Professional Documents

Culture Documents

Tgs Pogram PascaUIT (AKK)

Tgs Pogram PascaUIT (AKK)

Uploaded by

ernawati. SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tgs Pogram PascaUIT (AKK)

Tgs Pogram PascaUIT (AKK)

Uploaded by

ernawati. SCopyright:

Available Formats

Created by Dr.Muhtar Sapiri,SE.,MM.,M.Kes.,Ak.

,CPA 1

TUGAS

No.1 ( EOQ)

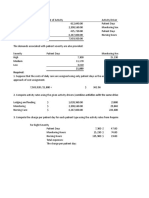

Geneva Company produces safety goggles for coal miner. Goggle are produced in batches according to

model and size. Although the setup and production time varies for each model, the smallest lead time

is 6 days. The most popular model, Model SG4, takes 2 days for setup and the production rate is 750

units per day. Th expected annual demand for the model is 36.000 units. Demand for the model,

however, can reach 45.000 units. The cost of carrying one SG4 unit is $3 per unit. The setup cost is

$6.000 . Geneva chooses its batch size based on the economic order quantity criterion. Expected

annual demand is used to computed the EOQ.

Recently, Geneva has encountered some stiff competition, especially from foreign sources. Some of the

foreign competitors have been able to produce and deliver the googles to retailers in half the time it

takes Geneva to produce. For example, a large retailer recently requested a delivery of 12.000 SG4

googles with the stipulation that they be delivered within 7 working days. Geneva had 3.000 units of

SG4 in stock. The informed the potential customer that they could deliver 3.000 units immediately and

the other 9.000 units in about 14 working days.. with the possibility of interim partial orders being

delivered. The costumer declined the offer indicating that the total order had to be delivered within 7

working days so that their stores could take advantage of same special local condition. The costumer

expressed regret and indicated that they would accept the order from another competitor who could

satisfy the time requirements.

REQUIRED:

1. Calculated the optimal batch size for model SG4 using the EOQ model. Was Geneva response

to the costumer right ? Would it take the time indicated to produces the number of units wanted

by the costumer ? Explain with supporting computation.

2. Upon learning of the lost order, the marketing manager grumbled about Geneva’s inventory

policy “ We lost the order because we didn’t have sufficient inventory. We need to carry more

units in inventory would have been needed to meet customer requirements? In the future, should

geneva carry more inventory? Can you think of other solutions?

3. Fenton gray, the head of industrial engineering, reacted differenty to the lost order “ Our

problem is more complex than insufficient inventory. I know that our foreign competitor carry

much less inventory than we do. What we need to do is decrease the lead time. I have been

studying this problem and my staff has found a way to reduce setup time for model SG4 from 2

days to 1,5 hours. Using the new procedure, setup cost can be reduced to about $94. Also, by

rearranging the plant layout for this product--- creating what are called manufacturing cells---

we can increase the production rate from 750 units per days to about 2.000 units per days.

Assume that the engineer’s estimated are on target. Compute the new optimal batch size (using

the EOQ formula). What is the new lead time ? Given this new information, would Geneva

have been able to meet the costumer time requirement? Assume that there are eight hours

available in each workday.

4. Suppose that the setup time and cost are reduced to 0,5 hours and $100, respectively. What is

the batch size now? As setup time approaches zero and the setup cost becomes negligible, what

does this imply? Assume for example that it takes 5 minutes to setup and cost about $0,864 per

setup.

No.2 (BREAK EVENT POINT)

Danna Lumus, the marketing manager for a division that produces variety of paper product, was

considering the divisional manager’s request for a sales forcast for a new line of paper napkins. The

divisional manager was gathering data so that he could choose between two different production

processes. The first process would have a variable cost of $10 per case produced and fixed cost of

$100.000. The second process would have a variable cost of $6 per case and fixed cost of $200.000,-.

The selling price would be $30 per case. Danna had just completed a marketing analysis that projected

annual sales of $30.000 cases.

Danna was reluctant to report the 30.000 forecast to the divisional manager. She knew that the first

process was labor intensive, whereas the second was largely automated with little labor and no

requirement for an aaditional production supervisor. If the first process were chosen, jerry Johnson, a

good friend, would be appointed as the line supervisor. If the second process were chosen, Jerry and an

entire line of laborers would be laid off. After some consederation, Danna revised the projected sales

downward to 22.000 cases.

