Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

2K views1st Exam

1st Exam

Uploaded by

Charles1. The document discusses estate taxation in the Philippines, including taxable transfers, exemptions, valuation of property, and determining what is included in a decedent's gross estate.

2. It provides examples of different scenarios involving the estates of decedents of various citizenships and residencies, and which properties would be included in the Philippine gross estate in each case.

3. Key issues covered include transfers subject to estate tax, exemptions, valuation of transferred property, determining situs of property, and applicability of reciprocity for non-resident aliens.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- University of Batangas Estate Tax: Multiple Choice ExercisesDocument5 pagesUniversity of Batangas Estate Tax: Multiple Choice ExercisesEdnel Loterte100% (1)

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- Estate Tax Sample Problems 2Document7 pagesEstate Tax Sample Problems 2Arj Sulit Centino Daqui0% (1)

- Donor S Tax Exam - Answers4Document5 pagesDonor S Tax Exam - Answers4Ednel Loterte100% (2)

- DocDocument68 pagesDocTrem GallenteNo ratings yet

- Quiz 1 - Estate TaxDocument7 pagesQuiz 1 - Estate TaxKevin James Sedurifa Oledan100% (4)

- AIR - Donor's TaxDocument5 pagesAIR - Donor's TaxRaz Jisryl100% (1)

- Taxation - Donors-Tax - Quizzer - 2018Document6 pagesTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- Final Exam Bus Tax 2nd Sem 2018-2019Document6 pagesFinal Exam Bus Tax 2nd Sem 2018-2019Renalyn Paras100% (2)

- Quiz Week 1Document10 pagesQuiz Week 1Katherine Ederosas50% (2)

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Estate Tax & Deductions TheoriesDocument12 pagesEstate Tax & Deductions TheoriesDanaNo ratings yet

- Big Data - Storage, Sharing and SecurityDocument449 pagesBig Data - Storage, Sharing and SecurityAlexandruNo ratings yet

- Gross Estate Tax QuizzerDocument6 pagesGross Estate Tax QuizzerLloyd Sonica100% (1)

- Gross Estate Tax Quizzer 1103aDocument6 pagesGross Estate Tax Quizzer 1103aCharry Ramos67% (3)

- Estate Tax PrelimsDocument28 pagesEstate Tax PrelimsSeanmigue TomaroyNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- Estate TaxationDocument25 pagesEstate TaxationNicolas Alonso100% (1)

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Taxbook PDFDocument151 pagesTaxbook PDFMARIA100% (1)

- Estate QuizDocument6 pagesEstate QuizJedi DuenasNo ratings yet

- 1 Intro DonationDocument27 pages1 Intro DonationMae NamocNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Orca Share Media1532355060231Document18 pagesOrca Share Media1532355060231Let it beNo ratings yet

- 1st PBDocument12 pages1st PBDin Rose Gonzales100% (2)

- ACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Document21 pagesACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Elizalen MacarilayNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- PrefinalDocument7 pagesPrefinalLeisleiRagoNo ratings yet

- Gross Income and DeductionsDocument6 pagesGross Income and DeductionsIvan Fausto OranteNo ratings yet

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- CHAPTER 13A - Transfer and Business TaxDocument20 pagesCHAPTER 13A - Transfer and Business TaxKatKat Olarte80% (5)

- Practical Accounting IIDocument19 pagesPractical Accounting IIChristine Nicole BacoNo ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Estate WorkbookDocument10 pagesEstate WorkbookXin ZhaoNo ratings yet

- Chapter 3 Inclusions in The Gross Income PDFDocument11 pagesChapter 3 Inclusions in The Gross Income PDFkimberly tenebro100% (1)

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- Capital Gains TaxDocument3 pagesCapital Gains TaxMary Christen Canlas0% (1)

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- Other Percentage TaxespdfDocument5 pagesOther Percentage TaxespdfAngeilyn RodaNo ratings yet

- Inter Tax FinalDocument4 pagesInter Tax FinalJil Macasaet0% (1)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Taxation Quizzer Quizzes For Tax PDFDocument62 pagesTaxation Quizzer Quizzes For Tax PDFCelestino AlisNo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- DeductionsDocument10 pagesDeductionsceline marasiganNo ratings yet

- 4 Gross-IncomeDocument5 pages4 Gross-IncomeSamantha Nicole HoyNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- p2 Foreign CurrencyDocument4 pagesp2 Foreign CurrencyJustine Goes KaizerNo ratings yet

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerMark Noel SanteNo ratings yet

- Transfer Taxes Theory QuizzerDocument15 pagesTransfer Taxes Theory QuizzerKenNo ratings yet

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Bus Law and TaxDocument15 pagesBus Law and Taxkay_kleirNo ratings yet

- Transfer Taxes Tax 2Document45 pagesTransfer Taxes Tax 2Nat PantsNo ratings yet

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesNo ratings yet

- Evaluate 1 - Estate Taxation Answer KeyDocument3 pagesEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoNo ratings yet

- BP Form 201 - Summary of Obligations and Proposed Activities / Projects (In Thousand Pesos)Document1 pageBP Form 201 - Summary of Obligations and Proposed Activities / Projects (In Thousand Pesos)CharlesNo ratings yet

- Status - 1 Submitted Page 1 ofDocument1 pageStatus - 1 Submitted Page 1 ofCharlesNo ratings yet

- BP 201 A RlipDocument1 pageBP 201 A RlipCharlesNo ratings yet

- Operating Unit Authorization New General Appropriations Department State Universities and Colleges (Sucs) Agency Davao Del Sur State CollegeDocument9 pagesOperating Unit Authorization New General Appropriations Department State Universities and Colleges (Sucs) Agency Davao Del Sur State CollegeCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocument20 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNo ratings yet

- BP Form 100-B Statement of Other Receipts/Expenditures Off-Budgetary and Custodial Funds FY 2020 - 2022 (In Thousand Pesos)Document1 pageBP Form 100-B Statement of Other Receipts/Expenditures Off-Budgetary and Custodial Funds FY 2020 - 2022 (In Thousand Pesos)CharlesNo ratings yet

- BP 201 A PSDocument2 pagesBP 201 A PSCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocument3 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Region: Region Xi - Davao Authorization: AllDocument18 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Region: Region Xi - Davao Authorization: AllCharlesNo ratings yet

- 5 - Establishment of Teacher Education Academic (TEP) BuildingDocument4 pages5 - Establishment of Teacher Education Academic (TEP) BuildingCharlesNo ratings yet

- 1Document32 pages1CharlesNo ratings yet

- 4-Establishment of Business Education and Governance Academic BuildingDocument4 pages4-Establishment of Business Education and Governance Academic BuildingCharlesNo ratings yet

- 3-Establishment of DSSC ICTC HubDocument4 pages3-Establishment of DSSC ICTC HubCharlesNo ratings yet

- 6-Professional Services (Additional 107 Administrative Personnel)Document4 pages6-Professional Services (Additional 107 Administrative Personnel)CharlesNo ratings yet

- BP Form CDocument3 pagesBP Form CCharlesNo ratings yet

- 2-Establishment of Instructional Materials Production CenterDocument4 pages2-Establishment of Instructional Materials Production CenterCharlesNo ratings yet

- BP Form A - Total Proposed ProgramDocument4 pagesBP Form A - Total Proposed ProgramCharlesNo ratings yet

- 1 - Repair of Earthquake-Damaged ICET Academic BuildingDocument4 pages1 - Repair of Earthquake-Damaged ICET Academic BuildingCharlesNo ratings yet

- Objectives of Good Store DesignDocument19 pagesObjectives of Good Store DesignanuradhaNo ratings yet

- SE SSE For RS Advt. No 85050421 q06njk2Document6 pagesSE SSE For RS Advt. No 85050421 q06njk2krishna singhNo ratings yet

- Dela Cruz, Jumar James BDocument2 pagesDela Cruz, Jumar James BSantiago Buladaco100% (1)

- Assignment AgreementDocument3 pagesAssignment AgreementMariaHelena Das Neves PereiraNo ratings yet

- Aris - User Guide It Architect S enDocument118 pagesAris - User Guide It Architect S enheidilille100% (1)

- Complete Final Business Plan 3Document38 pagesComplete Final Business Plan 3Lannie Garin100% (1)

- Long-Quiz CFASDocument20 pagesLong-Quiz CFASAya AlayonNo ratings yet

- Ijcs 2016 0303013 PDFDocument4 pagesIjcs 2016 0303013 PDFeditorinchiefijcsNo ratings yet

- Principles of Macroeconomics - FullDocument375 pagesPrinciples of Macroeconomics - FullHafsa YusifNo ratings yet

- How To Include Nonrecoverable Tax in Mass Additions in R12Document3 pagesHow To Include Nonrecoverable Tax in Mass Additions in R12nghazaly100% (1)

- Mobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptDocument30 pagesMobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptSimon ShresthaNo ratings yet

- GTU Ch-7 EntrepreneurshipDocument40 pagesGTU Ch-7 EntrepreneurshipMehul PatelNo ratings yet

- Jubilee Financial Report 2022Document328 pagesJubilee Financial Report 2022uroosa farooqNo ratings yet

- Absolute Deed of Sale - Mini VanDocument2 pagesAbsolute Deed of Sale - Mini VanAlly ClenistaNo ratings yet

- Uppcl 3Document6 pagesUppcl 3Anshu gautamNo ratings yet

- TH THDocument9 pagesTH THP.MannaNo ratings yet

- ReNew Power Strengthens Leadership Team Media Announcement PDFDocument2 pagesReNew Power Strengthens Leadership Team Media Announcement PDFNavneet KaurNo ratings yet

- Ch08 ITMDocument27 pagesCh08 ITMAbdulkadir JeilaniNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Modern Concepts of The Theory of The Firm: Springer-Verlag Berlin Heidelberg GMBHDocument650 pagesModern Concepts of The Theory of The Firm: Springer-Verlag Berlin Heidelberg GMBHAn TrầnNo ratings yet

- HR - Planning and Recruitment PDFDocument45 pagesHR - Planning and Recruitment PDFSatoto SubandoroNo ratings yet

- Sustainable Cocoa Production Program (SCPP) : Case StudyDocument19 pagesSustainable Cocoa Production Program (SCPP) : Case StudyfrendystpNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Dortch Lorae Social Media Audit 1Document11 pagesDortch Lorae Social Media Audit 1api-648504393No ratings yet

- Complan Case StudyDocument2 pagesComplan Case StudySiddharth Himmatramka0% (1)

- ZeriaDocument16 pagesZeriaBhaskar KulkarniNo ratings yet

- 7 Types of Business StrategiesDocument7 pages7 Types of Business StrategiesJaine Pantua GratilNo ratings yet

- Nuqui - Quiz On Special JournalsDocument25 pagesNuqui - Quiz On Special JournalsJesther NuquiNo ratings yet

- Original Skills MatrixDocument46 pagesOriginal Skills MatrixFrank Alexander Gustav SchulzNo ratings yet

1st Exam

1st Exam

Uploaded by

Charles100%(1)100% found this document useful (1 vote)

2K views4 pages1. The document discusses estate taxation in the Philippines, including taxable transfers, exemptions, valuation of property, and determining what is included in a decedent's gross estate.

2. It provides examples of different scenarios involving the estates of decedents of various citizenships and residencies, and which properties would be included in the Philippine gross estate in each case.

3. Key issues covered include transfers subject to estate tax, exemptions, valuation of transferred property, determining situs of property, and applicability of reciprocity for non-resident aliens.

Original Description:

Lancelot

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document discusses estate taxation in the Philippines, including taxable transfers, exemptions, valuation of property, and determining what is included in a decedent's gross estate.

2. It provides examples of different scenarios involving the estates of decedents of various citizenships and residencies, and which properties would be included in the Philippine gross estate in each case.

3. Key issues covered include transfers subject to estate tax, exemptions, valuation of transferred property, determining situs of property, and applicability of reciprocity for non-resident aliens.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

2K views4 pages1st Exam

1st Exam

Uploaded by

Charles1. The document discusses estate taxation in the Philippines, including taxable transfers, exemptions, valuation of property, and determining what is included in a decedent's gross estate.

2. It provides examples of different scenarios involving the estates of decedents of various citizenships and residencies, and which properties would be included in the Philippine gross estate in each case.

3. Key issues covered include transfers subject to estate tax, exemptions, valuation of transferred property, determining situs of property, and applicability of reciprocity for non-resident aliens.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

TRANSFER TAXATION- ESTATE TAXES

February 6, 2020

Part I- Theory (1 pt.)

1. The following transfers are taxable, except?

a. Transfer passing under special power of appointment

b. Transfers with a right to revoke but not exercised by the decedent to the time of his death

c. Transfer in contemplation of death

d. Properties passing under general power of appointment

2. The following transfers are exempt and hence excluded from gross estate, except?

a. Merger of the usufruct in the owner of the naked title

b. All bequest, devise, legacies and transfers to social welfare, cultural and charitable institution no part of the income of

which inures to the benefit any person and not more than 30% of such bequest, devise or legacies or transfers are used

for administration purposes

c. The transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the fideicomissary

d. The transmission from the first heir, legatee, or donee in favor of another beneficiary, in accordance with the desire of the

predecessor

3. I. In taxable transfers, the value to include in gross estate is the fair value of the property at the time of death, any

consideration given by the counterparty is treated as an obligation deductible to gross estate

II. In taxable transfers, if the fair value at the time of death is lesser than the consideration given, no value is included in

gross estate

III. In taxable transfers, if at the date of transfer the fair value is higher than the consideration received, the fair value at

the time of death is included in gross estate regardless of whether at the time of death the value of the property is lower

than the consideration given

Which is correct?

a. I only b. I and II only c. II and III only d. II only

4. The reciprocity on exemption of intangible properties located in the Philippines of non-resident aliens may apply on the

following conditions, except when the foreign country where the non-resident alien is a citizen

a. do not have an estate tax law.

b. has estate tax only to residents or citizens therein.

c. has estate tax only to properties of a citizen thereon regardless of nature.

d. has no income tax imposed on income earned by the estate but imposes transfer taxes.

5. The gross estate of this decedent shall be comprised of properties situated in the Philippines only:

a. Filipino residing in the Philippines; c. Filipino residing in the US;

b. American residing in the Philippines; d. American residing in the US.

6. One of the following is not included in the gross estate of a citizen decedent:

a. Land situated outside the Philippines; c. Investment in stock in a Japanese corporation;

b. Car situated within the Philippines; d. Benefits received from group insurance.

7. For estate tax purposes, the rule of reciprocity applies:

I. When the decedent is a non-resident alien;

II. With respect to intangible personal properties situated in the Philippines;

a. Only I is correct; c. Both I and II are correct;

b. Only II is correct; d. Neither I nor II are correct.

8. One of the following is not an intangible personal property situated in the Philippines:

a. Shares, obligations or bonds issued by any corporation or sociedad anonima organized or constituted in the Philippines

in accordance with its laws;

b. Shares, obligations or bonds issued by any foreign corporation 85% of the business of which is located in the Philippines;

c. Shares, obligations or bonds issued by any foreign corporation if such shares, obligations or bonds have acquired

business situs in the Philippines;

d. Shares, obligations or bonds issued by a non-resident foreign corporation.

9. For estate tax purposes, one of the following is not an intangible personal property.

a. Accounts receivable; c. Bank deposit;

b. Investment in stock; d. Livestock.

10. John Johnson, an American domiciled in South Africa, died in 2005. He left the following property:

Rest house in Hawaii;

A Villa in Switzerland;

Shares of stock in LA Corporation, USA;

Shares of stock in San Miguel Corporation, Philippines;

Shares of stock in Union Corp, a foreign corporation where 85% of its business is in the Philippines;

Time deposit, Philippine National Bank, Manila;

Lease contract over his Manhattan, New York, USA apartment leased to the Philippine Consulate.

John Johnson’s Philippine gross estate shall consist of:

a. All property enumerated above; c. Only property a. b. and d.;

b. Only property d. e. and f.; d. None of the property enumerated above.

11. Using the same data in the preceding question, assuming there is reciprocity, John Johnson’s Philippine gross estate

shall consist of:

a. All properties enumerated above c. Only property f

b. Only properties d, e and f d. None of the properties enumerated above

12. Mr. Juan Cruz, Filipino citizen, died in the United States of America in 2005. He left the following properties:

House and lot, California, USA

Shares of stock in PLDT, domestic corporation

Bank deposit, First Bank of California, USA

Bank deposit, BPI-Manila

Tax-free long term Philippine government bonds

Car, registered in the name of his 21-year old son

The Philippine gross estate shall consist of:

a. All properties enumerated above c. All properties enumerated above except e and f

b. All properties enumerated above except f d. Only properties a and d

13. Case I – X transfer shares of stock of Y on the condition that X shall receive or enjoy the dividends during X’s lifetime,

thereafter to Y or his estate.

Case II – B makes a transfer of property in trust, income payable to himself for six (6) years, thereafter to C or his estate. B

dies before the six (6) years lapsed.

a. Both transfers are with retention and reservation of certain rights, hence taxable

b. Both transfers are exempt from estate tax

c. The first transfer is taxable, the second is exempt

d. The first transfer is exempt, the second is taxable

14. One of the following is not included in the gross estate of a decedent

a. Cash dividend that accrued before death

b. Shares of stock transferred in contemplation of death

c. Land held in trust but in the decedent’s possession before death

d. Rent income on property that accrued before death

15. One of the following is not a motive which precludes a transfer from category of one made in contemplation of death.

a. To reward services rendered c. To settle family litigated and unlitigated disputes

b. To save on donor’s and estate tax d. To relieve the donor from burden of management

16. Which of the following proceeds shall be included in the taxable gross estate?

a. Insurance proceeds from SSS and GSIS

b. Amount receivable by any beneficiary, irrevocably designated in the policy by the insured

c. Amount receivable by any beneficiary designated in the insurance policy

d. Proceeds of group insurance taken out by a company for its employees

17. The widow and children of a passenger who died in an airplane crash were paid P3,500,000 by the airline. This figure

was released after negotiation between the heirs of the deceased and the insurer of the airline, the latter having

received indubitable evidence that the deceased had a net income of P350,000 at the time of his death and that 10

productive years would have insured financial stability for his family. Should the heirs declare this amount in the estate

tax return?

a. No, the heirs should not declare the P3,500,000 in the estate tax return because the amount is not part of the

decedent’s properties at the time of death.

b. No. the heirs should not declare the P3,500,000 in the estate tax return because it was a result of a negotiation between

the heir and the airline company.

c. Yes. The heirs should declare the P3,500,000 in the estate tax return because the designation of the beneficiary is not

known, hence, negotiable.

d. Yes. The heirs should declare the P3,500,000 in the estate tax return because the amount would have earned by the

decedent if he did not die.

18. The following are transactions and acquisitions exempt from transfer taxes, except

a. Transmission from the first heir or donee in favor of another beneficiary in accordance with the desire of the predecessor

b. Transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the fideicommissary

c. The merger of the usufruct in the owner of the naked title

d. All bequests, devises, legacies or transfers to social welfare, cultural and charitable institutions

19. Which of the following exempt transactions will still require the inclusion of the property in the gross estate?

a. Merger of the usufruct in the owner of the naked title

b. Bequest, devises, legacies or transfers to social welfare, cultural and charitable institutions the administration expenses

of which do not exceed 30% of such bequest, devises, legacies or transfers

c. Transfer from the first heir to a second heir designated by the decedent

d. Death benefits received from SSS and GSIS

20. Case I – Y devised in his will a piece of land; naked title to B and usufruct to C for as long as C lives, thereafter to B. The

transmission from Y to B and C is subject to estate tax but the merger of the usufruct and the naked title in B upon the

death of C is exempt.

Case II – Z devised in his will real property to his brother D who is entrusted with the obligations to preserve and to

transmit the property to E, a son of D, when he becomes of age. The transmission from D to his son E is subject to tax.

a. Both statement as to the taxability and non-taxability of the transmissions are correct

b. Both statement as to the taxability and non-taxability of the transmissions are incorrect

c. Only the first statement as to the taxability and non-taxability of the transmissions is correct

d. Only the second statement as to the taxability and non-taxability of the transmission is correct

21. Statement 1: For marriages on or after August 3, 1988, the property relationship between husband and wife, in the

absence of a written agreement between them, is the system of absolute community of property.

Statement 2: There may be a property relationship of conjugal partnership of gains even if marriage was on or after

August 3, 1988.

a. Only the first statement is true

b. Only the second statement is true

c. Both statements are true

d. Both statements are false

22. Statement 1: As a rule , donations to candidates in local and/or national elections are not subject to donor’s tax.

Statement 2: Donation to a political party is not subject to donor’s tax if it is reported by the donor to the Comelec and

by the candidate in his Statement of Expenditures.

a. True; True c. False; False

b. True; False d. False; True

23. Statement 1: The gross gifts of a donor who is a non-resident alien will include all properties regardless of location.

Statement 2: The gross gifts of a donor who is a non-resident alien of the Philippines, will include only property located in

the Philippines.

a. both statements are correct

b. both statements are wrong

c. The first statement is correct and the second statement is wrong.

d. The first statement is wrong and the second statement is correct.

24. Don Fortunato, a widower, died in May 2020. In his will, he left his estate of P100 million to four children. He named his

compadre, Don Epitacio, to be the administrator of the estate. When the BIR sent a demand letter to Don Epitacio for

the payment of the estate tax, he refused to pay claiming that he did not benefit from the estate, he not being an heir.

Forthwith, he resigned as administrator. As a result of the resignation, who may be held liable for the payment of the

estate tax?

a. Don Epitacio since the tax became due prior to his resignation.

b. The eldest child who would be reimbursed by the others.

c. All the four children, the tax to be divided equally among them.

d. The person designated by the will as the one liable.

25. Mr. William died on June 30, 2019, leaving among others the following charges and obligations: Real property tax for the

calendar year 2019 – P20,000; On an interest-bearing promissory note (notarized): face value of the note – P10,000;

accrued interest on the note at the time of death – P600; and interest to accrue on the note from the date of death to

the date of maturity – P400. The deduction from the gross estate is:

a. 30,600 b. 21,000 c. 20,600 d. 31,000

26. Mr. Simon, a citizen and resident of Puerto Rico, dies during the year. Puerto Rico does not impose transfer taxes on properties

of decedent not residing therein. He left the following properties among others:

Shares of stock, San Miguel Corporation,

Manila House and lot, Puerto Rico

Leasehold on a condominium unit, Philippines

Contract for public works, Philippines

What properties are to be included in his Philippine gross estate. What answer will you give him?

a. Include all properties except shares of stock and house and lot

b. Include all properties except house and lot in Puerto Rico

c. Include contract for public works only

d. Include all the properties

27. Which of the following is not true regarding a claim against insolvent person?

a. The decedent’s claim which cannot be collected is deductible according to the ratio of the debtor’s assets to

liabilities.

b. The decedent’s claim must be included in full in the gross estate.

c. The decedent’s claim is deductible in full because the debtor’s liabilities exceed his remaining assets.

d. Claim against insolvent person is a claim against a person whose assets are not sufficient to pay his liabilities.

28. Which of the following cancellation or forgiveness of debt shall be included in the gross estate of the creditor?

a. Forgiveness or cancellation of debt where the debtor did not render service in a favor of the creditor to take effect

while the creditor is alive.

b. Forgiveness or cancellation of debt where the debtor rendered service in favor of the creditor.

c. Forgiveness or cancelation of debt where the debtor did not render service in favor of the creditor to take after the

creditor dies.

d. Forgiveness or cancellation of debt by a creditor-corporation in favor of a debtor-stockholder.

29. Mr. Jose donated completely a parcel of land to his son a few months Mr. Jose was accidentally hit over by a speeding

car and died. The particular parcel of land is includible in the gross estate of Mr. Jose which is subject to the estate tax

because

a. It is revocable transfer

b. It is a transfer for insufficient consideration

c. It is not to be included in the gross estate of Mr. Jose

d. It is part of the transfers in contemplation of death

30. Gardo, a citizen of the Philippines and resident of Baguio City died intestate on July 4, 2017. Among his gross estate is a

property inherited from his deceased father who died on June 10, 2014. What percentage of deduction will be used in

computing the amount of vanishing deduction?

a. 80% b. 60% c. 40% d. 20%

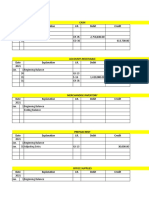

Part II- Problems (2 pts)

31. You are given the following information about the estate of a resident citizen decedent:

Columbia Net estate of P100,000 and estate tax paid of P1,500

Indonesia Net estate of P200,000 and estate tax paid of P1,800

Philippines Net estate of P1,500,000

The allowable amount of tax credit for estate tax paid in foreign countries amount to:

a. 3,000 b. 2,800 c. 3,300 d. 5,500

32. Genie and Gem got married before the effectivity of the New Family Code, devoid of any pre-nuptial agreement. A year

later, Gem received a donation consisting of a 400 square meter lot with modest bungalow house erected. The couple

leased the house to a tenant and saved the entire rental thereon. The said rental receipts were then sued to construct

their own residence on the vacant one-half portion of the same lot. Gem died, and the following information was

available at the time of her death.

FMV of 400 square-meter lot P800,000

FMV of rented bungalow house 200,000

FMV of family house 500,000

The gross estate of Gem amounts to:

a. P1,250,000 b. 1,000,000 c. 1,500,000 d. 800,000

33. Mr. A died on March 1, 2018. The following data were available in connection with the property:

Assessed value, 6 months before death 2,500,000

FV at the time of filing estate tax on Feb. 29, 2019 3,000,000

Zonal value, March 1, 2018 2,000,000

What would be the value of the land in the gross estate?

a. 2,000,000 b. 2,500,000 c. 3,000,000 d. 5,000,000

34. Mr. A also left 10,000 UM shares. The shares were traded in the PSE. At the time of death, the following data were

available:

Fair market value 400/ share

Average between the highest and lowest quotation 500/ share

Book value 350/ share

What is the value to be included in the gross estate?

a. 3,500,000 b. 4,000,000 c. 5,000,000 d. 6,000,000

35. Mr. Fatay died leaving the following properties:

House and Lot in Davao, acquired before marriage 6,000,000

Income from property in Davao 600,000

Apartment in Cebu, brought to marriage by wife 3,600,000

Income from such apartment 360,000

Townhouse in Cagayan, acquired during marriage 10,500,000

Income from such townhouse 1,050,000

Car, donated to wife during marriage( the will provided

that it shall be common to both spouses) 1,300,000

Jewelry, acquired during marriage for exclusive use of wife 200,000

How much is the conjugal properties under CPG?

a. 12,510,000 b. 18,510,000 c. 22,310,000 d. 23,610,000

36. How much is the gross estate under CPG?

a. 12,510,000 b. 18,510,000 c. 22,310,000 d. 23,610,000

37. How much is the community properties under ACP?

a. 12,510,000 b. 18,510,000 c. 22,310,000 d. 23,610,000

38. How much is the gross estate under ACP?

a. 12,510,000 b. 18,510,000 c. 22,310,000 d. 23,610,000

39. The estate of F, resident citizen decedent, married, who died on April 1, 2018, are as follows:

House and lot (Family Home) 14,000,000

The lot was acquired at a cost of 3M before marriage while the house was constructed on March 1, 2018,

during marriage, at a cost of 10M from partnership funds. The lot had a FV of 4M after construction of the

house

Other properties acquired during marriage 6,000,000

Jewelry, inherited on Feb 14, 2017, during marriage, then with

FV of 1.3M 2,500,000

Property in US received as gift during marriage from a friend on

Jan. 12, 2017 (applicable donor’s tax not paid by donor) 1,300,000

Accrued rental income from above property to date 1,200,000

Funeral expenses 420,000

Judicial expenses 800,000

Casualty-losses- Dec. 10, 2018 600,000

Claims against the estate 1,600,000

Medical expenses, within 1 year prior to death, (50% unreceipted) 4,000,000

How much is the net taxable estate under CPG?

a. 3,926,000 b. 6,426,000 c. 3,426,000 d. 1,348,000

40. How much is the net taxable estate under CPG?

a. 4,836,000 b. (2,174,000) d. 1,174,000 d. 2,174,000

You might also like

- University of Batangas Estate Tax: Multiple Choice ExercisesDocument5 pagesUniversity of Batangas Estate Tax: Multiple Choice ExercisesEdnel Loterte100% (1)

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- Estate Tax Sample Problems 2Document7 pagesEstate Tax Sample Problems 2Arj Sulit Centino Daqui0% (1)

- Donor S Tax Exam - Answers4Document5 pagesDonor S Tax Exam - Answers4Ednel Loterte100% (2)

- DocDocument68 pagesDocTrem GallenteNo ratings yet

- Quiz 1 - Estate TaxDocument7 pagesQuiz 1 - Estate TaxKevin James Sedurifa Oledan100% (4)

