Professional Documents

Culture Documents

Chapter1 Liability

Chapter1 Liability

Uploaded by

Vrix Ace MangilitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter1 Liability

Chapter1 Liability

Uploaded by

Vrix Ace MangilitCopyright:

Available Formats

Angeles University Foundation | Bachelor of Science in Accountancy LIABILITY The goal is to earn the title –

CPA

Liability The entity holds the liability primarily for the purpose of

The entity has a present obligation trading

The obligation is to transfer an economic resource The entity does not have an unconditional right do defer

The liability arises from a past event settlement of the liability for at least twelve months after

the reporting period.

Present obligation Trade Payable and accruals for employee and other

Legal or constructive obligation operating cost are part of the working capital used in the

entity’s normal operating cycle are classified as current

Transfer of an economic resource liabilities even if settled more than twelve months after the

Without payment of money, transfer of noncash asset, reporting period.

performance of service, there is no accounting liability.

When an entity declares cash dividend.

Share dividend (share dividend payable) is not an Non-current Liabilities

accounting liability. Non-current portion of long-term debt

Finance lease liability

Past event Deferred tax liability

Obligating event Long-term obligation to officers

The entity has no realistic alternative but settle the Long-term deferred revenue

obligation created by the event

For example, acquisition of goods on account. The

Long-term debt falling due within one year

obligation event is the acquisition of goods.

Refinancing

Current- after the reporting period and before the FS

Example of liabilities authorized for issue

Accounts Payable to suppliers for the purchase of goods.

Non-current- on or before the end of the reporting period

Amounts withheld from employees for taxes and for

contribution to the SSS.

Accruals for salaries, interest, rent, taxes, product Covenants

warranties and profit -sharing bonus. Attached to borrowing agreements (undertaking by the

Cash dividend declared but not paid. borrower)

Deposits and advances from customers. Breach of covenants

Debt obligation from borrowed funds-notes, mortgages Payable on demand

and bonds payable. Current- at the end of the reporting period

Income tax payable Non-current- on or before the reporting period (grace

Unearned revenue period, ending at least 12 months)

Measurement of liabilities .

——— —DEC.31—————————

Current Liability

Presentation of current Liabilities

Not discounted anymore

Recorded and reported at their face amount (FA and PV a. Trade and other Payables

are not material) b. Current Provisions

c. Short-term borrowings

Non-current Liability d. Current portion of long-term debt

Initially measured at present value and subsequently e. Current tax liability

measured at amortized cost.

Interest bearing note is initially and subsequently Estimated Liabilities

measured at face amount. FA and PV are equal. Amounts are definite

Either current or non-current

Premium, award points, warranties, gift certificates and

Current Liabilities bonus

The entity expects to settle the liability within the entity’s

normal operating cycle or within 12 months.

VAM | Values - Attitude – Motivation Source: Valix 2019

Angeles University Foundation | Bachelor of Science in Accountancy LIABILITY The goal is to earn the title –

CPA

Deferred Revenue 4,400,0000

Cash receipts from service contracts sold 1,000,000

Service contract costs paid 500,000 REFUNDABLE DEPOSITS

Service contract revenue recognized 800,000 After compliance with certain conditions

Returnable containers like bottles, drums, tanks and

barrels.

To record the cash receipts from service contact sold:

Cash 1,000,000

Unearned service revenue 1,000,000

Execution

Cash xxx

To record the service contract costs paid: Containers’ deposit xxx

Service contract expense 500,000

Cash 500,000

Return of deposit

To record the service contact revenue recognized:

Failure to return the deposit

Unearned service revenue 800,000

Service contract revenue 800,000

Gift Certificate Payable

When the Gift Certificate are sold

Cash xxx

Gift Certificate Payable xxx

When the Gift Certificates are redeemed

Gift Certificate Payable xxx

Sales xxx

When the Gift Certificates are expired

Gift Certificates Payable xxx

Forfeited Gift Certificates xxx

BONUS COMPUTATION

Income before bonus and before tax 4,400,000

Bonus 10%

Income tax rate 30%

Income before bonus and before tax

4,400,000 * 10% = 440,000

Income after bonus but before tax

4,400,000 - 110%

4,000,000 - 100%

400,000 - 10%

Income after bonus and after tax

4,400,000

Income after tax but before bonus

VAM | Values - Attitude – Motivation Source: Valix 2019

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Labor Relations Striking A Balance 4th Edition Budd Solutions ManualDocument21 pagesLabor Relations Striking A Balance 4th Edition Budd Solutions Manualdanielaidan4rf7100% (29)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- (Stephen Spinelli JR., Robert Rosenberg, Sue Birle (BookFi) PDFDocument256 pages(Stephen Spinelli JR., Robert Rosenberg, Sue Birle (BookFi) PDFSulthonul Aulia100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 8-12Document21 pagesChapter 8-12yashpareek5100% (1)

- Intermacc Property, Plant and Equipment Prelec WaDocument2 pagesIntermacc Property, Plant and Equipment Prelec WaClarice Awa-ao100% (1)

- Cost Behavior AnaysisDocument19 pagesCost Behavior AnaysisVrix Ace MangilitNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesVrix Ace MangilitNo ratings yet

- CLASSIQUE Furniture Co. Trial Balance 2019Document1 pageCLASSIQUE Furniture Co. Trial Balance 2019Vrix Ace MangilitNo ratings yet

- Application For Business Permit: Amendment: AmendmentDocument2 pagesApplication For Business Permit: Amendment: AmendmentVrix Ace MangilitNo ratings yet

