Professional Documents

Culture Documents

Assignment 3 ACC 401

Assignment 3 ACC 401

Uploaded by

ShannonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 3 ACC 401

Assignment 3 ACC 401

Uploaded by

ShannonCopyright:

Available Formats

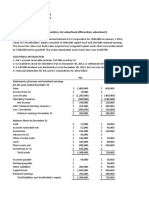

P4-1

#1: Goodwil at December 31, 2020:

$ 800,000 Goodwill = 1,600,000 x 50% =

#2 Noncontrolling Interest Share for 2020:

$ 180,000 Adjusted Income = 2,000,000

8 (years) = 80,000 ; 800,000

Non-Controlling Int Share = 72

#3 Consolidated retained earnings at December 31, 2019:

$ 3,340,000

#4 Consolidated retained earnings at December 31, 2020:

$ 4,510,000 3,340,000 + (8,000,000 - 6,37

#5 Consolidated net income for 2020:

$ 2,170,000 10,000,000 - (6,370,000 + 1,20

#6 Noncontrolling interest at December 31, 2019:

$ 1,480,000 Plant assets = 640,000 - (80,00

4,800,000 + 0 + 320,000 + 800

#7 Noncontorlling interest at December 31, 2020:

$ 1,560,000 Plant assets = 640,000 - (80,00

5,200,000 + 0 + 240,000 + 800

Calculations:

odwill = 1,600,000 x 50% = 800,000

justed Income = 2,000,000 - 1,200,000 = 800,000 ; 1,600,000 x 40% = 640,000 ; 640,000 /

years) = 80,000 ; 800,000 - 80,000 = 720,000

n-Controlling Int Share = 720,000 x 25% = 180,000

340,000 + (8,000,000 - 6,370,000 + 540,000) -1,000,000 = 4,510,000

,000,000 - (6,370,000 + 1,200,000) = 2,430,000 ; 2,430,000 - 260,000 = 2,170,000

ant assets = 640,000 - (80,000 x 4) = 320,000

800,000 + 0 + 320,000 + 800,000 = 5,920,000 ; 5,920,000 x 25% = 1,480,000

ant assets = 640,000 - (80,000 x 5) = 240,000

200,000 + 0 + 240,000 + 800,000 = 6,240,000 ; 6,240,000 x 25% = 1,560,000

Initial Calculations:

4,800,000 / 75% = 6,400,000

6,400,000 - 4,800,000 = 1,600,000

Excess Allocated:

10% to inventories 1,600,000 x 10% =160,000

40% to plant assets 1,600,000 x 40% = 640,000

50% to goodwill 1,600,000 x 50% = 800,000

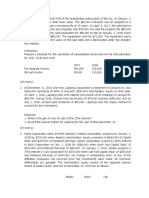

P4-5

Pam Corporation and Subsidiary Consolidation Workpaper

for year ended December 31, 2016

Pam 70% Sun Debits Credits

Income Statement

Sales $ 1,600,000 $ 1,400,000

Income from Sun $ 119,000 $ - a $ 119,000

Cost of Sales $ (600,000) $ (800,000) c $ 10,000

Depreciation Expense $ (308,000) $ (120,000) d $ 4,000

e $ 14,000

Other Expense $ (320,000) $ (280,000) f $ 2,000

Net Income

Noncontrolling interest share i $ 51,000

Controlling share of Net Income $ 491,000 $ 200,000

Retained Earnings Statement

Retained Earnings - Pam $ 600,000 $ -

Retained Earnings - Sun $ - $ 200,000 b $ 200,000

Dividends $ (400,000) $ (100,000) a $ 70,000

i $ 30,000

Net Income $ 491,000 $ 200,000

Retained Earnings - December 31 $ 691,000 $ 300,000

Balance Sheet

Cash $ 172,000 $ 120,000

Accounts Receivable $ 200,000 $ 140,000 g $ 20,000

Dividends receivables $ 28,000 $ - h $ 28,000

Inventories $ 300,000 $ 200,000

Other current assets $ 140,000 $ 60,000

Land $ 100,000 $ 200,000

Buildings - net $ 280,000 $ 320,000 c $ 28,000 d $ 4,000

Equipment - net $ 1,140,000 $ 660,000 c $ 42,000 e $ 14,000

Investment in Sun $ 1,029,000 $ - a $ 49,000

b $ 980,000

Excess Allocated to Trademarks c $ 80,000 f $ 2,000

Excess Allocated to Goodwill c $ 40,000

Total Unamortized excess b $ 200,000 c $ 200,000

Total Assets $ 3,389,000 $ 1,700,000

Accounts payable $ 400,000 $ 170,000 g $ 20,000

Dividends payable $ 200,000 $ 40,000 h $ 28,000

Other Liabilities $ 98,000 $ 190,000

Capital sotck $ 2,000,000 $ 1,000,000 b $ 1,000,000

Retained Earnings $ 691,000 $ 300,000

Total Equities $ 3,389,000 $ 1,700,000

Noncontrolling Interest January 1 b $ 420,000

Noncontrolling Interest December 31 i $ 21,000

$ 1,838,000 $ 1,838,000

Calculations:

Consolidation

Statements

$ 3,000,000 1,600,000 + 1,400,000 = 3,000,000

$ - 119,000 - 119,000 = 0

$ (1,410,000) 600,000 + 800,000 + 10,000 = 1,410,000

308,000 + 120,000 + 4,000 + 14,000 = 446,000

$ (446,000)

$ (602,000) 320,000 + 280,000 + 2,000 = 602,000

$ 542,000 3,000,000 - 1,410,000 - 446,000 - 602,000 = 542,000

$ (51,000)

$ 491,000

$ 600,000 600,000 - 0 = 600,000

$ -

400,000 + 100,000 - 70,000 - 30,000 = 400,000

$ (400,000)

$ 491,000

$ 691,000

$ 292,000 172,000 + 120,000 = 292,000

$ 320,000 200,000 + 140,000 - 20,000 = 320,000

$ - 28,000 - 28,000 = 0

$ 500,000 300,000 + 200,000 = 500,000

$ 200,000 140,000 + 60,000 = 200,000

$ 300,000 100,000 + 200,000 = 300,000

$ 624,000 280,000 + 320,000 + 28,000 - 4,000 = 624,000

$ 1,828,000 1,140,000+ 660,000 + 42,000 - 14,000 = 1,828,000

1,029,000 - 49,000 - 980,000 = 0

$ -

$ 78,000 80,000 - 2,000 = 78,000

$ 40,000 40,000 - 0 = 40,000

$ - 200,000 - 200,000 = 0

$ 4,182,000

$ 550,000 400,000 + 170,000 - 20,000 = 550,000

$ 212,000 200,000 + 40,000 - 20,000 = 212,000

$ 288,000 98,000 + 190,000 = 288,000

$ 2,000,000 2,000,000 + 1,000,000 - 1,000,000 = 2,000,000

$ 691,000

1,400,000 x 30% = 420,000

$ 441,000 420,000 + 21,000 = 441,000

$ 4,182,000

Initial Calculations:

Fair Value = 980,000 / 70% = 1,400,000

Book Value of Sun = 1,000,000 + 200,000 =1,200,000

Excess Fair Value = 1,400,000 - 1,200,000 =200,000

Noncontrolling Interest (30% of Fair Value) = 1,400,000 x 30% = 420,000

Undervalued Inventory = 10,000

Undervalued Building = 28,000 with 7 year life

Undervalued Equipment = 42,000 with 3 year life

Trademark = 80,000 with 40 year life

10,000 + 28,000 + 42,000 + 80,000 = 160,000

Remainder of 200,000 to Goodwill = 200,000 - 160,000 = 40,000

Net income = 200,000

Undervalued Invenotry (full value) = 10,000

1 year of depreciation of Building = 28,000 / 7 = 4,000

1 year of depreciation of equipment = 42,000 / 3 = 14,000

1 year of amoritization of trademark = 80,000 / 40 = 2,000

Adjusted Income of Sun = 200,000 - 10,000 - 4,000 - 14,000 - 2,000 = 170,000

Pam's 70% controlling interest value = 170,000 x 70% = 119,000

Sun's 30% noncontrolling interest value = 170,000 x 30% = 51,000

Journal Entries for 2016

a) Income for Sun (170,000 x 70%) $ 119,000

Dividends (100,000 x 70%) $ 70,000

Investment in Sun $ 49,000

b) Capital Stock for Sun $ 1,000,000

Retained Earnings for Sun as of Jan 1 $ 200,000

Excess of Fair Value $ 200,000

Investment in Sun $ 980,000

Noncontrolling interest (Jan 1) $ 420,000

c) Undervalued Inventories $ 10,000

Undervalued Building $ 28,000

Undervalued Equipment $ 42,000

Trademarks $ 80,000

Goodwill $ 40,000

Excess Fair Value $ 200,000

d) Depreciation Expense (28,000 / 7) $ 4,000

Undervalued Building (1 year) $ 4,000

e) Depreciation Expense (42,000 / 3) $ 14,000

Undervalued Equipment (1 year) $ 14,000

f) Other Expenses (80,000 / 40) $ 2,000

Amortization of Trademark (1 year) $ 2,000

g) Accounts Payable $ 20,000

Accounts Receivable $ 20,000

h) Dividneds Payable $ 28,000

Dividends Receivable $ 28,000

i) Noncontrolling Interest value (30%) $ 51,000

Dividends of Sun (100,000 x 30%) $ 30,000

Noncontrolling interest $ 21,000

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Technology Heterogeneity and Poverty Traps A Latent Class Approach To Technology Gap Drivers of Chronic PovertyDocument19 pagesTechnology Heterogeneity and Poverty Traps A Latent Class Approach To Technology Gap Drivers of Chronic PovertyVictor Afari-SefaNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Lovatt EasyExtraIncome BHPTDocument4 pagesLovatt EasyExtraIncome BHPTVAGA ATENDENTENo ratings yet

- U2A2 - Assignment - Business TransactionsDocument2 pagesU2A2 - Assignment - Business TransactionsZoya IliasNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Marsh AnswersDocument6 pagesMarsh AnswersVhertotNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- ACC 430 Exam 2 Answer KeyDocument2 pagesACC 430 Exam 2 Answer KeyShannonNo ratings yet

- CLOSING CASE-Working Conditions in A Chinese FactoryDocument3 pagesCLOSING CASE-Working Conditions in A Chinese Factoryrohanfyaz00100% (1)

- Honda - StrategyDocument21 pagesHonda - StrategyAarushi Sethi100% (1)

- Dimensions of TourismDocument3 pagesDimensions of TourismJennifer Penuliar100% (4)

- Pip Pnsmv004Document12 pagesPip Pnsmv004Ricardo Zárate GodinezNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Pangestu Jalu Bagaskoro F0317079Document2 pagesPangestu Jalu Bagaskoro F0317079Geroro D'PhoenixNo ratings yet

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- CHAPTER 4 DERIVATIONS 7 PGDocument7 pagesCHAPTER 4 DERIVATIONS 7 PGzee abadillaNo ratings yet

- Sazkiya Aldina - Lat Soal AKL 1 Chapter 2Document3 pagesSazkiya Aldina - Lat Soal AKL 1 Chapter 2sazkiyaNo ratings yet

- Assignment 4Document4 pagesAssignment 4zhoudong910105No ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Tugas 2 - AKL 1Document2 pagesTugas 2 - AKL 1Geroro D'PhoenixNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Financial Statements EQUIPO 1Document14 pagesFinancial Statements EQUIPO 1David TorresNo ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Latihan Soal Segment and Interim ReportingDocument5 pagesLatihan Soal Segment and Interim ReportingNebula JrNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- Book 1Document8 pagesBook 1Alejandra LamasNo ratings yet

- BE Chap 17Document3 pagesBE Chap 17TIÊN NGUYỄN LÊ MỸNo ratings yet

- A031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Document2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Rezky ApriliantiNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- POA MCQ SolutionsDocument141 pagesPOA MCQ SolutionssyrasgamingttNo ratings yet

- (IFA 13) - Rendy Filiang - 1402210324Document10 pages(IFA 13) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- MC Problems Chap 2Document4 pagesMC Problems Chap 2AlexandriteNo ratings yet

- Forum ACC Sesi 12 - WM RevisiDocument4 pagesForum ACC Sesi 12 - WM RevisiWindy MartaputriNo ratings yet

- Chapter 7 in Class Practice SolutionDocument12 pagesChapter 7 in Class Practice Solution919282902No ratings yet

- Inter-Group TransactionDocument11 pagesInter-Group Transaction庄敏敏No ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Question 1 - Pretend CorporationDocument6 pagesQuestion 1 - Pretend Corporationyusuf pashaNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Devia Febrina 43221110106 - Kuis 10 AKL 2Document4 pagesDevia Febrina 43221110106 - Kuis 10 AKL 2nara kimNo ratings yet

- Tugas AlimDocument3 pagesTugas AlimHappy MichaelNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Gonzalez Rincon - Evidencia 3Document17 pagesGonzalez Rincon - Evidencia 3sebgonzalez072006No ratings yet

