Professional Documents

Culture Documents

RMC No 100-2017 PDF

RMC No 100-2017 PDF

Uploaded by

GLEMICH BUILDERS INCCopyright:

Available Formats

You might also like

- Aryaduta JakartaDocument3 pagesAryaduta JakartaDeny Saputra0% (1)

- Final Business PlanDocument35 pagesFinal Business Planjeanuel100% (1)

- RR 10-2019Document2 pagesRR 10-2019Jackie PadasasNo ratings yet

- RR 9-2018 Tax On StockDocument2 pagesRR 9-2018 Tax On StockRomer LesondatoNo ratings yet

- RMC No 89-2017Document3 pagesRMC No 89-2017Mark Lord Morales BumagatNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Suspension of Audit - RMC 76-2022Document1 pageSuspension of Audit - RMC 76-2022ECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDocument2 pagesRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENo ratings yet

- RR 22-2020Document2 pagesRR 22-2020Christopher ArellanoNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018Document2 pagesRR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018sdysangcoNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- RMC No 54-18 Interest and Penalty PDFDocument2 pagesRMC No 54-18 Interest and Penalty PDFGil PinoNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- 5gBJECT:: Regulations BIR ofDocument6 pages5gBJECT:: Regulations BIR ofErica CaliuagNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- Ii) ) .I:/'i-'Ii: Ijri 4lrl-I T/EERDocument1 pageIi) ) .I:/'i-'Ii: Ijri 4lrl-I T/EERGoogleNo ratings yet

- RMC 2019 No. 142 eDST Balance Adjustment As An Option For Recovery of Erroneously Deducted DSTDocument2 pagesRMC 2019 No. 142 eDST Balance Adjustment As An Option For Recovery of Erroneously Deducted DSTBien Bowie A. CortezNo ratings yet

- RMC No. 14-2021Document1 pageRMC No. 14-2021nathalie velasquezNo ratings yet

- Rmo01 04Document8 pagesRmo01 04Eric SavinaNo ratings yet

- RMC No. 105-2016 PDFDocument1 pageRMC No. 105-2016 PDFReymund BumanglagNo ratings yet

- RMC No. 135-2019Document4 pagesRMC No. 135-2019Jeffrey Dela Rosa BautistaNo ratings yet

- RR No. 22-2020 PDFDocument2 pagesRR No. 22-2020 PDFSandyNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RMC No. 112-2020Document1 pageRMC No. 112-2020Tina Reyes-BattadNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RR No. 1-2017Document3 pagesRR No. 1-2017Kayelyn LatNo ratings yet

- RMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsDocument2 pagesRMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsMiming BudoyNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StocksDocument1 pageRMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StockszooeyNo ratings yet

- RMC No. 45-2021Document1 pageRMC No. 45-2021Raffy AmosNo ratings yet

- RMC No. 133-2020Document2 pagesRMC No. 133-2020nathalie velasquezNo ratings yet

- RMC No. 49-2020Document4 pagesRMC No. 49-2020Juna May YanoyanNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- 47470rmc No. 51-2009 PDFDocument5 pages47470rmc No. 51-2009 PDFEarl PatrickNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- Bir RMC 51-2009Document5 pagesBir RMC 51-2009Reg YuNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- RR 5-2016Document3 pagesRR 5-2016McrislbNo ratings yet

- "4" Amnesty On: Tax De!Inqllencies IlllDocument2 pages"4" Amnesty On: Tax De!Inqllencies IlllRonald Allan Valdez Miranda Jr.No ratings yet

- 51562-2015-Submission of Inventory List and Other20210524-11-Dry51yDocument6 pages51562-2015-Submission of Inventory List and Other20210524-11-Dry51ycatherine joy sangilNo ratings yet

- Uprii ,: Memorandum Circular Clarifies CertainDocument9 pagesUprii ,: Memorandum Circular Clarifies CertainBert AslorNo ratings yet

