Professional Documents

Culture Documents

Auditor's Report (Finolex Industries) Year End: Mar '10: Auditors

Auditor's Report (Finolex Industries) Year End: Mar '10: Auditors

Uploaded by

suchi_23goyalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditor's Report (Finolex Industries) Year End: Mar '10: Auditors

Auditor's Report (Finolex Industries) Year End: Mar '10: Auditors

Uploaded by

suchi_23goyalCopyright:

Available Formats

Auditors

Auditor's Report (Finolex Industries) Year End : M

We have audited the attached Balance Sheet of Finolex Industries

Limited as at 31st March 2010, and also the Profit and Loss Account and

the Cash Flow Statement for the year ended on that date annexed

thereto. These financial statements are the responsibility of the

Companys management. Our responsibility is to express an opinion on

these financial statements based on our audit.

We conducted our audit in accordance with the auditing standards

generally accepted in India. Those Standards require that we plan and

perform the audit to obtain reasonable assurance whether the financial

statements are free of material mis-statement. An audit includes

examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made

by management, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for

our opinion.

1. As required by the Companies (Auditors Report) Order, 2003 issued

by the Government of India, in terms of sub-section (4A) of Section 227

of the Companies Act, 1956, we enclose in the Annexure a statement on

the matters specified in the paragraphs 4 and 5 of the said Order.

2. Further to our comments in the Annexure referred to in paragraph 1

above, we report that:

a) We have obtained all the information and explanations, which to the

best of our knowledge and belief were necessary for the purposes of our

audit;

b) In our opinion, proper books of account as required by law have been

kept by the Company so far as appears from our examination of the books

and proper returns adequate for the purpose of our audit have been

received from the branches not visited by us;

c) The Balance Sheet, Profit and Loss Account and Cash Flow Statement

dealt with by this report are in agreement with the books of account;

d) In our opinion, the Balance Sheet, Profit and Loss Account and Cash

Flow Statement dealt with by this report comply with the Accounting

Standards referred to in sub-section (3C) of Section 211 of the

Companies Act, 1956;

e) On the basis of the written representations received from the

Directors as on 31st March, 2010 and taken on record by the Board of

Directors, we report that none of the Directors are disqualified as on

31st March, 2010 from being appointed as Director in terms of clause

(g) of sub-section (1) of Section 274 of the Companies Act, 1956 on the

said date;

f) In our opinion, and to the best of our information and according to

the explanations given to us, the said accounts, read together with the

Companys accounting policies and the Notes thereto, give the

information required by the Companies Act, 1956 in the manner so

required and give a true and fair view in conformity with the

accounting principles generally accepted in India:

i) in the case of the Balance Sheet, of the state of affairs of the

Company as on 31st March, 2010;

ii) in the case of the Profit and Loss Account, of the profit for the

year ended on that date; and

iii) in the case of Cash Flow Statement, of the cash flows for the year

ended on that date.

Referred to in paragraph 1 of our Report of even date:

i. (a) The Company has maintained proper records showing full

particulars including quantitative details and situation of fixed

assets.

(b) Assets have been physically verified by the management during the

year based on the regular programme of verification, which in our

opinion is reasonable having regard to the size of the Company and the

nature of its assets. As explained, the discrepancies noticed were not

material and the same have been properly dealt with in the books of

account.

(c) In our opinion and according to the information and explanations

given to us, during the year, the Company has not disposed of any

substantial/major part of fixed assets.

ii. (a) As explained to us, the inventory has been physically verified

during the year by the management. In our opinion, the frequency of

verification is reasonable.

(b) In our opinion and according to the information and explanations

given to us, the procedures for the physical verification of

inventories followed by the management are reasonable and adequate in

relation to the size of the Company and the nature of its business.

(c) In our opinion and according to the information and explanations

given to us and on the basis of our examination of the records of the

inventory, the Company is maintaining proper records of inventory.

Discrepancies noticed on verification between the physical stocks and

the book records were not material and have been appropriately dealt

with in the books of account.

iii. 1. (a) The Company had granted an unsecured loan of Rs. 45 lakhs

to Finolex Plasson Industries Limited, an associate company, listed in

the register maintained under Section 301 of the Companies Act, 1956

which has been repaid during the year.

(b) According to the information and explanations given to us, in our

opinion, the rate of interest and other terms and conditions of the

above loan granted by the Company, were not prima facie, prejudicial to

the interest of the Company.

(c) According to the information and explanations given to us, the

company to whom loans and advances in the nature of loan were given had

been repaying the principal amount as stipulated and was also regular

in payment of interest.

