Professional Documents

Culture Documents

Income and Tax Simplified Tables

Income and Tax Simplified Tables

Uploaded by

NiñoMaurin0 ratings0% found this document useful (0 votes)

38 views3 pagesOriginal Title

Income and Tax Simplified Tables.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

38 views3 pagesIncome and Tax Simplified Tables

Income and Tax Simplified Tables

Uploaded by

NiñoMaurinCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Simplified Rules on Income Within and Without (Section 40 of the NIRC):

Income Test of Source of Income

1. Interest Residence of the debtor

2. Dividends Income within

a. From DC 1. Income within if 50% or more of the

b. From foreign corporation gross income of the FC for the

preceding 3 years prior to the

declaration of dividend, was derived

from sources with the Philippines. [but

only to the amount that bears with the

percentage]

2. Income without if less than 50% subject

to the same condition.

(Use also in other unallocated

income/expenses)

Formula:

3-year Gross Income from within

= 50% Rule

3-year Gross Income from all sources

3. Services Place of performance Service performed in the

Philippines

4. Rentals Location of property located in the Philippines

5. Royalties Place of use of intangibles used in the

Philippines

6. Sale of Real Property Location of property located in the Philippines

7. Sale of Personal Property

a. Produced within and sold without Partly within and without

(vice versa)

b. Purchased within and sold without Entirely in the country sold

(vice versa)

8. Shares of stocks in a DC Entirely from sources within

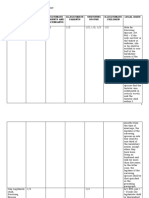

Taxability of Income Simplified

Taxpayer Items on Gross Income

Within Without

1. RC

2. RA, NRC, NRAETB, NRANETB X

3. DC

4. RFC and NRFC X

Income Taxation Simplified

Base of Tax Icome Tax Rates NIRC

1. RC Taxable Income 0% - 35% or 8% Sec. 24 (A)(2)(a)(b)(c)

Gross sales or gross

receipts

2. NRC Same Same Same

3. RA Same Same Same

4. NRAETB Same Same Sec. 25 (A)

5. NRANETB Gross Income 25% Sec. 25 (B)

6. AEMOP Gross Income 15% Sec. 25 (C)(D)(E)

7. DC Taxable Income 30% Sec. 27(A)

8. PEIH Taxable Income 10% Sec. 27 (B)

9. RFC Taxable Income 30% Sec. 28 (A)

10. IC-RFC GPB 2.5% Sec. 28 (A)(a)(b)

11. OBU-ROHM Interest Income 10% Sec. 28 (A)(4)

12. NRFC Gross Income 30% Sec. 28 (B)(1)

13. NRCFOLD- Gross Income 25% Sec. 28 (B)(2)

NRFC

14. NROLV-NRFC Gross Rental 4.5% Sec. 28 (B)(3)

15. NROLAMO- Gross Rental 7.5% Sec. 28 (B)(4)

NRFC

Individual Income Taxation Simplified

- Taxable NIT – Net Income Tax TI- Taxable Income

X – Not taxable GIT – Gross Income Tax GI – Gross Income

Individual Taxpayer Source of Income Kind of Tax Tax Base Tax Rate

Within Without

1. RC NIT/ OGIT T.I/ GS or 0%-35% or

GR 8%

2. NRC X NIT/ OGIT T.I/ GS or 0%-35% or

GR 8%

3. OCW X NIT/ OGIT T.I/ GS or 0%-35% or

GR 8%

4. RA X NIT/ OGIT T.I/ GS or 0%-35% or

GR 8%

5. NRAETB X NIT/ OGIT T.I/ GS or 0%-35% or

GR 8%

6. NRANETB X GIT G.I 25%

Capital Gains Tax Simplified

TAXPAYERS RC, NRC, RA, NRAETB, and NRANETB

1. On the Gross Selling Price or Fair 6%

Market Value, real property Located

within and classified as Capital asset

2. On the net capital gain on shares of 15%

stock not listed and traded through

stock exchange

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Bars & Nightclubs in The US Industry ReportDocument30 pagesBars & Nightclubs in The US Industry ReportAubrey BaileyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- CH 6Document40 pagesCH 6yosefnaserNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Articles 315 To 318 Criminal Law CasesDocument91 pagesArticles 315 To 318 Criminal Law CasesNiñoMaurinNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Local Government - Case DigestDocument1 pageLocal Government - Case DigestNiñoMaurinNo ratings yet

- CIR v. Fisher - Foreign LawDocument3 pagesCIR v. Fisher - Foreign LawNiñoMaurinNo ratings yet

- Case DigestDocument57 pagesCase DigestNiñoMaurinNo ratings yet

- Case Digest - Admin LawDocument3 pagesCase Digest - Admin LawNiñoMaurinNo ratings yet

- First Case Digest - Illegal RecruitmentDocument9 pagesFirst Case Digest - Illegal RecruitmentNiñoMaurinNo ratings yet

- Prescriptive Period Rights To Subrogation of The InsurerDocument2 pagesPrescriptive Period Rights To Subrogation of The InsurerNiñoMaurinNo ratings yet

- Income and Tax Simplified TablesDocument3 pagesIncome and Tax Simplified TablesNiñoMaurinNo ratings yet