- FAR Answer SheetsDocument10 pagesFAR Answer SheetsVrix Ace MangilitNo ratings yet

- Working Capital & Cash Management: Collecting Center Concentration BankingDocument3 pagesWorking Capital & Cash Management: Collecting Center Concentration BankingVrix Ace MangilitNo ratings yet

- 31-Bir (1906) Filled OutDocument1 page31-Bir (1906) Filled OutVrix Ace MangilitNo ratings yet

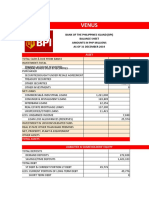

- Statement of Financial Position As of March 31, 2020Document5 pagesStatement of Financial Position As of March 31, 2020Vrix Ace MangilitNo ratings yet

- Book1 (AutoRecovered)Document13 pagesBook1 (AutoRecovered)Vrix Ace MangilitNo ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Vrix Ace MangilitNo ratings yet

- Type Type of Books To Be Registered Quantity From ToDocument1 pageType Type of Books To Be Registered Quantity From ToVrix Ace MangilitNo ratings yet

- Book 1Document1 pageBook 1Vrix Ace MangilitNo ratings yet

- FINMARKDocument4 pagesFINMARKVrix Ace MangilitNo ratings yet

- Finmar ReqsDocument2 pagesFinmar ReqsVrix Ace MangilitNo ratings yet

- Managerial and SupervisoryDocument2 pagesManagerial and SupervisoryVrix Ace MangilitNo ratings yet

- PFRSDocument6 pagesPFRSVrix Ace MangilitNo ratings yet

- StratCost CVP 1Document65 pagesStratCost CVP 1Vrix Ace MangilitNo ratings yet

- STRATCOSTDocument57 pagesSTRATCOSTVrix Ace MangilitNo ratings yet

- Assessment EvidenceDocument11 pagesAssessment Evidenceapi-283127505No ratings yet

- Young Entrepreneur From J-K's Shopian Sells Kashmiri Apples Online, Introduces New PackagingDocument1 pageYoung Entrepreneur From J-K's Shopian Sells Kashmiri Apples Online, Introduces New PackagingJatinder SinghNo ratings yet

- FR Balance Sheet Reconciliations InstructionsDocument10 pagesFR Balance Sheet Reconciliations Instructionsnarendra990% (1)

- Lecture-3 Income Classsification and Residential StatusDocument25 pagesLecture-3 Income Classsification and Residential Statusimdadul haqueNo ratings yet

- The Different Phases of Economic DevelopmentDocument16 pagesThe Different Phases of Economic DevelopmentLenyBarroga100% (1)

- Accounting StandardsDocument24 pagesAccounting Standardslakhan619No ratings yet

- Golf Business Plan TemplateDocument58 pagesGolf Business Plan TemplateBrian JerredNo ratings yet

- A UN Treaty Now Under Discussion Looks PromisingDocument3 pagesA UN Treaty Now Under Discussion Looks PromisingAsfawosen DingamaNo ratings yet

- International Womens Day - Ulat Lila - Full SummaryDocument8 pagesInternational Womens Day - Ulat Lila - Full SummaryJazz TraceyNo ratings yet

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Document9 pagesRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasNo ratings yet

- 11 - Introduction To Supply ChainDocument12 pages11 - Introduction To Supply ChainAnshuman RoutNo ratings yet

- Analysing The Strategic Activities and Decisions of A Multinational CompanyDocument20 pagesAnalysing The Strategic Activities and Decisions of A Multinational CompanyKazi FaizullahNo ratings yet

- Business English Final TestDocument7 pagesBusiness English Final TestChan Phakkdey100% (1)

- Cash Receipts Cash DisbursementDocument5 pagesCash Receipts Cash DisbursementLala BubNo ratings yet

- Portfolio DocumentDocument544 pagesPortfolio DocumenttestNo ratings yet

- Trading in Securities and RegulationsDocument25 pagesTrading in Securities and Regulationsgunn RastogiNo ratings yet

- 06-28 Staff Report W AttachDocument125 pages06-28 Staff Report W AttachMatthew JensenNo ratings yet

- J. Larmour - A Study of Procurement Routes 2011Document63 pagesJ. Larmour - A Study of Procurement Routes 2011d1stortedNo ratings yet

- Dare To Disrupt - The Rise of Grocery Startups in Pakistan: Prepared by I2i's Insights Lab & Released November 18, 2020Document20 pagesDare To Disrupt - The Rise of Grocery Startups in Pakistan: Prepared by I2i's Insights Lab & Released November 18, 2020Bushra GoharNo ratings yet

- CASE 1: Himalaya Herbal Toothpaste: FindingsDocument2 pagesCASE 1: Himalaya Herbal Toothpaste: Findingsriya agarwalNo ratings yet

- Chap 2. New Issue Market3Document6 pagesChap 2. New Issue Market3Dharmesh Bhikadiya67% (3)

- Mergers and Acquisitions Topic 4 Accounting For MergersDocument10 pagesMergers and Acquisitions Topic 4 Accounting For MergersMohit OberoiNo ratings yet

- Building Strong Brands Aaker en 359Document6 pagesBuilding Strong Brands Aaker en 359Ana Lucia Valenzuela CadavidNo ratings yet

- Resource Allocation and Strategy Maritan2017Document10 pagesResource Allocation and Strategy Maritan2017crystalia diamondaNo ratings yet

- 09000000000015119142Document1 page09000000000015119142celle0625No ratings yet

- Apoorva Javadekar - CVDocument3 pagesApoorva Javadekar - CVApoorva JavadekarNo ratings yet