- RR No. 25-2020Document2 pagesRR No. 25-2020Kram Ynothna BulahanNo ratings yet

- 9:41 Lwua : 0058 Ert (A#F/FtlvDocument1 page9:41 Lwua : 0058 Ert (A#F/FtlvYna YnaNo ratings yet

- RDAO No. 2-2019Document1 pageRDAO No. 2-2019Earl PatrickNo ratings yet

- RMO No.5-2019Document2 pagesRMO No.5-2019Jhenny Ann P. SalemNo ratings yet

- 57 2015Document4 pages57 2015Carlo100% (1)

- RR No 21-2018Document3 pagesRR No 21-2018Larry Tobias Jr.No ratings yet

- RMC No 10-2018 - Wholding Tax On CreditorsDocument2 pagesRMC No 10-2018 - Wholding Tax On CreditorsMinnie JulianNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021REX FABERNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021lara.zestoNo ratings yet

- NR ZBG: Republic Department Finance of InternalDocument1 pageNR ZBG: Republic Department Finance of InternalAlden Christopher LumotNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Salary Slip PDFDocument1 pageSalary Slip PDFQamar BahadarNo ratings yet

- Ak Social Studies Daily MaterialDocument40 pagesAk Social Studies Daily MaterialJuliusNo ratings yet

- Truebell - Fin - Tax - Config - GST TaxDocument103 pagesTruebell - Fin - Tax - Config - GST TaxRajesh ChowdaryNo ratings yet

- Students Feedback About The Learning OutcomesDocument12 pagesStudents Feedback About The Learning OutcomesThea BacsaNo ratings yet

- The Role of The Entrepreneur SummaryDocument3 pagesThe Role of The Entrepreneur SummaryEzra HutahayanNo ratings yet

- Chapter 4 FARDocument20 pagesChapter 4 FARSree Mathi SuntheriNo ratings yet

- J. B. Nagar 06 02 2011 - CA. Tarun GhiaDocument18 pagesJ. B. Nagar 06 02 2011 - CA. Tarun GhiaShailesh ChhajedNo ratings yet

- ACC 312 - Exam 1 - Form A - Fall 2012 PDFDocument14 pagesACC 312 - Exam 1 - Form A - Fall 2012 PDFGeetika InstaNo ratings yet

- 35-TAX-Manila Memorial Park vs. DSWD and DOFDocument2 pages35-TAX-Manila Memorial Park vs. DSWD and DOFJoesil Dianne100% (1)

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Economic Development Strategy 2013 2017Document88 pagesEconomic Development Strategy 2013 2017Magdalena PalomaresNo ratings yet

- Concepts in Federal Taxation 23rd Edition by Murphy Higgins ISBN Solution ManualDocument99 pagesConcepts in Federal Taxation 23rd Edition by Murphy Higgins ISBN Solution Manualrichard100% (29)

- Tutorial 8Document17 pagesTutorial 8Christie Ann WeeNo ratings yet

- The Local Government Code of The PhilippinesDocument130 pagesThe Local Government Code of The PhilippinesJennifer AndoNo ratings yet

- Gasbill 3851735781 202003 20200423020450Document1 pageGasbill 3851735781 202003 20200423020450Shahzaib GujjarNo ratings yet

- GSTR3B 09hbjps0079a1zi 042022Document3 pagesGSTR3B 09hbjps0079a1zi 042022birpal singhNo ratings yet

- Taxation 1 DigestsDocument14 pagesTaxation 1 DigestsgabbieseguiranNo ratings yet

- InvoiceDocument1 pageInvoiceShabbir BurhanpurwalaNo ratings yet

- Gas Stove InvoiceDocument1 pageGas Stove Invoiceधांगड धिंगाNo ratings yet

- Chapter 8 - National IncomeDocument34 pagesChapter 8 - National IncomePhranxies Jean Loay BlayaNo ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- First Statement:: Answer: ADocument6 pagesFirst Statement:: Answer: AJames DiazNo ratings yet

- Department of MathematicsDocument31 pagesDepartment of MathematicsmcdabenNo ratings yet

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Document20 pagesScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderNo ratings yet

- Coll v. Batangas, 54 OG 6724Document7 pagesColl v. Batangas, 54 OG 6724Marge OstanNo ratings yet

- InvoiceDocument1 pageInvoicebalu.nitwNo ratings yet

- SalarySlip NovDocument1 pageSalarySlip Novsavan anvekarNo ratings yet

- 1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearDocument4 pages1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearramNo ratings yet

RMC No 100-2017 PDF

RMC No 100-2017 PDF

Uploaded by

GLEMICH BUILDERS INCOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No 100-2017 PDF

RMC No 100-2017 PDF

Uploaded by

GLEMICH BUILDERS INCCopyright:

Available Formats

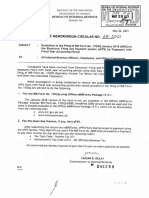

I HE PHILIPPINES

RI-,I)L]BLI(] OF

DEPARTN4I-\T OF F'IN ANC. E

BTII{EAT I OFJ\TI,ItI.! AT- REVEN Ti II-

Qlrezon L lt)

December 18.2011

REVENUE MEMORANDUM CIRCULAR NO. I N - 2O I 7

SUBJECT clarifying the sanctions for the Non-Submission of Alphabetical List of

Em ployees/Payees of Income Payments

TO All Internal Revenue Officers and Others Concerned

Section 57 and 79(A) of the Tax Code of I997. as implemented b1' Revenue Regulations No. 2-9g,

as amended. require the withholding of taxes by the pavor ol incorne/employer (withholding agept)

on

cetlain income payments and on salaries and wages of employees, respectively. Such taxes withheld shall

then be remitted by the withholding agent to the BIR by' filing the monthly remittance returns (BIR Form

1601E, 1601F. 1601C) and paying the corresponding tax due.

In addition to the filing of remittance returns and payment of the taxes withheld, withholding agents

are likewise required. pursuant to Section 58(C) and 83(B) of the same Code, to submit to the BIR an

Annual Information Return (BIR Form 1604E. l604CF) together with the Alphabetical List of payees/

Employees. Such return is a no payment return. instead. it coniains. among others. the information

regarding the monthly remittance of taxes withheld and the summary of payees from whom taxes were

withheld and already remitted to the BIR during the taxable year.

With the filing of monthly remittance returns and pavment of the taxes withheld, the requirement

for the deductibility of expenses which have been subjected to withholding tax were already complied.

Thus, failure to file the Alphabetical List of Payees/Employees or failure to re-submit the complete

and

corrected alphabetical list after the validation process conducted by the BIR shall not resuli to the non-

deductibiliti'of the expenses considering that the taxes corresponding thereto were ajready withheld and

remitted.

However, considering that failure/non-filing of alphabetical list of pal,ees/employees or the failure

to submit the complete or corrected one is a violation of the provisions of the Tax Code and existing

issuances, a compromise penalty of One Thousand Pesos (P1,000.00) shall be imposed for

each failure to

make. file or submit the said information return which aggregate amount to be imposecl for such failures

during the calendar year shall not exceed Twenty Five Thousand Pesos (P25,000.00), pursuant

to Revenue

Memorandum Order No. 7-2015. Payment of the compromise penalty shal1. in no wav, relieve

the

withholding agent from the submission of the required Alphabetical List or the complete

or correcred

alphabetical Iist.

This Circular supersedes Revenue Memorandum CircularNo. 5-2014. in so far as ltem

No. l5 is

concerned. and al1 other issuances inconsistent herer.vith.

All concerned are hereby enjoined to give this Circular a wide publicity as possible.

,f.,j._j*gl NEnt./J

EilEfiE

/tr4"'-t**V

,.

.i.--OR.DS Me,f. nnt:C..i

e i:n:"

-t9; s

CEClgllfi /t

CAESAR R. DLILAY

Commissioner of Internal Revenue

012 0 0 1

REcE trvWfr"

You might also like

- Aryaduta JakartaDocument3 pagesAryaduta JakartaDeny Saputra0% (1)

- Final Business PlanDocument35 pagesFinal Business Planjeanuel100% (1)

- RR 10-2019Document2 pagesRR 10-2019Jackie PadasasNo ratings yet

- RR 9-2018 Tax On StockDocument2 pagesRR 9-2018 Tax On StockRomer LesondatoNo ratings yet

- RMC No 89-2017Document3 pagesRMC No 89-2017Mark Lord Morales BumagatNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Suspension of Audit - RMC 76-2022Document1 pageSuspension of Audit - RMC 76-2022ECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDocument2 pagesRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENo ratings yet

- RR 22-2020Document2 pagesRR 22-2020Christopher ArellanoNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018Document2 pagesRR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018sdysangcoNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- RMC No 54-18 Interest and Penalty PDFDocument2 pagesRMC No 54-18 Interest and Penalty PDFGil PinoNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- 5gBJECT:: Regulations BIR ofDocument6 pages5gBJECT:: Regulations BIR ofErica CaliuagNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- Ii) ) .I:/'i-'Ii: Ijri 4lrl-I T/EERDocument1 pageIi) ) .I:/'i-'Ii: Ijri 4lrl-I T/EERGoogleNo ratings yet

- RMC 2019 No. 142 eDST Balance Adjustment As An Option For Recovery of Erroneously Deducted DSTDocument2 pagesRMC 2019 No. 142 eDST Balance Adjustment As An Option For Recovery of Erroneously Deducted DSTBien Bowie A. CortezNo ratings yet

- RMC No. 14-2021Document1 pageRMC No. 14-2021nathalie velasquezNo ratings yet

- Rmo01 04Document8 pagesRmo01 04Eric SavinaNo ratings yet

- RMC No. 105-2016 PDFDocument1 pageRMC No. 105-2016 PDFReymund BumanglagNo ratings yet

- RMC No. 135-2019Document4 pagesRMC No. 135-2019Jeffrey Dela Rosa BautistaNo ratings yet

- RR No. 22-2020 PDFDocument2 pagesRR No. 22-2020 PDFSandyNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RMC No. 112-2020Document1 pageRMC No. 112-2020Tina Reyes-BattadNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RR No. 1-2017Document3 pagesRR No. 1-2017Kayelyn LatNo ratings yet

- RMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsDocument2 pagesRMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsMiming BudoyNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StocksDocument1 pageRMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StockszooeyNo ratings yet

- RMC No. 45-2021Document1 pageRMC No. 45-2021Raffy AmosNo ratings yet

- RMC No. 133-2020Document2 pagesRMC No. 133-2020nathalie velasquezNo ratings yet

- RMC No. 49-2020Document4 pagesRMC No. 49-2020Juna May YanoyanNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- 47470rmc No. 51-2009 PDFDocument5 pages47470rmc No. 51-2009 PDFEarl PatrickNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- Bir RMC 51-2009Document5 pagesBir RMC 51-2009Reg YuNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- RR 5-2016Document3 pagesRR 5-2016McrislbNo ratings yet

- "4" Amnesty On: Tax De!Inqllencies IlllDocument2 pages"4" Amnesty On: Tax De!Inqllencies IlllRonald Allan Valdez Miranda Jr.No ratings yet

- 51562-2015-Submission of Inventory List and Other20210524-11-Dry51yDocument6 pages51562-2015-Submission of Inventory List and Other20210524-11-Dry51ycatherine joy sangilNo ratings yet

- Uprii ,: Memorandum Circular Clarifies CertainDocument9 pagesUprii ,: Memorandum Circular Clarifies CertainBert AslorNo ratings yet

- RR No. 25-2020Document2 pagesRR No. 25-2020Kram Ynothna BulahanNo ratings yet

- 9:41 Lwua : 0058 Ert (A#F/FtlvDocument1 page9:41 Lwua : 0058 Ert (A#F/FtlvYna YnaNo ratings yet

- RDAO No. 2-2019Document1 pageRDAO No. 2-2019Earl PatrickNo ratings yet

- RMO No.5-2019Document2 pagesRMO No.5-2019Jhenny Ann P. SalemNo ratings yet

- 57 2015Document4 pages57 2015Carlo100% (1)