- Tablas Caso Examen HHCDocument12 pagesTablas Caso Examen HHCCristian MuñozNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 02 - Worldwide Accounting DiversityDocument24 pagesChapter 02 - Worldwide Accounting DiversityShannonNo ratings yet

- May 19, 2020, 20:17 PDFDocument4 pagesMay 19, 2020, 20:17 PDFShannonNo ratings yet

- S.A. Harrington CompanyDocument6 pagesS.A. Harrington CompanyShannonNo ratings yet

- ACC 430 Assignment 1 SU12020Document3 pagesACC 430 Assignment 1 SU12020ShannonNo ratings yet

- ACC 430 HW QUESTIONS Mod 1Document2 pagesACC 430 HW QUESTIONS Mod 1Shannon0% (1)

- ACC 430 Assignment 2 SU12020Document2 pagesACC 430 Assignment 2 SU12020Shannon100% (1)

- ACC430 Instructor's Class InformationDocument3 pagesACC430 Instructor's Class InformationShannonNo ratings yet

- G'12s SP 2 2020Document3 pagesG'12s SP 2 2020ShannonNo ratings yet

- Module 6 Application AssignmentDocument1 pageModule 6 Application AssignmentShannonNo ratings yet

- Project Management: Precedences 3 Time EstimatesDocument17 pagesProject Management: Precedences 3 Time EstimatesShannonNo ratings yet

- Network Analysis: Minimum Spanning TreeDocument8 pagesNetwork Analysis: Minimum Spanning TreeShannonNo ratings yet

- Joint Venture AgreementDocument5 pagesJoint Venture AgreementAndrea JimenezNo ratings yet

- Instant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF ScribdDocument23 pagesInstant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF Scribdmarian.hillis984100% (45)

- Module+5 1Document10 pagesModule+5 1Franco James SanpedroNo ratings yet

- Pre Auction Listing Icici - West - Fe - 22.02.2021Document12 pagesPre Auction Listing Icici - West - Fe - 22.02.2021Rahul VishwakarmaNo ratings yet

- Raymond's Experiment With KhadiDocument17 pagesRaymond's Experiment With KhadiRaymond BaldelovarNo ratings yet

- Elasticity in EconomicsDocument3 pagesElasticity in Economicstracy-ann smithNo ratings yet

- Concept of Entrepreneurship Class Notes 2Document4 pagesConcept of Entrepreneurship Class Notes 2Rodrick MumbaNo ratings yet

- Ethic Case CSR Samsung in ThailandDocument20 pagesEthic Case CSR Samsung in ThailandANH NGUYỄN TUẤNNo ratings yet

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DaymudeyNo ratings yet

- Pippa SmallDocument14 pagesPippa SmallroNo ratings yet

- Iso 31030 2021Document15 pagesIso 31030 2021Kevin MudiNo ratings yet

- Mrunal Sir's Economy 2020 Batch - Handout PDFDocument21 pagesMrunal Sir's Economy 2020 Batch - Handout PDFssattyyaammNo ratings yet

- The Entrepreneurial Magazine Aug Pub 1Document63 pagesThe Entrepreneurial Magazine Aug Pub 1Christopher S ChironzviNo ratings yet

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoNo ratings yet

- Study of Consumer AwarenessDocument5 pagesStudy of Consumer AwarenessSupriya ThomasNo ratings yet

- MGTDocument4 pagesMGTapi-3813174100% (1)

- Elements of A Business PlanDocument8 pagesElements of A Business Plancandy lollipoNo ratings yet

- SAP S4 HANA General Ledger Configuration & End-UserDocument32 pagesSAP S4 HANA General Ledger Configuration & End-UseraravintharkNo ratings yet

- Shipping Business Examiners Report May 2019 RevDocument5 pagesShipping Business Examiners Report May 2019 RevdiablolcNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaPankaj JainNo ratings yet

- Integrated Telecommunications Case: AcquisitionDocument7 pagesIntegrated Telecommunications Case: AcquisitionMarsa Syahda NabilaNo ratings yet

- Dwnload Full Strategic Human Resource Management Canadian 2nd Edition Noe Solutions Manual PDFDocument35 pagesDwnload Full Strategic Human Resource Management Canadian 2nd Edition Noe Solutions Manual PDFnoahgrantz23b100% (14)

- Hindalco Industries: IndiaDocument8 pagesHindalco Industries: IndiaAshokNo ratings yet