(d) There is no overdue amount of loan granted to the company listed in

the register maintained under Section 301 of the Companies Act, 1956.

2. (a) According to the information and explanations given to us and on

the basis of our examination of the records, the Company has accepted

Inter-Corporate Deposits from the following parties listed in the

register maintained under Section 301 of the Companies Act, 1956 -

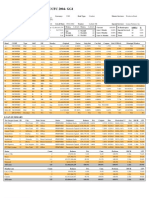

Name of the Company Relationship Maximum Outstanding

amount as at March

Rs. lakhs 31,2010

Rs. lakhs

AkashTatva Investments Pvt. Ltd. CommonDirector 277.00 207.00

Coated Fabrics Pvt. Ltd. Common Director 638.00 537.00

Corrugated Box Industries

(I) Pvt. Ltd. Common Director 125.00 125.00

Finolib Chemicals Pvt. Ltd. Common Director 70.00 70.00

Orbit Electricals Pvt. Ltd. Common Director 177.00 50.00

(b) According to the information and explanations given to us, in our

opinion, the rate of interest and other terms and conditions of above

loans granted to the Company, are not prima facie, prejudicial to the

interest of the Company.

(c) According to the information and explanations given to us, the

Company is regular in repayment of principal and payment of interest.

(d) There is no overdue amount of Inter-Corporate Deposits accepted

from the parties listed in the register maintained under Section 301 of

the Companies Act, 1956.

iv. In our opinion and according to the information and explanations

given to us, there is an adequate internal control system commensurate

with the size of the Company and the nature of its business with regard

to purchase of inventories and fixed assets and with regard to the sale

of goods and services. In our opinion and according to the information

and explanations given to us, there is no continuing failure to correct

major weakness in internal control system. v. In respect of

transactions entered in the register maintained in pursuance of Section

301 of Companies Act, 1956;

a) Based on audit procedures applied by us, to the best of our

knowledge and belief and according to the information and explanations

given to us, we are of the opinion that the particulars of contracts or

arrangements have been entered in the register required to be

maintained under Section 301.

b) According to the information and explanations given to us and

excluding certain transactions of purchase of goods and materials of

special nature for which alternate quotations are not available, in our

opinion, the transactions have been made at prices which are, prima

facie, reasonable having regard to the prevailing market prices at the

relevant time.

vi. In our opinion and according to the information and explanations

given to us, the Company has not accepted any deposits from the public.

Hence, the provisions of Section 58A and 58AA and any other relevant

provisions of the Companies Act, 1956 and rules framed there under are

not applicable.

vii. In our opinion, the Company has an internal audit system

commensurate with the size and nature of its business. viii.We have

broadly reviewed the books of accounts maintained by the Company

relating to the manufacture of PVC Resin, pursuant to the rules made by

the Central Government for the maintenance of cost records under

Section 209(1 )(d) of the Companies Act, 1956 and are of the opinion

that prima facie the prescribed accounts and records have been

maintained. We have not, however, made a detailed examination of the

records with a view of determining whether they are accurate and

complete. ix. a) According to the information and explanations given

to us and on the basis of our examination of the records of the

Company, the Company has generally been regular in depositing

undisputed statutory dues including Provident Fund, Investor Education

and Protection Fund, Employees State Insurance Contribution, Income

Tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty,

cess and other material statutory dues with the appropriate

authorities. b) According to the records of the Company and

information and explanations given to us, dues of Income Tax, Sales

tax, Wealth Tax, Service Tax, Customs Duty and Excise Duty and cess,

which have not been deposited on account of disputes and forum where

dispute is pending are as under:

Name of statute Nature of dues Amount Period to Forum where

(in Rs.which the pending

lakhs) amount

relates

Finance Act, 1994

(Service Tax) Service Tax Demand 167.45 2001-02 Commissioner

Finance Act, 1994

(Service Tax) Service Tax Demand 489.12 2005-06 High Court

Finance Act, 1994

(Service Tax) Service Tax Demand 67.22 2006-07 Commissioner

Finance Act, 1994

(Service Tax) Service Tax Demand 5.01 2007-08 CESTAT

Finance Act, 1994

(Service Tax) Service Tax Demand 0.79 2008-09 CESTAT

Finance Act, 1994

(Service Tax) Service Tax Demand 286.98 2008-09 Commissioner

Finance Act, 1994

(Service Tax) Service Tax Demand 18.54 2008-09 Deputy

Commissioner

Finance Act, 1994

(Service Tax) Service Tax Demand 6.18 2009-10 Deputy

Commissioner

Customs Customs Demand 26.94 2000-01 CESTAT

Customs Customs Demand 14.03 2001-02 CESTAT

Central Excise Excise Demand 32.54 1996-97 High Court

Central Excise Excise Demand 2.07 1999-00 High Court

Central Excise Excise Demand 18.17 2002-03 CESTAT

Central Excise Excise Demand 13.11 2005-06 Commissioner

(A)