- RR No 21-2018Document3 pagesRR No 21-2018Larry Tobias Jr.No ratings yet

- RMC No 10-2018 - Wholding Tax On CreditorsDocument2 pagesRMC No 10-2018 - Wholding Tax On CreditorsMinnie JulianNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021REX FABERNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021lara.zestoNo ratings yet

- NR ZBG: Republic Department Finance of InternalDocument1 pageNR ZBG: Republic Department Finance of InternalAlden Christopher LumotNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Salary Slip PDFDocument1 pageSalary Slip PDFQamar BahadarNo ratings yet

- Ak Social Studies Daily MaterialDocument40 pagesAk Social Studies Daily MaterialJuliusNo ratings yet

- Truebell - Fin - Tax - Config - GST TaxDocument103 pagesTruebell - Fin - Tax - Config - GST TaxRajesh ChowdaryNo ratings yet

- Students Feedback About The Learning OutcomesDocument12 pagesStudents Feedback About The Learning OutcomesThea BacsaNo ratings yet

- The Role of The Entrepreneur SummaryDocument3 pagesThe Role of The Entrepreneur SummaryEzra HutahayanNo ratings yet

- Chapter 4 FARDocument20 pagesChapter 4 FARSree Mathi SuntheriNo ratings yet

- J. B. Nagar 06 02 2011 - CA. Tarun GhiaDocument18 pagesJ. B. Nagar 06 02 2011 - CA. Tarun GhiaShailesh ChhajedNo ratings yet

- ACC 312 - Exam 1 - Form A - Fall 2012 PDFDocument14 pagesACC 312 - Exam 1 - Form A - Fall 2012 PDFGeetika InstaNo ratings yet

- 35-TAX-Manila Memorial Park vs. DSWD and DOFDocument2 pages35-TAX-Manila Memorial Park vs. DSWD and DOFJoesil Dianne100% (1)

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Economic Development Strategy 2013 2017Document88 pagesEconomic Development Strategy 2013 2017Magdalena PalomaresNo ratings yet

- Concepts in Federal Taxation 23rd Edition by Murphy Higgins ISBN Solution ManualDocument99 pagesConcepts in Federal Taxation 23rd Edition by Murphy Higgins ISBN Solution Manualrichard100% (29)

- Tutorial 8Document17 pagesTutorial 8Christie Ann WeeNo ratings yet

- The Local Government Code of The PhilippinesDocument130 pagesThe Local Government Code of The PhilippinesJennifer AndoNo ratings yet

- Gasbill 3851735781 202003 20200423020450Document1 pageGasbill 3851735781 202003 20200423020450Shahzaib GujjarNo ratings yet

- GSTR3B 09hbjps0079a1zi 042022Document3 pagesGSTR3B 09hbjps0079a1zi 042022birpal singhNo ratings yet

- Taxation 1 DigestsDocument14 pagesTaxation 1 DigestsgabbieseguiranNo ratings yet

- InvoiceDocument1 pageInvoiceShabbir BurhanpurwalaNo ratings yet

- Gas Stove InvoiceDocument1 pageGas Stove Invoiceधांगड धिंगाNo ratings yet

- Chapter 8 - National IncomeDocument34 pagesChapter 8 - National IncomePhranxies Jean Loay BlayaNo ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- First Statement:: Answer: ADocument6 pagesFirst Statement:: Answer: AJames DiazNo ratings yet

- Department of MathematicsDocument31 pagesDepartment of MathematicsmcdabenNo ratings yet

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Document20 pagesScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderNo ratings yet

- Coll v. Batangas, 54 OG 6724Document7 pagesColl v. Batangas, 54 OG 6724Marge OstanNo ratings yet

- InvoiceDocument1 pageInvoicebalu.nitwNo ratings yet

- SalarySlip NovDocument1 pageSalarySlip Novsavan anvekarNo ratings yet

- 1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearDocument4 pages1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearramNo ratings yet