Professional Documents

Culture Documents

INCTXQUIZ3

INCTXQUIZ3

Uploaded by

Ket ThmOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INCTXQUIZ3

INCTXQUIZ3

Uploaded by

Ket ThmCopyright:

Available Formats

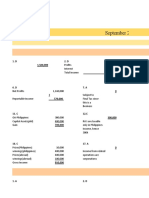

QUIZ 3 #3

CHAPTER 5 CORPORATE TAXPAYERS XYZ Corporation has the

SET A Gross Income, PH

1. C 6. A 11. B 16. C Gross Income, USA

2. D 7. C 12. A 17. B Expenses, PH

3 8. C 13. B 18. D Expenses, USA

4. E 9. C 14 19. A Interest on bank deposits

5 10.C 15 20. D Dividend from DC

Prizes and winnings, PH

#1 Prizes and winnings, PH

PASADO Corporation shows the ff data during the taxable year. Prizes and winnings, USA

Sales 500,000

Int. Inc., net of 20% final tax 24,000 6. What is the amount of

COS 300,000 7. What is the amount of

Sal. Exp. 120,000

Int. Exp. 60,000 All Regular Income

Rent Exp. 24,000 Gross Income, PH

Adv. Exp. 6,000 Gross Income, USA

Dep. Exp. 5,000 (Expenses, PH)

(Expenses, USA)

1. How much is the amount of the corp.'s itemized deductions? Prizes and winnings, PH

COS 300,000 Prizes and winnings, USA

Dep. Exp. 5,000 Taxable Income

305,000 Income tax rate

Tax due and payable

2. What is the amount of the corp.'s taxable net income?

Sales 500,000 8. What is the amount of

(COS) 300,000 All w/ regardless

GP 200,000 Gross Income, PH

Other Income 24,000 Interest on bank deposits

Total 224,000 Dividend from DC

(OPEX Sal to Dep Exp) 215,000 Prizes and winnings, PH

Taxable Net Income 9,000 Prizes and winnings, PH

Income Tax Rate 30% Taxable Income

Income Tax Payable 2700 Tax Rate

Income Tax Payable

#2

SYLVANIA Corporation provided the ff data for calendar year ending Dec. 31, 2018 #4

PH Abroad SAYONATO, a DC, already

Gross Income 7,000,000 $60,000 ff the taxable yr in which

Total Deduction 5,000,000 $25,000

Sales

ForEx $1 PHP 50 Sales Returns

Cost of Sales

3. What is the income tax assuming it is a DC? Operating Expenses

PH Abroad Total

Gross Income 7,000,000 3,000,000 10,000,000 9. How much is the incom

(Total Deduction) 5,000,000 1,250,000 6,250,000 10. How much is the inco

3,750,000

4. What is the income tax assuming it is a RFC? Sales

PH (Sales Returns)

Gross Income 7,000,000 (Cost of Sales)

(Total Deduction) 5,000,000 Gross Income

Total 2,000,000 (Operating Expenses)

Inc. Tax Rate 30% Net Income

Income Tax 600,000 NOLCO

Taxable Income

5. What is the income tax assuming it is a non-profit hospital?

Tax due w/cever is higher

Less: Carryover

Income tax payable

XYZ Corporation has the ff info for the current yr 2018

Gross Income, PH 850,000

Gross Income, USA 700,000

Expenses, PH 650,000

Expenses, USA 575,000

Interest on bank deposits, PH 100,000

Dividend from DC 50,000

Prizes and winnings, PH 12,000

Prizes and winnings, PH 9,500

Prizes and winnings, USA 10,000

6. What is the amount of taxable income assuming the taxpayer is a RFC?

7. What is the amount of tax due and payable assuming the taxpayer is a DC?

All Regular Income DC w/ w/o RFC w/n

Gross Income, PH 850,000 850,000

Gross Income, USA 700,000

(Expenses, PH) 650,000 650,000

(Expenses, USA) 575,000

Prizes and winnings, PH 9,500 9,500

Prizes and winnings, USA 10,000

Taxable Income 344,500 no. 6: 209,500

Income tax rate 30%

Tax due and payable no. 7: 103,350

8. What is the amount of income tax due and payable assuming the taxpayer is a NRFC?

All w/ regardless

Gross Income, PH 850,000

Interest on bank deposits, PH 100,000

Dividend from DC 50,000

Prizes and winnings, PH 12,000

Prizes and winnings, PH 9,500

Taxable Income 1,021,500

30%

Income Tax Payable 306,450

SAYONATO, a DC, already on its 4th yr of operation as of 2017, immediately

ff the taxable yr in which the corporation commenced its operations. The ff financial data were given