Central Excise Excise Demand 0.96 2005-06 CESTAT

Central Excise Excise Demand 2.71 2005-06 High Court

Central Excise Excise Demand 0.46 2006-07 Commissioner

Central Excise Excise Demand 981.99 2007-08 Commissioner

Central Excise Excise Demand 9.49 2008-09 Additional

Commissioner

Central Excise Excise Demand 0.54 2009-10 Deputy

Commissioner

x. The Company does not have accumulated losses at the end of the

financial year and the Company has not incurred any cash losses in the

current and the immediately preceding financial year.

xi. Based on our audit procedures and on the basis of information and

explanations given by the management, we are of the opinion that the

Company has not defaulted in the payment of dues to its bankers,

financial institutions and debenture holders.

xii. According to the information and explanations given to us, the

Company has not granted any loans and advances on the basis of security

by way of pledge of shares, debentures and other securities.

xiii.The provisions of any Special Statute applicable to chit fund or

nidhi / mutual benefit fund / societies are not applicable to the

Company.

xiv. a) Based on the records examined by us and according to the

information and explanations given to us, we are of the opinion that

the Company is maintaining proper records of the transactions and

contracts of dealing in shares and securities and timely entries have

been made in these records.

b) Based on our audit procedures and to the best of our knowledge and

belief and according to the information and explanations given to us,

the shares and securities have been held by the Company in its own

name.

xv. According to the information and explanations given to us, the

Company has not given any guarantee for loans taken by others from

banks and financial institutions.

xvi.To the best of our knowledge and belief and according to

explanations given to us, term loans availed by the Company were, prima

facie, applied by the Company during the year for the purpose for which

loans were obtained.

xvii.On the basis of overall examination of the financial statements

including Cash Flow Statement and other financial information

furnished, we are of the opinion that the funds raised on short term

basis have not been used for long term investments, except to the

extent of approximately Rs. 10,860.01 lakhs for acquisition /

construction of fixed assets.

xviii.The Company has not made preferential allotment of shares to

parties covered in the register maintained under Section 301 of the

Companies Act, 1956 during the year.

xix.According to the information and explanations given to us, security

or charge has been created in respect of debentures issued.

xx. The Company has not raised any money by public issues during the

year.

xxi.To the best of our knowledge and belief and according to the

information and explanations given to us, no fraud on or by the

Company has been noticed or reported during the course of our audit.

You might also like

- IESE MBA Brochure 23 24 Final OnlineDocument16 pagesIESE MBA Brochure 23 24 Final Onlinebea.gyerroNo ratings yet

- Auto Repair Service Business PlanDocument14 pagesAuto Repair Service Business Plangauravmawar80% (5)

- WarzoneDocument3 pagesWarzoneWilmar Abriol0% (1)

- Auditors' Report To The Members Of: Sultania Trade PVT - LTDDocument7 pagesAuditors' Report To The Members Of: Sultania Trade PVT - LTDAankit Kumar Jain DugarNo ratings yet

- Auditing 2Document110 pagesAuditing 2Nitesh KotianNo ratings yet

- Specimen Auditors Report With CaroDocument5 pagesSpecimen Auditors Report With CaroaakashagarwalNo ratings yet

- BalansheetDocument13 pagesBalansheetraman0007No ratings yet

- V.Ghatalia: & AssociatesDocument33 pagesV.Ghatalia: & AssociatesPorusSinghNo ratings yet

- V.Ghatalia Associates: Auditors' Report To The Members of National Spot Exchange LimitedDocument34 pagesV.Ghatalia Associates: Auditors' Report To The Members of National Spot Exchange LimitedPorusSinghNo ratings yet

- Auditors Reports 2012 IoclDocument4 pagesAuditors Reports 2012 IoclSunita NairNo ratings yet

- Caro Audit ReportDocument4 pagesCaro Audit ReportAfroz AhmedNo ratings yet

- Auditors Report FinalDocument5 pagesAuditors Report FinalloyalkaNo ratings yet

- Audit Report of AciDocument5 pagesAudit Report of Acimizanur rahmanNo ratings yet

- ESV-report 1-1Document5 pagesESV-report 1-1asphalt 9 legendsNo ratings yet

- ITC Report of AuditorsDocument3 pagesITC Report of AuditorsRajavati NadarNo ratings yet

- Auditor'S Report To The ShareholdersDocument5 pagesAuditor'S Report To The ShareholdersAbhishek ChoudhriNo ratings yet

- Auditor's Report (TVS Motor Company)Document12 pagesAuditor's Report (TVS Motor Company)Viraj WadkarNo ratings yet

- Independent Auditor'S ReportDocument5 pagesIndependent Auditor'S ReportHimanshu ThakkarNo ratings yet

- 2007Document72 pages2007anilkumbarNo ratings yet

- ITC Auditors ReportDocument3 pagesITC Auditors Reportubaid7491No ratings yet

- S.K.Kapoor & Co: PNB Housing Finance LTD., NEW DELHI - 110 001Document25 pagesS.K.Kapoor & Co: PNB Housing Finance LTD., NEW DELHI - 110 001Shoaib RehmanNo ratings yet

- Haldiram Foods International LTD 2005Document10 pagesHaldiram Foods International LTD 2005Saurabh PatilNo ratings yet

- Auditors' Report To The Members of HSCC (India) LTDDocument5 pagesAuditors' Report To The Members of HSCC (India) LTDPraveen KumarNo ratings yet

- A9 RORUkwaaDocument8 pagesA9 RORUkwaaanzy3011No ratings yet

- Lupin Pharma Care LTD., InDIADocument22 pagesLupin Pharma Care LTD., InDIAPradeesh ChowraaNo ratings yet

- ESV-report 1Document5 pagesESV-report 1asphalt 9 legendsNo ratings yet

- Luthra & Luthra: Auditor'S ReportDocument5 pagesLuthra & Luthra: Auditor'S Reportswatis_49No ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- Auditors' Report To, The Members Of: XYZ (India) LTDDocument5 pagesAuditors' Report To, The Members Of: XYZ (India) LTDalisha_bhalmeNo ratings yet

- IcplDocument7 pagesIcplDeepak GuptaNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- Haldiram Foods International LTD Annual Report 2005Document10 pagesHaldiram Foods International LTD Annual Report 2005Nishant SinghNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- S.B.Dandeker & Co.: Auditors ReportDocument5 pagesS.B.Dandeker & Co.: Auditors Reportravibhartia1978No ratings yet

- Audit Assignment: Name: Pallavi Minz Roll No: 225 Sec: I Tut Group: I 50Document4 pagesAudit Assignment: Name: Pallavi Minz Roll No: 225 Sec: I Tut Group: I 50Pallavi Minz LakraNo ratings yet

- RRK Finhold Private LimitedDocument23 pagesRRK Finhold Private LimitedVanusha AdihettyNo ratings yet

- Annexure To The AuditorsDocument4 pagesAnnexure To The AuditorsTejashree Gharat-KaduNo ratings yet

- Stand Alone Ar 201112 CrainDocument18 pagesStand Alone Ar 201112 CrainParas KhushiramaniNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'ReportRavi BhartiaNo ratings yet

- Reports of CrisilDocument24 pagesReports of CrisilAditya MishraNo ratings yet

- Audit Report-2013Document4 pagesAudit Report-2013anjalisingh183chNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- Audit Report Trif ConstDocument2 pagesAudit Report Trif ConstcmakuldeepNo ratings yet

- Indiawin Sports Annual ReportDocument28 pagesIndiawin Sports Annual ReportTony ThomasNo ratings yet

- ABN AMRO Asset Management (India) Limited: Annual Accounts 2003-2004Document14 pagesABN AMRO Asset Management (India) Limited: Annual Accounts 2003-2004manuel querolNo ratings yet

- Bhavya Creators PVT LTD BalanceSheet 2011Document16 pagesBhavya Creators PVT LTD BalanceSheet 2011ghyNo ratings yet

- Auditing CIA 1Document9 pagesAuditing CIA 1Kalyani JayakrishnanNo ratings yet

- Annual Report: ABN AMRO Asset Management (India) LimitedDocument17 pagesAnnual Report: ABN AMRO Asset Management (India) Limitedmanuel querolNo ratings yet

- Independent AuditorsDocument5 pagesIndependent AuditorsHamza ShafiqNo ratings yet

- Annual - Report - 2010-11 PDFDocument62 pagesAnnual - Report - 2010-11 PDFVijender SinghNo ratings yet