- AIR - Donor's TaxDocument5 pagesAIR - Donor's TaxRaz Jisryl100% (1)

- Taxation - Donors-Tax - Quizzer - 2018Document6 pagesTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- Final Exam Bus Tax 2nd Sem 2018-2019Document6 pagesFinal Exam Bus Tax 2nd Sem 2018-2019Renalyn Paras100% (2)

- Quiz Week 1Document10 pagesQuiz Week 1Katherine Ederosas50% (2)

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Estate Tax & Deductions TheoriesDocument12 pagesEstate Tax & Deductions TheoriesDanaNo ratings yet

- Big Data - Storage, Sharing and SecurityDocument449 pagesBig Data - Storage, Sharing and SecurityAlexandruNo ratings yet

- Gross Estate Tax QuizzerDocument6 pagesGross Estate Tax QuizzerLloyd Sonica100% (1)

- Gross Estate Tax Quizzer 1103aDocument6 pagesGross Estate Tax Quizzer 1103aCharry Ramos67% (3)

- Estate Tax PrelimsDocument28 pagesEstate Tax PrelimsSeanmigue TomaroyNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- Estate TaxationDocument25 pagesEstate TaxationNicolas Alonso100% (1)

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Taxbook PDFDocument151 pagesTaxbook PDFMARIA100% (1)

- Estate QuizDocument6 pagesEstate QuizJedi DuenasNo ratings yet

- 1 Intro DonationDocument27 pages1 Intro DonationMae NamocNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Orca Share Media1532355060231Document18 pagesOrca Share Media1532355060231Let it beNo ratings yet

- 1st PBDocument12 pages1st PBDin Rose Gonzales100% (2)

- ACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Document21 pagesACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Elizalen MacarilayNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- PrefinalDocument7 pagesPrefinalLeisleiRagoNo ratings yet

- Gross Income and DeductionsDocument6 pagesGross Income and DeductionsIvan Fausto OranteNo ratings yet

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- CHAPTER 13A - Transfer and Business TaxDocument20 pagesCHAPTER 13A - Transfer and Business TaxKatKat Olarte80% (5)

- Practical Accounting IIDocument19 pagesPractical Accounting IIChristine Nicole BacoNo ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Estate WorkbookDocument10 pagesEstate WorkbookXin ZhaoNo ratings yet

- Chapter 3 Inclusions in The Gross Income PDFDocument11 pagesChapter 3 Inclusions in The Gross Income PDFkimberly tenebro100% (1)

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- Capital Gains TaxDocument3 pagesCapital Gains TaxMary Christen Canlas0% (1)

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- Other Percentage TaxespdfDocument5 pagesOther Percentage TaxespdfAngeilyn RodaNo ratings yet

- Inter Tax FinalDocument4 pagesInter Tax FinalJil Macasaet0% (1)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Taxation Quizzer Quizzes For Tax PDFDocument62 pagesTaxation Quizzer Quizzes For Tax PDFCelestino AlisNo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- DeductionsDocument10 pagesDeductionsceline marasiganNo ratings yet

- 4 Gross-IncomeDocument5 pages4 Gross-IncomeSamantha Nicole HoyNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- p2 Foreign CurrencyDocument4 pagesp2 Foreign CurrencyJustine Goes KaizerNo ratings yet

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerMark Noel SanteNo ratings yet

- Transfer Taxes Theory QuizzerDocument15 pagesTransfer Taxes Theory QuizzerKenNo ratings yet

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Bus Law and TaxDocument15 pagesBus Law and Taxkay_kleirNo ratings yet

- Transfer Taxes Tax 2Document45 pagesTransfer Taxes Tax 2Nat PantsNo ratings yet

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesNo ratings yet

- Evaluate 1 - Estate Taxation Answer KeyDocument3 pagesEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoNo ratings yet

- BP Form 201 - Summary of Obligations and Proposed Activities / Projects (In Thousand Pesos)Document1 pageBP Form 201 - Summary of Obligations and Proposed Activities / Projects (In Thousand Pesos)CharlesNo ratings yet

- Status - 1 Submitted Page 1 ofDocument1 pageStatus - 1 Submitted Page 1 ofCharlesNo ratings yet

- BP 201 A RlipDocument1 pageBP 201 A RlipCharlesNo ratings yet

- Operating Unit Authorization New General Appropriations Department State Universities and Colleges (Sucs) Agency Davao Del Sur State CollegeDocument9 pagesOperating Unit Authorization New General Appropriations Department State Universities and Colleges (Sucs) Agency Davao Del Sur State CollegeCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocument20 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNo ratings yet

- BP Form 100-B Statement of Other Receipts/Expenditures Off-Budgetary and Custodial Funds FY 2020 - 2022 (In Thousand Pesos)Document1 pageBP Form 100-B Statement of Other Receipts/Expenditures Off-Budgetary and Custodial Funds FY 2020 - 2022 (In Thousand Pesos)CharlesNo ratings yet

