 12-30-10 59bmoakNo ratings yet

- #280 BBB 12-30-10 141Document1 page#280 BBB 12-30-10 141bmoakNo ratings yet

- #280 BBB 12-30-10 99Document1 page#280 BBB 12-30-10 99bmoakNo ratings yet

- #280 BBB 12-30-10 67Document1 page#280 BBB 12-30-10 67bmoakNo ratings yet

- #280 BBB 12-30-10 100Document1 page#280 BBB 12-30-10 100bmoakNo ratings yet

- #280 BBB 12-30-10 215Document1 page#280 BBB 12-30-10 215bmoakNo ratings yet

- #280 BBB 12-30-10 218Document1 page#280 BBB 12-30-10 218bmoakNo ratings yet

- TcodeDocument2 pagesTcodeMere HamsafarNo ratings yet

- CM1A Masterclass IAIDocument52 pagesCM1A Masterclass IAIHimal ThapaNo ratings yet

- Bases of Credit and Credit Investigation AppraisalDocument14 pagesBases of Credit and Credit Investigation AppraisalLaraya, Roy MatthewNo ratings yet

- 10000021266Document30 pages10000021266Chapter 11 DocketsNo ratings yet

- Life InsuranceDocument16 pagesLife InsuranceKanika LalNo ratings yet

- Credit Card Debt Assignment Josh ButlerDocument3 pagesCredit Card Debt Assignment Josh Butlerapi-242789076No ratings yet

- The Power of CreditDocument32 pagesThe Power of CreditSanjay RagupathyNo ratings yet

- Interest Practice ProblemsDocument26 pagesInterest Practice ProblemsSaadia Anwar Ali100% (1)

- VLKhqyk TBP MWL 5 D YDocument3 pagesVLKhqyk TBP MWL 5 D YAman ChaudharyNo ratings yet

- Zainab TrabishiDocument28 pagesZainab Trabishialaaemam79No ratings yet

- Webnotice - Po - MT CRP Xii 2024-25Document15 pagesWebnotice - Po - MT CRP Xii 2024-25arunkumarNo ratings yet

- Idfc Bank 4160Document7 pagesIdfc Bank 4160manishasurywanshi91No ratings yet

- Axis Bank - 123456763542 - Sample Statement - cc319740Document5 pagesAxis Bank - 123456763542 - Sample Statement - cc319740Seemab LatifNo ratings yet

- StatementOfAccount 3092378518 Jul17 141113.csvDocument49 pagesStatementOfAccount 3092378518 Jul17 141113.csvOur educational ServiceNo ratings yet

- Sheria Pay CHK 04-12-2019 2 PDFDocument1 pageSheria Pay CHK 04-12-2019 2 PDFLynn JonesNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- Module2 EconDocument45 pagesModule2 EconandreslloydralfNo ratings yet

- Jan 31, 2022Document2 pagesJan 31, 2022kramergeorgec397No ratings yet

- RateSheet January 2024 ReviewedDocument1 pageRateSheet January 2024 Revieweddonovansaunders058No ratings yet

- MayaSavings SoA 2023OCTDocument17 pagesMayaSavings SoA 2023OCTfitdaddyphNo ratings yet

- Financing - Study SheetDocument6 pagesFinancing - Study SheetAnand100% (1)

- The Fidelity Self-Employed 401 (K) Contribution W Worksheet For Unincorporated BusinessesDocument2 pagesThe Fidelity Self-Employed 401 (K) Contribution W Worksheet For Unincorporated BusinessesokumurakozoNo ratings yet

- Economics Chapter 3Document6 pagesEconomics Chapter 3Aavy MishraNo ratings yet

- Account Statement 57387 15 08 2023T15 08 08Document1 pageAccount Statement 57387 15 08 2023T15 08 08Abdul Naeem KhanNo ratings yet

- Plastic Money PDFDocument6 pagesPlastic Money PDFJosé BurgeiroNo ratings yet

- Monzo Bank Statement 2022 05 01-2022 07 31 2034Document6 pagesMonzo Bank Statement 2022 05 01-2022 07 31 2034tunichabentoNo ratings yet

- APY Subscriber Registration FormDocument1 pageAPY Subscriber Registration FormknlsinhaNo ratings yet

- 1.permanent Account Number (Pan)Document15 pages1.permanent Account Number (Pan)Santosh kumer DasNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet