Professional Documents

Culture Documents

II A - Income Tax Questions

II A - Income Tax Questions

Uploaded by

Rohith krishnan ktOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

II A - Income Tax Questions

II A - Income Tax Questions

Uploaded by

Rohith krishnan ktCopyright:

Available Formats

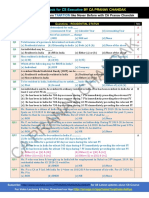

INCOME TAX QUESTIONS

Unit II - Residential Status

1) Hariharan comes to India, for the first time on April 16, 2017. During his stay in India up to October 5,

2019, he stays at Delhi up to April 10, 2019 and thereafter remains in Chennai till his departure from

India. Determine his residential status for the assessment year 2020-21.

2) Ramesh is a foreign citizen (not being a person of Indian origin), leaves India for the first time in the last

20 years on November 20, 2017. During the calendar year 2018, he comes to Indian on September 1 for a

period of 30 days. During the calendar year 2019, he does not visit India at all but comes to India on

January 16, 2020. Determine the residential status of Ramesh for the assessment year 2020-21.

3) Suresh is a foreign citizen (not being a person of Indian origin). During the financial year 2019-20, he

came to India for 70 days. Determine his residential status for the assessment year 2020-21 on the

assumption that during financial year 2005-06 to 2019-20, he was present in India as follows:

2018-19 100 days 2011-12 181 days

2017-18 80 days 2010-11 90 days

2016-17 60 days 2009-10 71 days

2015-16 126 days 2008-09 4 days

2014-15 80 days 2007-08 8 days

2013-14 70 days 2006-07 55 days

2012-13 23 days 2005-06 298 days

4) Girish, an Indian citizen, who is appointed as senior taxation officer by the Government of Nigeria,

Leaves India, for the first time, on September 26, 2018 for joining his duties in Nigeria. During the

previous year 2019-20, he comes to India for 176 days. Determine the residential status of X for the

assessment years 2019-20 and 2020-21.

5) Harish, an Indian citizen, leaves India for the first time on September 20, 2017 for the purpose of

employment. He comes to India for a visit of 146 days on April 10, 2018. He finally comes back on May

16, 2019. Find out the residential status of X for the assessment year 2020-21.

6) Sarvanan, is an Indian citizen and a member of the crew of a Singapore bound Indian ship engaged in

carriage of passenger in international traffic departing from Chennai port on 6 th June, 2019. From the

following details for PY 2019-20, determine the residential status of X for AY 2020-21, assuming that his

stay in India in the last 4 previous year (preceding PY 2019-20) is 400 days and last seven previous year

(preceding PY 2019-20) is 750 days.

Particulars Date

date entered into the Continuous Discharge Certificate in respect of joining the ship 6th Jun, 2019

by Mr. X

Date entered into the Continuous Discharge Certificate in respect of signing off the 9th Dec, 2019

ship by Mr.X

Christ (Deemed to be University) – B.Com(F&A) Page 1

You might also like

- Master CylinderDocument180 pagesMaster Cylindergestada023No ratings yet

- TAXDocument3 pagesTAXravishNo ratings yet

- Residential StatusDocument4 pagesResidential StatusTauseef AzharNo ratings yet

- Unit 2 Scope of Total Income and Residential StatusDocument16 pagesUnit 2 Scope of Total Income and Residential StatusDeepeshNo ratings yet

- Practice Questions Residential Status 1Document2 pagesPractice Questions Residential Status 1Varsha .kNo ratings yet

- Residential Status QuestionsDocument2 pagesResidential Status QuestionsVrinda GoelNo ratings yet

- DT (Q&a)Document186 pagesDT (Q&a)mktg.seagullshippingNo ratings yet

- Assignment DTDocument2 pagesAssignment DTJayashree SahaNo ratings yet

- Taxtion Law Unit IIDocument44 pagesTaxtion Law Unit IIMathew KanichayNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- Practice ProblemsDocument1 pagePractice ProblemsAyush SarawagiNo ratings yet

- Problems On Residential Status PDFDocument5 pagesProblems On Residential Status PDFChelsy RochlaniNo ratings yet

- Residential Status & Scope of Total IncomeDocument12 pagesResidential Status & Scope of Total IncomekiranmayeeNo ratings yet

- RESIDENTIAL STATUS OF AN ASSESSEE ProblemsDocument2 pagesRESIDENTIAL STATUS OF AN ASSESSEE Problemsgoli pandeyNo ratings yet

- Taxation Important Q's CAtestseriesDocument358 pagesTaxation Important Q's CAtestseriessarvan kumarNo ratings yet

- Tax Imp Question 1 100 1620383817Document95 pagesTax Imp Question 1 100 1620383817Surya NavikNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- Income Tax Divyastra CH 1 Residential Status RDocument9 pagesIncome Tax Divyastra CH 1 Residential Status RCRO0658286 DEEPANSHU GOYALNo ratings yet

- 15UPA515 - Direct TaxDocument26 pages15UPA515 - Direct TaxPrincy MonicaNo ratings yet

- CHAPTER - 2 Residential Status.Document21 pagesCHAPTER - 2 Residential Status.deepikadobriyal1No ratings yet

- Residential StatusDocument33 pagesResidential StatusMeghna ShettyNo ratings yet

- Residential StatusDocument4 pagesResidential StatusShaji KuttyNo ratings yet

- UNIT 1 B Residental StatusDocument26 pagesUNIT 1 B Residental StatusGanesh PNo ratings yet

- Residential Status Practice Sums PY 21-22Document6 pagesResidential Status Practice Sums PY 21-22VEDANT SAININo ratings yet

- Solution: IllustrationDocument10 pagesSolution: IllustrationRishabh JainNo ratings yet

- Unit - 2 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document3 pagesUnit - 2 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singhNo ratings yet

- Test 2 SolutionDocument5 pagesTest 2 SolutionYash PathakNo ratings yet

- Residential Status SolDocument4 pagesResidential Status SolNaveen KumarNo ratings yet

- Q & A Marathon DT Question Bank Part 1Document181 pagesQ & A Marathon DT Question Bank Part 1Gagan SahuNo ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- UNIT 1 B Residental Status GaneshDocument26 pagesUNIT 1 B Residental Status GaneshGanesh PNo ratings yet

- Residential StatusDocument8 pagesResidential StatusUthra PandianNo ratings yet

- Test 2 Residential Status Without SolutionDocument6 pagesTest 2 Residential Status Without SolutionRavenNo ratings yet

- UNIT 1 B Residental StatusDocument26 pagesUNIT 1 B Residental StatusPrayag DasNo ratings yet

- RS and ITDocument19 pagesRS and ITRahul Agrawal100% (1)

- Residential StatusDocument16 pagesResidential StatusJimmy ShergillNo ratings yet

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Kishan Kumar Income Tax Amendments May2021Document6 pagesKishan Kumar Income Tax Amendments May2021ileshrathod0No ratings yet

- Chapter 2 Residential StatusDocument6 pagesChapter 2 Residential StatusGrave diggerNo ratings yet

- Residential Status - IllustrationsDocument6 pagesResidential Status - IllustrationsAnirban ThakurNo ratings yet

- Residential Statuts 20216171446260Document23 pagesResidential Statuts 20216171446260Neha singhNo ratings yet

- Residential Status & Scope of Total IncomeDocument23 pagesResidential Status & Scope of Total IncomeKartikNo ratings yet

- Residential Status & Scope of Total IncomeDocument19 pagesResidential Status & Scope of Total IncomeNidhi LathNo ratings yet

- Chapter 1: Residential Status of An AssesseeDocument4 pagesChapter 1: Residential Status of An AssesseeHahNo ratings yet

- 31162sm DTL Finalnew-May-Nov14 Cp2Document25 pages31162sm DTL Finalnew-May-Nov14 Cp2gvcNo ratings yet

- Determination of Residential StatusDocument3 pagesDetermination of Residential StatusIshaan MehraNo ratings yet

- Tax - M-1 ProblemsDocument14 pagesTax - M-1 ProblemsChikke GowdaNo ratings yet

- Residential StatusDocument40 pagesResidential StatusSmartNo ratings yet

- Bos 58983Document20 pagesBos 58983Kartik0% (1)

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Chapter 11 - Residence and Scope of Total Income - NotesDocument14 pagesChapter 11 - Residence and Scope of Total Income - NotesAkshay PooniaNo ratings yet

- Residential Status: Multiple Choice QuestionsDocument15 pagesResidential Status: Multiple Choice QuestionsNisha PasariNo ratings yet

- Prepared By: Sikha Sadani Assistant Professor, IITMDocument39 pagesPrepared By: Sikha Sadani Assistant Professor, IITMTANYANo ratings yet

- Tax Residence TutorialDocument11 pagesTax Residence TutorialHazlina HusseinNo ratings yet

- Paper 7: Direct Tax Laws & International Taxation: Questions and AnswersDocument19 pagesPaper 7: Direct Tax Laws & International Taxation: Questions and Answersneeraj sharmaNo ratings yet

- Residential StatusDocument18 pagesResidential StatusShruti DoshiNo ratings yet

- Residential Status MCQs - Part 1Document5 pagesResidential Status MCQs - Part 1Manikandan ManoharNo ratings yet

- Residential ChapterDocument34 pagesResidential ChapterManohar LalNo ratings yet

- SCH 4Document3 pagesSCH 4pramod singhNo ratings yet

- D TAX I Questions With SolutionDocument33 pagesD TAX I Questions With SolutionLakshmi PrabhuNo ratings yet