CY 2017 CY 2018 CY 2019

2,104,000 2,800,000 3,100,000

Sales Returns 50,000 110,000 0

Cost of Sales 1,000,000 800,000 1,550,000

Operating Expenses 950,000 2,100,000 1,200,000

9. How much is the income tax due and payable in 2018?

10. How much is the income tax due and payable in 2019?

CY 2017 CY 2018 CY 2019

2,104,000 2,800,000 3,100,000

(Sales Returns) 50,000 110,000 0

(Cost of Sales) 1,000,000 800,000 1,550,000

Gross Income 1,054,000 1,890,000 1,550,000

(Operating Expenses) 950,000 2,100,000 1,200,000

Net Income 104,000 -210,000 350,000

-210,000

Taxable Income 104,000 0 140,000

RCIT 30% 31,200 42,000

MCIT(GI) 2% 21,080 37,800 31,000

Tax due w/cever is higher 31,200 no. 9: 37,800 42,000

Less: Carryover

2017 – – –

2018 – – 37,800

Income tax payable no. 10: 4,200

#5

MAGALING COLLEGE has the ff selected info for the taxable yr 2018

Tuition fee exclusively 5,900,000

used for educational purposes

Miscellaneous fees exclusively 18,000,000

used for educational purposes

Rental Income, net 7,125,000

Operating expenses related to rental income 2,300,000

Interest from bank deposits 100,000

Interest income from FCDS deposits 80,000

Dividend income from a domestic corporation 70,000

Dividend income from a foreign corporation 50,000

Quarterly income tax payments 75,000

Additional school building was built and finished on May 1, 2018 at cost of

4000 000 with a depreciable life of 25 years. Only if applicable, assume the educational

institution opted to claim the cost of construction as an outright expense.

11. How much is the income tax payable for 2018 assuming MAGALING College

is a non-stock non profit educational institution?

12.How much is the income tax payable for 2018 assuming MAGALING College

is a government educational institution?

Rental Income, net 7125000/.95 7,500,000

(OPEX related to rental income) 2,300,000

Dividend income from a foreign corporation 50,000

Taxable income 5,250,000

Tax Rate 30%

Income Tax Due 1575000

Less: Quarterly Pay 75,000

CWT on Rent 75000000*.05 375000 450,000

Income Tax Payable no. 11 & 12: 1,125,000

13. .How much is the income tax payable for 2018 assuming MAGALING College

is a proprietary educational institution?

School Fees 20.5M+5.9M 26,400,000

(OPEX- Fees) 18,000,000

(OPEX- Building) 4,000,000

Rental Income 7,500,000

(OPEX Rent) 2,300,000

Dividend Income- foreign 50,000

Taxable Income 9,650,000

Tax Rate 10%

Income tax due 965,000

Less: 450,000

Income tax payable 515,000

#6

CATCHAY PACIFIC Airlines Inc., a RFC has the ff data for the taxable yr 2018 as follows

Origin Destination Gross Receipts

Passengers Airfare China PH 2,000,000

Passengers Airfare PH China 1,800,000

Airfare for cargoes PH China 1,450,000

Airfare for cargoes China PH 800,000

14. How much is the income tax payable?

15. How much is the common carrier's tax for the year?

You might also like

- Chapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Document20 pagesChapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Asi Cas Jav100% (2)

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Annex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Document4 pagesAnnex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Kristel Anne Liwag100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- Tax Due DiligenceDocument29 pagesTax Due Diligencearya1808100% (2)

- SARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxDocument8 pagesSARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxSariephine Grace ArasNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Take Home Seatwork 11.25.2023Document2 pagesTake Home Seatwork 11.25.2023rhenzadrian.11No ratings yet

- Find Study Resources: Answered Step-By-StepDocument12 pagesFind Study Resources: Answered Step-By-StepBisag AsaNo ratings yet

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Chapter 5Document15 pagesChapter 5Coursehero PremiumNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Individual Illustration and Activity No. 2Document22 pagesIndividual Illustration and Activity No. 2Angela CanayaNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- 03 Income Taxation For Individuals Sample ProblemsDocument15 pages03 Income Taxation For Individuals Sample ProblemsclaraNo ratings yet

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen Aùgùst100% (1)

- Tax On Corporations (Additional Exercises)Document2 pagesTax On Corporations (Additional Exercises)April PacanasNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- 08 Actvity 1Document3 pages08 Actvity 1Angelo MorenoNo ratings yet

- Basic Corporate TaxationDocument11 pagesBasic Corporate TaxationJoy ConsigeneNo ratings yet

- Individual Illustration and Activity No. 2Document19 pagesIndividual Illustration and Activity No. 2김유나100% (1)

- Incotax GT1 PDFDocument3 pagesIncotax GT1 PDFSoahNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)lyndon delfinNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- Corporation Part 2Document35 pagesCorporation Part 2annyeongchingu100% (2)

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- TAx 1 - OSD and Itemized DeductionsDocument16 pagesTAx 1 - OSD and Itemized DeductionsKatrina Vianca DecapiaNo ratings yet

- Prefinal Exam Phil TaxDocument4 pagesPrefinal Exam Phil TaxDarren GreNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Seatwork 1 - Final Tax and Compensation Income 2.0Document2 pagesSeatwork 1 - Final Tax and Compensation Income 2.0Magical LunaNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Document8 pagesSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Invoice PDFDocument1 pageInvoice PDFStyle Icon MusicNo ratings yet

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateDocument49 pagesChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeNo ratings yet

- Scientific Research and Experimental Development (SR&ED) Expenditures ClaimDocument37 pagesScientific Research and Experimental Development (SR&ED) Expenditures ClaimShannon HutchinsonNo ratings yet

- Tax Rev - RemediesDocument71 pagesTax Rev - RemediesJanelle TabuzoNo ratings yet

- Payroll FAQ For Santa EmployeesDocument1 pagePayroll FAQ For Santa EmployeesLeigh ScottNo ratings yet

- NEW Clearance Worklife 03.03.22 1Document3 pagesNEW Clearance Worklife 03.03.22 1Ibe AstorgaNo ratings yet

- BinocsTaxReportFY2022-23 Ankit KumarDocument7 pagesBinocsTaxReportFY2022-23 Ankit KumarMayuresh SinghNo ratings yet

- Financial Management: Howard & UptonDocument4 pagesFinancial Management: Howard & Uptonak21679No ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf Mergedjeeson thekkekaraNo ratings yet

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalNo ratings yet

- Bir Form 2305Document4 pagesBir Form 2305fatmaaleahNo ratings yet

- Taxation Law II SyllabusDocument9 pagesTaxation Law II SyllabusRio Porto100% (1)

- SHABIR AKBAR JATOI-Salary SlipDocument1 pageSHABIR AKBAR JATOI-Salary SlipshabirjatoiNo ratings yet

- Government GrantsDocument14 pagesGovernment GrantsAngelica PagaduanNo ratings yet

- TY 2008 Intake and Interview SheetDocument2 pagesTY 2008 Intake and Interview SheetVita Volunteers WebmasterNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Pgp37 Fra MT 2021 CaseDocument3 pagesPgp37 Fra MT 2021 CaseDebayan ChakrabortyNo ratings yet

- GST Outward: CAMC Charges For The Period 1-12-2021 To 1-3-2021Document2 pagesGST Outward: CAMC Charges For The Period 1-12-2021 To 1-3-2021majidNo ratings yet

- 174 - Raavela Interiors PVT-VDocument3 pages174 - Raavela Interiors PVT-VbsudhareddyNo ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- Letter To Fly JonesDocument4 pagesLetter To Fly JonesLya HellenNo ratings yet

- 5KW With BatteryDocument1 page5KW With BatteryKidzee KidzeeNo ratings yet

- Topic:-Clubbing of Incomes and Aggregation of IncomesDocument31 pagesTopic:-Clubbing of Incomes and Aggregation of IncomesmaanikyanNo ratings yet

- Mcq-Donor's TaxesDocument6 pagesMcq-Donor's TaxesRandy ManzanoNo ratings yet

- Sajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillDocument1 pageSajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillMuzammal HamadNo ratings yet

- Invoice 2122200Document4 pagesInvoice 2122200fighter kongNo ratings yet

- 313 Smuggling and Its EffectsDocument3 pages313 Smuggling and Its EffectsWati KaNo ratings yet

- 2024 EdDocument10 pages2024 EdJosé Andrés Concepción TorresNo ratings yet