- Annexure C1 PDFDocument21 pagesAnnexure C1 PDFMita SethiNo ratings yet

- .V Porwal: J IA Auto Components LTDDocument12 pages.V Porwal: J IA Auto Components LTDShyam SunderNo ratings yet

- 34 Reliance Trends LimitedDocument24 pages34 Reliance Trends LimitedQuashif SheikhNo ratings yet

- Auditors' ReportDocument3 pagesAuditors' ReportTanvi NaharNo ratings yet

- S.B.Dandeker & CoDocument4 pagesS.B.Dandeker & CoRavi BhartiaNo ratings yet

- DLF LIMITED Auditors ReportDocument6 pagesDLF LIMITED Auditors ReportAvinash MulikNo ratings yet

- Analysis of Audit ReportsDocument5 pagesAnalysis of Audit ReportsPhilip WellsNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Statements of Wipro LimitedDocument18 pagesFinancial Statements of Wipro LimitedVijay HalalliNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- A Study On Portfolio Construction/ManagementDocument81 pagesA Study On Portfolio Construction/ManagementAshickNo ratings yet

- Noufal Bank of AmericaDocument20 pagesNoufal Bank of AmericanoufaNo ratings yet

- Topic 1 - Accounting EnvironmentDocument33 pagesTopic 1 - Accounting EnvironmentdenixngNo ratings yet

- GCCFC 2004-gg1Document6 pagesGCCFC 2004-gg1ZerohedgeNo ratings yet

- Finance 2midterm 2010 - SolutionsDocument5 pagesFinance 2midterm 2010 - SolutionsKelvin FuNo ratings yet

- Rural Marketing - InsuranceDocument106 pagesRural Marketing - InsurancesinghinkingNo ratings yet

- FYP-Home Loan Comparison and Credit RatingDocument67 pagesFYP-Home Loan Comparison and Credit RatingGiridhar NaiduNo ratings yet

- Beyond BiasDocument10 pagesBeyond BiasJoão Ricardo MarquesNo ratings yet

- The Advantages of OutsourcingDocument12 pagesThe Advantages of OutsourcingManpreet Kaur Sekhon100% (1)

- Banking Sector Reforms in India After 1991Document6 pagesBanking Sector Reforms in India After 1991pooja dayamaNo ratings yet

- Research PaperDocument39 pagesResearch PaperVisal SasidharanNo ratings yet

- Module 5 Commodities KgvYZGgiU3Document2 pagesModule 5 Commodities KgvYZGgiU3NAMAN JAINNo ratings yet

- OVDV Bloomberg Equity Volatilities: Features and Benefits 21 June 2010Document8 pagesOVDV Bloomberg Equity Volatilities: Features and Benefits 21 June 2010Raphaël FromEverNo ratings yet

- Ejercicios Indices PDFDocument7 pagesEjercicios Indices PDFborritaNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Presentation Lime RoadDocument15 pagesPresentation Lime RoadShantanu TanwarNo ratings yet

- Best Way 23Document13 pagesBest Way 23Ibrar ShahNo ratings yet

- Sify Sample Aptitude Placement Paper Level1Document7 pagesSify Sample Aptitude Placement Paper Level1placementpapersampleNo ratings yet

- Takeover Project McomDocument58 pagesTakeover Project McomParinShahNo ratings yet

- $PERY Perry Ellis 2012 Corporate Investor Presentation Slides Deck PDFDocument18 pages$PERY Perry Ellis 2012 Corporate Investor Presentation Slides Deck PDFAla BasterNo ratings yet

- Entrepreneurship Development - IIDocument6 pagesEntrepreneurship Development - IIPragati GuptaNo ratings yet

- A - 24 - IB Assignment 1Document7 pagesA - 24 - IB Assignment 1KAJAL RAINo ratings yet

- Shopping Center ClassificationDocument25 pagesShopping Center ClassificationemiliaNo ratings yet

- Quickbooks NotesDocument21 pagesQuickbooks NotesWaivorchih Waibochi GiterhihNo ratings yet

- Financial Management Principles and Applications 13th Edition Titman Solutions Manual 1Document31 pagesFinancial Management Principles and Applications 13th Edition Titman Solutions Manual 1tammy100% (47)

- Mandakini Hydropower Limited PDFDocument42 pagesMandakini Hydropower Limited PDFAnil KhanalNo ratings yet

- BAFI1100 Assignment 2Document5 pagesBAFI1100 Assignment 2Mariann Jane GanNo ratings yet