Created by Dr.Muhtar Sapiri,SE.,MM.,M.Kes.,Ak.,CPA 2

She believed that the revision downward was justified. Since it would lead the divisional manager to

choose the manual system, it showed a sensitivity to the needs of current employees sensitivity that she

was afraid her divisional manager did not possess. He was too focused on quantitative factors in his

decision making and usually ignored the qualitative aspects.

REQUIRED :

1. Compute the break eventpoint for each process

2. Compute the sales volume for wich the two process are equally profitable. Indentify the range

of sale for wich the manual process is more profitable than automated process. Identify the

range of sale for wich the automated process is more profitable than manual process. Why did

the divisional manager want the sales forecast?

3. Discuss Danna’s decision to alter the sales forecast. Do you agree with it ? Disd she act

ethically? Was her decision justified since it helped a number of employees retain their

employment? Should the impact on employees be factored nto decision? In fact, is it unethical

not to consider the impact of decisions on employees?

------------------- SELAMAT MENGERJAKAN-------------------

You might also like

- ABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitDocument3 pagesABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitKailash KumarNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Corporate Goverance - Exercise 2Document4 pagesCorporate Goverance - Exercise 2Aprille Gay FelixNo ratings yet

- 1.kieso 2020-1118-1183Document66 pages1.kieso 2020-1118-1183dindaNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument80 pagesSegmented Reporting, Investment Center Evaluation, and Transfer PricingHanabusa Kawaii Idou0% (1)

- E7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDocument3 pagesE7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDhiva Rianitha Manurung100% (1)

- Chapter 19 SolutionsDocument13 pagesChapter 19 SolutionsreginaNo ratings yet

- Chapter 17 HWDocument40 pagesChapter 17 HWEejay MagatNo ratings yet

- Chapter 3 Managerial AccDocument3 pagesChapter 3 Managerial AccLydia SamosirNo ratings yet

- SolutionDocument14 pagesSolutionRishiaendra Cool100% (1)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanNo ratings yet

- Horngren Cost 7ce ISM Ch14Document36 pagesHorngren Cost 7ce ISM Ch14Alan WenNo ratings yet

- Tata Firmansyah - 018 - Assignment Job Order CostingDocument8 pagesTata Firmansyah - 018 - Assignment Job Order CostingTata FirmansyahNo ratings yet

- CH 15Document35 pagesCH 154ever.loveNo ratings yet

- BS 1722-14-1992 Specification For Open Mesh Steel Panel FencesDocument24 pagesBS 1722-14-1992 Specification For Open Mesh Steel Panel FencesAnoyNo ratings yet

- Akmen Soal Review Uas PDFDocument8 pagesAkmen Soal Review Uas PDFvionaNo ratings yet

- Tugas AkmenDocument1 pageTugas AkmenArie ArganthaNo ratings yet

- Calculus Company Makes Calculators For StudentsDocument2 pagesCalculus Company Makes Calculators For StudentsElliot RichardNo ratings yet

- CH 21 SMDocument45 pagesCH 21 SMNafisah Mambuay100% (1)

- Excel RevenueDocument44 pagesExcel RevenueromaricheNo ratings yet

- Exercise 6Document4 pagesExercise 6Tania MaharaniNo ratings yet

- Meyerson S Bakery Is Considering The Addition of A New LineDocument1 pageMeyerson S Bakery Is Considering The Addition of A New LineLet's Talk With HassanNo ratings yet

- AC2101 Sem 7 Group 3 PPT AmendedDocument39 pagesAC2101 Sem 7 Group 3 PPT AmendedKwang Yi JuinNo ratings yet

- ELEMOS, Marianne Joselle D.-BSM21-HW#4Document8 pagesELEMOS, Marianne Joselle D.-BSM21-HW#4Marianne ElemosNo ratings yet

- CH 19 SMDocument26 pagesCH 19 SMNafisah MambuayNo ratings yet

- Wahyudi Syaputra - Assignment Week 13Document11 pagesWahyudi Syaputra - Assignment Week 13Wahyudi SyaputraNo ratings yet