- BP 201 A PSDocument2 pagesBP 201 A PSCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocument3 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Region: Region Xi - Davao Authorization: AllDocument18 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Region: Region Xi - Davao Authorization: AllCharlesNo ratings yet

- 5 - Establishment of Teacher Education Academic (TEP) BuildingDocument4 pages5 - Establishment of Teacher Education Academic (TEP) BuildingCharlesNo ratings yet

- 1Document32 pages1CharlesNo ratings yet

- 4-Establishment of Business Education and Governance Academic BuildingDocument4 pages4-Establishment of Business Education and Governance Academic BuildingCharlesNo ratings yet

- 3-Establishment of DSSC ICTC HubDocument4 pages3-Establishment of DSSC ICTC HubCharlesNo ratings yet

- 6-Professional Services (Additional 107 Administrative Personnel)Document4 pages6-Professional Services (Additional 107 Administrative Personnel)CharlesNo ratings yet

- BP Form CDocument3 pagesBP Form CCharlesNo ratings yet

- 2-Establishment of Instructional Materials Production CenterDocument4 pages2-Establishment of Instructional Materials Production CenterCharlesNo ratings yet

- BP Form A - Total Proposed ProgramDocument4 pagesBP Form A - Total Proposed ProgramCharlesNo ratings yet

- 1 - Repair of Earthquake-Damaged ICET Academic BuildingDocument4 pages1 - Repair of Earthquake-Damaged ICET Academic BuildingCharlesNo ratings yet

- Objectives of Good Store DesignDocument19 pagesObjectives of Good Store DesignanuradhaNo ratings yet

- SE SSE For RS Advt. No 85050421 q06njk2Document6 pagesSE SSE For RS Advt. No 85050421 q06njk2krishna singhNo ratings yet

- Dela Cruz, Jumar James BDocument2 pagesDela Cruz, Jumar James BSantiago Buladaco100% (1)

- Assignment AgreementDocument3 pagesAssignment AgreementMariaHelena Das Neves PereiraNo ratings yet

- Aris - User Guide It Architect S enDocument118 pagesAris - User Guide It Architect S enheidilille100% (1)

- Complete Final Business Plan 3Document38 pagesComplete Final Business Plan 3Lannie Garin100% (1)

- Long-Quiz CFASDocument20 pagesLong-Quiz CFASAya AlayonNo ratings yet

- Ijcs 2016 0303013 PDFDocument4 pagesIjcs 2016 0303013 PDFeditorinchiefijcsNo ratings yet

- Principles of Macroeconomics - FullDocument375 pagesPrinciples of Macroeconomics - FullHafsa YusifNo ratings yet

- How To Include Nonrecoverable Tax in Mass Additions in R12Document3 pagesHow To Include Nonrecoverable Tax in Mass Additions in R12nghazaly100% (1)

- Mobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptDocument30 pagesMobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptSimon ShresthaNo ratings yet

- GTU Ch-7 EntrepreneurshipDocument40 pagesGTU Ch-7 EntrepreneurshipMehul PatelNo ratings yet

- Jubilee Financial Report 2022Document328 pagesJubilee Financial Report 2022uroosa farooqNo ratings yet

- Absolute Deed of Sale - Mini VanDocument2 pagesAbsolute Deed of Sale - Mini VanAlly ClenistaNo ratings yet

- Uppcl 3Document6 pagesUppcl 3Anshu gautamNo ratings yet

- TH THDocument9 pagesTH THP.MannaNo ratings yet

- ReNew Power Strengthens Leadership Team Media Announcement PDFDocument2 pagesReNew Power Strengthens Leadership Team Media Announcement PDFNavneet KaurNo ratings yet

- Ch08 ITMDocument27 pagesCh08 ITMAbdulkadir JeilaniNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Modern Concepts of The Theory of The Firm: Springer-Verlag Berlin Heidelberg GMBHDocument650 pagesModern Concepts of The Theory of The Firm: Springer-Verlag Berlin Heidelberg GMBHAn TrầnNo ratings yet

- HR - Planning and Recruitment PDFDocument45 pagesHR - Planning and Recruitment PDFSatoto SubandoroNo ratings yet

- Sustainable Cocoa Production Program (SCPP) : Case StudyDocument19 pagesSustainable Cocoa Production Program (SCPP) : Case StudyfrendystpNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Dortch Lorae Social Media Audit 1Document11 pagesDortch Lorae Social Media Audit 1api-648504393No ratings yet

- Complan Case StudyDocument2 pagesComplan Case StudySiddharth Himmatramka0% (1)

- ZeriaDocument16 pagesZeriaBhaskar KulkarniNo ratings yet

- 7 Types of Business StrategiesDocument7 pages7 Types of Business StrategiesJaine Pantua GratilNo ratings yet

- Nuqui - Quiz On Special JournalsDocument25 pagesNuqui - Quiz On Special JournalsJesther NuquiNo ratings yet

- Original Skills MatrixDocument46 pagesOriginal Skills MatrixFrank Alexander Gustav SchulzNo ratings yet