- Jurisdiction of Supreme Court of IndiaDocument4 pagesJurisdiction of Supreme Court of Indiaamol96No ratings yet

- 5 10 DigestsDocument3 pages5 10 DigestsYour Public ProfileNo ratings yet

- Cash Credits LLB Notes Income Tax Act Gen Law CollegeDocument8 pagesCash Credits LLB Notes Income Tax Act Gen Law CollegeJohn WickNo ratings yet

- End of Service Benefit (Eosb) Calculation: DMCC'S Employment Mediation ServicesDocument5 pagesEnd of Service Benefit (Eosb) Calculation: DMCC'S Employment Mediation ServicesJOHN PETER.SNo ratings yet

- Plaintiff-Appellee, Accused-AppellantsDocument8 pagesPlaintiff-Appellee, Accused-AppellantsBianca DawisNo ratings yet

- Accounting Cycle of A Service Business-ExerciseDocument50 pagesAccounting Cycle of A Service Business-ExerciseHannah GarciaNo ratings yet

- Admission Notice 2022-23 For Class IDocument3 pagesAdmission Notice 2022-23 For Class IPrashant A UNo ratings yet

- Bitcoin - ASA Agreement Template Rel1Document13 pagesBitcoin - ASA Agreement Template Rel1stonecoldltdNo ratings yet

- AUGUST 20, 2021: Calendar Business of The DayDocument5 pagesAUGUST 20, 2021: Calendar Business of The DayArniel Fred Tormis FernandezNo ratings yet

- Written Arguments by R4 and R2Document26 pagesWritten Arguments by R4 and R2Sana ParveenNo ratings yet

- Concise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using FormulaDocument31 pagesConcise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using Formulayashvi ghatkarNo ratings yet

- Vat ZNZDocument6 pagesVat ZNZAndrey PavlovskiyNo ratings yet

- B012-Netri-Dave-English Ica PaperDocument11 pagesB012-Netri-Dave-English Ica Paperpizzabythebay kNo ratings yet

- Mcdonald's Corporation v. Mcjoy G.R. No. 166115 February 2, 2007Document6 pagesMcdonald's Corporation v. Mcjoy G.R. No. 166115 February 2, 2007Recson BangibangNo ratings yet

- Cdi 6 Case Scenario..Document7 pagesCdi 6 Case Scenario..Ivy Batuhan AmanoNo ratings yet

- Sps. Yusay vs. CADocument1 pageSps. Yusay vs. CAOnnie LeeNo ratings yet

- AR-ASTRA-May11 LowresDocument140 pagesAR-ASTRA-May11 Lowresmild incNo ratings yet

- A Review of The Strengthening of The Nigeria Consumer Protection Framework Via Judicial Activism Within The Hospitality and Tourism BusinessesDocument17 pagesA Review of The Strengthening of The Nigeria Consumer Protection Framework Via Judicial Activism Within The Hospitality and Tourism BusinessesProf. Wasiu BabalolaNo ratings yet

- Kupdf Com Admin Law by Agpalo Reviewer PDFDocument3 pagesKupdf Com Admin Law by Agpalo Reviewer PDFPrincess Caroline Nichole Ibarra0% (1)

- Ebook PDF Business Law Text Cases An Accelerated Course 14th Edition PDFDocument42 pagesEbook PDF Business Law Text Cases An Accelerated Course 14th Edition PDFmary.cardin710100% (43)

- SMC Vs UnionDocument3 pagesSMC Vs UnionRyan ChristianNo ratings yet

- The Standard: COVID-19Document25 pagesThe Standard: COVID-19julietNo ratings yet

- Circular Development Release Sites Layout 24 5 2004Document6 pagesCircular Development Release Sites Layout 24 5 2004Sai VivekNo ratings yet

- NACE MR0175 ISO15156 Part2Document15 pagesNACE MR0175 ISO15156 Part2earlangga rmpNo ratings yet

- NyconXL100Sheet060414-macro PPDocument2 pagesNyconXL100Sheet060414-macro PPuğur alparslanNo ratings yet

- MCQ - CPWD CHAPTER 9 - Works AccountsDocument41 pagesMCQ - CPWD CHAPTER 9 - Works AccountsBeauty Queen75% (4)

- Application For Waiver 3rd TimeDocument5 pagesApplication For Waiver 3rd TimeSyed Kamran AliNo ratings yet

- LIP DigestsDocument55 pagesLIP DigestsJM Guevarra0% (1)

- DOI: Http://ijmer - In.doi./2021/10.08.04 Article Received: 4 August Publication Date:30 August 2021Document14 pagesDOI: Http://ijmer - In.doi./2021/10.08.04 Article Received: 4 August Publication Date:30 August 2021Neha JalanNo ratings yet