- 9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Document4 pages9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Christy Angkouw0% (1)

- Cost and Management Accounting - Tugas 6 - 5 November 2019Document3 pagesCost and Management Accounting - Tugas 6 - 5 November 2019AlfiyanNo ratings yet

- Slide Akuntansi ManahemenDocument10 pagesSlide Akuntansi ManahemenHandaru Edit Sasongko0% (1)

- Tugas 5Document17 pagesTugas 5Syafiq RamadhanNo ratings yet

- Beams11 ppt05Document39 pagesBeams11 ppt05Christian TambunanNo ratings yet

- Chapter 09 Indirect and Mutual HoldingsDocument12 pagesChapter 09 Indirect and Mutual HoldingsNicolas ErnestoNo ratings yet

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDocument4 pagesThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDocument2 pagesKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Capitalization of Interest Langer Airline Is Converting From Pis PDFDocument1 pageCapitalization of Interest Langer Airline Is Converting From Pis PDFAnbu jaromiaNo ratings yet

- Problem 18 - 18 18 - 31 and 18 - 32Document5 pagesProblem 18 - 18 18 - 31 and 18 - 32anon_459698449No ratings yet

- 5 Part 1,2 and 3 Chapter 12 PricingDocument14 pages5 Part 1,2 and 3 Chapter 12 PricingZaid Al-rakhes100% (1)

- Chapter 09 Indirect and Mutual HoldingsDocument22 pagesChapter 09 Indirect and Mutual HoldingsKukuh HariyadiNo ratings yet

- AKL 2 - Tugas 4 Marselinus A H T (A31113316)Document5 pagesAKL 2 - Tugas 4 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Beams Aa13e SM 08Document36 pagesBeams Aa13e SM 08Akila Kirana RatriNo ratings yet

- Intermediate Accounting III Homework Chapter 18Document15 pagesIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- IFRS 15 Session4 Handout 1Document2 pagesIFRS 15 Session4 Handout 1Simon YossefNo ratings yet

- Chapter 6 - Accounting and The Time Value of MoneyDocument96 pagesChapter 6 - Accounting and The Time Value of MoneyTyas Widyanti100% (2)

- Chapter 7 Problem 7.3 Nathali, Jeffrey, TasyaDocument6 pagesChapter 7 Problem 7.3 Nathali, Jeffrey, Tasyavtech netNo ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Chapter 20 - Inventory Management, Just in Time & Back Flush CostingDocument3 pagesChapter 20 - Inventory Management, Just in Time & Back Flush Costingaprina.sNo ratings yet

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocument22 pagesAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNo ratings yet

- Soal Bab 15Document5 pagesSoal Bab 15suci monalia putriNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Capacity: Critical Thinking ExercisesDocument6 pagesCapacity: Critical Thinking ExercisesJennysanNo ratings yet

- LittleField A7 Section ADocument5 pagesLittleField A7 Section APraveen PamnaniNo ratings yet

- Capacity Critical Thinking ExercisesDocument3 pagesCapacity Critical Thinking ExercisesLe MinhNo ratings yet

- Relevant Costing ConceptsDocument7 pagesRelevant Costing ConceptsAngel Lilly100% (1)

- Case Questions 2019Document5 pagesCase Questions 2019Dark HamsterNo ratings yet

- Donner Company 2Document6 pagesDonner Company 2Nuno Saraiva0% (1)

- Asistensi - AbmDocument3 pagesAsistensi - AbmIlpram YTNo ratings yet

- Prezi Presentation RubricDocument2 pagesPrezi Presentation Rubricapi-236366511No ratings yet

- SDSDSDDocument2 pagesSDSDSDPascuala MallillinNo ratings yet

- Case Application - Fast Fashion (10 Marks) Please Read The Following Case Application and Answer The Question Posed at The End of CaseDocument2 pagesCase Application - Fast Fashion (10 Marks) Please Read The Following Case Application and Answer The Question Posed at The End of CaseZojaan AheerNo ratings yet

- Arada V CaDocument2 pagesArada V CaElaizza ConcepcionNo ratings yet

- Gmail - CY 2021 1st Quarter School-Level NSED ReportDocument5 pagesGmail - CY 2021 1st Quarter School-Level NSED ReportMICHELLE ORGENo ratings yet