- Agilent v. Integrated Silicon - Foreign CorporationDocument8 pagesAgilent v. Integrated Silicon - Foreign CorporationNiñoMaurinNo ratings yet

- Legal EthicsDocument187 pagesLegal EthicsNiñoMaurinNo ratings yet

- Labor Law Review Case Digest Duka - Book I To Book IIDocument24 pagesLabor Law Review Case Digest Duka - Book I To Book IINiñoMaurinNo ratings yet

- Bar Questions - AppealsDocument6 pagesBar Questions - AppealsNiñoMaurin100% (1)

- Criminal Law - Case 2 (Book 2 - Title 2 To 7)Document53 pagesCriminal Law - Case 2 (Book 2 - Title 2 To 7)NiñoMaurinNo ratings yet

- Legitime - AmountsDocument10 pagesLegitime - AmountsNiñoMaurinNo ratings yet

- Atong-Paglaum and Banat Case DigestDocument4 pagesAtong-Paglaum and Banat Case DigestNiñoMaurinNo ratings yet

- List of Aggravating CircumstanceDocument2 pagesList of Aggravating CircumstanceNiñoMaurinNo ratings yet

- Conflicts of Law - Midterm ReviewerDocument7 pagesConflicts of Law - Midterm ReviewerNiñoMaurinNo ratings yet

- Republic of The Philippines, Represented by The Bureau ofDocument14 pagesRepublic of The Philippines, Represented by The Bureau ofNiñoMaurinNo ratings yet

- Conflicts of Law - PropertyDocument45 pagesConflicts of Law - PropertyNiñoMaurinNo ratings yet

- WP10 2013 Distribution Income and Fiscal Incidence 18062013Document49 pagesWP10 2013 Distribution Income and Fiscal Incidence 18062013akinky3sumNo ratings yet

- Statement of Comprehensive IncomeDocument13 pagesStatement of Comprehensive IncomeJethro RafaNo ratings yet

- Final Exam Simulation 2Document32 pagesFinal Exam Simulation 2Carmel Rae TalimioNo ratings yet

- Module 4 Absorption and Variable Costing WA PDFDocument8 pagesModule 4 Absorption and Variable Costing WA PDFMadielyn Santarin MirandaNo ratings yet

- CH 04Document71 pagesCH 04Khánh Ngọc NguyễnNo ratings yet

- PE Micro Project Group 3Document10 pagesPE Micro Project Group 3puxinhdep2709No ratings yet

- It SiaDocument180 pagesIt Siasupriya gupta100% (1)

- Ecovisionnaire Must Do QuestionsDocument6 pagesEcovisionnaire Must Do QuestionsAastha VermaNo ratings yet

- OperationDocument18 pagesOperationRozuNo ratings yet

- Applied Taxation ACCT 370: Rabia SaleemDocument23 pagesApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiNo ratings yet

- Steps by Step Process in Projecting Income Statement and Balance SheetDocument8 pagesSteps by Step Process in Projecting Income Statement and Balance Sheetjennie martNo ratings yet

- Level I - Simple Business PlanDocument8 pagesLevel I - Simple Business PlanJerome BenipayoNo ratings yet

- WelfareSocietiesConferencePaper-No1 Schimank VolkmannDocument129 pagesWelfareSocietiesConferencePaper-No1 Schimank VolkmannsupersevNo ratings yet

- Partnership AgreementDocument4 pagesPartnership AgreementTuy and Community MPCNo ratings yet

- Lec 3 Central Problems of Every Economic SocietyDocument16 pagesLec 3 Central Problems of Every Economic SocietyJutt TheMagicianNo ratings yet

- Bevacqua 3rd Edition Chapter 3 SlidesDocument35 pagesBevacqua 3rd Edition Chapter 3 SlidesjosephrafaraciNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelAnshul NemaNo ratings yet

- Inequality in India: A Review of Levels and Trends: Make Your Publications VisibleDocument29 pagesInequality in India: A Review of Levels and Trends: Make Your Publications Visiblerishi.ma22No ratings yet

- Practicing Task 1 - Writing 1Document2 pagesPracticing Task 1 - Writing 1Yallitza LoncharichNo ratings yet

- Profit & Loss - Maruti Suzuki India LTD.: PrintDocument5 pagesProfit & Loss - Maruti Suzuki India LTD.: PrintPushkar VermaNo ratings yet

- LU20 - Tax StrategyDocument56 pagesLU20 - Tax StrategyAnil HarichandreNo ratings yet

- Salary Income NotesDocument14 pagesSalary Income NotesHani ShehzadiNo ratings yet

- PIS Report 2Document1 pagePIS Report 2Ravi MalikNo ratings yet

- Analysis of SFP - SPLOCIDocument26 pagesAnalysis of SFP - SPLOCIAkib Mahbub KhanNo ratings yet

- Contract Construction SurveyDocument70 pagesContract Construction SurveyMelkamu DemewezNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupAnjas AdeputNo ratings yet

- 978402applied Math Test Paper - Xi Set 2 - Sem 2Document4 pages978402applied Math Test Paper - Xi Set 2 - Sem 2MehulNo ratings yet