- Veto Message - LD 554Document4 pagesVeto Message - LD 554NEWS CENTER MaineNo ratings yet

- Complaint and Motion For InjunctionDocument142 pagesComplaint and Motion For InjunctionLisa AutryNo ratings yet

- Rhetorical Analysis FinalDocument6 pagesRhetorical Analysis Finalapi-40517138450% (2)

- Korea Herald 20100418Document1 pageKorea Herald 20100418raiseyNo ratings yet

- Handout Technology 2018 - para AV2020Document105 pagesHandout Technology 2018 - para AV2020Cintia CariddiNo ratings yet

- Powerpoint Rubric-BiomesDocument1 pagePowerpoint Rubric-Biomesapi-578922660No ratings yet

- Lesson 2 Research TopicsDocument8 pagesLesson 2 Research TopicsQueen Alexza PrandasNo ratings yet

- Wikipedia Is An Online Free Content Encyclopedia Project Helping Create A World in Which Everyone Can Freely Share in The Sum of All KnowledgeDocument1 pageWikipedia Is An Online Free Content Encyclopedia Project Helping Create A World in Which Everyone Can Freely Share in The Sum of All KnowledgeJakub PolańskiNo ratings yet

- Software Configuration Management: Presented By: Susan SekiraDocument27 pagesSoftware Configuration Management: Presented By: Susan SekiraHanifTirNo ratings yet

- DTE Case 1 - Hyperloop v4.0Document5 pagesDTE Case 1 - Hyperloop v4.0Prathamesh KirtaneNo ratings yet

- IESE Executive-MBA PDFDocument24 pagesIESE Executive-MBA PDFfreeware freeNo ratings yet

- Boost Your Brainstorm Effectiveness With The Why HabitDocument2 pagesBoost Your Brainstorm Effectiveness With The Why HabitavrahamscNo ratings yet

- Inventory AssDocument3 pagesInventory AssJudd Ralph SamaniegoNo ratings yet

- Physical Education and Health (H.O.P.E. 4) : Quarter 3 - Module 2Document10 pagesPhysical Education and Health (H.O.P.E. 4) : Quarter 3 - Module 2Nizzan Mae AnunciadoNo ratings yet

- Faculty Motivation PowerPoint 21Document27 pagesFaculty Motivation PowerPoint 21Prasad ShahNo ratings yet

- Regional Integration in Industrial Development in ECOWAS by Bitrus Kyangmah Samaila, BSC, MSC, MBA in View, University of Maiduguri, Nigeria.Document9 pagesRegional Integration in Industrial Development in ECOWAS by Bitrus Kyangmah Samaila, BSC, MSC, MBA in View, University of Maiduguri, Nigeria.BitrusNo ratings yet

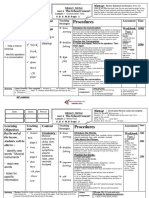

- تحضير لغة انجليزية الصف السادس الابتدائي الترم الثاني 2020Document34 pagesتحضير لغة انجليزية الصف السادس الابتدائي الترم الثاني 2020Leilanew HassanNo ratings yet

- Nugrawan Advis Satria - September 2019Document9 pagesNugrawan Advis Satria - September 2019Nugrawan Satria100% (1)

- Prep - VN: VocabularyDocument5 pagesPrep - VN: VocabularyPhan PhanNo ratings yet

- Carabinz Tourism R05AJ4829: Print TicketDocument2 pagesCarabinz Tourism R05AJ4829: Print Ticketjuveriya farooqNo ratings yet

- Table 4. Quits Levels and Rates by Industry and Region, Seasonally AdjustedDocument2 pagesTable 4. Quits Levels and Rates by Industry and Region, Seasonally AdjustedWXYZ-TV Channel 7 DetroitNo ratings yet

- Independent University, Bangladesh: Summer 2013 Semester Courses and Class ScheduleDocument47 pagesIndependent University, Bangladesh: Summer 2013 Semester Courses and Class ScheduleMd Sharif HossainNo ratings yet

- School Profile BCSDocument18 pagesSchool Profile BCSJacklyn BurnsNo ratings yet